Notice is hereby given that an Ordinary

Meeting of Southland District Council will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Tuesday, 19

May 2015

9am

Council Chambers

15 Forth Street

Invercargill

|

|

Council Agenda

OPEN

|

MEMBERSHIP

|

Mayor

|

Mayor Gary Tong

|

|

|

Deputy Mayor

|

Paul Duffy

|

|

|

Councillors

|

Lyall Bailey

|

|

|

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

|

Committee Advisor

|

Maree Fyffe

|

|

|

Chief Executive

|

Steve Ruru

|

|

Delegations of Council/Committee/Community Board/CDA insert

text here.

|

Council

19 May 2015

|

|

TABLE OF CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Council Minutes 5

Reports - Policy and Strategy

7.1 Disqualification

from owning a dog - Objection from Frederick John McCullough 7

7.2 Draft

Submission to Rules Reduction Taskforce 19

7.3 Long

Term Plan 2015-2025 - Public Consultation and Feedback 35

7.4 Council

Officers' Amendments to the Long Term Plan 2015-2025 and Supporting Information

Documents 53

7.5 Long

Term Plan 2015-2025 - Key Issues and Funding Requests 65

7.6 Appendix

1: Strategies, Financial Issues and Rating 73

7.7 Appendix

2: NZTA Investment Programme 93

7.8 Appendix

3: Maintaining Roads and Levels of Service 99

7.9 Appendix

4: Roading Rate Model 111

7.10 Appendix

5: Sealing the Catlins Road 125

7.11 Appendix

6: Funding Infrastructure and Depreciation 141

7.12 Appendix

7: Rating Differential 149

7.13 Appendix

8: Fees and Charges 161

7.14 Appendix

9: Funding and Grant Requests 169

7.15 Appendix

10: Around the Mountains Cycle Trail 177

7.16 Appendix

11: Curio Bay Wastewater Project 183

7.17 Appendix

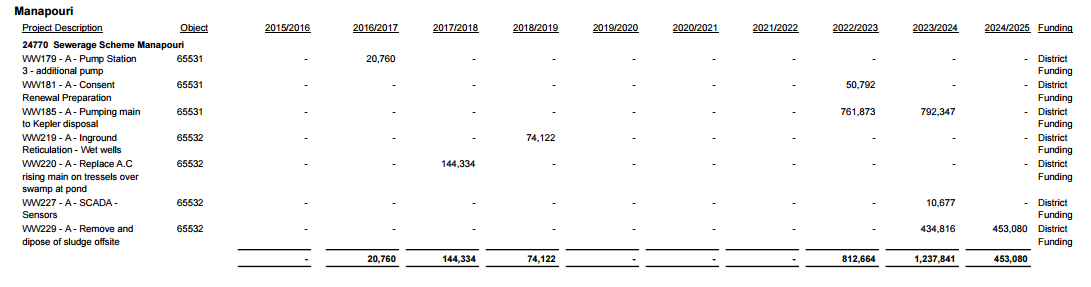

12: Manapouri Wastewater Disposal 191

7.18 Appendix

13: District and Local Issues and Comments 197

7.19 Appendix

14: Operational Matters 211

7.20 Appendix

15: Performance Measures 217

7.21 Development

and Financial Contributions Policy 221

7.22 Remission

and Postponement of Rates Policy 261

7.23 Remission

and Postponement of Rates on

Māori Freehold Land Policy 279

7.24 Early

Payment of Rates Policy 289

Reports - Operational Matters

Nil

Reports - Governance

Nil

Public Excluded

Procedural motion

to exclude the public 299

C10.1 Public

Excluded Minutes of the Council Meeting dated 22 April 2015 299

|

Council

19 May 2015

|

|

1 Apologies

At the close of

the agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Councillors are

reminded of the need to be vigilant to stand aside from decision-making when a

conflict arises between their role as a councillor and any private or other

external interest they might have. It is also considered best practice for

those members in the Executive Team attending the meeting to also signal any

conflicts that they may have with an item before Council.

4 Public Forum

Notification to

speak is required by 5pm at least two days before the meeting. Further

information is available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the Council to consider any further

items which do not appear on the Agenda of this meeting and/or the meeting to

be held with the public excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i) The

reason why the item was not on the Agenda, and

(ii) The reason why the

discussion of this item cannot be delayed until a subsequent meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a) That item

may be discussed at that meeting if-

(i) That item is a minor

matter relating to the general business of the local authority; and

(ii) the presiding member

explains at the beginning of the meeting, at a time when it is open to the

public, that the item will be discussed at the meeting; but

(b) no resolution,

decision or recommendation may be made in respect of that item except to refer

that item to a subsequent meeting of the local authority for further

discussion.”

6 Confirmation

of Council Minutes

6.1 Meeting

minutes of Council, 22 April 2015

|

Council

19 May 2015

|

|

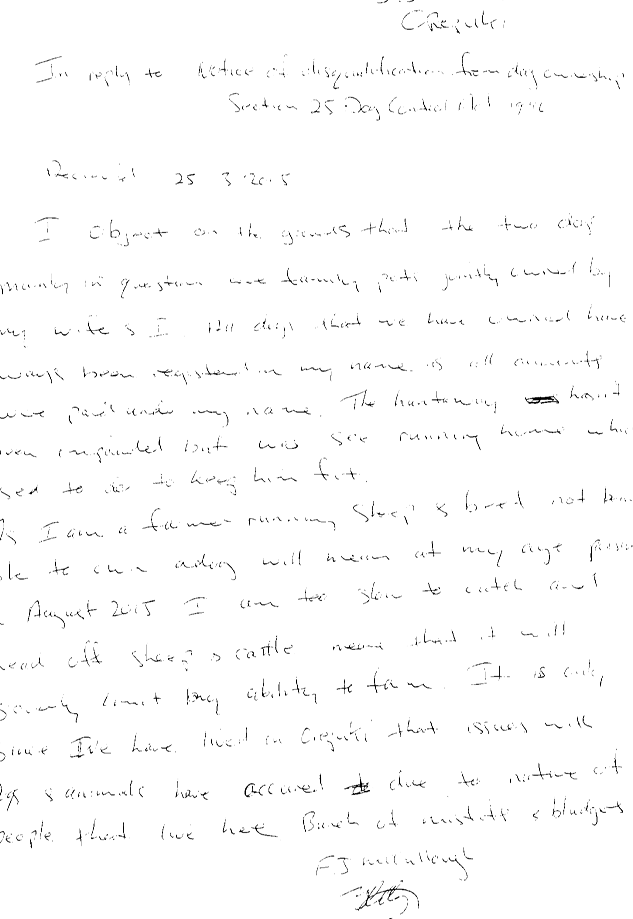

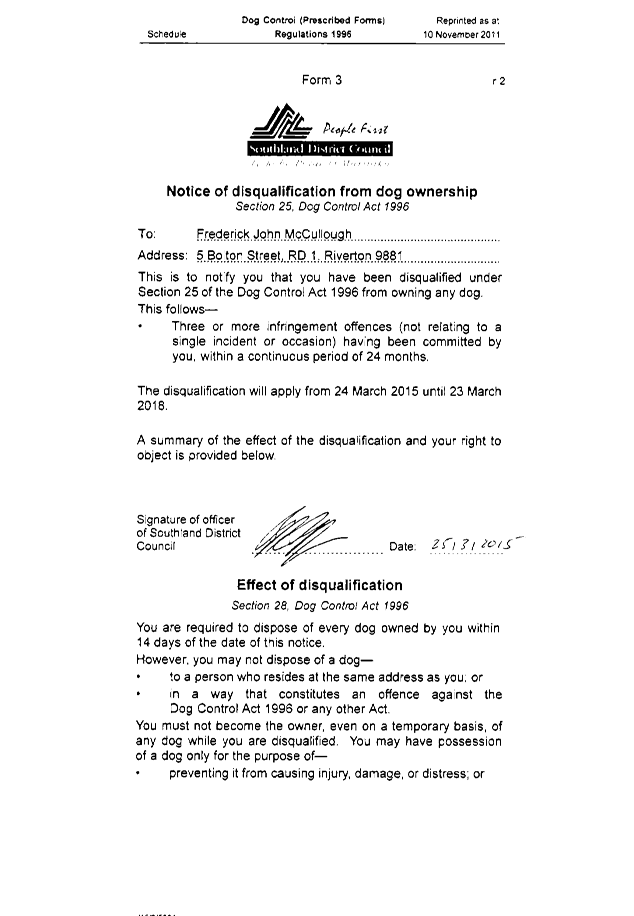

Disqualification

from owning a dog - Objection from Frederick John McCullough

Record No: R/15/4/6825

Author: Michael Sarfaiti, Environmental Health Manager

Approved by: Bruce Halligan, GM - Environment and Community

☒

Decision ☐ Recommendation ☐ Information

Purpose

1 To

determine Mr Frederick John McCullough’s objection to disqualification

from owning a dog.

