Notice is hereby given that a Meeting of

the Activities Performance Audit Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Wednesday, 15

July 2015

1pm

Council Chambers

15 Forth Street

Invercargill

|

|

Activities Performance Audit Committee Agenda

OPEN

|

MEMBERSHIP

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

|

Chief Executive

|

Steve Ruru

|

|

|

Committee Advisor

|

Fiona Dunlop

|

|

Terms of

Reference for the Activities Performance Audit Committee

This committee is a committee of Southland

District Council and has responsibility to:

·

Monitor and review Council’s performance

against the 10 Year Plan

·

Examine, review and recommend changes relating

to Council’s Levels of Services.

·

Monitor and review Council’s financial

ability to deliver its plans,

·

Monitor and review Council’s risk

management policy, systems and reporting measures

·

Monitor the return on all Council’s

investments

·

Monitor and track Council contracts and

compliance with contractual specifications

·

Review and recommend policies on rating, loans,

funding and purchasing.

·

Review and recommend policy on and to monitor

the performance of any Council Controlled Trading Organisations and Council

Controlled Organisations

·

Review arrangements for the annual external

audit

·

Review and recommend to Council the completed

financial statements be approved

·

Approve contracts for work, services or supplies

in excess of $200,000.

|

Activities Performance Audit Committee

15 July 2015

|

|

TABLE OF

CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of

Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Minutes 5

Reports

7.1 Annual

Report 2014/2015 Timetable 13

7.2 Financial

Report to 31 May 2015 21

At the close of the

agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Committee Members are

reminded of the need to be vigilant to stand aside from decision-making when a

conflict arises between their role as a member and any private or other

external interest they might have.

4 Public Forum

Notification to speak

is required by 5pm at least two days before the meeting. Further information is

available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the committee

to consider any further items which do not appear on

the Agenda of this meeting and/or the meeting to be held with the public

excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i) The

reason why the item was not on the Agenda, and

(ii) The

reason why the discussion of this item cannot be delayed until a subsequent

meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a)

That item may be discussed at that meeting if-

(i)

That item is a minor matter relating to the general

business of the local authority; and

(ii)

the presiding member explains at the beginning of the

meeting, at a time when it is open to the public, that the item will be

discussed at the meeting; but

(b) no resolution,

decision or recommendation may be made in respect of that item except to refer

that item to a subsequent meeting of the local authority for further

discussion.”

6 Confirmation

of Minutes

6.1 Meeting

minutes of Activities Performance Audit Committee, 24 June 2015

|

Activities Performance Audit Committee

OPEN MINUTES

|

Minutes of

a meeting of Activities Performance Audit Committee held in the Council

Chambers, 15 Forth Street, Invercargill on Wednesday, 24 June 2015 at 10.39am.

present

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

Chief Executive Steve Ruru, Group Manager

Environment and Community Bruce Halligan, Group Manager Services and Assets Ian

Marshall, Group Manager Policy and Community Rex Capil, Chief Information

Officer Damon Campbell, Chief Financial Officer Anne Robson, Communications and

Governance Manager Louise Pagan and Committee Advisor Fiona Dunlop.

1 Apologies

Apologies for absence were received from Cr Dobson.

|

Resolution

Moved Cr Dillon, seconded Cr Kremer and resolved:

That the Activities Performance Audit Committee accept the apology.

|

2 Leave

of absence

There were no

requests for leave of absence.

3 Conflict

of Interest

There were no

conflicts of interest declared.

4 Public

Forum

There was no public

forum.

5 Extraordinary/Urgent

Items

There were no

Extraordinary/Urgent items.

6 Confirmation

of Minutes

|

Resolution

Moved Cr

Macpherson, seconded Cr Dillon and resolved:

That the

Meeting minutes of Activities Performance Audit Committee, 3 June 2015 be

confirmed.

|

(Cr Duffy

joined the meeting at 10.41am.)

Reports for Resolution

|

7.1

|

Southern Rural Fire Authority - Draft Statement of Intent

2015-2018

Record No: R/15/5/7953

|

|

|

Group

Manager Bruce Halligan was in attendance for this item. He advised that

the Southern Rural Fire Authority had provided its draft Statement of Intent

2015-2018 to Southland District Council for consideration and feedback.

The

draft Statement of Intent was approved for circulation by the Southern Rural

Fire Authority Board (SRFA) at its meeting on 10 April 2015. It

outlines key SRFA objectives, key performance areas and goals and future

funding expectations from participant stakeholders/members.

|

|

|

Resolution

Moved Cr Kremer, seconded Cr Dillon and

resolved recommendation a:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Southern Rural Fire Authority - Draft Statement of

Intent 2015-2018” dated 6 May 2015.

|

|

|

Resolution

Moved Cr Baird, seconded Cr

Duffy and resolved recommendations b – d:

That the Activities

Performance Audit Committee:

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Provides

any feedback it may have to the Southern Rural Fire Authority Chief Executive.

|

|

7.2

|

Finance Report to 30 April 2015

Record No: R/15/6/9839

|

|

|

Management Accountant Susan McNamara was

in attendance for this item. She advised that the report outlines

the financial results to 30 April 2015 with 83% of the financial year gone. There were no significant issues contained in the report identified

that raised any concerns for Council relating to the end of year financial

position. Overall for the year to date, income is $272,000 under

budget.

As in prior years, all budget managers

have been instructed to have a strong focus on their budget and expenditure

items that they can control in the current economic climate.

The financial commentary centres on the summary sheet

which draws the totals from each of the key sections together. Although

you are able to obtain more detailed key variance explanations from senior

managers in these sections, these will be summarised below, concentrating on

the YTD results.

|

|

|

Resolution

Moved Cr Macpherson, seconded Cr

Douglas and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Finance Report to 30 April 2015” dated 9 June

2015.

|

|

7.3

|

Audit Arrangements Letter for the Year Ended 30 June 2015

Record No: R/15/5/8609

|

|

|

1 Finance

Manager Sheree Marrah was in attendance for this item. She advised that

the report was to provide an overall summary of the audit arrangements letter

for the annual report for the year ended 30 June 2015 recently received from

Audit New Zealand and seek approval for the Mayor to sign this letter on

Council’s behalf.

2 Audit

New Zealand requires Council to confirm the arrangements it makes for the

audit of the 2014/2015 annual report of Council. As part of this

confirmation, Audit New Zealand has provided Council with an audit arrangements

letter for the year ended 30 June 2015.

3 The

letter is required to be signed by the Mayor and returned to Audit New

Zealand to confirm Council’s acceptance of the proposed arrangements.

The report provides a summary of the letter for the Committee’s

information. A copy of this letter is attached to the officers report.

|

|

|

Resolution

Moved Cr Harpur, seconded Cr Keast and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Audit Arrangements Letter for the Year Ended 30 June

2015” dated 24 June 2015.

|

|

|

Resolution

Moved Cr Ford, seconded Cr

Dillon

That the Activities

Performance Audit Committee:

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Authorises

the Mayor to sign the audit arrangements letter for the year ended 30 June

2015 on Council’s behalf.

|

|

7.4

|

Changes to the Accounting Standards for Public Benefit Entities

Record No: R/15/6/9638

|

|

|

Finance Manager Sheree Marrah was

in attendance for this item. She advised that the report was to update

Council on the changes to the accounting standards that form the basis of the

financial statements included in the annual report for the year ended 30 June

2015. In the 2015 financial year Council transitioned from using

standards that are used by all reporting entities to those that are

specifically designed for Public Benefit Entities.

2 The

report also outlined the process Audit New Zealand has identified that will

enable a smooth transition between the standards and the areas of the

standards Council staff have identified as impacting on our financial

statements.

3

|

|

|

Resolution

Moved Cr Macpherson, seconded Cr Keast and

resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Changes to the Accounting Standards for Public

Benefit Entities” dated 11 June 2015.

|

Public Excluded

Exclusion of the Public: Local Government Official Information and

Meetings Act 1987

|

Resolution

Moved Cr Douglas, seconded Cr Baird and resolved

That the Activities Performance Audit Committee exclude the public

from the following part(s) of the proceedings of this meeting.

C8.1 Public Excluded Minutes of the Activities Performance Audit

Committee Meeting dated 3 June 2015

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter, and the

specific grounds under section 48(1) of the Local Government Official Information

and Meetings Act 1987 for the passing of this resolution are as follows:

|

|

General subject of each

matter to be considered

|

Reason for passing this

resolution in relation to each matter

|

Ground(s) under section

48(1) for the passing of this resolution

|

|

Public Excluded Minutes

of the Activities Performance Audit Committee Meeting dated 3 June 2015

|

s7(2)(a) - The

withholding of the information is necessary to protect the privacy of natural

persons, including that of a deceased person.

s7(2)(b)(ii) - The

withholding of the information is necessary to protect information where the

making available of the information would be likely unreasonably to prejudice

the commercial position of the person who supplied or who is the subject of

the information.

s7(2)(f)(ii) - The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers, employees

and persons from improper pressure or harassment.

s7(2)(h) - The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities.

s7(2)(i) - The

withholding of the information is necessary to enable the local authority to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations).

s7(2)(j) - The

withholding of the information is necessary to prevent the disclosure or use

of official information for improper gain or improper advantage.

|

That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding exists.

|

Permit the Chief Executive, Group Manager

Environment and Community, Group Manager Services and Assets, Group Manager,

Policy and Community, Chief Information Officer, Chief Financial Officer,

Communications & Governance Manager and Committee Advisor to remain at this

meeting, after the public has been excluded, because of their knowledge of C8.1 Public Excluded Minutes of the Activities Performance Audit

Committee Meeting dated 3 June 2015. This knowledge, which will be of assistance in relation to the matters

to be discussed, is relevant to that matter because of their specialist

knowledge.

The meeting went into public excluded at

11.36am and returned to open session at 11.37am.

Resolutions in

relation to the confidential items are recorded in the confidential section of

these minutes and are not publicly available unless released here.

The meeting concluded at 11.37am. CONFIRMED

AS A TRUE AND CORRECT RECORD AT A MEETING OF THE Activities Performance Audit Committee HELD ON 24 JUNE 2015.

DATE:...................................................................

CHAIRPERSON:...................................................

|

Activities

Performance Audit Committee

15 July 2015

|

|

Annual

Report 2014/2015 Timetable

Record No: R/15/6/10985

Author: Shannon

Oliver, Planning and Reporting Analyst

Approved by: Rex Capil,

Group Manager, Policy and Community

☐

Decision ☐ Recommendation ☒ Information

Purpose

1 The

purpose of the report is to provide the key dates for Annual Report 2014/2015

timetable for information.

Executive

Summary

2 The

Annual Report is the key document for Council. This Annual Report reports

on Council’s performance against the 2014/2015 Annual Plan (which is

based on the third year of the Council’s Long Term Plan

2012-2022).

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Annual Report 2014/2015 Timetable” dated 2

July 2015.

b) Determines

that this matter or decision be recognised as not significant in terms of

Section 76 of the Local Government Act 2002.

|

Content

Background

3 The

Annual Report is the key reporting document for Council. This Annual

Report reports on Council’s performance against the 2014/2015 Annual Plan

(which is based on the third year of the Council’s Long Term Plan

2012-2022).

