Notice is hereby given that a Meeting of

the Activities Performance Audit Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Wednesday, 18

March 2015

1pm

Council Chambers

15 Forth Street

Invercargill

|

|

Activities Performance Audit Committee Agenda

OPEN

|

MEMBERSHIP

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Members

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

|

Chief Executive

|

Steve Ruru

|

|

|

Committee Advisor

|

Fiona Dunlop

|

|

Terms of

Reference for the Activities Performance Audit Committee

This committee is a committee of Southland

District Council and has responsibility to:

·

Monitor and review Council’s performance

against the 10 Year Plan

·

Examine, review and recommend changes relating

to Council’s Levels of Services.

·

Monitor and review Council’s financial

ability to deliver its plans,

·

Monitor and review Council’s risk

management policy, systems and reporting measures

·

Monitor the return on all Council’s

investments

·

Monitor and track Council contracts and

compliance with contractual specifications

·

Review and recommend policies on rating, loans,

funding and purchasing.

·

Review and recommend policy on and to monitor

the performance of any Council Controlled Trading Organisations and Council

Controlled Organisations

·

Review arrangements for the annual external

audit

·

Review and recommend to Council the completed

financial statements be approved

·

Approve contracts for work, services or supplies

in excess of $200,000.

|

Activities Performance Audit Committee

18 March 2015

|

|

TABLE OF

CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of

Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Minutes 5

Reports for Resolution

7.1 Financial

Report to 31 January 2015 17

Reports for Recommendation

8.1 Contract

Extension - Southland Streetlight Maintenance Contract 09/42 45

Public Excluded

Procedural motion

to exclude the public 47

C9.1 Public

Excluded Minutes of the Activities Performance Audit Committee Meeting dated 18

February 2015 47

C9.2 Rating

Sale 32A Redan Street, Wyndham 48

C9.3 Road

Maintenance Contracts Extensions 48

At the close of

the agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Councillors are

reminded of the need to be vigilant to stand aside from decision-making when a

conflict arises between their role as a councillor and any private or other

external interest they might have. It is also considered best practice for

those members in the Executive Team attending the meeting to also signal any

conflicts that they may have with an item before Council.

4 Public Forum

Notification to

speak is required by 5pm at least two days before the meeting. Further

information is available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the Council to consider any further

items which do not appear on the Agenda of this meeting and/or the meeting to

be held with the public excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i) The

reason why the item was not on the Agenda, and

(ii) The

reason why the discussion of this item cannot be delayed until a subsequent

meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a) That

item may be discussed at that meeting if-

(i)

That item is a minor matter relating to the general

business of the local authority; and

(ii)

the presiding member explains at the beginning of the

meeting, at a time when it is open to the public, that the item will be

discussed at the meeting; but

(b) no

resolution, decision or recommendation may be made in respect of that item

except to refer that item to a subsequent meeting of the local authority for

further discussion.”

6 Confirmation

of Minutes

6.1 Meeting minutes of Activities Performance

Audit Committee, 18 February 2015

|

Activities Performance Audit Committee

OPEN MINUTES

|

Minutes of

a meeting of Activities Performance Audit Committee held in the Council

Chambers, 15 Forth Street, Invercargill on Wednesday, 18 February 2015

commencing at 1.02pm.

present

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Bruce Ford

|

|

|

|

Julie Keast

|

|

|

|

Gavin Macpherson

|

|

IN ATTENDANCE

Chief Executive Steve Ruru, Group Manager

Environment and Community Bruce Halligan, Group Manager Services and Assets Ian

Marshall, Chief Information Officer Damon Campbell, Communications &

Governance Manager Louise Pagan, Committee Advisor Fiona Dunlop, Project

Engineer Mark Simpson (Item C7.1 Contract 14/45 - Southland District Council

Regional Desludging)

1 Apologies

Apologies were

received from Councillors Duffy, Harpur and Paterson.

|

Moved by Cr

Dobson, seconded by Cr Dillon and resolved:

That the Activities Performance Audit

Committee accept the apologies.

|

2 Leave

of absence

There were no

requests for leave of absence.

3 Conflict

of Interest

There were no

conflicts of interest declared.

4 Public

Forum

Vin Smith, Director

of Policy, Planning and Regulatory, and Anita Dawe, Policy and Planning Manager

of Environment Southland presented an update to the Committee on the “Water

and Land 2020 & Beyond” project.

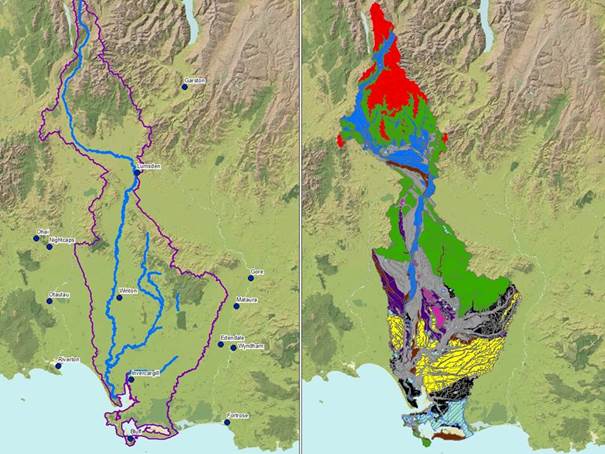

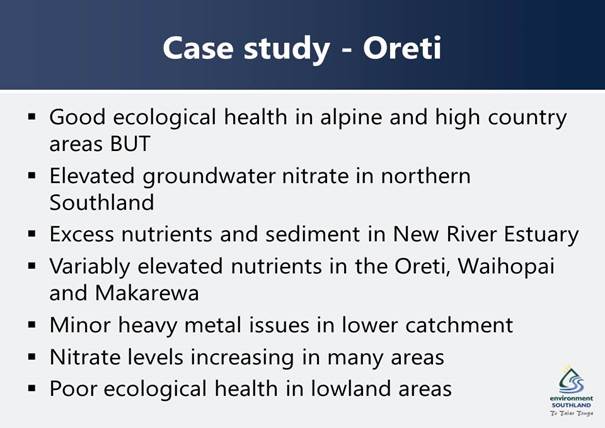

They advised that

the “Water and Land 2020 & Beyond” is Southland’s

response to water quality and quantity issues, partnership project with Ngai

Tahu ki Murihiku, draft water and plan and a platform for limit setting on a

catchment by catchment basis. A copy of the presentation is attached to

the minutes as appendix 1.

5 Extraordinary/Urgent

Items

There were no

Extraordinary/Urgent items.

6 Confirmation

of Minutes

|

Resolution

Moved by Cr

Ford, seconded by Cr Keast and resolved:

That the Activities

Performance Audit Committee confirm the minutes of Activities Performance

Audit Committee, 28 January 2015 as a true and correct record of that meeting.

|

Public Excluded

Exclusion of the Public: Local Government Official Information and

Meetings Act 1987

|

Resolution

Moved by Cr

Ford, seconded by Cr Dobson and resolved:

That the

Activities Performance Audit Committee exclude the public from the following

part(s) of the proceedings of this meeting.

C7.1 Contract

14/45 - Southland District Council Regional Desludging

C7.2 Public Excluded Minutes of the Activities Performance Audit

Committee Meeting dated 28 January 2015

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s)

under section 48(1) for the passing of this resolution

|

|

Contract

14/45 - Southland District Council Regional Desludging

|

s7(2)(b)(ii)

- The withholding of the information is necessary to protect information

where the making available of the information would be likely unreasonably to

prejudice the commercial position of the person who supplied or who is the

subject of the information.

The report

reviews tenders submitted for Contract 14/45 including prices..

|

That the

public conduct of the whole or the relevant part of the proceedings of the

meeting would be likely to result in the disclosure of information for which

good reason for withholding exists.

|

|

Public

Excluded Minutes of the Activities Performance Audit Committee Meeting dated

28 January 2015

|

7(2)(a) - protect the privacy of natural persons,

including that of deceased natural persons

7(2)(f)(ii) -

maintain the effective conduct of public affairs through the protection of

such members, officers, employees, and persons from improper pressure or

harassment;

s7(2)(h) - The withholding of the information is

necessary to enable the local authority to carry out, without prejudice or

disadvantage, commercial activities.

7(2)(i) enable the Council to carry out negotiations

without prejudice or disadvantage (including commercial and industrial

negotiations);

7(2)(j) prevent the disclosure or use of official

information for improper gain or advantage. s7(2)(b)(ii) - The withholding of the information is

necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial position

of the person who supplied or who is the subject of the information.

Commercial sensitivity around audit fee proposal.

|

That the

public conduct of the whole or the relevant part of the proceedings of the

meeting would be likely to result in the disclosure of information for which

good reason for withholding exists.

|

Permit

the Chief Executive, Group Manager Environment and Community, Group Manager

Services and Assets, Chief Information Officer, Communications & Governance

Manager, Committee Advisor and Project Engineer to remain at this meeting,

after the public has been excluded, because of their knowledge of C7.1 Contract 14/45 - Southland District Council Regional Desludging

and C7.2 Public Excluded Minutes of the Activities Performance Audit Committee

Meeting dated 28 January 2015. This

knowledge, which will be of assistance in relation to the matters to be

discussed, is relevant to that matter because of their specialist knowledge.

The public were

excluded at 1.31pm.

Resolutions in

relation to the confidential items are recorded in the confidential section of

these minutes and are not publicly available unless released here.

The meeting returned to open session at

1.58pm.

The meeting closed at 1.58pm CONFIRMED

AS A TRUE AND CORRECT RECORD AT A MEETING OF THE Activities Performance Audit Committee HELD ON WEDNESDAY 18

FEBRUARY 2015.

DATE:...................................................................

