Notice is hereby given that a Meeting of

the Policy Review Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Wednesday, 26

August 2015

10.30am

Council Chambers

15 Forth Street

Invercargill

|

|

Policy Review Committee Agenda

OPEN

|

MEMBERSHIP

|

Chairperson

|

Rodney Dobson

|

|

|

Councillors

|

Lyall Bailey

|

|

|

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

|

|

Mayor Gary Tong

|

|

IN ATTENDANCE

|

Chief Executive

|

Steve Ruru

|

|

|

Committee Advisor

|

Debbie Webster

|

|

Terms of Reference for Policy Review

Committee

This committee is a committee of Southland

District Council and has responsibility to:

·

Review Council policies on a regular

basis as to their relevancy and appropriateness.

·

Recommend new policies or changes to

existing policies as required.

·

Ascertain the impact of proposed

Government legislation on Council policies or activities and make

responses/submissions on regional matters, SOEs, etc.

·

Review Asset Management Plans (including the

renewal policy) for Council's infrastructural assets such as roading, water and

sewage schemes and other Council property.

|

Policy Review Committee

26 August

2015

|

|

TABLE OF

CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of

Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Minutes 5

Reports for Recommendation

7.1 Action

Sheet Report Policy Review Committee meeting 15 July 2015 11

Reports

8.1 Report

to Policy Review Committee - Venture Southland Community Development Update 13

8.2 2015

ILT Kidzone Festival Report 39

8.3 Southland

Tourism Trade Product Opportunities 43

8.4 Southland

Registration of Interest to Ministry of Business, Innovation and Employment

- Ultra Fast Broadband 2, Rural Broadband Initiative 2 and Mobile

Blackspot Fund 57

At the close of

the agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Committee Members are

reminded of the need to be vigilant to stand aside from decision-making when a

conflict arises between their role as a member and any private or other

external interest they might have.

4 Public Forum

Notification to speak

is required by 5pm at least two days before the meeting. Further information is

available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the committee

to consider any further items which do not appear on

the Agenda of this meeting and/or the meeting to be held with the public

excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i) The

reason why the item was not on the Agenda, and

(ii) The reason why the

discussion of this item cannot be delayed until a subsequent meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a) That item

may be discussed at that meeting if-

(i)

That item is a minor matter relating

to the general business of the local authority; and

(ii)

The presiding member explains at the

beginning of the meeting, at a time when it is open to the public, that the

item will be discussed at the meeting; but

(b)

No resolution, decision or recommendation may be made in respect of that

item except to refer that item to a subsequent meeting of the local authority

for further discussion.”

6 Confirmation

of Minutes

6.1 Meeting

minutes of Policy Review Committee, 15 July 2015

|

Policy Review Committee

OPEN MINUTES

|

Minutes of

a meeting of Policy Review Committee held in the Council Chambers,

15 Forth Street, Invercargill on Wednesday, 15 July 2015 at 10.30am.

present

|

Chairperson

|

Rodney Dobson

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Lyall Bailey

|

|

|

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

Chief Executive Steve Ruru, Group Manager Environment

and Community Bruce Halligan, Group Manager Services and Assets Ian Marshall,

General Manager Policy and Community Rex Capil, Strategy and Policy Manager

Susan Cuthbert, Communications and Governance Manager Louise Pagan, Chief

Information Officer Damon Campbell, Committee Advisor Debbie Webster.

1 Apologies

An apology for

absence was received from Cr Dillon.

|

Moved Cr Douglas, seconded Cr Baird and resolved:

That the Policy Review Committee accept the apology.

|

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

There were no conflicts of interest declared.

4 Public

Forum

There was public

forum.

5 Extraordinary/Urgent

Items

There were no

Extraordinary/Urgent items.

6 Confirmation

of Minutes

|

Moved Cr

Harpur, seconded Cr Keast and resolved:

That the

meeting minutes of the Policy Review Committee,24 June 2015 be

confirmed.

|

Reports for Resolution

|

7.1

|

Venture Southland - Community Development Update

Record No: R/15/6/11127

|

|

|

Venture Southland General Manager Events

and Tourism Bobbi Brown and Venture Southland Community Development Planner

Julie Russell were in attendance for this item. Mrs Brown noted an

error in the report, should read Mararoa Waimea Ward and not Waiau Aparima

Ward .

Mrs Brown highlighted the current

research and strategies, regional initiatives, local initiative and other

projects Venture Southland are currently working on. She noted there

was a stake holder meeting for the Cruise Strategy planned for August.

Ms Russell commented she has met with

business owners in Athol in particular Stu’s Fly Fishing on the

Official Partner Programme for the Around The Mountain Cycle Trail and

discussed potential ideas for a museum or café. She has also

spoken with a business at Five Rivers who are developing a robotic milking

shed which will also host a café. The milking shed will be

located right on the cycle trail and the farm was a unique tourism product

which the trail will help to promote.

Mrs Brown noted the Tourism New Zealand

workshop had been held and they are now looking at how best to progress this

work. She also noted the Joseph Parker fight scheduled for 1 August

2015 and the promotion around that event. Visits to schools and local

boxing clubs are planned. A series of short vignette films are being

created to promote Southland events which will be shown during advertising

slots on ESPN and the FOX television networks with international coverage.

Mayor Tong queried the LINZ land at

Garston being gifted to the School, Mrs Brown to follow up on this.

|

|

|

Resolution

Moved Cr Duffy, seconded Cr Paterson

and resolved that the Policy Review Committee:

a) Receives

the report titled “Venture Southland - Community Development

Update” dated 29 June 2015.

|

Reports

for Recommendation

|

8.1

|

Community Assistance Policy - Grants and Donations

Record No: R/15/5/8944

|

|

|

1 Communications and Governance Manager Louise Pagan spoke to the report noting the purpose of the report

was to recommend the Community Assistance Policy - Grants and Donations be

adopted by Council.

2 Southland

District Council managed its Community Assistance Grants in various ways,

with the majority going through the allocations process via the Allocations

Committee.

Council had also historically allocated grants and donations to a wide range

of community organisations. Some have gone through the Long Term

Plan/Annual Plan process while others had become annual allocations through

the passage of time. The draft policy sets out the process of

allocating grants and donations, describes the types of grants and the

criteria for allocating them.

Mrs Pagan noted that two changes to the policy. The

first under 4.3 Sport NZ Rural Travel Fund, the last sentence “Total

fund available for distribution each year is” to be removed as

unnecessary. And 4.5.3 Other Grants the last sentence in the first

paragraph should read “ These grants remain within Council

responsibilities and are administered by the Governance and Communications

Manager and other staff.” To include the words in bold.

Cr Baird raised the issue of what happened to applications

to the Allocations Committee and Ohai Railway Fund that were received outside

the funding rounds. Mr Capil responded this could be looked at, as to

how best to manage applications out of funding rounds. Mr Ruru suggested

Standing Orders could be amended to include teleconference meetings to deal

with the issue. Mrs Pagan mentioned a list would go in First Addition

giving the list of scholarships/grants available with opening and closing

dates giving the community greater notice of these.

Cr Duffy commented scholarships that go to schools should

be presented by the Ward Councillor or a Council representative in order to

have recognition the grant has come from the Southland District Council.

|

|

|

|

|

|

Resolution

Moved Cr Duffy, seconded Cr Paterson

and resolved:

That the Policy Review Committee:

a) Receives

the report titled “Community Assistance Policy - Grants and

Donations” dated 3 July 2015.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Recommend

the Community Assistance Policy - Grants and Donations be adopted by Council with

the wording changes under 4.3 Sport NZ Rural Travel Fund, the last sentence

“Total fund available for distribution each year is” to be

removed. And 4.5.3 Other Grants “These grants remain within

Council responsibilities and are administered by the Governance and

Communications Manager and other staff.” Underlined to be

included.

|

The meeting closed at 11.01 am CONFIRMED

AS A TRUE AND CORRECT RECORD AT A MEETING OF THE Policy Review Committee HELD ON 15 JULY 2015

DATE:...................................................................

