Notice is hereby given that a Meeting of

the Activities Performance Audit Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Wednesday, 24

June 2015

10.30am

Council Chambers

15 Forth Street

Invercargill

|

|

Activities Performance Audit Committee Agenda

OPEN

|

MEMBERSHIP

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

|

Chief Executive

|

Steve Ruru

|

|

|

Committee Advisor

|

Fiona Dunlop

|

|

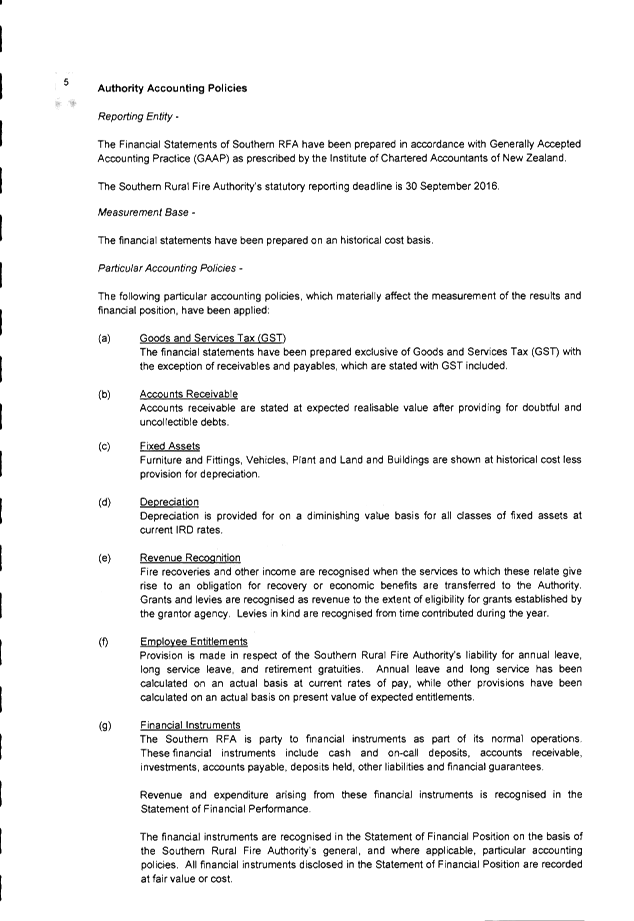

Terms of

Reference for the Activities Performance Audit Committee

This committee is a committee of Southland

District Council and has responsibility to:

·

Monitor and review Council’s performance

against the 10 Year Plan

·

Examine, review and recommend changes relating

to Council’s Levels of Services.

·

Monitor and review Council’s financial

ability to deliver its plans,

·

Monitor and review Council’s risk

management policy, systems and reporting measures

·

Monitor the return on all Council’s

investments

·

Monitor and track Council contracts and

compliance with contractual specifications

·

Review and recommend policies on rating, loans,

funding and purchasing.

·

Review and recommend policy on and to monitor

the performance of any Council Controlled Trading Organisations and Council

Controlled Organisations

·

Review arrangements for the annual external

audit

·

Review and recommend to Council the completed

financial statements be approved

·

Approve contracts for work, services or supplies

in excess of $200,000.

|

Activities Performance Audit Committee

24 June 2015

|

|

TABLE OF

CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of

Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Minutes 5

Reports for Resolution

7.1 Southern

Rural Fire Authority - Draft Statement of Intent 2015-2018 17

7.2 Finance

Report to 30 April 2015 63

7.3 Audit

Arrangements Letter for the Year Ended 30 June 2015 97

7.4 Changes

to the Accounting Standards for Public Benefit Entities 113

Public Excluded

Procedural motion

to exclude the public 119

C8.1 Public

Excluded Minutes of the Activities Performance Audit Committee Meeting dated 3

June 2015 119

At the close of

the agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Councillors are

reminded of the need to be vigilant to stand aside from decision-making when a

conflict arises between their role as a councillor and any private or other

external interest they might have. It is also considered best practice for

those members in the Executive Team attending the meeting to also signal any

conflicts that they may have with an item before Council.

4 Public Forum

Notification to

speak is required by 5pm at least two days before the meeting. Further

information is available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the Council to consider any further

items which do not appear on the Agenda of this meeting and/or the meeting to

be held with the public excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i) The

reason why the item was not on the Agenda, and

(ii) The

reason why the discussion of this item cannot be delayed until a subsequent

meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a)

That item may be discussed at that meeting if-

(i)

That item is a minor matter relating to the general

business of the local authority; and

(ii)

the presiding member explains at the beginning of the

meeting, at a time when it is open to the public, that the item will be

discussed at the meeting; but

(b)

no resolution, decision or recommendation may be made in

respect of that item except to refer that item to a subsequent meeting of the

local authority for further discussion.”

6 Confirmation

of Minutes

6.1 Meeting minutes of Activities Performance

Audit Committee, 3 June 2015

|

Activities Performance Audit Committee

OPEN MINUTES

|

Minutes of

a meeting of Activities Performance Audit Committee held in the Council

Chambers, 15 Forth Street, Invercargill on Wednesday, 3 June 2015 at 10.28am.

present

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

Chief Executive Steve Ruru, Group Manager

Environment and Community Bruce Halligan, Group Manager Services and Assets Ian

Marshall, Group Manager Policy and Community Rex Capil, Chief Information

Officer Damon Campbell, Chief Financial Officer Anne Robson, Communications and

Governance Manager Louise Pagan, Committee Advisor Debbie Webster and Strategic

Transport Manager Joe Bourque

1 Apologies

Apologies were

received from Crs Douglas and Ford.

|

Moved Cr

Paterson, seconded Cr Baird and resolved:

That the

Activities Performance Audit Committee accept the apologies.

|

2 Leave

of absence

There were no

requests for leave of absence.

3 Conflict

of Interest

There were no

conflicts of interest noted and declared.

4 Public

Forum

There was no Public Forum.

5 Extraordinary/Urgent

Items

There were no

Extraordinary/Urgent items.

6 Confirmation

of Minutes

|

Resolution

Moved Cr Macpherson, seconded Cr Keast and resolved:

That the Meeting minutes of the Activities Performance Audit Committee, 22

April 2015 be confirmed.

|

(Cr Dobson joined the meeting at 10.34am)

Reports for Resolution

The following item was brought forward

in the agenda.

|

8.2

|

Health and Safety

Record No: R/15/4/7081

|

|

|

1 Human

Resources Manager Janet Ellis was in attendance for this item. She

provided an update to the Activities Performance Audit Committee on health

and safety activity within Southland District Council (SDC). Mrs Ellis

noted the new Health and Safety legislation - the Health and Safety at Work

Act currently before parliament was to be reported back on by the new Select

Committee on 29 May 2015, this has been delayed until July. Mrs Ellis

commented she wants to wait to see what was in the new legislation before

making further changes to Councils health and safety processes. She

would keep Councillors updated on the new legislation as it comes to

pass. Mrs Ellis noted a Memorandum of Understanding had been drafted

and was being circulated the Chief Executives Officers of Councils through

the Chief Executives Forum.

|

|

|

Mrs Ellis noted the SDC had passed its

ACC Audit, held in May this year, retaining tertiary status. Having

tertiary status provided a considerable discount to Council on ACC levies.

Mr Halligan noted and affirmed the work

done by Mrs Ellis and the HR team around attaining the tertiary level

again. He commented the saving made to the SDC on ACC levies was

considerable and having the tertiary level communicates to the community that

we are serious about health and safety. He also noted the work done on

items 15 - 17 of the report on the Contractor Management Project shows a

greater commitment to health and safety across the district. Mayor Tong

endorsed Mr Halligan’s comments.

|

|

|

Resolution

Moved Cr Duffy, seconded Cr Kremer

and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Health and Safety” dated 18 May 2015.

|

The meeting resumed to the original

order in the agenda.

|

7.1

|

Financial Report to 31 March 2015

Record No: R/15/4/7341

|

|

|

Management Accountant Susan McNamara was

in attendance for this report. She advised that the report

outlined the financial results to 31 March 2015 with 75% of the financial

year complete. She noted that overall for the year to date,

income is 1% ($499K) under budget and expenditure is 5% ($1.94M) under

budget. Ms McNamara highlighted some of the key variances in her report

and commented that capital expenditure is 6% ($902K) under budget.

There was discussion on the Stewart

Island Visitor Levy which was noted as a ‘money in, money out’

process and discussion on the roading underspend where it was queried if it

would be carried through to the following year? Mr Marshall responded

that the NZTA funding will not be carried over however the local funding

would be. He also commented the lower bitumen cost have contributed to

the underspend in the current financial year.

|

|

|

Resolution

Moved Cr Dillon, seconded Cr Baird

and resolved:

That the Activities Performance Audit Committee:

a) Receives

the report titled “Financial Report to 31 March 2015” dated 18

May 2015.

|

|

7.2

|

Report to Activities Performance Audit Committee on outcome of

2015 International Accreditation New Zealand (IANZ) Reaccreditation Audit of

Southland District Council Building Control Section

Record No: R/15/5/8389

|

|

|

Group Manager Environment and Community

Bruce Halligan and Manager Building Control Kevin O’Connor were in

attendance for this item. Mr Halligan noted and affirmed the work of Mr

O’Connor and the Building Control team in achieving for the Southland

District Council reaccreditation for a further two years with no corrective

actions required, with March 2017 being the next assessment audit. He

also mentioned International Accreditation New Zealand (IANZ) has made a

series of recommendations that were not corrective actions required (CARS)

but recommendations useful for the continuous improvement process which Mr

O’Connor and his team will address.

Mr O’Connor noted that during the

audit process IANZ affirmed and commented on the collaborative work between

Southland District Council, Invercargill City Council, Gore and Clutha

District Councils, around combined systems and processes.

Cr Bailey resonated Mr Halligan’s

positive comments for Mr O’Connor and the Building Team.

|

|

|

Resolution

Moved Cr Harpur, seconded Cr Keast and

resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Report to Activities Performance Audit Committee on

outcome of 2015 International Accreditation New Zealand (IANZ)

Reaccreditation Audit of Southland District Council Building Control

Section” dated 19 May 2015.

|

|

7.3

|

Request for Council to Maintain Irthing Road, Five Rivers

Record No: R/15/4/7505

|

|

|

1 Group

Manager Services and Assets Ian Marshall and Road Engineer James McCallum was

in attendance for this item. Mr Marshall noted there was a request from

residents to the Southland District Council to consider taking on the

maintenance of a previously unmaintained section of roadway. Mr

McCallum commented that 2 Irthing Road, located near Five Rivers, was partly

maintained by Council. The maintained section was between State Highway 97

(Mossburn Five Rivers Road) and the intersection of Irthing and Mulholland

Roads.

3 The

Strategic Transport Department had received a request from an adjacent land

owner to start maintaining the metalled roadway that extends beyond the

intersection of Irthing and Mulholland Roads. The existing road was largely

formed within the road reserve margins.

4 Mr

McCallum noted that based on Council’s current Extent of Network

Policy, maintenance of the roadway was justified. Cr Bailey queried the use

of the land, Mr McCallum responded it was farmland with no dwelling on the

property however it was well utilised farm property. Cr Duffy asked if

there were other sections of road that provide for mostly private access that

the SDC looks after? Mr Marshall responded that there was not an active

programme of work to do that however it could be considered by the roading

team to undertake that work.

|

|

|

|

|

|

Resolution

Moved Cr Dillon, seconded Cr Dobson

and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Request for Council to Maintain Irthing Road, Five

Rivers” dated 26 May 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Approves

the Strategic Transport Department recommendation to maintain Irthing Road,

beyond the intersection of Mulholland Road in accordance with the Extent of

Network conditions of the Roading Policy.

|

|

7.4

|

Signs Maintenance Service

Record No: R/15/4/7342

|

|

|

Group Manager Services and Assets Ian Marshall and Roading

Asset Management Engineer Hartley Hare were in attendance for this

item. Mr Marshall introduced the report noting the signs maintenance

contract would expire 30 June 2015. Mr Hare stated that during an

investigation process the option of incorporating the signs maintenance

services into the respective Road Alliance Contracts was considered and

explored. The option allows for a trial period on the proposed service

delivery method, with no long term commitment from Council. The

proposed period was from 1 July 2015 until 30 June 2016. Mr Hare

commented that it would reduce activities such as additional travel for

Council staff having to go out to the site to address issues, the contractor

would do it and deal with the issue at the time. He noted that the

option provides lower procurement costs as not tendering process was

required.

Cr Bailey commented it was logical to have the alliance

contractors to do the work as they are out in the field daily. He did

ask if financially it would benefit the Council? Mr Hare responded that

he did expect an increase in cost however that was expected under the current

contract. That is why a trial period was proposed.

|

|

|

Resolution

Moved Cr Keast, seconded Cr Baird

and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Signs Maintenance Service” dated 22 May 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local Government

Act 2002 to the extent necessary in relation to this decision; and in

accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Approve

delegated authority be granted to the Group Manager Services and Assets to

negotiate and incorporate the road signs maintenance activity within

the respective road maintenance contracts.

|

Reports for Recommendation

|

8.1

|

Southland District Council 2015/2016 Resurfacing Contract -

Contract 15/21

Record No: R/15/5/8622

|

|

|

Group

Manager Services and Assets Ian Marshall and Roading Asset Management

Engineer Hartley Hare were in attendance for this item. Mr Hare

noted the report seeks endorsement from the Activities Performance Audit

Committee for the proposed tendering methodology planned for the 2015/2016

Southland District Council’s Resurfacing Programme. Which

included seeking delegated approval for the Chief Executive to let the

tender.

2 The

report covered the procurement methodology proposed for Contract 15/21 - SDC

2015/2016 Resurfacing. It was proposed that the full 2015/2016

resurfacing programme that SDC was responsible for of approximately 950,000m2

be let under authority delegated to the Chief Executive as a single

District-wide one year contract.

There was discussion on how there

are several contracts with one contractor holding them all. It made

sense to consider one single contract encompassing all the work. It was

commented there are two main contractors in the south who tend to bid for the

work however with a large single contract it may attract contractors from

further up the South Island.

|

|

|

|

|

|

Resolution

Moved Cr Dobson, seconded Cr Harpur

and resolved:

That the Activities Performance Audit Committee:

a) Receives

the report titled “Southland District Council 2015/2016 Resurfacing

Contract - Contract 15/21” dated 26 May 2015.

b) Determines

that this matter or decision be recognised as

not significant in terms of Section 76 of the Local

Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Endorses

the procurement methodology proposed for Contract 15/21 for the 2015/2016

Southland District Council Resurfacing Programme, and in particular:

i. The

work be let as a single contract.

ii. The

contract cover only the 2015/2016 programme.

iii. The

Chief Executive be delegated authority to let the contract subject to being

satisfied that it provides suitable value for money.

|

|

8.3

|

Management Report from Audit New Zealand for the 2015-25

Consultation Document

Record No: R/15/3/5908

|

|

|

Chief Financial Officer Anne

Robson was in attendance for this item. She noted that as part of the

audit process, Audit New Zealand provides Council with a report at the end of

each stage of its audit outlining the work that was performed and any

recommended areas for improvement.

2 In

the Management Report, Audit NZ noted that Council clearly communicated in

its consultation document the key issues on which to consult with the

community. They noted that Councils overall financial position was

sound with low debt being a notable feature. The challenge for Council

they indicate will be to balance income levels while having a strong focus on

affordability for ratepayers.

4 Audit New

Zealand issued an unmodified opinion on Councils Long Term Plan Consultation

document (LTP CD), on 18 March 2015. That meant Council’s LTP

CD “met its statutory purpose and provided an effective basis for

public participation in Council’s decisions about the proposed content

of the 2015 – 2025 LTP”. In doing so Audit NZ found the LTP

CD had no “material” misstatements.

5 Audit NZ will

also issue an opinion and management report on the final LTP, which was to be

adopted by Council on 24 June 2015.

|

|

|

|

|

|

Resolution

Moved Cr Macpherson, seconded Cr

Dillon and resolved:

That the Activities Performance Audit Committee:

a) Receives

the report titled “Management Report from Audit New Zealand for the

2015-25 Consultation Document” dated 18 May 2015.

|

|

8.4

|

Council's Insurance Policies

Record No: R/15/5/8570

|

|

|

Chief Financial Officer Anne Robson was in attendance for

this item. Ms Robson noted the report was to update Council on

its current insurance programme it had to manage its risks, with a view to

undertaking a comprehensive review of its insurance policies and risks in the

coming year.

Mr Ruru noted that the Christchurch situation had provided

many lessons on the cost of reinstatement of infrastructure being

considerably higher than replacement value. He asked Ms Robson to

review the approach on the traditional 60/40 funding split in the event of

national disaster. He commented it may be possible Central Government

60% share may reduce going forward.

|

|

|

Resolution

Moved Cr Keast, seconded Cr Kremer

and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Council's Insurance Policies” dated 22 May

2015.

|

|

8.5

|

Venture Southland - Relationship Management and Approach

Record No: R/15/4/7163

|

|

|

1 Group

Manager Policy and Community Rex Capil was in attendance for

this item. He noted the report was to brief the Committee on

changes made to improve management of the Venture Southland relationship and

work programme.

2 He

commented the Southland District Council had two distinct roles with Venture

Southland - as an owner and as a purchaser of services. It was

important these two roles are acknowledged and understood. Mr

Capil noted the letter of expectation 2015/2016 - Implementation of Key Areas

for Consideration as an Owner and the letter of expectation 2015/2016 -

Implementation of Key Areas for Consideration as a Purchaser of Services, as

being important documents in defining and developing the SDC and Venture

Southland relationship.

Following discussion on the

timing of reporting from Venture Southland Community Development team it was

agreed to keep the current bi-monthly reporting to the Policy Review

Committee.

|

|

|

|

|

|

Resolution

Moved Cr Duffy, seconded Cr Kremer

and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Venture Southland - Relationship Management and

Approach” dated 22 May 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Supports

Option 1 to progress the Southland District Council-Venture Southland

partnership approach.

Option 1

|

Advantages

|

Disadvantages

|

|

· Supports

SDC and VS to deliver the Letter of Expectation priority projects in

2015/2016.

· Provides

clarity and confirmation of measurable deliverables.

· Assists

in SDC and VS delivering projects of relevance as demanded.

· Promotes

a collaborate approach to SDC-VS relationship management.

|

· May

increase pressure on existing resource allocation for VS.

· May

create tension between SDC and VS as to what are priority projects

required.

|

|

Public Excluded

Exclusion of the Public: Local Government Official Information and

Meetings Act 1987

|

Resolution

Moved Cr Dobson, seconded Cr Dillon and

resolved:

That the Activities Performance Audit Committee exclude the public

from the following part(s) of the proceedings of this meeting:

C9.1 Public Excluded Minutes of the Activities Performance Audit

Committee Meeting dated 22 April 2015

C9.2 Milford Development Authority Update

C9.3 Professional Services Contract 12/03 Extension

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter, and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

|

General subject of each

matter to be considered

|

Reason for passing this

resolution in relation to each matter

|

Ground(s) under section

48(1) for the passing of this resolution

|

|

Public Excluded Minutes

of the Activities Performance Audit Committee Meeting dated 22 April 2015

|

s7(2)(a) - The withholding of the information is

necessary to protect the privacy of natural persons, including that of a

deceased person.

s7(2)(b)(ii) - The withholding of the information is

necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial position

of the person who supplied or who is the subject of the information.

s7(2)(f)(ii) - The withholding of the information is

necessary to maintain the effective conduct of public affairs through the

protection of such members, officers, employees and persons from improper

pressure or harassment.

s7(2)(h) - The withholding of the information is

necessary to enable the local authority to carry out, without prejudice or disadvantage,

commercial activities.

s7(2)(i) - The withholding of the information is

necessary to enable the local authority to carry on, without prejudice or

disadvantage, negotiations (including commercial and industrial

negotiations).

s7(2)(j) - The withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage.

|

That the public conduct of the whole or the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding exists.

|

|

Milford Development

Authority Update

|

s7(2)(b)(ii) - The

withholding of the information is necessary to protect information where the

making available of the information would be likely unreasonably to prejudice

the commercial position of the person who supplied or who is the subject of

the information.

s7(2)(h) - The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities.

|

That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding exists.

|

|

Professional Services Contract

12/03 Extension

|

s7(2)(b)(ii) - The

withholding of the information is necessary to protect information where the

making available of the information would be likely unreasonably to prejudice

the commercial position of the person who supplied or who is the subject of

the information.

|

That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding exists.

|

Permit the Chief Executive, Group Manager

Environment and Community, Group Manager Services and Assets, Group Manager,

Policy and Community, Chief Information Officer, Human Resources Manager, Chief

Financial Officer, Communications & Governance Manager and Committee

Advisor to remain at this meeting, after the public has been excluded, because

of their knowledge of C9.1 Public Excluded Minutes of

the Activities Performance Audit Committee Meeting dated 22 April 2015, C9.2

Milford Development Authority Update and C9.3 Professional Services Contract

12/03 Extension and also permit Joe Bourque – Strategic Transport Manager

to remain for item C9.3 Professional Services Contract 12/03 Extension. This knowledge, which will be of assistance in relation to the matters

to be discussed, is relevant to that matter because of their specialist

knowledge.

The public were

excluded at 11.45am.

Resolutions in

relation to the confidential items are recorded in the confidential section of

these minutes and are not publicly available unless released here.

The meeting

concluded at 12.14pm.

CONFIRMED

AS A TRUE AND CORRECT RECORD AT A MEETING OF THE Activities Performance Audit Committee HELD ON WEDNESDAY 3

JUNE 2015.

DATE:...................................................................

CHAIRPERSON:...................................................