CHAIRPERSON:...................................................

|

Activities

Performance Audit Committee

18 March 2015

|

|

Financial

Report to 31 January 2015

Record No: R/15/2/3932

Author: Susan McNamara, Management Accountant

Approved by: Anne Robson, Chief Financial Officer

☐

Decision ☐ Recommendation ☒ Information

|

Recommendation

That the Activities Performance Audit Committee:

a) Receives

the report titled “Financial Report to 31 January 2015” dated 18 March 2015.

b) Determines that

this matter or decision be recognised as not significant in terms of Section

76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

|

Attachments

a Report to Activities

Performance Audit Committee (APAC) - 18 March 2015 - Report to 31 January 2015 View

|

Activities

Performance Audit Committee

|

18 March 2015

|

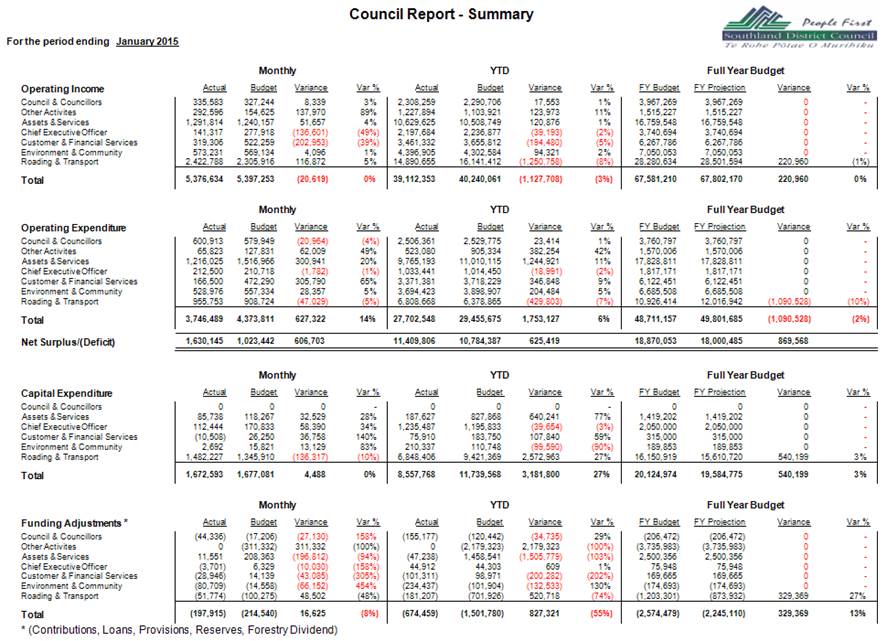

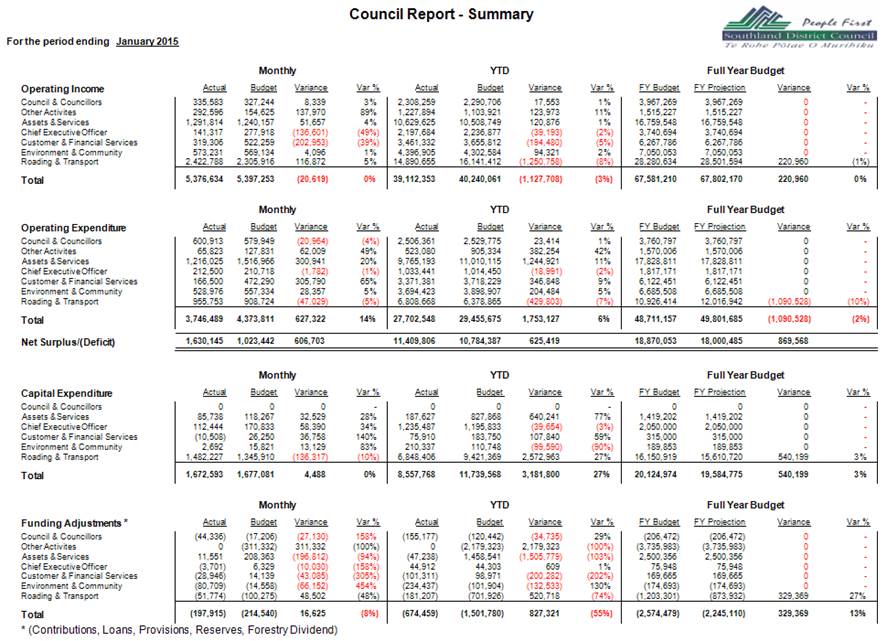

Background

This report outlines the financial results to 31 January

2015. Within this report, no significant issues have been identified that

raise any concerns for Council relating to the end of year financial position.

Percentage of year gone: 58%.

OVERVIEW

Management Accountant - January Finance Overview

As in prior years, all budget managers have been instructed

to have a strong focus on their budget and expenditure items that they can

control in the current economic climate and this report shows no significant

issues.

The financial commentary centres on the summary sheet which

draws the totals from each of the key sections together. Although you are

able to obtain more detailed key variance explanations from senior managers in

these sections, these will be summarised below, concentrating on the YTD

results.

Income

Overall for the YTD, income is 3% ($1.128M) under

budget. This is primarily due to NZTA funding being $1.47M under

budget. This is offset by Assets and Services $121K and Environment and

Community Group $94K.

Key variances are as follows:

The Council and Councillors’ activity is 1% ($18K)

over budget for the year-to-date.

Other activities income is 11% ($124K) over budget for the

year-to-date.

This is predominantly due to the timing of income received from interest on

investments.

Overall Services and Assets income

(excluding roading) is tracking $121K (1%) above

year-to-date budget. This is due to:

• Engineering Consultants is $19K (4%) under budget. As

income is fully recovered and driven by

expenditure levels the reduced expenditure impacts directly on

income.

• Forestry

Income is $108K (6%) over budget. This is predominantly due to harvesting

in Waikaia $935K over budget. This is offset by Dipton Forest $460K and

Ohai Forest $366K under budget.

• Work

Schemes (CTF) is $22K (13%) over budget year-to-date, due to the timing of job completion.

Within the Chief Executive section, income received is $39K

(2%) under budget due to:

• Chief

Executive - $43K (13%) under budget due to the timing of rates penalties.

• Human

Resources - $63K or 20% over budget, as this is internally funded this is a

result of increased expenditure.

• Around

the Mountains Cycle Trail - $51K (4%) over budget due to timing on invoicing

the Ministry, in earlier years. Council has completed the invoicing

relating to Stage 1.

Within the Corporate and Financial Services Group, year-to-date

income is 5% ($194K) under budget. As the majority of the business units

in this activity are internally funded, this reflects lower expenditure for the

year-to-date.

Within the Environmental and Community Group, year-to-date

income is $94K (2%) over budget.

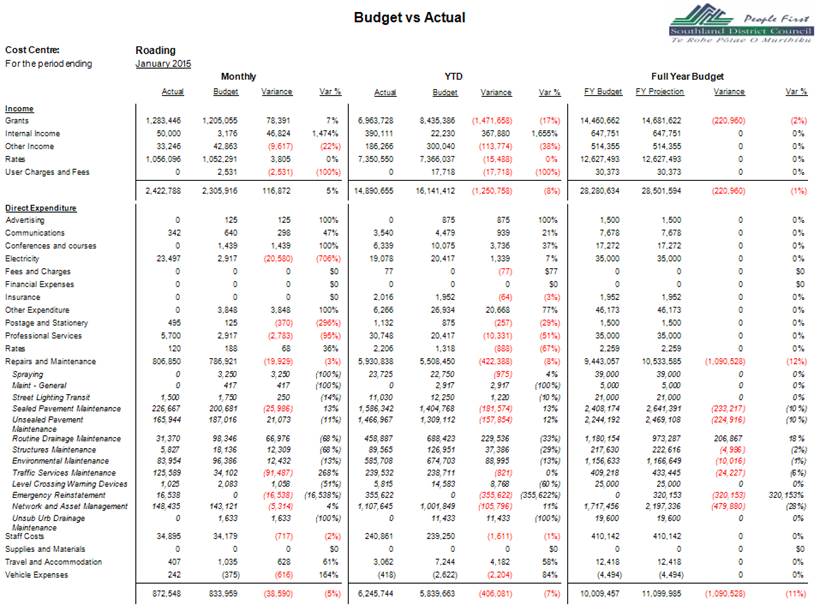

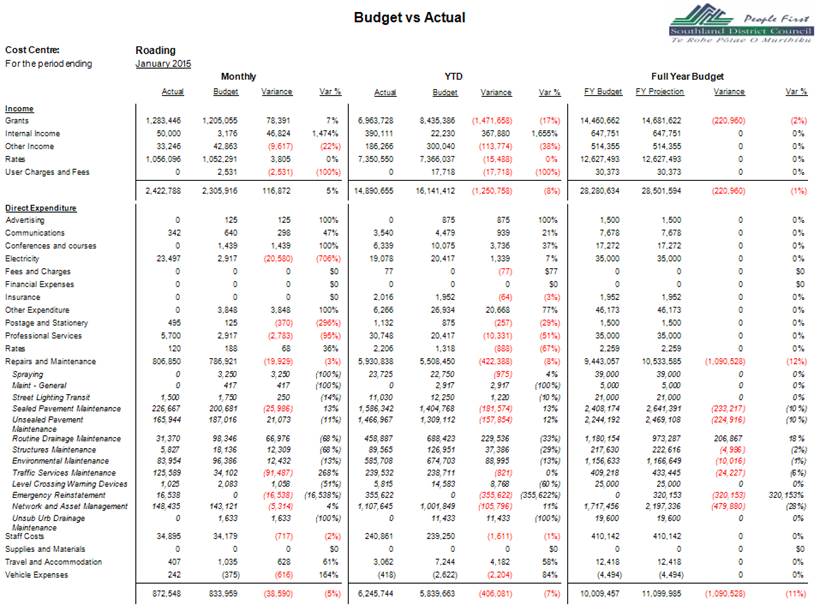

Within the Roading and Transport section, income is 8%

($1.25M) under budget, which is predominantly due to the timing of planned

works and associated New Zealand Transport Agency (NZTA) funding.

