Notice is hereby given that a Meeting of

the Activities Performance Audit Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Wednesday, 26

August 2015

1pm

Council Chambers

15 Forth Street

Invercargill

|

|

Activities Performance Audit Committee Agenda

OPEN

|

MEMBERSHIP

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

|

Chief Executive

|

Steve Ruru

|

|

|

Committee Advisor

|

Fiona Dunlop

|

|

Terms of

Reference for the Activities Performance Audit Committee

This committee is a committee of Southland

District Council and has responsibility to:

·

Monitor and review Council’s performance

against the 10 Year Plan

·

Examine, review and recommend changes relating

to Council’s Levels of Services.

·

Monitor and review Council’s financial

ability to deliver its plans,

·

Monitor and review Council’s risk

management policy, systems and reporting measures

·

Monitor the return on all Council’s

investments

·

Monitor and track Council contracts and

compliance with contractual specifications

·

Review and recommend policies on rating, loans,

funding and purchasing.

·

Review and recommend policy on and to monitor

the performance of any Council Controlled Trading Organisations and Council

Controlled Organisations

·

Review arrangements for the annual external

audit

·

Review and recommend to Council the completed

financial statements be approved

·

Approve contracts for work, services or supplies

in excess of $200,000.

|

Activities Performance Audit Committee

26 August

2015

|

|

TABLE OF

CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of

Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Minutes 5

Reports

7.1 Management

Report from Audit New Zealand for the Long Term Plan 1 July 2015 to 30 June

2025 13

7.2 Financial

Report to 30 June 2015 17

At the close of

the agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Committee Members

are reminded of the need to be vigilant to stand aside from decision-making

when a conflict arises between their role as a member and any private or other

external interest they might have.

4 Public Forum

Notification to

speak is required by 5pm at least two days before the meeting. Further

information is available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the committee

to consider any further items which do not appear on

the Agenda of this meeting and/or the meeting to be held with the public

excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i) The

reason why the item was not on the Agenda, and

(ii) The

reason why the discussion of this item cannot be delayed until a subsequent

meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a)

That item may be discussed at that meeting if-

(i)

That item is a minor matter relating to the general

business of the local authority; and

(ii)

the presiding member explains at the beginning of the

meeting, at a time when it is open to the public, that the item will be

discussed at the meeting; but

(b)

no resolution, decision or recommendation may be made in

respect of that item except to refer that item to a subsequent meeting of the

local authority for further discussion.”

6 Confirmation

of Minutes

6.1 Meeting minutes of Activities Performance

Audit Committee, 5 August 2015

|

Activities Performance Audit Committee

OPEN MINUTES

|

Minutes of

a meeting of Activities Performance Audit Committee held in the Council

Chambers, 15 Forth Street, Invercargill on Wednesday, 5 August 2015 at 10.30am.

present

|

Chairperson

|

Lyall Bailey

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

Chief Executive Steve Ruru, Group Manager

Environment and Community Bruce Halligan, Group Manager Services and Assets Ian

Marshall, Group Manager Policy and Community Rex Capil, Chief Financial Officer

Anne Robson, Communications and Governance Manager Louise Pagan and Committee

Advisor Debbie Webster.

1 Apologies

There were no

apologies

2 Leave

of absence

There was a

request for leave of absence from Cr Paterson from 20 August to 2 September

2015, Cr Harpur from 14 August to mid-September and Cr Macpherson from 11

August to 1 September 2015.

|

Moved Mayor

Tong, seconded Cr Douglas and resolved that the Activities

Performance Audit Committee accept the request for leave of absence from Crs

Paterson, Harpur and Macpherson.

|

3 Conflict

of Interest

There were no conflicts of interest declared.

4 Public

Forum

There was no public

forum.

5 Extraordinary/Urgent

Items

There were no

Extraordinary/Urgent items.

6 Confirmation

of Minutes

|

Resolution

Moved Cr

Baird, seconded Cr Duffy and resolved:

That the

meeting minutes of Activities Performance Audit Committee, held on 15 July

2015 be confirmed.

|

Reports

|

7.1

|

Property File Digitisation Business Case

Record No: R/15/6/11256

|

|

|

Knowledge

Manager Gillian Cavanagh and Business Process and

Project Analyst Andrew Kinloch were in attendance for

this report.

|

|

|

Mrs Cavanagh advised that the

purpose of the report was to enable the Committee to review the Property File

Digitisation business case and make a decision to approve the undertaking of

the project as per the Southland District Council 10 Year Plan 2015-2025.

2 The

Committee noted that the in the 10 Year Plan 2015-2025 one of the key

budgeted projects for the Corporate Support activity was the Property File

Digitisation project. The project aims to scan all of Council’s

property records in order to reduce risk, increase statutory compliance,

eliminate physical space demands, provide a platform for future service

delivery improvements eg electronic consent lodgement and processing, and

improve the publics’ and staffs access to Council’s property

files.

3 The

Committee also noted that the Southland District Council currently operates a

paper based property filing system for the storage of its property

records. This system has increased by approximately 239 linear metres

or 58% of its original capacity in the last 10 years and weighs approximately

9 tonnes. As a result in the increase this has placed increasingly high

demands on the storage space available to Council to store these vital

records. With limited options to expand the storage of the property

files without reducing the level of service and increasing risk of loss or

damage, digitisation has become a vital component of being an effective Council.

Mrs Cavanagh advised that the digitisation project will

enable Council staff to work smarter and have access to any property file,

wherever they work and will enable the public to access any public property

information online and from any Council office.

Mrs Cavanagh highlighted to the Committee the project was

specifically relating to property files, with historical files going back to

1942. When queried she also noted that with digitisation there was the

potential to dispose of hard copy records.

Cr Bailey asked if the digitisation would be completed in

incremental blocks? Mr Campbell responded it would be preferred however

would depend on the capacity of the Vendor chosen to undertake the project.

Cr Douglas queried the cost of the project and the value

of the efficiencies to be gained from it. It was responded that from other

Councils experience in similar projects, digitisation helps significantly

with staff efficiency in accessing files and significantly improves records

standards. Cr Keast asked if estimates had been done on the value of

the efficiencies gained, being greater than the cost of the project. Mr

Campbell responded that estimates had not been done however based on other

Councils experiences the efficiencies gained were worth the project

cost. Mrs Cavanagh also noted that on average 250 - 300 property files

were out with staff in the District creating significant risk of loss and

damage to files.

Cr Kremer asked if individuals would be able to access

their electronic property files and how would security around this be

managed? Mr Ruru responded there would be a complex process around the

managing of records confidentiality. Mr Campbell commented a part of

the project was changing the EMDRS system to support this.

Cr Duffy queried the keeping of hard files that might have

heritage value? Mrs Cavanagh responded they would work with Heritage

New Zealand to identify these.

|

|

|

|

|

|

Resolution

Moved Cr Dobson, seconded Cr Kremer and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Property File Digitisation Business Case”

dated 24 July 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Approves

the Property File Digitisation Business Case and to undertake the

digitisation project using the ‘single year digitisation’

option as outlined in the business case document.

|

|

7.2

|

Library Activities

Record No: R/15/7/12561

|

|

|

Library Manager Lynda Hodge was in

attendance for this item. Mr Halligan introduced Mrs Hodge and noted

the positive library activities happening across the District. He also

noted there was an initial service delivery review underway, currently

developing the scope of the review, considering what people want from library

services in the District.

Mrs Hodge

advised that the purpose of the report was to provide the Committee with

an update on recent Library Services trends and activities. She noted

the issues at Southland District Council libraries have increased in the past

year by 12.58%. However the figures are captured from the Symphony

library computer system and have a margin for error as not all libraries are

computerised so the figures are a combination of statistics from the Symphony

system and manual counts from the non-computerised libraries.

Cr Bailey queried the inconsistency

in rating for library services across the District. He asked if there

might be some form of District wide funding? Mr Halligan

responded some Community Boards are querying the variances in what

communities are paying for library services, if there was a District Rate for

library services it would need to be in the District Plan and undergo public

consultation. Further work was required around this as there are

significant disparities across the District.

Mr Halligan noted point 24 on

Mrs Hodges report where it highlights the positive move of staff member

Roslyn Gray stepping into the vacated Team Leader role for Library Services.

|

|

|

Resolution

Moved Cr Dillon, seconded Cr Macpherson and

resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Library Activities” dated 24 July 2015.

b) Determines

that this matter or decision be recognised as not significant in terms of

Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

|

Public Excluded

Exclusion of the Public: Local Government Official Information and

Meetings Act 1987

|

Resolution

Moved Cr Baird, seconded Cr Douglas and

resolved:

That the Activities Performance Audit Committee exclude the public

from the following part(s) of the proceedings of this meeting.

C8.1 Recent Building Act Determinations and Other Matters

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter, and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

|

General subject of each

matter to be considered

|

Reason for passing this

resolution in relation to each matter

|

Ground(s) under section

48(1) for the passing of this resolution

|

|

Recent Building Act

Determinations and Other Matters

|

s7(2)(g) - The

withholding of the information is necessary to maintain legal professional

privilege.

s7(2)(i) - The

withholding of the information is necessary to enable the local authority to

carry on, without prejudice or disadvantage, negotiations (including commercial

and industrial negotiations).

|

That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding exists.

|

That the Chief Executive

Steve Ruru, Group Manager Environment and Community Bruce Halligan, Group

Manager Services and Assets Ian Marshall, Group Manager Policy and Community

Rex Capil, Chief Financial Officer Anne Robson, Communications and Governance

Manager Louise Pagan and Committee Advisor Debbie Webster, be permitted to remain at this meeting, after the public has

been excluded, because of their knowledge of the items C8.1 Recent Building Act Determinations and Other Matters. This knowledge, which will be of assistance

in relation to the matters to be discussed, is relevant to those matters

because of their knowledge on the issues discussed and meeting procedure.

The public were

excluded at 11.10 am.

Resolutions in

relation to the confidential items are recorded in the confidential section of

these minutes and are not publicly available unless released here.

The meeting concluded at 11.27 am CONFIRMED

AS A TRUE AND CORRECT RECORD AT A MEETING OF THE Activities Performance Audit Committee HELD ON WEDNESDAY 5 AUGUST

2015.

DATE:...................................................................