|

Activities

Performance Audit Committee

24 June 2015

|

|

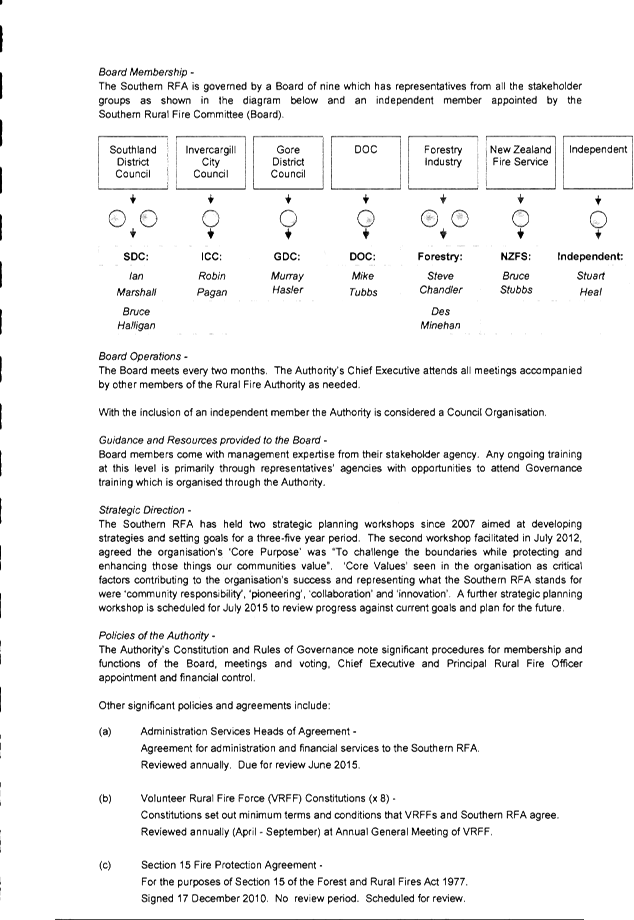

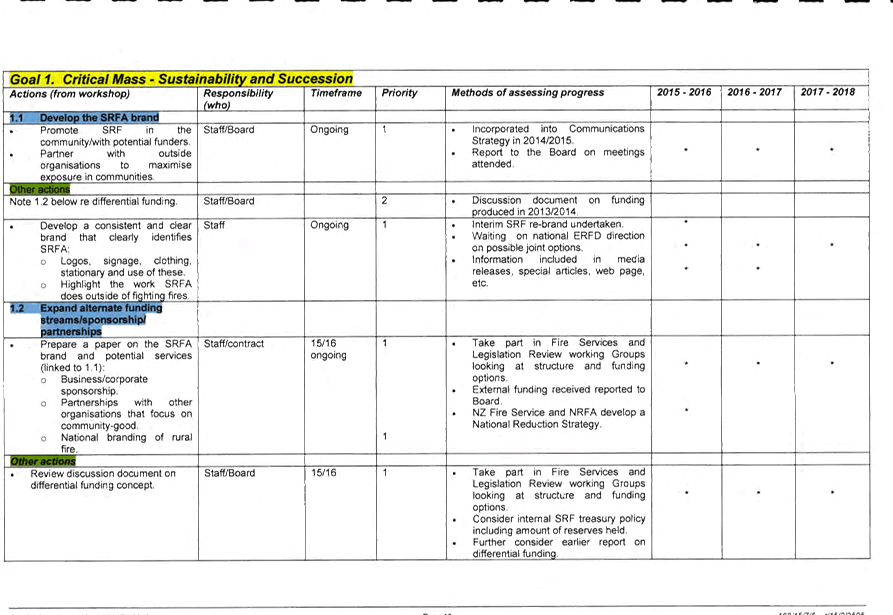

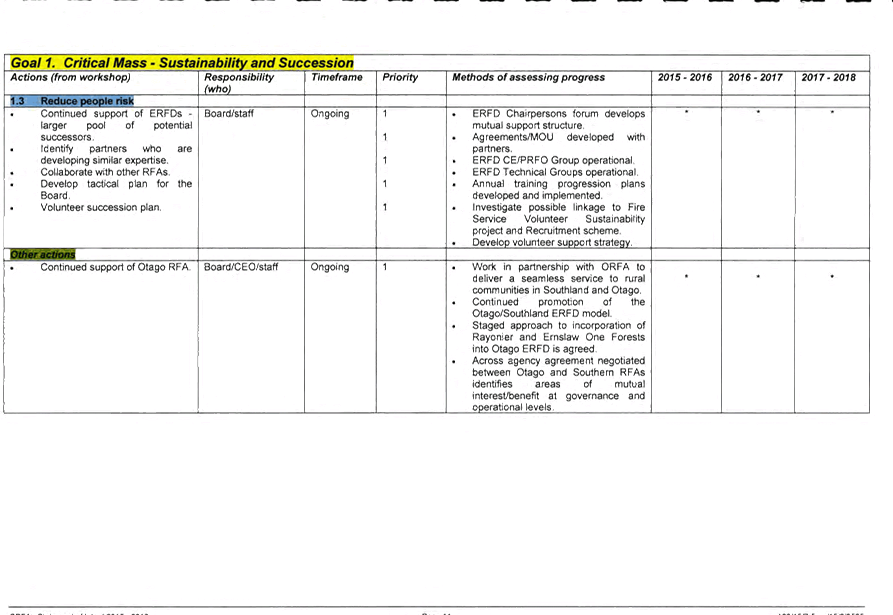

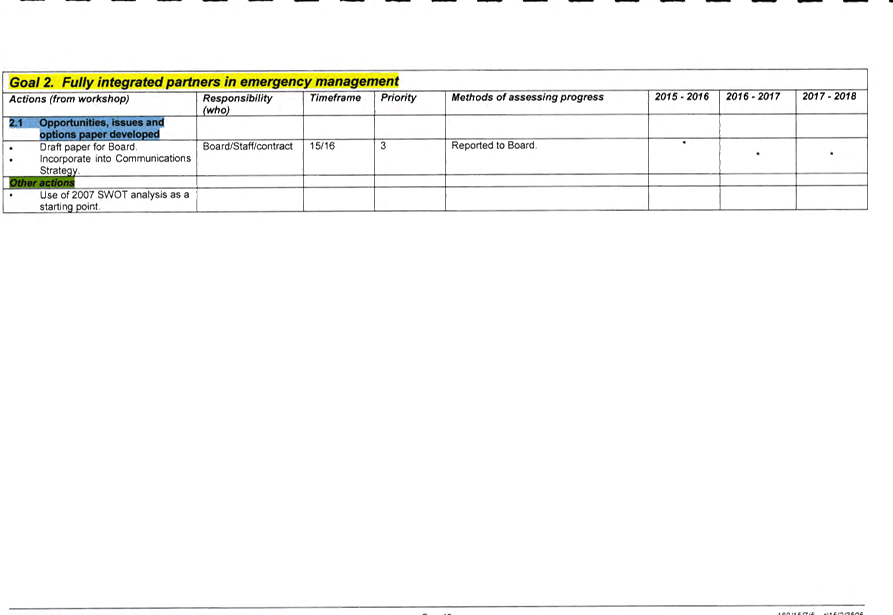

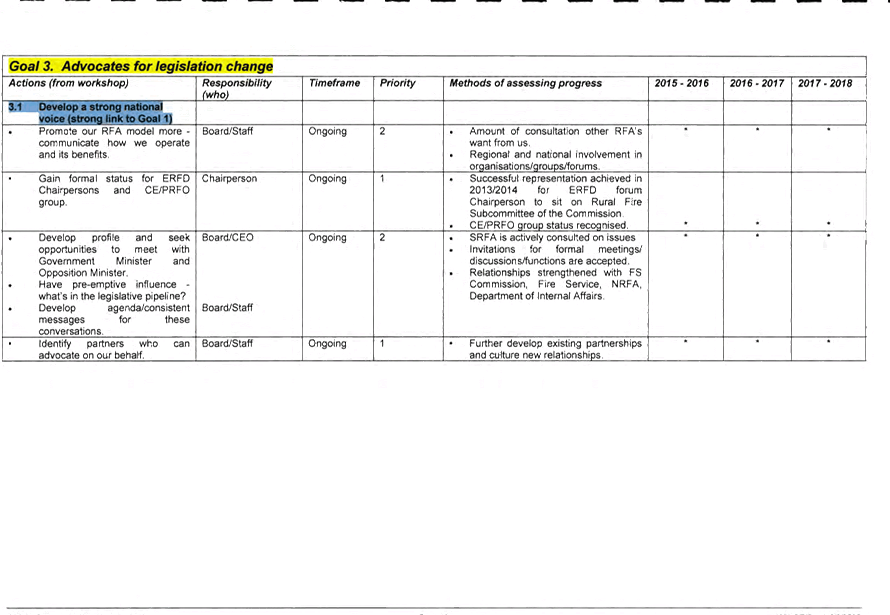

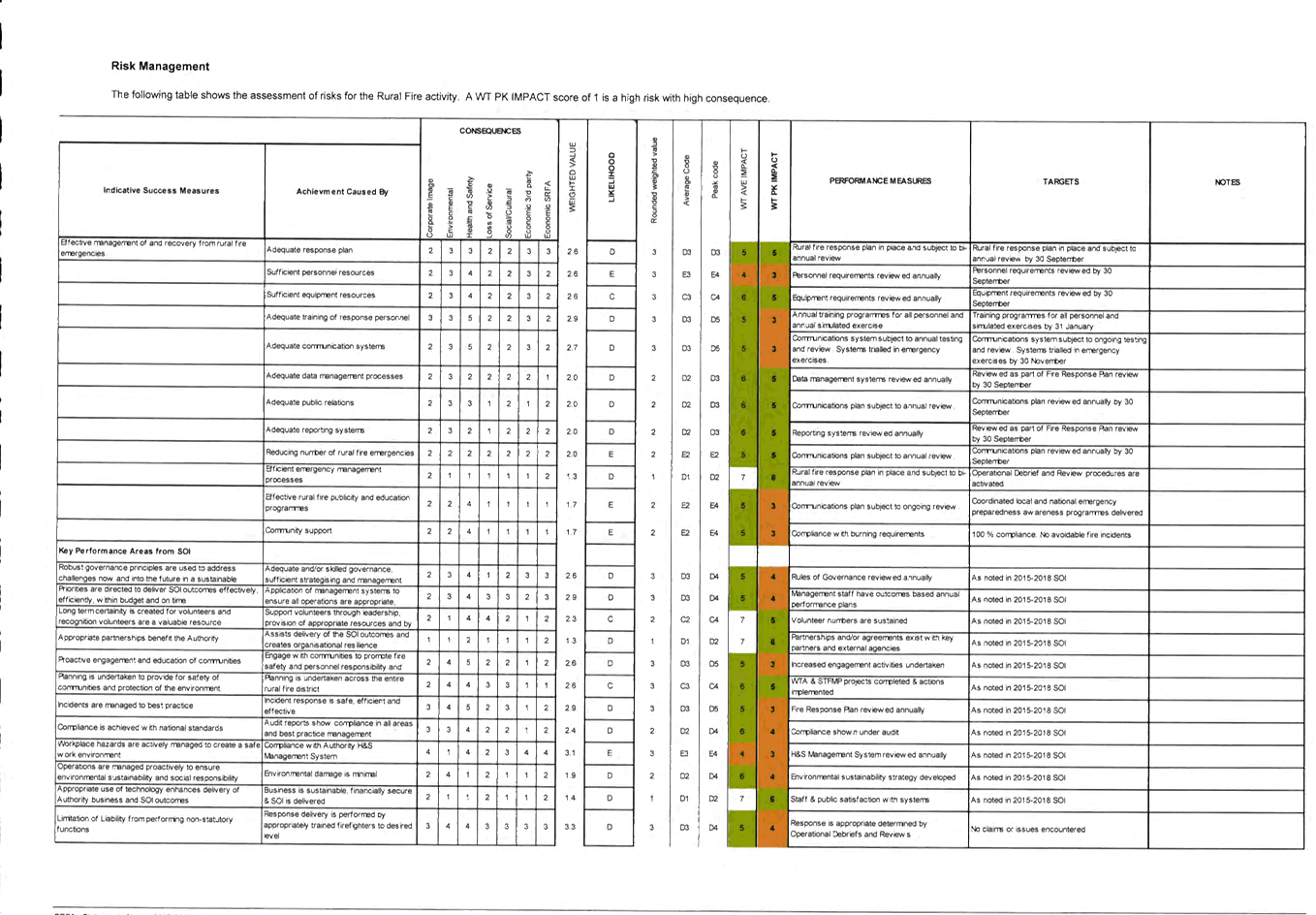

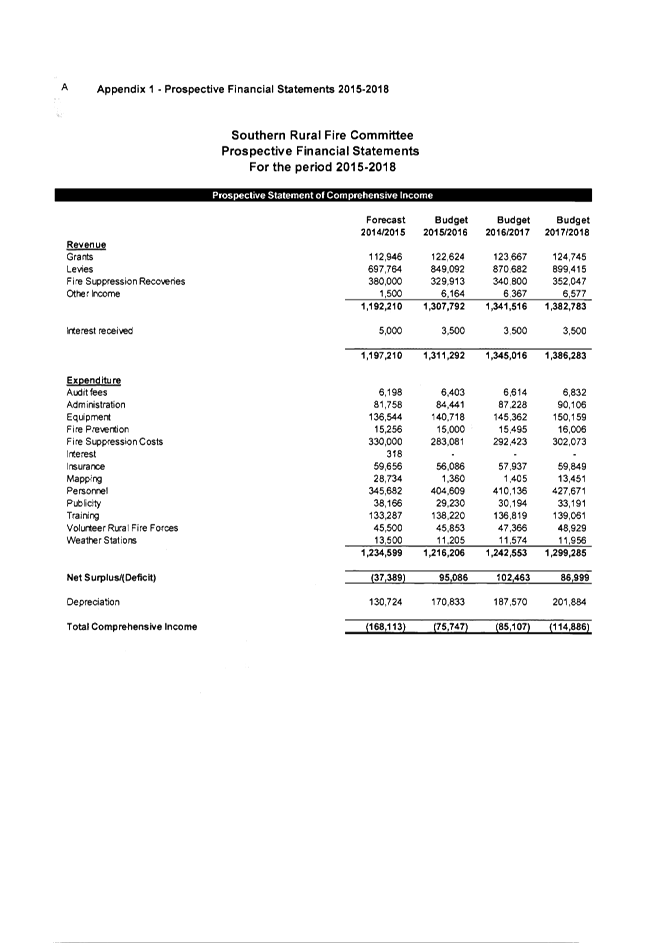

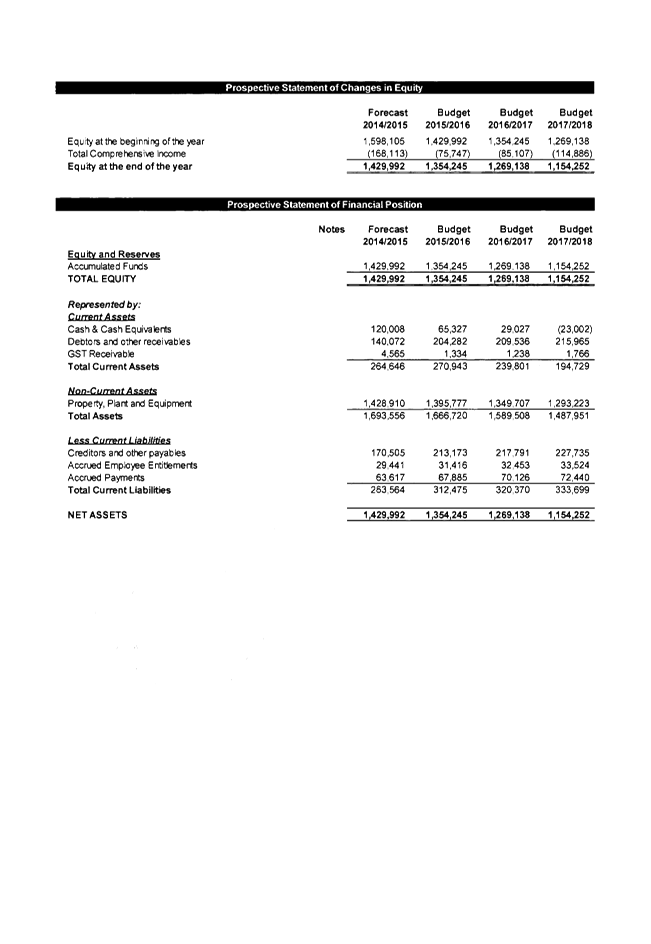

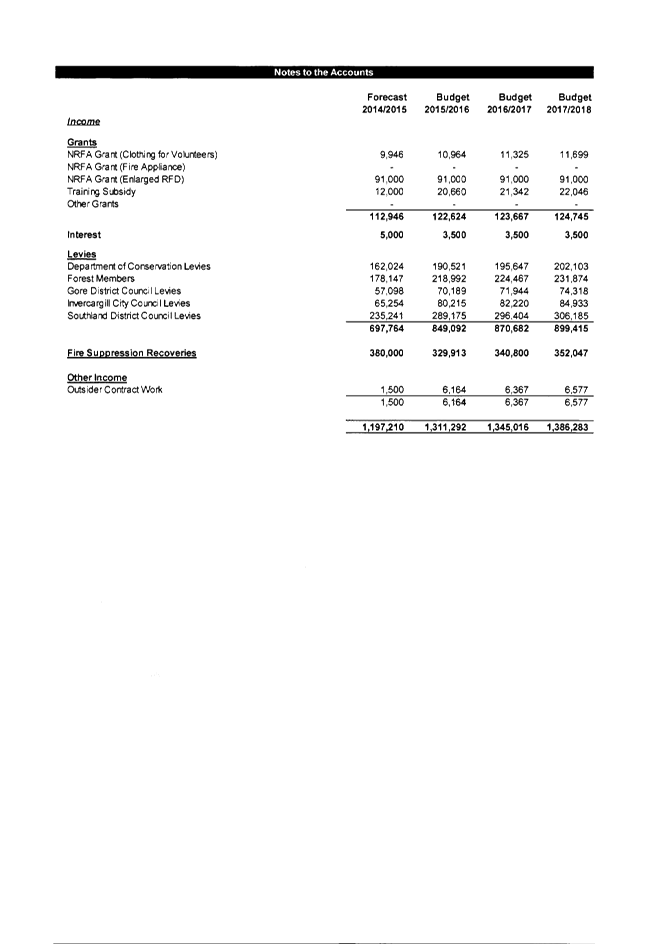

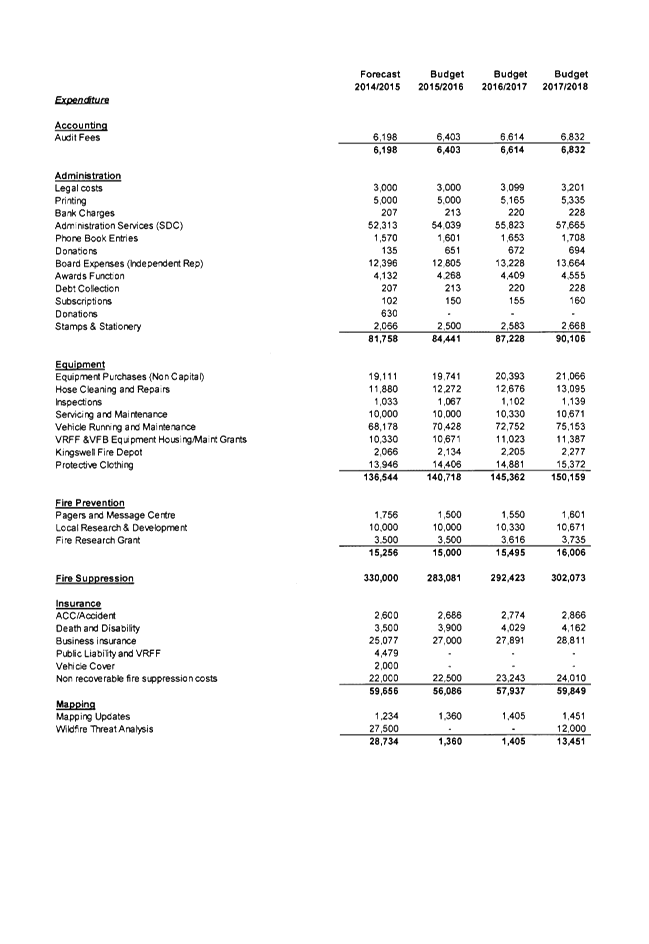

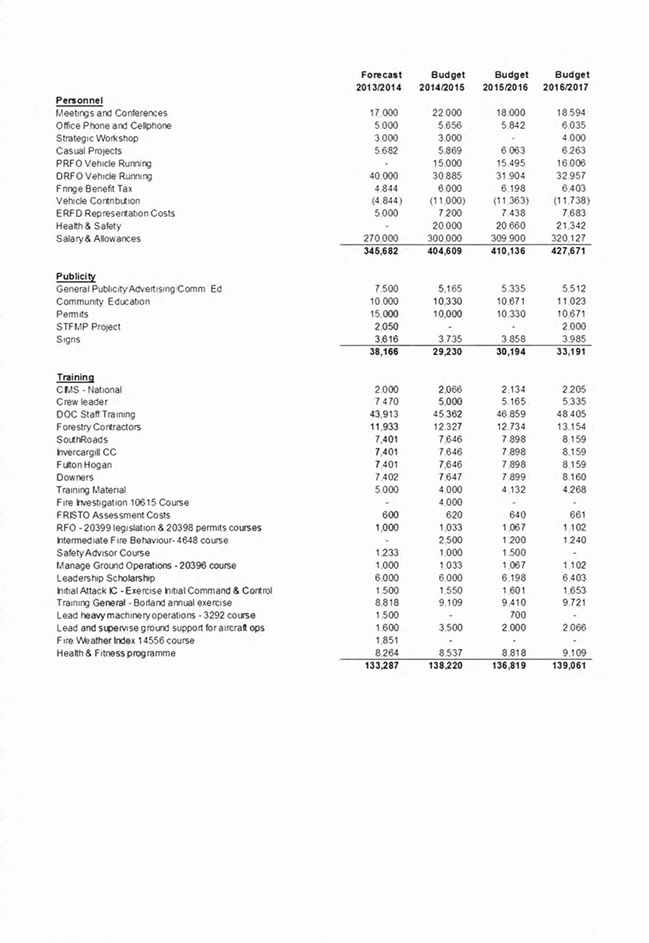

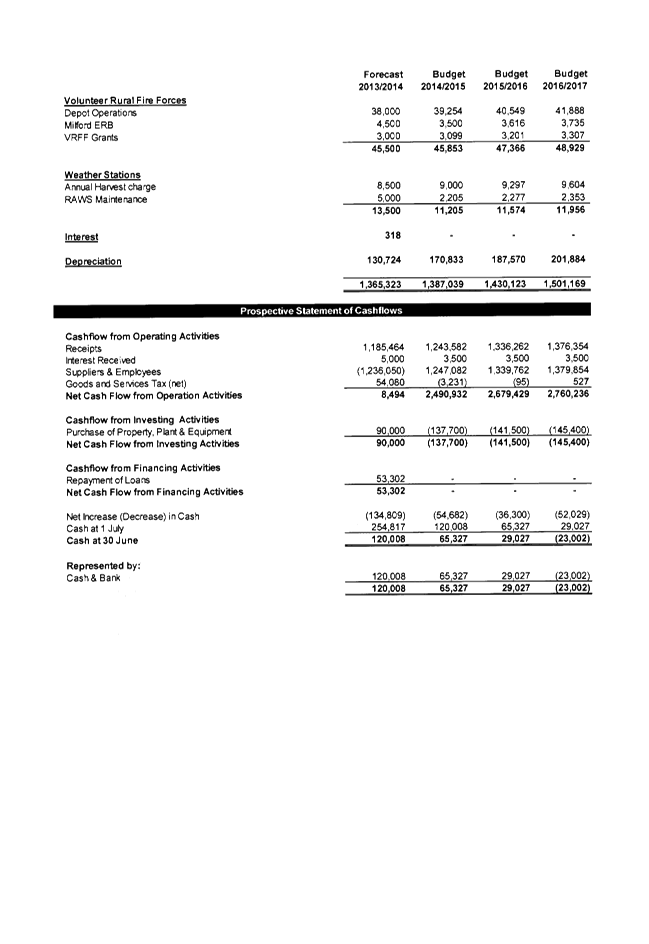

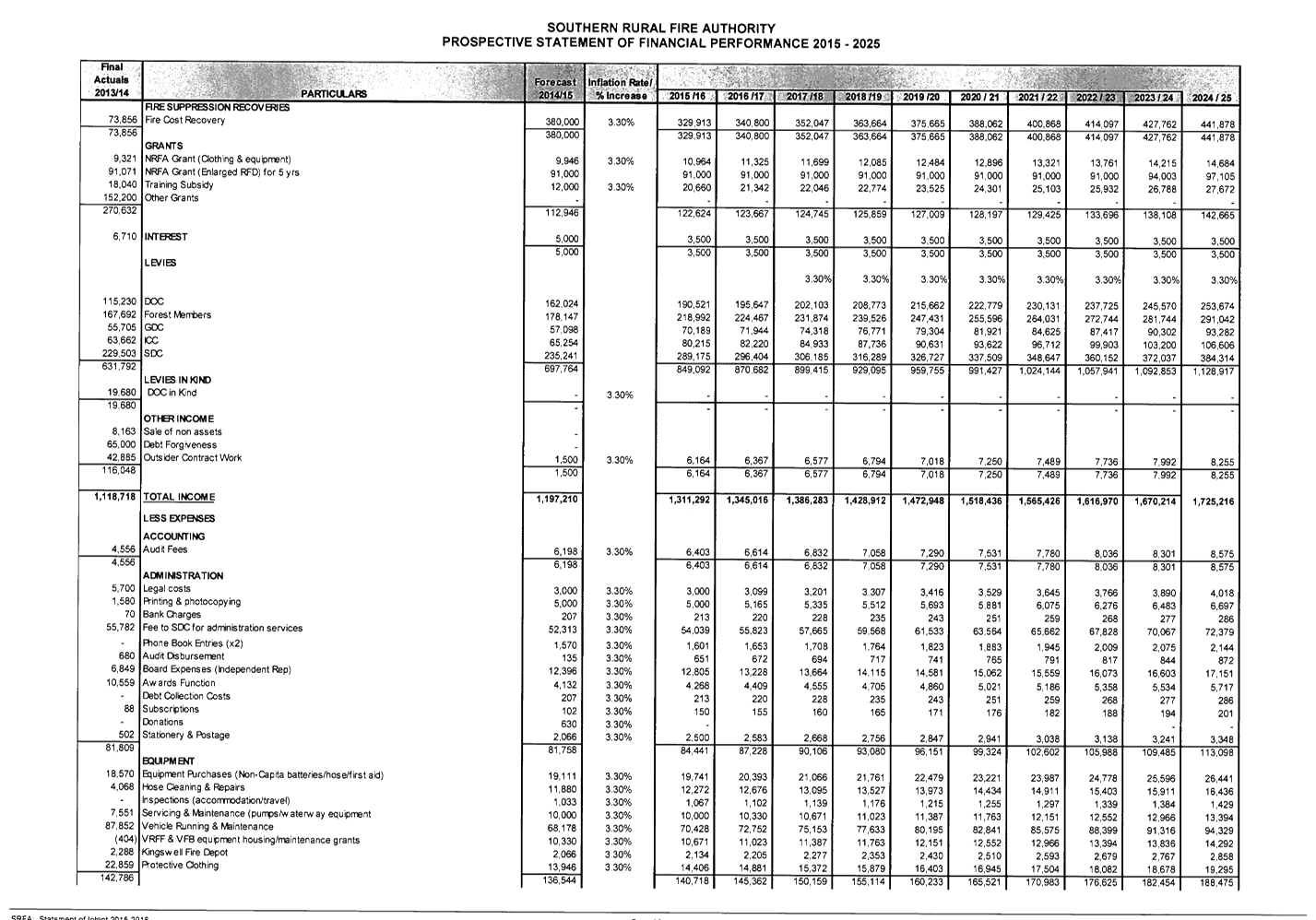

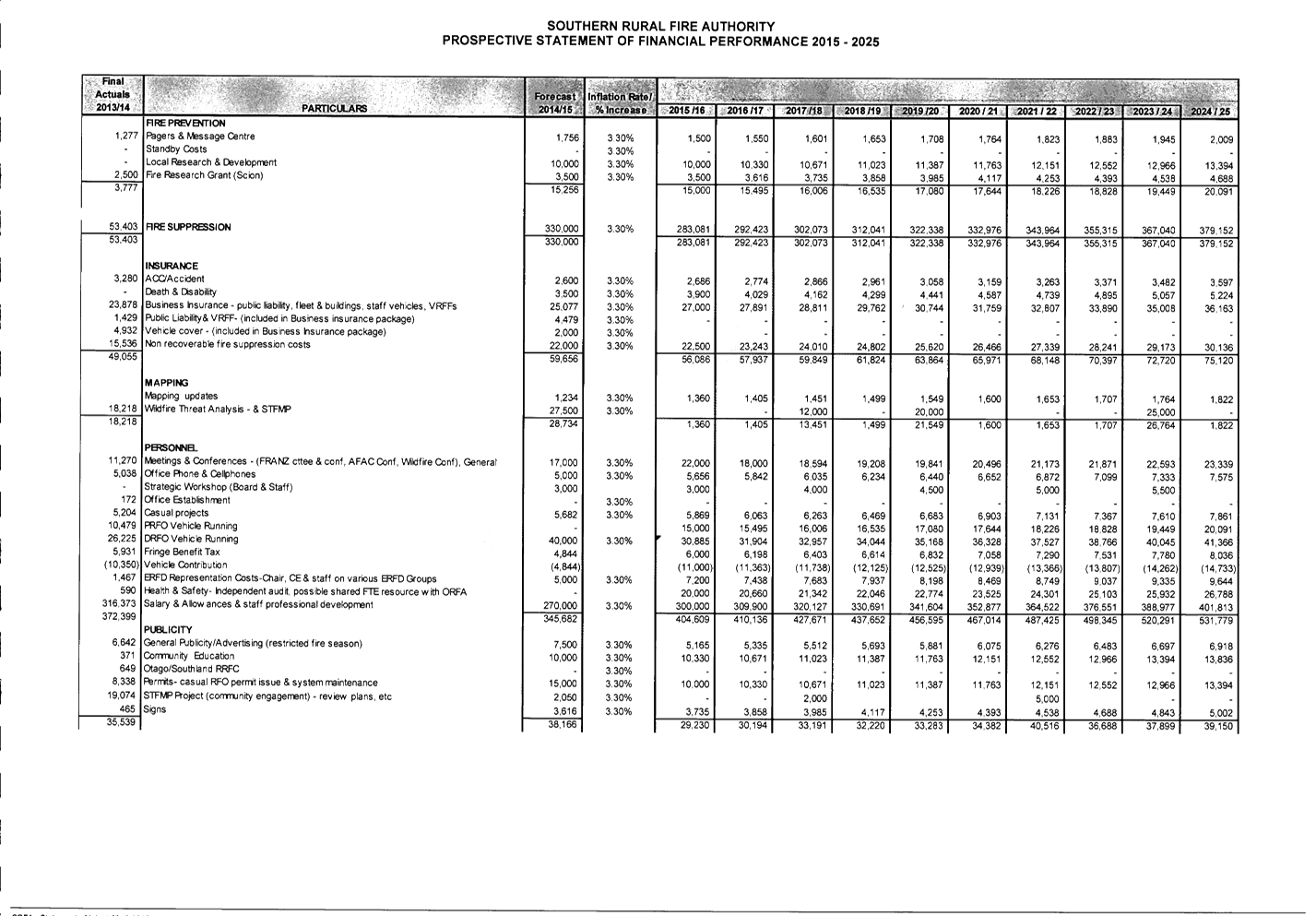

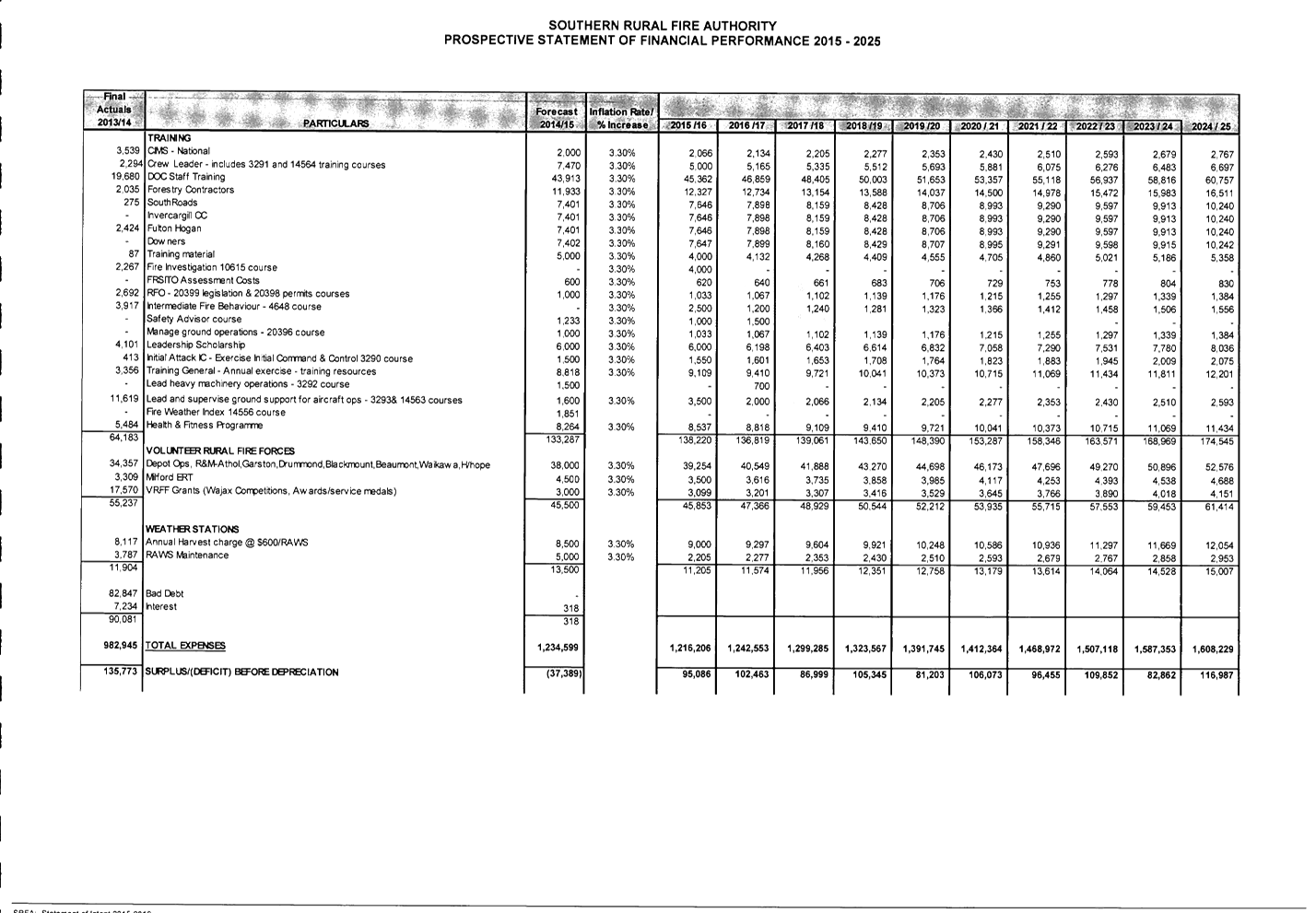

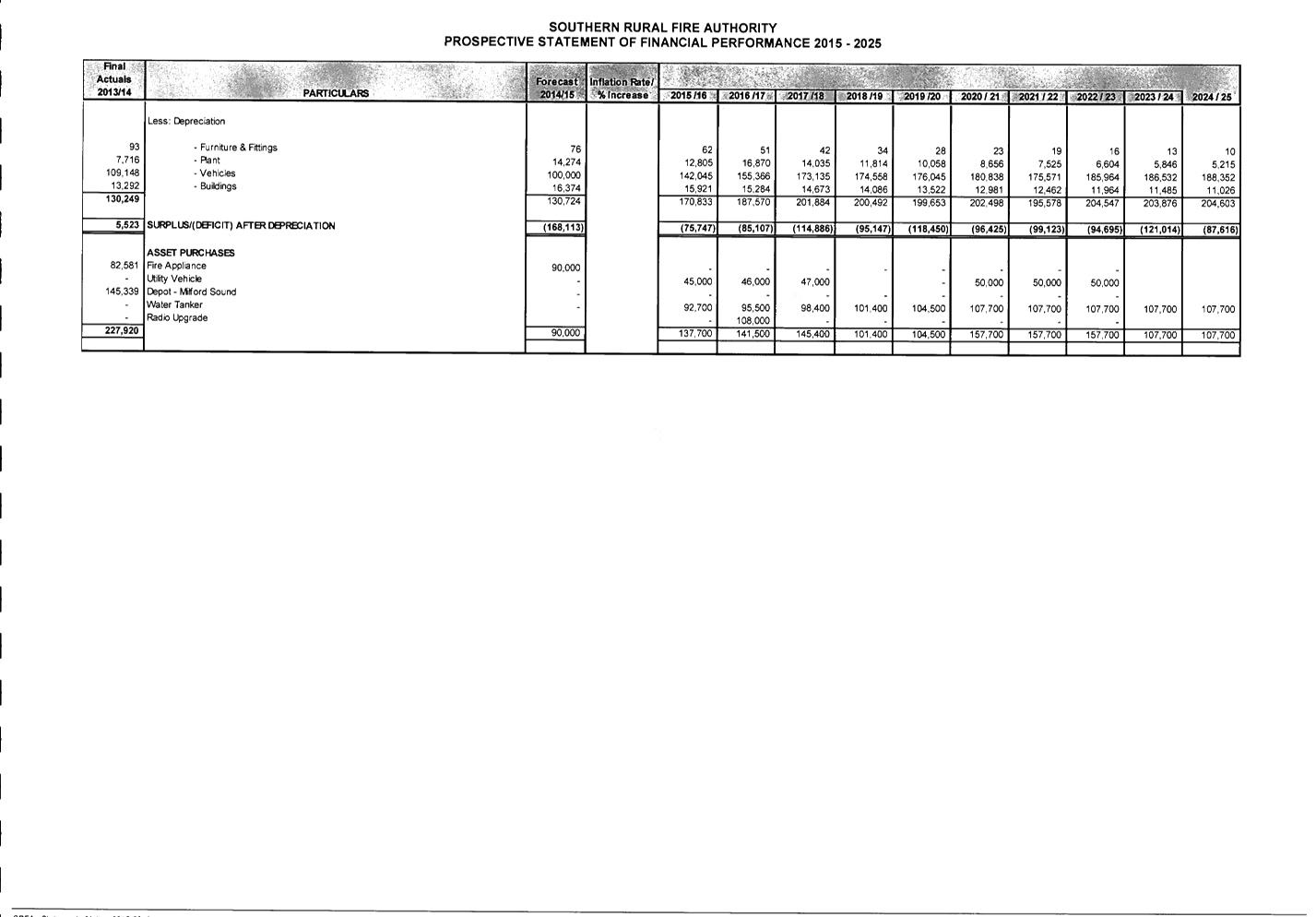

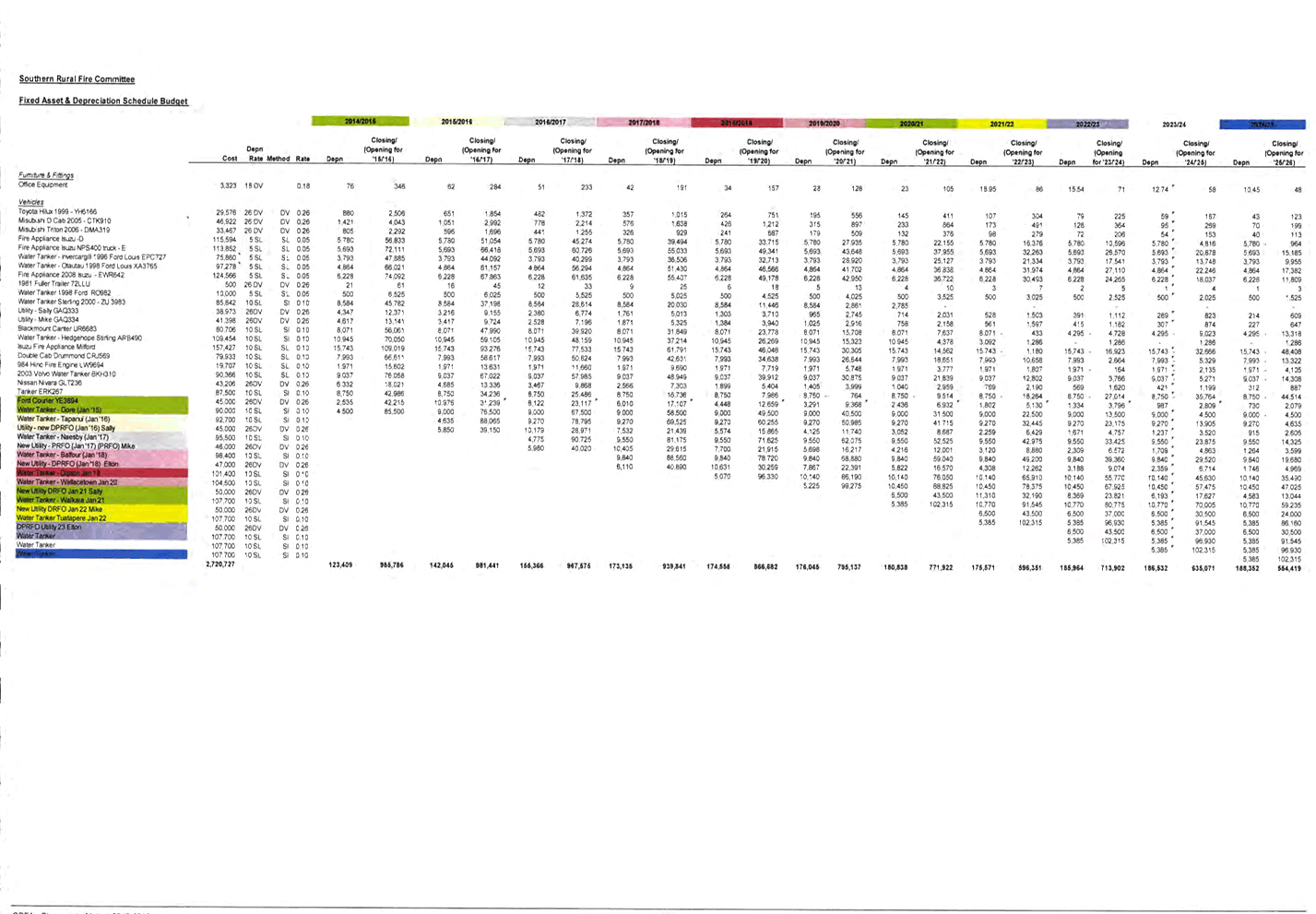

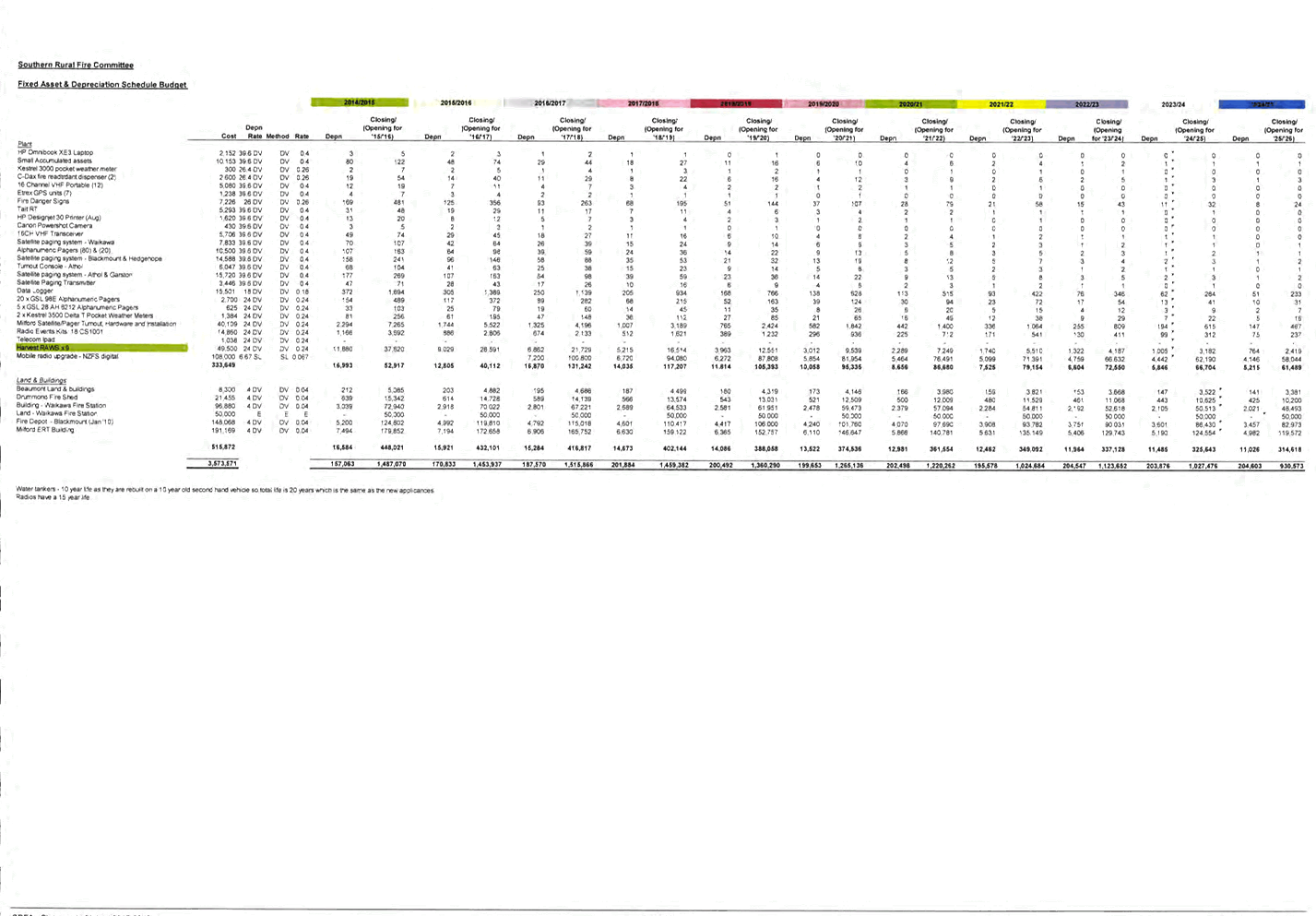

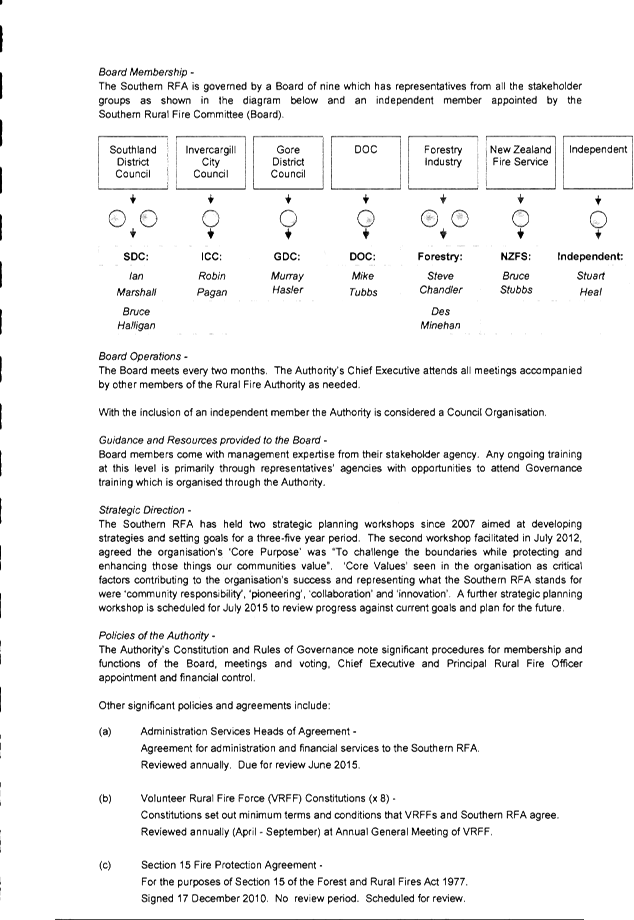

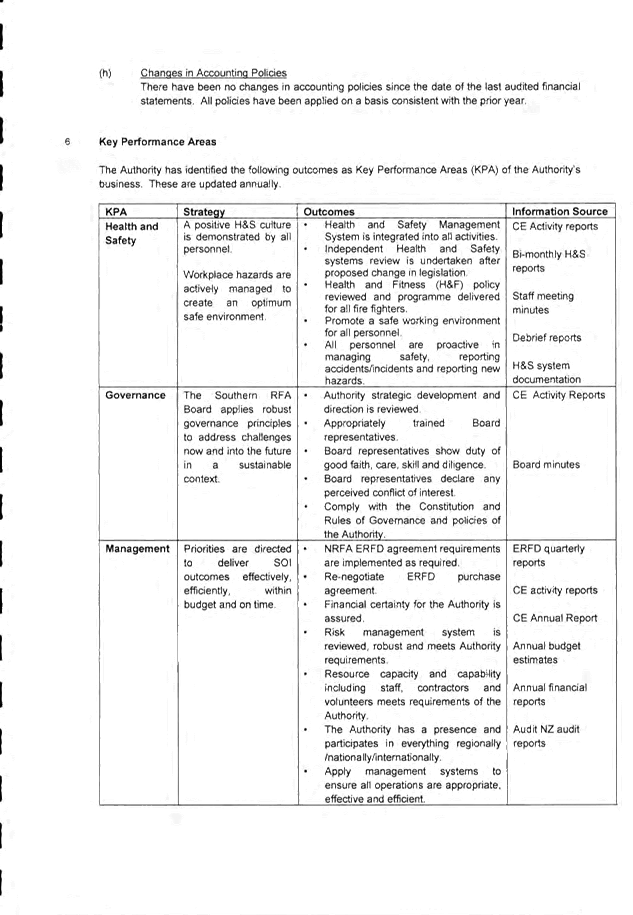

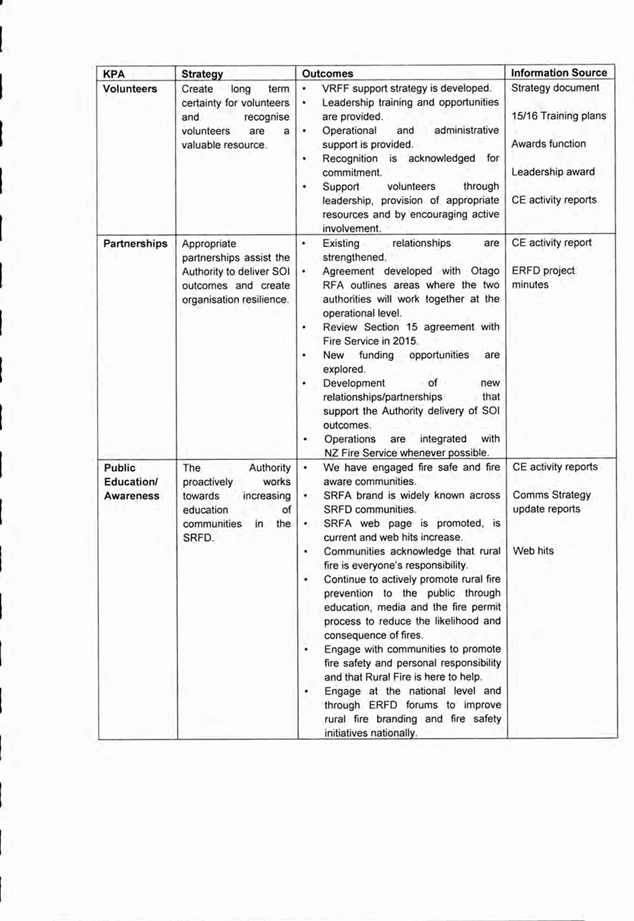

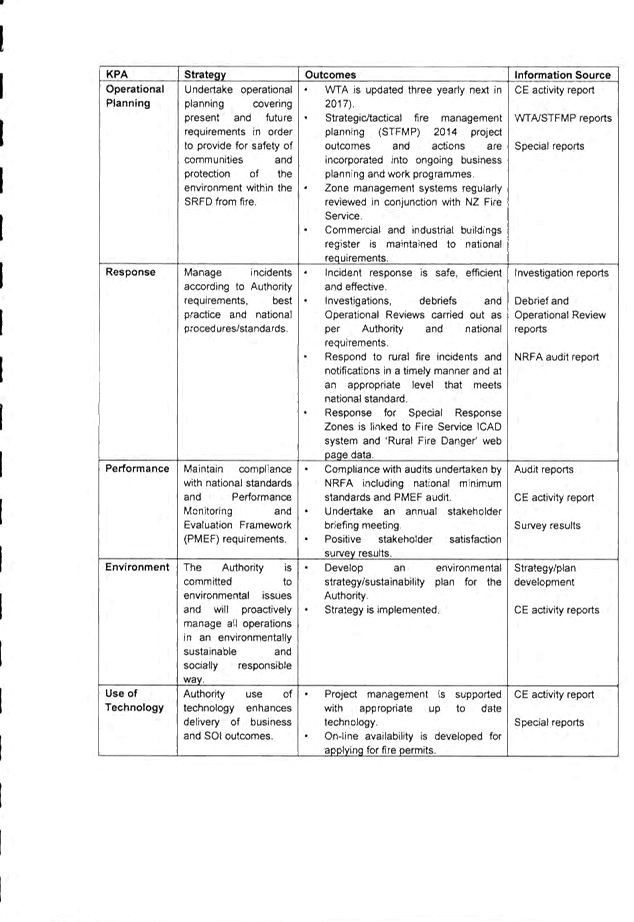

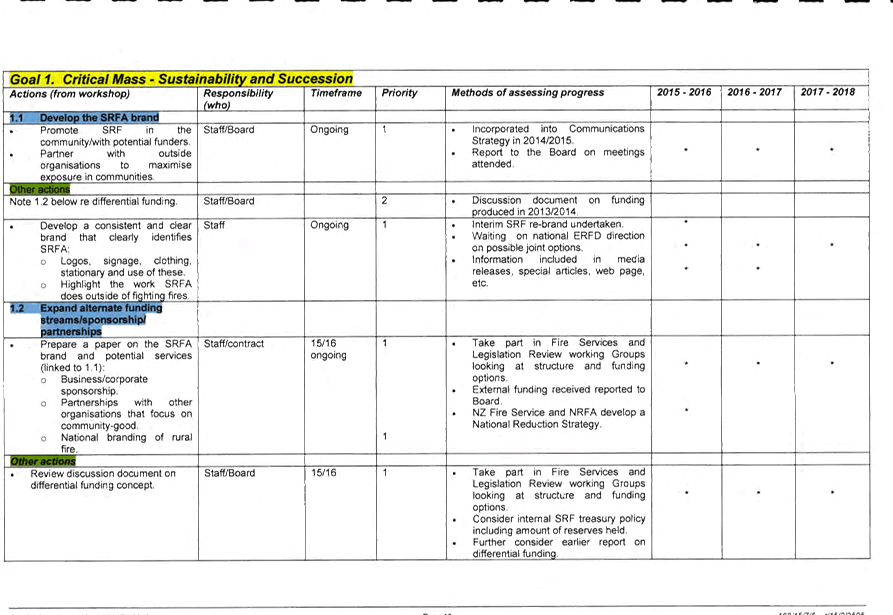

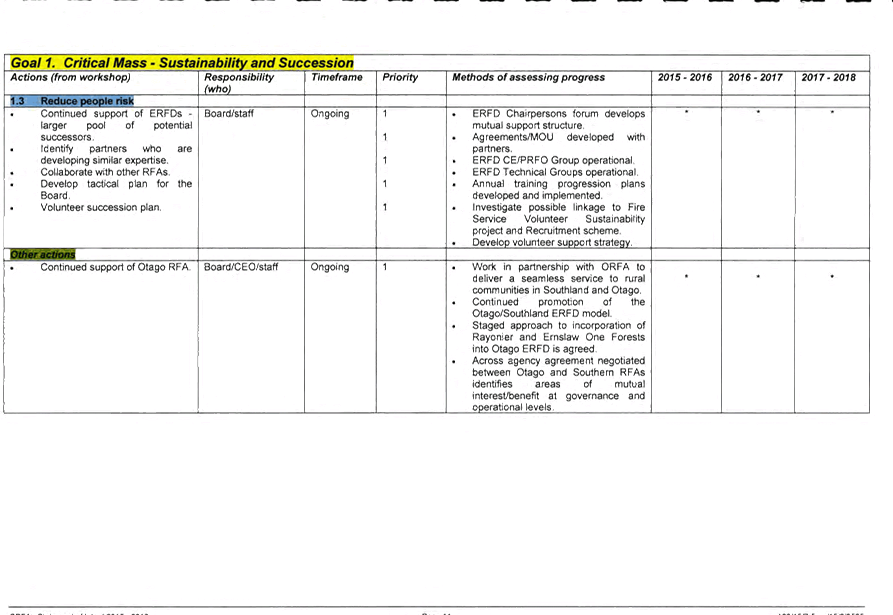

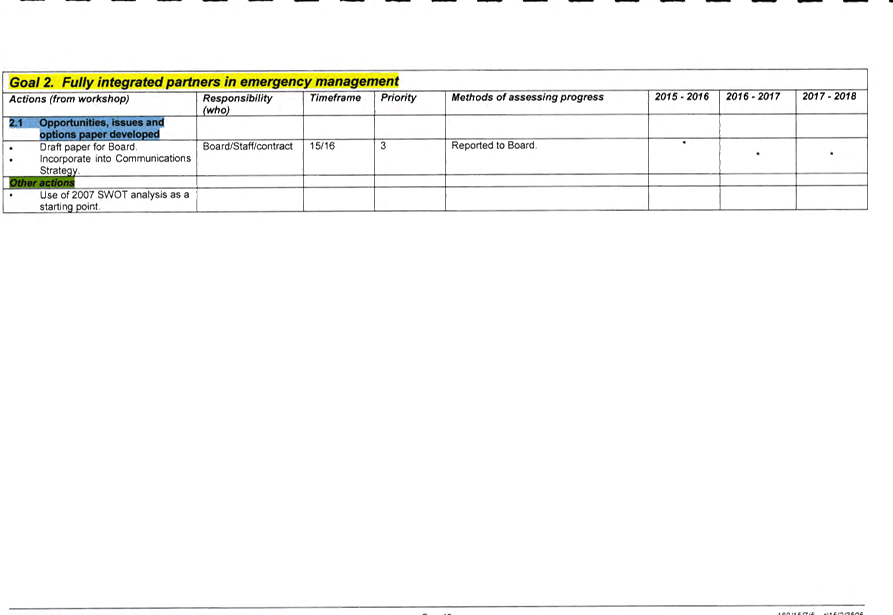

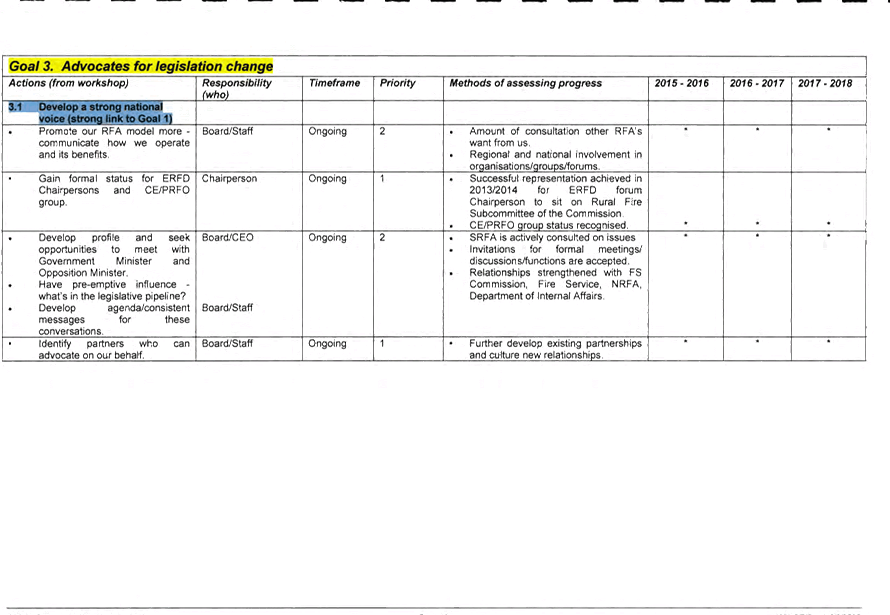

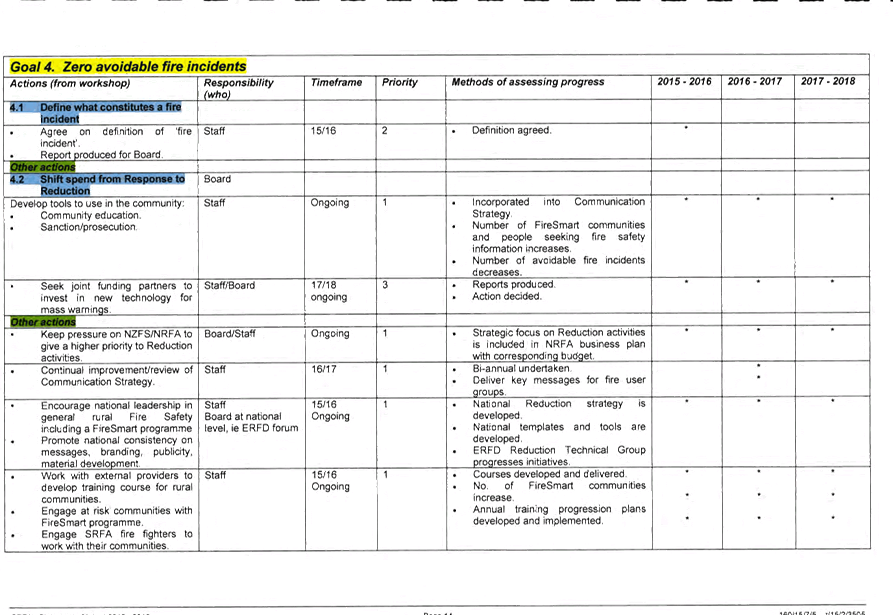

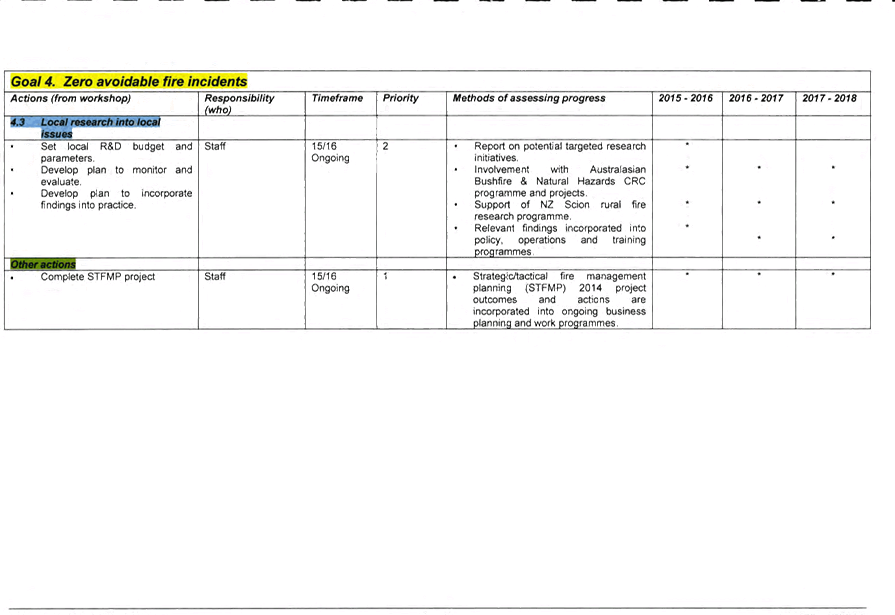

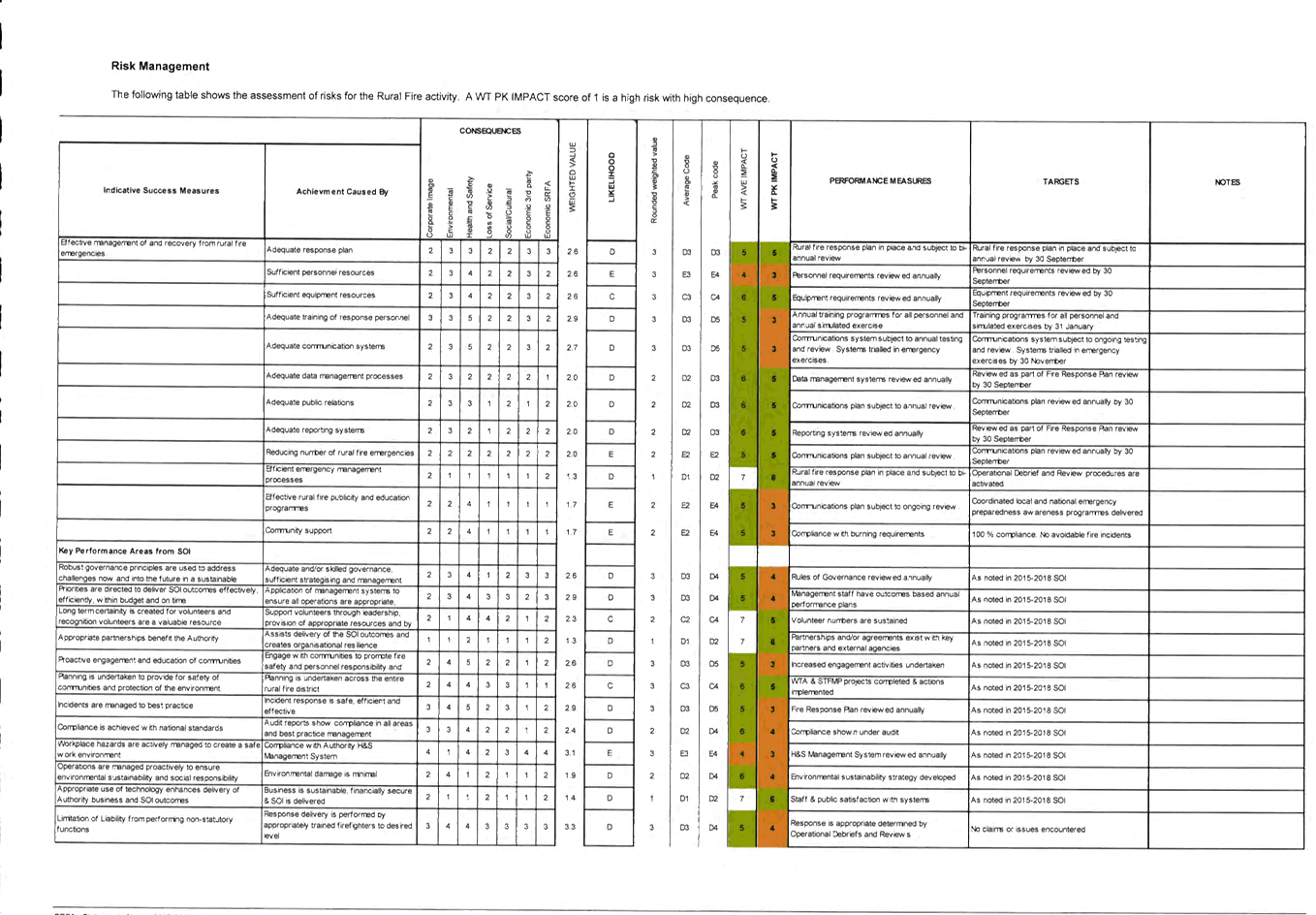

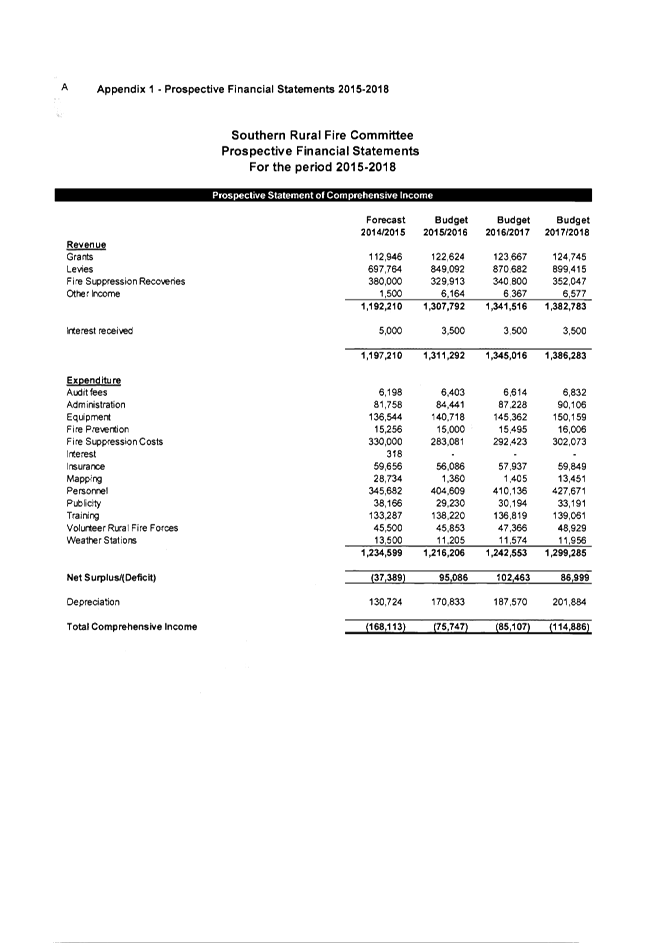

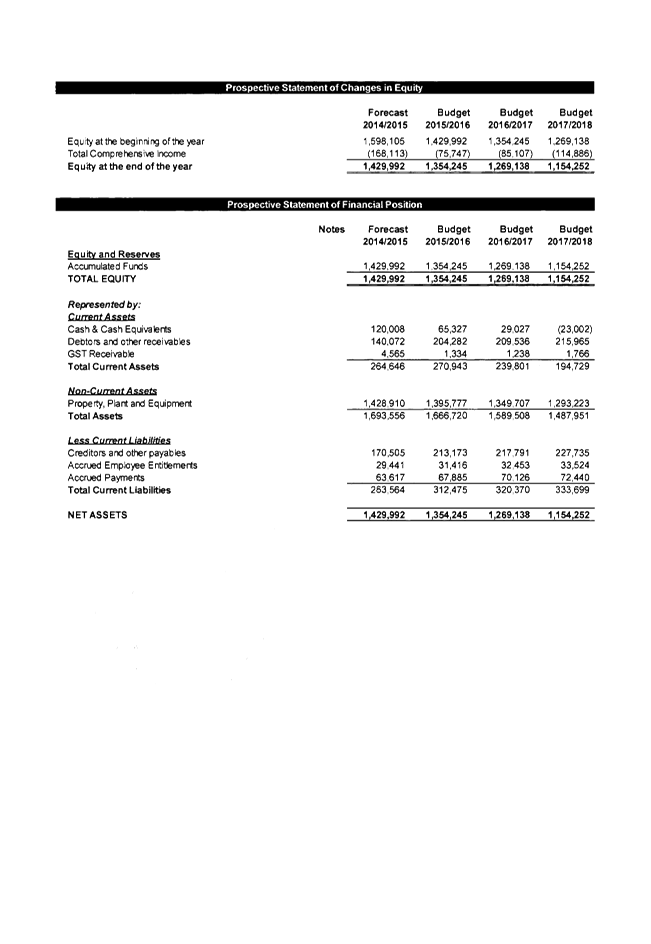

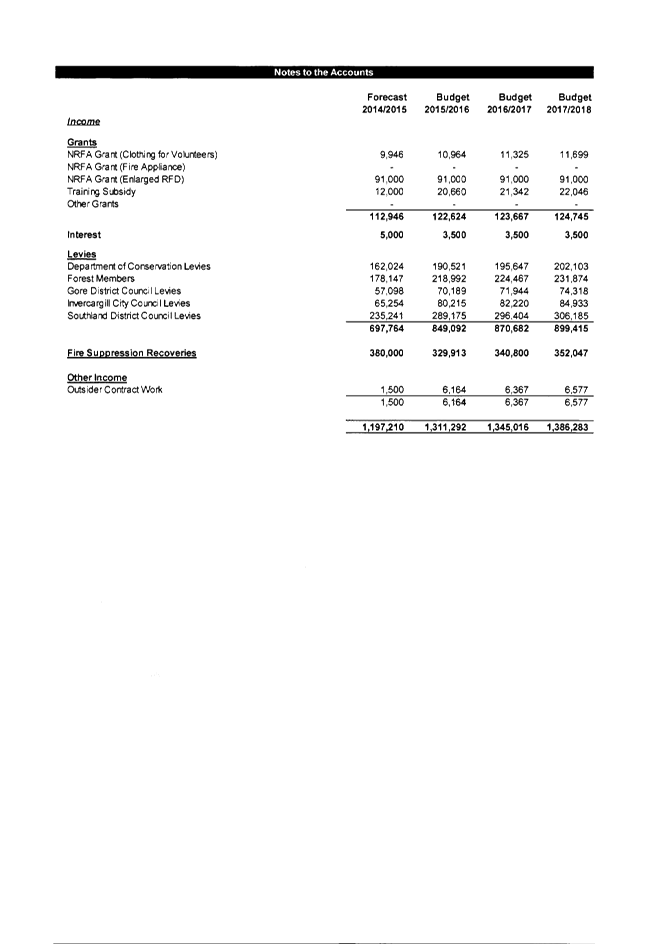

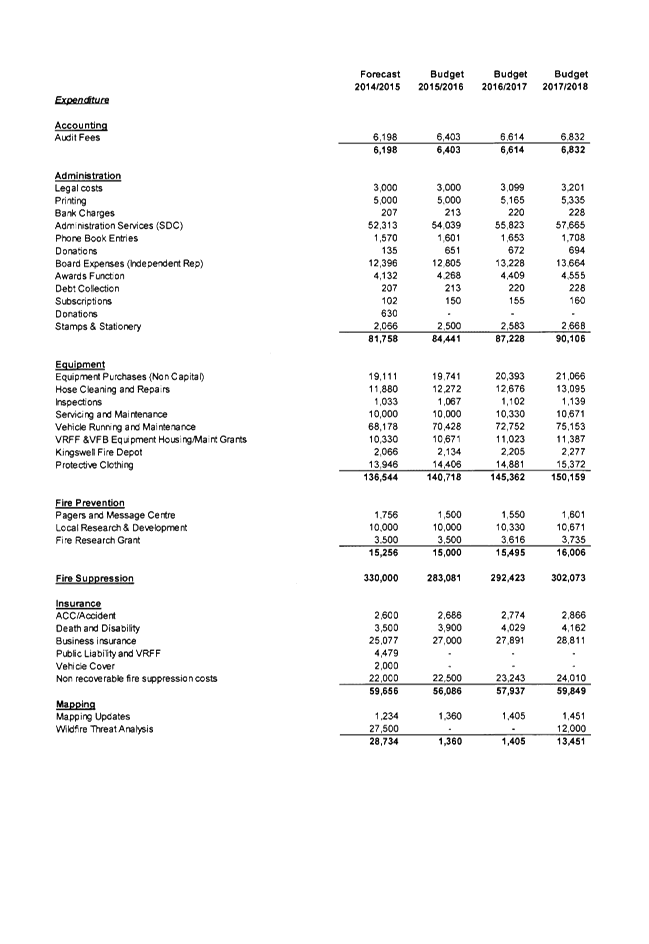

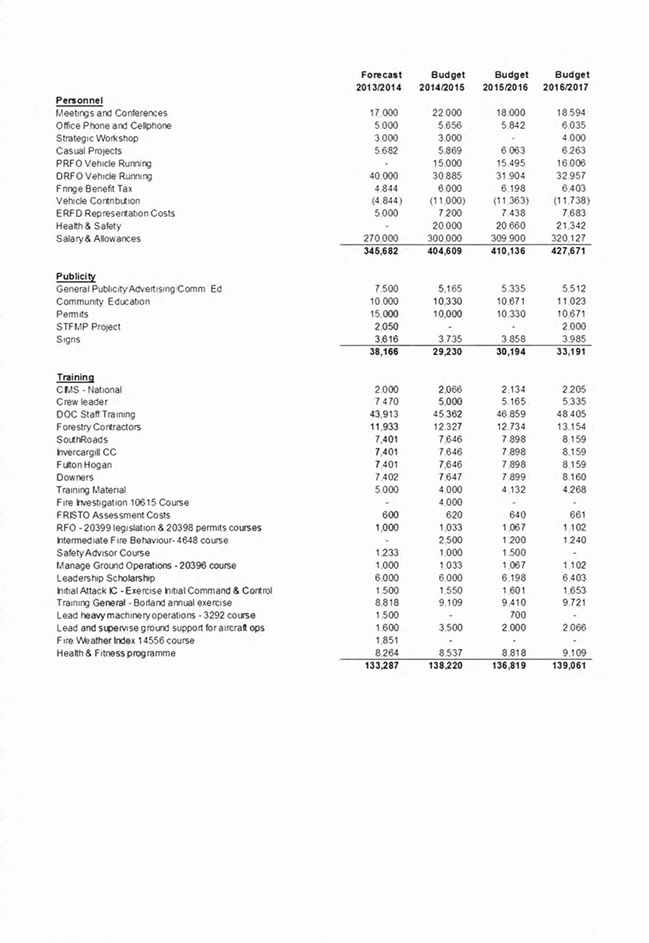

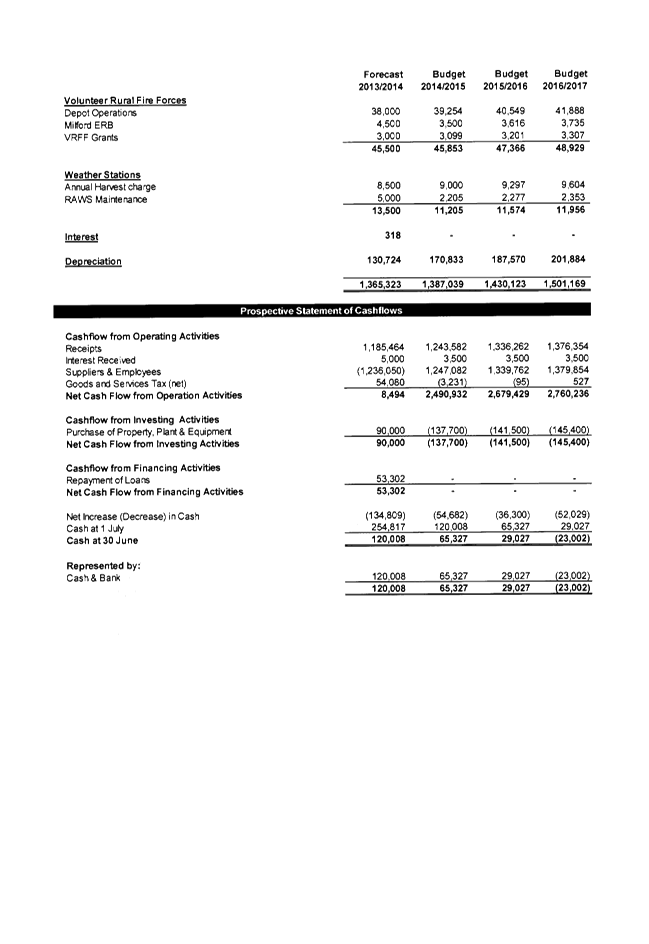

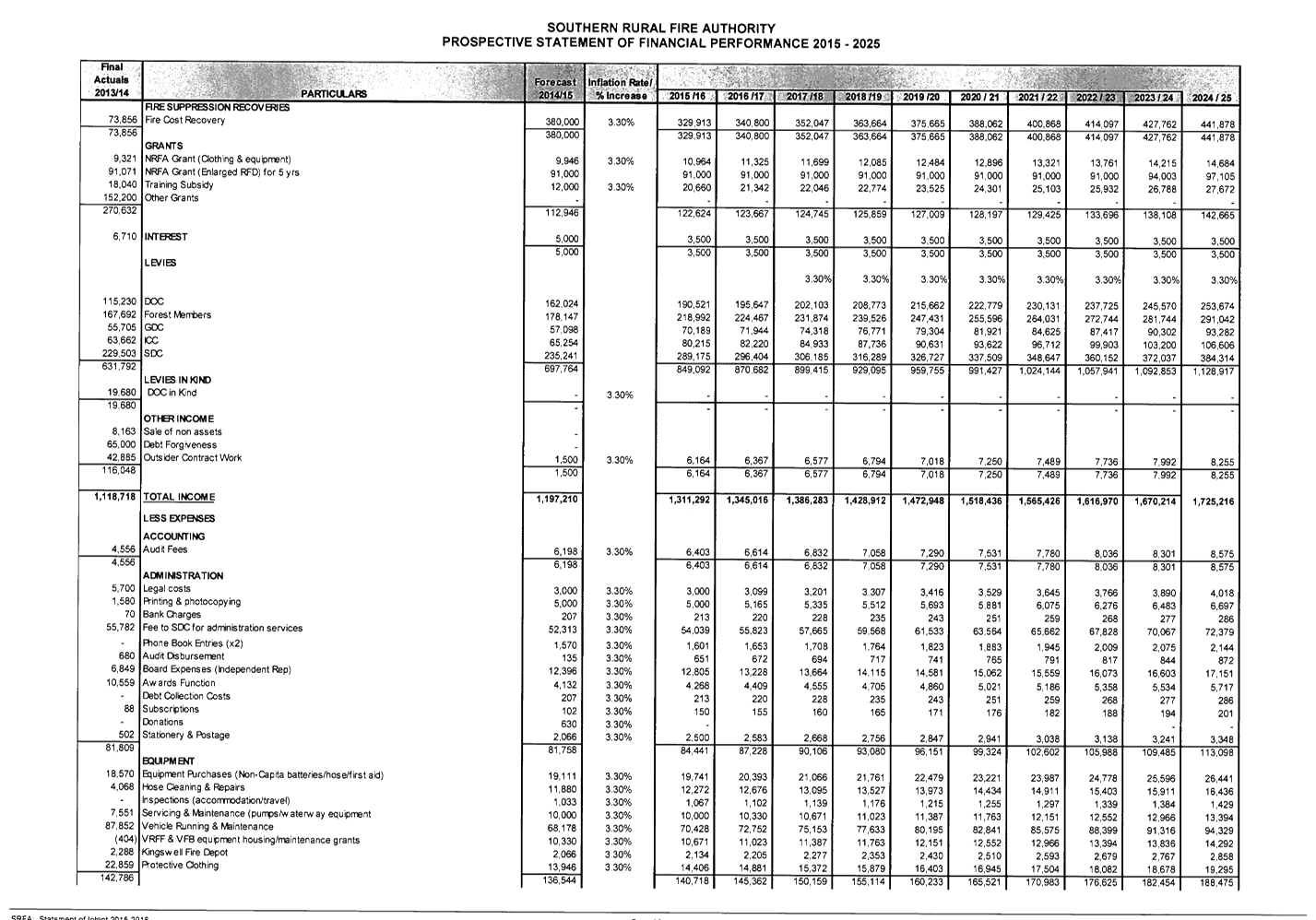

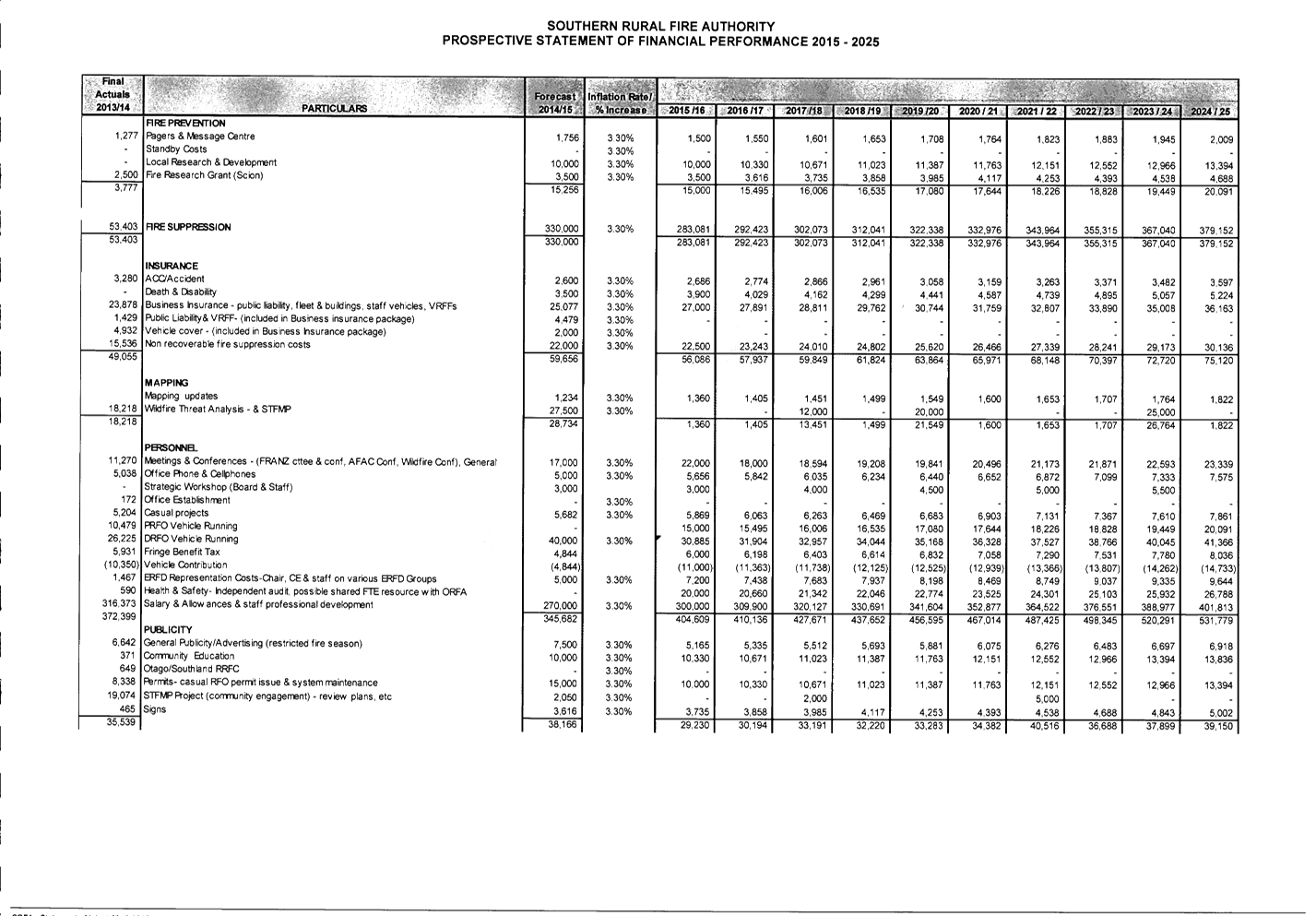

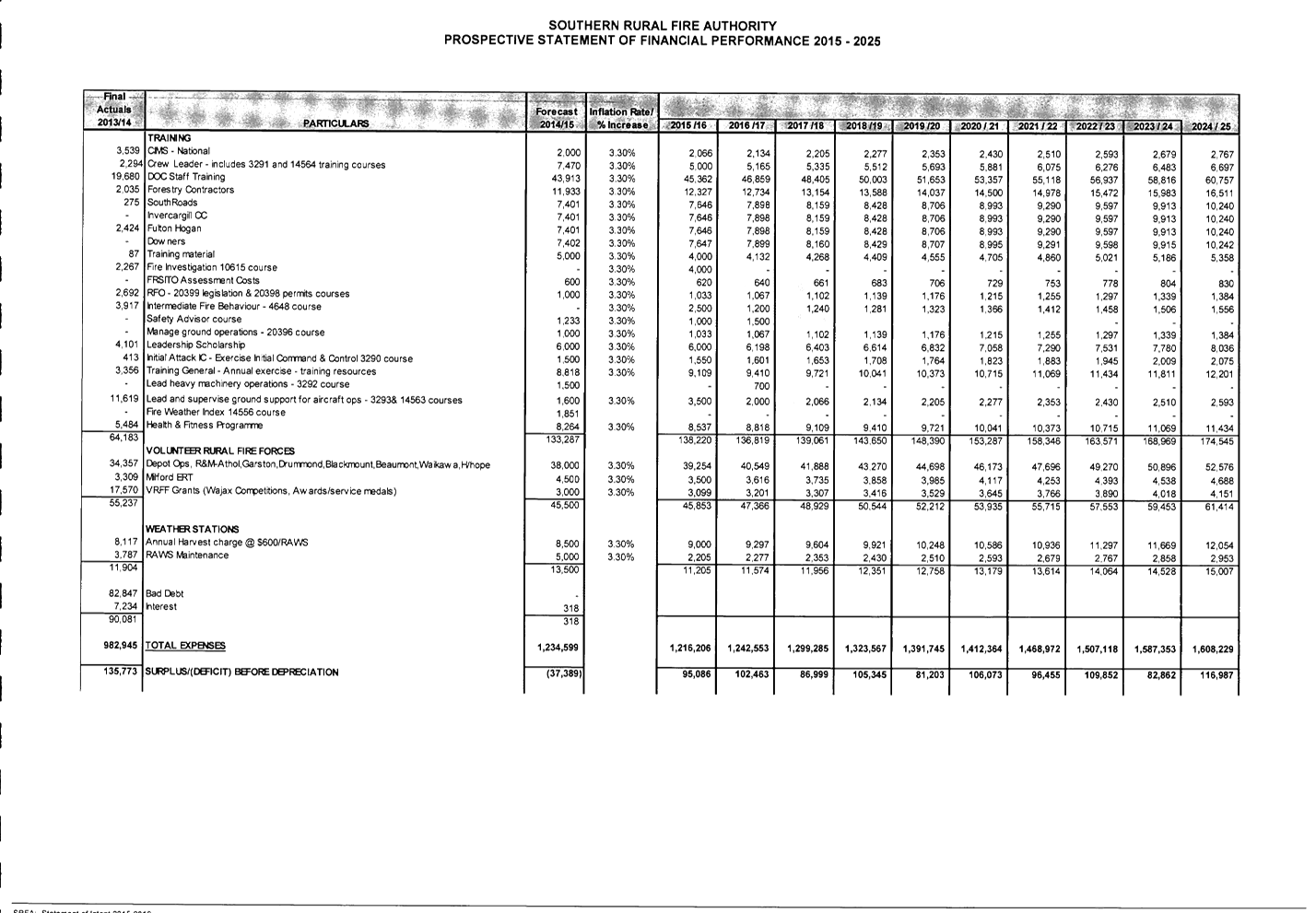

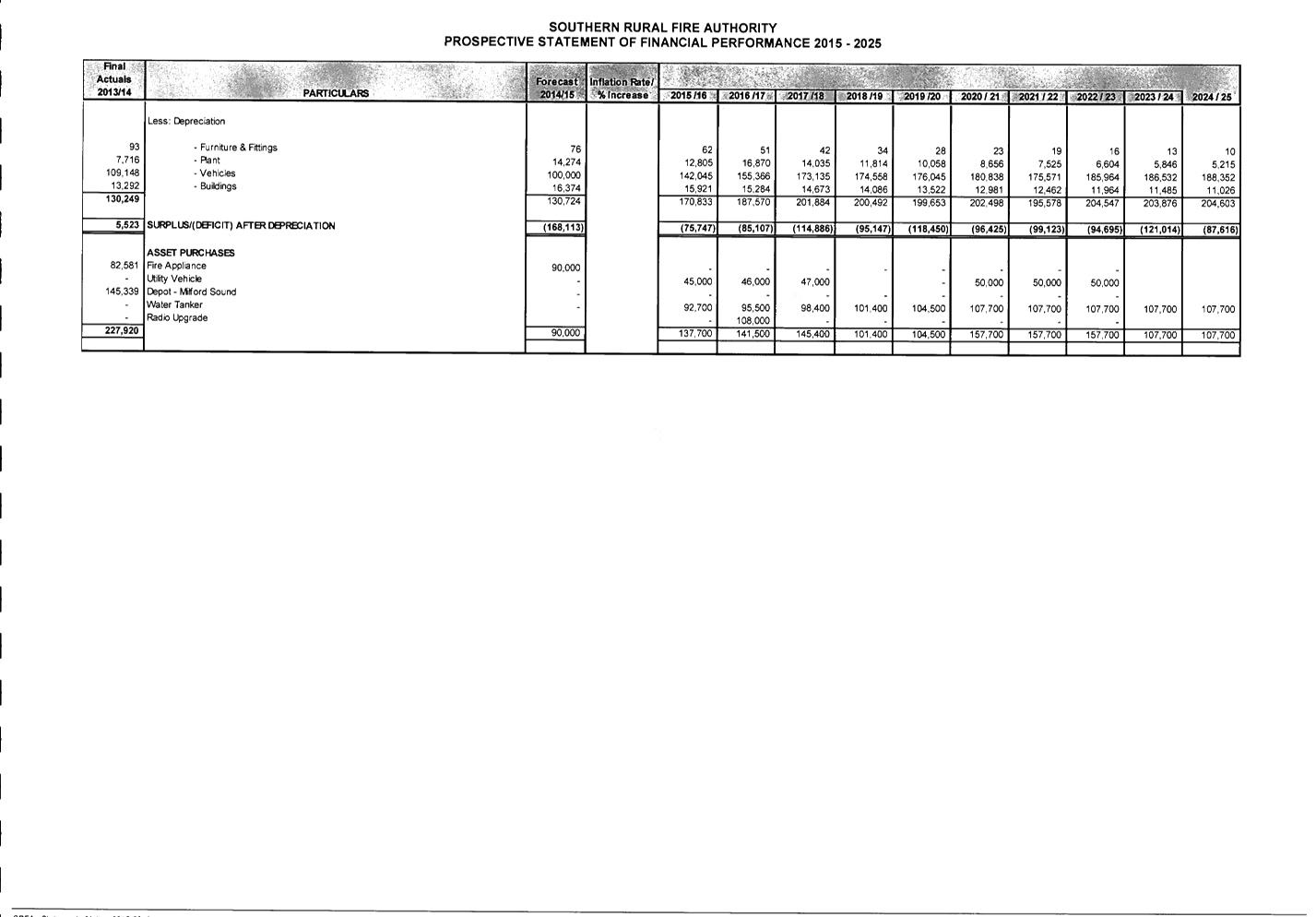

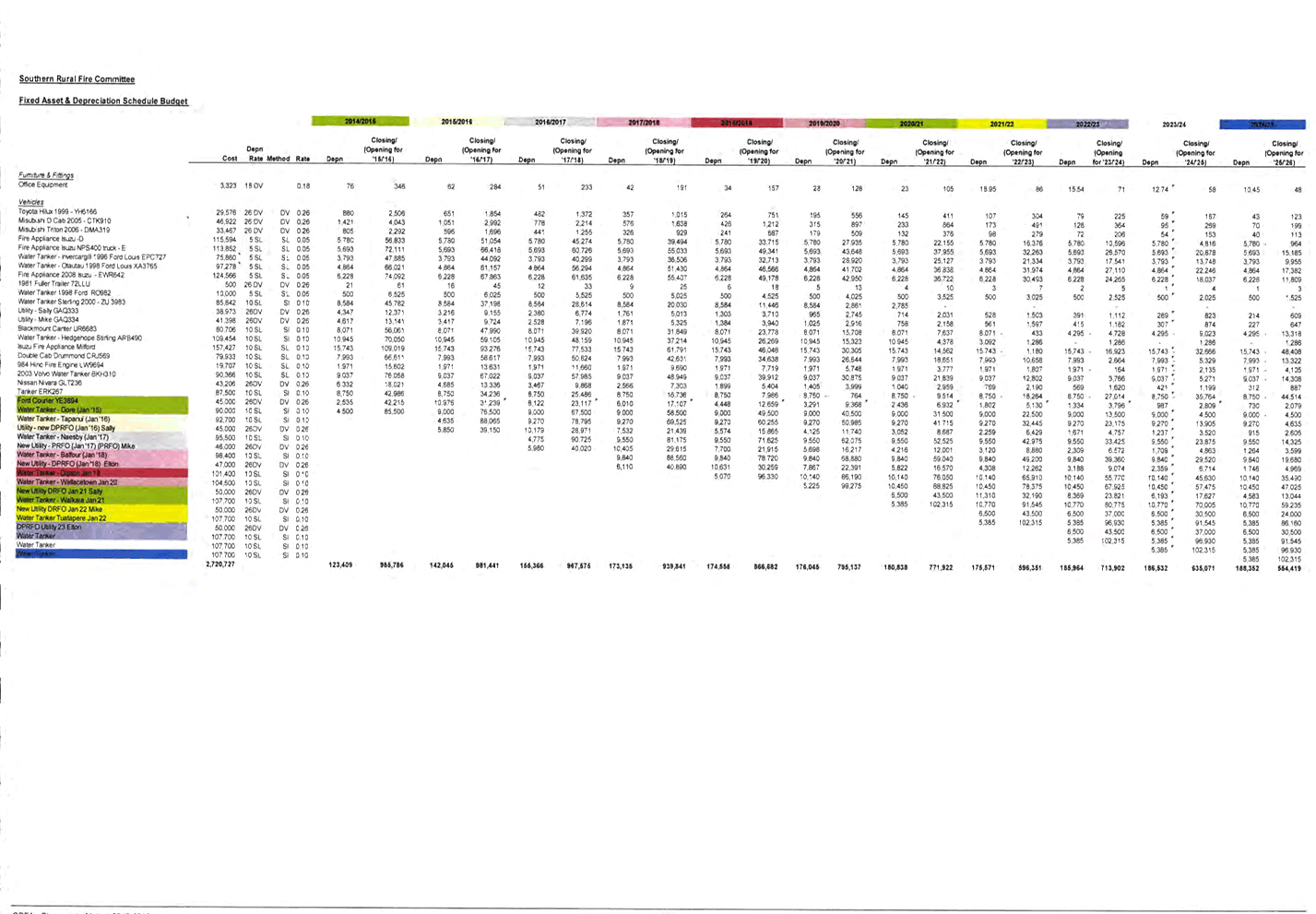

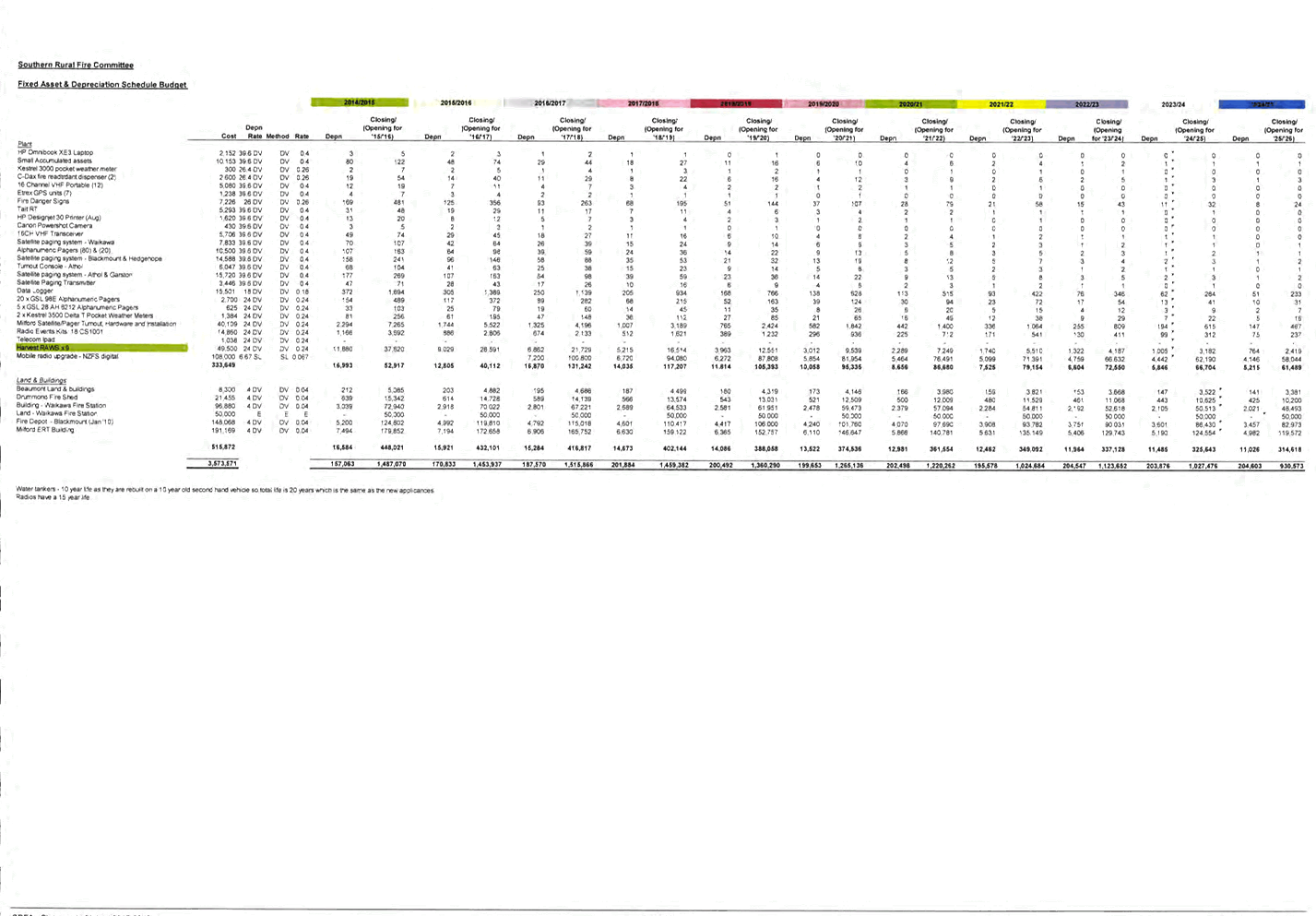

Southern

Rural Fire Authority - Draft Statement of Intent 2015-2018

Record No: R/15/5/7953

Author: Bruce

Halligan, GM - Environment and Community

Approved by: Steve Ruru,

Chief Executive

☐