Expenditure

Overall for the year-to-date, expenditure is 6% ($1.75M)

under budget.

The key variances are as follows:

The Council and Councillors’ activity is 1% ($23K)

under budget primarily due to Grant Payments yet to be requested and lower

Councillor salary costs.

Other Activities expenditure is 42% ($382K) under budget as

the calculation of interest on reserves is calculated as a year-end

entry.

The Services and Assets Group is 11% ($1.24M) under

budget. Key variances are as follows:

• Council Property is $29K (5%) over budget predominantly due

to maintenance costs.

• District Water is $484K (26%) under budget as there has been minimal capital expenditure

year-to-date. A number of water projects are being started currently.

• District Sewerage is $763K (27%) under budget. Year-to-date there has been minimal capital expenditure

due to the timing of the Te Anau sewerage scheme

being completed.

• Waste

Management is $30K (1%) over budget.

• Water Services is $80K (10%) under budget predominately due

to project consultant costs ($77K), consultant costs ($35K) and staff costs

($16K). This is offset by software licence fees incurred ($39K).

The Chief Executive activity is 2% ($19K) over budget.

Corporate and Financial Services Group is 9% ($347K) under

budget. This is predominantly due to reduced staff costs. Currently

no projects have been identified to use the funds identified in relation to the

Our Way Southland Community Outcomes.

The Environment and

Community Group is 5% ($204K) under budget. This is predominantly due to

expenditure on the district plan being lower than anticipated at this stage of

the year.

Roading expenditure is currently 7% ($430K) over

budget. This is due to Network and Maintenance costs which are over budget.

These are to be monitored closely throughout the year but please note that it is forecast that the Repairs,

Maintenance and Capital Expenditure will be over budget at year end. This

is primarily driven by underspends in previous years and Council’s key

objective of maximising New Zealand Transport Agency approved funding.

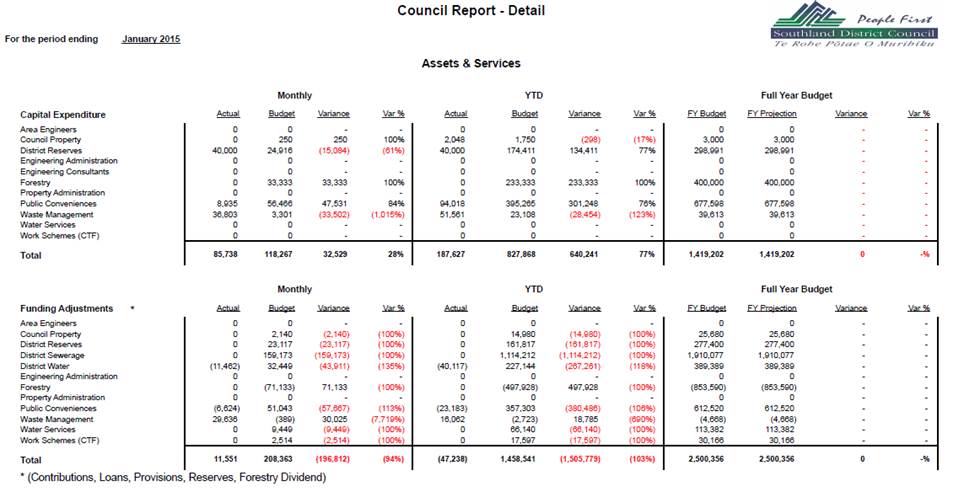

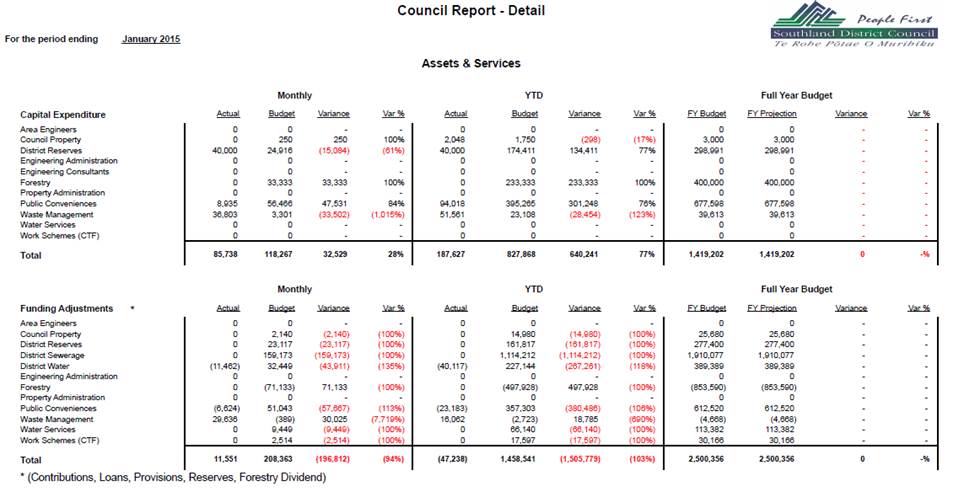

Capital Expenditure

Overall for the year-to-date, capital expenditure is 27%

($3.18M) under budget.

The key variances are as follows:

• Services

and Assets are under budget by 77% ($640K) with minimal capital expenditure to

date.

• Capital

Expenditure in the Chief Executive activity is over budget by $40K (3%)

predominately due to vehicle replacement costs $58K. The Around the

Mountains Cycle Trail capital expenditure is currently on budget.

• Corporate

and Financial Services is under budget by 59% ($108K) with minimal capital

expenditure to date.

• Environment

and Community is over budget by 90% ($100K) for the

year-to-date primarily due to vehicle replacement costs.

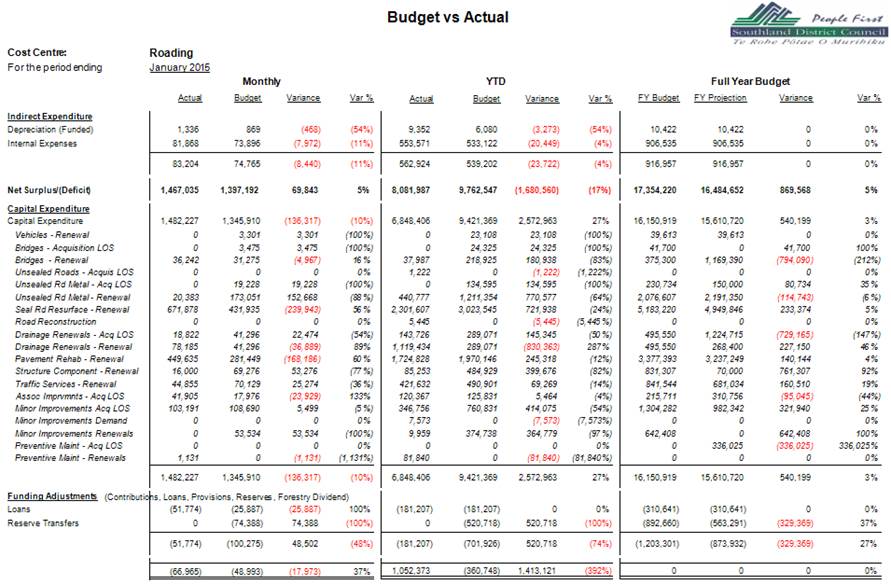

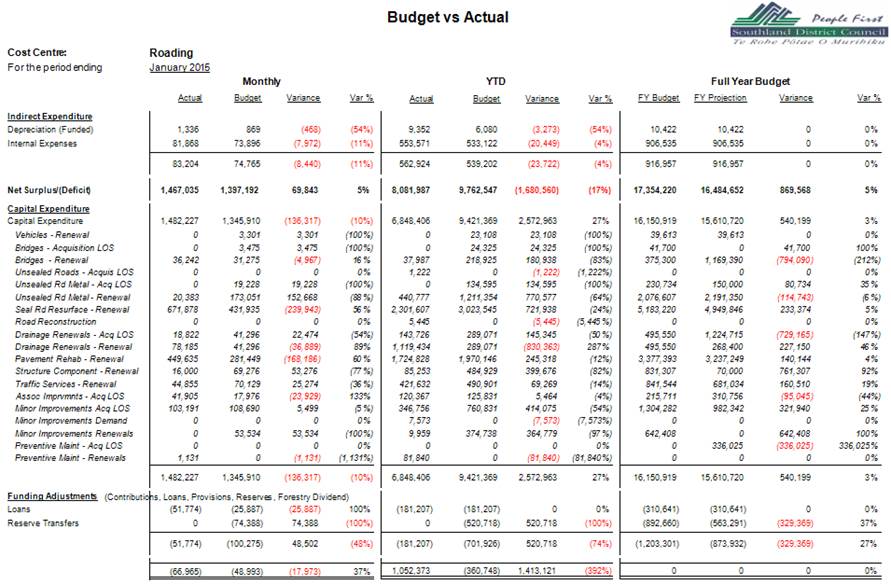

• Roading

capital expenditure is under budget by 27% ($2.57M) due to timing on planned

road renewal and pavement renewal.

Funding Adjustments

Funding adjustments are significantly under budget as

typically ‘balancing’ of business units is not undertaken until the

end of the financial year.

Journals are being processed for reserve transfers,

predominantly in relation to vehicle movements, and loan draw-downs (ie for

project funding), throughout the year at the request of budget managers.

Key Financial Indicators

|

Indicator

|

Target*

|

Actual

|

Variance

|

Compliance

|

|

External Funding:

Non rateable income/Total income

|

> 39%

|

37%

|

-2%

|

x

|

|

Working Capital:

Current Assets/Current Liabilities

|

>1.09

|

2.41

|

1.32

|

a

|

|

Debt Ratio:**

Total Liabilities/Total Assets

|

<0.73%

|

0.78%

|

0.05%

|

x

|

|

Debt To Equity Ratio:

Total Debt/Total Equity

|

<0.01%

|

0.00%

|

0.01

|

a

|

*All target indicators have

been calculated using the 2014/15 Annual Plan figures.