CHAIRPERSON:...................................................

|

Policy Review

Committee

26 August

2015

|

|

Action Sheet

Report Policy Review Committee meeting 15 July 2015

Record No: R/15/7/12943

Author: Debbie

Webster, Committee Advisor

Approved by:

☐

Decision ☐ Recommendation ☒ Information

1 Action

Sheet Report Policy Review Committee meeting 15 July 2015

|

Recommendation

That the Policy

Review Committee:

a) Receives

the report titled “Action Sheet Report Policy Review Committee meeting

15 July 2015” dated 19 August 2015.

b) Determines

that this matter or decision be recognised not as significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

|

Attachments

a Action

Sheet Report Policy Review Committee Meeting View

|

Policy Review

Committee

|

26 August 2015

|

|

Policy

Review Committee Action Sheet - Including Public Excluded

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Author

|

Due Date

|

Subject

|

Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recently Closed Action Items

|

|

|

|

|

|

|

|

|

|

|

|

Author

|

Completion Date

|

Subject

|

Notes

|

|

Sheree

Marrah

|

24/07/2015

|

District

Rates Modeling

|

Action

completed by: Sheree Marrah Report complete.

|

|

Sheree

Marrah

|

24/07/2015

|

Draft

Revenue and Financing Policy for 2015-25 Long Term Plan

|

Reminder

of request from Cr Douglas to view the format of how the rates assessment

notice will look with the proposed changes to compare to current

notice

•Action completed by: Sheree Marrah Report complete

|

|

Louise

Pagan

|

28/07/2015

|

Community

Assistance Policy - Grants and Donations

|

Going

to Council on 5 August

•Action completed by: Louise Pagan Report sent to Council on 5

August 2015

|

|

|

r/15/8/14946

|

Policy Review

Committee

26 August

2015

|

|

Report to

Policy Review Committee - Venture Southland Community Development Update

Record No: R/15/7/11569

Author: Juanita

Thornton, Community Development Planner

Approved by: Rex Capil, Group

Manager, Policy and Community

☐

Decision ☐ Recommendation ☒ Information

Purpose

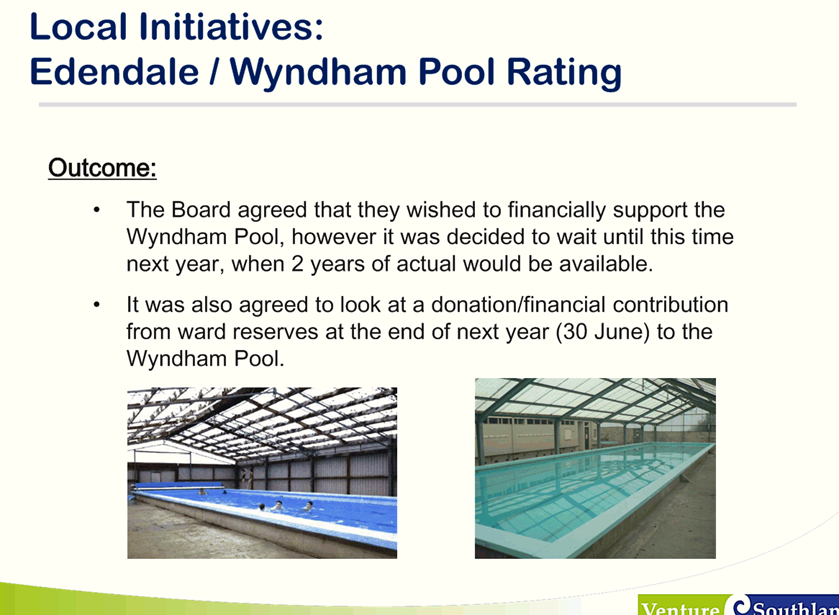

1 The

purpose of this report is to update the Southland District Council on Venture

Southland community development activities. The accompanying power point

presentation provides information about both regional projects and local

initiatives.

|

Recommendation

That the Policy

Review Committee:

a) Receives

the report titled “Report to Policy Review Committee - Venture

Southland Community Development Update” dated 13 August 2015.

|

Attachments

a Venture

Southland Community Development Update View

|

Policy Review

Committee

|

26 August 2015

|

|

Policy Review

Committee

26 August

2015

|

|

2015 ILT Kidzone Festival Report

Record No: R/15/8/13673

Author: Sally

Hayes, ILT Kidzone Festival Director

Approved by: Rex Capil,

Group Manager, Policy and Community

☐

Decision ☐ Recommendation ☒ Information

Purpose

1 That

the report on the 2015 ILT Kidzone Festival be received.

Executive

Summary

2 This

report provides an insight into the 2015 ILT Kidzone Festival.

|

Recommendation

That the Policy

Review Committee:

a) Receives

the report titled “2015 ILT Kidzone Festival Report” dated 17

August 2015.

|

Content

3 Southland’s

most popular family event, the ILT Kidzone Festival took place for the 11th

time over six days in the July school holidays from Wednesday, 8 July to

Monday, 13 July 2015.

PATRONS

4 Our

patron numbers were once again significantly pleasing with over 11,000 tickets

sold for the 2015 festival.

STAFFING

5 Pack

in, pack out and six days of festival result in the event team being required

to work a 12-day stretch. There is a large contribution from Venture

Southland staff in many aspects of the festival. On top of the Festival

Director another eight staff members from Venture Southland contribute a

great deal of time and effort into the setup and running of this

festival. This includes staffing, design, marketing, maintenance of

equipment, volunteer coordination, ticket issues and cashflow.

6 It

is important to note that these contributions are vital components of ILT

Kidzone, however we still require at least 120 volunteers a day to ensure all

the activities are fully operational throughout the festival.

FEEDBACK

7 The

2015 ILT Kidzone Festival has again been well supported by the Southland

community and further abroad. A survey was emailed to patrons at the

conclusion of the festival in which they were able to leave a comment which

best described their experience at ILT Kidzone. Some of the comments are

outlined below:

“Absolutely

awesome day!! Best thing was once you had paid for your tickets you

didn’t have to pay for anything else, you didn’t have to say

“no” to your kids, they could do everything.”

“We look forward to it

every year, such a great thing for Southland.”

“I think what you offer

is unique and a great way to get families to interact together! There is a

great balance of boys vs. girls activities. The volunteers are amazing

and I think it is a great thing for the young ones to do.”

“Absolutely awesome

experience. Our children talk about Kidzone all year long and eagerly

await the festival each year. We think it is fantastic value for money.

The volunteers do an amazing job.”

“It is a credit to

Invercargill and all the organisers and sponsors that we have such an amazing

event to offer!”

(Feedback received via Survey

Monkey)

ACCOMMODATION STAYS

8 Out

of our patrons surveyed, 21% stayed at another location in Invercargill rather

than returning home after the festival. For those that stayed at another

location in Invercargill, it was a 60/40 split between staying with friends

and/or family and another accommodation (eg, motel, hotel, camping)

respectively. For the fourth consecutive year, ILT Kidzone partnered with

the Ascot Park Hotel to offer a package deal of accommodation and ILT Kidzone

tickets. The uptake of this package continues to be popular with patrons

attending the festival from out of town.

MARKETING

9 Our

main marketing tool for ILT Kidzone is the official ILT Kidzone Festival

Programme. 15,000 programmes (A5, 16 pages) are printed and distributed to

primary schools and childcare facilities throughout Invercargill, Southland,

Gore and Fiordland.