Decision ☒ Recommendation ☐ Information

Purpose

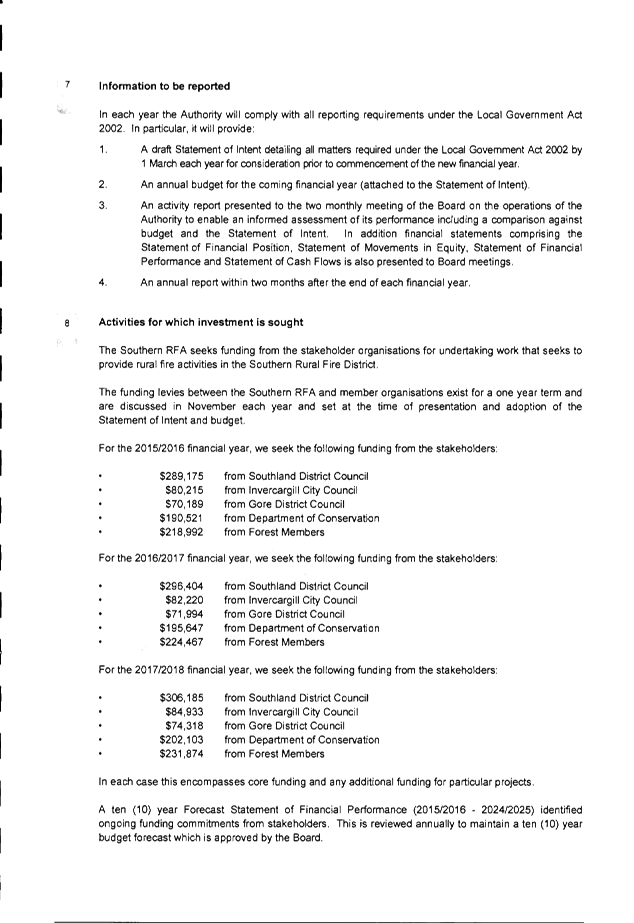

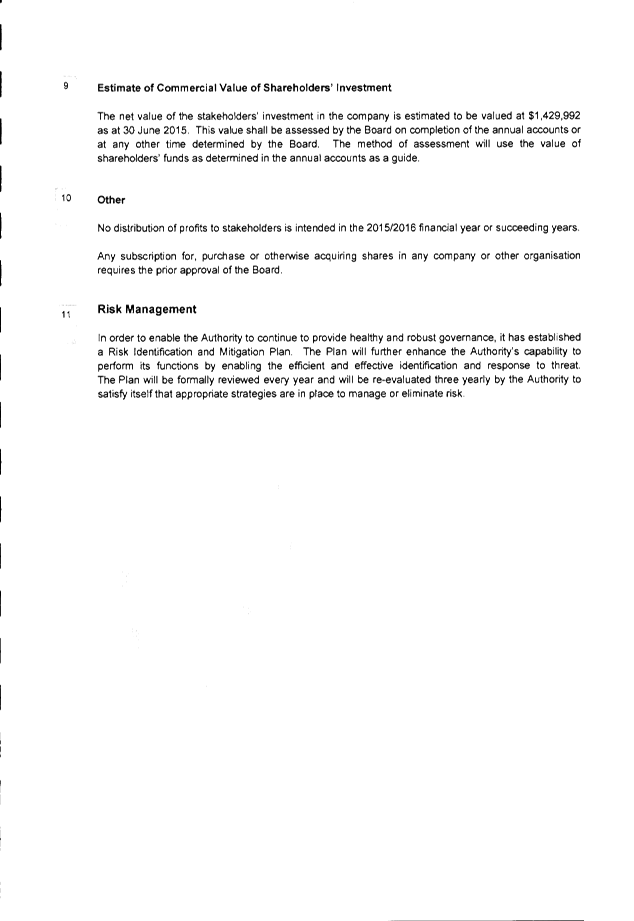

1 The

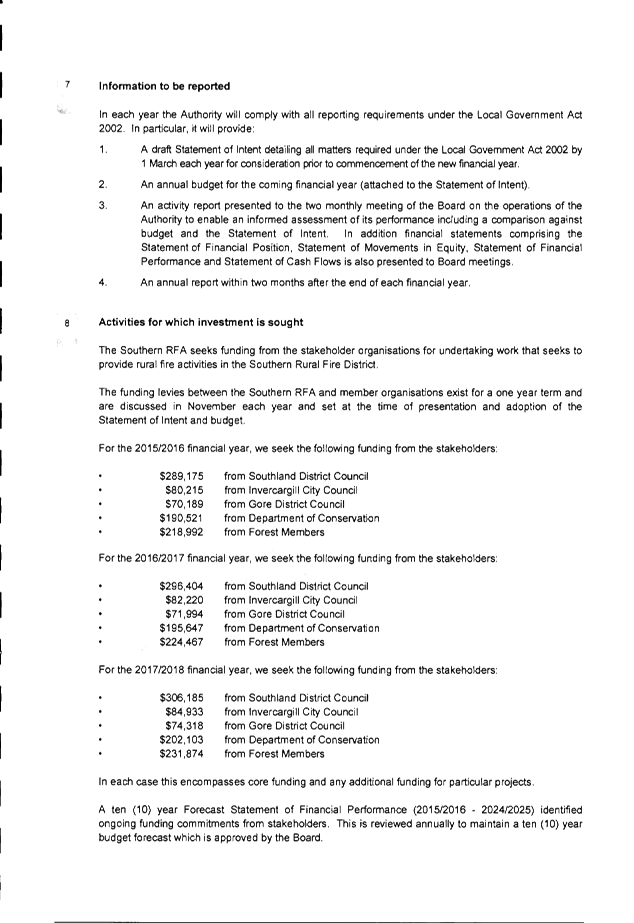

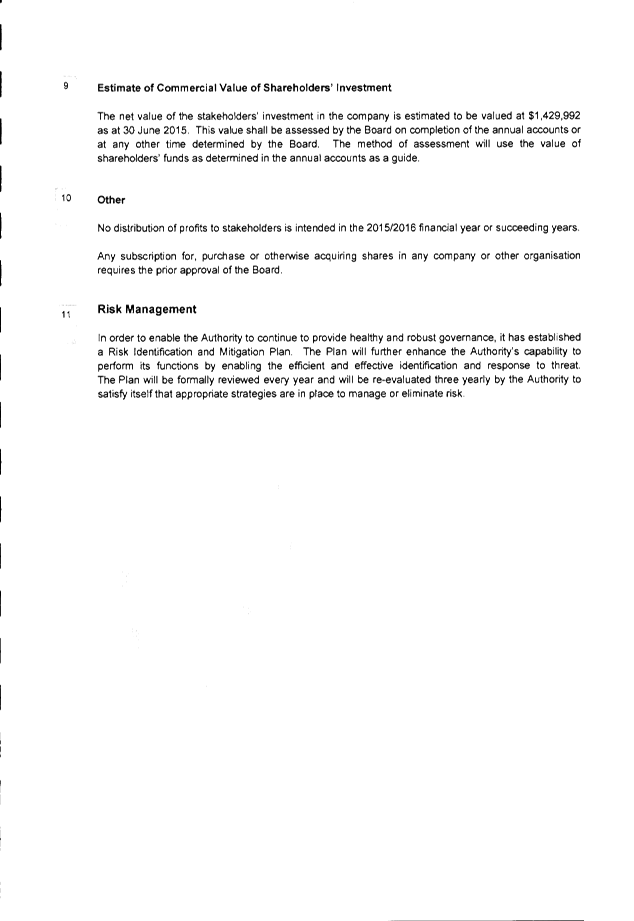

Southern Rural Fire Authority (SRFA) has provided its draft Statement of Intent

2015-2018 to Council and has requested any feedback from stakeholders.

2 As

Councillors will be aware, the Southland District Council has been a

long-standing member of SRFA and Mr Ian Marshall, Group Manager Services and

Assets and myself sit on the SRFA Board.

3 The

Draft Statement of Intent was approved for circulation by the SRFA Board at its

meeting on 10 April 2015 and outlines key SRFA Objectives, Key Performance

Areas and Goals and future funding expectations from participant

stakeholders/members.

4 Councillors’

feedback on the SRFA Draft Statement of Intent 2015-2018 is sought, and

Mr Mike Grant, SRFA CEO will be in attendance to speak to the Draft

Statement of Intent and answer any questions the Committee may have.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Southern Rural Fire Authority - Draft Statement of

Intent 2015-2018” dated 6 May 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Provides

any feedback it may have to the Southern Rural Fire Authority

Chief Executive.

|

Attachments

a Draft

SRFA Statement of Intent 2015-2018 View

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

24 June 2015

|

|

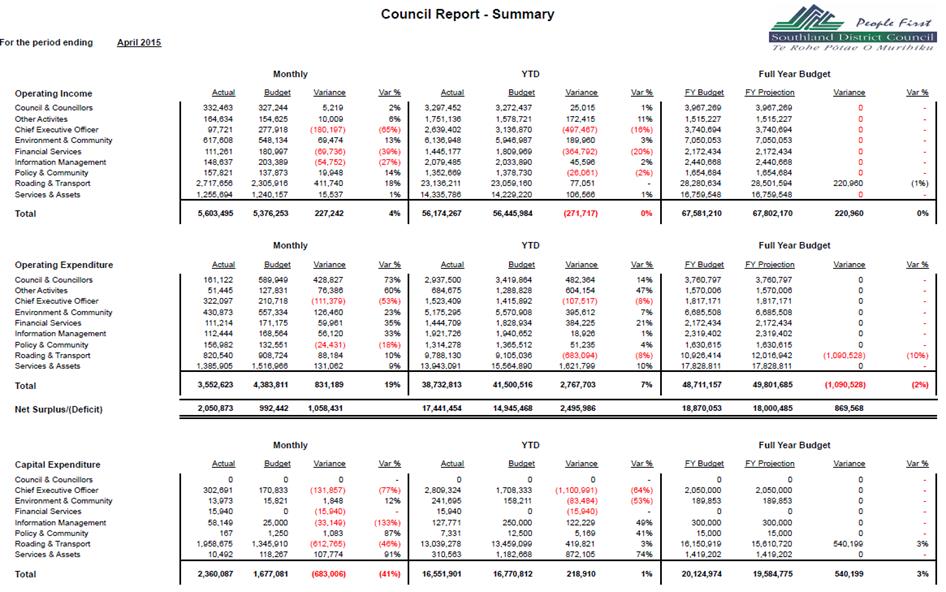

Finance

Report to 30 April 2015

Record No: R/15/6/9839

Author: Susan McNamara, Management Accountant

Approved by: Anne Robson, Chief Financial Officer

☐

Decision ☐ Recommendation ☒ Information

|

Recommendation

That

the Activities Performance Audit Committee:

a) Receives the

report titled “Finance Report to 30 April 2015” dated 9 June 2015.

|

Attachments

a Report

to Activities Performance Committee (APAC) - 24 June 2015 - Report to 30 April

2015 View

|