** Excludes internal loans.

Financial Ratios

Calculations:

|

Non

Rateable Income

|

|

Total

Income

|

External Funding:

This ratio indicates the percentage of revenue received

outside of rates. The higher the proportion of revenue that the Council

has from these sources the less reliance it has on rates income to fund its

costs.

|

Current

Assets

|

|

Current

Liabilities

|

Working Capital:

This ratio indicates the amount by which short-term assets

exceed short term obligations. The higher the ratio the more comfortable

the Council can fund its short term liabilities.

|

Total

Liabilities

|

|

Total

Assets

|

Debt Ratio:

This ratio indicates the capacity of which the Council can

borrow funds. This ratio is generally used by lending institutions to

assess entities financial leverage. Generally the lower the ratio the

more capacity to borrow.

Debt to Equity Ratio:

It indicates what proportion of equity and debt the Council

is using to finance its assets.

|

Activities

Performance Audit Committee

|

18 March 2015

|

|

Activities Performance

Audit Committee

|

18 March 2015

|

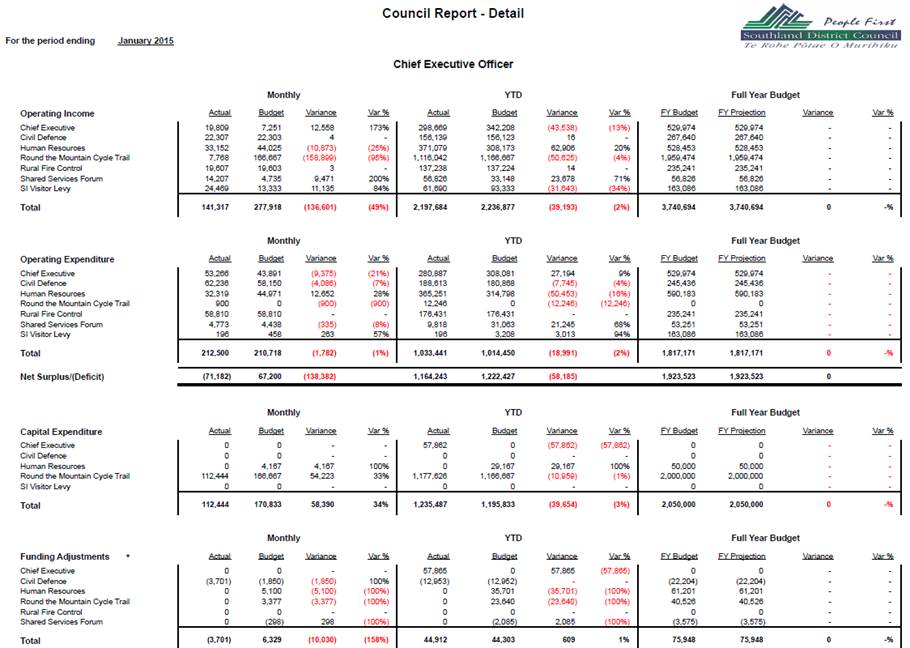

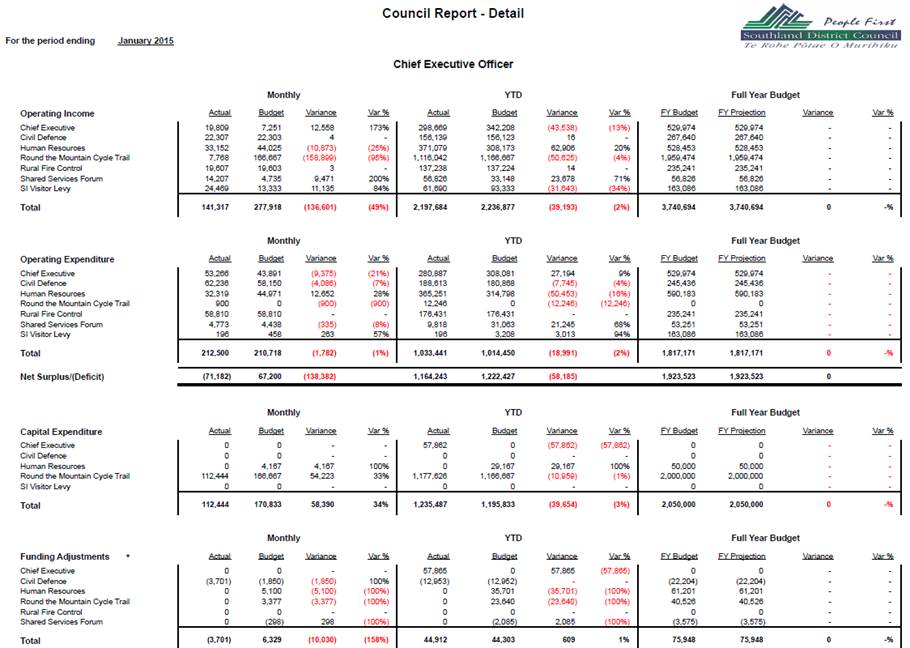

CHIEF EXECUTIVE COMMENTARY

For the year-to-date, income is under budget by $39K

(2%). Expenditure is over budget by $19K (2%), therefore resulting in a

net year-to-date position of $58K under budget.

Chief Executive

Income in this business unit is $44K (13%) under budget this

is due to the timing of rates penalties. Expenditure is $27K (9%) under

budget, primarily due to staff costs $61K under budget. This is offset by

project consultant fees $31K.

Civil Defence

Income is on budget. Expenditure is $8K (4%) over

budget due to Emergency Management Southland Grant.

Human Resources

Income is $63K (20%) under budget. Expenditure

year-to-date is $50K (16%) over budget, due to training costs $56K. As

this activity is internally funded, the increased expenditure impacts directly

on income.

Around the Mountains Cycle Trail

Income is $51K (4%) over budget due to timing on invoicing

the Ministry. No further invoicing is due to be completed in relation to

Stage 1. Expenditure is $12K over budget and capital expenditure over

budget by $11K due to timing of work being completed.

Rural Fire Control

Income and Expenditure is on budget for the year.

Shared Services Forum

Income is $24K (71%) over budget due to the timing on

contributions. Expenditure for

year-to-date is under budget by $21K (68%), with low activity for the

year.

Stewart Island Visitor Levy

Income is $32K (34%) under budget due to the seasonal nature

of visitors to the Island. Expenditure is $3K under budget as the first

allocation meeting is set to occur later in the financial year.