4 The

Annual Report is a means for Council to account and report to the community on

its performance of the preceding financial year - in this case from 1 July 2014

to 30 June 2015. It reports on outcomes, performance measures (both

financial and non-financial) and provides information on the result achieved

against budgeted results.

5 The

Annual Report is audited by Audit New Zealand which provides the reader with a

level of assurance of the consistency and accuracy of the information

reported.

6 The

purposes of an Annual Report are:

(a) To

compare the actual activities and the actual performance of the local authority

in the year with the intended activities and the intended level of performance

as set out in respect of the year in the Long Term Plan and the Annual Plan;

and

(b) To

promote the local authority's accountability to the community for the decisions

made throughout the year by the local authority.

7 As

with previous years both an Annual Report and a Summary Document are

produced. Similarly, as previously done, the Summary Document will be

distributed to all Council’s offices and made available on request.

Both the Summary Document and full Annual Report will be made available on the

Council’s website. The report availability will be advertised on

the Saturday edition of The Southland Times on 24 October 2015 (the delay is to

allow for the printers to produce the printed versions).

8 Key

dates for Council in relation to the timetable are:

· Council

workshop of the unaudited draft Annual Report – 16 September 2015

· Audit

visit - Monday, 7 September to Friday, 18 September 2015

· Adoption

of the Annual Report - Wednesday, 7 October 2015

· Annual

Report available on Council’s website - Monday, 12 October 2015

· Public

notice on the availability of the Annual Report - Saturday, 24 October 2015

(printed version available).

Factors

to Consider

Legal and Statutory

Requirements

9 Section

98 of the Local Government Act 2002 states that:

(1) A

local authority must prepare and adopt in respect of each financial year an

Annual Report containing in respect of that year the information required by

Part 3 of Schedule 10.

(2) The

purposes of an Annual Report are—

(a) to

compare the actual activities and the actual performance of the local authority

in the year with the intended activities and the intended level of performance

as set out in respect of the year in the Long Term Plan and the Annual Plan;

and

(b) to

promote the local authority's accountability to the community for the decisions

made throughout the year by the local authority.

(3) Each

Annual Report must be completed and adopted, by resolution, within four months

after the end of the financial year to which it relates.

(4) A

local authority must, within one month after the adoption of its Annual Report,

make publicly available—

(a) its

Annual Report; and

(b) a

summary of the information contained in its Annual Report.

(5) The

summary must represent, fairly and consistently, the information regarding the

major matters dealt with in the Annual Report.

(6) A

local authority must, within one month after the adoption of its Annual Report,

send copies of that report and of the summary prepared under subsection (4)(b)

to—

(a) the

Secretary; and

(b) the

Auditor-General; and

(c) the

Parliamentary Library.

10 Information

that must be included can be found in Schedule 10 Part 3 of the Act, and

includes:

· groups

of activities

· capital

expenditure for groups of activities

· statement of

service provision, funding impact statement for groups of activities,

internal borrowing

· council-controlled

organisations

· financial

statements

· rating

base information

· reserve

funds

· remuneration

issues

· employee

staffing levels and remuneration

· severance

payments

· statement

of compliance

· the

activities that the local authority has undertaken in the year to establish and

maintain processes to provide opportunities for Māori to contribute to the

decision-making processes of the local authority.

11 The

Annual Report and Summary Document reports on Council’s performance

against the Annual Plan (which is based on the third year of the

Council’s Long Term Plan 2012-2022) under the Act.

12 As

each Annual Report must be completed and adopted, by resolution, within four months

after the end of the financial year to which it relates, this makes 31 October

the last day available to meet this timeframe.

Community

Views

13 As

the Annual Report is a report on activities undertaken during the year, no

consultation is required as the consultation has already occurred as part of

the Annual Plan process.

Costs

and Funding

14 There

is a fee provided to Audit New Zealand to audit the Annual Report.

Policy

Implications

15 There are no

policy implications.

Assessment of Significance

16 Whilst

the Annual Report is an important accountability document for Council this

report merely sets out the associated timetable key dates and is therefore of

low significance.

Next Steps

17 The

project team will provide a draft document to Council at a workshop on 16

September 2015.

Attachments

a Annual

Report 2014/2015 timetable View

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Tasks

|

Department

|

Due date

|

|

MAY

|

|

|

|

Executive Leadership team (ELT) approve timetable.

|

Strategy

|

Monday 25 May

|

|

JUNE

|

|

|

|

Meet to discuss approach to summary and content and review content of

previous Annual Report (AR).

|

Project Team

|

Tuesday 30 June

|

|

JULY

|

|

|

|

Book in project team dates and project updates to general staff.

|

Strategy

|

Wednesday 1 July

|

|

Communication plan/key dates circulated at

Team Leader Forum to all Activity Managers with key

deadlines entered into their diaries

|

Strategy

|

Friday 3 July

|

|

Finalise AR template. Split into sections for editing.

|

Strategy/Finance

|

Friday 3 July

|

|

Debtors and creditors cut-off (invoices to be paid and invoices to be

issued with Linda/Colin).

|

Finance

|

Friday 10 July

|

|

Activity Managers to provide audit file of all base KPI data to

Strategy and Policy.

|

Activity Managers and associated Group Manager signoff

|

Wednesday 15 July

|

|

Timetable report to APAC.

|

Strategy

|

Wednesday 15 July

|

|

Circulate spreadsheet of 2014/2015 projects to Finance to complete

actual cost figures.

|

Strategy

|

Thursday 16 July

|

|

All businesses unit managers meet with Finance rep and balanced up

all business units.

|

Staff

|

Tuesday 28 July

|

|

Collate performance results for each activity and draft up activity

sections (narrative, projects tables, and performance tables).

|

Strategy

|

By Friday 31 July

|

|

Draft narrative for Key Highlights, CCOs, Community

Outcomes, Summary Activity Report and Opportunities for Māori to

Contribute to Decision-Making.

|

Strategy

|

By Friday 31 July

|

|

AUGUST

|

|

|

|

Complete actual costs for 2014/2015 projects.

|

Finance with

Group Manager signoff

|

Monday 3 August

|

|

Issue draft activity sections to staff to complete.

|

Strategy

|

Monday 3 - 6 August

|

|

All activity sections from Activity Managers due.

|

Activity Managers and associated Group Manager signoff

|

Friday 7 August

|

|

Activity sections completed and incorporated and link sent to

activity managers.

|

Strategy

|

Monday 10 August

|

|

Reports due for ELT - review of year end business unit reports and

rough draft of AR.

|

Finance

|

Wednesday 12 August

|

|

ELT meeting - review year end business unit reports and rough draft

of AR.

|

Finance

|

Monday 17 August

|

|

Draft financial statements, FIS etc.

|

Finance

|

Friday 21 August

|

|

Significant variances explanations and Financial Overview completed.

|

Finance

|

Friday 21 August

|

|

Assemble Annual Report incorporating any changes.

|

Strategy

|

Monday 17 - 24 August

|

|

Proofreading – Editing and Grammar

|

WP

|

Monday 24 - 26 August

|

|

Initial proofread of document – Flow check.

|

Comms

|

Thurs 27 - Fri 28 August

|

|

Document locked down and merged into one document.

|

Strategy

|

Monday 31 August

|

|

Unaudited AR to ELT to discuss unaudited full AR including KPI

results.

|

Strategy

|

Monday 31 August

|

|

SEPTEMBER

|

|

|

|

ELT feedback.

|

ELT

|

Thursday 3 September

|

|

Complete “Message from the Mayor and

Chief Executive”.

|

Comms

|

Friday 4 September

|

|

Put on Hub - APAC - unaudited AR First Cut

|

Strategy

|

Wednesday 9 September

|

|

APAC workshop 9.00 -10.30 am

Note - draft form only not with audit changes.

|

ALL

|

Wednesday 16 September

|

|

Audit arrives.

|

Audit

|

Monday 7 - 18 September

|

|

Send summary text to Auditors.

|

Comms

|

Monday 14 September

|

|

Final proofing and quality check of highlighted changes.

|

WP/Comms

|

Week starting 14 - 23 September

|

|

Audit leaves - incorporate changes into AR.

|

Audit/Strategy/Finance

|

Friday 18 & 21 September

|

|

Give final audit changes on summary to Communications.

|

Strategy/Finance

|

Friday 18 September

|

|

Send final summary text to graphics designer.

|

Comms

|

Monday 21 September

|

|

Graphics cover page completed.

|

|

Monday 21 September

|

|

Report and AR due for ELT agenda.

|

Strategy/Finance

|

Monday 21 September - noon

|

|

ELT agenda check + any changes from audit tabled.

|

ELT

|

Thursday 24 September

|

|

Agenda finalised and put on the hub.

|

Governance

|

Monday 28 September

|

|

OCTOBER

|

|

|

|

Send copy of Council report and outline any final audit changes to

ELT and Audit that are to be tabled.

|

Strategy/Finance/Comms

|

Monday 5 October

|

|

Adoption of Annual Report, Summary document and Audit opinion.

|

Council

|

Wednesday 7 October

|

|

AR master completed and added to website, including Audit disclosure.

|

Strategy

|

Friday 9 October

|

|

Summary and AR documents to be completed and printed.

|

Comms

|

Tuesday 20 October

|

|

Print AR and Summary and circulate to area offices.

|

Strategy/Comms

|

Tuesday 20 October

|

|

Advertise availability of report (public notice).

|

Strategy

|

Saturday 24 October

|

|

Circulate summary and report to relevant persons on corporate mailing

list.

|

Strategy

|

Monday 26 October

|

|

Debrief/lessons learned session.

|

All

|

Friday 30 October

|

|

Activities

Performance Audit Committee

15 July 2015

|

|

Financial Report to 31 May 2015

Record No: R/15/6/9971

Author: Susan

McNamara, Management Accountant

Approved by: Anne

Robson, Chief Financial Officer

☐

Decision ☐ Recommendation ☒ Information

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Financial Report to 31 May 2015” dated 6 July

2015.

|

Attachments

a Report

to Activities Performance Committee (APAC) - 15 July 2015 - Report to 31 May

2015.