Executive

Summary

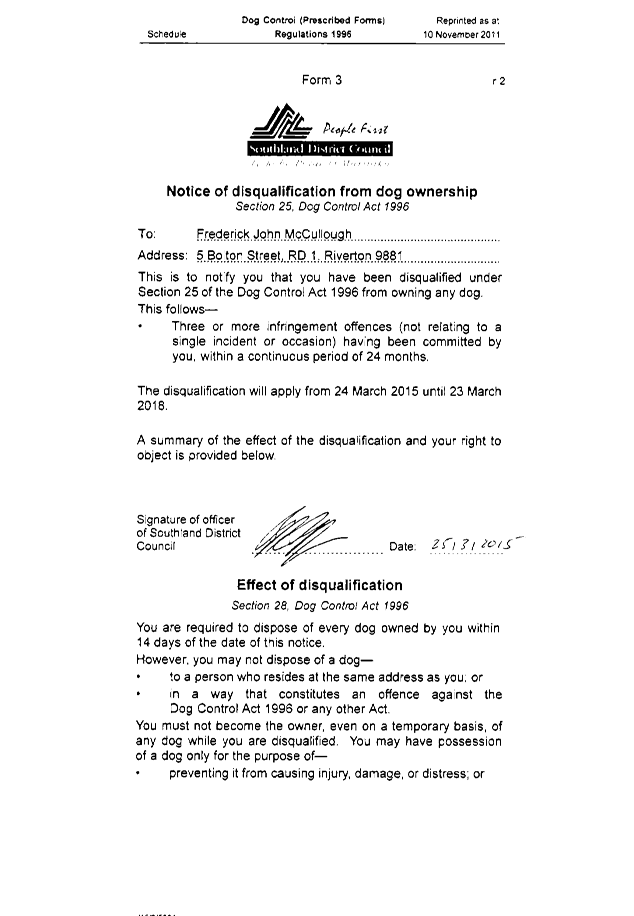

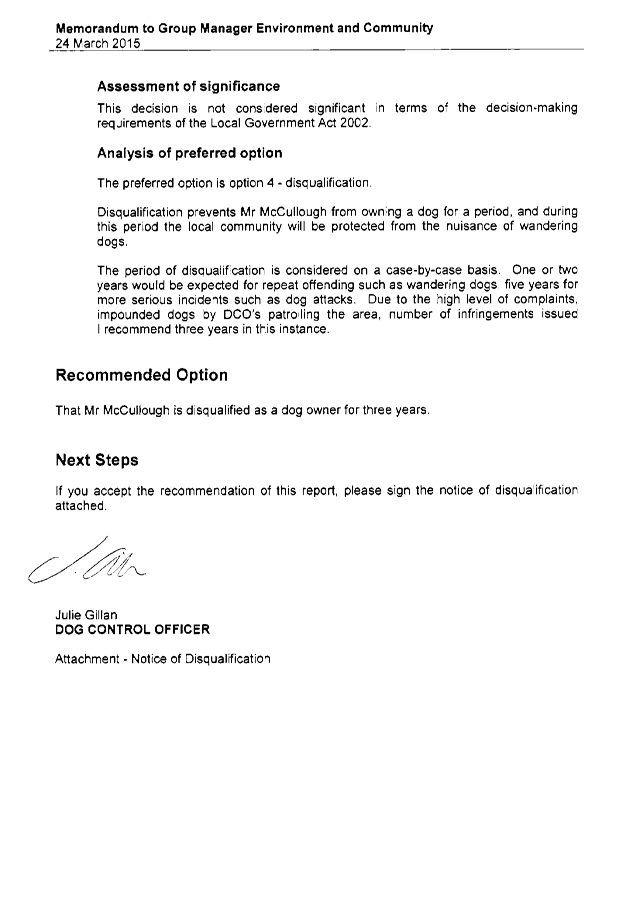

2 On

23 March 2015, the Group Manager Environment and Community disqualified

Mr McCullough, of 5 Bolton Street, Orepuki, from owning a dog until 23 March

2018, in accordance with Section 25 of the Dog Control Act 1996.

3 Mr

McCullough has objected to the disqualification, and is entitled to appear

before the Council and speak in support of the objection.

|

Recommendation

That the Council:

a) Receives

the report titled “Disqualification from owning a dog - Objection from

Frederick John McCullough” dated 12 May 2015.

b) Determines

that this matter or decision be recognised as

not significant in terms of Section 76 of the Local

Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Upholds

the decision to disqualify Mr Frederick John

McCullough and gives notice of this decision to Mr McCullough

in accordance with Section 26(4) of the Dog Control Act 1996.

|

Content

Background

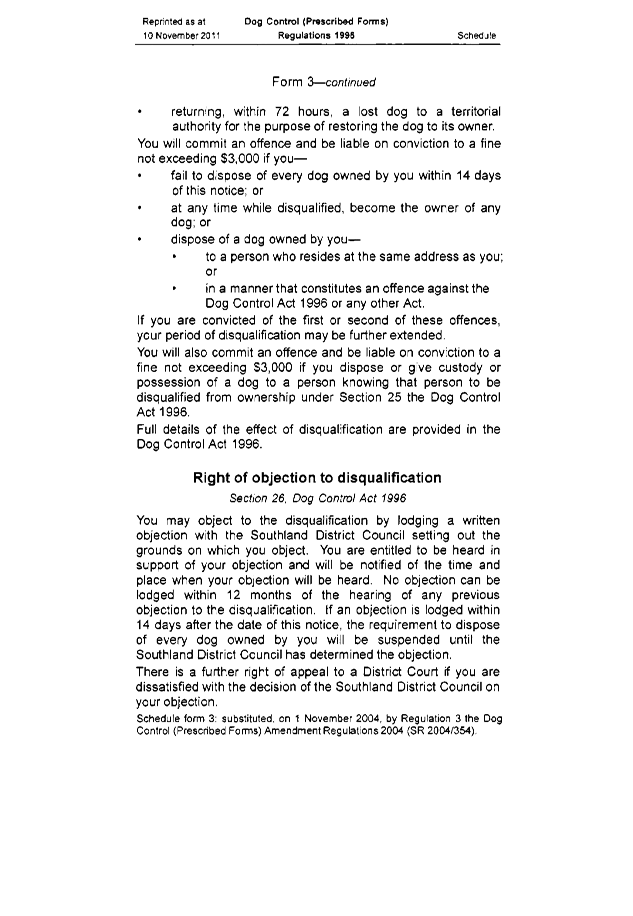

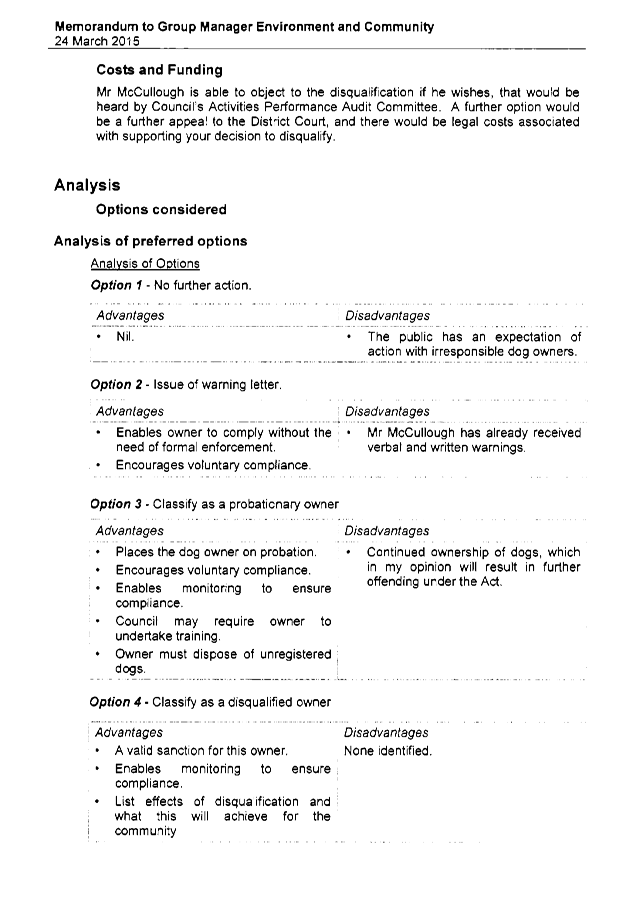

4 Animal Control has received a large number of complaints since 2009 regarding

Mr McCullough's dogs wandering in Orepuki. He has received verbal

warnings, written warnings, had his dogs impounded and received multiple infringements.

5 Mr

McCullough’s infringement history within the

last two years is as follows:

|

Infringement Number

|

Date of Offence

|

Offence

|

|

3072

|

10/7/2014

|

Failed to keep dog under control

|

|

3073

|

10/7/2014

|

Failed to keep dog under control

|

|

3090

|

5/9/2014

|

Failed to keep dog under control

|

|

3098

|

22/9/2014

|

Failed to keep dog under control

|

|

3149

|

16/11/2014

|

Kept an unregistered dog

|

|

3150

|

16/11/2014

|

Kept an unregistered dog

|

6 At

the time of writing, all of Mr McCullough’s dogs are registered, largely

due to the number of impoundings.

7 One

of Mr McCullough’s dogs is declared a working dog (‘Sam’).

8 Being

satisfied that the legal criteria had been met, on 23 March 2015 the

Group Manager Environment and Community disqualified Mr McCullough from owning

a dog until 23 March 2018.

Issues

9 Section

26(3) of the Dog Control Act prescribes the matters that Council is required to

have regard to in considering this objection. These are outlined below.

10 The

circumstances and nature of the offence or offences in respect of which the

person was disqualified.

11 The

infringement history above shows a history of significant repeat offending

under the

Dog Control Act 1996 (the Act).

12 The

competency of the person objecting in terms of responsible dog ownership:

13 Mr McCullough is not

practicing responsible ownership by his repeated offending and failure to work

with dog control staff.

14 Any

steps taken by the owner to prevent further offences:

15 Officers

are not aware of any steps taken.

16 The

matters advanced in support of the objection:

17 Mr

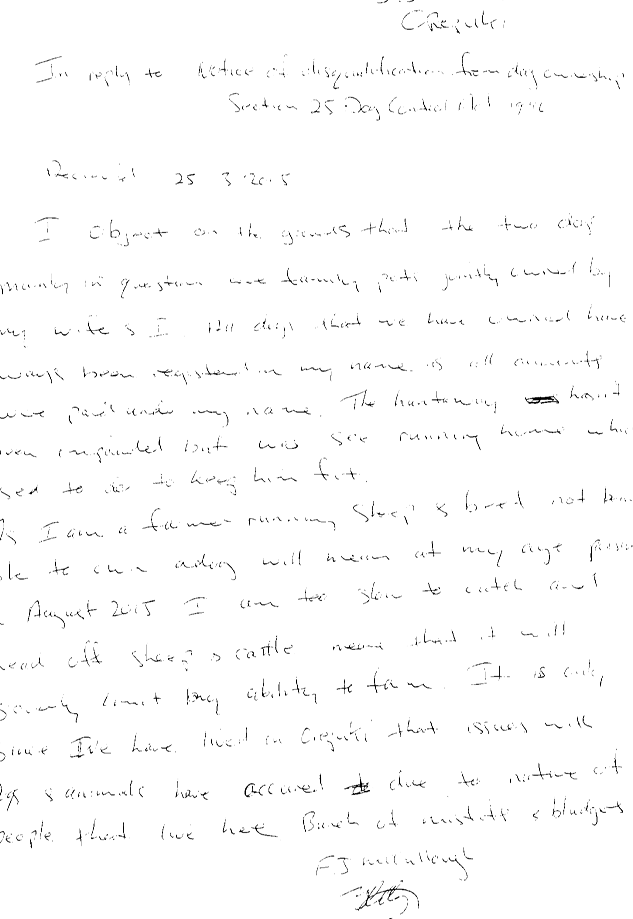

McCullough advises:

· Joint

ownership with his wife,

· Effect on his

ability to herd stock without working dogs,

· The character

of the town populace.