CHAIRPERSON:...................................................

|

Activities

Performance Audit Committee

26 August

2015

|

|

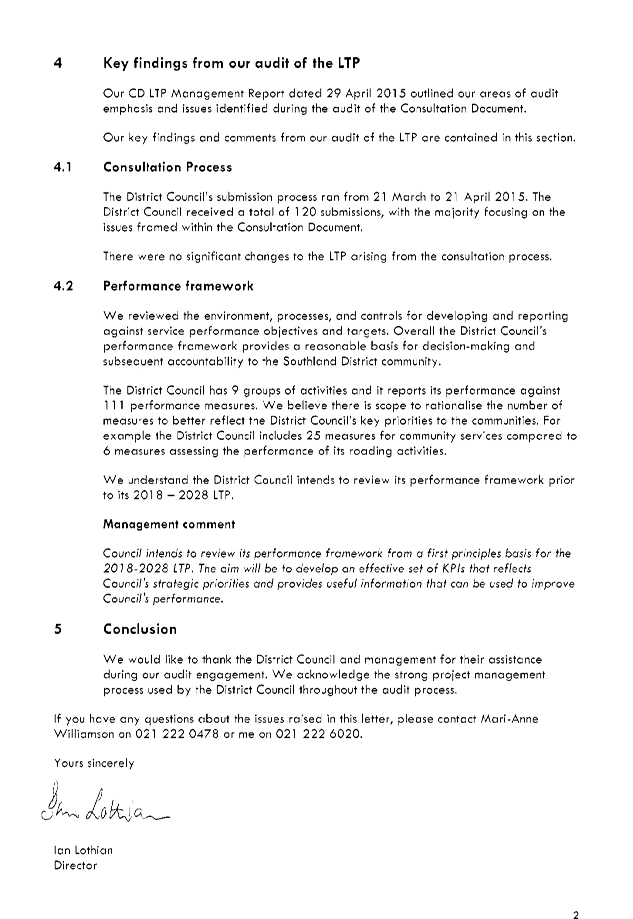

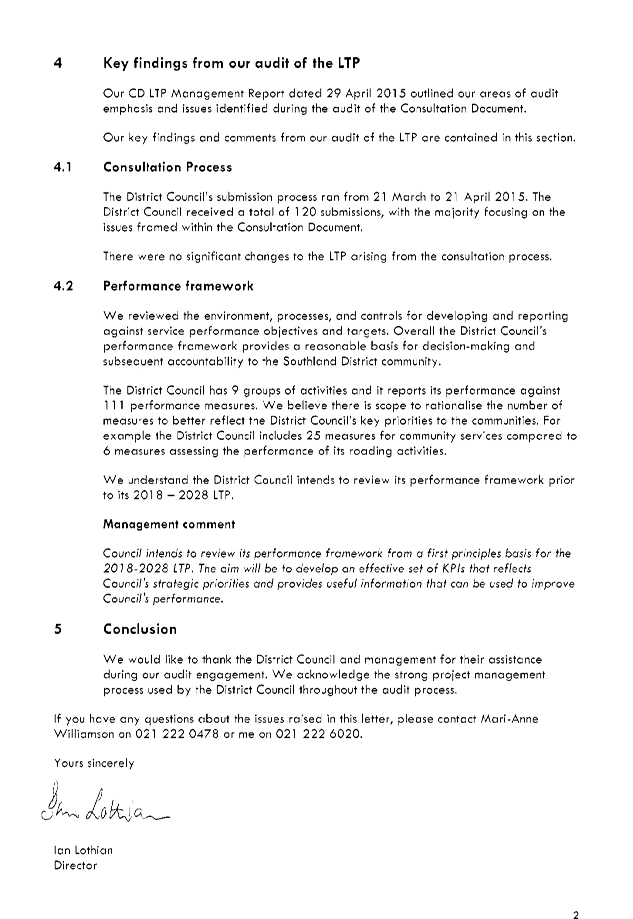

Management

Report from Audit New Zealand for the Long Term Plan 1 July 2015 to 30 June

2025

Record No: R/15/6/11244

Author: Sheree

Marrah, Finance Manager

Approved by: Anne

Robson, Chief Financial Officer

☐

Decision ☐ Recommendation ☒ Information

Summary of

Report

1 As

part of the audit process, Audit New Zealand provides Council with a report at

the end of its audit outlining the work that was performed and any recommended

areas for improvement.

2 Attached

is the management report received from Audit New Zealand in relation to the

audit of the 2015-25 Long Term Plan (LTP) (Appendix A).

3 In

the Management Report, Audit NZ noted that Council has 9 groups of activities

and it reports its performance against 111 performance measures. Audit New

Zealand believes there is scope to rationalise the number of measures to better

reflect the Council’s key priorities to the communities. For example,

Council includes 25 measures for community services compared to 6 measures

assessing the performance of its roading activities. Council responded

noting that it is Council’s intention to review its performance framework

prior to its 2018 – 2028 LTP.

4 Audit

New Zealand issued an unmodified opinion on Councils Long Term Plan document on

24 June 2015. This meant that Council’s LTP “met its statutory

purpose and provided an effective basis for public participation in

Council’s decisions about the proposed content of the 2015 – 2025

LTP”. In doing so Audit NZ found the LTP had no

“material” misstatements.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Management Report from Audit New Zealand for the

Long Term Plan 1 July 2015 to 30 June 2025” dated 13 August 2015.

|

Attachments

a Final

Management letter - Long Term Plan 2015-2025 View

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities Performance

Audit Committee

26 August

2015

|

|

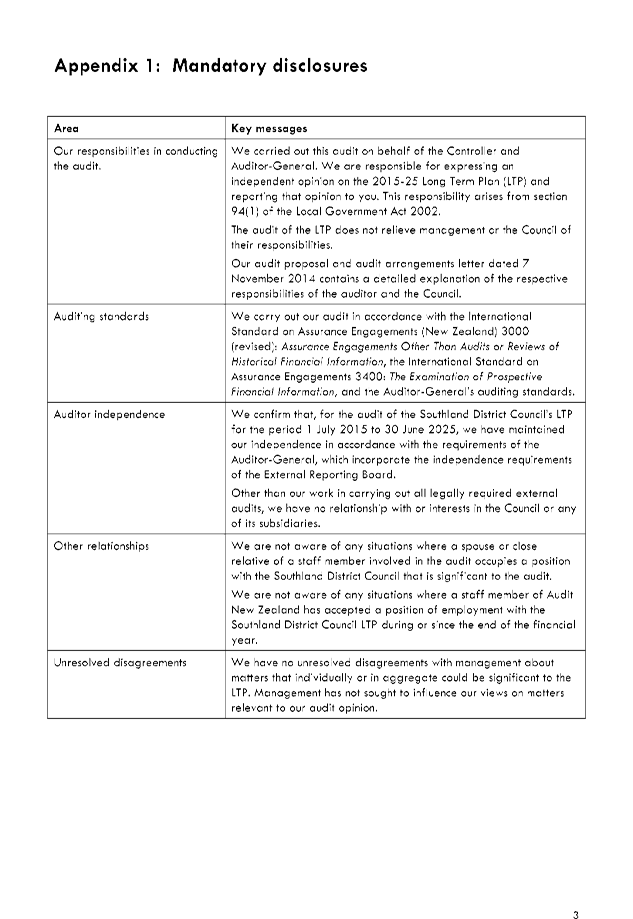

Financial Report to 30 June 2015

Record No: R/15/6/9979

Author: Susan

McNamara, Management Accountant

Approved by: Anne

Robson, Chief Financial Officer

☐

Decision ☐ Recommendation ☒ Information

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Financial Report to 30 June 2015” dated 19

August 2015.

|

Attachments

a Report

to Activities Performance Audit Committee - 26 August 2015 - Report to 30 June View

|

Activities

Performance Audit Committee

|

26 August 2015

|

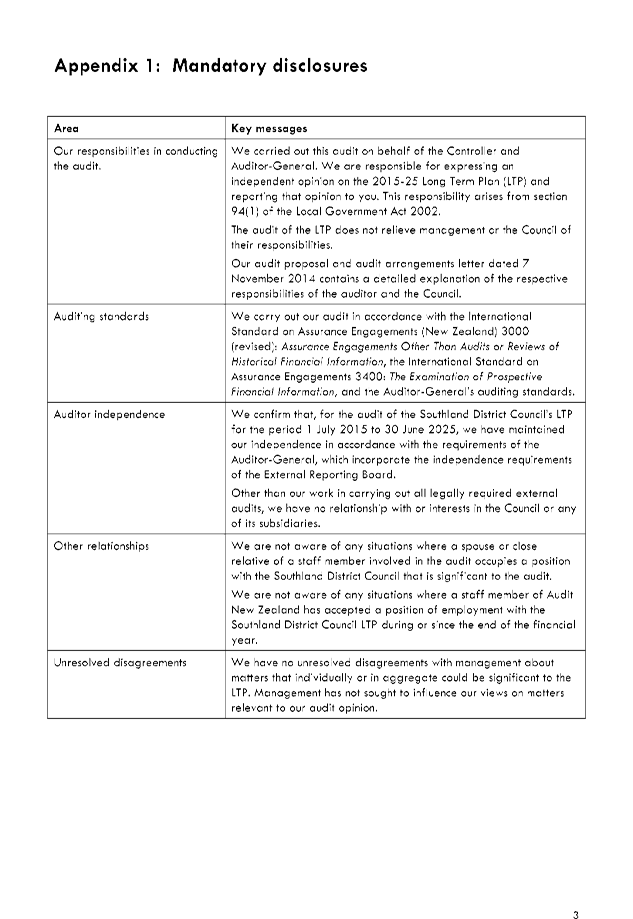

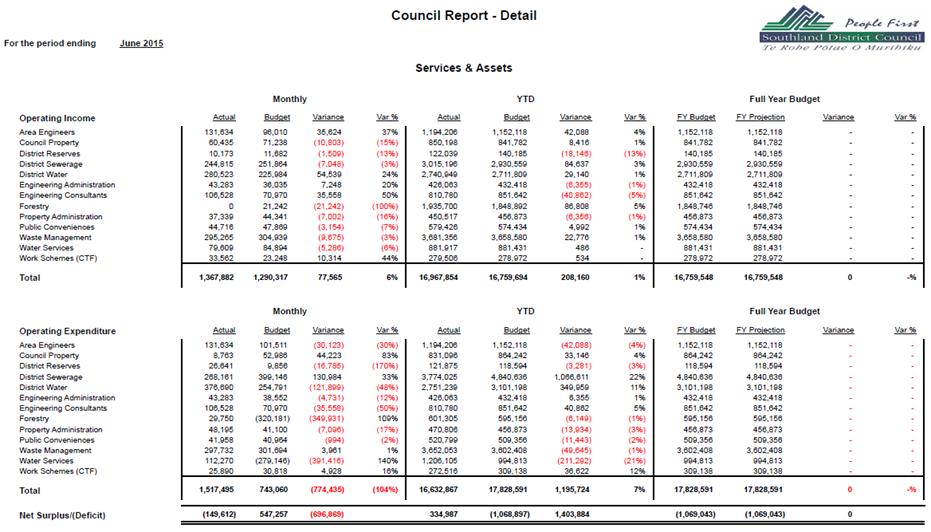

Background

This report outlines the interim financial results to 30

June 2015. These reports are based on the financial information as at 10 July

2015, before year end processing was undertaken. Year-end processing primarily

involves balancing up business units using either loans or appropriate

reserves, calculating interest on internal reserves and loans along with a

final depreciation calculation. The process also brings in accruals for

employee benefits and ACC and revaluations relating to infrastructure and forestry

for the year.