|

Activities

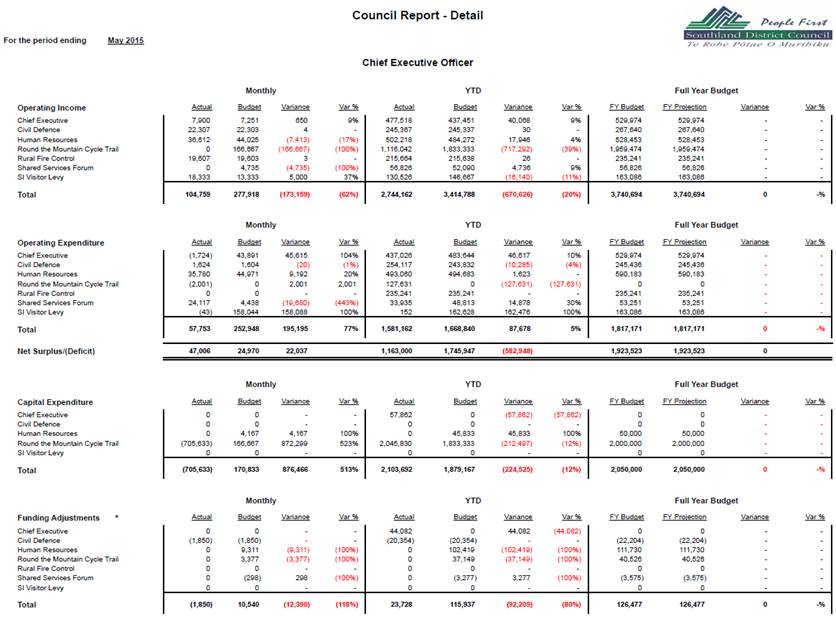

Performance Audit Committee

|

15 July 2015

|

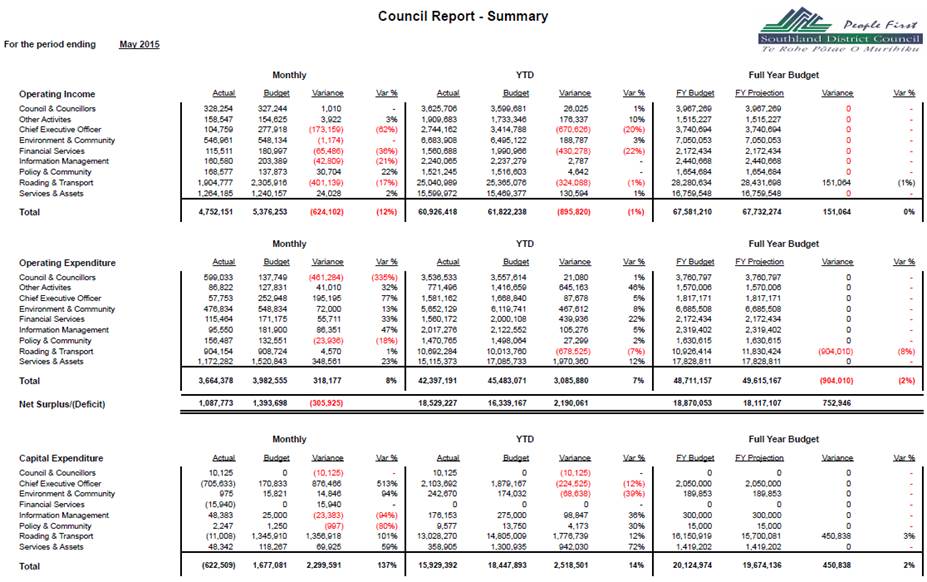

Background

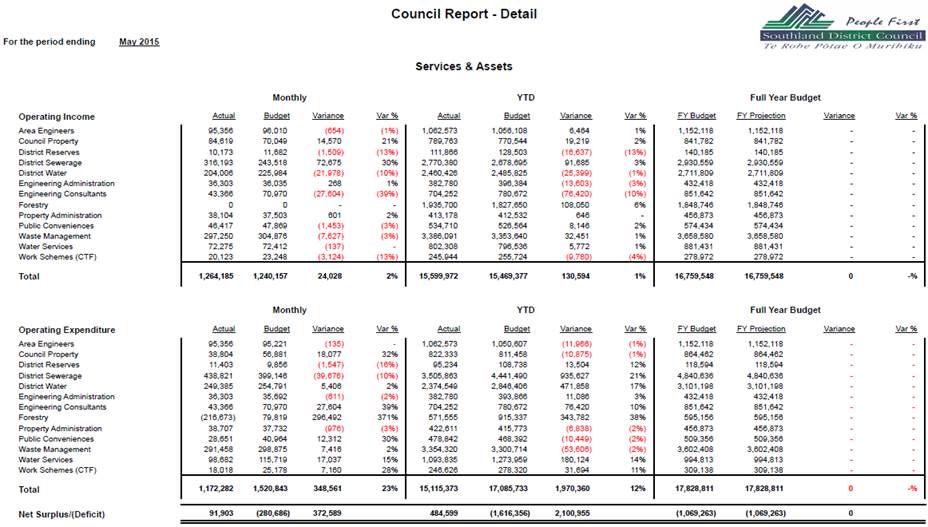

This report outlines the financial results to 31 May

2015.

Percentage of year gone: 92%.

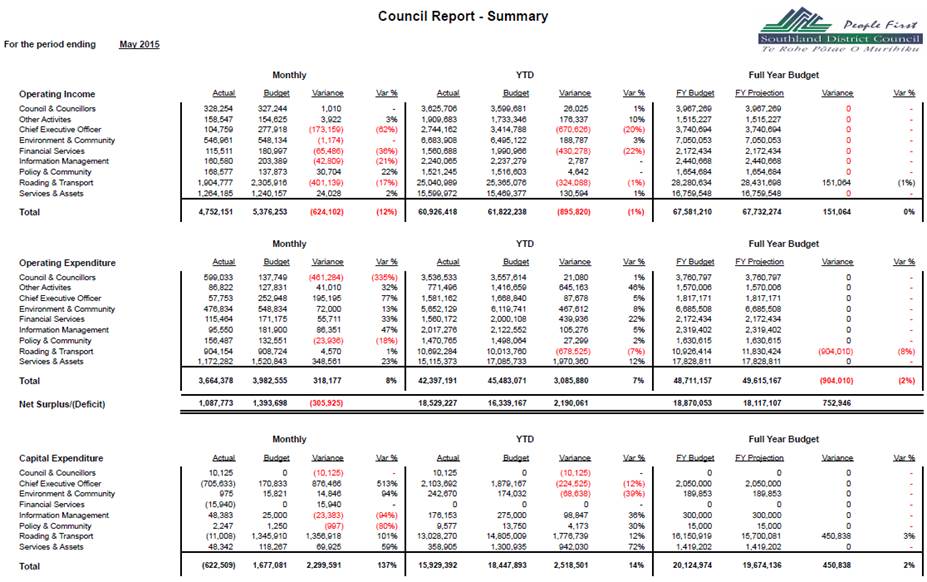

OVERVIEW

Management Accountant May Finance Overview

As in prior years, all budget managers have been instructed

to have a strong focus on their budget and expenditure items.

The financial commentary centres on the summary sheet which

draws the totals from each of the key sections together. Although you are

able to obtain more detailed key variance explanations from senior managers in

these sections, these will be summarised below, concentrating on the YTD

results.

Income

Overall for the YTD, income is 1% ($896K) under

budget.

Key variances are as follows:

The Council and Councillors’ revenue is 1% ($26K) over

budget for the year-to-date, primarily due to unbudgeted internal catering

income of $15K.

Other activities income is 10% ($176K) over budget for the

year-to-date. This is predominantly due to the timing of income received from

interest on investments.

Within the Chief Executive section, income received is 20%

($671K) under budget due to:

• Chief

Executive - 9% ($40K) over budget due to an unbudgeted vehicle sale and the

quarterly application of rates penalties.

• Stewart

Island Visitors Levy - Income is 11% ($16K) under budget. With the cruise

ship period completed, income is expected to be approximately $27K under budget

at year end.

• Around

the Mountains Cycle Trail - 39% ($717K) under budget due to final invoicing to

the Ministry being completed last financial year. This is expected to be

$840K under budget at year end.

Within the Environmental and Community Group, year-to-date

income is 3% ($189K) over budget, this is principally due to increased revenue

in Dog and Animal Control from infringement notices ($68K) and increased

numbers of dog registrations ($20K), as well as increased resource consent fees

($53K) as a result of the invoicing of two significant notified consents.

Within the Financial Services Group, income is 22% ($430K)

under budget. As this activity is internally funded this is due to

reduced expenditure.

Within the Information Management Group, year-to-date income

is $3K over budget, predominantly due to internal computer hire income of $43K

from additional items of hardware and software being provided. This is

offset by lower income in the Knowledge Management and Property and Spatial

Services due to lower expenditure as these activities are internally funded.

Within the Policy and Community Group, year-to-date income

is $5K over budget. As this activity is internally funded this is a

result of increased expenditure.

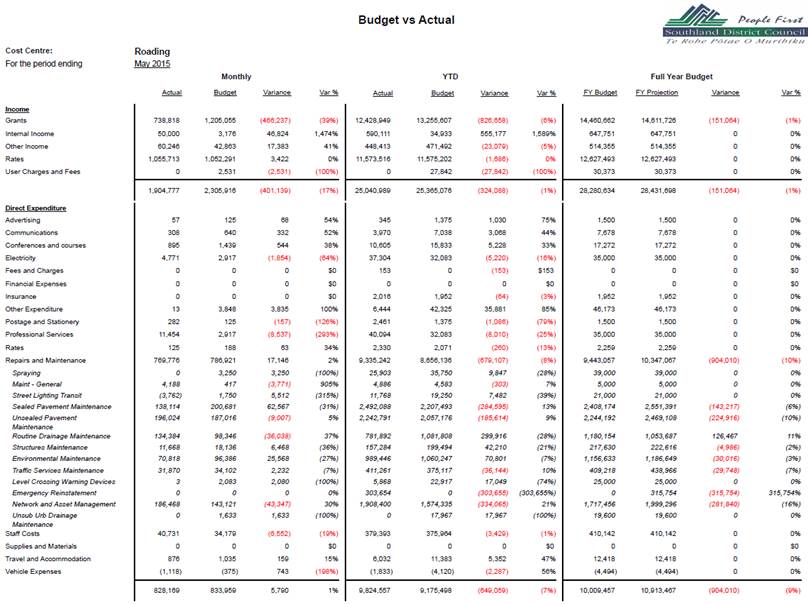

Within the Roading and Transport section, compared to the

Annual Plan total income is 4% ($324K) under budget. NZTA income is

currently 6% ($826K) under Annual Plan budget and is offset by the timing of

$555K of internal interest income (the internal interest income will realign at

year end). Roading are forecasting NZTA income to be 1% ($151K) under the

Annual Plan budget at the end of year. We are currently finalising the

income relating to the NZTA three year programme of works but it is anticipated

to be slightly under the three year approved budget.

Overall Services and Assets income

(excluding Roading) is tracking 1% ($131K) above

year-to-date budget. This is due to:

• Engineering Consultants being 10% ($76K) under

budget. As this activity is internally funded this is a result of

reduced levels of expenditure.

• Overall

Forestry income received is 6% ($108K) over budget, this is expected to be the

position at the end of the year. This is predominantly due to harvesting

revenues from Waikaia forest being $935K over budget, offset by Dipton and Ohai

forest revenues being under budget ($460K and $366K respectively).

No harvesting was included in the Annual Plan for Waikaia, Dipton is lower than

the amount in the Annual Plan whereas no harvesting occurred at

Ohai.

The

tonnes harvested per hectare were higher at Waikaia than was estimated at the

time harvesting began (559.88 actual versus 556 estimate); at Dipton the tonnes

harvested per hectare was lower than was estimated (476.73 actual versus 495

estimate).

• District Sewerage is 3% ($92K) over budget as income was

received from Landcorp for leasing land at the Kepler site ($60K).

Expenditure

Overall for the year-to-date, expenditure is 7% ($3.09M)

under budget.

The key variances are as follows:

Other activities expenditure is 46% ($645K) under budget as

the calculation and allocation of interest on reserves is completed as part of

the year-end process.