10 Other

marketing collateral included advertising with The Southland Times via a home

page take over on the Stuff website; promotions with local radio stations - The

Hits and More FM; our ILT Kidzone Facebook page; street banners and street

flags located on Esk, Don and Dee Streets.

11 We

utilised our in-house photography skills and partnered with Videocopter to

create high quality imagery and promotional film clips of this event.

These clips can be viewed on

You Tube by searching ‘ILT Kidzone 2015’.

12 We

are fortunate to have a great relationship with the media around this festival,

so ILT Kidzone was covered extensively in The Southland Times, as well as being

featured in

The Southland Express, The Eye and The Ensign.

FINANCIALS

13 ILT

Kidzone works on a breakeven budget of around $300,000. The majority of

the festival’s income, aside from ticket sales, comes from our community

funders and grants such as the Invercargill Licensing Trust, ILT Foundation,

Community Trust of Southland, ICC Events Fund, Lotteries, SDC Community Initiatives

Fund, ICC Creative Communities Scheme, SDC Creative Communities Scheme and The

Southern Trust. We have a fantastic team of corporate sponsors - Macaulay

Mazda, H&J Smith, Mitre 10 Mega Invercargill, Distinction Hotels,

Spotlight, PORSE and McIntyre Dick & Partners - who sponsor the event in a

variety of ways from naming right sponsorship to being part of our business

partnership programme. There are so many local organisations that support ILT

Kidzone in so many ways.

WASTE MANAGEMENT

14 A

Waste Management Plan was once again implemented at ILT Kidzone for the fourth

consecutive year. The ILT Kidzone Management Team took full

responsibility for the initiative, along with some guidance from

WasteNet. Venture Southland worked with the Invercargill Environment

Centre at the festival.

VOLUNTEERS

15 We

had a fantastic team of over 200 volunteers register to assist with this

year’s ILT Kidzone. This year’s volunteers were of a very

high calibre and so much positive feedback has been received. Our

volunteer numbers ensured all activities and stations were fully operational,

however we were very short with volunteers on both the Saturday and Sunday of

the festival - this may be due to other work commitments and/or sport

commitments.

We once again ran training sessions in specific areas prior to the event.

A face painting and hairdo lesson was held one evening, prior to the

event. ILT Kidzone also worked with

Radio Southland to provide volunteers with the opportunity to spend time at

Radio Southland and learn how to broadcast. It is definitely worth

building on these opportunities for next year.

CONCLUSION / SUMMARY

16 Based

on the feedback and the current evaluation of the financials we believe that

the 2015 ILT Kidzone Festival was a success and will continue to be an iconic

and popular Southland event.

17 Planning

for the 2016 festival is underway for Wednesday, 13 July - Monday, 18 July

2015.

Attachments

There are no attachments for

this report.

|

Policy Review

Committee

26 August

2015

|

|

Southland Tourism Trade Product Opportunities

Record No: R/15/8/14315

Author: Bobbi

Brown, Group Manager Tourism, Events and Community

Approved by: Rex Capil,

Group Manager, Policy and Community

☐

Decision ☐ Recommendation ☒ Information

Purpose

1 This

report details the current situation regarding a lack of commercial tourism

product in Southland and seeks agreement to work together on identifying and

advancing product development opportunities.

Executive

Summary

2 The

report sets out what is happening in tourism, and in particular Southland, with

its key characteristics and challenges. It describes the importance of having

unique selling points and the need for a regional approach in regards to

maximising the opportunities of tourism.

|

Recommendation

That the Policy

Review Committee:

a) Receives

the report titled “Southland Tourism Trade Product Opportunities”

dated 13 August 2015.

|

Background

3 On

6 July 2015, delegates from Tourism New Zealand (Industry Relations Manager

Paul Yeo, Trade Development Manager, Paul Trowell and Product Development

Manager Kim Cormack) in collaboration with the Venture Southland tourism team

presented to Councillors and Executive Leadership teams from Southland, Gore

and Invercargill Councils (18 representatives).

4 The

objectives of this presentation were to gain a further understanding of:

· The Southland

tourism situation including key characteristics and challenges

· What

‘trade’ is & its importance within the tourism industry

· The importance of

‘unique selling points’

· The need for a

regional approach in regards to maximising the opportunities of tourism

5 Paul

Yeo commenced the meeting discussing the significance of the industry, with

over $24 billion being earned annually. Furthermore tourism is forecast to

continue its growth to be the largest export industry for the country

(surpassing dairy). Mr Yeo stressed the importance of coordinated regional

representation through activities such regional tourism organisations (such as

Venture Southland and Destination Fiordland), international marketing alliances

(such as Pure Southland Land – Southland, Clutha, Dunedin and Waitaki)

and recognised visitor information services (such as the i-SITE network and

Qualmark accreditation process).

6 Tourism

New Zealand is active in international marketing with three major activities:

· Marketing

(advertising and promotion)

· Public Relations

· Trade

7 The

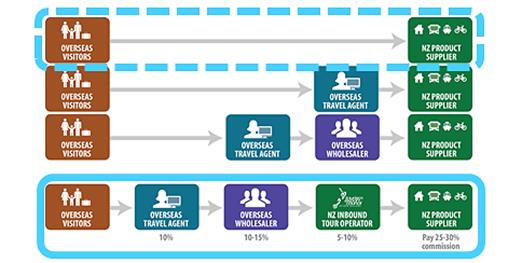

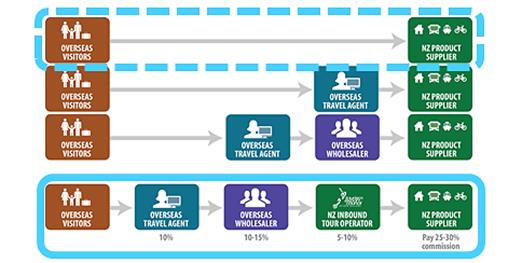

importance of trade activity was stressed by Tourism New Zealand, as this is a

proven method to increase both the value and development of tourism to a

country/region. The tourism trade channel involves tourism product (e.g.

attractions/activities that charge a fee) being sold around the world by

different travel agents, wholesalers and inbound operators through their

brochures, itineraries and tours.

Note

variance between none-trade channels (top) and trade channels (three below).

With the use of trade the level of distribution is increased significantly.

8 This

provides the opportunity for a tourist attraction to reach customers that they

would no other method of affordably accessing; can create another specific

market for the business and can receive more attention from international

media. This is enabled by paying a commission (a proportion of their sale

price) to the trade channel only if they sell an entry to their attraction.

Southland Tourism Insights

9 The

Venture Southland tourism team then presented some key insights into the

performance of tourism in the region, key points being:

· 3rd largest GDP

contributor - $380 million in 2014

· Domestic tourism

worth $232 million (particularly from South Island regions and North Island

major populations)

· International

tourism worth $157 million (major markets being Australia, USA, UK and Germany)

· Employs 1 in 10

employees in region

· Experienced

tourism activity growth between 4% and 17% over the last 12 months

10 The key

reasons/motives for visiting Southland include:

· Visiting friends

and relatives

· Business travel

· Special interest

travel (e.g. tramping, hunting, fishing, cycling, birding, racing, photography)

· Leisure

destination (e.g. Stewart Island, Invercargill, The Catlins, Gore District)

· Leisure touring

(e.g. South Island road trips, the Southern Scenic Route)

· Event attendees

(e.g. sports tournaments, cultural events)

11 The

major marketing propositions of Southland revolve around the “The New

Zealand we all dream of” where Southland allows access to environments

and people that remain unique (unlike many ubiquitous destinations). Key

messages (such as imagery and editorial) focus specifically on facets such as:

· Recreation

(lifestyle and special interest)