|

Activities Performance

Audit Committee

|

18 March 2015

|

|

Activities

Performance Audit Committee

|

18 March 2015

|

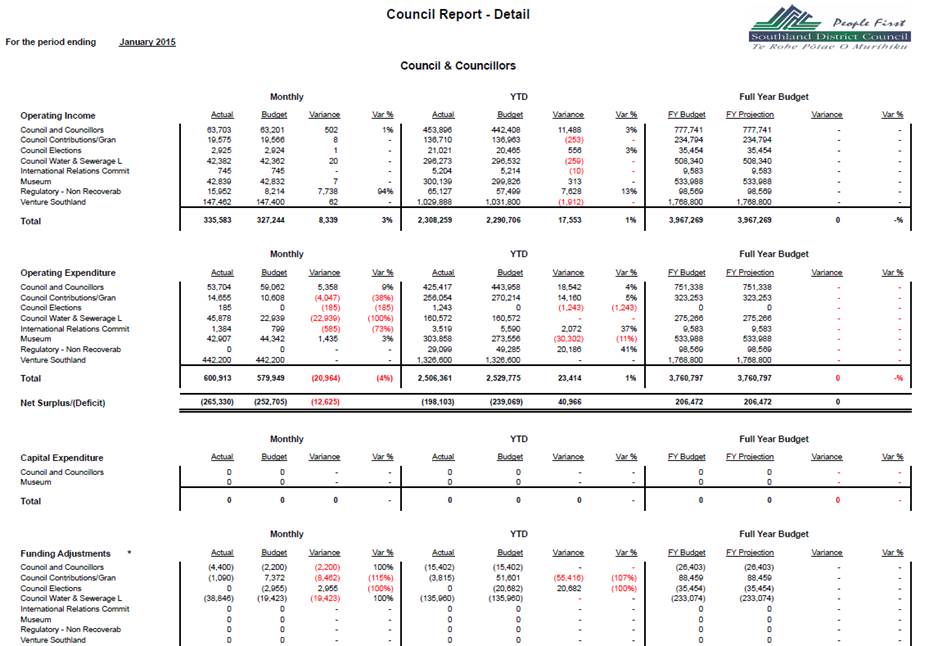

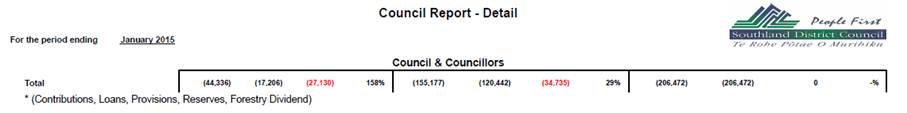

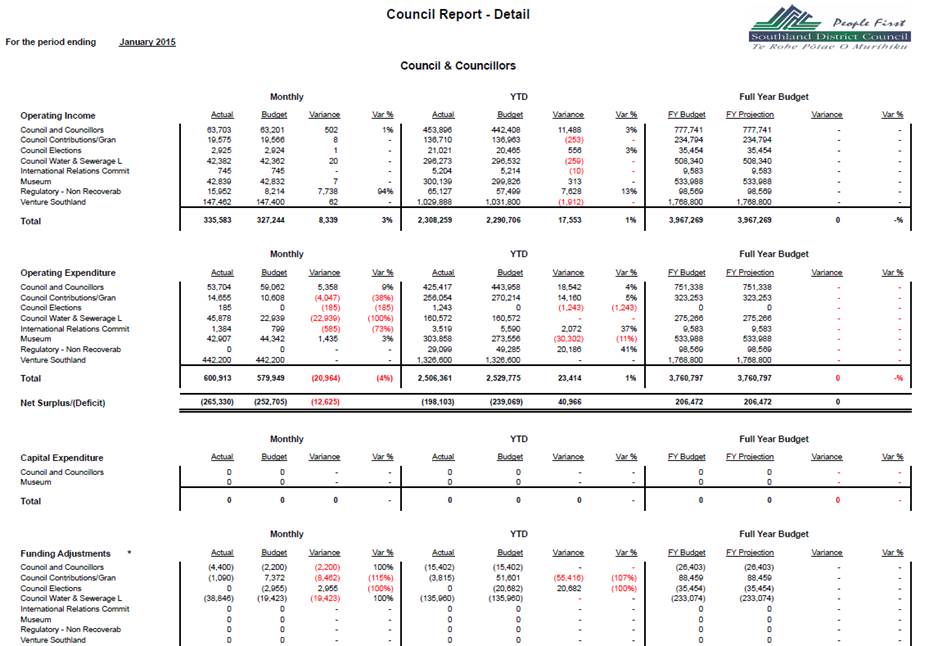

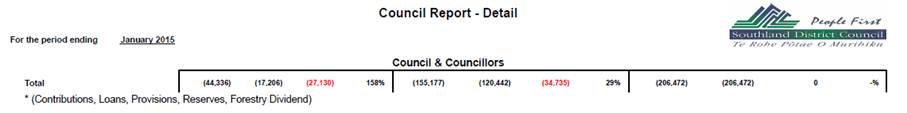

Council and Councillors’ Commentary

For the year-to-date, income is $18K (1%) over budget.

Expenditure is under budget by

$23K (1%), therefore resulting in a net year-to-date position of $41K over

budget.

Council and Councillors

Income is $11K (3%) over budget. Expenditure is under budget

by $19K (4%) primarily due to Councillors’

salaries of $6K.

Council Contributions/Grants

Income is on budget for the year-to-date. Expenditure

is under budget by $14K (5%) due to grant payments yet to be requested.

Council Elections

Income is on budget. Expenditure is $1K over budget

due to the Mararoa-Waimea Ward Councillor election. There are further

costs to be incurred once the election is complete in February.

Council Water and Sewerage Loans

Income and expenditure is on budget for the year-to-date.

International Relations Committee

Income is on budget for the year-to-date. Expenditure

is $2K (37%) under budget due to the timing of committee activities.

Museum

Income is on budget. Expenditure is over budget $30K

(11%) due to timing on the Museum Trust Board Levy.

Regulatory - Non-Recoverable

Income is $8K (13%) over budget for the year-to-date.

Expenditure is under budget by

$20K (41%) as a minimal expenditure to date.

Venture Southland

Income and Expenditure is on budget for the year-to-date.

|

Activities

Performance Audit Committee

|

18 March 2015

|

|

Activities

Performance Audit Committee

|

18 March 2015

|

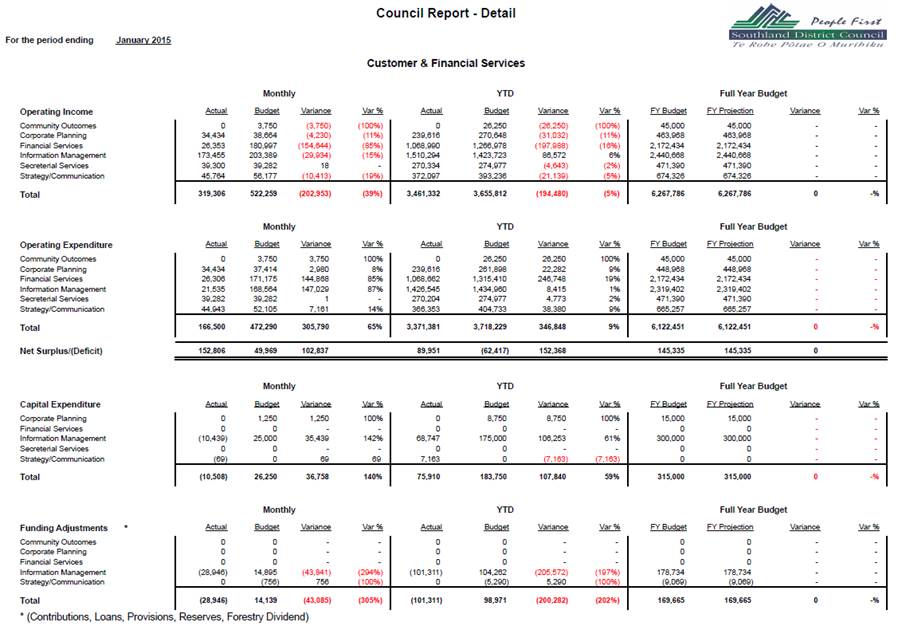

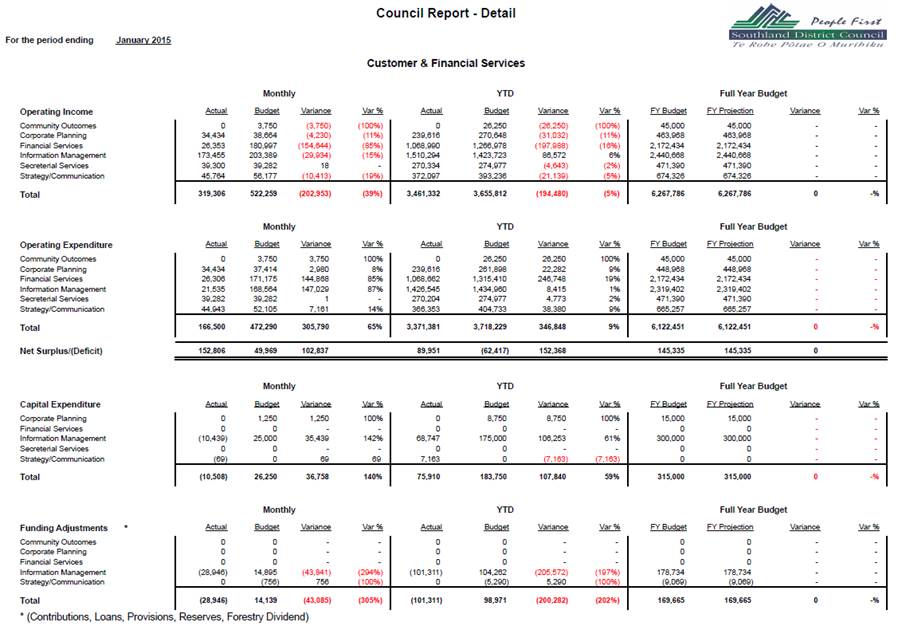

CORPORATE AND

FINANCIAL SERVICES’ COMMENTARY

Income for the year-to-date is $194K (5%) under

budget. Expenditure for the year-to-date is $347K (9%) under

budget. The net result for the year-to-date is a surplus of $90K against

a forecasted deficit of $62K, a positive variance of $152K.

Community Outcomes

Income and expenditure is under budget $26K as no

expenditure projects have been identified in the current period. Funds

are available for projects relating to the Our Way Southland Community

Outcomes.

Corporate Planning

Income is $31K (11%) under budget. Expenditure is $22K

(9%) under budget due to employee costs $27K below budget this is offset by

Long Term Plan (LTP) costs of $27K. As this activity is internally

funded the reduced expenditure impacts directly on income.

Financial Services

Income is $198K (16%) under budget. Expenditure is

$247K (19%) under budget; this is predominantly due to underspending in staff

costs $143K and Insurance $44K. This is offset by consultant costs of

$33K and Valuation Roll Maintenance of $14K. As this activity is

internally funded the reduced expenditure impacts directly on income.

Information Management

Income is $87K (6%) over budget due to internal computer

hire $24K and internal photocopying $29K. Expenditure is $8K (1%) over

budget.

Secretarial Services

Income is $5K (2%) under budget. Expenditure is $5K

(2%) under budget predominately due to advertising costs of $3K. As this

activity is internally funded, the reduced expenditure impacts directly on

income.

Strategy/Communication

Income is $21K (5%) under budget. Expenditure is

underspent by $38K (9%) predominately due to staff costs $31K and communication

costs $9K below budget. As this activity is internally funded the reduced

expenditure impacts directly on income.