The Chief Executive activity is 5% ($88K) under budget due

to timing of Stewart Island Visitors Levy Grants with $117K being paid in June,

as well as lower payroll costs of $71K, as a result of the CEO position being

vacant for three months. These underspends are offset principally by

internal consenting costs relating to the Around the Mountains Cycle Trail of

$128K.

The Environment and Community Group is 8% ($468K) under

budget. This is predominantly due to expenditure on the District Plan

being lower than anticipated at this stage of the year. The expenditure

on the District Plan is currently $346K under budget and is expected to be

$400K under budget at the end of the year. It is anticipated that

additional costs will be incurred in the Environment Court appeal/mediation

process in the 2015/16 financial year. Dog and animal control is $76K

over budget predominantly as a result of additional payroll related costs for

after-hours work, these additional costs are sufficiently offset by the

additional revenue generated in this activity in the current year.

Within Financial Services, expenditure is 22% ($440K) under

budget, primarily due to the timing of audit costs ($138K) and staff vacancies

($211K). Although some costs will be incurred before the end of the year,

Financial Services is expected to be $300K under budget at the end of the year

after the accrual of audit fees to the end of the year.

Within the Information Management group, overall expenditure

is 5% ($105K) under budget, predominantly due to the weather conditions

impacting the ability for aerial photography to be undertaken ($79K).

Within the Policy and Community Group, expenditure is 2%

($27K) under budget due to no expenditure to date for community outcomes ($41K)

and lower than expected staff costs due to maternity leave, these have been

offset by additional costs relating to the 10 Year Plan.

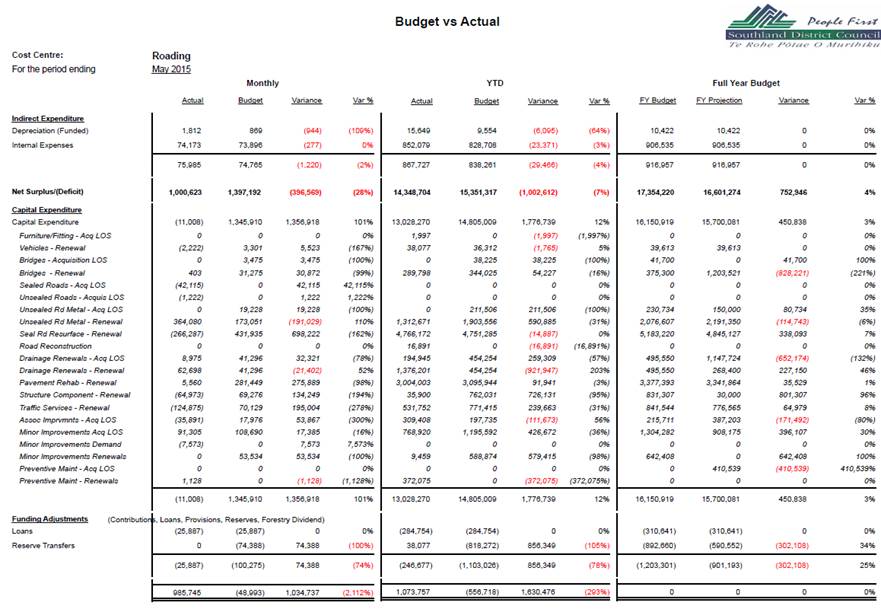

Roading expenditure is currently 7% ($679K) over Annual Plan

budget. Operations and maintenance costs are forecast to be $904K over

Annual Plan budget at year end. This will be partially offset by

underspends in capital expenditure (estimated at $451K) and underspends in the

previous two years. The forecast three year programme table which details

total expenditure (both capital and maintenance) is shown in the roading

section of this report. This outlines a forecasted underspend of $1.02M

compared to the programme approved by NZTA.

Actual operational expenditure for

Services and Assets year-to-date is 12% ($1.97M) under budget.

Key variances are as follows:

• District

Water is 17% ($472K) under budget, predominantly as a result of lower than

planned capital expenditure for the year-to-date ($414K actual capital works

compared to $959K budgeted).

• District

Sewerage is 21% ($936K) under budget, predominantly as a result of lower than

planned capital expenditure for the year-to-date ($1.82M actual capital works

compared to $2.62M budgeted).

• Water

Services is 14% ($180K) under budget predominately due to fewer services of

project consultant costs being required than budgeted.

• Engineering

Consultants is 10% ($76K) under budget due to a lower level of expenditure in

consultants and internal services.

• Forestry

expenditure is 38% ($344K) under budget as a result of lower expenditure across

all operations.

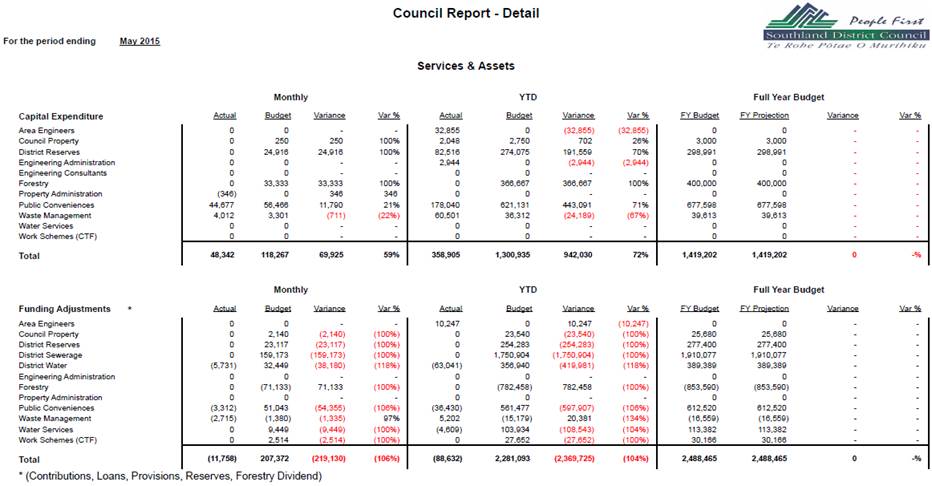

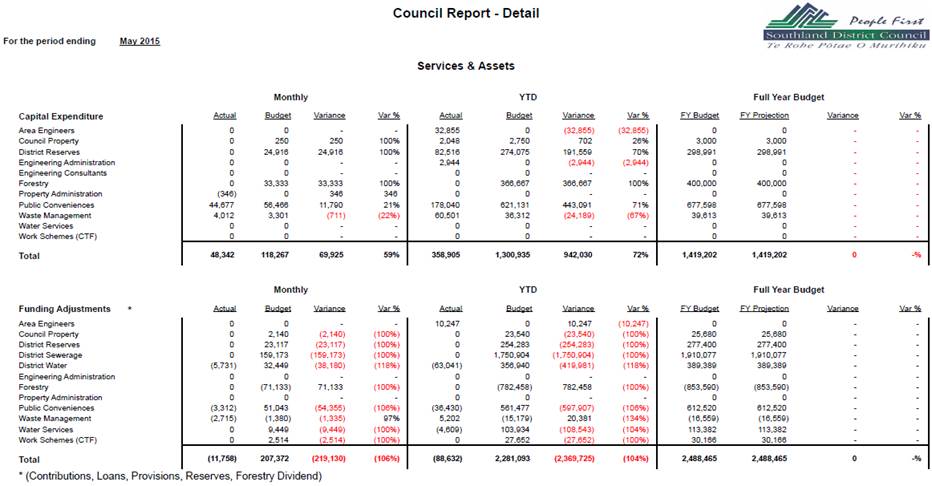

Capital Expenditure

Overall for the year-to-date, capital expenditure is 14%

($2.52M) under budget.

The key variances are as follows:

• Capital

expenditure in the Chief Executive activity is over budget by 12% ($225K)

due to the progress on Stage Two of the Around the Mountains Cycle Trail.

• Environment

and Community is over budget by 39% ($69K) primarily due to an additional

vehicle purchase for Animal Control funded by a loan to be repaid from external

income and the timing of the replacement of an Environmental Health vehicle.

• Information

Management capital expenditure is under budget by 36% ($99K) due to minimal

costs to date being incurred on the Records Improvement Plan. During the year

Info Council and Promapp have been purchased. A vehicle has also been purchased

that has been funded by a loan that is to be repaid from funds budgeted to

lease a vehicle.

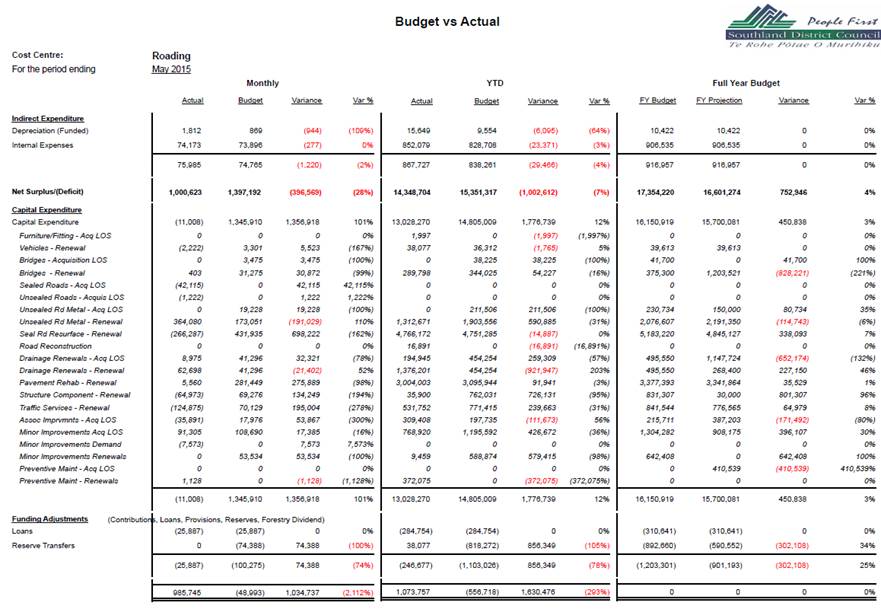

• Roading

capital expenditure is under Annual Plan budget by 12% ($1.78M) due to timing

on planned road and pavement renewals. The capital budget at year end is

forecast to be $451K below Annual Plan budget.

• Services

and Assets are under budget by 72% ($942K) with minimal capital expenditure to

date on projects planned in public conveniences, district reserves and

forestry.

Funding Adjustments

Funding adjustments are significantly under budget as

typically ‘balancing’ of business units is not undertaken until the

end of the financial year.

Journals are being processed for reserve transfers,

predominantly in relation to vehicle movements, and loan draw-downs (ie for

project funding), throughout the year at the request of budget managers.

Key Financial Indicators

|

Indicator

|

Target*

|

Actual

|

Variance

|

Compliance

|

|

External Funding:

Non rateable income/Total income

|

> 39%

|

37%

|

-2%

|

x

|

|

Working Capital:

Current Assets/Current Liabilities

|

>1.09

|

3.08

|

1.99

|

a

|

|

Debt Ratio:**

Total Liabilities/Total Assets

|

<0.73%

|

0.53%

|

0.2%

|

x

|

|

Debt To Equity Ratio:

Total Debt/Total Equity

|

<0.01%

|

0.00%

|

0.01

|

a

|

* All

target indicators have been calculated using the 2014/15 Annual Plan

figures.

** Excludes

internal loans.