Any other relevant matters

18 Attack

post disqualification - on 18 April 2015 Council was notified of a sheep that

had been mauled, but still alive, at the corner of Salford Street and Dover

Street at Orepuki.

The Ranger attended and euthanised the sheep. Later, Mr

McCullough’s wife

Marg McCullough advised the Ranger that the sheep was theirs and the dog

belonged to their son Michael who was in Australia. Mr McCullough had the

dog destroyed (a Smithfield cross). Mr McCullough was issued an

infringement for failure to keep a dog under control, being a legal owner of

the dog by possession.

Factors to Consider

Legal and Statutory

Requirements

19 The

Dog Control Act provides:

“25 Disqualification

of owners

(1) A

territorial authority must disqualify a person from being an owner of a dog if —

(a) the

person commits 3 or more infringement offences (not relating to a single

incident or occasion) within a continuous period of 24 months; or

(1A) Subsection (1) does not apply

if the territorial authority is satisfied that the circumstances of the offence

or offences are such that—

(a)

disqualification is not warranted; or

(b) the

territorial authority will instead classify the person as a probationary owner

under Section 21.”

Community Views

20 The

public is particularly concerned about wandering dogs and irresponsible owners,

and expects Council to take appropriate action to protect communities.

Costs and Funding

21 Mr

McCullough is entitled to appeal the Council’s decision to the District

Court, and so there would be legal costs associated with any appeal process.

Policy Implications

22 Council’s

Dog Control Policy 2010 enables Council to accept the recommendation of this

report.

Analysis

Options Considered

23 The

following are the options for the Council to consider:

Analysis of Options

Option 1 - Uphold the disqualification.

|

Advantages

|

Disadvantages

|

|

· Prevents

Mr McCullough from owning a dog for a period, and during this period the

local community will have relief.

· Fulfils

the public expectation of firm action with irresponsible owners and wandering

dogs.

|

· None identified.

|

Option 2 - Bring forward the date of termination of the

disqualification.

|

Advantages

|

Disadvantages

|

|

· An option if the Council believes that the period of

disqualification is too long.

|

· The period of disqualification is reasonable in my view, given

Mr McCullough’s disregard for complying with dog control laws despite

efforts from dog control staff to resolve his non-complying.

|

Option 3 - Immediately terminate the disqualification.

|

Advantages

|

Disadvantages

|

|

· None identified.

|

· The criteria for disqualification has been met, and there is not

sufficient reason to terminate the disqualification.

|

Assessment of Significance

This decision is not considered

significant in terms of the decision-making requirements of the Local Government

Act 2002.

Recommended Option

24 Option 1 is

recommended. Mr McCullough has

shown considerable irresponsibility in dog ownership in repeatedly offending

under the Act. Despite a number of visits from

Animal Control staff encouraging Mr McCullough to be

more responsible he has failed to do so. In upholding the disqualification, the

Orepuki community will be protected during this period.

Next Steps

25 To give notice of this

decision to Mr McCullough in accordance with Section 26(4) of the

Dog Control Act 1996, and Dog Control staff will ensure that the

disqualification will be complied with.

Attachments

a Letter

of objection View

b Signed

Notice of Disqualification View

c Signed

Memo to Bruce Halligan View

|

Council

19 May 2015

|

|

Draft Submission to Rules Reduction Taskforce

Record No: R/15/4/6996

Author: Bruce

Halligan, GM - Environment and Community

Approved by: Steve Ruru,

Chief Executive

☒

Decision ☐ Recommendation ☐ Information

Purpose

1 A

draft submission has been prepared to the Government’s Rules Reduction

Taskforce.

The Council’s consideration of this draft submission is requested and if

the Council is comfortable with this submission, or subject to any amendments

which the Council may require, approval is sought to send this to the

Taskforce.

Executive

Summary

2 The

Government has initiated the Rules Reduction Taskforce, with a key aim being to

seek to focus on regulatory requirements which may impose additional costs and

delays to development activities for little or no added value. This

workstream has arisen from the Government’s initiatives to seek to manage

housing affordability and assist with increasing the supply of housing.

3 An

opportunity exists until 1 June 2015 for the Southland District Council to

lodge a submission to the Taskforce. A draft submission is attached as Attachment

A for the Council’s consideration.

|

Recommendation

That the Council:

a) Receives

the report titled “Draft Submission to Rules Reduction Taskforce”

dated 8 May 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Authorises

the Group Manager - Environment and Community to forward the submission to

the Taskforce before the closing date of 1 June 2015.

|

Content

Background

4 As

referred to above, the Government currently has a strong focus on improving

housing affordability and increasing the supply of housing, particularly in the

major metropolitan areas such as Auckland and Christchurch.

5 The

Rules Reduction Taskforce has been created to focus on identifying key

regulatory barriers to these goals, particularly any such barriers which may be

adding increased costs and delays for little demonstrable benefit.

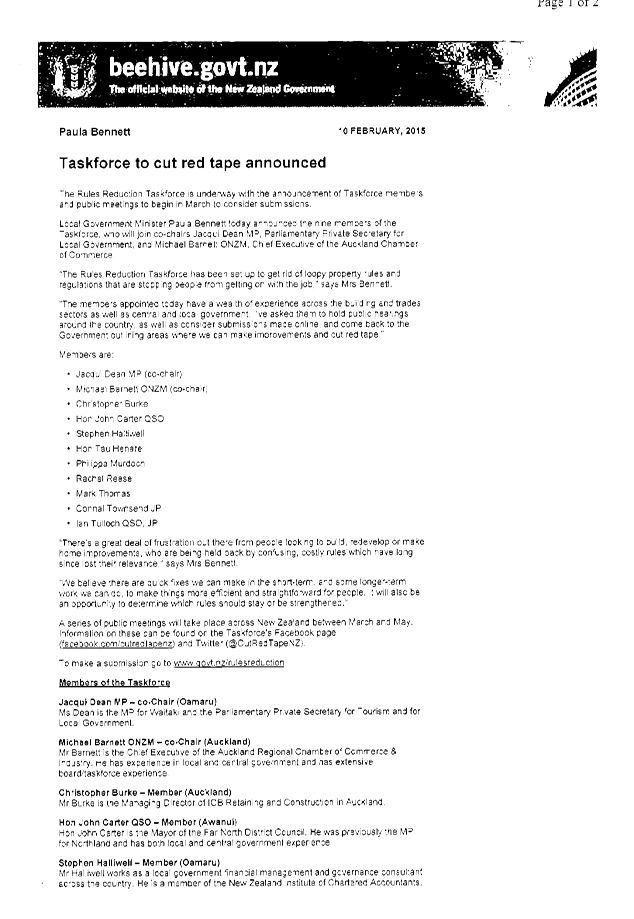

6 The

Taskforce itself is made up of a diverse range of representatives (see Attachment

B), with local representation for Southland included in the form of Mr Ian

Tulloch, QSM JP,

ex-Mayor of the Gore District Council. The Taskforce recently visited

Southland and Mayor Tong and other Council representatives were in attendance.

7 An

opportunity currently exists for any party to lodge a submission on this matter

until

1 June 2015. It is suggested that it is worthwhile for the Southland

District Council to present its perspectives on this issue, and hence a draft

submission has been prepared for the Council’s consideration and is

attached as Attachment A.

8 In

formulating this draft submission, I discussed this matter with the Chief

Executive, and also sought feedback from the Council’s second and third

tier Managers as to whether there were any rules and requirements which they

were regularly striking which were adding delays and costs for little

demonstrable benefit. The feedback received is reflected in the attached

submission.

9 As

stated in the draft submission, it is always worthwhile to put concerns about

local and central government rules in context, as there are usually “two

sides to the story”.

Just because one or more parties may have a concern about a rule, this does not

automatically mean it is flawed. Likewise, while some sectors are of the

view that there are too many rules governing some areas (eg management of the

environment), other sectors consider that there are not enough rules, and/or

that the rules that do exist are too weak. Often, rules that do exist are

there for important reasons, such as maintaining water quality or protection of

local biodiversity.

10 In

so saying, as stated in the draft submission, any rules which do exist should

be appropriate and necessary, and framed in such a way that they are

unambiguous and administratively efficient. The Southland District

Council has had a strong focus in the current District Plan review on removing

or minimising SDC planning rules which have generated consent requirements for

little value, and every effort has been made to minimise such rules in the

second generation District Plan.

Local Government New Zealand (LGNZ)

has prepared a submission to this process on behalf of this sector. I

have received a copy of the LGNZ submission. It seeks quite a wide range

of changes to many of the key Acts which councils administer. In

contrast, the Southland District Council submission is narrower and refers more

specifically to issues that this Council has experienced, although the two

submissions generally have no inconsistent content.

Issues

11 As

above.

Factors to Consider

Legal and Statutory Requirements

12 The

Rules Reduction Taskforce is a non-statutory initiative which the Council has

an opportunity to lodge a submission on, as does any other party, until 1 June

2015.