This report covers Council’s financial performance for

district wide activities only. Those activities reported to Community

Boards, Community Development Areas, Rural Water Supplies are not included.

This is consistent with reporting throughout the financial year.

Staff will update the committee at the meeting as to the

preliminary year end result.

As part of the year end process staff have also identified a

number of projects that are either in progress or not started that still need

to occur. These projects have been identified and included in a separate

report to Council titled ‘Projects from 2014/2015 to be carried forward

into 2015/2016 Financial Year’.

Percentage of year gone: 100%.

OVERVIEW

Management Accountant June Finance Overview

As in prior years, all budget managers have been instructed

to have a strong focus on their budget and expenditure items.

The financial commentary centres on the summary sheet which

draws the totals from each of the key sections together. Although you are

able to obtain more detailed key variance explanations from senior managers in

these sections, the key variances are summarised below, concentrating on the

YTD results.

Income

Overall for the YTD, income is $216K under budget.

Key variances are as follows:

Other activities income is 37% ($564K) over budget for the

year-to-date. This is predominantly due to the interest being earned from banks

on cash investments ($414K), which was not budgeted for. This is the

result of Council having a higher cash balance than anticipated.

Within the Chief Executive section, income received is 16%

($604K) under budget due to:

• Stewart

Island Visitors Levy - Income is 18% ($29K) under budget.

• Around

the Mountains Cycle Trail - 30% ($593K) due to the budget including monies

invoiced to the Ministry being completed prior to 30 June 2014.

• Human

Resources – 2% ($12K) over budget. As this business unit is

internally funded this is the result of increased expenditure.

Within the Environmental and Community Group, year-to-date

income is 3% ($235K) over budget due to:

• Increased

revenue in Dog and Animal Control principally due to higher infringement

notices than was budgeted ($73K), higher impounding fess than was budged ($17K)

and increased stock recoveries ($8K)

• Increased

internal Resource Consent income ($43K) mainly related to Around the Mountain

Cycle Trail consents.

• Building

Regulation ($27K) over budget due to higher than budgeted income from Building

Inspections (32K), on charging of third party consultancy costs incurred ($31K)

and proceeds from the sale of vehicles ($13K). This has been offset by

lower code of compliance income ($51K) than was budgeted.

• Area

Offices is over budget $27K with unbudgeted income received for advertisements

on Otautau News and Views and photocopying recoveries ($10K) and cemetery

interment fees ($12K).

• Environmental

Health is also over budget ($26K), due to higher income received from the Gore

District Council in relation to the Environmental Health Service Contract

($15K), higher licence fee income ($6K), and the unbudgeted sale of a vehicle

($8K).

• Alcohol

Licencing is over budget ($16K) with higher income from application fees ($12K)

and annual fees ($16K). This is offset by lower income from Managers

Certificate Fees ($9K).

Within the Financial Services Group, income is 17% ($379K)

under budget. As this activity is internally funded this is due to

reduced expenditure.

Within the Policy and Community Group, year-to-date income

is 5% ($89K) over budget. As this activity is internally funded this is a

result of increased expenditure.

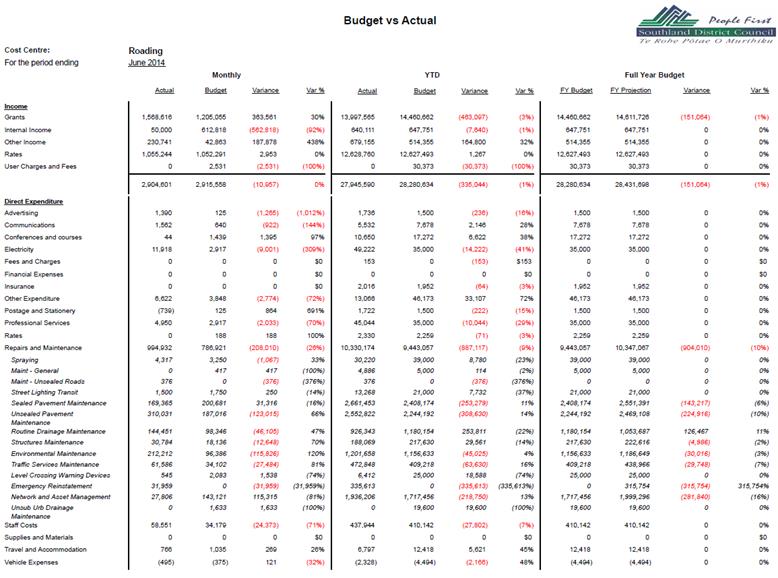

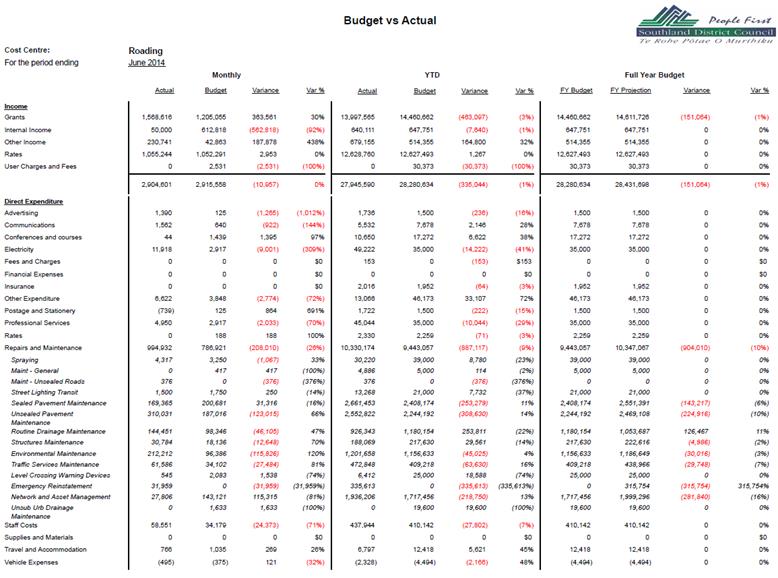

Within the Roading and Transport section, compared to the

Annual Plan total income is 1% ($335K) under budget. NZTA income is 3%

($463K) under Annual Plan budget. It is under the NZTA approved programme by

$1.045M for the three year period.

Overall Services and Assets income

(excluding Roading) is tracking 1% ($208K) above

year-to-date budget. This is due to:

• Area

Engineers being 4% ($42K) over budget and Engineering

Consultants 5% ($41K) under budget. As these business units are

internally funded this is a result of increased expenditure.

• Overall

Forestry income received is 5% ($87K) over budget. This is predominantly due to

harvesting revenue from Waikaia forest being $935K over budget, offset by

Dipton and Ohai forests revenue being lower than expected ($460K and $366K).

These variances are as a result of changes to the planned harvesting activities

for the year.

• District Sewerage is 3% ($85K) over budget, due to the

receipt received from Landcorp for the leasing land at the Kepler site

($60K).

Expenditure

Overall for the year-to-date, expenditure is 4% ($1.75M)

under budget.

The key variances are as follows:

Council & Councillors

Expenditure is 1% ($24K) under budget due to non-recoverable regulatory work

required throughout the year being lower than budgeted.

Other activities expenditure is 43% ($675K) under budget as

the calculation and allocation of interest on reserves is completed as part of

the year-end process.

The Environment and Community Group is 5% ($335K) under

budget. This is predominantly due to expenditure on the District Plan

being lower than anticipated during the year. With District Plan charges $230K

under budget of which $100K is proposed to be carried forward to the 15-16

year. Other variances are:

• Alcohol

licencing is under budget $35K due to lower Councillor and Board Member salary

costs ($30K) than was anticipated when the new structure was set up.

• District

Libraries is $60K under budget predominantly due to lower staff costs ($31K)

and slightly lower expenditure across a number in other areas.

• Area

Offices are also under budget $42K due to internal interest costs processed

through the Otautau office being completed as part of the year end process.

• Dog

and animal control is $96K over budget predominantly as a result of additional

payroll related costs for after-hours work required, these additional costs are

offset by the additional revenue generated in this activity in the current

year.

Within Financial Services, expenditure is 17% ($379K) under

budget, primarily due to the timing of audit costs ($88K), staff vacancies

($188K) and material damage insurance costs ($44K). Audit costs will

realign to within $10K of budget with the accrual of costs relating to the June

2015 audit being included as part of the year-end process.

Within the Information Management group, overall expenditure

is 5% ($124K) under budget, predominantly due to the weather conditions

impacting the ability for aerial photography to be undertaken ($84K) as well as

lower consultant costs in Property and Spatial Services ($19K).

Within the Policy and Community Group, expenditure is 4%

($58K) over budget due to consultants used for the LTP due to vacancies in

staff ($32K) and unbudgeted costs relating to the new position of Group

Manager - Policy and Community ($61K).This is offset by no expenditure to date

for community outcomes $45K and also savings from vacancies in Financial

Services.

Roading expenditure is currently 8% ($928K) over

budget. Operations and maintenance costs are $887K over budget at year

end due to sealed pavement maintenance ($253K), unsealed pavement maintenance

($309K), network and asset management ($219K) and Emergency reinstatement

($336K). This is offset by routine damage maintenance ($254K).

Actual operational expenditure for

Services and Assets year-to-date is 7% ($1.20M) under budget.

Key variances are as follows:

• District Water is 11% ($349K) under budget, predominantly

as a result of lower than planned capital expenditure for the year-to-date

($622K actual capital works compared to $1.05M budgeted). There are two

projects at Riverton that are proposed to be carried forward to the 2015-16

financial year where work has been started. There has also been

reticulation renewal two projects at Tuatapere deferred until further testing

is completed, likely to be in 2018-19; along with lateral replacements at

Ohai/Nightcaps that have been deferred for additional testing in 2016-17.

• District

Sewerage is 22% ($1.07M) under budget, predominantly as a result of lower than

planned capital expenditure for the year-to-date ($1.94M actual capital works

compared to $2.86M budgeted). There are six projects that have been

proposed to carry forward to the 2015-16 financial year, where work has been

started. A project at Ohai for treatment upgrade has been deferred for

additional condition assessment and testing.

• Water Services is 21% ($211K) under budget predominately

due to fewer project consultant costs being required than budgeted.

• Engineering Consultants business unit is 10% ($76K) under

budget due to less expended in consultants this is offset by internal services

$8K.

• Area

Engineers is 4% ($42K) over budget primarily due to

one budgeted position only filled part way through the year.