Financial

Ratios Calculations:

|

Non

Rateable Income

|

|

Total

Income

|

External Funding:

This ratio indicates the percentage of revenue received

outside of rates. The higher the proportion of revenue that the Council

has from these sources the less reliance it has on rates income to fund its

costs.

|

Current

Assets

|

|

Current

Liabilities

|

Working Capital:

This ratio indicates the amount by which short-term assets

exceed short term obligations. The higher the ratio the more comfortable

the Council can fund its short term liabilities.

|

Total

Liabilities

|

|

Total

Assets

|

Debt Ratio:

This ratio indicates the capacity of which the Council can

borrow funds. This ratio is generally used by lending institutions to

assess entities financial leverage. Generally the lower the ratio the

more capacity to borrow.

Debt to Equity Ratio:

It indicates what proportion of equity and debt the Council

is using to finance its assets.

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

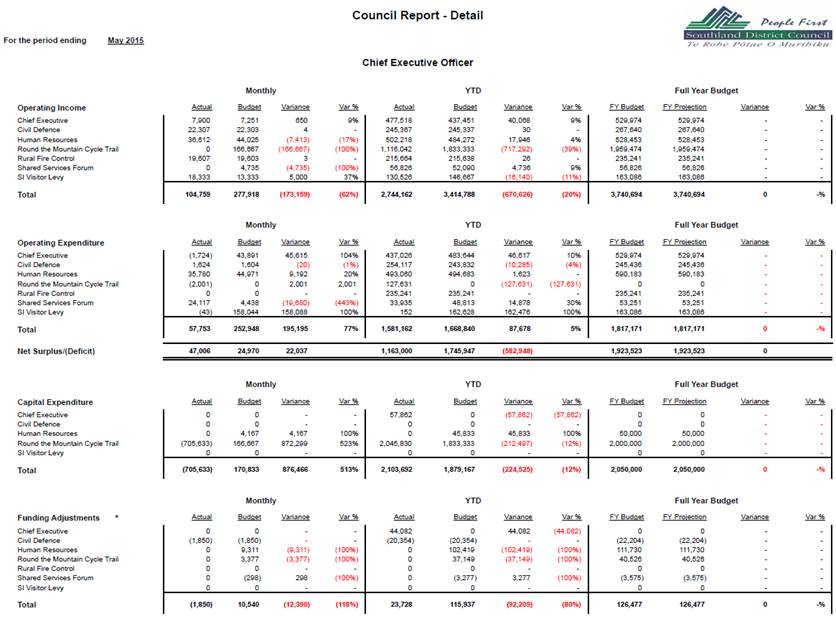

CHIEF EXECUTIVE COMMENTARY

For the year-to-date, income is under budget by 20%

($671K). Expenditure is under budget by 5% ($88K), therefore resulting in

a net year-to-date position of $583K under budget.

Chief Executive

Income in this business unit is 9% ($40K) over budget, this

is due to proceeds on an unbudgeted vehicle sale ($14K) and rates penalties

income ($14K). Expenditure is 10% ($47K) under budget, predominantly due

to staff costs being under budget ($71K). This is offset by project

consultant fees being over budget ($31K).

Civil Defence

Income is on budget. Expenditure is 4% ($10K) over

budget due to the Emergency Management Southland grant being slightly higher

than budgeted. It is anticipated to be $10K over budget at year end.

Human Resources

Income is 4% ($18K) over budget. Expenditure

year-to-date is $2K over budget, due to training costs ($50K) offset by

underspends in survey expenses ($19K), consultant costs ($18K) and staff costs

($17K). As this activity is internally funded, the increased expenditure

impacts directly on income.

Around the Mountain Cycle Trail

Income is 39% ($717K) under budget due to final invoicing to

the Ministry being completed last financial year. It is expected to be

$590K under budget at year end. Capital expenditure is over budget by

$340K with work being undertaken on Stage 2.

Rural Fire Control

Income and expenditure is on budget for the year.

Shared Services Forum

Income is 9% ($5K) over budget due to the timing of

contributions. Expenditure for

year-to-date is under budget by 30% ($15K), with low activity for the

year.

Stewart Island Visitor Levy

Income is 11% ($16K) under budget. With the cruise

ship period completed, income is expected to be under budget at year end.

Expenditure is $162K under budget with grant allocations having been approved

but not yet paid out.

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Activities Performance

Audit Committee

|

15 July 2015

|

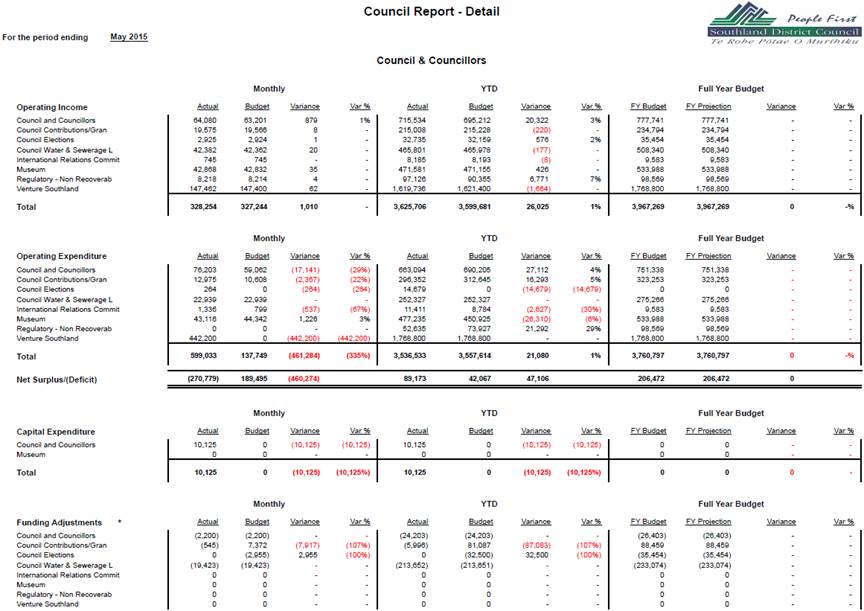

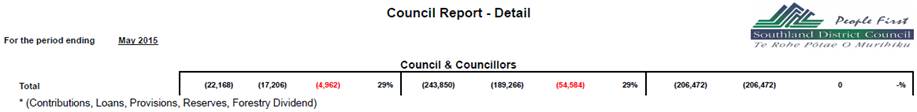

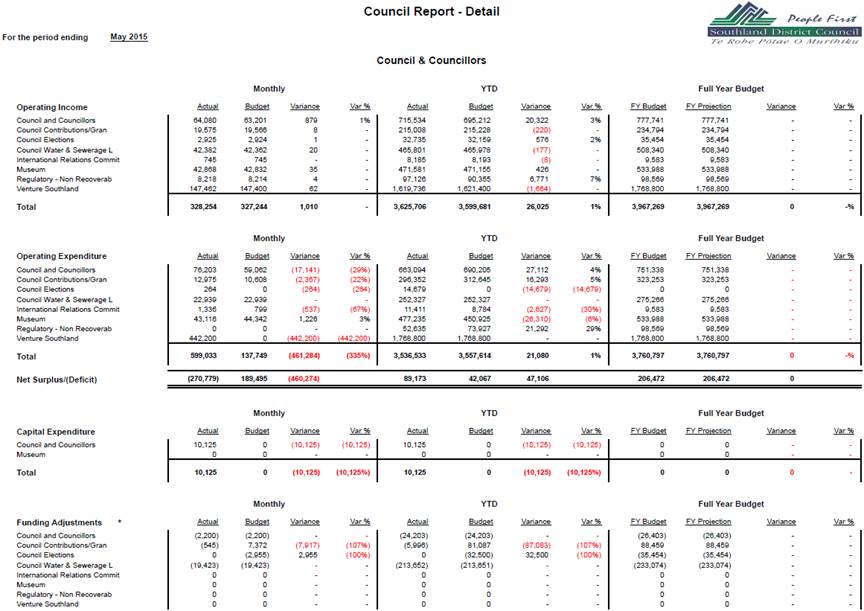

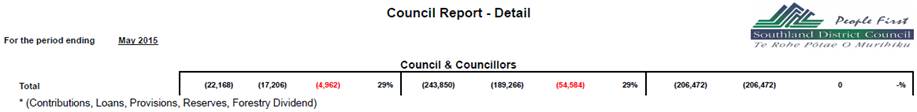

Council and Councillors’ Commentary

For the year-to-date, income is 1% ($26K) over budget.

Expenditure is under budget by

1% ($21K). This resulted in a net year-to-date position of $47K over

budget.

Council and Councillors

Income is 3% ($20K) over budget as a result of unbudgeted

income from internal catering $15K and funding for Leadlab project from

Ministry of Youth Development. Expenditure is under budget by 4% ($27K)

primarily due to Councillors’ salaries of $20K and Youth Council costs

$6K, however we are anticipating higher year-end costs as a result of the

Leadlab project.

Council Contributions/Grants

Income is on budget for the year-to-date. Expenditure

is under budget by 50% ($16K) due to grant payments yet to be requested and

paid and two grants being deferred until next year.

Council Elections

Income is on budget. Expenditure is $15K over budget

due to the Mararoa Waimea Ward Councillor election. No additional costs

are expected this year relating to elections.

Council Water and Sewerage Loans

Income and expenditure is on budget for the year-to-date.

International Relations Committee

Income is on budget for the year-to-date. Expenditure

is $3K over budget with attendance at the Sister Cities Conference in

March. It is expected to be $2K over budget at year end.

Museum

Income is on budget. Expenditure is over budget 6% ($26K)

due to timing of the Museum Trust Board Levy, it is expected to be on

budget at the end of the year.

Regulatory - Non-Recoverable

Income is 7% ($7K) over budget for the year-to-date.

Expenditure is under budget by

29% ($21K) as a result of minimal non-recoverable costs incurred for the year

to date.

Venture Southland

Income and expenditure are on budget. This will be on budget

at the end of the year.

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

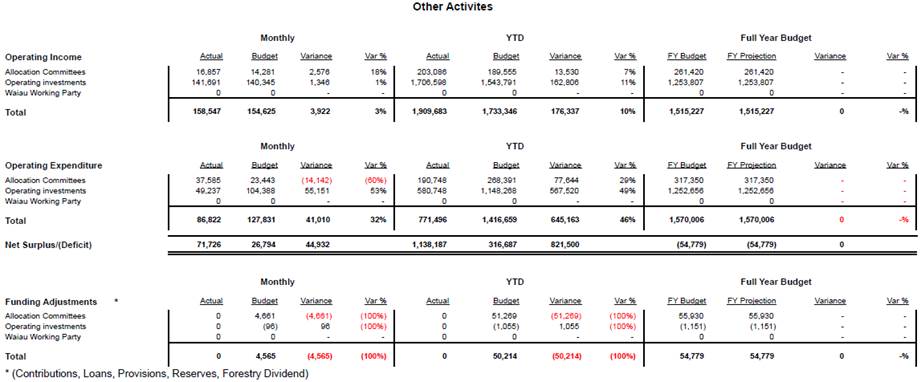

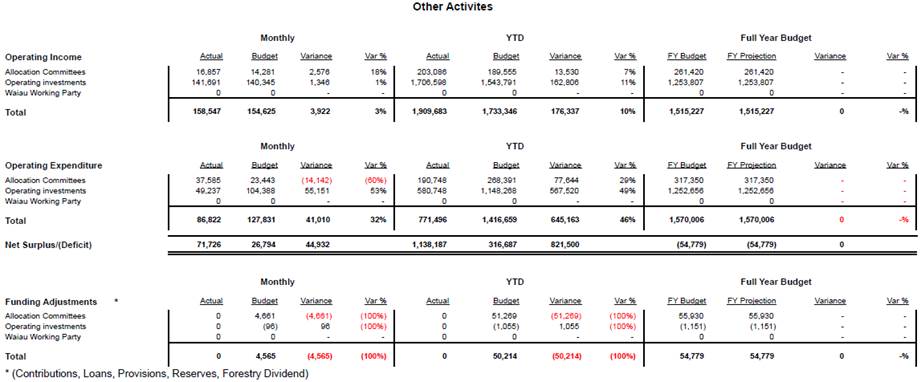

OTHER

ACTIVITIES COMMENTARY

Allocations Committee

Income is 7% ($14K) over budget due to timing of grants

received. Expenditure is under budget by 29% ($78K) due to the timing of

grant payments.