Activities

Performance Audit Committee

|

24 June 2015

|

Background

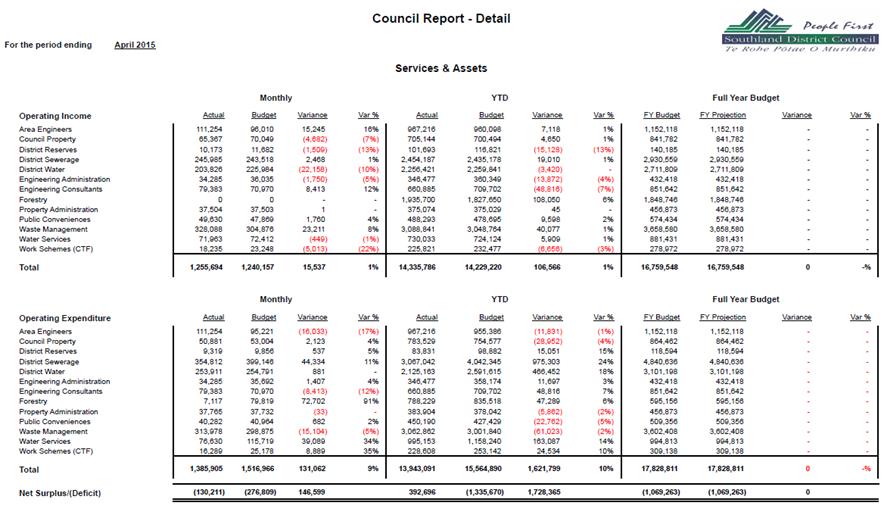

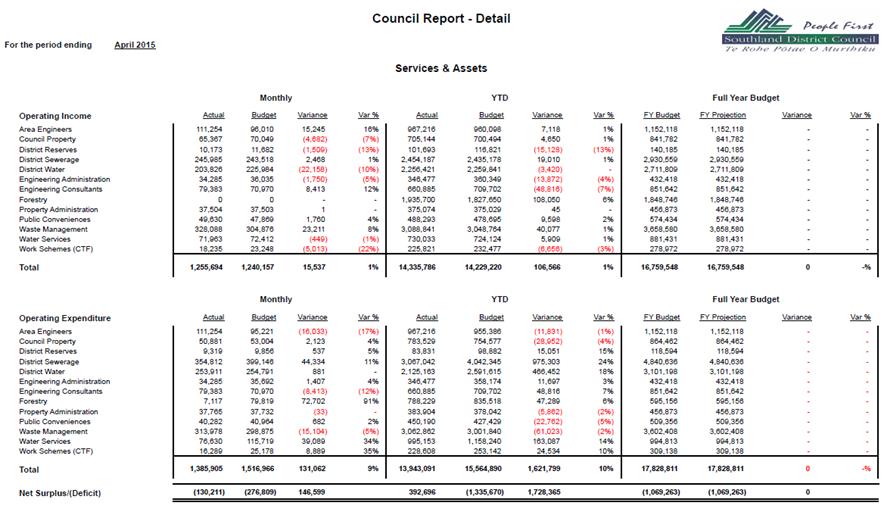

This report outlines the financial results to 30 April

2015.

Percentage of year gone: 83%.

OVERVIEW

Management Accountant April Finance Overview

As in prior years, all budget managers have been instructed

to have a strong focus on their budget and expenditure items.

The financial commentary centres on the summary sheet which

draws the totals from each of the key sections together. Although you are

able to obtain more detailed key variance explanations from senior managers in

these sections, these will be summarised below, concentrating on the YTD

results.

Income

Overall for the YTD, income is $272K under budget.

Key variances are as follows:

The Council and Councillors’ activity is 1% ($25K)

over budget for the year-to-date.

Other activities income is 11% ($172K) over budget for the

year-to-date. This is predominantly due to the timing of income received from

interest on investments.

Within the Chief Executive section, income received is $497K

(16%) under budget due to:

• Chief

Executive - 9% ($39K) over budget due to an unbudgeted vehicle sale and the

quarterly application of rates penalties.

• Stewart

Island Visitors Levy - Income is 16% ($21K) under budget. With the cruise

ship period completed, income is expected to be well under budget at year end.

• Around

the Mountains Cycle Trail – 33% ($551K) under budget due to final

invoicing to the Ministry being completed last financial year. This is

expected to be $840K under budget at year end.

Within the Environmental and Community Group, year-to-date

income is 3% ($190K) over budget, this is principally due to increased revenue

in Dog and Animal Control from infringement notices ($65K) and increased

numbers of dog registrations ($19K), as well as increased resource consent fees

as a result of invoicing of two significant notified consents.