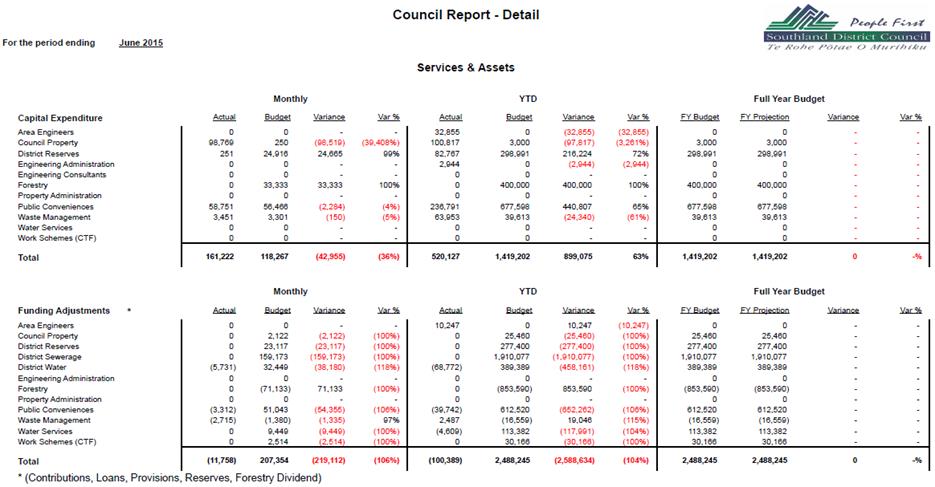

Capital Expenditure

Overall for the year-to-date, capital expenditure is 5%

($907K) under budget.

The key variances are as follows:

• Capital

expenditure in the Chief Executive activity is over budget by 59% ($1.22M)

due to the timing of work completed on Stage Two of the Around the Mountains

Cycle Trail compared to the budget prepared.

• Environment

and Community is over budget by 40% ($77K) primarily due to an additional

vehicle purchase for Animal Control (funded by a loan to be repaid from

external income), and the timing of the replacement of an Environmental Health

vehicle.

• Information

Management capital expenditure is under budget by 31% ($93K) due to the

deferral of the Records Improvement Plan to be included as part of the Property

file Digitisation project. During the year Info Council and Promapp have been

purchased and funded from the District Operations Reserve. A vehicle has

been replaced by purchase rather than lease (funded by a loan to be repaid from

vehicle lease cost budgeted).

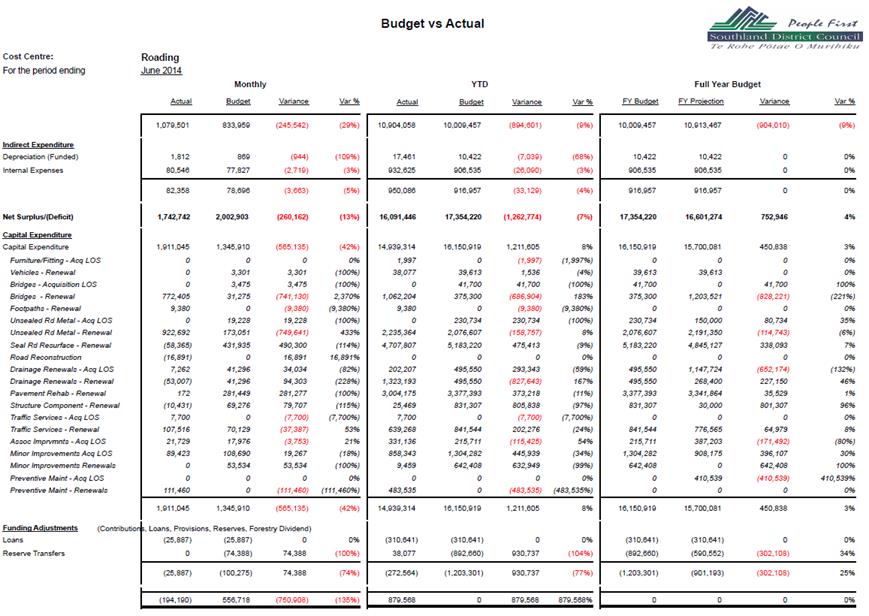

• Roading

capital expenditure is under budget by 8% ($1.2M) primarily due to timing on

planned roading, structural component and pavement renewals.

• Services

and Assets are under budget by 63% ($899K) with minimal capital expenditure to

date on projects planned in public conveniences and district reserves. A public

convenience at Mossburn has been completed with a revised scope ($149K actual

versus $423K budget) and one at Garston is still in progress and is proposed to

be carried forward. As part of year end processing the revaluation for

forestry will be included in capital, this has a budget of $400K.

Funding Adjustments

Funding adjustments are significantly under budget as

typically ‘balancing’ of business units is not undertaken until the

end of the financial year.

Journals are being processed for reserve transfers,

predominantly in relation to vehicle movements, and loan draw-downs (ie for

project funding), throughout the year at the request of budget managers.

Key Financial Indicators

|

Indicator

|

Target*

|

Actual

|

Variance

|

Compliance

|

|

External Funding:

Non rateable income/Total income

|

> 39%

|

37%

|

-2%

|

x

|

|

Working Capital:

Current Assets/Current Liabilities

|

>1.09

|

2.11

|

1.02

|

a

|

|

Debt Ratio:**

Total Liabilities/Total Assets

|

<0.73%

|

0.76%

|

0.03%

|

a

|

|

Debt To Equity Ratio:

Total Debt/Total Equity

|

<0.01%

|

0.00%

|

0.01

|

a

|

* All

target indicators have been calculated using the 2014/15 Annual Plan

figures.

** Excludes

internal loans.

Financial

Ratios Calculations:

|

Non

Rateable Income

|

|

Total

Income

|

External Funding:

This ratio indicates the percentage of revenue received

outside of rates. The higher the proportion of revenue that the Council

has from these sources the less reliance it has on rates income to fund its

costs.

|

Current

Assets

|

|

Current

Liabilities

|

Working Capital:

This ratio indicates the amount by which short-term assets

exceed short term obligations. The higher the ratio the more comfortable

the Council can fund its short term liabilities.

|

Total

Liabilities

|

|

Total

Assets

|

Debt Ratio:

This ratio indicates the capacity of which the Council can

borrow funds. This ratio is generally used by lending institutions to

assess entities financial leverage. Generally the lower the ratio the

more capacity to borrow.

Debt to Equity Ratio:

It indicates what proportion of equity and debt the Council

is using to finance its assets.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

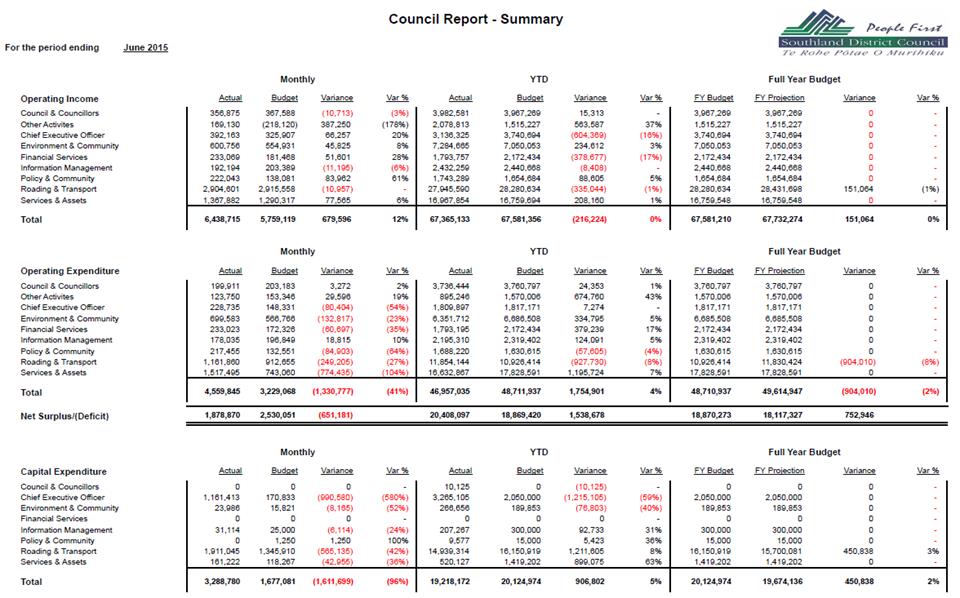

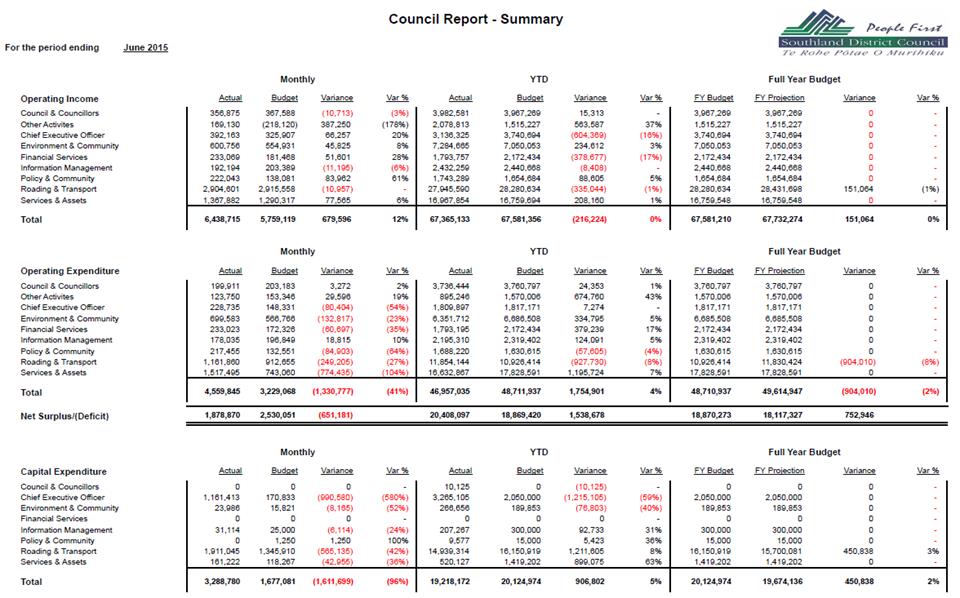

CHIEF EXECUTIVE COMMENTARY

For the year-to-date, income is under budget by 16% ($604K).

Expenditure is on budget. The year-to-date position is $597K under budget.

Chief Executive

Income in this business unit is 1% ($6K) over budget, this

is due to proceeds on an unbudgeted vehicle sale ($14K). Expenditure is

8% ($43K) under budget, predominantly due to staff costs being under budget

($61K). This is offset by project consultant fees being over budget

($31K).

Civil Defence

Income is on budget. Expenditure is 4% ($11K) over budget

due to the Emergency Management Southland grant being slightly higher than

budgeted.

Human Resources

Income is 2% ($12K) over budget. Expenditure

year-to-date is 10% ($60K) under budget due to underspends in survey expenses

($22K), consultant costs ($21K), relocation costs ($15K) and staff costs

($9K). This is offset by training costs ($45K). As this activity is

internally funded, the increased expenditure impacts directly on income.

Around the Mountain Cycle Trail

Income is 30% ($593K) under budget due to final invoicing to

the Ministry being completed last financial year. Capital expenditure is over

budget by 60% ($1.2M) with work being undertaken on Stage 2.