Operating Investments

Currently, the majority of

Council’s reserves are internally loaned by Council or its local

communities for major projects. Council has set the interest rate to be

charged on these loans as part of its 10 Year Plan process and interest is

being charged on a monthly basis on all internal loans drawndown at 30 June

2014.

|

Activities Performance

Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

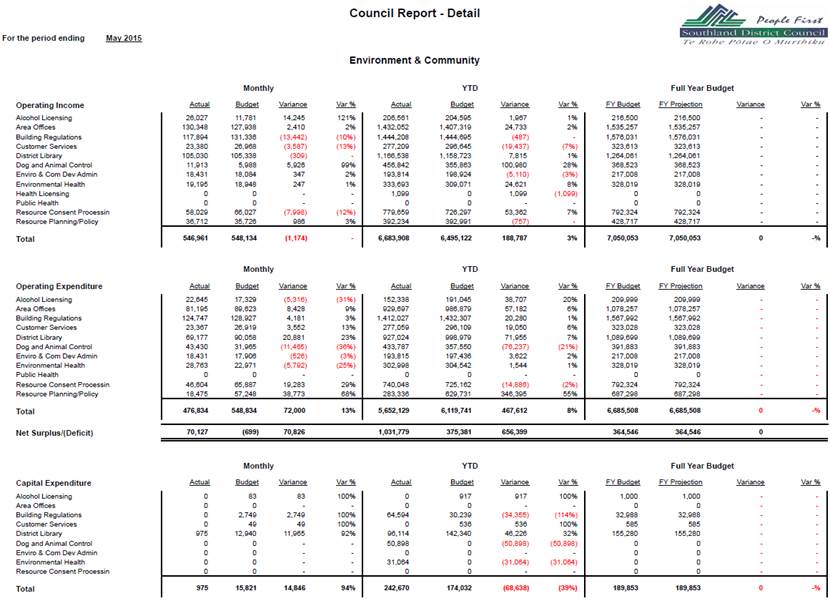

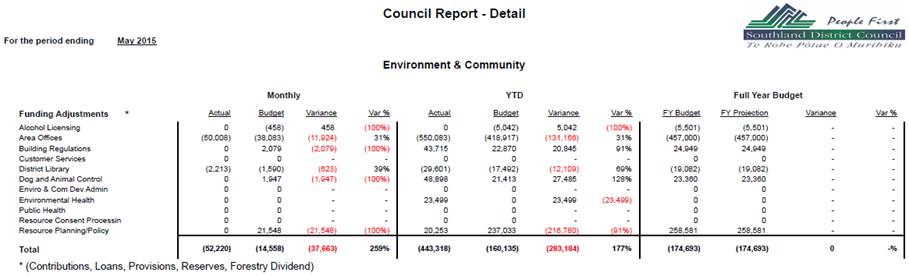

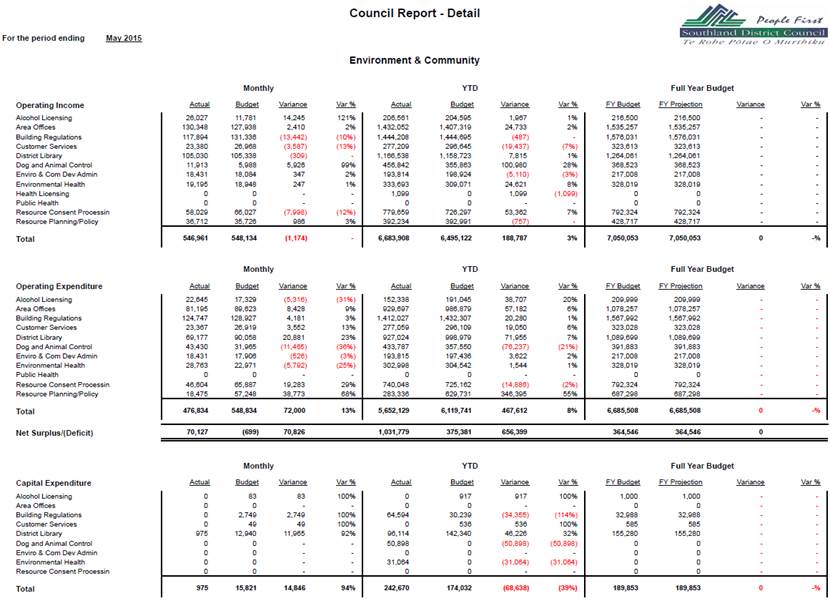

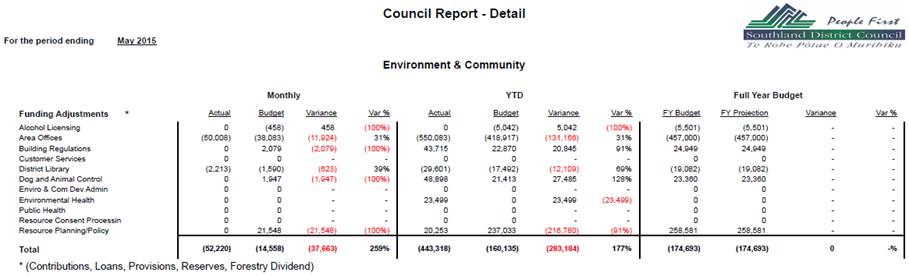

ENVIRONMENT AND

COMMUNITY COMMENTARY

Overall May 2015 monthly income for the Environment and

Community Group tracked almost exactly to budget at $547K actual v $548K

budget.

Key features of this month’s income were that Alcohol

Licensing and Animal Control income were well ahead of budget by 121% ($14K)

and 99% ($6K) respectively. The Alcohol Licensing result was due to a

correction around ordinary time payments, so is a one-off adjustment. The

Animal Control result was due to income from infringements and the courts being

ahead of budget.

Conversely, Building Control income was 10% ($13K) below

budget, and Resource Consent income was 12% ($8K) below budget, both reflecting

reduced levels of activity.

Overall May 2015 monthly expenditure for the Environment

and Community Group was 13% ($72K) below budget ($477K actual v $549 budget).

Most departments were below budget in expenditure,

reflecting a close focus on spending, with the exception of Animal Control

which incurred some significant additional salary costs for after-hours work.

The Resource Planning/Policy area was underspent by 68%

($39K), with less expenditure than anticipated on the District Plan project

over this period. Mediation processes which were expected to occur in

April to June 2015 have been delayed at the direction of the

Environment Court due to the status of Environment Southland’s Regional

Policy Statement content relating to the biodiversity issues, which is relevant

to several District Plan appeals.

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

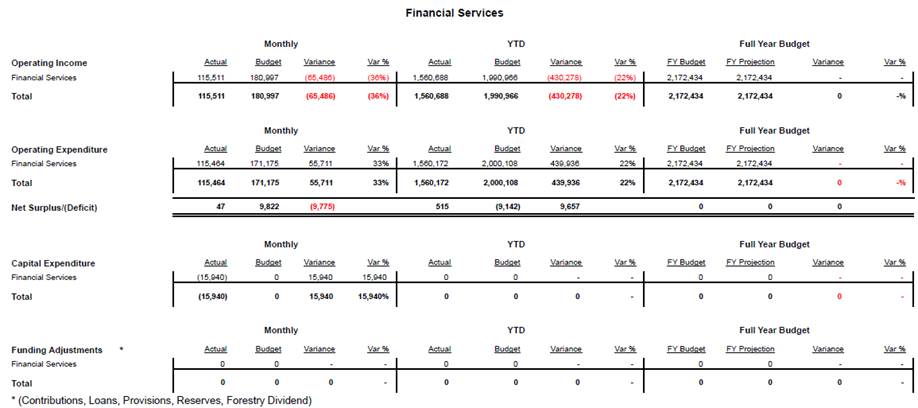

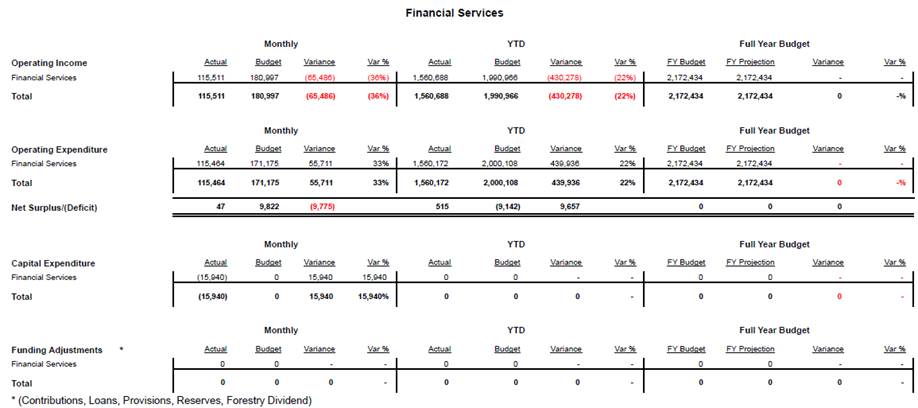

FINANCIAL

SERVICES COMMENTARY

Income is 22% ($430K) under budget. As this activity

is internally funded the reduced expenditure impacts directly on income.

Expenditure is 22% ($440K) under budget. This is primarily

due to the following:

• The

timing of audit costs ($138K)

• Staff

vacancies in the finance team ($211K)

• Visa/MasterCard

charges currently under budget ($19K)

• Material

damage insurance review costs related to insuring water and wastewater above

ground assets, has now been correctly coded to the water and waste business

units. This has resulted in actual costs being less than budgeted by

$45K.

At year end it is expected that

the business unit will remain under budget by approximately $300K due to the

above.