· Scenery,

landscapes and wildlife (national parks, southern coast,

penguins/kiwis/tuatara, Aurora Australis etc)

· People, heritage

and industry (Maori/European colonisation, personalities, transportation,

agriculture and manufacturing etc)

· Food (wild and

farmed seafood, farmed produce, processed/manufactured foods and beverages)

· Events (that

celebrate all the above)

12 It was

noted that Southland still has a relatively infant industry in comparison to

other regions of New Zealand. This means that the tourism industry is still

growing and is subject to “teething problems” such as inconsistency

in demand and supply. This provides significant opportunity for the growth of

the region. Some of these infancy challenges include:

· Extreme seasonality

with large peaks and troughs in visitation

· Strong competition

from more developed regions

· Travellers with

limited money, time and awareness of Southland

· Operators are

still developing standard product and business expectations that appeal to visitors

(such as opening periods, staffing, investment, quality standards, and industry

marketing standards)

· Points of

difference are not commercialised for economic return (e.g. The Catlins, Bluff

Oysters, heritage, scenery)

· Lack of commercial

product (trade attraction/activity)

Commercial Tourism

Attractions/Activities

13 The

lack of commercially driven attractions, which operate as trade products,

impacts the ability to expand and develop within trade marketing channels. This

was highlighted with Southland having fewer than 20 commissionable

attractions/activities as an entire region (with Queenstown having over 180,

Fiordland 45 and Dunedin 45). With this limited number many trade contacts

(both inbound and wholesale businesses who sell regions and products within

international markets) have advised that while they find Southland an

attractive destination, they are not able to include Southland as a key product

proposition in their itineraries, tours and brochures. This is because they are

unable to earn the same amount of money as when in other destinations

(including local destinations of Queenstown, Fiordland and Dunedin).

Fortunately Southland does boast a number of accommodation providers who work

with Trade; however these are secondary motivations to activities and

attractions of a region.

14 This

challenge faces every developing destination, and four cases exemplified how

different stakeholders have successfully built products to provide commercially

oriented attractions to their regions. These in turn have assisted in

attracting both trade and consumer customers creating consistent employment,

visitor activity, increasing length of stay and basically compelling reasons to

visit. The case studies included details around the Blue Penguin Colony in

Oamaru (a Council driven operation), Olveston House Dunedin (operated by a

Charitable Trust with Council support), Cadbury World Dunedin (privately

operated) and Whale Watch Kaikoura (operated by iwi). Please see attachment to

this report.

15 All of

these case studies demonstrated the following characteristics which contribute

to their success:

· Unique proposition

(based on a natural or cultural heritage)

· Economically

significant commercially viable products (all charging commissionable entry

fees generating between $600, 000 to over $11 million pa)

· Part of a cluster

of attractions/activities with close proximity to other products

· With hub &

spoke or chain models of visitor distribution

· Experientially

oriented with interaction, multi-sensory and educational components

· Diversification of

revenue

· Different levels

of products/prices (including tours, hospitality and retail)

· Flexible

operations to suit requirements of different customer markets

· Support of

community

16 Currently

in Southland, while there are over 130 visitor attractions/activities in the

region, commercial tourism attractions/activities are limited to clusters in:

· Stewart Island (7)

– guided tours & walks, charters,

· Western Southland

(3) – jet boat/boat cruises, guided walks

· Invercargill (1)

– guided tours

· Northern Southland

(3) – cycling, fishing tours

· Gore District (2)

– fishing and outdoors guiding

17 Note

that Queenstown boasts more than 180, while both Fiordland and Dunedin both

have 45 respectively.

18 Invercargill

is soon to benefit from the opening of the Bill Richardson Transport World,

which has been devised as a commercial attraction and has been developed to

ensure it can work with trade channels. This however is not a silver bullet,

and challenges will continue to remain to leverage the most out of this and

other attractions in the region.

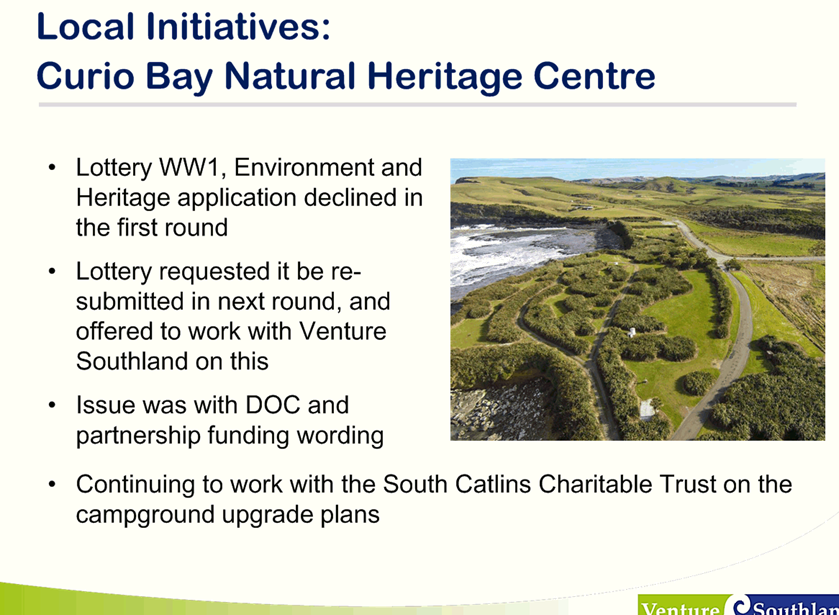

19 Similarly

the developments in Northern Southland (current attractions such as the Around

the Mountains Cycle Trail and Welcome Rock Trails; and proposed attractions

such as the Eyre Estate Dairy Experience and the Athol Fish Story) and The

Catlins (such as the Natural Heritage Centre) show promise to develop further

the attraction based experiences in the region. Important to the development is

the consideration of commercial and community needs, which need not be mutually

exclusive.

20 Discussion

then moved to possible developments for future commercial products in Southland

that fulfil the need to develop products unique and sustainable for Southland. Opportunities

were identified around Southland’s current strengths, with some

suggestions including:

· Bluff Oysters

(most searched online product from international markets) – oyster

centre, bar & restaurant, factory tours, shucking demonstrations, giant oyster

etc

· Andersons Park

– historic home tours (like Larnach’s Castle/Olveston House),

agriculture heritage

· Wildlife –

Penguin tours at Curio Bay, sustainable shark diving, Kakapo and Tuatara

· Hokonui heritage

precinct – guided tours through Moonshine, Art Gallery, Croydon Aircraft

(and flights)

· Natural Heritage

– Geology, Prehistoric New Zealand

· Agriculture

– dairy/sheep farming experiences, farm stay networks (retirees)

· Regional Outdoor

Art – enhancing tourism products

· Transport Heritage

– regional packages

· Coastal vistas

– hot pools with a view, luxury accommodation/hospitality

Developing Commercial

Attractions/Activities in Southland

21 To

advance these discussions Venture Southland has a number of activities in

progress or proposed.

2016-2020

Southland Visitor Strategy

22 Firstly

the development of the 2016-2020 Southland Visitor Strategy includes a key

objective of developing enhanced experiences that provide economic and social

opportunities for the community of Southland. This strategy will be developed

in a consultative manner with a variety of stakeholders in the Southland

community. The key principles of product development (as outlined with success

characteristics) will be used to reinforce the process of experience

enhancement.

23 The

development of this Strategy will begin soon and will be completed by March

2016. It will include and reference other strategies and sector

investigation relating to Fiordland, cruise, cycling, telecommunications and

sub regions such as The Catlins and Stewart Island.