Within the Financial Services Group, income is 20% ($365K)

under budget. As this activity is internally funded this is a result of

reduced expenditure.

Within the Information Management Group, year-to-date income

is 2% ($46K) over budget, predominantly due to recovery of internal

photocopying charges ($17K) and internal computer hire ($36K).

Within the Policy and Community Group, year-to-date income

is 2% ($26K) under budget. As this activity is internally funded this is a

result of reduced expenditure.

Within the Roading and Transport section, income is $77K

over budget. NZTA income is currently 3% ($360K) under budget and is

offset by internal income being $508K over budget. Roading are still

forecasting NZTA income to be 1% ($221K) under budget at the end of year.

Overall Services and Assets income

(excluding roading) is tracking 1% ($107K) above

year-to-date budget. This is due to:

• Overall

forestry income received is 6% ($108K%) over budget. This is expected to

be the position at year end.

• District reserves is 13% ($15K) under budget as reserve

transfers in relation to Curio Bay have yet to be actioned.

• Engineering consultants is $49K (7%) under budget. As

this activity is internally funded this is a result of reduced

expenditure.

Expenditure

Overall for the year-to-date, expenditure is 7% ($2.8M)

under budget.

The key variances are as follows:

The Council and Councillors’ activity is 14% ($482K)

under budget due to the timing of the payment to Venture Southland. This

will realign before the end of year.

Other activities expenditure is 47% ($604K) under budget as

the calculation of interest on reserves is calculated as a year-end

entry.

The Chief Executive activity is 8% ($108K) over budget due

to internal consenting costs relating to the Around the Mountains Cycle

Trail. This is partially offset by costs relating to Shared Services

forum which has had minimal costs for the year.