Rural Fire Control

Income and expenditure is on budget for the year.

Shared Services Forum

Income is on budget. Expenditure for year-to-date is under

budget by 2% ($1K).

Stewart Island Visitor Levy

Income is 18% ($29K) under budget. Expenditure is 20% ($46K)

under budget with $117K in grants being approved during the period.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

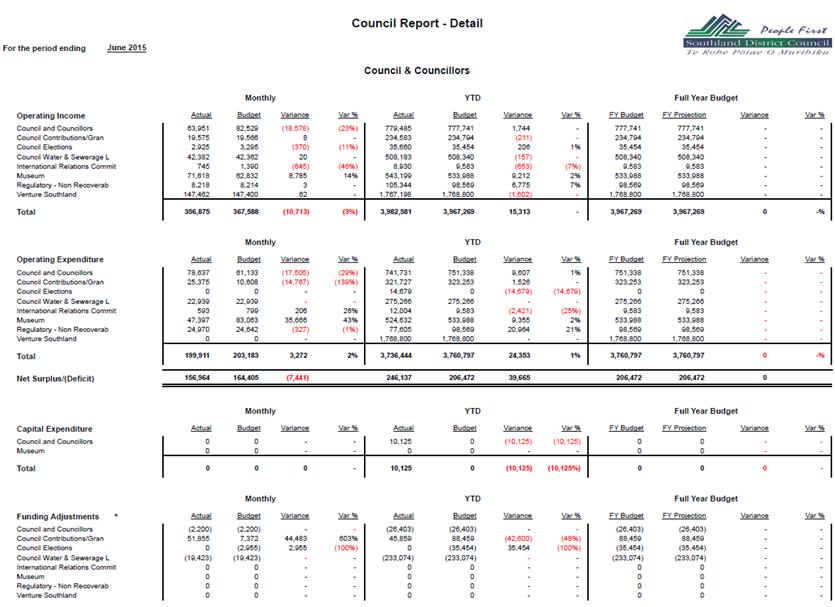

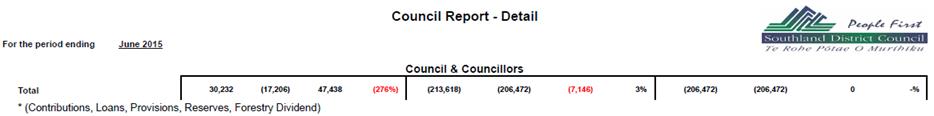

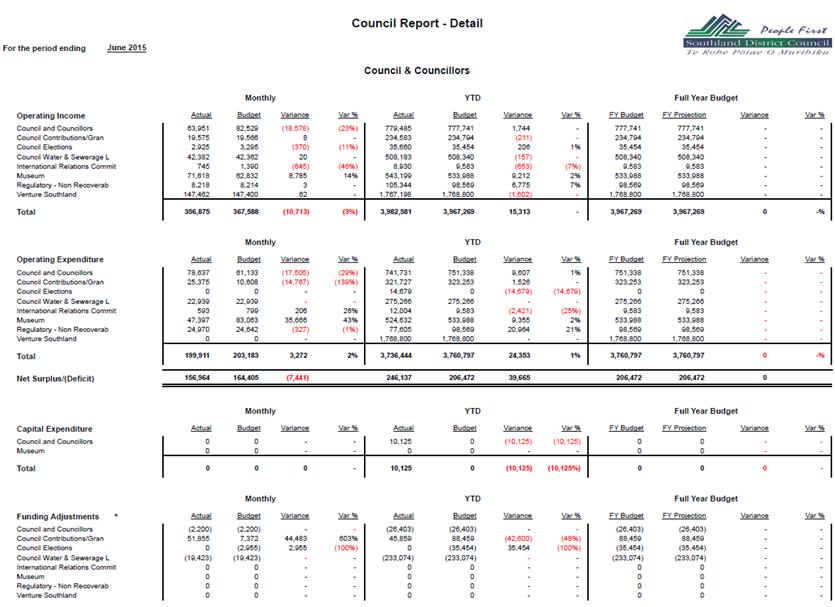

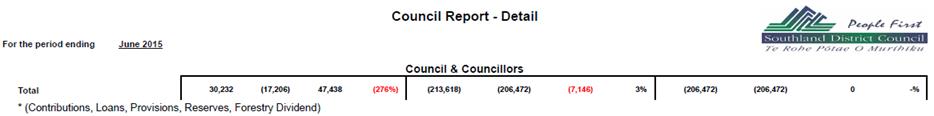

Council and Councillors’ Commentary

For the year-to-date, income is on budget. Expenditure is

under budget by

1% ($24K). The year-to-date position is $40K over budget.

Council and Councillors

Income is on budget. Expenditure is under budget by 1%

($10K) primarily due to Councillors’ salaries of $9K and Youth Council

costs $6K. This is offset by office consumables ($12K).

Council Contributions/Grants

Income and Expenditure is on budget for the

year-to-date.

Council Elections

Income is on budget. Expenditure is $15K over budget

due to the Mararoa Waimea Ward Councillor election.

Council Water and Sewerage Loans

Income and expenditure is on budget for the year-to-date.

International Relations Committee

Income is 7% ($1K) under budget for the year-to-date with

the calculation of interest on reserves yet to occur. Expenditure is $2K

over budget with attendance at the Sister Cities Conference in March.

Museum

Income is 2% ($9K) over budget. Expenditure is under budget

2% ($9K) due to General Expenses $5K, Staff Costs $2K and Training Costs $1K.

Regulatory - Non-Recoverable

Income is 7% ($7K) over budget for the year-to-date as the

result of invoicing for the demolition of a dangerous building. It is likely

this will not be recovered. Expenditure is under budget by 21% ($21K) as

a result of minimal non-recoverable costs incurred for the year.

Venture Southland

Income and expenditure are on budget.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

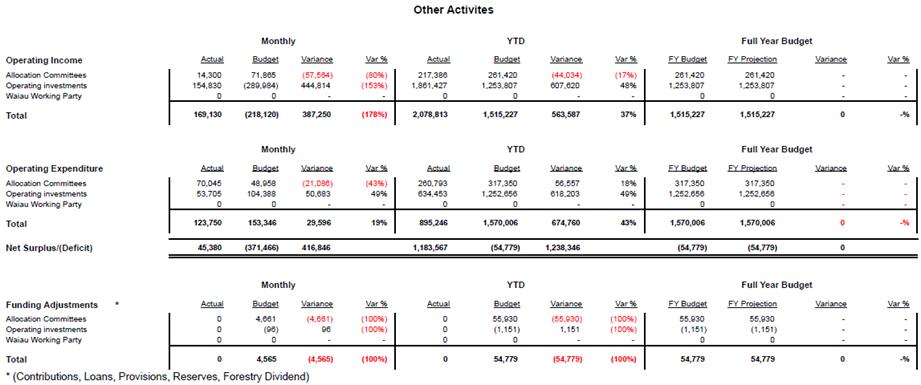

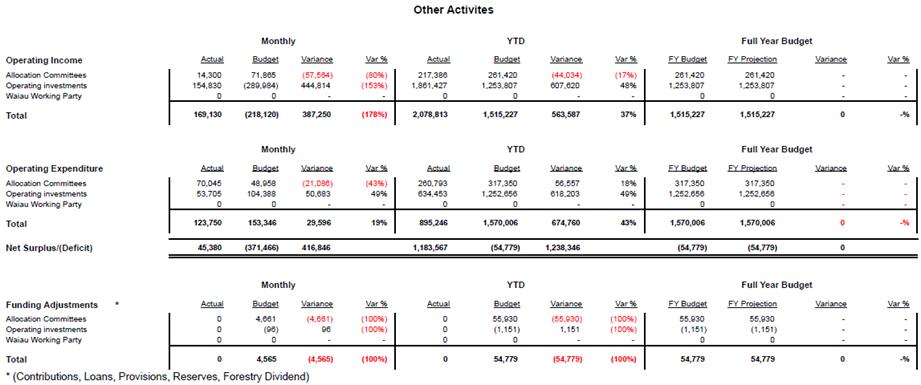

OTHER

ACTIVITIES COMMENTARY

Allocations Committee

Income is 17% ($44K) under budget due to the timing of

interest on reserve calculations. Expenditure is under budget by 18%

($57K) predominantly due to a lower level of grants from the Ohai Railway Fund

($59K) than was budgeted.