|

Activities

Performance Audit Committee

|

18 March 2015

|

|

Activities

Performance Audit Committee

|

18 March 2015

|

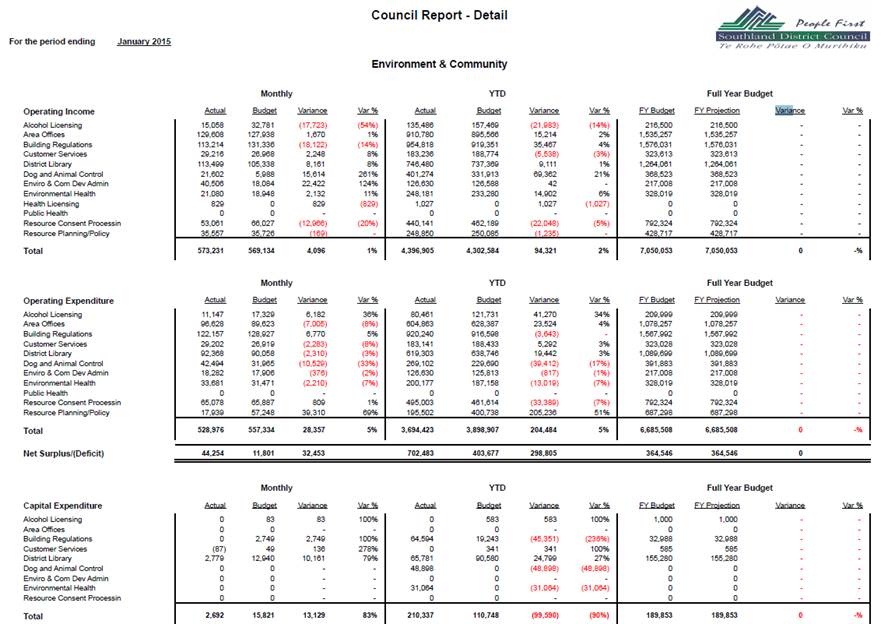

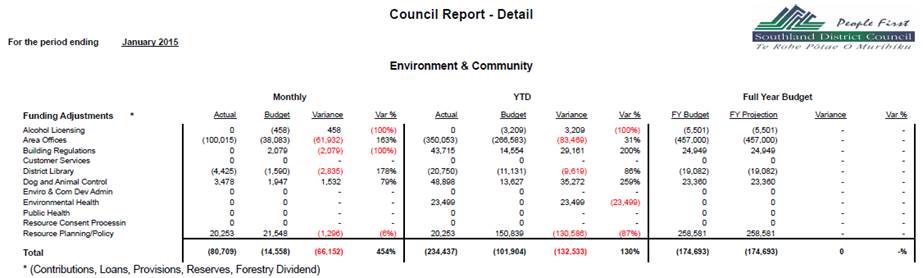

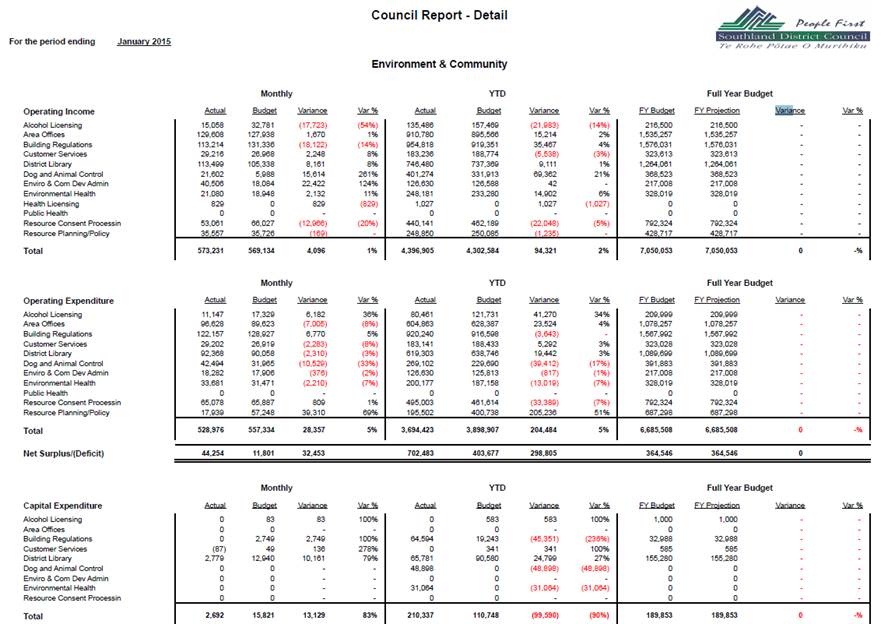

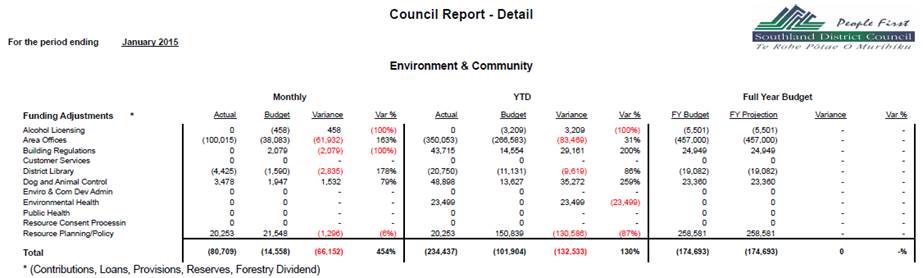

ENVIRONMENT AND COMMUNITY COMMENTARY

Overall January 2015 monthly income for the Environment

and Community Group was $4K (1%) ahead of budget ($573K actual v $569K budget),

as shown on the attached report.

Key features of this month’s income were that Animal

Control Income was $16K (261%) ahead of budget due to income received from the

Courts and infringement notices. Environment and Community Administration

was $22K ahead of budget (124%) although this later item was due to an internal

journal transfer which did not happen from the previous month. However,

Building Consent Income was $18K (14%) below budget, reflecting consents lodged

during the month, and Resource Consent Processing income was

$13K (20%) below budget - although there are some significant costs from recent

major resource consents processed which are yet to be invoiced.

Overall January 2015 monthly expenditure for the

Environment and Community Group was $28K (5%) below budget ($529K actual v

$557K budget).

While expenditure in most departments was running fairly

close to budget, the

Resource Planning/Policy area was significantly underspent by $39K (69%)

relating to the timing of District Plan work, and the Animal Control area was

$11K (33%) overspent, due to additional on call and other staff response costs

over the New Year and early January holiday period and purchase of some

additional personal protective equipment.

Overall YTD Summary

Overall YTD Income at the end of January 2015 for the

2014/15 financial year is

$94K (2%) ahead of budget, at $4.4M actual versus $4.3M budget.

Overall YTD Expenditure at the end of January 2015 of the

2014/15 financial year is $204K (5%) below budget at $3.7M actual versus $3.9M

budget.

It is noted that within the group there are several large

debtors where costs have been invoiced but these are yet to be paid. This

could impact on budgetary position in the

group in the second half of the 2014/15 year. As referred to above, there

are also some significant resource consent processes completed recently where

costs are yet to be invoiced to applicants.

Month by month development activity in the District is still

quite up and down, rather than there being any sustained trend.

The Resource Planning/Policy area is significantly under

budget year-to-date, but it is likely that further costs will be incurred in

the Environment Court appeal/mediation process from March 2015, with nine

appeals having been received.

|

Activities

Performance Audit Committee

|

18 March 2015

|

|

Activities

Performance Audit Committee

|

18 March 2015

|

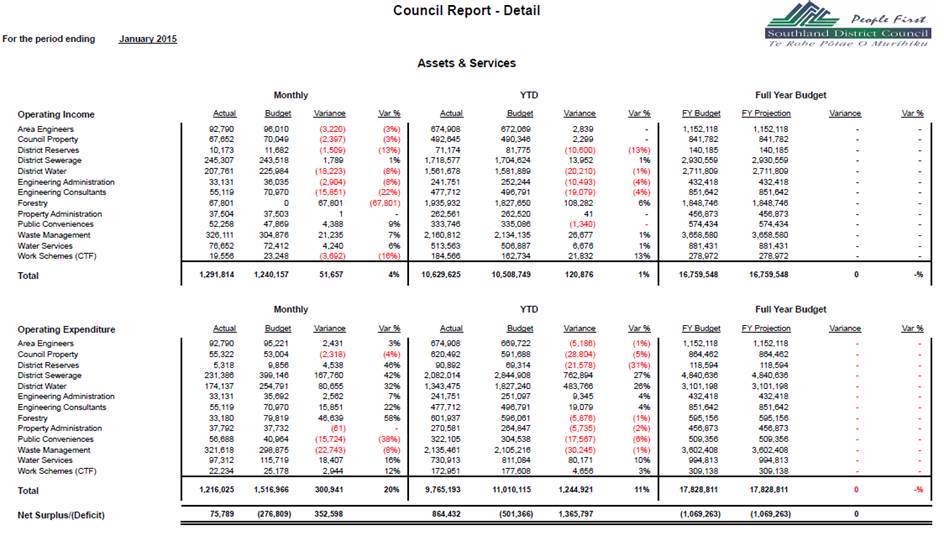

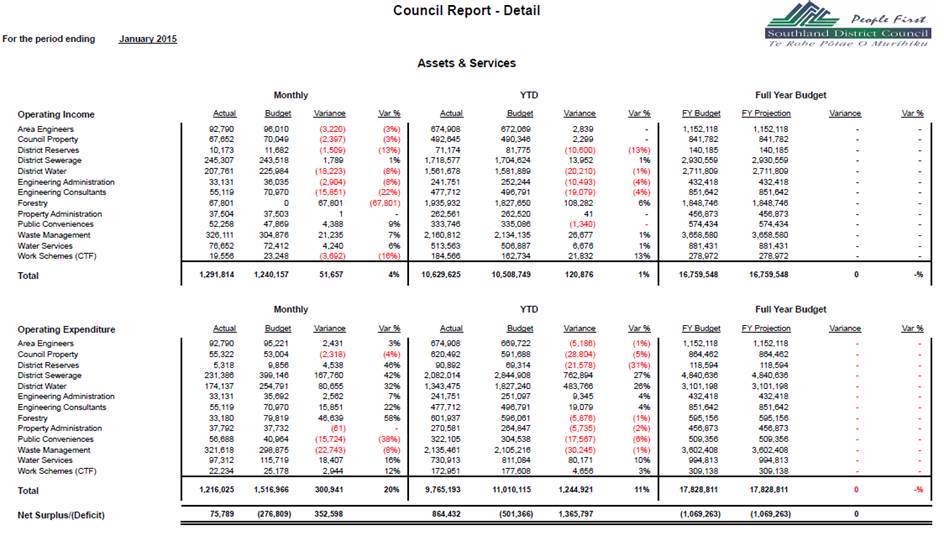

SERVICES AND

ASSETS (Excluding Roading)

COMMENTARY

Income

Overall Services and Assets

(Excluding Roading) actual income is $121K (1%) over

year-to-date budget ($10.5M). This is primarily driven by Forestry income

$108K over budget.

Key highlights are:

• Area Engineers is $3K over budget primarily due to its

expenditure being under budget. Revenue is collected from other business

units to balance the

Area Engineers’ business unit each month.