Council

Consultation

24 The

second initiative is scheduled meetings with each of the Councils to examine

the opportunities that exist within their authority and examine the best

process to advance opportunities. These opportunities may be a variety of

relationship, ownership and funding models between public and private entities

identified (including Department of Conservation, Iwi, Council, charitable

trusts, Ministry of Business, Innovation and Employment). Furthermore Venture

Southland is committed to providing advice, support and introductions for

Council developments that have a visitor context.

Industry

Consultation and Education

25 The

third initiative is a scheduled educational programme with existing and

prospective operators. The content of this programme includes the introduction

of trade channels and one-to-one mentoring in developing trade propositions.

Tourism

Product Development Proposals

26 Through

Venture Southland’s tourism product development role (and wider tourism,

business and community development teams) this intends to identify and foster

the development of commercial business ventures (integrating

learning’s’ from Council and industry consultation). This

potentially includes the development of options’ strategies and business

case plans for future development.

Identification

of Tourism Cluster Zones

27 Working

with stakeholders, it is proposed that key zones are identified to focus

tourism product development in (and to complement other community initiatives

and infrastructure provision). Potentially these tourism cluster zones would

include a minimum of three commercial attractions/activities that would be

supported by other community recreational opportunities and

hospitality/accommodation functions. Through the definition of these it is

proposed it can assist in:

Increasing regional guest nights

(length of stay and expenditure) through creation of sub-regional destinations

Encouraging repeat visitation to the

region (to marketed attractions they become aware of but were unable to visit)

Using the hub and spoke or chain

model where visitors can visit one or more spokes/links during their visit.

28 To

facilitate this, Venture Southland would implement a programme of cluster zone

audits and strategies to identify opportunities for the variety of stakeholders

(including existing industry, entrepreneurs, diversification of other industry,

Council, promotions and community groups). This is proposed to focus on a

minimum of one cluster zone per annum.

Attachments

a Venture

Southland tourism trade product case studies View

|

Policy Review

Committee

|

26 August 2015

|

TOURISM

TRADE PRODUCT CASE STUDIES

Presented

at the Tourism Workshop 6 July 2015 by Hannah Whyte

Introduction

Included

here is a brief summary of four examples of New Zealand trade product that are

working well in other regions. This is no way suggesting these should be

developed in Southland, rather food for thought on the potential development

for the region. First up, Southland does have a different visitor model to the

regions we have listed as they have different economic and tourism drivers.

Approximate visitor numbers per annum:

Southland –

500,000 visitors p.a.

Fiordland – 500,000

visitors p.a

Dunedin –

2,000,000 visitors p.a

Waitaki –

500,000 visitors p.a

Kaikoura –

500,000 visitors p.a

The

listed activities introduced here highlight how these products, all of which

have different ownership models, have adapted and developed their product to

work within a commercial tourism environment. A key theme amongst all of them

is that they have developed multi-sensory, memorable experiences that are

unique in their own way, that contribute significantly to their local

economies. This summary will highlight their strengths, particularly from

a trade perspective, but also how these products have all capitalised on their

regions natural strengths.

Blue

Penguin Colony, Oamaru

This

has been a fairly significant development within the Waitaki region and has had

a noticeable impact upon the region’s tourism landscape. This was once an old

quarry that ceased working in the late 1970s that was considered a regional

eyesore. In 1992 the decision was made to delegate the area a protected

breeding zone for the Blue Penguin. From this early point the space was managed

by a team of volunteers. However, in 1997 this all changed when the publicly

funded Waitaki Development Board took over the management of the colony.

From

this point, the development of the Blue Penguin tourism experience was in

motion. It took a few years to develop the product and it is understood that a

few million dollars were invested. However, today the operation is fully self-funding, generating an

approximate 30% profit increase each year. Thirteen permanent staff are

directly employed, plus other seasonal and senior management staff. Visitor

numbers have grown significantly from around 35,000 in 2006 to a rough average

of 80,000 total people today. They had just under 60,000 ticketed visitors

alone this last financial year.

Aiding

this growth is the colony’s transition from a ‘gold coin entry

product’ to a multi layered experience which offers both strong retail

and a range of tour offerings. Standard adult rates range from a $10 entry fee

during the day, with a basic adult evening viewing of $28 per person, to a $40

adult premium evening viewing.

Crucially,

trade has been able to work with this product and the colony now receives

approximately 20,000 inbound tour visitors per year (as a direct result of

working with trade channels). Nearly all trade itineraries into the region

include the colony and because the premium evening experience works well within

the trade space, this has encouraged the need for an overnight stay in Oamaru.

Wonderfully, all profits

are redistributed into district

development, which includes further work at the colony and tourism project

development around the Oamaru harbour.

When

asked why this product has been such a success, the colony stated:

“Because

it is unrivalled. There are only two facilities (Oamaru and Phillip Island) in

the world that provide this experience and both are quite different; we have

invested heavily in research of our specific penguin population, and this alone

has raised the international reputation and profile of the organisation. We

have emphasised ecological work, and are gold certified in both Qualmark and

Earthcheck, as well as being carbon neutral. We have provided an

individualised experience, close to town, built on natural wildlife

interaction. This has been well received”

To

sum it up the colony’s key strengths are:

· It’s uniqueness –

it’s the only place in New Zealand (and nearly the world), offering an

experience like this.

· Capitalised on its strengths which

was the abundance of little blue penguins.

· In conjunction with product

development, they have transitioned from a gold coin donation and created a

commercial product that can work with the independent traveller and trade

· It offers a small range of

experiences and price points, including an evening experience, which encourages

an overnight stay in the area

· It’s located close to the

centre of town

· Ongoing commitment and support from

the local community

· Because of all of this it now

generates substantial profit increases which support further tourism

development in the region.

This

has consequentially assisted in development of the Waitaki region, particularly

Oamaru which now boasts a cluster of attractions that include SteamPunk HQ, the

Heritage Precinct, and a variety boutique art, food and beverage purveyors.

Olveston

House, Dunedin

Within

trade marketing channels, Dunedin has a strong product portfolio and this

allows the city to be marketed as a two night stay. The impacts commissionable

product have on length of stay are significant. The more commissionable product

a region has, the longer you can advocate visitors stay (within the trade

marketing space). As a rule, a standard Dunedin itinerary includes – half day travel time –

afternoon activities (city based), full day nature tours on the peninsula, 2nd

overnight in Dunedin and a half day morning activity (city based again on the

third).

Olveston

House fits into this product portfolio well. It opened in 1967 and is today managed by a

Charitable Trust which includes public funding from the Dunedin City Council. Over the years they have developed

this product to work for both the Dunedin community and visitors to the

region. Currently Olveston House welcomes over 30,000 visitors and has a total

revenue exceeding $600,000 per annum.

First

off - it’s one of the only period homes in New Zealand to showcase its

unique history and offer tour experiences. It’s a low impact activity

– which basically means anyone can do it. The facilities are open for 364 days

of the year from 9am - 5pm and, every day, six one hour tours are hosted by a number

of contracted staff. All tours are hosted in English, but they have options

available for foreign languages if the group size is large enough.

Tour

prices range from $15 to $20 per person and Dunedin residents get a special

rate of $15 per person. You must take part in a tour if you would like to

experience the interior space of Olveston House and entry to the gardens and

gift shop are free. Outside of this they host numerous special interest tours,

local’s days and private events.

Again,

Olveston House works with trade and due to the fact it is low impact and has a

number of guides, it can cater for both large and smaller groups. As part of

this package, trade can choose to just participate in the tour but they offer

an “add-on” of morning tea where requested. The length of the tour

is important to note when considering trade, as on its own, Olveston House

isn’t the strongest product proposition in Dunedin – meaning that

on its own it wouldn’t be something that people travel specifically to

Dunedin for.

However,

when combined with other products in the area it compliments well. Its short

one hour tours and regular departure times allow it the flexibility to be

packaged into a range of itineraries easily.