The Environment and Community Group is 7% ($396K) under

budget. This is predominantly due to expenditure on the District Plan

being lower than anticipated at this stage of the year. The expenditure

on the District Plan in currently $307K under budget and is expected to be

slightly under $400K under budget at the end of the year. It is

anticipated that additional costs will be incurred in the Environment Court

appeal/mediation process in the 2015/16 financial year.

Within Financial Services, expenditure is 21% ($385K) under

budget, primarily due to the timing of audit services ($120K) and staff

vacancies ($197K). Although some costs will be incurred before the end of

the year, Financial Services is expected to be $200K under budget at the end of

the year.

Within the Information Management Group, overall expenditure

is 1% ($19K) over budget.

Within the Policy and Community Group, expenditure is 4%

($51K) under budget due to no expenditure to date for community outcomes $30K

and lower than expected staff costs due to maternity leave.

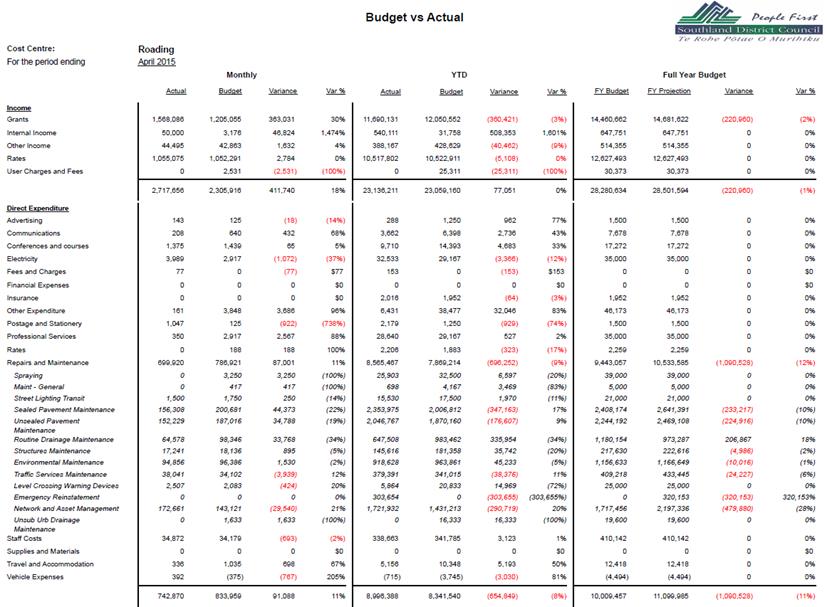

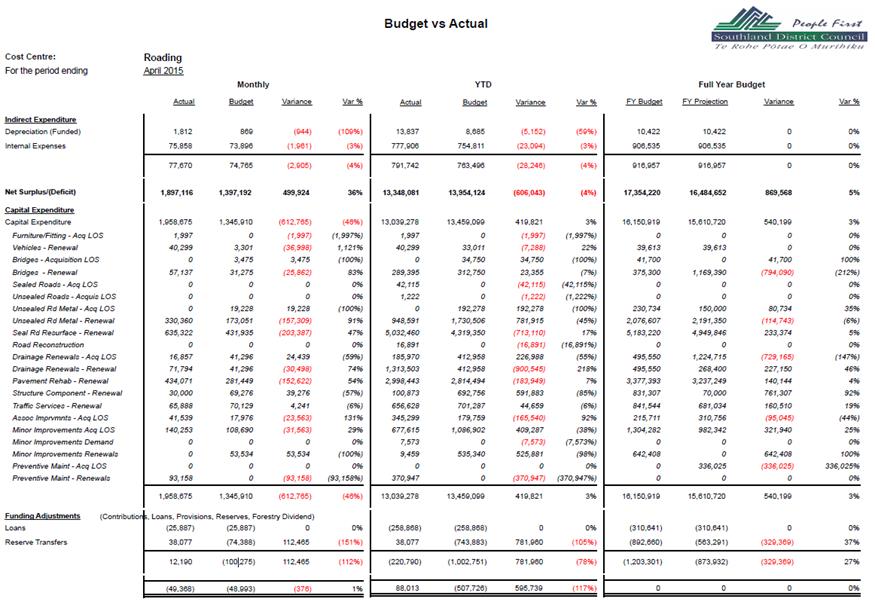

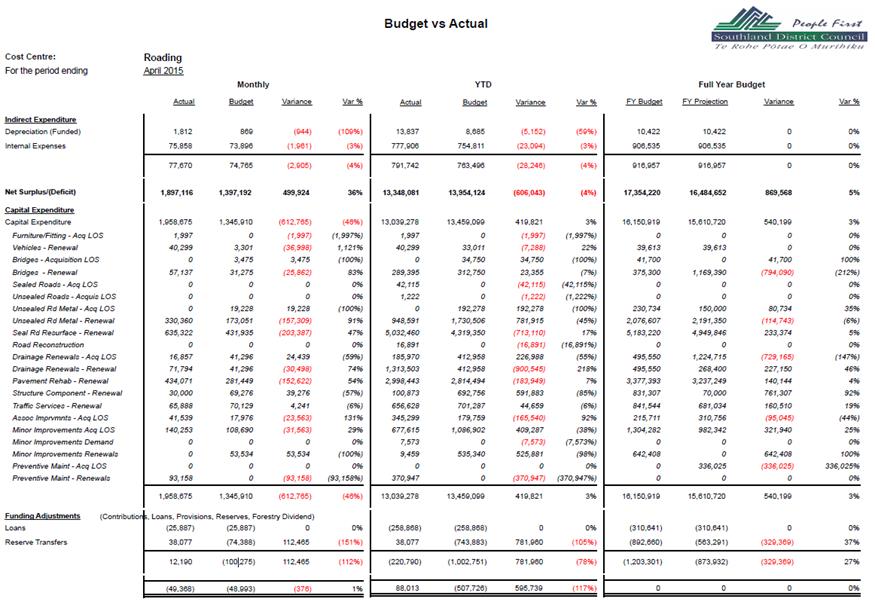

Roading expenditure is currently 8% ($683K) over

budget. It is forecasted that operations and maintenance costs will be

$1.1M over budget at year end. This will be partially offset by

underspends in capital expenditure ($540K) and underspends in the previous two

years. The forecasted overspend can be also be contributed to unbudgeted

emergency works projects Stewart Island Slips and the Ohai Clifden Slip.

The Services and Assets Group is 10% ($1.62M) under budget. Key variances are as

follows:

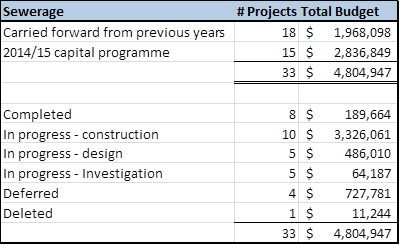

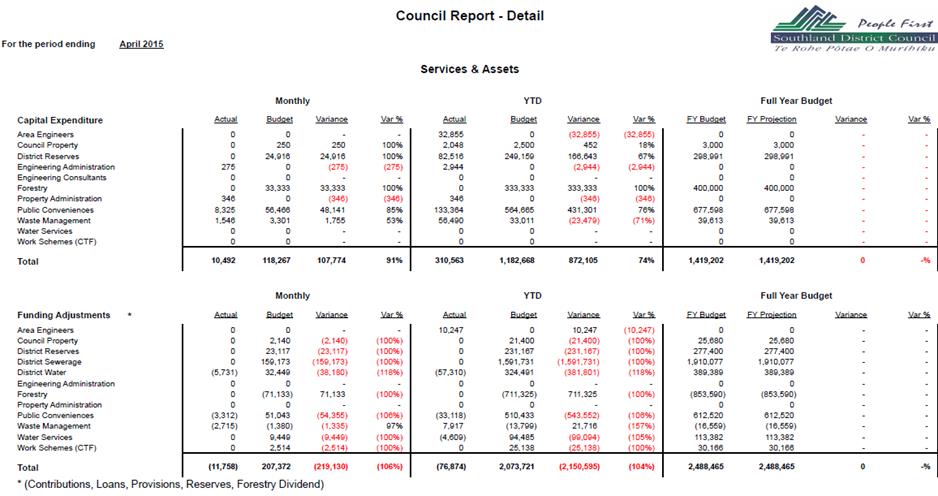

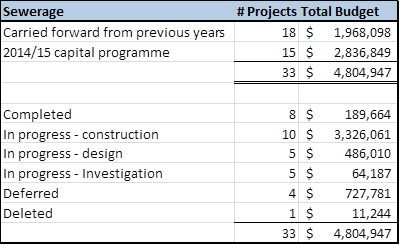

• District sewerage is 24% $975K under budget. Year to date $3.07M actual versus $4.04M budget has been

completed.

Currently

five District funded projects totalling $739K have been deferred or

deleted. Investigation has shown $11K is not required, $6K has been

rescheduled to a new year and $722K is waiting on additional testing or other

work to be completed.

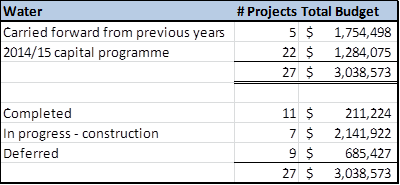

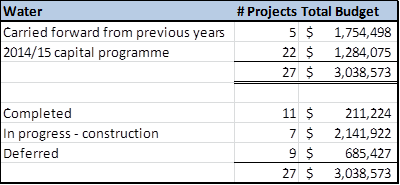

• District water is 18% ($466K) under budget as there has been minimal capital expenditure year-to-date

($335K actual v $872K budget).

Currently, nine District funded projects totalling $685K have been

deferred. Investigation has shown $181K is not required at this stage,

$156K has been rescheduled to a new year and $348K is waiting additional

testing or other work to be completed.

• Engineering Consultants business unit is $49K (7%) under

budget due to reduced expenditure in consultants and internal services.

• Forestry

is 6% ($47K) under budget predominantly due to the timing of pruning and

replanting activity within the various forests.

• Waste

management is 2% ($61K) over budget due to increased waste transfer, recycling

and internal waste charges at Stewart Island and Te Anau transfer

stations.

• Water services is $163K (14%) under budget predominately

due to less project consultant costs being required than budgeted.

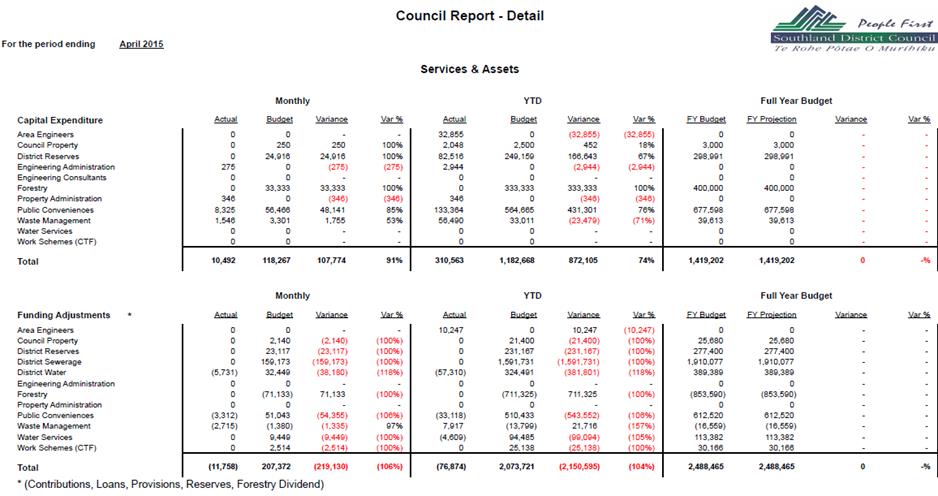

Capital Expenditure

Overall for the year-to-date, capital expenditure is 1%

($219K) under budget.

The key variances are as follows:

• Capital

expenditure in the Chief Executive activity is over budget by 64% ($1.1M)

due to the progress on stage 2 of the Around the Mountains Cycle Trail.

• Environment

and Community is over budget by 53% ($83K) for the

year-to-date primarily due to an additional vehicle purchase for Animal Control

and the timing of the replacement of a vehicle for Environmental Health.

• Information

Management capital expenditure is under budget by 49% ($122K) due to minimal

costs to date being incurred in the Records Improvement Plan.

• Roading

capital expenditure is under budget by 3% ($420K) due to timing on planned road

and pavement renewals. The capital budget at year end is forecast to be

$540K below budget.

• Services

and Assets are under budget by 74% ($872K) with minimal capital expenditure to

date on projects planned in public conveniences, district reserves and

forestry.

Funding Adjustments

Funding adjustments are significantly under budget as

typically ‘balancing’ of business units is not undertaken until the

end of the financial year.

Journals are being processed for reserve transfers,

predominantly in relation to vehicle movements, and loan draw-downs (ie for

project funding), throughout the year at the request of budget managers.

Key Financial Indicators

|

Indicator

|

Target*

|

Actual

|

Variance

|

Compliance

|

|

External Funding:

Non rateable income/Total income

|

> 39%

|

37%

|

-2%

|

x

|

|

Working Capital:

Current Assets/Current Liabilities

|

>1.09

|

2.24

|

1.15

|

a

|

|

Debt Ratio:**

Total Liabilities/Total Assets

|

<0.73%

|

0.77%

|

0.04%

|

x

|

|

Debt To Equity Ratio:

Total Debt/Total Equity

|

<0.01%

|

0.00%

|

0.01

|

a

|

* All

target indicators have been calculated using the 2014/15 Annual Plan

figures.

** Excludes

internal loans.

Financial

Ratios Calculations:

|

Non

Rateable Income

|

|

Total

Income

|

External Funding:

This ratio indicates the percentage of revenue received

outside of rates. The higher the proportion of revenue that the Council

has from these sources the less reliance it has on rates income to fund its

costs.

|

Current

Assets

|

|

Current

Liabilities

|

Working Capital:

This ratio indicates the amount by which short-term assets

exceed short term obligations. The higher the ratio the more comfortable

the Council can fund its short term liabilities.

|

Total

Liabilities

|

|

Total

Assets

|

Debt Ratio:

This ratio indicates the capacity of which the Council can

borrow funds. This ratio is generally used by lending institutions to

assess entities financial leverage. Generally the lower the ratio the

more capacity to borrow.

Debt to Equity Ratio:

It indicates what proportion of equity and debt the Council

is using to finance its assets.

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

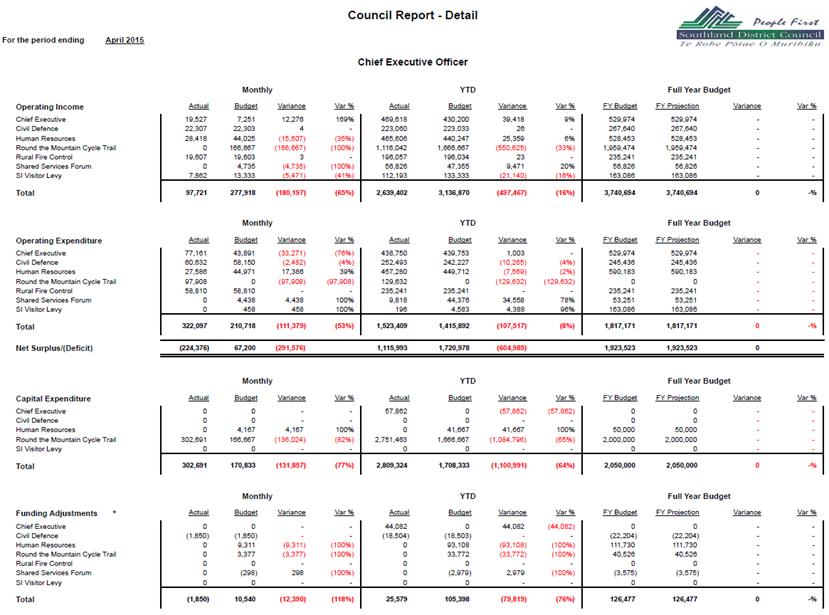

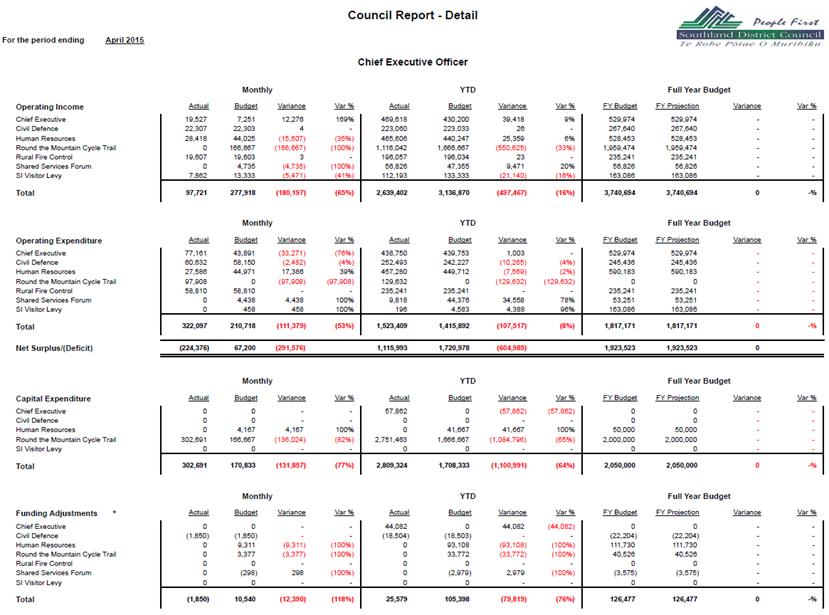

CHIEF EXECUTIVE COMMENTARY

For the year-to-date, income is under budget by $497K

(16%). Expenditure is over budget by $108K (8%), therefore resulting in a

net year-to-date position of $605K under budget.

Chief Executive

Income in this business unit is $39K (9%) over budget, this

is due to proceeds on an unbudgeted vehicle sale $14K and rates penalties

income $12K. Expenditure is $1K under budget, due to staff costs $69K

under budget. This is offset by project consultant fees $31K and

membership fees $48K which is due to a coding error that will be corrected in

May.

Civil Defence

Income is on budget. Expenditure is $10K (4%) over

budget due to the Emergency Management Southland grant being slightly higher

than was budgeted. It is anticipated to be $10K over budget at year end.

Human Resources

Income is $25K (6%) over budget. Expenditure

year-to-date is $8K (2%) over budget, due to training costs $47K offset by

survey expenses $22K consultant costs $14K and staff costs $13K. As this

activity is internally funded, the increased expenditure impacts directly on

income.

Around the Mountain Cycle Trail

Income is $551K (33%) under budget due to final invoicing to

the Ministry being completed last financial year. It is expected to be

$840K under budget at year end. Expenditure is $130K over budget and

capital expenditure is over budget by $1.09M with work being undertaken on

Stage 2.

Rural Fire Control

Income and expenditure is on budget for the year.

Shared Services Forum

Income is $9K (20%) over budget due to the timing on

contributions. Expenditure for

year-to-date is under budget by $35K (78%), with low activity for the

year.

Stewart Island Visitor Levy

Income is $21K (16%) under budget. With the cruise

ship period completed, income is expected to be under budget at year end.

Expenditure is $4K under budget with the allocation meeting occurring in May.

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

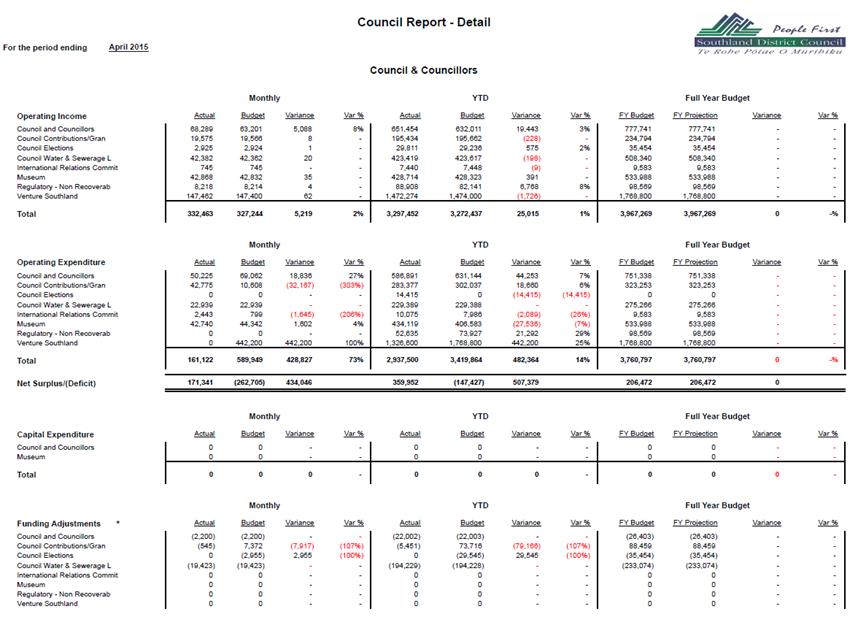

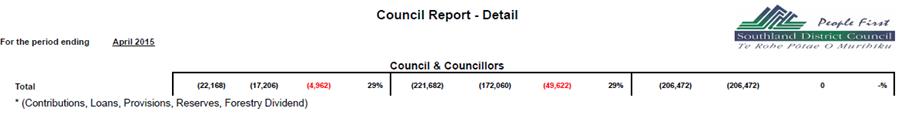

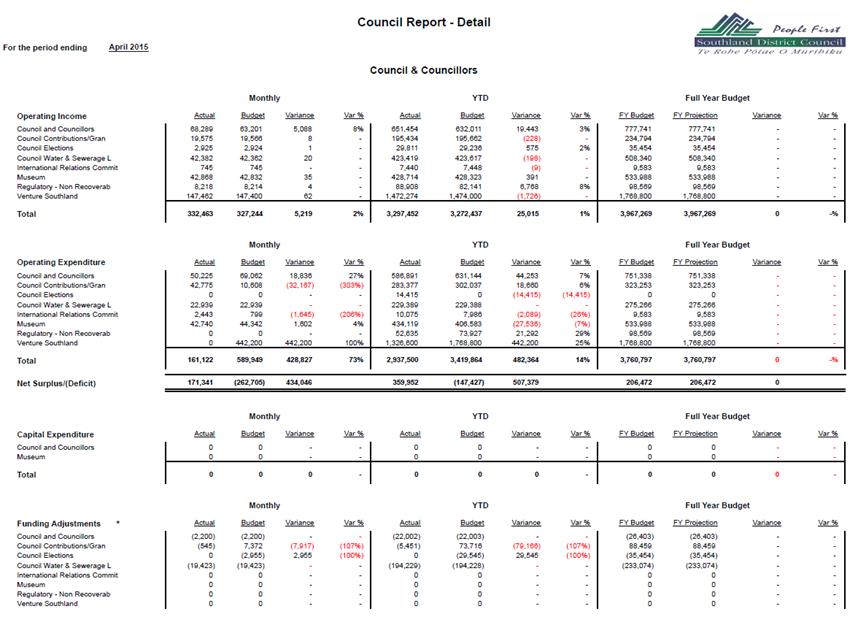

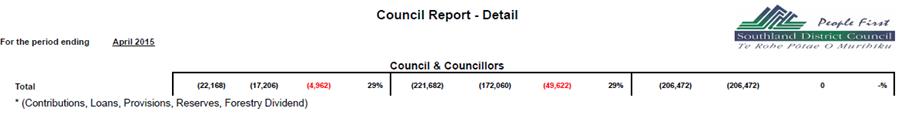

Council and Councillors’ Commentary

For the year-to-date, income is $25K (1%) over budget.

Expenditure is under budget by

$482K (14%), primarily due to a budgeting error in the timing of grants to

Venture Southland. This resulted in a net year-to-date position of $507K over

budget.

Council and Councillors

Income is $19K (3%) over budget as a result of unbudgeted

income from internal catering $14K% funding for Leadlab. Expenditure is

under budget by $44K (7%) primarily due to Councillors’ salaries of $17K,

travel $5K and Youth Council costs $7K however we are anticipating higher

year-end expenditure in relation to Leadlab. NZLGA costs are also $9K under

budget due to an error which will be corrected in May.

Council Contributions/Grants

Income is on budget for the year-to-date. Expenditure

is under budget by $19K (6%) due to grant payments yet to be requested and the

upcoming grant allocation round.

Council Elections

Income is on budget. Expenditure is $14K over budget

due to the Mararoa Waimea Ward Councillor election. No additional costs

are expected this year relating to the election.

Council Water and Sewerage Loans

Income and expenditure is on budget for the year-to-date.

International Relations Committee

Income is on budget for the year-to-date. Expenditure

is $2K over budget with attendance at the Sister Cities Conference in

March. It is expected to be on budget at year end.

Museum

Income is on budget. Expenditure is over budget $28K (7%)

due to timing on the Museum Trust Board Levy, it is expected to be on

budget at the end of the year.

Regulatory - Non-Recoverable

Income is $7K (8%) over budget for the year-to-date.

Expenditure is under budget by

$21K (29%) as a result of minimal expenditure to date.

Venture Southland

Income is on budget, expenditure is $442K under budget due

to the timing of grant payments not aligning with our budget. This will

be on budget at the end of the year.

|

Activities Performance

Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

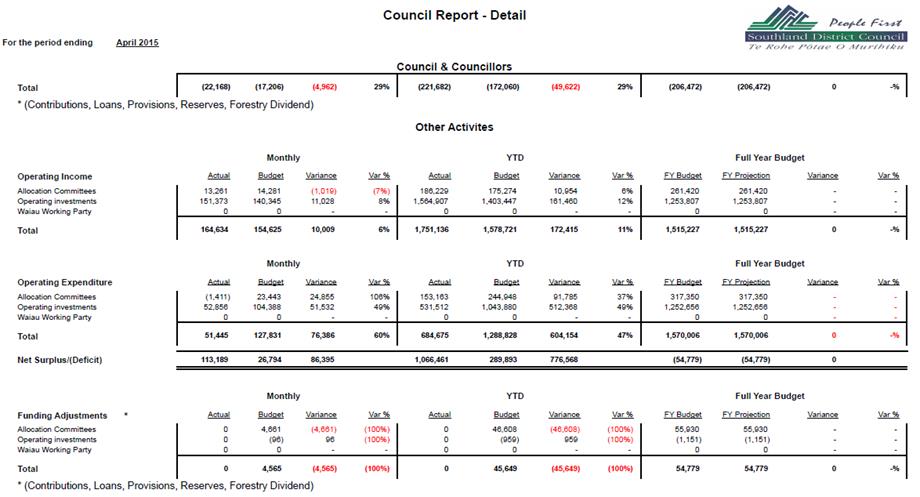

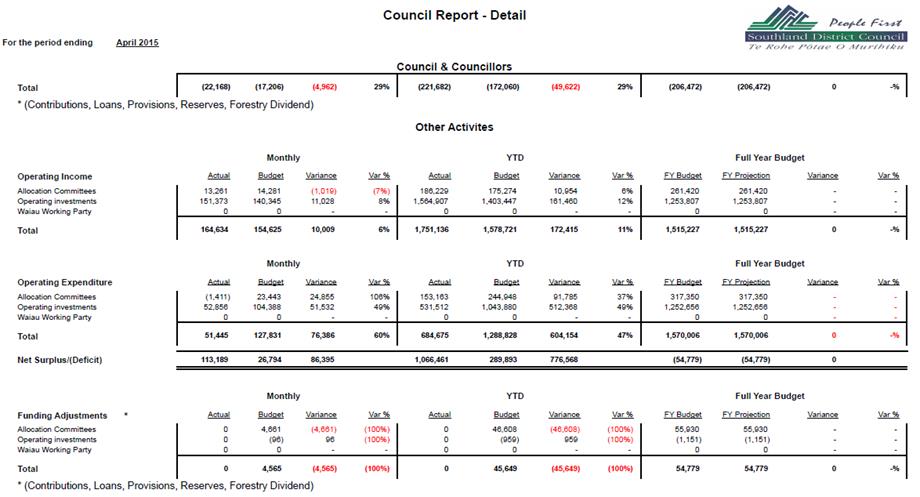

OTHER

ACTIVITIES COMMENTARY

Allocations Committee

Income is $11K (6%) over budget due to timing of grants

received. Expenditure is under budget by $92K (37%) due to the timing of

grant payments.

Operating Investments

Currently, the majority of

Council’s reserves are internally loaned by Council or its local

communities for major projects. Council has set the interest rate to be

charged on these loans as part of its 10 Year Plan process and interest is

being charged on a monthly basis on all internal loans drawn down at 30 June

2014.