Operating Investments

Currently, the majority of

Council’s reserves are internally loaned by Council or its local

communities for major projects. Council has set the interest rate to be

charged on these loans as part of its 10 Year Plan process and interest is

being charged on a monthly basis on all internal loans drawndown at 30 June

2014.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

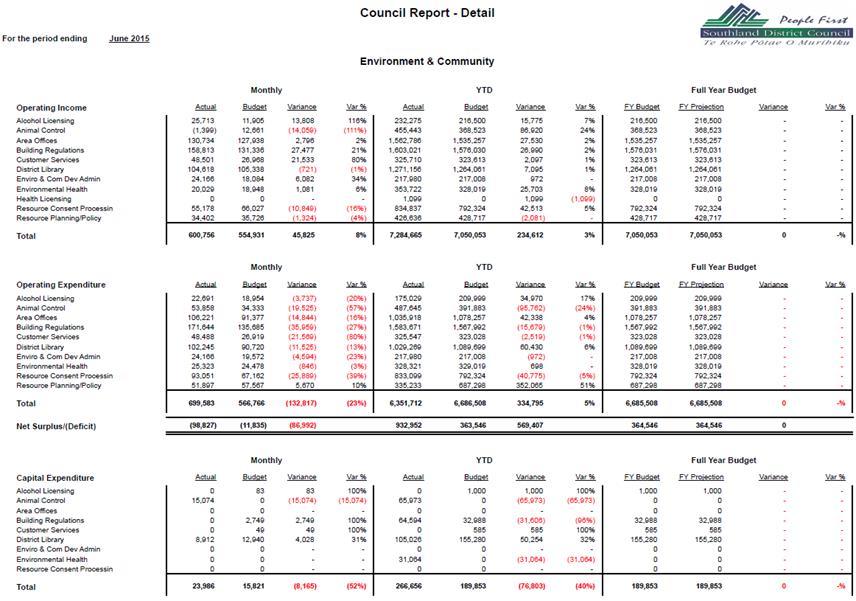

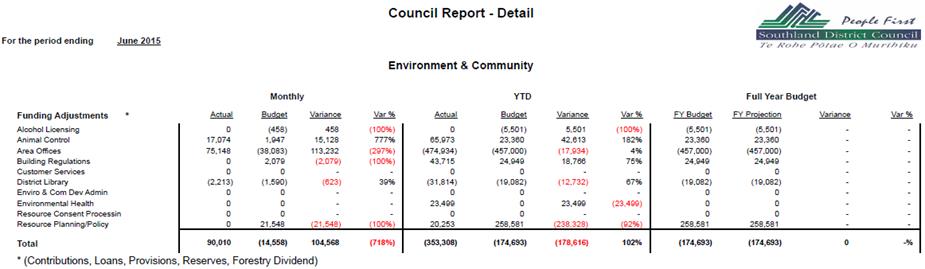

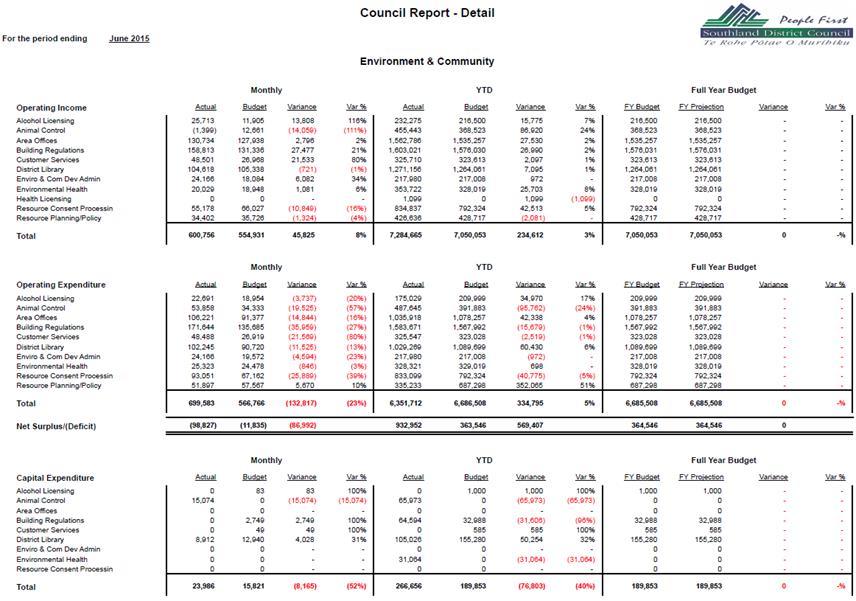

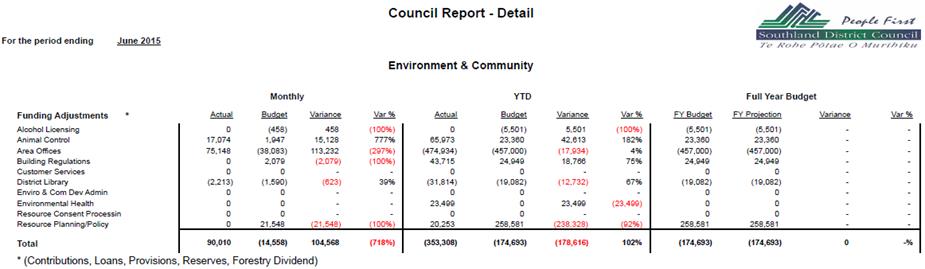

ENVIRONMENT AND

COMMUNITY COMMENTARY

Overall June 2015 monthly income for the Environment and

Community Group tracked slightly ahead of budget at $601K actual v $555K

budget.

Key features of June’s monthly income were Building

Control and Customer Services income ahead of budget by $27K (21%) and $22K

(80%) respectively. As Customer Services are internally funded this is a result

of increased expenditure for the month. Conversely, Dog and Animal Control

income is $14K under budget due to an adjustment for registration income

received in advance.

Overall June 2015 monthly expenditure for the Environment

and Community Group was $133K (23%) over budget ($700K actual v $567K budget).

All departments were over budget expenditure-wise, with the

exception of Resource Planning.

The key features for the month are Customer Services $22K

over due to training costs and staff costs. Resource Consent Processing $26K

and Building Regulation $36K were also over budget due $26K and $36K

respectively due to the timing of staff costs. Staff costs are higher for the

month due to an additional pay compared to the budget phasing.

Overall YTD Income at the

end of June 2015 for the 14/15 financial year is $235K (3%) ahead of budget, at

$7.28M actual versus $7.05M budget.

Animal Control income is $87K

(24%) ahead of budget due to infringement fees $73K and impounding fees $17K.

Resource Consent processing $43K over budget due to higher internal resource

consent charges $97K (mainly relating to Around the Mountain Cycle Trail). Income

was also over budget for Building Regulation ($27K), Area Offices ($27K) and

Environmental Health ($26K).

Overall YTD Expenditure at

the end of June 2015 of the 14/15 financial year is $335K (5%) below budget at

$6.35M actual versus $6.69M budget.

The Resource Planning/Policy area was underspent by $352K

(51%), with less expenditure than anticipated on the District Plan project over

this period. Mediation processes which were expected to occur in April

and May have been delayed at the direction of the Environment Court due to the

status of Environment Southland’s Regional Policy Statement content

relating to the biodiversity issues, which is relevant to several District Plan

appeals. Alcohol licencing is under budget $35K due to lower Councillor & Board

Member salary costs ($30K). District Libraries is $60K under budget

predominantly due to lower staff costs ($31K) and lower expenditure in other

areas. Area Offices are also under budget $42K due to lower internal interest

costs for the Otautau and Lumsden offices. Dog and animal control is $96K over

budget predominantly as a result of additional payroll related costs for

after-hours work, these additional costs are sufficiently offset by the

additional revenue generated in this activity in the current year.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

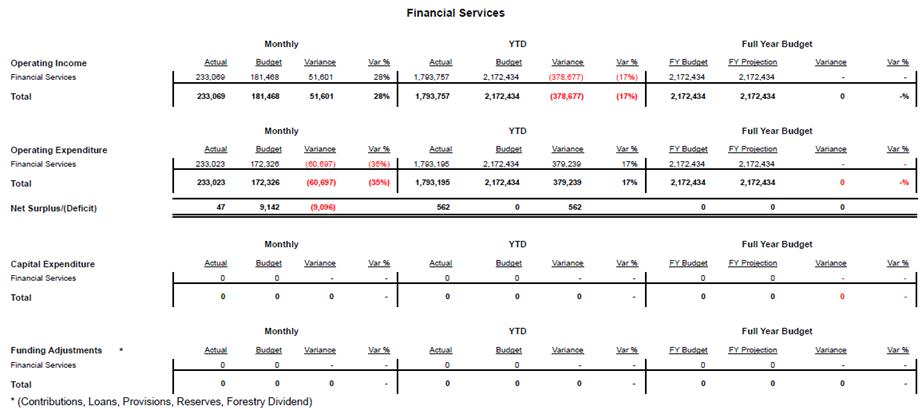

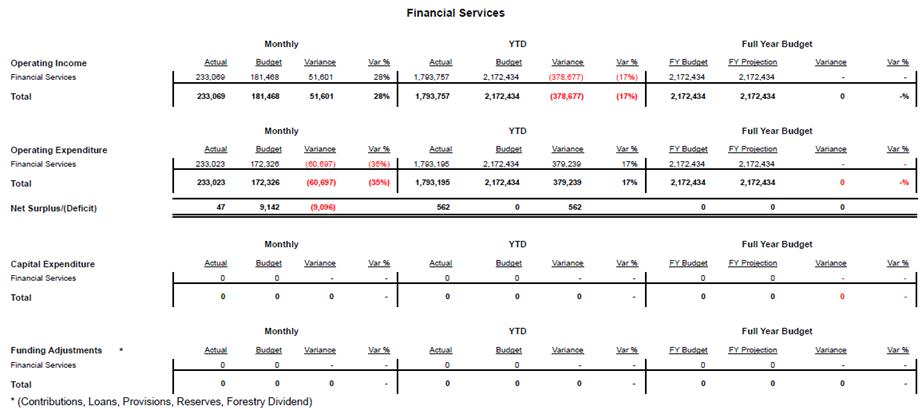

FINANCIAL

SERVICES COMMENTARY

Income is 17% ($379K) under budget. As this activity

is internally funded the reduced expenditure impacts directly on income.

Expenditure is 17% ($379K) under budget. This is primarily

due to the following:

• The

timing of audit costs ($88K); this will align closer to budget after year end

processing has occurred.

• Staff

vacancies in the finance team ($188K)

• Visa/MasterCard

charges currently under budget ($15K)

• Material

damage insurance review costs related to insuring water and wastewater above

ground assets, have now been correctly coded to the water and waste business

units. This has resulted in actual costs being less than budgeted by

$44K.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

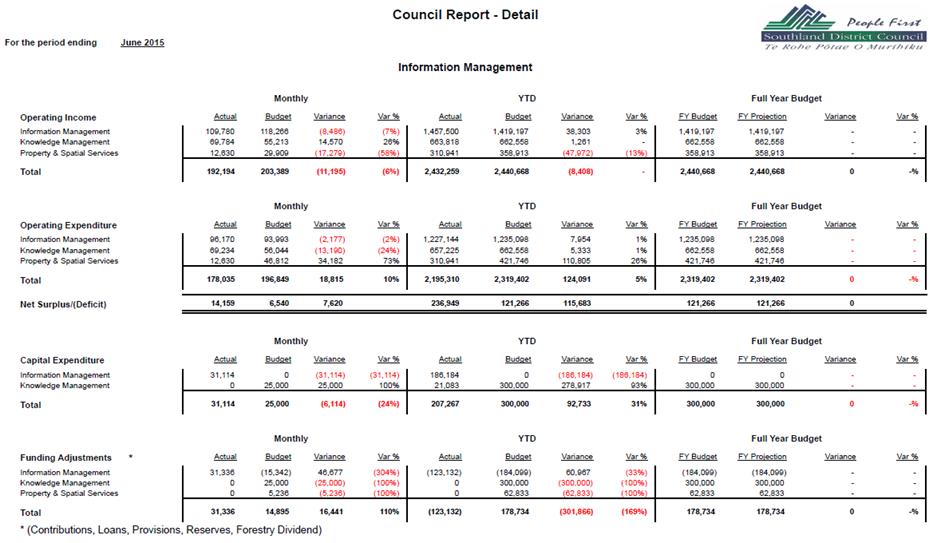

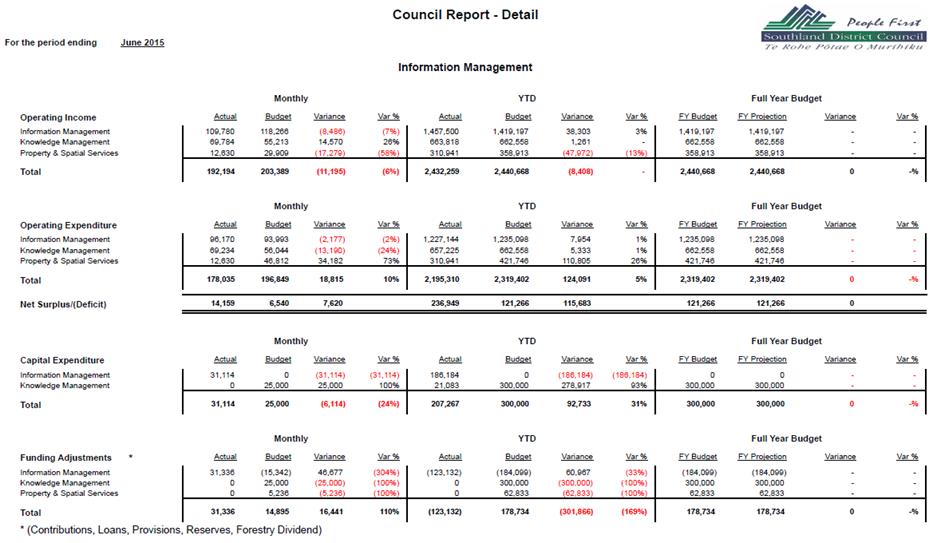

INFORMATION

MANAGEMENT COMMENTARY

For the year-to-date, income is on budget. Overall

expenditure is 5% ($124K) under budget. The year-to-date position is $116K over

budget.