Key

strengths:

· They have developed an attraction

they already had - to work for Dunedin residents, independent travellers and

trade.

· You can’t experience the

internal space of Olveston House without a tour which allows the product to

draw an income.

· Offers a flexible tour offering with

regular departures. These regular departures and short tour times allow it to

be built into itineraries with other Dunedin products.

· On its own the Olveston product

might not usually be strong enough to specifically attract visitors –

however, combined with others, the product compliments existing trade offerings

in Dunedin. As there are a few available (and more opportunity to make money)

Dunedin is an appealing as a destination within the trade marketing

space.

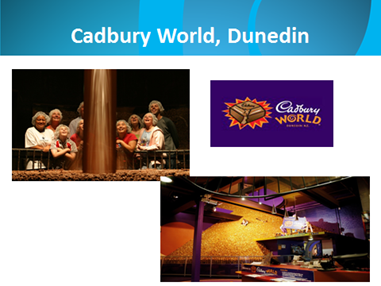

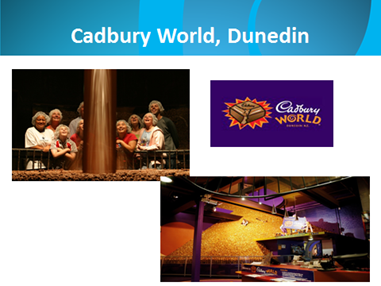

Cadbury World

Cadbury

World is another Dunedin tourism success story. As a private enterprise it

opened its commercial tours in 2003.

The attraction showcases

Dunedin’s industrial history which incorporates a unique savour component

but it also displays their industrial heritage strongly. This attraction is

unique to Dunedin, however it really is just a factory, but it is the only

working chocolate factory in the world which allows patrons and guests behind

the scenes.

Of

course the product is naturally strong due to its links to an iconic brand, but

they have exploited every possible revenue stream. They have done this by

inviting people into their factory via tours and by the establishment of events

such as the Cadbury Chocolate Carnival. In terms of visitor figures, the

factory now receives over 125,000 visitors per year.

Again

in order to visit the factory you must take part in a tour. Tours start from $2

to $22 per person and include family pass rates. These tours and activities run

7 days a week with three tour options available – 75 minutes, 45 minutes

and 10 minutes. Approximate revenue is estimated to be around $1,500,000

for tours and over $400,000 per year in gift shop sales. This brings their

total revenue on average to around $2,000,000.

Again

they work with trade. They have a variety of tours (different time, aspects of

factory and prices) on the same premise as Olvestons’. When working with

trade (including cruise ships), they will also customise their tours and

product offerings. This means they are flexible and are willing to develop

their product to work best with the needs or interests of the visiting party -

or they are willing to offer a tour that is slightly unique from their standard

product.

Key

strengths:

· They have developed and maximised

every possible revenue stream their product could offer through manufacturing,

tours, retail and events.

· Again like Olveston, you can’t

experience Cadbury World without a tour which generates an income for the

product and they offer flexible tour offering with regular departures which

means again they can work with trade and be built into itineraries with other

Dunedin products.

· They are flexible and prepared to

customise, meaning their product is a popular choice with visitor groups

including the Cruise Ship market and partnering with other tourist attractions

such as the Speight’s Brewery tours.

Whale Watch Kaikoura

Kaikoura

offers a number of nature and wildlife based attractions. One of their most

famous regional products is Whale Watch Kaikoura. This product was opened in

1987 and is an Iwi managed and operated attraction. It’s very unique to

Kaikoura and strongly showcases their region’s history, culture and

ecology. It would be considered one of, if not, the most iconic marine nature

attraction in New Zealand.

Annually

it receives around 100,000 visitors per year. Tour prices range from $60 - $145

per person and generally revenue is around the $11 million mark.

Obviously the attraction of whales is a huge draw card, but beyond this, one of

the product’s key strengths is that it’s very interactive and has

strong interpretation throughout. Throughout the tour you learn (through

various mediums like video and commentary) about the unique importance of the

area, why whales choose to live there etc. So strong are these interpretation

aspects that you have had a great experience before you even see the whales.

Another

key strength that works for the product and the region is that they are

prepared to package their product well and work with other complimentary

products. Packaging your product strategically with others is a useful

tool when working in tourism. Generally speaking, it allows companies to

broaden their marketing appeal, but because they are offering a great deal, it

can give them an advantage over their competitors. The package they

use is called the ‘Kaikoura Marine Combo’ i.e: Air Whale Watch

Experience, Sea Whale Watch Experience and a Dolphin Viewing Experience.

Experience sells for $396 per person. From a trade perspective this is also

great as it allows on average an $80 commission per guest – so there is

motivation to book.

A

key advantage of this tour from a regional perspective is that in order to do

it, they recommend you stay in Kaikoura for two nights – which helps with

increasing their length of stay.

Key

strengths:

· Play to your strengths,

use your natural and cultural heritage

· Strong interpretive and

interactive aspects to their product – which enhances the experience.

This allows the visitor to gain a strong understanding of the product before

they even see the main attraction.

· Not only do they work

with trade they have also packaged their product. Note that

“packaging” works well within the independent and trade space.

However, increases marketing appeal and competitive advantage.

What’s

going well in Southland in the Trade Space

In

the last year we have seen very positive progress and development within the

region.

Cycling

product has seen great progression with the development of two new products:

Around the Mountains and Welcome Rock Trails in Northern Southland.

What’s great with these two trails, is that they are totally different

products and will have completely different markets. One being cycle trail

cyclists and the second focussing on mountain biking / hiking.

Positively

for the region they both have commercial components and have developed

sophisticated and professional marketing platforms. Their introduction has

consequently added to investigation of further product development of

attractions such as a Fish Museum at Athol, Dairy Experience at Five Rivers to

complement resurgence in local accommodation and hospitality.

The

Humpridge Track in Western Southland has demonstrated simple packaging to

appeal to a variety of markets (such as guided Sherpa walk and, jet

boat/helicopter piggybacks). Some Stewart Island operators have adopted

packages deals such as the Stewart Island Multi-Saver and Birding Bonanza

(includes an Ulva Island Tour, Pelagic Bird Spotting and Kiwi Spotting).

Not

the silver bullet for Invercargill but it’s a wonderful advancement is

Transport World. A key strength of this activity is that it will be centrally

located, a multi-layered product and generally the overall experience will not

be too time consuming. It is worth noting that this is the first time

Invercargill will have an all-weather, commercial tourism product that is

commissionable. Entry and tours will be offered daily and will range from $25 -

$90 per person.

Experiences

such as Tussock Country Glamping provide a new direction and opportunity for

the region as they offer “experiential accommodation”. It’s

still as fairly unique experience and it’s rare to find throughout the

South Island. Positively for areas like The Catlins, Tussock Country Glamping

have the ability and flexibility to set up sites in places like Curio Bay. This

has been well received by some trade contacts who have been searching for

accommodation that can cater for that slightly higher level.

Opportunities

exist here in Southland – we have complementary attractions for a genuine

Southern New Zealand experience. For example activities like Transport World

will appeal to people who enjoy the Croydon Aircraft Museum or the Burt Munro

story. Curio Bay and its wildlife and geology complement the Tuatara and Stewart

Island. Our unique heritage is embellished with our variety of outstanding

foods. These opportunities do need development – particularly so they can

work from a trade perspective, as this is a recognised method (ask Dunedin and

Oamaru) to ensure that community gets a sustainable return from their unique

character.

|

Policy Review

Committee

26 August

2015

|

|

Southland Registration of Interest to Ministry of

Business, Innovation and Employment - Ultra Fast Broadband 2, Rural

Broadband Initiative 2 and Mobile Blackspot Fund

Record No: R/15/8/13374

Author: Stephen

Canny, Group Manager Enterprise & Strategic Projects

Approved by: Rex Capil,

Group Manager, Policy and Community

☐

Decision ☐ Recommendation ☒ Information

SUMMARY OF REPORT

1. Venture

Southland prepared and submitted on 10 July 2015 a response to the

Government’s Request for Proposal for the Rural Broadband (RBI) 2, Ultra

Fast Broadband (UFB) 2 and Mobile Blackspot Fund (MBSF). The report provides an

overview of the state of internet and mobile telecommunications revealed

through the consultation process and the two bids submitted.