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

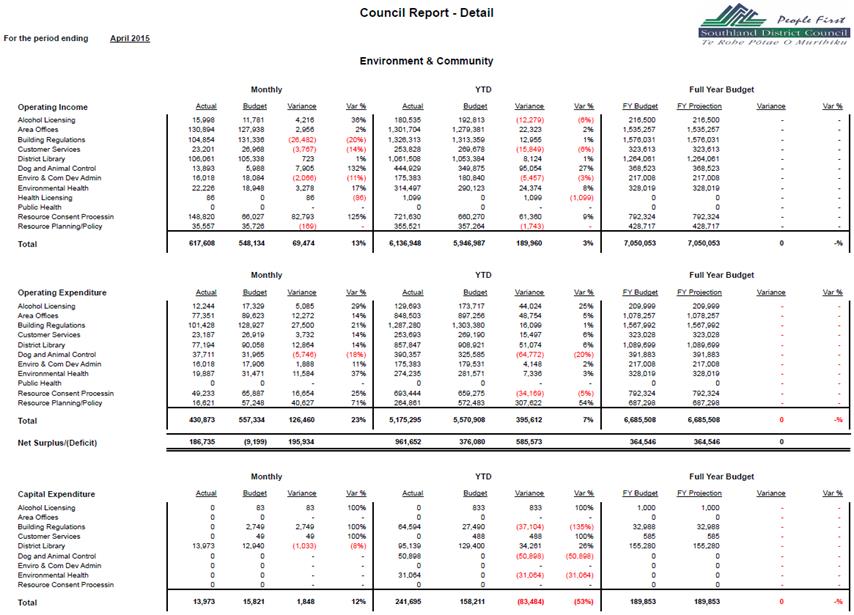

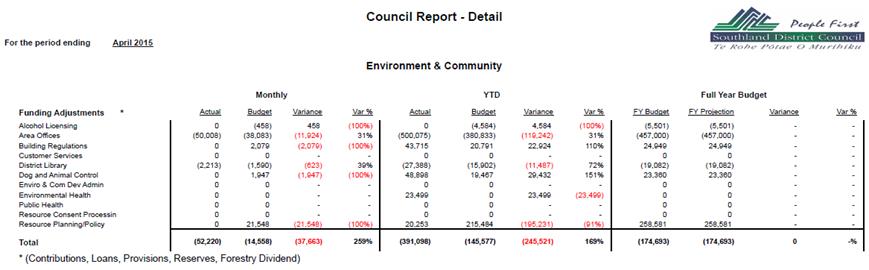

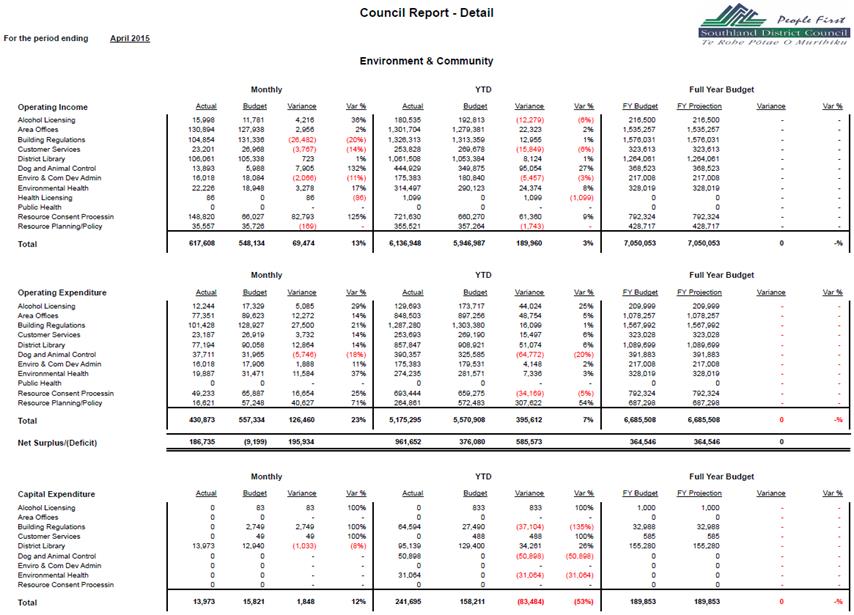

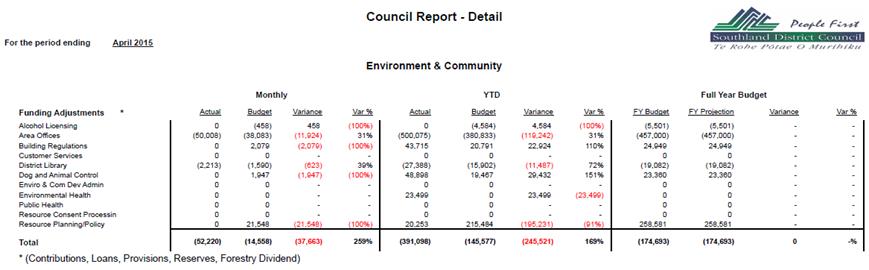

ENVIRONMENT AND

COMMUNITY COMMENTARY

Overall April 2015 monthly income for the Environment and

Community Group was $69K (13%) ahead of budget ($618K actual v $548K budget).

Key features of this month’s income were that Resource

Management and Animal Control income were well ahead of budget by $83K (125%)

and $8K (132%) respectively. The Resource Management variance was the result of

two major invoices for large notified consents which had involved several

months of processing. Conversely, Building Control income was down $26K

(20%) for the month.

Overall April 2015 monthly expenditure for the

Environment and Community Group was $126K (23%) below budget ($431K actual v

$557K budget).

All departments were below budget expenditure-wise,

reflecting a close focus on spending, with the exception of Animal Control

which incurred some additional costs for after-hours work.

The Resource Planning/Policy area was underspent by $41K

(71%), with less expenditure than anticipated on the District Plan project over

this period. Mediation processes which were expected to occur in April

and May have been delayed at the direction of the Environment Court due to the

status of Environment Southland’s Regional Policy Statement content

relating to the biodiversity issues, which is relevant to several District Plan

appeals .

Overall YTD Income at the

end of April 2015 for the 14/15 financial year is $190K (3%) ahead of budget,

at $6.14M actual versus $5.95M budget.

Overall YTD Expenditure at

the end of April 2015 of the 14/15 financial year is $396K (7%) below budget at

$5.18M actual versus $5.57M budget.

Based on this it is

anticipated that group income will be at or very slightly ahead of budget at

year-end, and expenditure will be within or slightly below budget.

Month by month development

activity in the District is still quite up and down, rather than there being

any sustained trend.

As referred to above, the

Resource Management area is significantly under budget year to date, but it is

likely that further costs will be incurred in the Environment Court

appeal/mediation process, although these are now mostly likely to fall in the

2015/2016 financial year now.

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

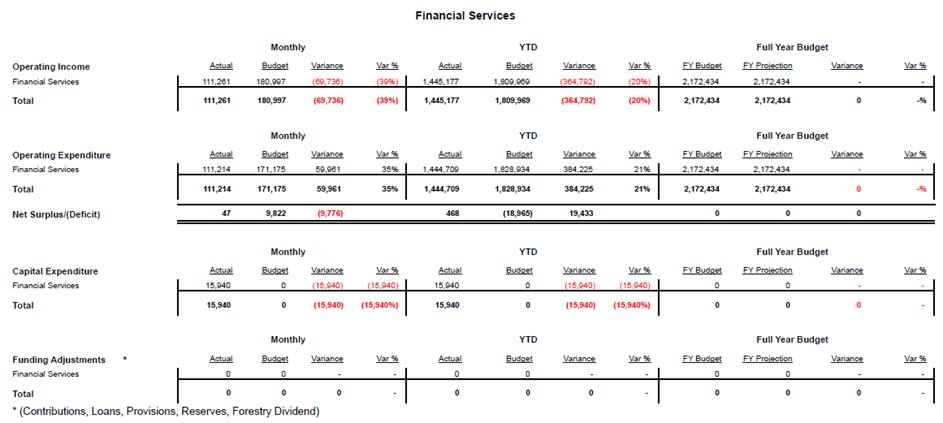

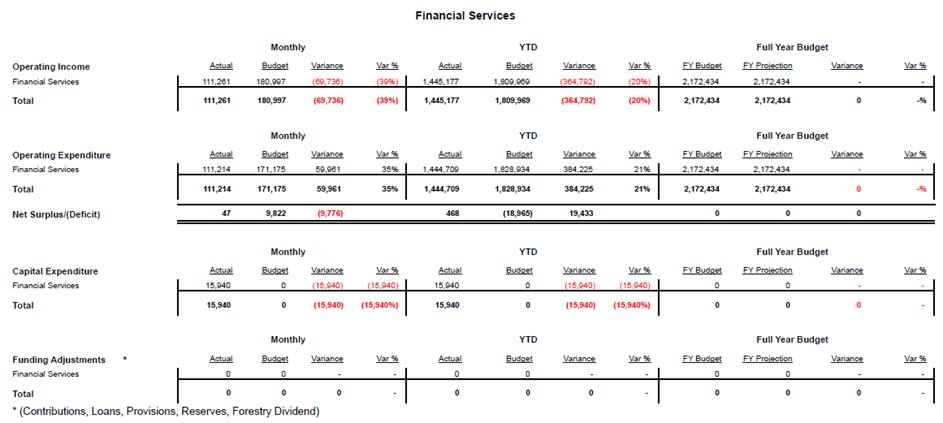

FINANCIAL

SERVICES COMMENTARY

Income is $365K (20%) under budget. As this activity is

internally funded the reduced expenditure impacts directly on income.

Expenditure is $384K (21%) under budget. This is primarily

due to the following:

• The

timing of audit services ($120K)

• Vacancies

in the finance team ($197K) offset by an increase in consultants costs to

assist with workload ($7K)

• Visa/MasterCard

charges currently under budget ($14K)

• As

a result of the material damage insurance review costs related to insuring

water and wastewater above ground assets have now been correctly coded to the

water and waste business units. This has resulted in actual costs being

less than budgeted by $45K.

At year end it is expected that

the business unit will remain under budget by approximately $200K due to the

above.

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

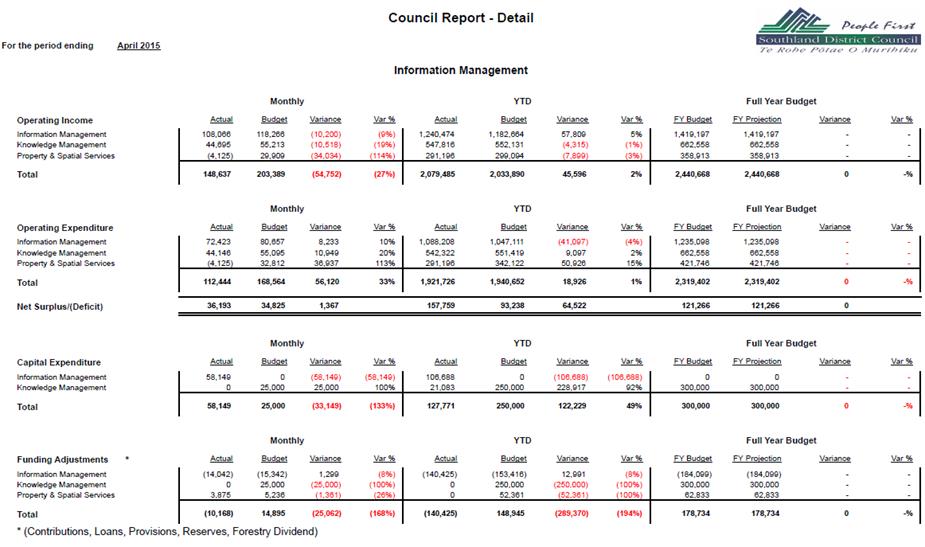

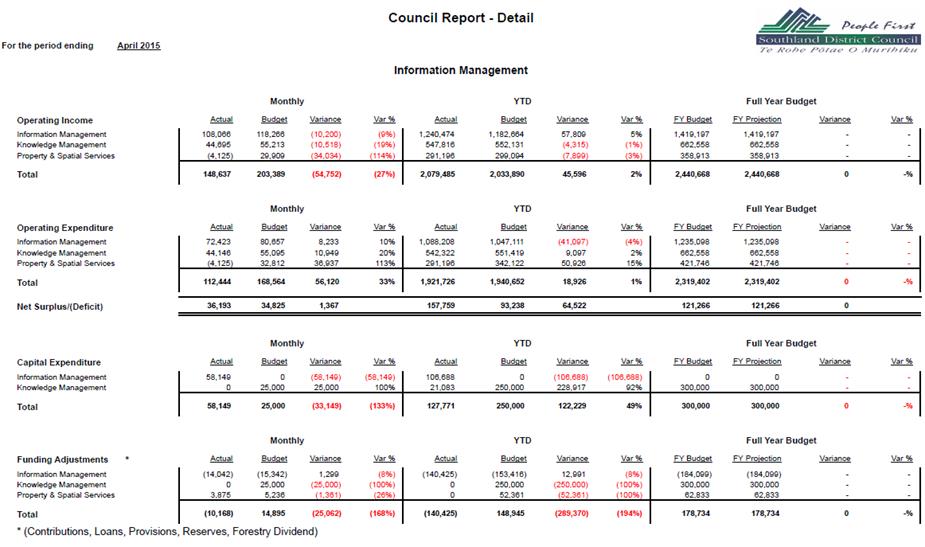

INFORMATION

MANAGEMENT COMMENTARY

For the year-to-date, income is $46K (2%) over budget.

Overall expenditure is $19K (1%) under budget, resulting in a positive variance

of $65K.

Information Management

Income is $58K (5%) over budget, predominantly due to

internal photocopying charges $17K and internal computer hire relating to

additional hardware $36K. Expenditure is $41K (4%) over budget.

This related primarily to Software Licence Fees $35K, which are estimated to be

around $44K over budget at year end. Additionally, Consultants costs are

$21K over budget as a result of the IM Strategy Review. This is offset by

photocopy user charges $23K.

Knowledge Management

Income is $4K (1%) under budget. Expenditure is $9K

(2%) under budget, this is due to internal computer hire costs $12K and staff

costs $7K. This is offset by postage costs and software licence fees

$5K. As this activity is internally funded the increased expenditure

impacts directly on income.

Property and Spatial Services

Income is $8K (3%) under budget. Expenditure is $51K

(15%) under budget due to timing on aerial photography costs $40K, software

licence fees $8K and staff costs $9K. This is offset by consultant costs

$12K. As this activity is internally funded the increased expenditure

impacts directly on income.

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

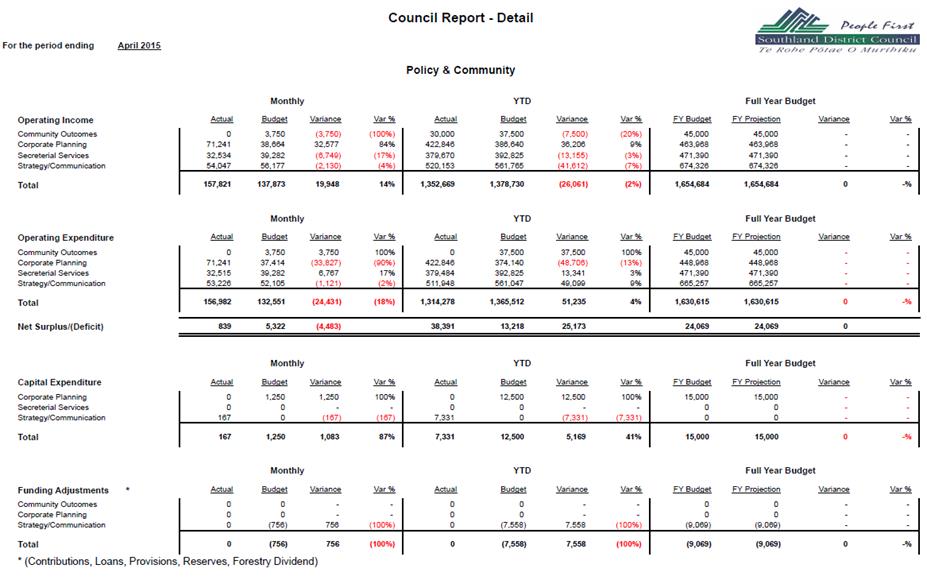

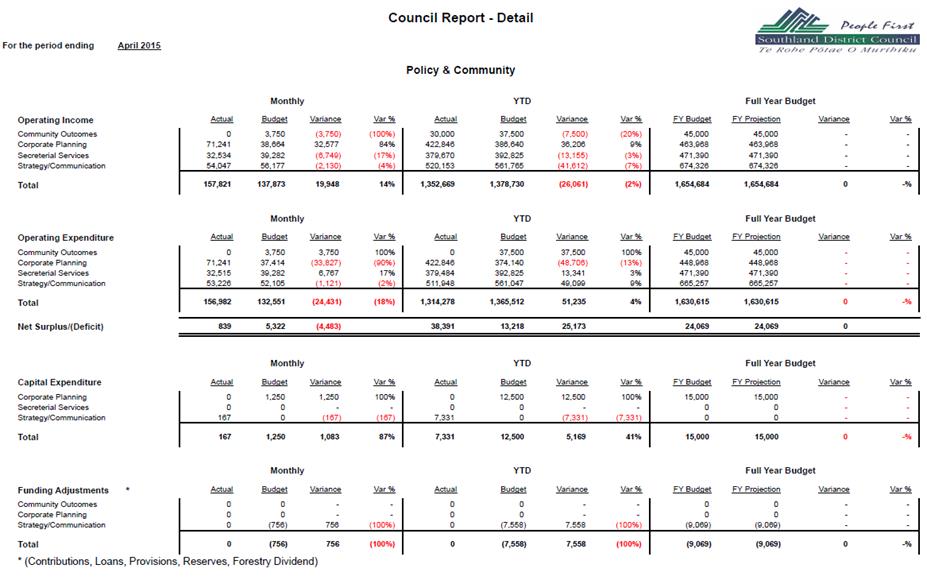

POLICY AND

COMMUNITY COMMENTARY

Income for the year-to-date is $26K (2%) under budget.

Expenditure for the year-to-date is $51K (4%) under budget. The net

result for the year-to-date is a surplus of $38K against a forecasted surplus

of $13K, a positive variance of $25K.

Community Outcomes

Income is on $8K under budget. Expenditure is under

budget $38K as no projects relating to the Our Way Southland Outcomes have been

identified in the current period.

Corporate Planning

Income is $36K (9%) over budget. Expenditure is $49K

(13%) over budget due to Long Term Plan (LTP) costs $50K and unbudgeted costs

relating to the Policy and Community business unit $27K. This is offset

by employee costs $18K. All costs relating to the LTP are being captured

in one place and it will exceed budget. As this activity is internally

funded the reduced expenditure impacts directly on income.

Secretarial Services

Income is $13K (3%) under budget. Expenditure is $13K

(3%) under budget predominately due to training costs $6K and Internal

Photocopying $2K. As this activity is internally funded, the reduced

expenditure impacts directly on income.

Strategy/Communication

Income is $42K (7%) under budget. Expenditure is

underspent by $49K (9%) predominately due to staff costs $37K and first edition

costs $22K below budget. As this activity is internally funded the

reduced expenditure impacts directly on income.

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

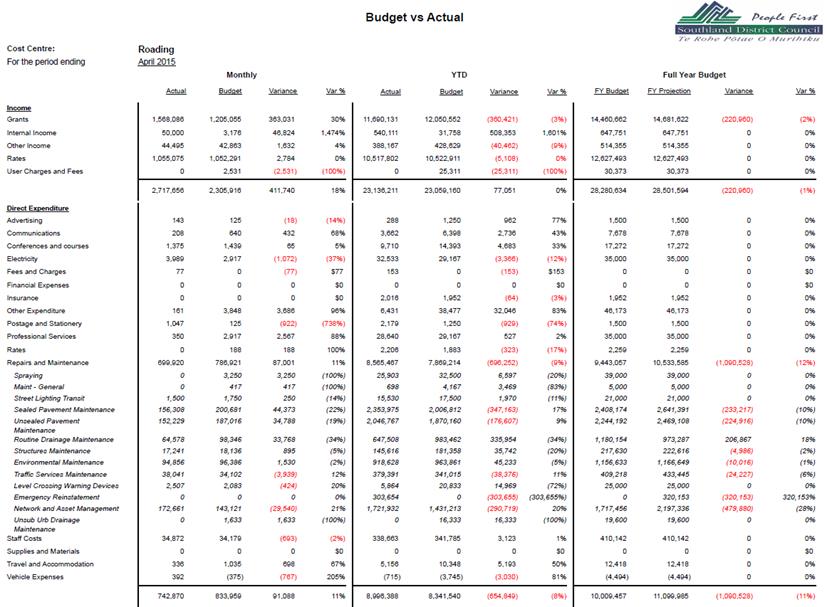

STRATEGIC TRANSPORT

Overall Financial Performance

A continued strong focus on making sure we fully utilise

NZTA approved funding along with optimising "value for money" remains

a challenge.

- Council

Transport overheads are generally tracking in line with budgets. Staff

costs may go slightly over budget with the appointment of the Safe Systems

Engineer.

- It

is forecasted that our operations and maintenance costs will be over budget at

year end. This will be partially offset by underspends in capital expenditure

and underspends in the previous two years. The forecasted overspend can

be also be contributed to unbudgeted emergency works projects Stewart Island

Slips and the Ohai Clifden Slip.

- Council

Transport capital expenditure is under budget and forecasted to be under budget

at year end. As we are coming to the end of the construction season some

projects will be deferred into the new financial year. This is primarily

due to the restrictions of weather.

Please

note that we are forecasting that our Repairs, Maintenance and Capital

Expenditure will be over budget at year end. This is primarily driven by

underspends in previous years and our key objective of maximising New Zealand

Transport Agency approved funding.

|

Key

|

|

|

Largely on Track

|

|

|

Monitoring

|

|

|

Action Required

|

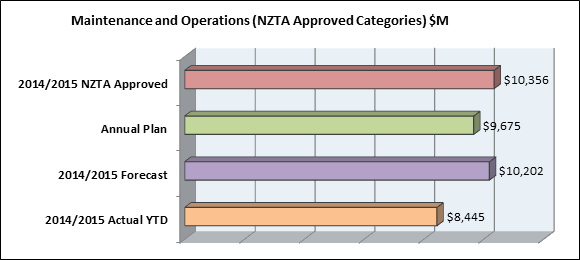

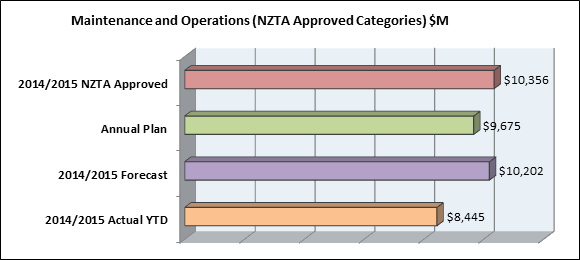

Maintenance and Operations (excluding Special Purpose

Roads):

|

Financial

Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

83%

|

83%

|

87%

|

82%

|

- A

holistic approach to maintenance management has seen sealed pavement and

unsealed pavement maintenance being over budget but offset with underspends in

other activities. Network and Asset Management costs will be over budget

primarily driven by bringing forward our high speed data collection from the

2015/2016 year.

- It

is expected that we will be well within NZTA’s approved maintenance

budgets.

*Note that Council can only

claim 30% of urban drainage. Unsubsidised work has being excluded from this forecast.

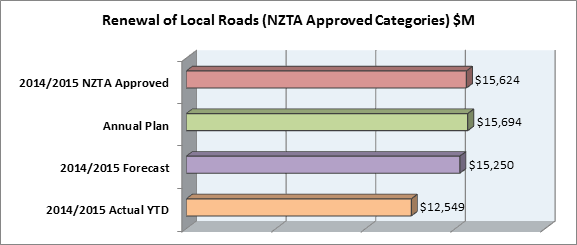

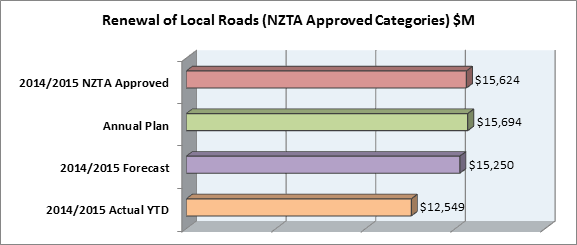

Renewals and Minor

Improvements:

|

Financial

Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

83%

|

82%

|

80%

|

80%

|

Renewals and Minor Improvement Commentary:

As we are coming the end of the

construction work is starting to be finalised before year end. This will

have an impact on completing some of our rehabilitation projects. It is

expected that most of the bridging work will be completed this year, as

Transport are pushing to get this work done to maximise the NZTA Funding Assistance

Rate for this category before it drops next year.

It is expected that roading will

be close to its forecasted amounts as per indicated on the financial report.

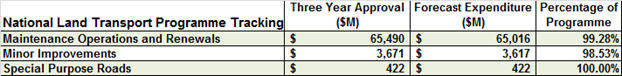

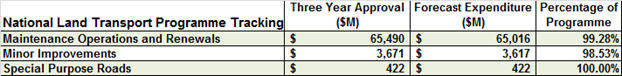

Three Year Programme:

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

|

24 June 2015

|

SERVICES AND

ASSETS (Excluding Roading)

COMMENTARY

Income

Overall Services and Assets

(excluding Roading) actual income is $107K (1%) over year to date budget

($14.23M). This is primarily driven by Forestry income $108K over budget.

Key highlights are:

• District Reserves is $15K under budget as some reserve

transfers for Curio Bay have yet to be actioned

• Engineering Consultants is $49K (7%) under budget. As

income is fully recovered and driven by

expenditure levels the reduced expenditure impacts directly on income

• Overall

Forestry income received is $108K (6%) over budget, this is expected to be the

position at the end of the year. This is predominantly due to harvesting in

Waikaia $935K over budget. This is offset by Dipton Forest $460K and Ohai

Forest $366K under budget.

Operating Expenditure

Actual operational expenditure for

Services and Assets year-to-date is $1.62M (10%) under budget.

Key highlights are:

• District Water is $466K (18%) under budget as there has been minimal capital expenditure year-to-date

($335K actual v $872K budget)

• District Sewerage is $975K (24%) under budget. Year to date $3.07M actual versus $4.04M budget has been

completed.

• Water Services is $163K (14%) under budget predominately

due to fewer services of project consultant costs being required than budgeted.

• Currently

the Engineering Consultants business unit is $49K

(7%) under budget due to under expenditure in consultants and internal

services.

Summary

of Water and Sewerage capital project status as at 30 April 2015

The

following information has been extracted from the information used for the

Corporate Performance Report.

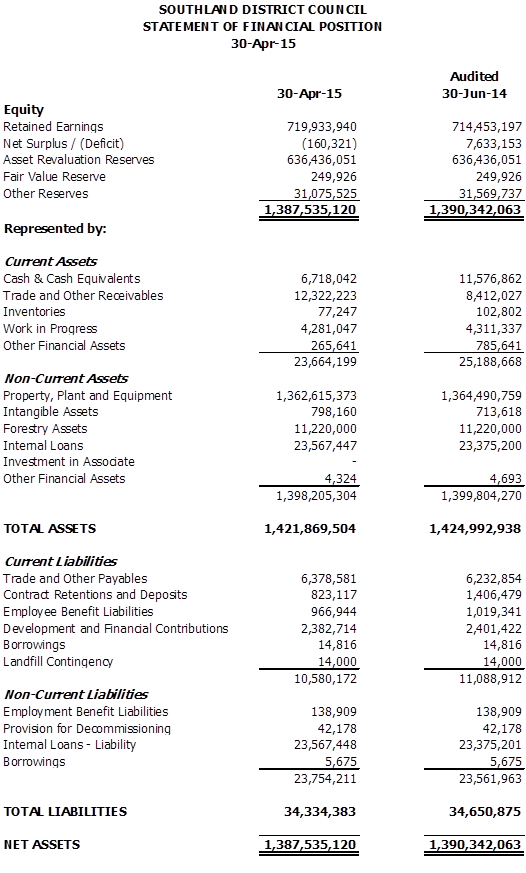

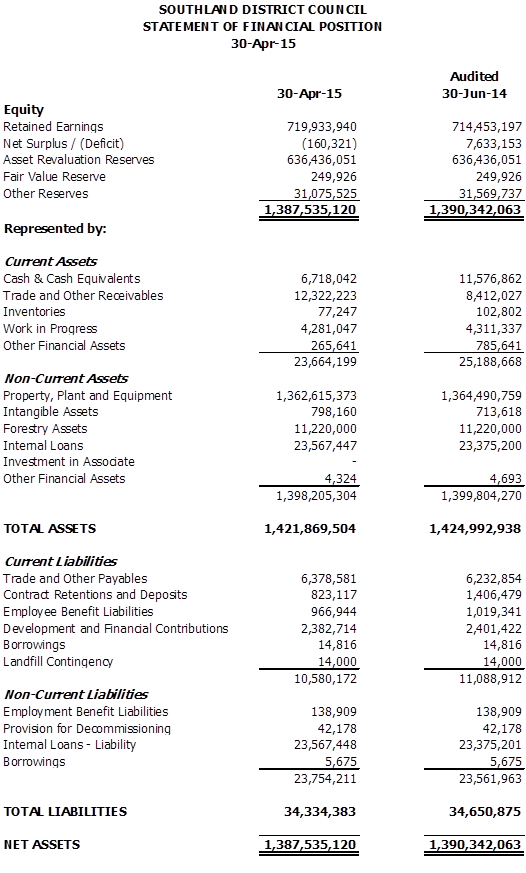

Statement of Financial Position

COMMENTARY

The balance sheet as at 30 June

2014 represents the audited balance sheet for activities of Council (ie

excludes SIESA and Venture Southland). The financial position at

30 April 2015 is before year-end adjustments and only for the activities of

Council.