Information Management

Income is 3% ($38K) over budget, predominantly due to

internal computer hire relating to additional hardware of $51K.

Expenditure is 1% ($8K) over budget. This relates primarily to Software

Licence Fees $42K. Additionally, consultants costs are $16K over budget as a

result of the Information Strategy Review. This is offset by photocopy

user charges $35K.

Knowledge Management

Income is on budget. Expenditure is 1% ($5K) under

budget, this is due to reduced operational leases ($9K) along with a number of

expenses slightly under budget. This is offset by increases in postage

costs ($10K) and staff costs ($6K). As this activity is internally funded the

reduced expenditure impacts directly on income.

Property and Spatial Services

Income is 13% ($48K) under budget. Expenditure is 26%

($111K) under budget predominantly due to timing on aerial photography costs

($84K). This is as a result of the original vendor going into

receivership and by the time a replacement was appointed weather conditions not

being suitable for aerial photography and therefore the majority of the work

not being completed. This is offset by consultant costs being overspent by

$19K. As this activity is internally funded the reduced expenditure

impacts directly on income.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

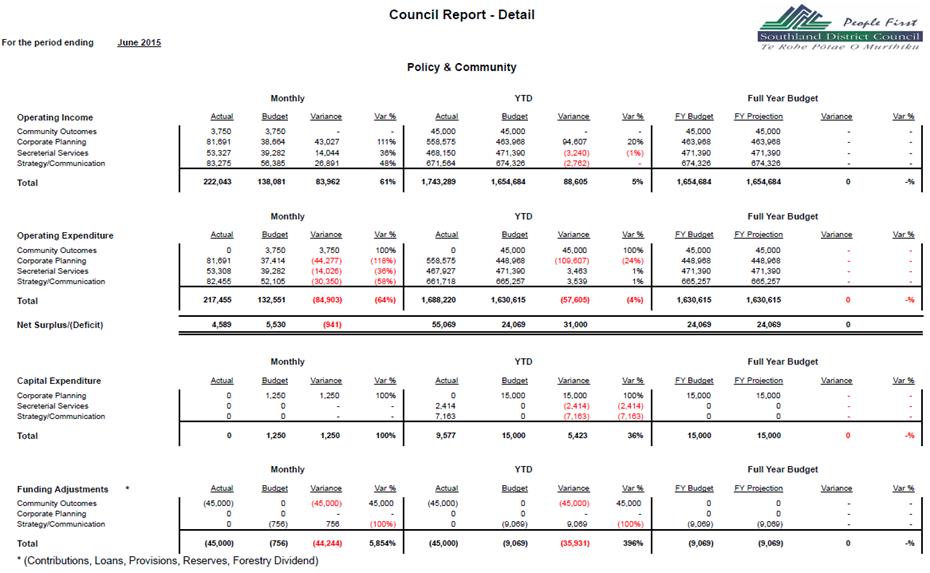

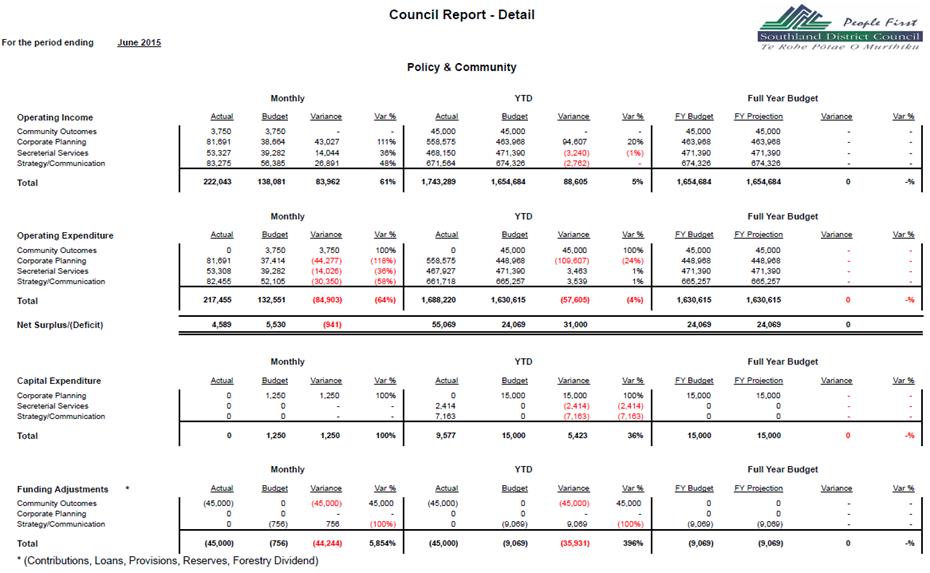

POLICY AND

COMMUNITY COMMENTARY

Income for the year-to-date is 5% ($89K) over budget.

Expenditure for the year-to-date is 4% ($58K) under budget. The net

result for the year-to-date is a surplus of $55K against a forecasted surplus

of $24K, a positive variance of $31K.

Community Outcomes

Income is on budget. Expenditure is under budget by

$45K as no projects relating to the

Our Way Southland Outcomes have been identified in the current period.

Corporate Planning

Income is 20% ($95K) over budget. Expenditure is 24% ($110K)

over budget due to

increased costs associated with the Long Term Plan ($32K) and unbudgeted costs

relating to the Policy and Community business unit ($31K). This is offset

by employee costs ($28K). As this activity is internally funded the

increased expenditure impacts directly on income.

Secretarial Services

Income is 1% ($3K) under budget. Expenditure is 1%

($3K) under budget predominately due to Internal Photocopying ($11K). This is

offset by Staff Costs ($13K). As this activity is internally funded, the

reduced expenditure impacts directly on income.

Strategy/Communication

Income is on budget. Expenditure is underspent by 1%

($4K) predominately due to staff costs ($19K) and first edition costs ($18K)

being below budget. This is offset by overspending on radio advertising ($12K)

and unbudgeted costs relating to the Policy and Community business unit

($31K). As this activity is internally funded the reduced expenditure

impacts directly on income.

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

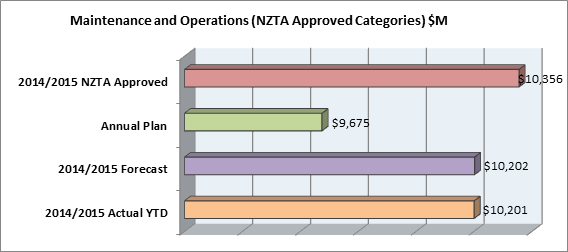

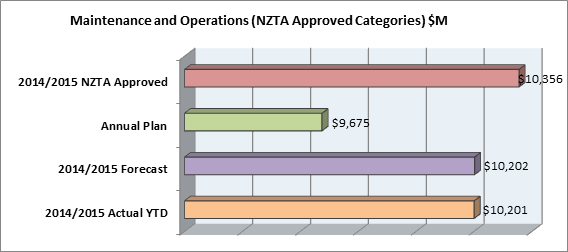

STRATEGIC TRANSPORT

Overall Financial Performance

A continued strong focus on making sure we fully utilise

NZTA approved funding along with optimising "value for money" has

been a challenge over the last year. This has been primarily driven by

the significant drop in the bitumen index.

While the roading activity is over the Annual Plan in

maintenance and operations expenditure this is offset with being under in

capital expenditure.

It is under the NZTA approved programme by $1.045M over

three years. As discussed above it was a primarily objective to spend of

the NZTA approved programme.

|

Key

|

|

|

Largely on Track

|

|

|

Monitoring

|

|

|

Action Required

|

Maintenance and Operations (excluding Special Purpose

Roads):

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

100%

|

100%

|

105%

|

98%

|

- The majority of

overhead expenses are in line with budget; apart from the professional services

budget and staff costs. This was driven by the employment of a Road

Safety Engineer and the review of the roading rate model.

- A

holistic approach to maintenance management has seen sealed pavement and

unsealed pavement maintenance being over budget but offset with underspends in

other activities. Network and Asset Management costs is over budget

primarily driven by bringing forward our high speed data collection from the

2015/2016 year this decision was driven for commercial and availability of

resources reasons.

Emergency Works

- These projects are

unbudgeted due to their unforeseeable nature. These are considered and

managed within the Local Share budgets.

2014/2015 Costs

|

Project

|

Expenditure 2014/2015

|

|

Horseshoe Bay/Leask Bay (Stewart Island)

|

$

119,224

|

|

Ohai Clifden Slip

|

$

169,686

|

|

Lower Hollyford Slip (special purpose road)

|

$

46,704

|

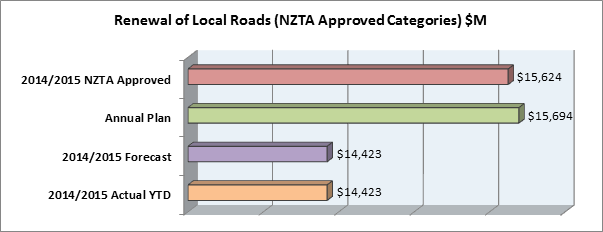

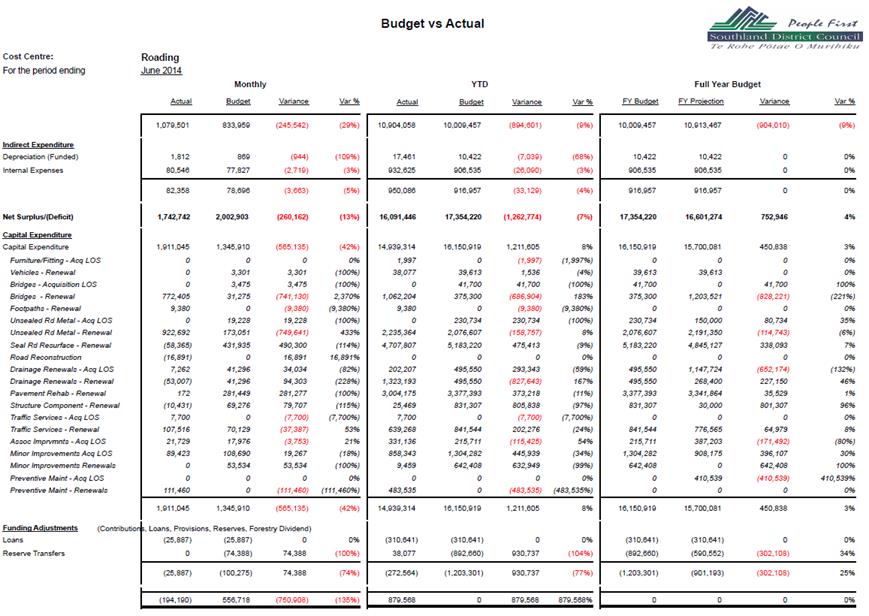

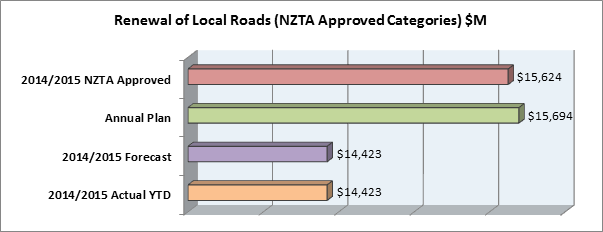

Renewals and Minor Improvements

Commentary

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

100%

|

100%

|

92%

|

92%

|

Renewals and Minor Improvement Commentary

As at the end of the year Transport has achieved expenditure

of 92% of the Annual Plan budget. This is partially offset with

maintenance and operations expenditure been over the Annual Plan budget.