REPORT

2. Ministry of

Business, Innovation and Employment (MBIE) has asked for Registration of

Interest from all Local Authorities for the second stage of Ultra Fast

Broadband (UFB2), the second stage of the Rural Broadband Initiative (RBI2) and

the new Mobile Blackspot Fund, to be submitted 10 July 2015.

3. The

Government has set aside the following funds for this project:

· UFB2

- $152 million to $210 million

· RB1

- $100 million

· Mobile

Blackspot Fund - $50 million

4. The Mayors

and Chief Executives of Invercargill City Council, Southland District Council

and Gore District Council have all agreed that a joint Southland bid is an

appropriate response and asked Venture Southland to coordinate this bid. All

three Councils have agreed to support the project by facilitating public

awareness, access to Infrastructure planning and Consent information.

Internet and Mobile Services in Southland

5. An overview

of the consultation process is outlined in the Preamble to the Compliant Bid

and the key findings are outlined in the Executive Summary of the Compliant

Bid, both of which are attached.

6. There are

significant technical and operational issues which need to be addressed in

Southland:

· Basic phone

services are failing in some areas with serious health and safety issues where

111 cannot be reached. In some areas like the Wyndham vicinity landlines

are failing due to copper degradation; at the same time there is no mobile

coverage so residents are being left without any way to communicate in the

event of an emergency.