Community Views

13 Any

party may submit to the Rules Reduction Taskforce currently. When

considering its submission content, it is also important for SDC to recognise

that most, if not all, local and central government rules go through a submission

process before they are adopted.

Costs and Funding

14 There

are no costs in SDC lodging a submission. There are costs to business and

developers of regulatory compliance and this is a key focus of this Government

Taskforce initiative.

Policy Implications

15 There

are no specific policy implications for the Council in relation to this draft

submission.

Analysis

Options Considered

16 The

Council can either opt to submit on this matter or opt not to submit.

Analysis of Options

Option 1

17 Lodge

a submission to the Rules Reduction Taskforce.

|

Advantages

|

Disadvantages

|

|

· Enables

Council’s views to be factored into the broader discussion.

|

· If

the Council identifies specific provisions as a “problem” in its

draft submission, then the relevant agency may feel aggrieved by this.

|

Option 2

18 Do

not lodge a submission to the Rules Reduction Taskforce.

|

Advantages

|

Disadvantages

|

|

· No

risk of causing offence to any other regulatory agency.

|

· Does

not allow SDC’s views to be factored into the broader discussion.

As a regulatory agency itself, SDC has considerable experience with balancing

competing aspirations.

|

Assessment of Significance

19 This

matter is not considered significant in terms of the Local Government Act

2002.

It involves a public submission process, with any party having a right to

submit.

Recommended Option

20 Option

1 of lodging a submission is recommended. Accordingly, a draft submission

is attached as Attachment A for the Council’s consideration.

Due to the timing of the close of submissions of 1 June 2015, delegation is

also sought for the author to make any amendments requested to the draft

submission and send it away.

Next Steps

21 If

the Council is agreeable to the lodgement of a submission, approval from it is

sought to delegate to the Group Manager - Environment and Community to lodge a

submission on behalf of the Council before the closing date. Councillors

may also have their own views which could be discussed at the meeting on 19 May

on any matters they wish to raise not already covered in the draft submission.

Attachments

a Draft

Letter to Department of Internal Affairs - Submission from Southland District

Council - Rules Reduction Taskforce View

b Rules

Reduction Taskforce View

When replying please

quote: 140/20/3/1

14 May 2015

Rules Reduction

Department of Internal Affairs

PO Box 805

Wellington 6140

rulesreduction@dia.govt.nz

Dear Sir/Madam

Rules Reduction Taskforce - Submission from the Southland

District Council

Thank you for the opportunity to submit in relation to the

Government’s

Rules Reduction Taskforce initiative.

At the outset, the Council would note that it supports the

Government’s initiative to seek to identify and remove any rules which

may be creating unnecessary impediments and/or adding unnecessary costs.

The Council is also committed to streamlining its processes

and removing unnecessary costs where it can. By way of example, the

Council is nearing the conclusion of a review of its District Plan prepared

under the Resource Management Act 1991, in order to create a second generation

District Plan. An important part of that review process was identifying

and addressing rules in the Operative (first generation) Southland District

Plan which had generated the requirement for resource consents to be obtained,

but where this process had added little value. The new second generation

Southland District Plan has been significantly streamlined, and fewer

activities now trigger the requirement for resource consent.

While the Rules Reduction process is seeking identification

of unnecessary and/or frustrating rules, the Council considers that it is

important that this process be placed in the appropriate context.

Just because a party or parties may find a rule frustrating,

this does not necessarily mean that the rule itself is flawed, inappropriate

and/or unnecessary. Good examples would be many of the environmental

rules which councils administer. While some land owners may hold the view

that they should be able to do whatever they like on their own property, doing

so can often generate significant adverse effects on the environment and/or

adjoining owners and occupiers. Hence, many of these

“frustrating” local Council rules have been formulated to reflect

local conditions and topography and to protect a level of amenity for adjoining

owners.

In all of its activities, the Council carefully considers

available options (as required by the Local Government Act, and other

legislation) before deciding to implement any new rules. A rule is

only one way to approach a particular issue, with other options including

non-regulatory incentives and/or education, both of which can often achieve the

same or more than a rules-based approach and in a less adversarial way.

The Council see it as important that the Taskforce develop a

full understanding of the background and context within which rules were

originally established prior to recommending that they be abolished or

changed. In many instances it may well be appropriate that there be

changes made but in others there will be a bigger context which may not be well

understood by all.

The Council sought feedback from staff as to any rules which

those staff were regularly striking which were adding significant costs and/or

timeframes for little benefit.

Detailed below are areas in which the Council considers that

changes may be needed to existing rules and/or legislation.

Local Government Act 1974

Section 342 (1) (a) - Road stopping in rural areas needs

Ministerial approval - the Council’s query is why only in rural areas as

defined in District Plan, and why at all, given there is already a public

objection process? This is considered by Council to be just another step

to be undertaken which slows the overall process and adds additional processing

and approval cost for no benefit.

Section 345 (a) (1) - Stopped road must be sold at valuation

which creates problems with many enquiries failing to proceed on that

basis. The Council considers that this should be changed to provide for

disposal by agreement. Valuation is just one tool in the disposal negotiation

process. Sale value to a private party should be for Council to decide

after considering all the relevant issues.

Tenth Schedule, Section 1 - In road stoppings full survey

must be completed prior to the public objection process. This creates

significant expense up-front with no guarantee that the stopping itself will

proceed. This process should be in line with Resource Management Act 1991

subdivision consent processes, in that objections and processing could be done

on an initial scheme diagram, with full survey completed/required only if the

road stopping actually proceeds.

Public Works Act 1981

Section 62 (1) (b) - Compensation value - all negotiations

should be on willing buyer/willing seller basis with the funding organisation

determining how much it is prepared to pay. Current rules place

restrictions on this, which limits the ability to undertake negotiations which

could be beneficial to obtaining agreements above valuation and thereby

minimising delays to projects.

Section 20 (1) and Section 114(1) - Currently this requires

ministerial approval to issue

Gazette Notices to acquire property. This should be delegated to

territorial local authorities as the current process creates delays and

additional costs for no benefit. Councils can acquire all of a title

without reference or approval from the Minister, yet to acquire part of a

title, which in most cases is a fraction of the whole title creates additional

costs as councils need Ministerial approval and have to pay for that approval.

Cadastral Survey Act 2002

Recent amendment to rules regarding completion of cadastral

surveys for road legalisation (proclamation surveys) now require the surveyor

to define the balance of the property to full survey standards. This adds

considerable cost to survey and thus the ratepayers to fix any historical

errors which the survey may uncover. The cost of fixing these errors

should not fall on ratepayers but rather on the Crown whose record it is.

Heritage New Zealand - identification of archaeological

sites in District Plans

Like most councils, in its District Plan the Southland

District Council has been requested to identify sites of archaeological

significance by Heritage New Zealand. There are several hundred such

identifiers on the Southland District Plan planning maps, with an associated

rules regime which can sometimes trigger the requirement for resource

consents. This can create delay and additional costs for consent

applicants.

It is noted that such sites are already protected by the

Heritage New Zealand

Pouhere Taonga Act 2014, whereby an archaeological authority is required from

Heritage New Zealand to modify, destroy or damage the site.

The Council would query whether this dual level of

protection is necessary as it no doubt contributes to many resource consents

being required across the country. It is suggested that the approval

process under the Heritage New Zealand Pouhere Taonga Act 2014 would

suffice.

Also, some of these archaeological sites are records of an

historic find and there may or may not be any material still present of

archaeological significance. The records held are often also not precise

in terms of the actual location of the site. Further refinement of the

location of such sites and the significance of the site would be useful to remove

or mitigate uncertainty.

Earthquake-prone Buildings Regime

While Council has submitted separately on the proposed

legislative changes to address earthquake prone building risks it wishes

to emphasise that the final shape of this legislation will be of

considerable importance to communities in terms of the ease to which it

provides for adaptive reuse and future development of buildings.

While recognising the importance of public safety, as

illustrated in the Christchurch earthquake, the Council is supportive of a form

of regime which recognises relative risks in differing contexts, eg an isolated

rural church used once a month versus a multi-storey commercial building in a

major urban centre where 200 plus people work every day.

The final shape of this legislation is crucial to the future

of Southland District and other rural communities, where the current economic

climate would make the costs, processes and delays of a very onerous

strengthening regime very difficult to bear for building owners.

This could lead to ‘demolition by neglect’ where building

owners could simply ‘walk away’ from their buildings or undertake

no upgrading or preventative maintenance.

In summary, the Council supports, in principle, the focus on

removing unnecessary impediments to economic activity and property development,

but also hopes that the Taskforce recognises that some rules are designed to

maintain environmental and amenity values.

This submission was considered and endorsed by the Council

prior to it being forwarded to the Department.

If you require any additional information, please do not

hesitate to contact the undersigned on 0800 732 732 or bruce.halligan@southlanddc.govt.nz

Yours faithfully

B G Halligan

GROUP MANAGER - ENVIRONMENT AND COMMUNITY

|

Council

19 May 2015

|

|

Long Term Plan 2015-2025 - Public Consultation and

Feedback

Record No: R/15/4/7409

Author: Susan

Cuthbert, Strategy and Policy Manager

Approved by: Rex Capil,

Group Manager, Policy and Community

☐

Decision ☐ Recommendation ☒ Information

Purpose

1 The

purpose of this report is to set out the public submissions and informal

feedback received during Council’s Long Term Plan public consultation

period 21 March - 21 April 2015.

Executive

Summary

2 Council

adopted the consultation document for Southland District Council’s 10

Year Plan “Working together for Southland’s future” on 18

March 2015 and public consultation on the consultation document and supporting

information occurred from 21 March to 21 April 2015. 120 submissions were

received which have been compiled into a separate submissions booklet and made

publicly available. As part of the public consultation process, Council

also ran six drop in sessions whereby elected members received informal

feedback, as well as receiving feedback via social media. The informal

feedback received is attached.

|

Recommendation

That the Council:

a) Receives

the report titled “Long Term Plan 2015-2025 - Public Consultation and

Feedback” dated 12 May 2015.

b) Receives

the public submissions received on the Long Term Plan 2015-2025 including the

four late submissions.

c) Receives

the informal feedback received at the six drop-in sessions held throughout

the District and received via social media during the Long Term Plan

2015-2025 consultation period.

|

Content

Background

3 Council

is required to use the special consultative procedure in adopting a Long Term

Plan (LTP). This requirement includes preparing a consultation document

that captures the big issues affecting the District and ensuring the document

is publicly available for not less than one month.