A strong push was done to complete as many bridges as possible to optimise the

NZTA Funding Assistance Rate.

Preventive Maintenance

|

Expenditure 2014/2015

|

|

Mullet Road

|

$

379,019

|

|

Golden Bay Road /Thule Road

(Stewart Island)

|

$

70,484

|

- These

projects are unbudgeted due to their

unforeseeable nature. These are considered and managed within the Local

Share budgets.

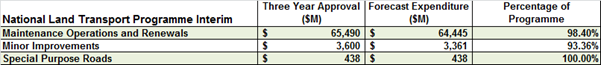

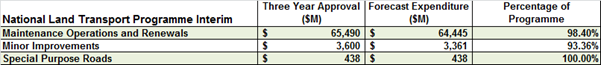

Three Year Programme

--------------------------------------------------------------------------------------------------------------------------

|

Activities

Performance Audit Committee

|

26 August 2015

|

|

Activities

Performance Audit Committee

|

26 August 2015

|

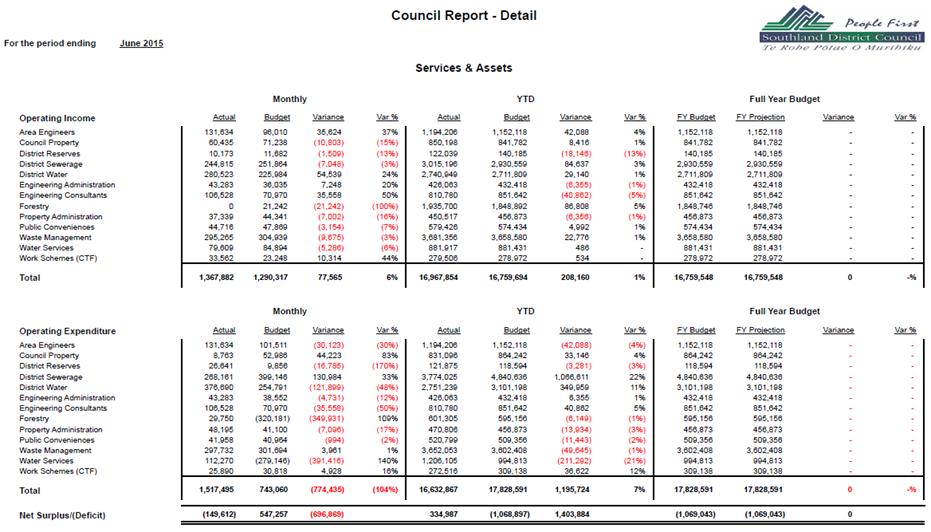

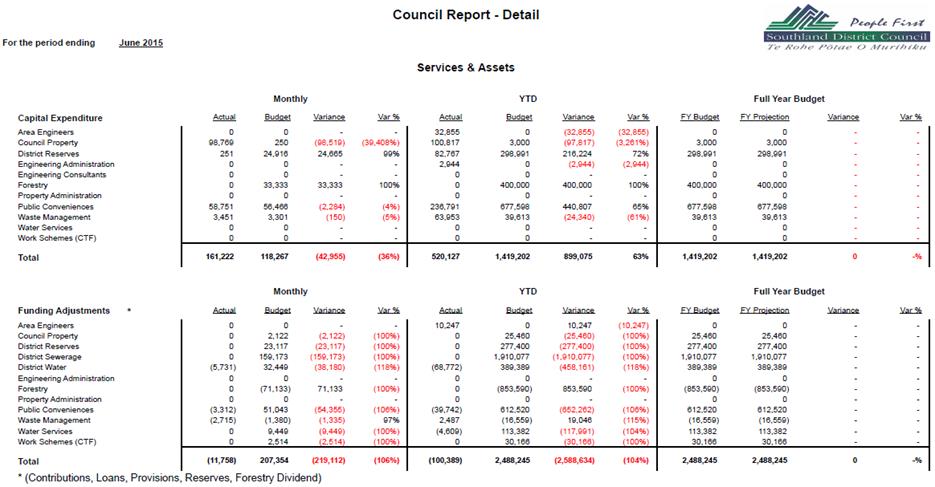

SERVICES AND

ASSETS (Excluding Roading)

COMMENTARY

Income

Overall Services and Assets

(excluding Roading) actual income is 1% ($208K) over budget for the year

($16.97M v $16.76M).

Key highlights are:

• Area

Engineers is 4% ($42K) over budget. As income is fully recovered and driven by expenditure levels the

increased expenditure impacts directly on income.

• Engineering Consultants is 5% ($41K) under budget. As

income is fully recovered and driven by

expenditure levels the reduced expenditure impacts directly on income.

• Overall

Forestry income received is 5% ($87K) over budget. This is predominantly due to

harvesting revenue from Waikaia forest being $935K over budget, offset by

Dipton and Ohai forests revenue being lower than expected ($460K and $366K).

• District Sewerage is 3% ($85K) over budget as a payment

was received from Landcorp for leasing land at the Kepler site ($60K).

Operating Expenditure

Actual operational expenditure for

Services and Assets year-to-date is 7% ($1.20M) under budget.

Key highlights are:

• District Water is 11% ($349K) under budget, predominantly

as a result of lower than planned capital expenditure for the year-to-date

($622K actual capital works compared to $1.05M budgeted).

• District

Sewerage is 22% ($1.07M) under budget, predominantly as a result of lower than

planned capital expenditure for the year-to-date ($1.94M actual capital works

compared to $2.86M budgeted).

• Water Services is 21% ($211K) under budget predominately

due to fewer project consultant costs being required than budgeted.

• Engineering Consultants business unit is 5% ($41K) under

budget due to under expenditure in consultants this is offset by internal

services $8K.

• Area

Engineers is 4% ($42K) over budget primarily due to

staff costs.

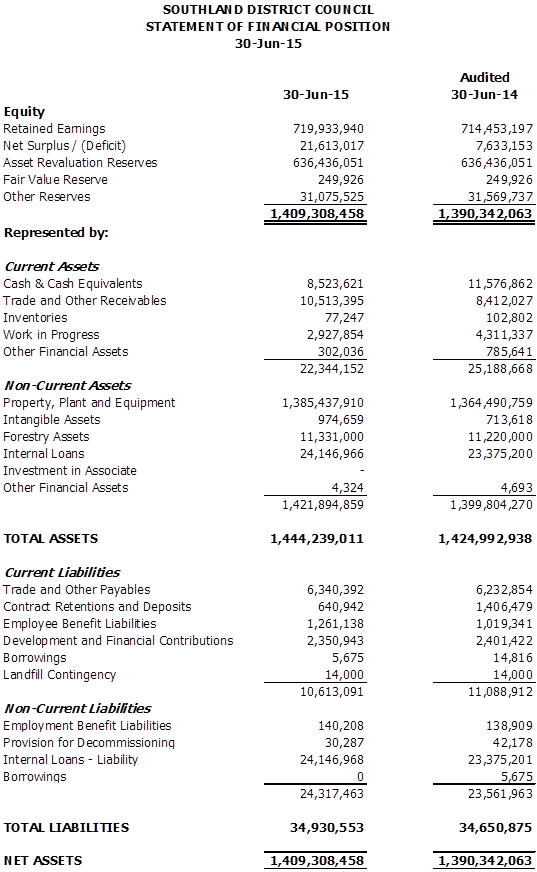

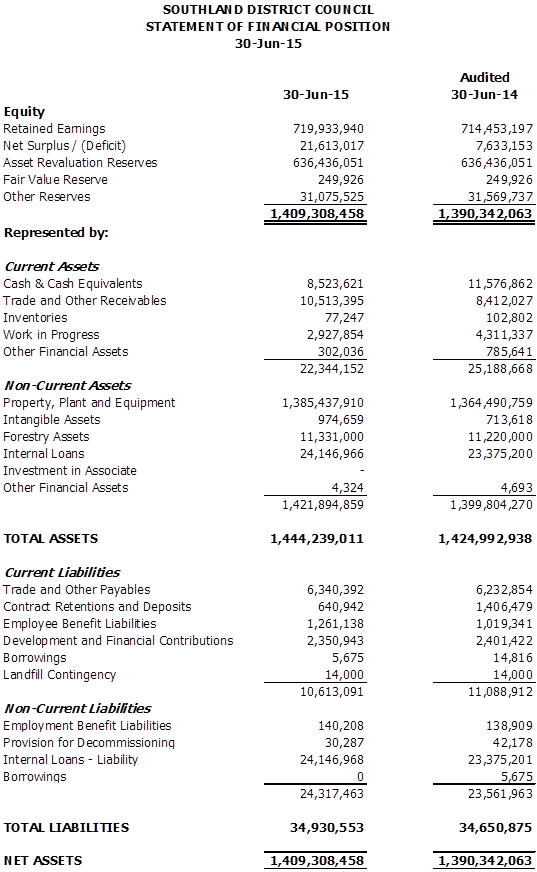

Statement of Financial Position

COMMENTARY

The balance sheet as at 30 June

2014 represents the audited balance sheet for activities of Council (ie

excludes SIESA and Venture Southland). The financial position at

30 June 2015 is before year-end adjustments and only for the activities of

Council.

External borrowings have still not

been required, with internal funds being used to meet obligations for the

year-to-date.

|

|

|

|

|

Susan McNamara

MANAGEMENT ACCOUNTANT

|

|

|

|

|

|