• Engineering Consultants is $19K (4%) under budget. As

income is fully recovered and driven by

expenditure levels the reduced expenditure impacts directly on

income.

• Forestry

Income is $108K (6%) over budget. This is predominantly due to harvesting

in Waikaia $935K over budget. This is offset by Dipton Forest $460K and

Ohai Forest $366K under budget.

• Work

Schemes (CTF) is $22K (13%) over budget year-to-date, due to the timing of job completion.

Operating Expenditure

Actual operational expenditure for

Services and Assets year-to-date is $1.24M (11%) under budget.

Key highlights are:

• Council Property is $29K (5%) over budget predominantly due

to maintenance costs.

• District Water is $484K (26%) under budget as there has been minimal capital expenditure year-to-date

($109K actual versus $610K budget).

• District Sewerage is $763K (27%) under budget. Year-to-date there has been minimal capital expenditure

due to the timing of the Te Anau sewerage scheme

being completed.

• Waste

Management is $30K (1%) over budget.

• Water Services is $80K (10%) under budget predominately due

to project consultant costs ($77K) consultant costs ($35K) and staff costs

($16K). This is offset by software licence fees incurred ($39K).

|

Activities

Performance Audit Committee

|

18 March 2015

|

|

Activities

Performance Audit Committee

|

18 March 2015

|

STRATEGIC TRANSPORT

Overall Financial Performance

A continued strong focus on making sure we fully utilise

NZTA approved funding along with optimising "value for money" remains

a challenge.

•

Council Transport overheads

are generally tracking in line with budgets or slightly under with the

exception of Professional Services (roading rate review).

• It

is forecasted that our Operations and Maintenance costs will be over budget at

year end. This will be partially offset by underspends in capital

expenditure and underspends in the previous two years.

• Council

Transport Capital Expenditure is under budget primarily due to timing. Physical

Works is expected to ramp up over the next few months. Significant amount

of capital expenditure on the Assets Bridges is to occur this financial year

(Minor Improvements to maximise funding). It is expected that some

of our resealing invoicing will occur in the coming months which will realign

our capital budgets.

Please note that we are forecasting that our Repairs, Maintenance

and Capital Expenditure will be over budget at year end. This is

primarily driven by underspends in previous years and our key objective of

maximising New Zealand Transport Agency approved funding.

|

Key

|

|

|

Largely on Track

|

|

|

Monitoring

|

|

|

Action Required

|

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

58%

|

55%

|

57%

|

60%

|

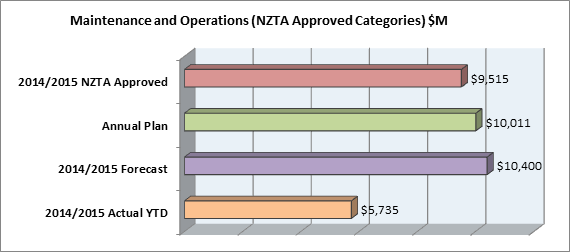

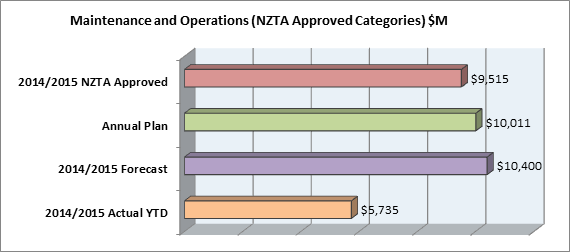

Maintenance and Operations Commentary:

Maintenance and Operation cost are currently over budget

this is due to:

•

Unbudgeted Emergency Works

costs due to slip repairs (Ohai Clifden and Stewart Island Slips).

• A

holistic approach to Maintenance Management has seen Sealed Pavement and

Unsealed Pavement Maintenance being over budget but offset with underspends in

other activities.

* Note that Council can only claim 30% of urban

drainage. Unsubsidised work has being excluded from this forecast.

Actions required:

Council intends to shift NZTA funding from our renewal

programme to help fund the gap between our 2014/15 forecast and NZTA approved

funding. This will be done once the majority of our renewal programme has

been tendered (late January). Transport does not anticipate any issues in

this being approved. This has been delayed as we await all our capital

works projects being firmed up.

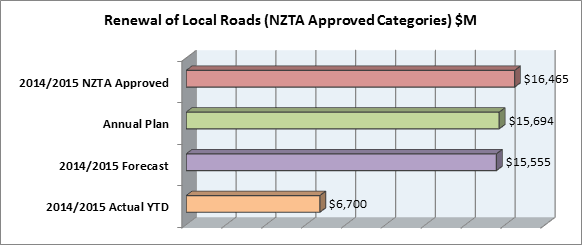

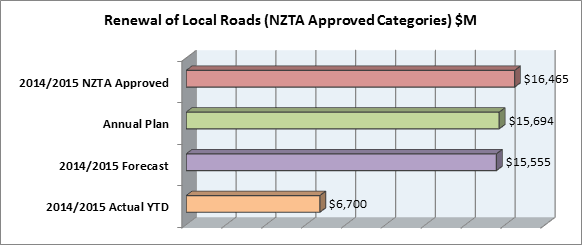

Renewals and Minor

Improvements:

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

58%

|

43%

|

43%

|

41%

|

Renewals and Minor Improvement Commentary:

The forecast is lower than actuals primarily due to the

timing of projects. Council expects that expenditure will increase in the

next few months as the construction season gets underway. Some unsealed

metalling, drainage work and some rehabilitation work is underway.

Bitumen costs are very volatile at the moment which has caused some

frustrations in the management of reseals and also other projects in what is to

be deferred and brought forward.

Actions required:

No funding action required at this stage. The

forecasted shortfall in NZTA approved expenditure will help fund the forecasted

overspend in maintenance and renewals.

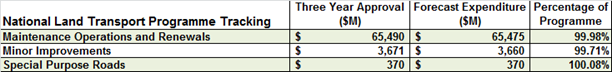

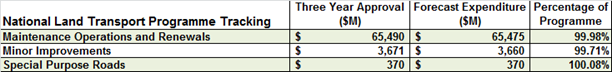

Three Year Programme:

It is expected that the Special Purpose Roads expenditure

will exceed approved amounts. We will be working with NZTA to get more

funding approval. This budget is managed by NZTA highways and is 100%

funded from NZTA.

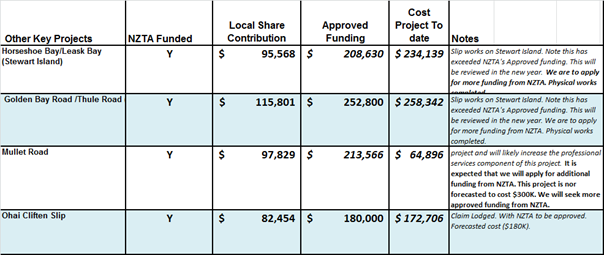

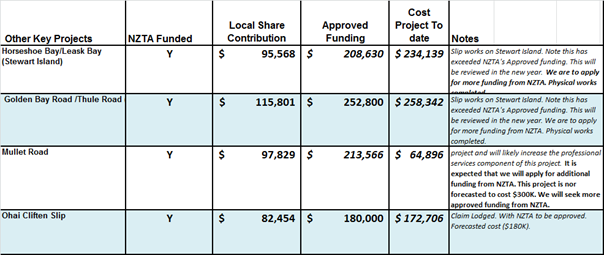

Other Key Projects:

Local share has been partially

funded by previous year underspends in our bridge renewal budgets and other renewal

underspends.

|

Activities

Performance Audit Committee

|

18 March 2015

|

|

Activities

Performance Audit Committee

|

18 March 2015

|

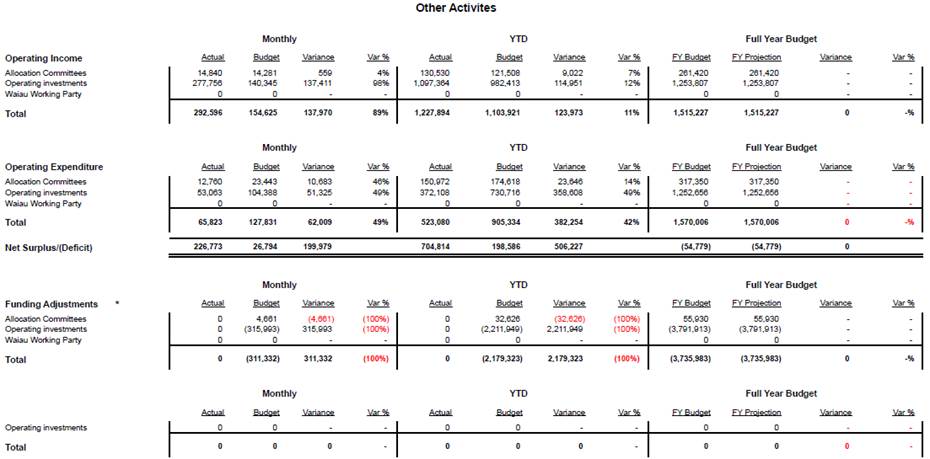

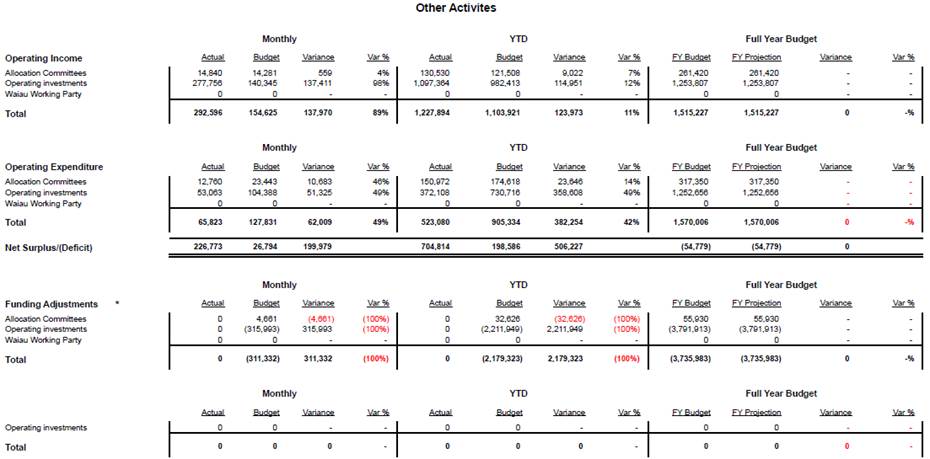

OTHER

ACTIVITIES COMMENTARY

Allocation Committee

Income is $9K (7%) over budget due to timing of grants

received. Expenditure is under budget by $24K (14%) due to the timing of

grant payments.