4 Council

adopted the consultation document for Southland District Council’s 10

Year Plan “Working together for Southland’s future” on 18

March 2015 and public consultation on the consultation document and supporting

information occurred from 21 March to 21 April 2015. The public consultation

period was advertised by newspaper and radio, and the consultation document was

distributed to all households in the District and posted to non-residential

ratepayers. Individual letters were sent to key stakeholders and

ratepayers who were substantially affected by the proposals.

5 120

submissions were received, including four late submissions.

|

LTP

Year

|

2009

|

2012

|

2015

|

|

No.

submissions

|

201

|

230

|

120

|

6 The

submissions have been compiled into a separate booklet and are available on

Council’s website and at Southland District Council offices. One

submission received did not include a name or address and so has not been

included in the submission booklet.

7 The

table below sets out how the public submissions were received.

Surprisingly, a large number of submissions were received via the online

submission form.

|

All Submissions by

Method Received

|

|

Submission Method

|

Number Received

|

Percentage

|

|

Email

|

12

|

10%

|

|

Letter

|

8

|

7%

|

|

Online

Form

|

61

|

52%

|

|

Submission

Form Insert

|

36

|

31%

|

|

Total

|

117

|

100%

|

8 In

addition to receiving formal submissions, Council decided to take two new

approaches to receiving informal feedback on the Long Term Plan issues.

The first was to run drop in sessions in Wyndham, Lumsden, Otautau, Stewart

Island, Te Anau and Winton to hear from people who might want to discuss issues

with elected members and Council officers in a more relaxed forum. These

meetings occurred between 8 - 15 April 2015 and each of the meetings took

around two hours.

9 While

the turnout was low (maximum number of attendees was 13 members of the public

at Wyndham) some useful conversations took place. The majority of issues

raised were of a local nature and a number of request for services

resulted. The feedback received at the meetings is attached. The

operational requests received have been forwarded on to Council officers to

action.

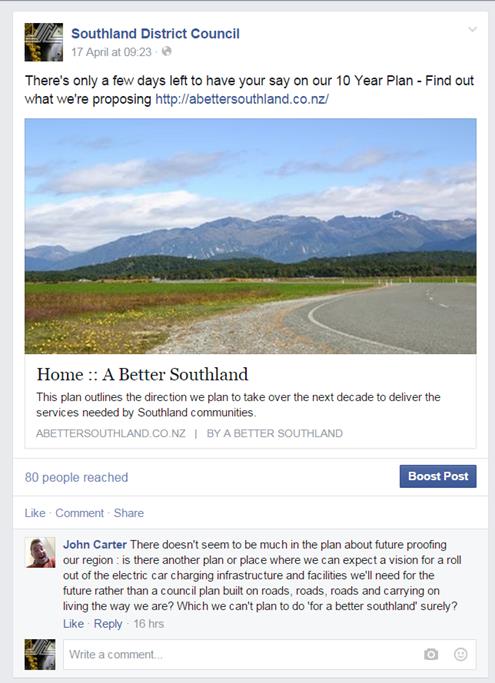

10 Secondly,

Council made it publicly known that it was open to receiving comments via its

Facebook page. Only one comment was received and is attached.

11 When

considering the Long Term Plan issues during deliberations, Council is asked to

take into account the informal feedback received.

12 Hearings

Council will be hearing formal

submissions from interested persons at a Council meeting on 19 and 20 May 2015.

13 A

total of 26 have indicated that they wish to speak to their submissions.

The hearings have been arranged to occur in Invercargill although

teleconference facilities have been made available at Te Anau.

14 The

process for hearing the submissions is as follows:

|

Tuesday, 19 from 9.00 am

|

Hear submitters wishing to speak to their submissions.

|

|

Wednesday, 20 May from 9.00 am

|

Hear submitters wishing to speak to their submissions

After morning tea, begin to deliberate on Long Term

Plan issues.

|

|

Thursday, 21 May

|

Deliberate on Long Term Plan issues.

|

Responding to submitters

15 Following

the submission hearings and Council deliberations on the Long Term Plan issues,

a set of meeting minutes will be produced that set out Council’s

decisions. These minutes will be made available on the Southland District

Council’s website and will also be sent to submitters to inform them of

Council’s decisions. Note, this process has changed from previous

years.

Issues

16 The

topics which have been submitted on are listed below. Note these do not

add to 120 as submitters can submit on more than 1 topic.

|

Submissions topic

|

Number

|

|

Maintaining Roads and levels of service

|

50

|

|

Roading Rate model

|

43

|

|

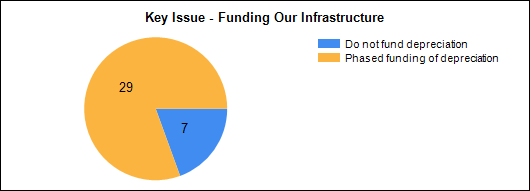

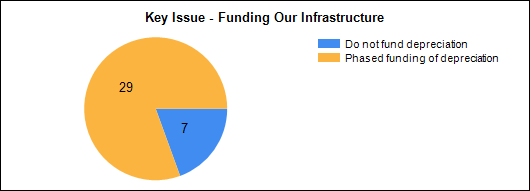

Funding infrastructure and depreciation

|

36

|

|

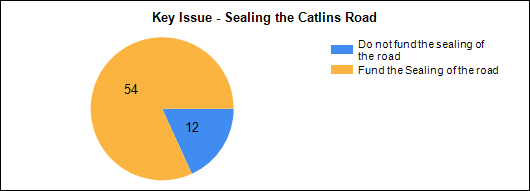

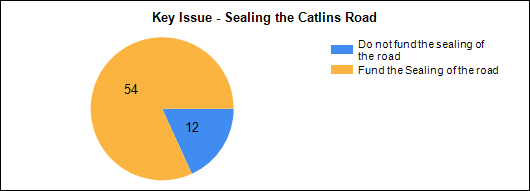

Sealing the Catlins' road

|

66

|

|

Financial issues and rating

|

23

|

|

Rating differential

|

1

|

|

Fees and charges

|

9

|

|

Funding and grant requests

|

9

|

|

Performance measures

|

1

|

|

Around the mountains cycle trail

|

3

|

|

Curio Bay wastewater project

|

10

|

|

Manapouri Wastewater upgrade

|

1

|

|

District and local issues

|

30

|

|

Operational matters

|

6

|

|

Early Payment of Rates

|

4

|

|

Remission and Postponement of Rates

|

4

|

|

Remission and Postponement of Rates on Maori Freehold land

|

6

|

|

Development and Financial Contributions Policy

|

5

|

17 A

suite of issues and options papers have been compiled under cover of a separate

report to assist Council to finalise its draft Long Term Plan.

Factors to Consider

Legal and Statutory Requirements

18 Council

is required in the course of its decision-making process in relation to a

matter to give consideration to the views and preferences of persons likely to

be affected by, or to have an interest in the matter (Section 78 Local

Government Act 2002 (LGA)].

19 The

views presented to the local authority should be received by the local

authority with an open mind and should be given by the local authority, in

making a decision, due consideration (Section 82(e) LGA).

Community Views

20 The

submissions and informal feedback received represent the views of the Southland

District residents, ratepayers and customers.

Costs and Funding

21 Not

applicable.

Policy Implications

22 Council

must adopt a Long Term Plan by 1 July 2015. In finalising the proposals

in its draft Long Term Plan and supporting information documents, Council is

required to take into account the views of the community.

Recommended Option

23 Council

is asked to receive the submissions and informal feedback it has received as

part of the Long Term Plan public consultation process.

Next Steps

24 Council

will be asked to hear oral submissions and consider the issues arising out of

the public submissions at its meeting on 19 - 21 May 2015.

Attachments

a LTP

2015-2025 Feedback received via social media View

b Notes

from LTP 2015-2025 drop in sessions View

Feedback from

our Facebook page relating to the 10 Year Plan:

20/04/2015

John Carter

There doesn't seem to be much in the plan about future proofing our

region : is there another plan or place where we can expect a vision for a roll

out of the electric car charging infrastructure and facilities we'll need for

the future rather than a council plan built on roads, roads, roads and carrying

on living the way we are? Which we can't plan to do 'for a better southland'

surely?

WYNDHAM SESSION

Johanna Stewart

General Discussions

· What

the issues are.

· How

this impacts rates.

Other Comments

· Rates

increase 2 x properties.

· Edendale/Wyndham

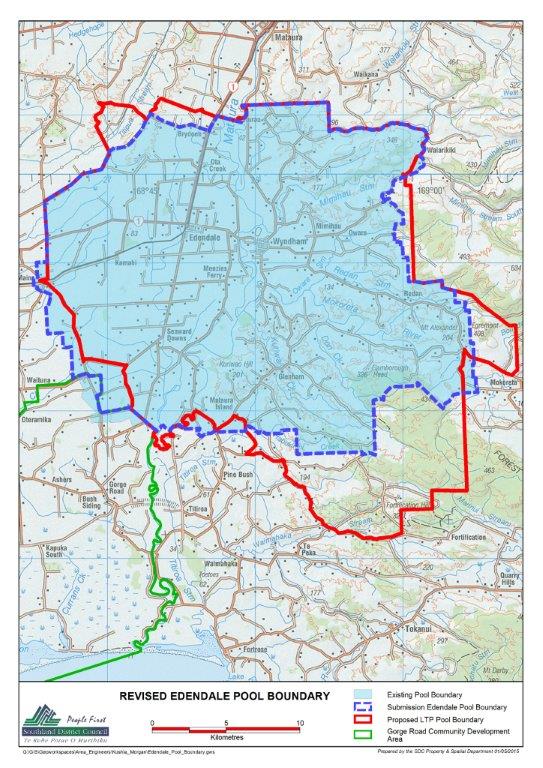

pool boundary.