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

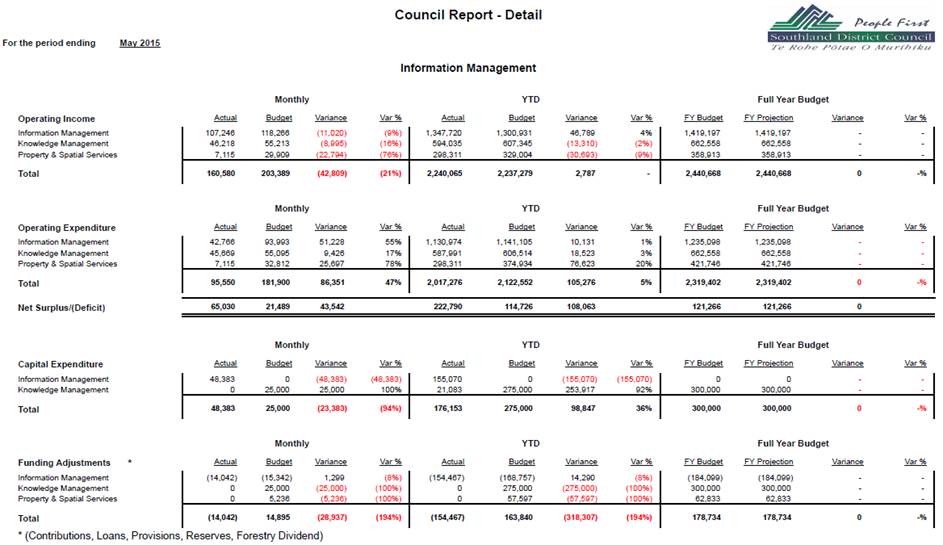

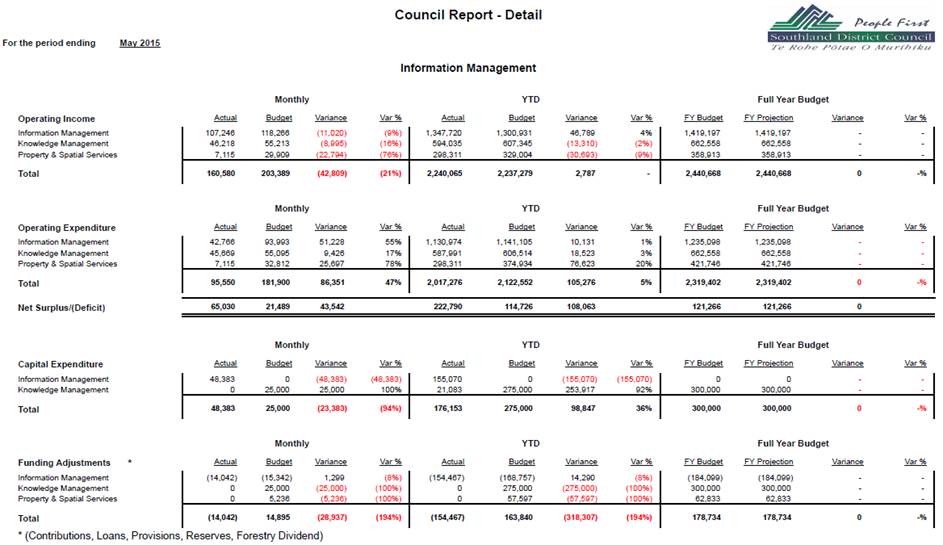

INFORMATION

MANAGEMENT COMMENTARY

For the year-to-date, income is $3K over budget. Overall

expenditure is 5% ($105K) under budget, resulting in a positive variance of

$108K.

Information Management

Income is 4% ($47K) over budget, predominantly due to internal

computer hire relating to additional hardware of $43K. Expenditure is 1%

($10K) over budget. This relates primarily to Software Licence Fees $41K,

which are estimated to be around $45K over budget at year end.

Additionally, consultants costs are $15K over budget as a result of the IM

Strategy Review. This is offset by photocopy user charges $31K.

Knowledge Management

Income is 2% ($13K) under budget. Expenditure is 3%

($19K) under budget, this is due to reduced internal computer hire costs ($13K)

and staff costs ($7K). This is offset by increases in postage costs ($7K)

and software licence fees ($3K). As this activity is internally funded

the reduced expenditure impacts directly on income.

Property and Spatial Services

Income is 9% ($31K) under budget. Expenditure is 20%

($77K) under budget predominantly due to timing on aerial photography costs

($79K). This is as a result of weather conditions not being suitable for

aerial photography and therefore the majority of the work not being

completed. Additionally software licence fees ($9K) and staff costs

($10K) are under budget. This is offset by consultant costs being

overspent by $9K. As this activity is internally funded the reduced

expenditure impacts directly on income.

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

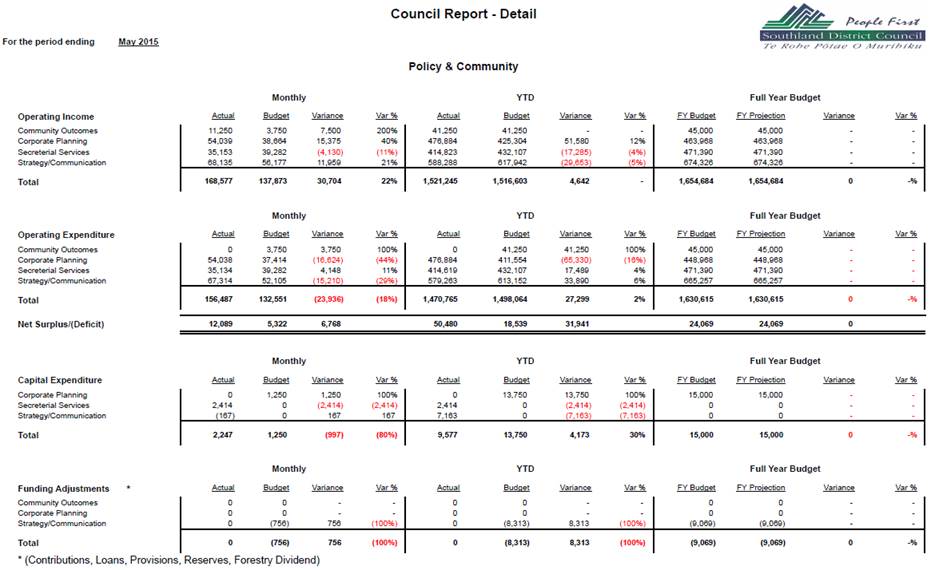

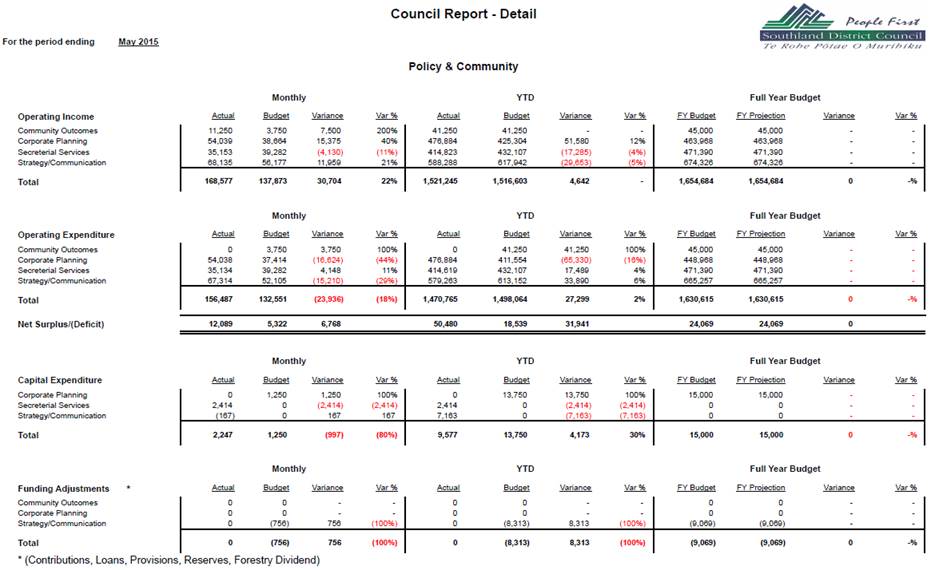

POLICY AND

COMMUNITY COMMENTARY

Income for the year-to-date is $5K over budget.

Expenditure for the year-to-date is 2% ($27K) under budget. The net

result for the year-to-date is a surplus of $50K against a forecasted surplus

of $19K, a positive variance of $32K.

Community Outcomes

Income is on budget. Expenditure is under budget by

$41K as no projects relating to the

Our Way Southland Outcomes have been identified in the current period.

Corporate Planning

Income is 12% ($52K) over budget. Expenditure is 16%

($65K) over budget due to

increased costs associated with the Long Term Plan ($40K) and unbudgeted costs

relating to the Policy and Community business unit $41K. This is offset

by increased employee costs ($6K). As this activity is internally funded

the increased expenditure impacts directly on income.

Secretarial Services

Income is 4% ($17K) under budget. Expenditure is 4%

($17K) under budget predominately due to training costs ($5K) and Internal

Photocopying ($7K). As this activity is internally funded, the reduced

expenditure impacts directly on income.

Strategy/Communication

Income is 5% ($30K) under budget. Expenditure is

underspent by 6% ($34K) predominately due to staff costs ($15K) and first

edition costs ($11K) being below budget. This is offset by overspending on

radio advertising ($12K). As this activity is internally funded the

reduced expenditure impacts directly on income.

|

Activities

Performance Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

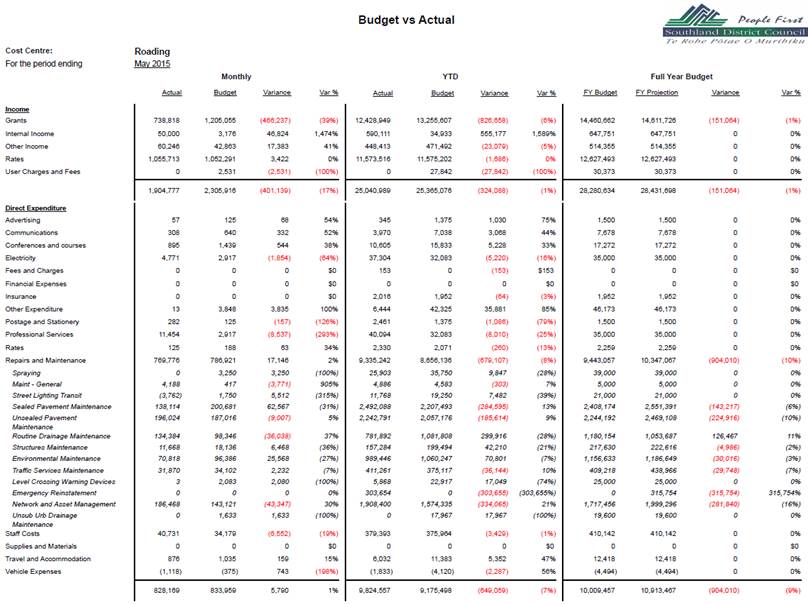

STRATEGIC

TRANSPORT

Overall Financial Performance

A continued strong focus on making sure we fully utilise

NZTA approved funding along with optimising "value for money" remains

a challenge.

It is forecasted that our operations and maintenance costs

will be over budget at year end. This will be partially offset by

underspends in capital expenditure and underspends in the previous two

years. The forecasted overspend can also be attributed to unbudgeted

emergency works projects for the Stewart Island Slips and the Ohai Clifden

Slip, as well as forecasted overspends in sealed, unsealed road maintenance and

Network and Asset Management.