External borrowings have still not

been required, with internal funds being used to meet obligations for the

year-to-date.

|

|

|

|

|

Susan McNamara

MANAGEMENT ACCOUNTANT

|

|

|

|

|

|

|

Activities

Performance Audit Committee

24 June 2015

|

|

Audit Arrangements Letter for the Year Ended 30 June

2015

Record No: R/15/5/8609

Author: Sheree

Marrah, Finance Manager

Approved by: Anne

Robson, Chief Financial Officer

☒

Decision ☐ Recommendation ☐ Information

Purpose

1 The

purpose of this report is to provide an overall summary of the audit

arrangements letter for the annual report for the year ended 30 June 2015

recently received from Audit New Zealand and seek approval for the Mayor to

sign this letter on Council’s behalf.

Executive Summary

2 Audit

New Zealand requires Council to confirm the arrangements it makes for the audit

of the 2014/2015 annual report of Council. As part of this

confirmation, Audit New Zealand has provided Council with an audit arrangements

letter for the year ended 30 June 2015.

3 This

letter is required to be signed by the Mayor and returned to Audit New Zealand

to confirm Council’s acceptance of the proposed arrangements.

4 This

report provides a summary of the letter for the Committee’s information.

A copy of this letter is attached to this report for your information.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Audit Arrangements Letter for the Year Ended 30 June

2015” dated 24 June 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Authorises

the Mayor to sign the audit arrangements letter for the year ended

30 June 2015 on Council’s behalf.

|

Content

Background

5 The

purpose of this report is to provide an overall summary of the audit

arrangements letter for the year ended 30 June 2015 recently received from

Audit New Zealand.

6 The

letter outlines the arrangements specific to the 2014/2015 year audit.

These are separated into four key areas as follows:

• Business

risks/issues and Council’s audit response

• Areas

of interest for all District Councils

• First

financial statements prepared using the new Public Benefit Entity (PBE)

accounting standards; and

• Logistics

(ie audit team, timing and fees).

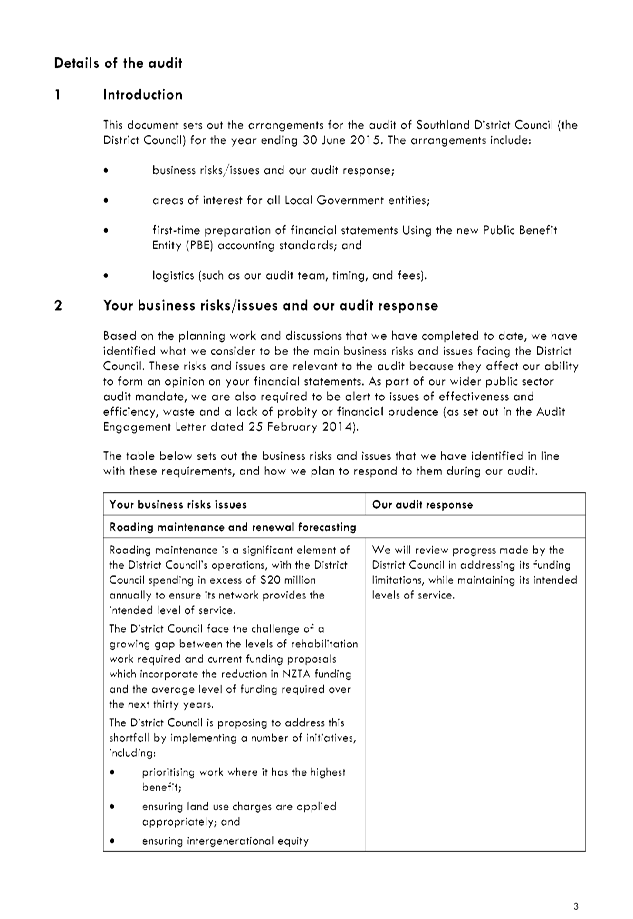

Business Risks/Issues and

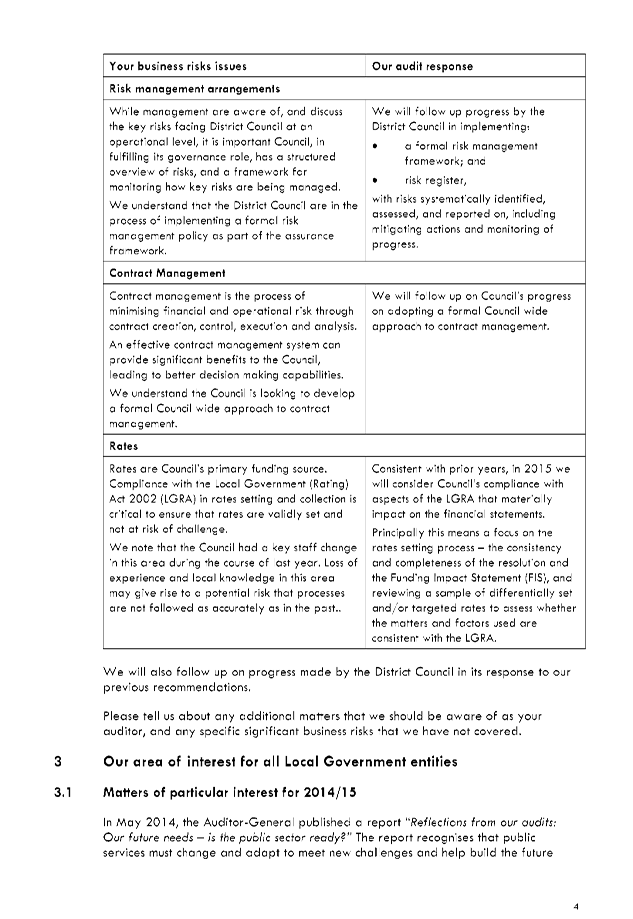

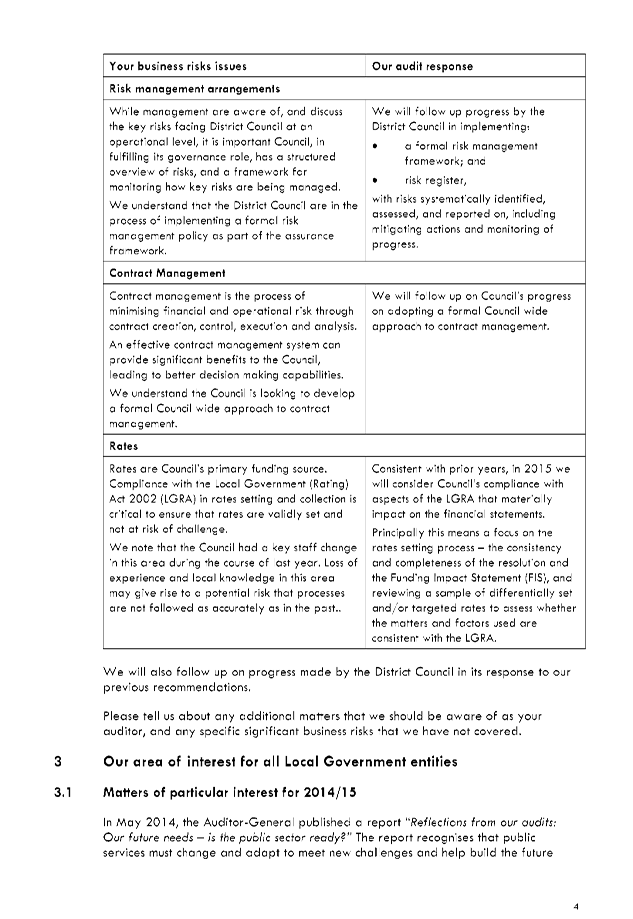

Council’s Audit Response

7 The

key risks/issues identified for Council by the auditor, and therefore areas of

audit focus for the current year are:

• Roading

maintenance and renewal forecasting

• Risk

management arrangements

• Contract

management; and

• Rates.

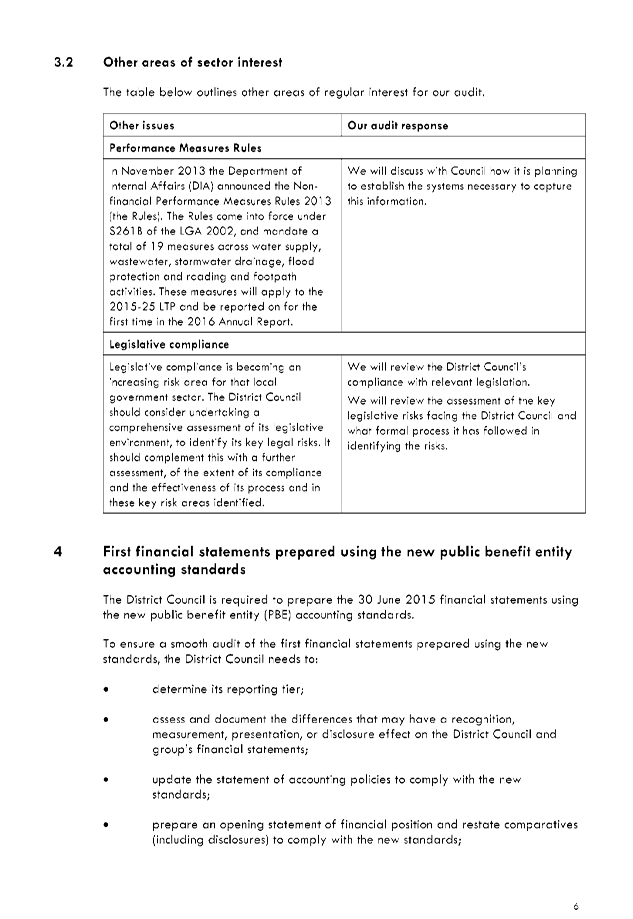

Areas of interest for all

District Councils

· Performance

measure rules

· Legislative

compliance

8 Specific

details of these risks/issues are included in the letter (Attachment A).

First Financial Statements

prepared using the new PBE Accounting Standards

9 Council

is required to prepare the 30 June 2015 financial statements using the new

public benefit entity (PBE) accounting standards. More specific

information in relation to the requirements of the PBE standards are outlined

in the APAC report dated 24 June 2015 entitled “Changes to accounting

standards for Public Benefit entities”.

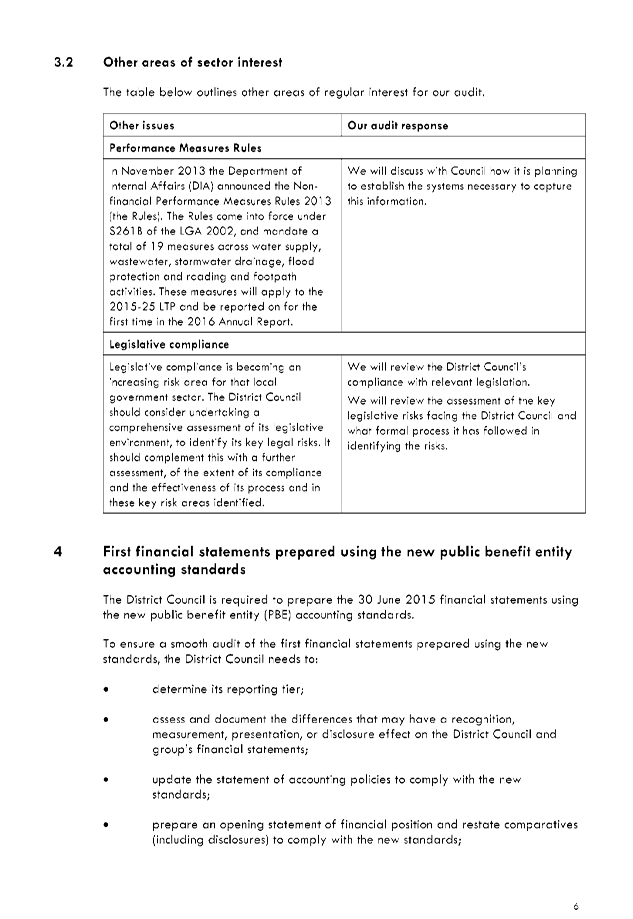

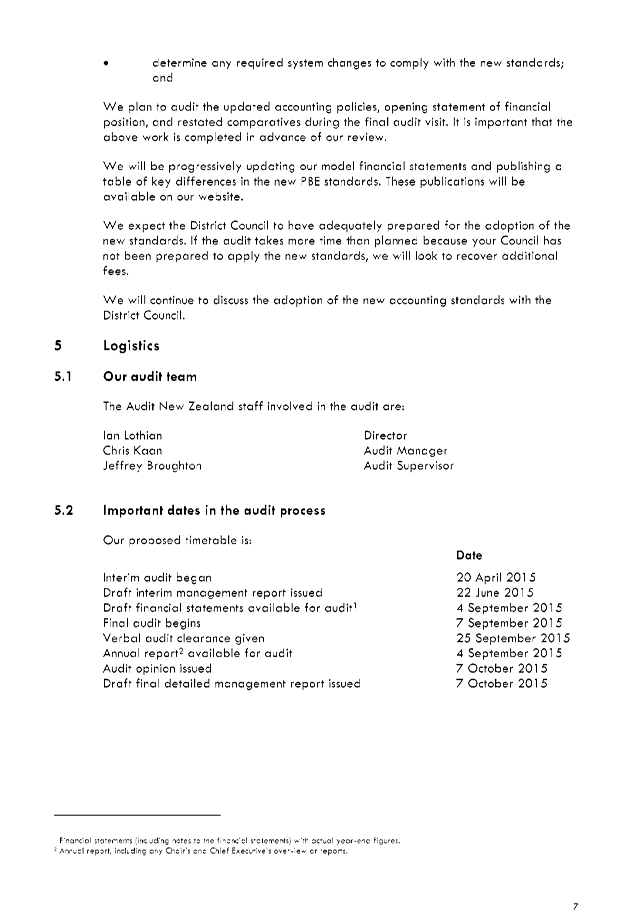

Logistics (ie audit team, timing

and fees)

10 The

audit team will consist of the following Audit New Zealand staff:

• Ian

Lothian Director

• Chris

Kaan Audit

Manager

• Jeffrey

Broughton Audit Supervisor

11 The

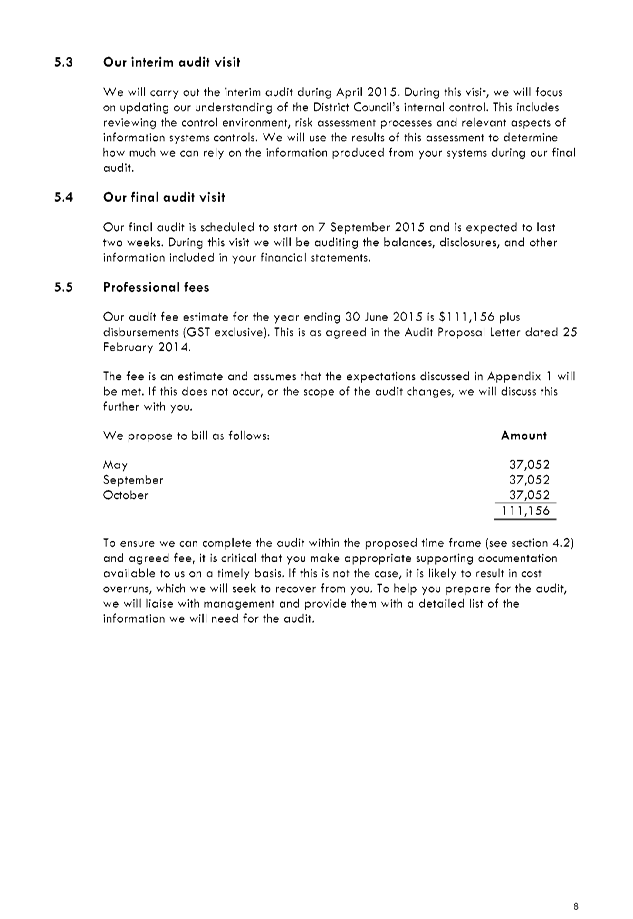

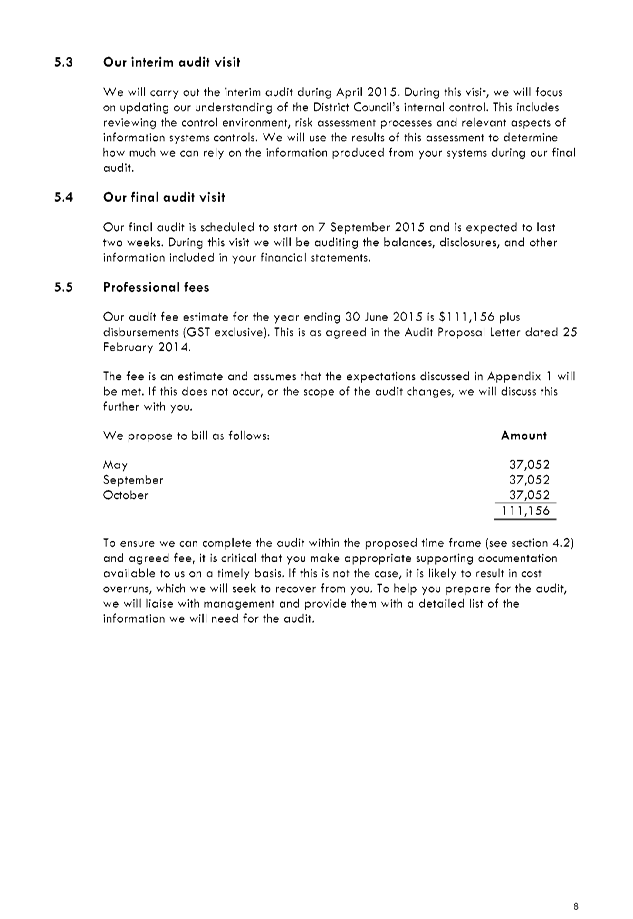

audit fee proposed for the 2014/2015 annual audit is $111,156 (GST exclusive)

plus disbursements, an increase of 1.55% on the 2013/2014 fee. This fee

is to be paid in three equal instalments consistent with the timing of the

work to be performed by the audit team.

12 The audit of

the 2014/2015 Annual Report is proposed to be carried out in the following

stages:

|

April 2015

|

Interim audit visit to:

• Understand

control environment

• Review

and test systems.

|

|

June 2015

|

Draft Interim Management Report

issued by Audit New Zealand

|

|

July 2015

|

Council staff to:

• Perform

year end close-off

• Finalise

30 June numbers.

|

|

August 2015

|

Council staff to:

• Balance

all business units

• Executive

Leadership Team review business unit reports

• Compile

unaudited consolidated financial statements.

|

|

September 2015

|

• Council

staff have prepared draft Annual Report

• Executive

Leadership Team review draft Annual Report and summary document

• Audit

New Zealand final visit to audit Annual Report and supporting work papers

• Verbal

audit clearance given by Audit New Zealand.

|

|

October 2015

|

• Council

considers draft Annual Report for adoption

• Council

staff finalise any required adjustments

• Council

approve final Annual Report

• Audit

New Zealand issue final audit opinion.

|

|

November 2015

|

• Summary

and final report advertised and circulated to public.

|

Issues

13 Council

Staff have no issues with the content of the audit arrangements letter

attached.

14 The purpose of an audit is to provide an

objective independent examination of the financial statements, which increases

the value and credibility of the financial statements produced by management,

thus increase user confidence in the financial statement. As such,

it is in Councils interest for Audit NZ to define the audit programme of work.

15 As part of drafting the audit arrangements

letter, Audit NZ sought feedback on the draft letter from Council staff.

The feedback wanted was is in regards to the clarity and understanding of the

draft letter and if Council staff, for the purposes of transparency, believe

that any additional business risks/issues should be included. In

reviewing the draft, staff only sought clarification on a couple of points

raised. Amendments made by Audit NZ staff have resulted in the attached

draft report for Council’s discussion and approval.

Factors to Consider

Legal

and Statutory Requirements

16 Section

98(1) of the Local Government Act 2002 requires the Council to prepare and

adopt an Annual Report each financial year. Section 99(1) requires the

Annual Report to include an auditor’s report.

17 In

accordance with Section 14(1) of the Public Audit Act 2001, the Council’s

Annual Report must be audited by the Office of the Auditor-General. Audit

New Zealand is the authorised audit service provider on behalf of the

Auditor-General.

Community

Views

18 As

the Annual Report is a report on activities undertaken during the year,

no consultation is required.

Costs

and Funding

19 See

paragraph 24 above for the cost associated with the audit of the Annual

Report. This amount has been budgeted for in the finance

department’s budget.

Policy

Implications

20 The

2014/2015 Annual Report is a report to the public on performance, against the

2014/2015 Annual Plan (third year of the Long Term Plan 2012-2022).

Analysis

Options Considered

Analysis of Options

Option 1 - Accept and sign the letter as provided

|

Advantages

|

Disadvantages

|

|

· Allows

the Annual Report process to continue as proposed.

|

· None,

unless Council requires clarification and this is not sought before signing.

|

Option 2 – Request clarification or inclusion of

any issue that Council wants included in the audit arrangements letter from

Audit NZ before signing the letter.

|

Advantages

|

Disadvantages

|

|

· Council

is able to seek the clarification it requires or discuss the inclusion of any

issue it would like incorporated into the audit.

|

· Could

delay the Audit process if Council and Audit New Zealand cannot agree to

these arrangements.

|

Assessment of Significance

21 The

audit of the Annual Report is not considered significant in terms of

Council’s significance policy.

Recommended Option

22 Accept

and sign the audit arrangements letter as provided.

Next Steps

23 Council

staff will work with Audit New Zealand to ensure that the necessary work is

completed for the 2014/2015 Annual Report to enable it to be adopted at the

meeting on 7 October 2015.

Attachments

a Audit

Arrangements Letter from Audit New Zealand - Audit for the year ending 30 June

2015 View

|

Activities

Performance Audit Committee

|

24 June 2015

|

|

Activities

Performance Audit Committee

24 June 2015

|

|

Changes to the Accounting Standards for Public Benefit

Entities

Record No: R/15/6/9638

Author: Sheree

Marrah, Finance Manager

Approved by: Anne

Robson, Chief Financial Officer

☐

Decision ☐ Recommendation ☒ Information

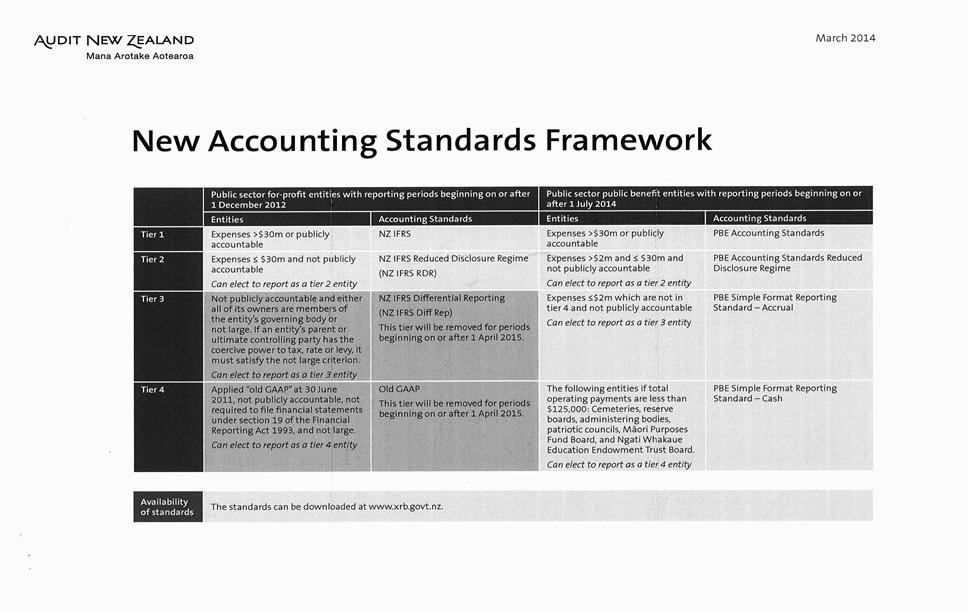

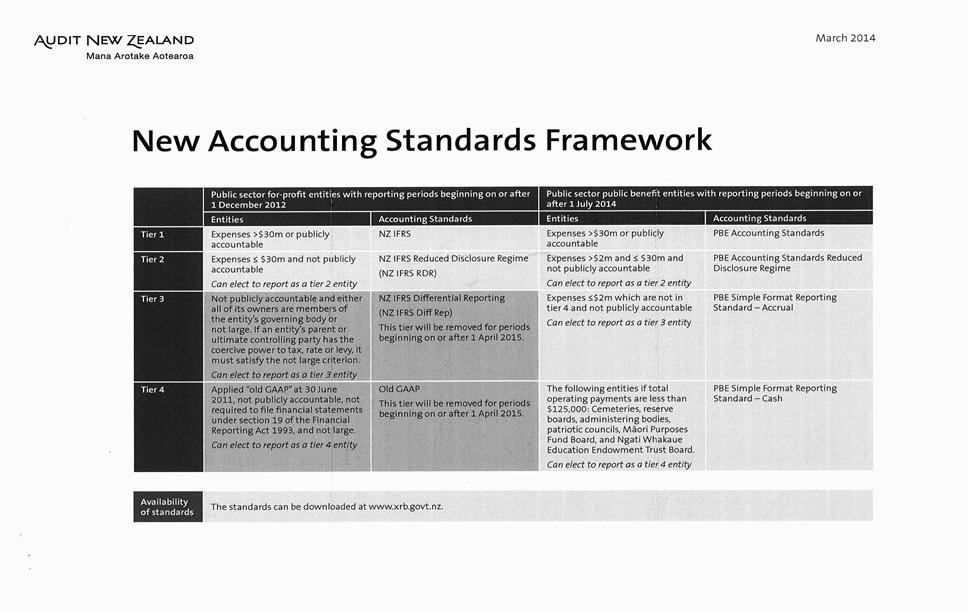

1 The

purpose of this report is to update Council on the changes to the accounting

standards that form the basis of the financial statements included in the

annual report for the year ended 30 June 2015. In the 2015 financial year

Council transitions from using standards that are used by all reporting

entities to those that are specifically designed for Public Benefit Entities.

2 This

report outlines the process Audit New Zealand has identified that will enable a

smooth transition between the standards and the areas of the standards Council

staff have identified as impacting on our financial statements.

3 In

2004 New Zealand adopted the New Zealand equivalent to International Financial

Reporting Standards (NZ IFRS) and Council has been completing financial

reporting using standards since the year ended 30 June 2007. NZ IFRS was

a one size fits all approach to financial reporting and covered both Public Benefit

Entities (PBEs) and For Profit Entities.

4 Since

the adoption of NZ IFRS the one size fits all approach has not met the

objective of providing transparent and useful information to the users of

financial statement in all sectors. As a result there has now been a move

internationally to a multi-standard approach to financial reporting.

5 The

External Reporting Board approved a new financial reporting framework in March

2012. The new framework introduces different financial reporting

requirements (ie a different set of rules) for Profit Entities and PBEs.

Profit Entities are required to use IFRS. The public sector is required