Alistair Wilson

Other Comments

· Roading

- look at innovative ways.

· Can

you close some roads to heavy traffic and put on alternative roads.

Emma Keen, Abbey Barron,

Sarah-Lee Gutsell

Other Comments

· Wyndham

pool rating process.

· Walkway

from Wyndham-Edendale.

Sarah-Lee Gutsell

Other Comments

· Drain

outside - floods footpath - still ongoing issue.

Alan Leitch

Other Comments

· Cycle

Trail - main issue is the option of the Mararoa. How is maintenance

funded. Are all ratepayers paying? The Mararoa option could have

been built easily. What about the section on Mount Nicholas Road,

that will be a dusty road. Does not believe the vehicle counts presented

at the hearing.

Simon McRae

1623 Wyndham-Mokoreta Road

Other Comments

· Concerns

about local pool - not anti-Edendale.

· Disquiet

rates not helping fund the Wyndham pool.

· Congestion

at Edendale pool.

· Bobbi

Brown commented - letter going to people from Board asking for feedback on

splitting rate.

· Swipe

card.

· Merged

Edendale-Wyndham - conflicted.

· Local

people like making own decisions.

· Wyndham

projects?

- Cellphone

coverage and internet.

- Widespread

endorsement for the pool.

- Pavements

needing concrete - older population.

- Great

to have rates under inflation rate.

· Mokoreta

Hall:

- Overdue

for repairs and maintenance work.

- Lifted

rates for hall from $23 to $90.

- Interviewed

everyone.

- Whole

community using it.

- Great

advertisement for communities working together.

- Road

busy.

Ross Melvin

Inkermann Street

Other Comments

· Footpaths

in Wyndham and the condition particularly Inkermann Street and the fact the

footpath on one side.

· Water

also runs into my section - stormwater issues (Inkermann Street). For me

to get onto footpath I have to go across the road. Wheelchair access -

difficult on footpaths and crossing.

· Cardigan

Road difficult - height of the steps into shops.

Brian Mason

Other Comments

Halls

· Edendale/Wyndham

- re Edendale proposal. Rugby Club lack of consultation with the

people. Thought that 98 out of 100 people asked thought the centre should

be west of the tracks. Why is it not in LTP?

· Main

concern is it is not in LTP.

Mac Todd

Other Comments

· Community

hall at Edendale. Parking space not available there. Growth in Edendale

has been to the east of railway.

· Positioning

of the community centre.

· Not

sufficient parking space for parking at community centre.

· Would

be good if Community Boards reported back through local newspaper - abbreviated

minutes.

Iris Everett

17 Malta Street, Wyndham

Sealing the final sections of

the Catlins Road

· Not

sure whether this a good thing or not.

Other Comments

· Rates

- keep them as low as possible.

· Library

- not always open.

· Need

to get younger people on board.

· Name

down for a flat.

Calyn Stewart

Other Comments

· Recycling

outside of the dump would be great.

· Disagree

with the boundary for the Wyndham pool. From the pool rate there should

be support for the Wyndham pool.

· I

still think the boundary is wrong for the Community Board - Fortification should

be in Tokanui and Mokoreta should be in Wyndham.

Ben Dooley

145 Mimihau School Road, RD 2,

Wyndham - (03) 206 4681 cobb808@hotmail.com

Other Comments

· Re

dogs and fines. Current reg pricing appealing the fines - sent back 10

days. Information - dogs reg two years ago - waiver signed.

· Thanks

for the work - there is a cost of the roads.

· Improvement

in river near us.

· About

time things tightened.

· Urea.

· Full

supporter.

LUMSDEN SESSION

Ian Canning / George Menlove

Other Comments

· Consultation

document only has one Lumsden issue - 43 and 45 Meadow Street. Flooding

off road into garage. The pipes aren’t big enough to take the

water. Accessway pipes too small. No work in Meadow Street for

years. No footpath at all, there is room for a path.

· Grass

mowing only seems to happen when it rains.

OTAUTAU SESSION

Ken Davidson

Other Comments

· Yellow

wheelie bin collected once a month.

· Rates

going up too much.

· No

services on his batch, rates are still nearly $1,000.

Andre

Managing our Roads and

Customer Expectations

· Why

not use rail for transporting goods instead of larger trucks 58T.

· Why

have large vehicles that impact on road quality.

· Need

to put ideas forward to central government.

Roading Rate Model

· Should

we be targeting specific users as they will forward the cost to consumers.

Sealing the Final Section of

the Catlins Road

· Agree

in concept.

Funding Depreciation

· Agree

that best method, so long as cost effective - affordability issues.

Other Comments

· Need

to utilise rail.

· Cost

of consulting - LTP, consultation document.

· Community

Engagement - need to increase to ensure ownership of issues.

Otautau Community Board

Member Ken Davidson

Other Comments

· Concerned

that the Community Board did not choose the projects to be included in the

consultation document.

· Need

to get clarification back on the following being included:

- Prune

trees

- Carpark

extension north end

- Sewerage

- Clitheroe Street

- Water

main replaced - district project still in?

- Asphalt

railway line (going on for two years).

Bruce and Jean Riddle

Managing our Roads and

Customer Expectations

· Noted

the changing use of roads over many years, and the importance of those who do

the damage pay for it.

· Respectful

of what we are trying to do with the 80/20 rule.

Funding Depreciation

· Concerned

that we had already paid for the road and we were collecting again.

They did not pick up that the next replacement would be funded from the

depreciation.

Other Comments

· They

are on fixed incomes. Any changes is significant for them.

· Very

concerned that the cycle trail will be funded from general ratepayers and they

see no benefit in this area.

· They

live beside a gravel road and cannot afford the “liability”

insurance we require for application of oil, even if they could get the oil for

free and also the $60 fee we would charge.

Mary Napper

Sealing the Final Section of

the Catlins Road

· How

to get hold of a grader? Snow on willows that break on to road reserve.

Other Comments

· Dog

Control review.

· Greater

cost should be apportioned to general rate.

· Cats

- owners having too many. Problem with neighbour with lots of cats in

Riverton.

· Footpaths

- why not just decide to have footpath on one side - cost savings.

· SouthRoads

much better but maintenance not lasting. Vehicles going too fast and

breaking causing corrugations. Wants more signage with speed limits.

· Wether

Hill Road, Beaumont Station Road, Wilanda Downs Road only getting service on

gravel roads when lodge service request. Roads - standards are dropping.

Dangerous on foggy days.

Maureen Johnson

Other Comments

Dog Control Review

· Concerned

that irresponsible dog owner won’t get registered; that responsible

owners will get kicked with extra cost.

STEWART

ISLAND SESSION

Helen Cave

Managing our Roads and

Customer Expectations

· Additional

chains onto road at Halfmoon Bay.

· Footpath

at the back of hotel - tiles have dropped and road to have sand placed

underneath.

· Public

toilet in community centre - cleaning standards.

· Drain

by community centre - need to check levels of drain.

Other Comments

· Hotel

licensing - not being processing. Licence expired in hotel.

· Bike

track to Masons Bay.

· Internet

and phone line to Horseshoe Bay.

· Bus

parks should be developed at popular stopping spots around the Island.

Ann Pullen

Other Comments

· Horseshoe

Bay Road - concrete bridge - should continue footpath from Kamahi Road to

bridge.

Helen Bissland

5 Golden Bay Road

Roading Rate Model

· Access

to Ringaringa beaches - build walking access to get down.

Other Comments

· Page

25 - Golden Bay to Fuschia Walkway - Footpath start at beginning of

Golden Bay Road.

John Foley

Other Comments

· Golden

Bay Road - Old concrete wall - antique wall. Embankment getting wider ie

scouring out from behind the wall.

· Also

run-off through road culvert into his property. Has an outlet (elephant

trunk) attached.

Beverly Osborn

Main Road

Other Comments

· Road

up to Presbyterian church.

· Church

Hill restaurant wants to build chalets.

· Concerned

about the strength of the road, it always seems damp.

· Shirley

Whipp’s house/property fronts on Horseshoe Bay Road and backs onto the

church property. So it could serve as an alternative access to the church

and other properties.

Furhana Ahmad

Managing our Roads and

Customer Expectations

· Public

signage for track work and public health.

Roading Rate Model

· DOC

good connection with Community Board.

Other Comments

· RMA/District

Plan

- Can’t run office and

backpackers in the same building.

- Guidelines are too strict.

- Street

signs for properties, Public Places Bylaw for sandwich signs except for Council

activity in residential zone.

· Governance

- Stewart Island Promotions Association to communicate with the Promotions

Officer and Ulva Island Trust.

· Horseshoe

Bay - beach seat - Resource Management Plan - resource consent decision.

Go back to Furhana.

· Enter

into the Resource Management Plan next due to be received.

· Response

to questions asked in public forum.

· Jetties

Committee

- membership

- Council

subcommittee appointment term.

· What

about road carpark markings

TE ANAU

SESSION - 14 APRIL 2015 - 4.00 PM - 6.00 PM

Irene Barnes

Other Comments

· Frasers

Beach Road bad - grader dragging gravel from one side to the other.

· Type

of gravel and how being done.

· Possible

sealing will help with dust.

· Still

confusion about what roads are managed by who.

· Swimming

pools so important - good to see SDC supporting Blackmount.

Shirley Mouat

Managing our Roads and

Customer Expectations

· Consider

Otta sealing of Murrell Avenue down towards Possum Lodge when doing

View Street.

Roading Rate Model

· Support

user-pays on roading. Cars have minimal damage, make those sectors which

generate the damage pay for it.

Sealing the Final Section of

the Catlins Road

· Support.

Getting money from central government. Helps with economic benefit from

tourist traffic.

Other Comments

· Concerned

about the cost of water supply upgrading - cost per resident represents a lot

of money for a small community. Requests more specifics on details of

this cost.