Operating Investments

Currently, the majority of

Council’s reserves are internally loaned by Council or its local

communities for major projects. Council has set the interest rate to be

charged on these loans as part of its Long Term Plan process and interest is

being charged on a monthly basis on all internal loans drawn down at 30 June

2014.

|

Activities

Performance Audit Committee

|

18 March 2015

|

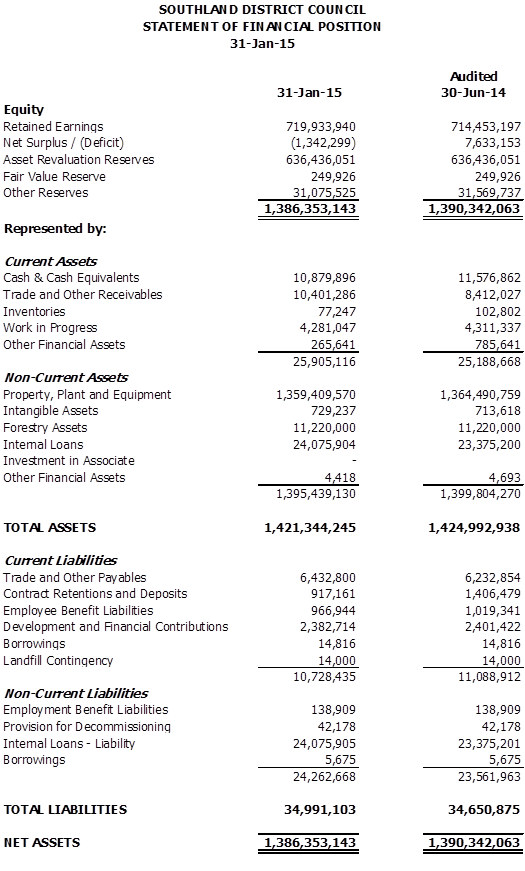

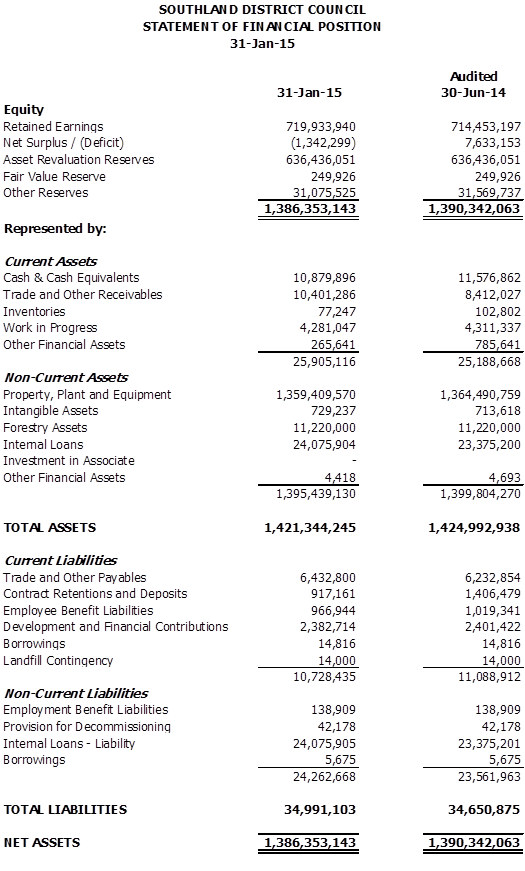

Statement of

Financial Position

COMMENTARY

The balance sheet as at 30 June

2014 represents the audited balance sheet for activities of Council (ie

excludes SIESA and Venture Southland). The financial position at 31

January 2015 is before year-end adjustments and only for the activities of Council.

External borrowings have still not

been required, with internal funds being used to meet obligations for the

year-to-date.

|

|

|

|

|

Susan McNamara

MANAGEMENT

ACCOUNTANT

|

|

|

|

|

|

|

Activities

Performance Audit Committee

18 March 2015

|

|

Contract

Extension - Southland Streetlight Maintenance Contract 09/42

Record No: R/15/2/3763

Author: James McCallum, Roading Engineer

Approved by: Ian Marshall, GM - Services and Assets

☐

Decision ☒ Recommendation ☐ Information

Introduction

& Background

1 Otago Power Services was

awarded the Southland Streetlight Maintenance contract (09/42) on 28 January

2010 with a commencement date of 1 March 2010. The contract was for an

initial period of three years (expiring 12.00 midnight 28 February 2013).

The contract made provision for a two year rollover, which was adopted in March

2013.

2 The two year rollover

expired at midnight 28 February 2015. As such, the Strategic Transport

Department is proposing an extension of a further 12 months.

3 Throughout

the five year period to date, communication between Council and Otago Power

Service has been excellent. Where service delays were inevitable or on

the rare occasion timeframes could not be met, Council was notified accompanied

by a valid explanation.

4 Otago

Power Services has adequately delivered on the requirements as set out in the

contract and on this basis the Strategic Transport Department recommend the

implementation of a 12 month extension.

Proposal

5 To

extend the contract by an additional year, the original contract base rates

will be adjusted in accordance with New Zealand Transport Agency’s Cost

Adjustments Factors, Table 1, Part 1 - Maintenance. These costs fit within the

current budget allocations.

6 A contract extension

has the following advantages:

· Allows time to confirm funding for an LED replacement programme from

NZTA. Upon confirmation of funding, this could allow for a potential

replacement programme to be incorporated into a new maintenance contract.

A timeframe extension will also help identify what the future maintenance requirements

may be for LED lighting.

· Allows time to investigate the current LED market as to what

products are available, cost effective options and the suitability of LED

lights for the SDC network.

Note:

LED streetlighting offers considerable savings in both energy and maintenance

expenditure on the network compared with the current technology we have in

place. The new LED technology is still being rolled out to the New

Zealand market and supplier options are currently being investigated by the

Strategic Transport Department.

· Allows

time for the Delivery of Service review to be carried out. This review is

a requirement of Section 17A of the Local Government Act. The review has

been triggered by the need to renew the roading maintenance contract for the

south east area. The scope of the review will include the provision of street

lighting.

7 A

letter has been sent to NZ Transport Agency for its input on the proposed

contract extension. Indications from NZTA are that they

are in agreeance with the SDC proposal.

|

Recommendation

That the Activities Performance Audit Committee:

a) Receives

the report titled “Contract Extension - Southland Streetlight

Maintenance Contract 09/42” dated 10 March 2015.

b) Determines

that this matter or decision be recognised as

not significant in terms of Section 76 of the Local

Government Act 2002.

c) Determines

that it has complied with the decision making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Approves

the extension of the Southland Streetlight Maintenance Contract 09/42

contract to 28th February 2016.

|

Attachments

There are no attachments for this report.

|

Activities Performance Audit Committee

18 March 2015

|

|

Exclusion of the Public: Local Government Official Information and

Meetings Act 1987

|

Recommendation

That the

public be excluded from the following part(s) of the proceedings of this

meeting.

C9.1 Public

Excluded Minutes of the Activities Performance Audit Committee Meeting dated

18 February 2015

C9.2 Rating Sale

32A Redan Street, Wyndham

C9.3 Road

Maintenance Contracts Extensions

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

|

General

subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48(1) for the passing of

this resolution

|

|

Public Excluded Minutes of the Activities Performance

Audit Committee Meeting dated 18 February 2015

|

s7(2)(a) - The withholding of the information is

necessary to protect the privacy of natural persons, including that of a

deceased person.

s7(2)(b)(ii) - The withholding of the information is

necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial position

of the person who supplied or who is the subject of the information.

s7(2)(f)(ii) - The withholding of the information is

necessary to maintain the effective conduct of public affairs through the

protection of such members, officers, employees and persons from improper

pressure or harassment.

s7(2)(h) - The withholding of the information is

necessary to enable the local authority to carry out, without prejudice or

disadvantage, commercial activities.

s7(2)(i) - The withholding of the information is

necessary to enable the local authority to carry on, without prejudice or

disadvantage, negotiations (including commercial and industrial negotiations).

s7(2)(j) - The withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage.

|

That the public conduct of the whole or the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding exists.

|

|

Rating

Sale 32A Redan Street, Wyndham

|

s7(2)(a) - The withholding of the information is

necessary to protect the privacy of natural persons, including that of a

deceased person.

s7(2)(i) - The withholding of the information is

necessary to enable the local authority to carry on, without prejudice or

disadvantage, negotiations (including commercial and industrial

negotiations).

|

That the public conduct of the whole or the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding exists.

|

|

Road

Maintenance Contracts Extensions

|

s7(2)(b)(ii) - The withholding of the information is

necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial position

of the person who supplied or who is the subject of the information.

s7(2)(h) - The withholding of the information is

necessary to enable the local authority to carry out, without prejudice or

disadvantage, commercial activities.

s7(2)(i) - The withholding of the information is

necessary to enable the local authority to carry on, without prejudice or

disadvantage, negotiations (including commercial and industrial

negotiations).

|

That the public conduct of the whole or the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding exists.

|