Transport capital expenditure is under budget and is

forecasted to be under budget at year end. As we are coming to the end of

the construction season some projects will be deferred into the new financial

year. This is primarily due to weather restrictions.

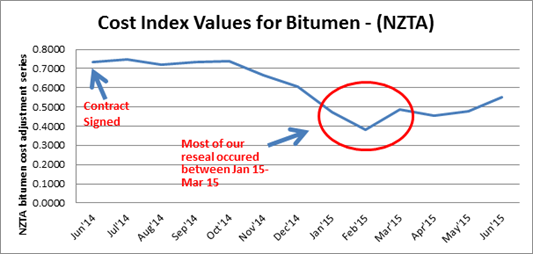

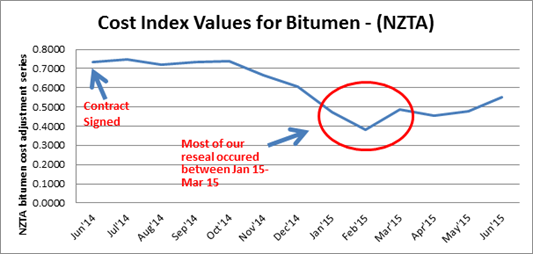

The significant reduction in the bitumen index over the construction period has

also contributed to the forecasted underspend. This is illustrated below:

|

Key

|

|

|

Largely on

Track

|

|

|

Monitoring

|

|

|

Action

Required

|

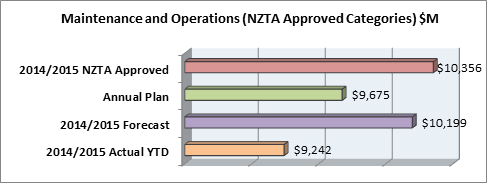

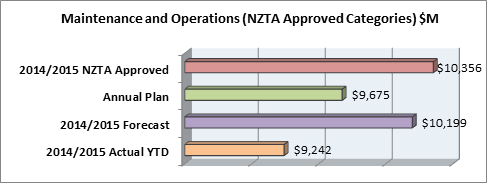

Maintenance and Operations (excluding Special Purpose

Roads):

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

92%

|

91%

|

96%

|

89%

|

- A

holistic approach to maintenance management has seen sealed pavement and

unsealed pavement maintenance being over budget but offset with underspends in

other activities. Network and Asset Management costs will be over budget

primarily driven by bringing forward our high speed data collection from the

2015/2016 year.

- It

is expected that we will be well within NZTA’s approved maintenance

budgets.

* Note that Council can only claim 30% of urban

drainage. Unsubsidised work has being excluded from this forecast.

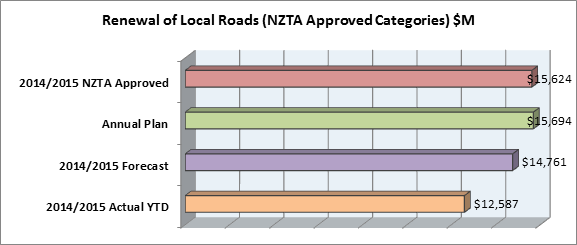

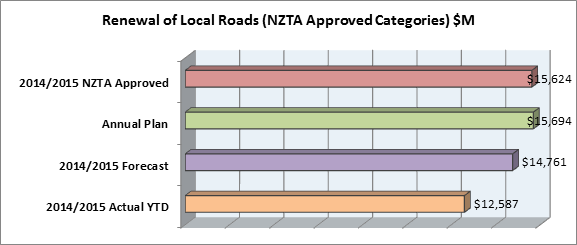

Renewals and Minor

Improvements:

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

92%

|

85%

|

80%

|

81%

|

Renewals and Minor Improvement Commentary:

As we are coming to the end of the

construction season, work is starting to be finalised before year end.

This will have an impact on completing some of our rehabilitation

projects. It is expected that most of the bridging work will be completed

this year, as Transport are pushing to get this work done to maximise the NZTA

Funding Assistance Rate for this category before it drops next year.

Recent weather events will likely impact on where these projects finish at year

end.

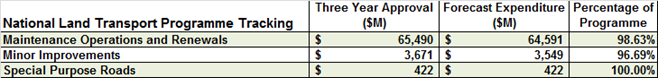

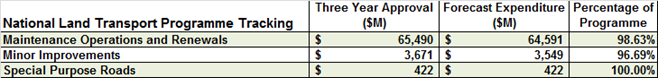

Three Year Programme:

|

Activities Performance

Audit Committee

|

15 July 2015

|

|

Activities

Performance Audit Committee

|

15 July 2015

|

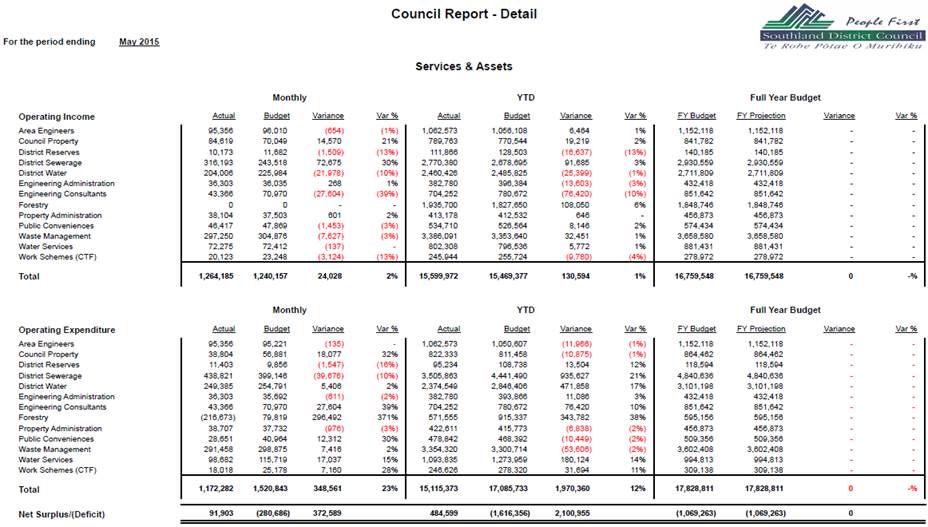

SERVICES AND

ASSETS (Excluding Roading)

COMMENTARY

Income

Overall Services and Assets

(excluding Roading) actual income is 1% ($131K) over year to date budget

($15.47M). This is primarily driven by Forestry income $108K over budget.

Key highlights are:

• Engineering Consultants is 10% ($76K) under budget.

As income is fully recovered and driven by

expenditure levels the reduced expenditure impacts directly on income.

• Overall

Forestry income received is 6% ($108K) over budget, this is expected to be the

position at the end of the year. This is predominantly due to harvesting

revenue from Waikaia forest being $935K over budget, offset by Dipton and Ohai

forests revenue being lower than expected ($460K and $366K).

• District Sewerage is 3% ($92K) over budget as a payment

was received from Landcorp for leasing land at the Kepler site ($60K).

Operating Expenditure

Actual operational expenditure for

Services and Assets year-to-date is 12% ($1.97M) under budget.

Key highlights are:

• District Water is 17% ($472K) under budget, predominantly

as a result of lower than planned capital expenditure for the year-to-date

($414K actual capital works compared to $959K budgeted).

• District

Sewerage is 21% ($936K) under budget, predominantly as a result of lower than

planned capital expenditure for the year-to-date ($1.82M actual capital works

compared to $2.62M budgeted).

• Water Services is 14% ($180K) under budget predominately

due to fewer project consultant costs being required than budgeted.

• Engineering Consultants business unit is 10% ($76K) under

budget due to under expenditure in consultants and internal services.

• Forestry

expenditure is 38% ($344K) under budget as a result of lower expenditure across

all forests and associated operations.

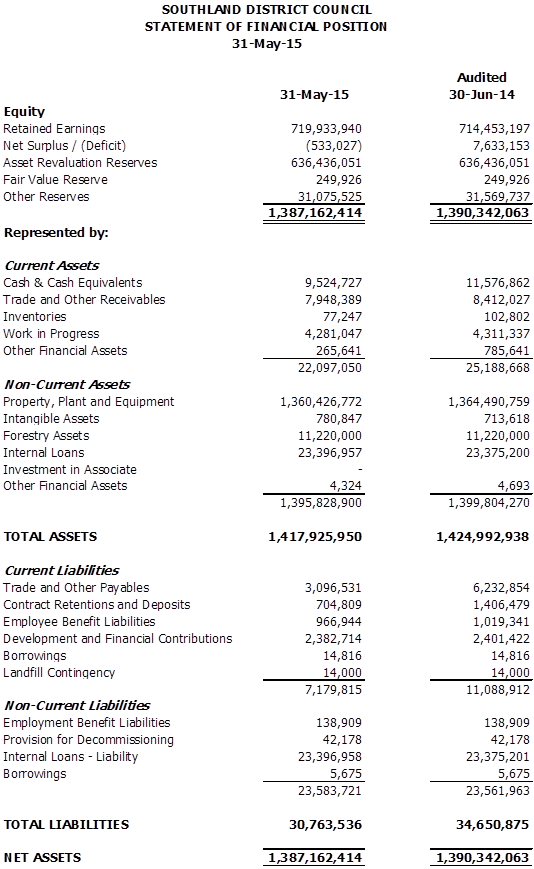

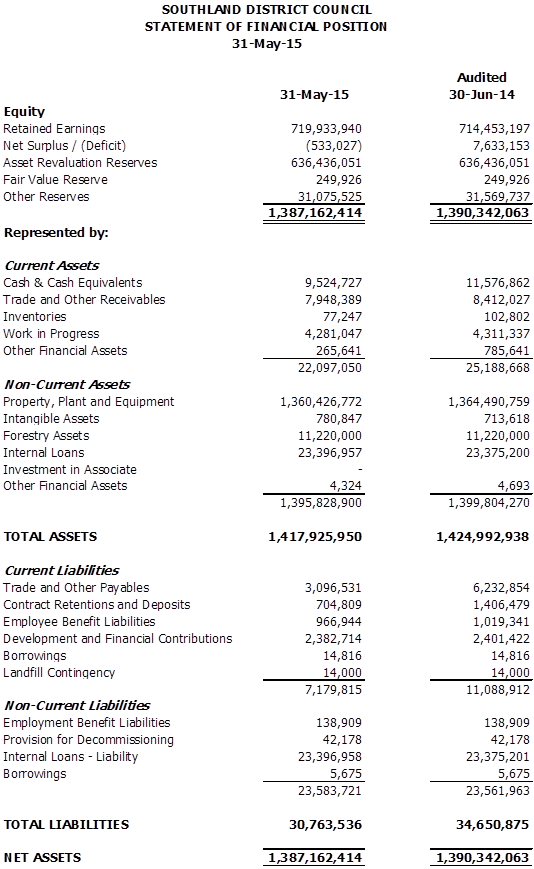

Statement of Financial Position

COMMENTARY

The balance sheet as at 30 June

2014 represents the audited balance sheet for activities of Council (ie

excludes SIESA and Venture Southland). The financial position at

31 May 2015 is before year-end adjustments and only for the activities of

Council.

External borrowings have still not

been required, with internal funds being used to meet obligations for the

year-to-date.

|

|

|

|

|

Susan McNamara

MANAGEMENT ACCOUNTANT

|

|

|

|

|

|