· Cost

of Manapouri sewage - $2.7 million is a big spend for the community. Need

to consider all alternatives, not just proposed connection to Te Anau wastewater.

Keep an open mind to all options.

· Not

enough time to submit - consider extending to 30 April if possible.

Samantha McBride

Other Comments

· Provision

of funding for airport and the use of it.

- Marketing

for users and businesses.

- Should

be in 10 Year Plan - just needs to be done.

- Not

our responsibility to increase the use of airport.

- We

provide the hangars.

· Council

needs to:

- Work

out how best to do this and how to resource it.

- Some

co-ordination for packaging demand.

- We

might think outside the box of what flights could be - is it passenger and

freight.

- Cray8

is looking at it.

- Is

Christchurch - Wanaka - Te Anau a viable option.

· Change

names of Te Anau and Manapouri to Lake Te Anau and Lake Manapouri to be seen as

the destination to go to - marketing perspective.

· Local

economic development - to generate more opportunity for the town. Venture

Southland role marketing - to create business cohesion. Chamber concept?

Ray Willett

Managing our Roads and Customer

Expectations

· Commented

on road signage. Referred to Dunedin sign with “Thank you for

staying with us and have a safe journey”.

· Stated

we should have them at all accommodation in multi-languages saying “Thank you

for staying with us. Please keep left.” Use example of

Milford Road. Where the road is “good” (i.e. well maintained

and straight) is where most fatalities occur - this is because of driver

behavour.

Other Comments

· Submitter

warns against investment in under researched projects citing the public toilets

and the airport. Submitter says these do not generate income as they had

proposed in business cases.

· Supports

local cycle trail development.

· Queries

carparking availability for cycle trail.

· Does

not agree that ATMCT will significantly disturb livestock.

Bev Thorne / Mary Cowan

Other Comments

· Ageing

population.

- Availability of facilities.

- Aged

care - not necessarily palliative care just self-contained units at a

reasonable price.

· Queried

sale of land around sewerage scheme. Sought further comment on

alternative systems. Queried the location in Manapouri as to whether Te

Anau site could be redeveloped.

· Peer

review of sewerage system proposal mentioned by Ian Marshall.

· Queried

ATMC coming to Te Anau. Was informed that there is currently a local

cycle trail being developed.

· Objects

to the fact that DOC Conservation Management Strategy does not allow cycling in

Fiordland National Park. This prevents cycle trail development and limits

the viability of a fantastic tourist product. Agrees it is a DOC issue

and a political issue but Council should lobby for change.

Ted Loose

Managing our Roads and

Customer Expectations

· Thinks

amalgamation would save dollars that could be spent on roading.

Sealing the Final Section of

the Catlins Road

· Supports.

Other Comments

· Amalgamation

- is pro-amalgamation for Southland District Council, Gore District Council,

Environment Southland and Invercargill City Council.

- Strength

in numbers in terms of advocacy - if we are speaking with one voice.

- SDC

staff interests may not necessarily be the same as those of District residents

as the majority live in Invercargill.

- This

would reduce overhead costs for things such as planning.

· Does

not wish for rates to keep increasing as affordability in Te Anau is

challenging even now.

· If

amalgamation was to occur, would support fewer Community Boards and no

Community Development Area Subcommittees.

Max Slee

Other Comments

· Rates

at Mountain View Road going up.

· Typical

of values in Te Anau - $500,000 land GV $1.2M - rates should be on land value

opposed to GV this year.

· Like

cycle trail from Te Anau to Manapouri.

· Mavora

Lakes Road from Burwood:

- 7

km of gravel road - maintenance poor.

- The

road is the worst piece driven on (just spent time driving 2,000 km on my

tractor on New Zealand).

- Grader

came but made no difference because of hard base.

- Lot

of tonnage done on the road.

· Nothing

worst than seeing wastage.

· 60%

loading on one-way bridges.

· Over

that there are 40,000-50,000 SU farmed.

· Guy

from Dunedin talking regarding rating. He said you guys will have to put

your hands in your pockets.

- Come

back and talk to us regarding the loadings.

- In

practical terms we should not be using it, but we have to.

- It

is on the roading programme for 2017/2018.

· Costs

of appeal of the cycle trail:

- We

should be going to Fish & Game for costs as people aren’t happy.

- We

maintain 20 km river for fishing people - acting like spoilt people.

Merv Cave

Other Comments

· Cycle

trail - trying to give SDC a road at no cost through Haast but cycle trail

spending.

- Gary

said no ratepayer dollars on second stage but there is, but Haast still no

go.

- Someone

needs to convince me that the cycle trail is of value.

- If

not putting our rates up, then not a problem.

· Blackmount

Road - dangerous approaches to one-lane bridge.

· Mossburn-Wreys

Bush the same.

· All

for Te Anau-Manapouri Road cycle trail - lots of people on it.

· Ongoing

commitment to trail is my concern.

· I

can’t see how it can be user-pays because I know cyclists and they

don’t want to pay for accommodations.

· Not

a lot of people on it now.

· Roading

- went to the meeting road users charges:

- Explained

about Venture project.

P C Taylor

Other Comments

· Cycle

trail - some sympathy for Fish & Game:

- Are

alternatives there for peace and quiet

· Haast

Hollyford

- Not

in favour.

- Transport

would change - logging trucks etc / changes the landscapes.

- Opportunity

lost if we did it.

- Replace

roads - greater lifespan - need to ensure greater maintenance - roading a

big cost.

· Te

Anau - Manapouri cycle trail is a link we must have.

WINTON SESSION

Frank O’Boyle, South

Port

Other Comments

· General

discussion on:

- Renewable Energy - Stewart

Island

- Stewart Island

infrastructure

- Cruise

ships

Ray Wilson

Managing our Roads and

Customer Expectations

· Support

the regime whereby those who generate the damage pay.

Roading Rate Model

· Support

the regime whereby those who generate the damage pay.

Sealing the Final Section of

the Catlins Road

· Support

the sealing of the road (spelling - should be “accessible”

not “assessable”).

Other Comments

· Wishes

to ensure that Southland is strongly involved in the lobbying for further

development of Broadband.

· This

is very important for the future development of Southland District and in

particular the tourist sector.

|

Council

19 May 2015

|

|

Council Officers' Amendments to the Long Term Plan

2015-2025 and Supporting Information Documents

Record No: R/15/4/7408

Author: Susan

Cuthbert, Strategy and Policy Manager

Approved by: Rex Capil,

Group Manager, Policy and Community

☐

Decision ☐ Recommendation ☒ Information

Purpose

1 This

report proposes changes to the draft Long Term Plan 2015-2025 (LTP) and/or

supporting information as requested by Council officers for the purposes of

accuracy or clarification. It also provides an update around New Zealand

Transport Authority (NZTA) funding.

Executive

Summary

2 The

proposed amendments to the draft LTP, as requested by Council officers, are set

out in this report. The recommended amendments have been incorporated

into the key issues papers under cover of a separate Council report.

|

Recommendation

That the Council:

a) Receives

the report titled “Council Officers' Amendments to the Long Term Plan

2015-2025 and Supporting Information Documents” dated 12 May 2015.

|

Content

Background

3 This

report proposes changes to the Long Term Plan and/or supporting information as

requested by Council officers. These changes are considered necessary for

accuracy or clarification.

4 Council

is asked to receive this set of proposed amendments for the purposes of

deliberating on the Long Term Plan. The recommended amendments have been

incorporated into the key issues papers under cover of a separate Council

report.

Proposed Amendments

5 The

proposed amendments are set out in the below table:

|

Issue:

|

Using the depreciation reserve generated by funding

depreciation for District Sewerage to fund capital projects included in the

Long Term Plan

|

|

Amendment required:

|

The draft Long Term Plan had funds raised from the

policy to fund depreciation accumulating into rate specific reserves.

The specific reserve for District Wastewater is $8,069,981 at the end of 10

years.

In the draft Long Term Plan some capital work in this

activity is funded by internal loans.

This amendment is to utilise the available depreciation

reserve for District Wastewater to fund capital works being completed, rather

than using loans while accumulating a reserve. It is proposed where

there is there is current year funding for deprecation or accumulated amounts

in the reserve they be applied to capital work being completed in the first

instance.

The amendment does not use any additional funds in the

proposed depreciation reserve to repay existing debt quicker.

|

|

Other comments:

|

Should the proposed amendment be accepted the balance

of the Depreciation Reserve for District Wastewater would be $2.893.834.

|

|

Documents that will require amendment:

|

Long Term Plan and Wastewater Asset Management Plan

|

|

Council officer:

|

Susan McNamara

|

|

Issue:

|

Using the depreciation reserve generated by funding

depreciation for District Water to fund capital projects included in the Long

Term Plan

|

|

Amendment required:

|

The draft Long Term Plan had funds raised from the

policy to fund depreciation accumulating into rate specific reserves.

The specific reserve for District Water is $5,030,022 at the end of 10

years.

In the draft Long Term Plan some capital work in this

activity is funded by internal loans.

This amendment is to utilise the available depreciation

reserve for District Water to fund capital works being completed, rather than

using loans while accumulating a reserve. It is proposed where there is

current year funding for deprecation or accumulated amounts in the reserve

they be applied to capital work being completed in the first instance.

The amendment does not use any additional funds in the

proposed depreciation reserve to repay existing debt quicker.

|

|

Other comments:

|

Should the proposed amendment be accepted the balance

of the Depreciation Reserve for District Sewerage would be $855,147.

|

|

Documents that will require amendment:

|

Long Term Plan and Water Supply Asset Management Plan

|

|

Council officer:

|

Susan McNamara

|

|

Issue:

|

Using the depreciation reserve generated by funding

depreciation for Te Anau Rural Water Supply to fund capital projects included

in the Long Term Plan

|

|

Amendment required:

|

The draft Long Term Plan had funds raised from the

policy to fund depreciation accumulating into rate specific reserves.

This results into a rate specific depreciation reserves. The specific

reserve for Te Anau Rural Water is $702,260 at the end of 10 years.

In the draft Long Term Plan some capital work in this

activity is funded by internal loans.

This amendment is to utilise the available

depreciation reserve for Te Anau Rural Water to fund capital works being

completed, rather than using loans while accumulating a reserve. It is

proposed where there is current year funding for deprecation or accumulated

amounts in the reserve they be applied to capital work being completed in the

first instance.

The amendment does not use any additional funds in the

proposed depreciation reserve to repay existing debt quicker.

|

|

Other comments:

|

Should the proposed amendment be accepted the balance

of the Depreciation Reserve for Te Anau Rural Water would be $248,485.

|

|

Documents that will require amendment:

|

Long Term Plan and Water Supply Asset Management Plan

|

|

Council officer:

|

Susan McNamara

|

|

Issue:

|

LTP - Addition of Two Wastewater Projects in

Riverton

|

|

Amendment required:

|

The addition of two additional wastewater related

projects within Riverton - due to health and safety requirements.

As outlined below:

1. Riverton

WWPS RPZ Project- $50K year to complete 2015/2016.

2. Riverton

WWMH Dropper Renewals Project $80K year to complete 2015/2016.

|

|

Documents that will require amendment:

|

Long Term Plan and Wastewater Asset Management Plan

|

|

Council officer:

|

Matt Keil

|

|

Issue:

|

Stormwater Renewals / Repairs in Tokanui

|

|

Amendment required:

|

Renewal of section of stormwater main culverts (900 mm

dia, approximately 40 metres in length) required in next three -

five years. Line currently piped under the Fire Station, will

need a new line laid with new alignment and access chamber, not going under a

building. Estimated cost circa $48K.

|

|

Documents that will require amendment:

|

LTP. Stormwater AMP

|

|

Council officer:

|

Kushla Tapper

|

|

Issue:

|

Edendale Community Centre

|

|

Amendment required:

|

Inclusion in Long Term Plan

for year 2016/2017 a $500,000.00 capital project (renewal) to provide a

community centre in Edendale.

|

|

Documents that will require amendment:

|

Community Centres Asset

Management Plan and budgets will need to be amended. This will also

affect the wording in the Long Term Plan document.

|

|

Council officer:

|

Kevin McNaught and Juanita Thornton

|

|

Issue:

|

Verandah Lighting in Winton

|

|

Amendment required:

|

The under verandah lighting description is displayed

in the Schedule of Fees and Charges for the coming financial year as a charge

to be levied against the shop owners whose premises are adjacent to the

lighting provided. This charge is proposed at $45 per light in the Long

Term Plan. The Winton Community Board resolved that due to a wider

public benefit ie, pedestrians at night for safety reasons, and visitors

through the town for amenity value to remove the fee from the schedule and fund

all expense from the local Winton rate.

|

|

Documents that will require amendment:

|

Schedule of Fees and Charges, Long Term Plan

|

|

Council officer:

|

Joshua Webb

|

|

Issue:

|

Heavy Traffic Bypass Feasibility Study for Winton

|

|

Amendment required:

|

Remove the project from Winton township as agreed by

the Board as of 2 February 2015

|

|

Documents that will require amendment:

|

Roading Asset Management Plan, Long Term Plan

|

|

Council officer:

|

Chris Dolan on behalf of Winton Community Board

|

|

Issue:

|

Woodland CDA Gravel and Walking Track Projects

|

|

Amendment required:

|

Remove $20K project in 2015/2016 and reserve funding.

Add new project $75K and fund grants and reserves.

|

|

Documents that will require amendment:

|

Roading Asset Management Plan and Long Term Plan.

|

|

Council officer:

|

Irwin Harvey on behalf of Woodland CDA Subcommittee.

|

|

Issue:

|

Haast Hollyford Road

|

|

Amendment required:

|

At its meeting on Wednesday, 22 April

2015 the Council passed a number of resolutions which recognised that the Haast

Hollyford Road project potentially has merit but further

information is needed to enable an informed consideration of the

project. Council also agreed that it should undertake a community

consultation process before it makes a decision on whether to approve the

project.

The recommendation is to amend the Long Term Plan to

include some wording around the project. No budget change is required

at this stage. If Council chooses to pursue the project in future an

amendment to the Long Term Plan will be requested.

|

|

Documents that will require amendment:

|

Long Term Plan

|

|

Council officer:

|

Susan Cuthbert

|

|

Issue:

|

Miscellaneous Financial Corrections

|

|

Amendment required:

|

· Consolidate

Venture Southland into our accounts.

· Remove

Makarewa Rates as contacted finance requesting it be stopped.

· Balance

internal work scheme codes.

· Balance

Matuku Depreciation Non Funding Impact Statement reserve

movement.

· Shift

new Policy and Community Manager associated costs to new business unit.

· Readjust

all hall rates as per balance of units as per assessments in Pathway.

|

|

Documents that will require amendment:

|

Profit and Loss, Balance Sheet, Funding Impact

Statement, Rates Funding Impact Statement, Reserves.

|

|

Council officer:

|

Shelley Dela Llana

|

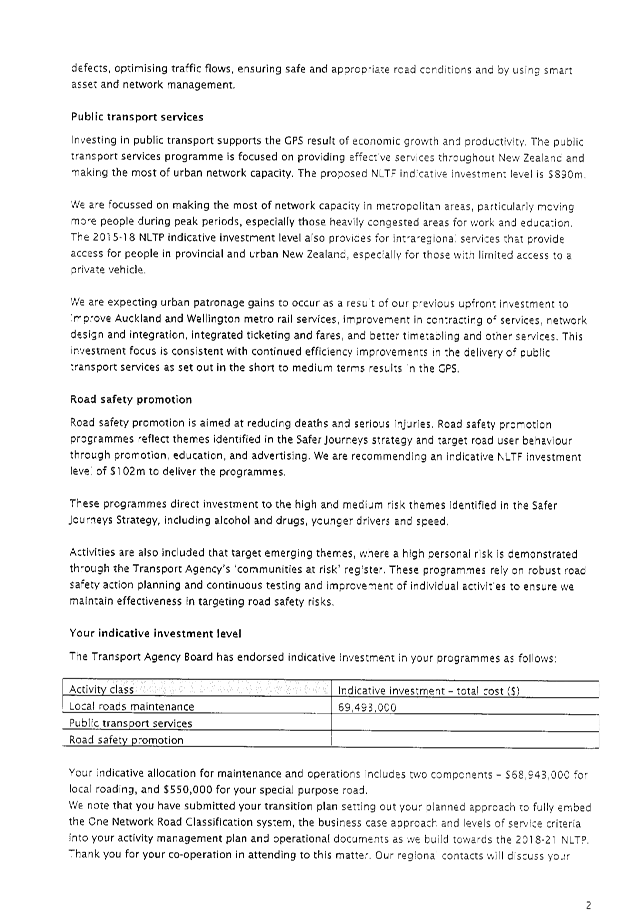

NZTA Funding

6 The

following provides an update around the indicative investment levels that NZTA

has allocated to the Southland District Region.

7 No

amendment is required to the Long Term Plan as a result of this change and this

update is merely provided as information.

8 NZTA

letter

The

following letter is attached: 2015-2018 National Land Transport Programme -

Indicative Investment Levels - Letter from Bruce Richards Regional Planning and

Investment Manager Southern notification to Council on funding reduction.

9 The

officer makes the recommendation that no changes are required to be made to the

Long Term Plan.

10 This

is a notification of the difference between the levels of funding that Council

has asked NZTA for and the indicative amount of investment that was notified by

NZTA in the attached letter. This letter could trigger a response to

realign budgets to match funding if Council desires to.

11 NZTA

has indicated funding of $68,943,000 for Council’s 2015-2018 maintenance

and renewal programme. Council had asked for funding of

$73,416,602. The $73.4M was over and above the Long Term Plan budgets for

the following reasons:

· NZTA

has indicated a change in how it funds Council’s administration to run

the roading network. By default NZTA gave Council an additional 2.25% on

top of the funding assistance rate Council receives from NZTA. Council

had asked for an additional 4.6% of the roading programme which was based on

administration budgets that Council occurs in running the network. In

preparing the Long Term Plan budget Council had allowed 2.25% as the

‘worst case’ scenario approach. The gap between what Council

asked NZTA for and what was budgeted in the Long Term Plan was $1.636M.

· Council

had applied for the LED streetlight project as a renewal. NZTA has

responded by saying it will fund the project as an improvement and that it has

been removed from the $73.4M that Council had applied to NZTA for. This

has an impact of $1.026M.

· After

taken into consideration these differences which have no impact in delivering

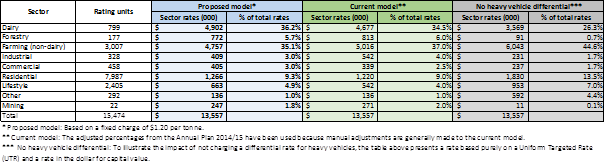

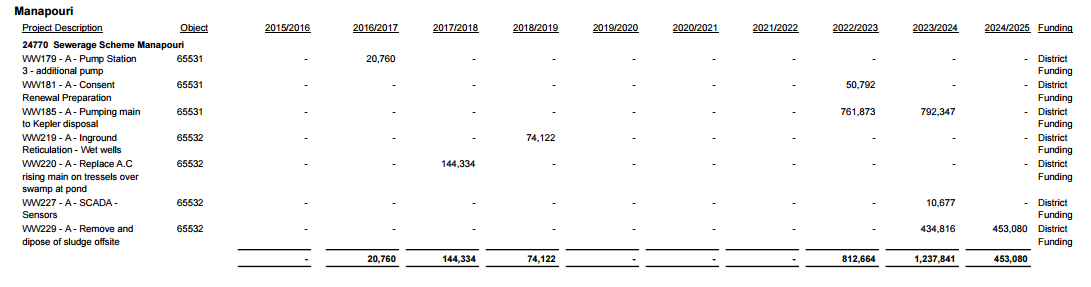

Council’s Long Term Plan, the difference is $1.8M over the three