· Mobile coverage

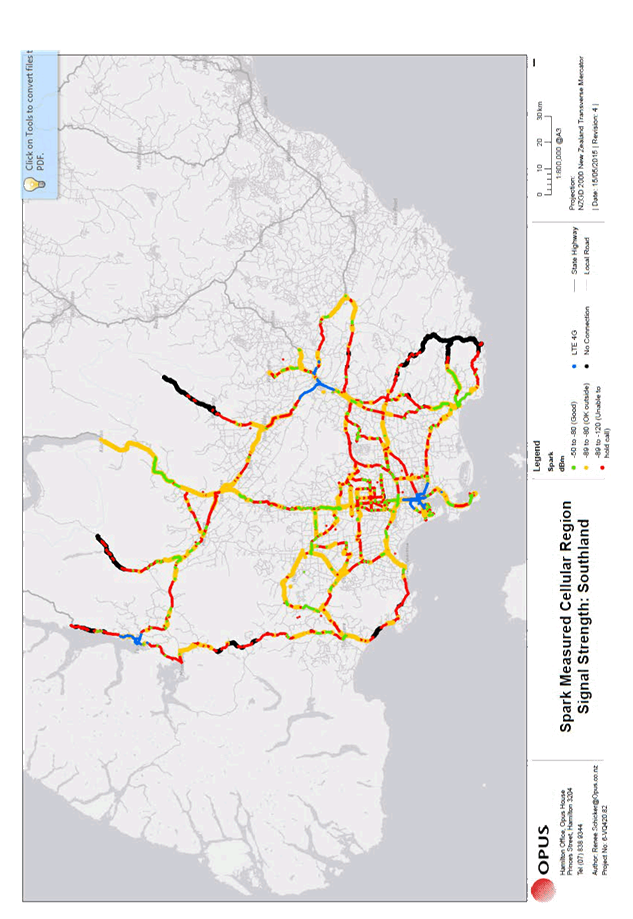

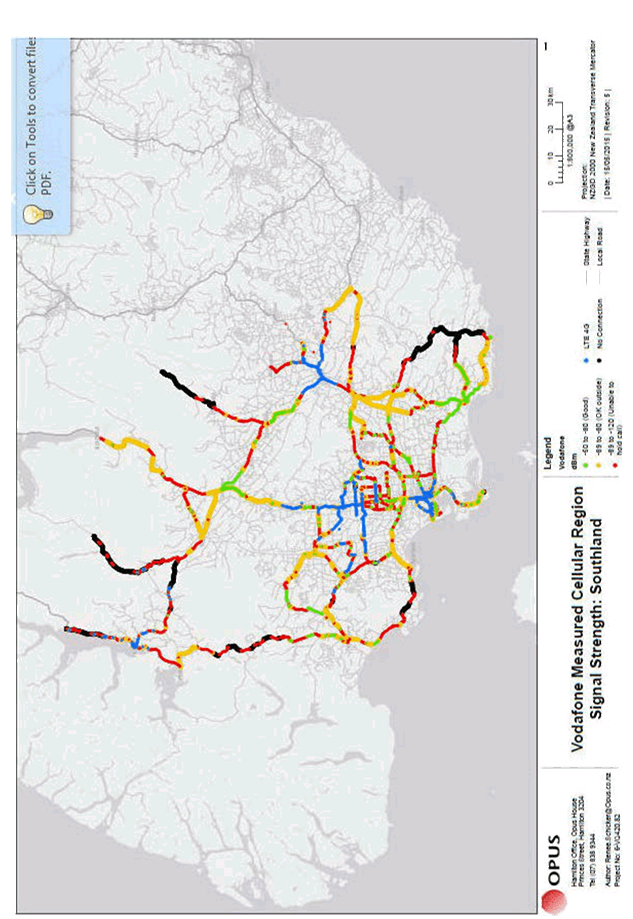

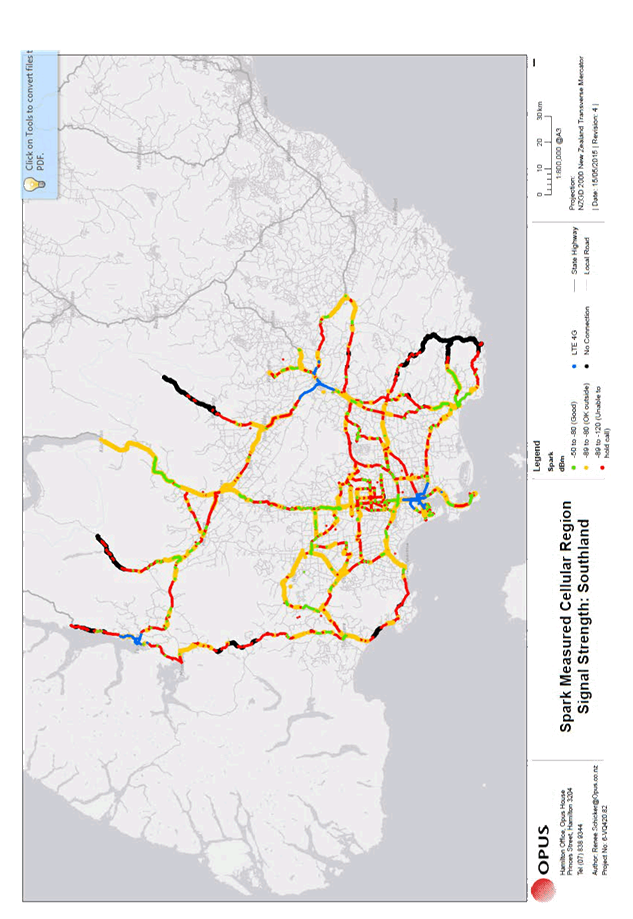

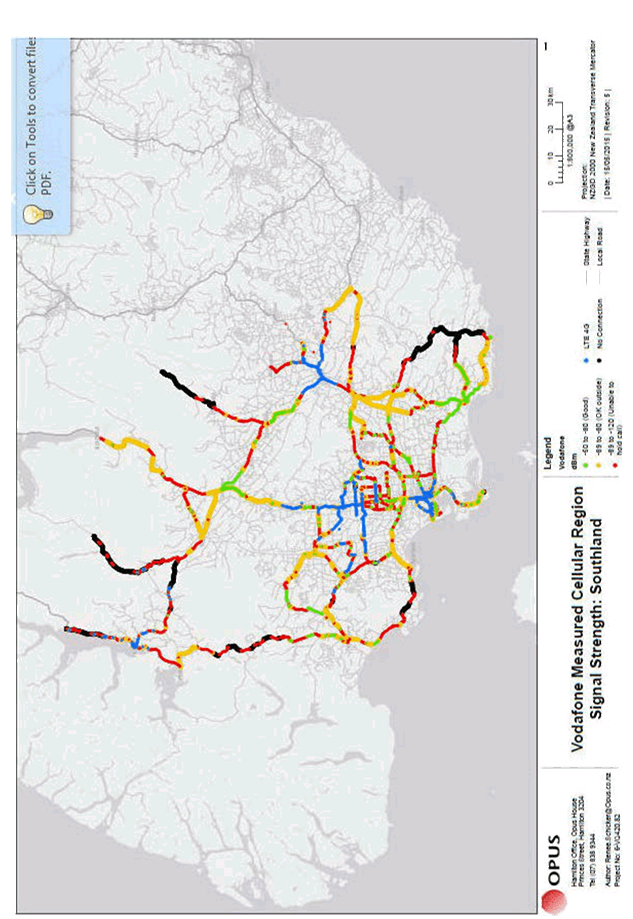

across Southland’s State Highway network, as measured in early May by

Opus, does not reflect official network coverage reports provided by the

Telecommunication companies. Many areas are without service. Business

travellers and tourists are frequently left without service even in areas where

coverage is available due to the lack of provision for roaming across networks.

· Take up of Ultra

Fast Broadband where it is available in Invercargill is low in part due to

confusion over how to access services – 75% are aware of UFB; 45% would

like to access fibre but don’t know how. This is compounded by reports

from businesses and others of long delays before connection and poor service

which appears to be linked to the complex relationship between Spark, Vodafone,

Chorus and their sub-contractors.

· Rural satisfaction

with Internet is low – 39% of people in rural areas believe their

internet is slow or unreliable. Satisfaction with RBI is even lower –

only 4% of people have noticed any improvement in their service. This is

not surprising when the service requirements laid out in the contract Vodafone

has with Central Government are considered. The basic requirement is only

40 – 45 kbps average speed within a 15 minute period. This speed is

only a little faster than dial up. User comments report experiences in

line with this, with some saying that dial up was more reliable.

· There is

widespread frustration due to poor information provided to customers.

Many in rural areas know that schools have received fibre or that fibre has

been laid down highway adjacent to their property and do not understand why

they cannot access this service. The way in which cable was laid means that

this is not possible. Customers in both rural and urban areas report that they

cannot get response to faults or are experiencing poor service, with providers

such as Spark and Vodafone giving feedback that the issue is with Chorus.

Chorus does not respond to retail customer queries; indeed it is nearly

impossible to find a number on which to contact them.

· It is Venture

Southland’s conclusion that there is a need for a strategic plan and

unified advocacy to improve services in the Southland region which includes:

- Critical appraisal of the

future network architectures and network development strategy that are being

proposed for the region and funded via the ‘UFB2/ RBI2/ MOBILE BLACKSPOT

FUND’

- Adoption of contemporary

(2015) network performance standards

- Independent verification

of network coverage and performance

- Deployment of wireless

and mobile technologies which are contemporary ‘standards based’

and support a future proofed technology migration and integration pathways

- Mandated roaming across

Mobile networks

- Completion of RBI1 and

UFB1 commitments to 2015 standards

- Review and update of

existing service contracts to reflect the points raised in items 1 – 5

above.

Registrations of Interest

7. Comprehensive

Registrations of Interest (ROI) were completed on 8 July. The ROI was made up

of two main parts; a 600 page Compliant Bid and a 100 page Alternative Bid

which was submitted as a companion document.

8. Key

defining features of the Compliant Bid and the Alternative Bid is as follows:

· The Compliant Bid:

focuses on a commitment to improving services in Southland as well as

development of new Fibre optic cable services, Wireless Broadband and

additional Mobile services within a central government lead framework and

process.

· The Alternative Bid:

focuses on a regionally lead deployment of services focused on a strategic

investment in the enduring elements of the broadband and mobile infrastructure.

It promotes the continual deployment of region-wide fibre optic cable; to

replace the aging copper network and investment in hilltop towers; both of

which are 50year plus pieces of infrastructure. This approach will provide an

enduring infrastructure platform for the future which will not require further

investment for many decades.

9. Both bids

promote seamless mobile service roaming in the rural areas of Southland as well

as a priority commitment to the completion of the Rural Broadband Initiative

and Urban Fibre Network deployment as part of Phase 1 deployment commitment

announced in 2013. The ROI bids also promote improvement in

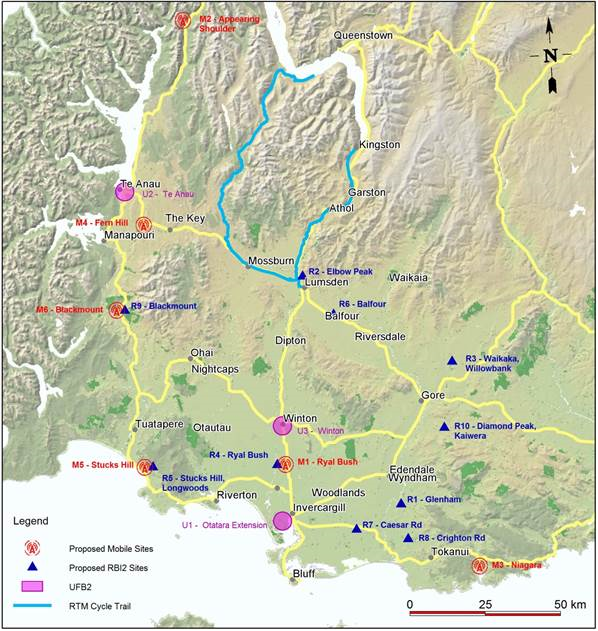

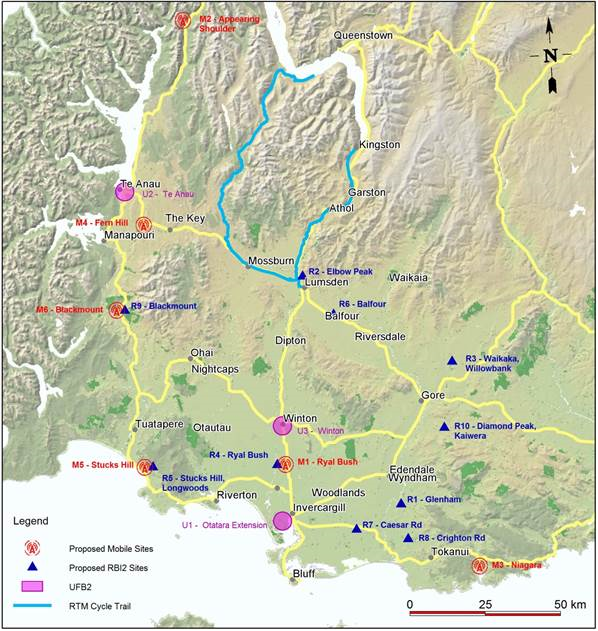

services in the areas shown below.

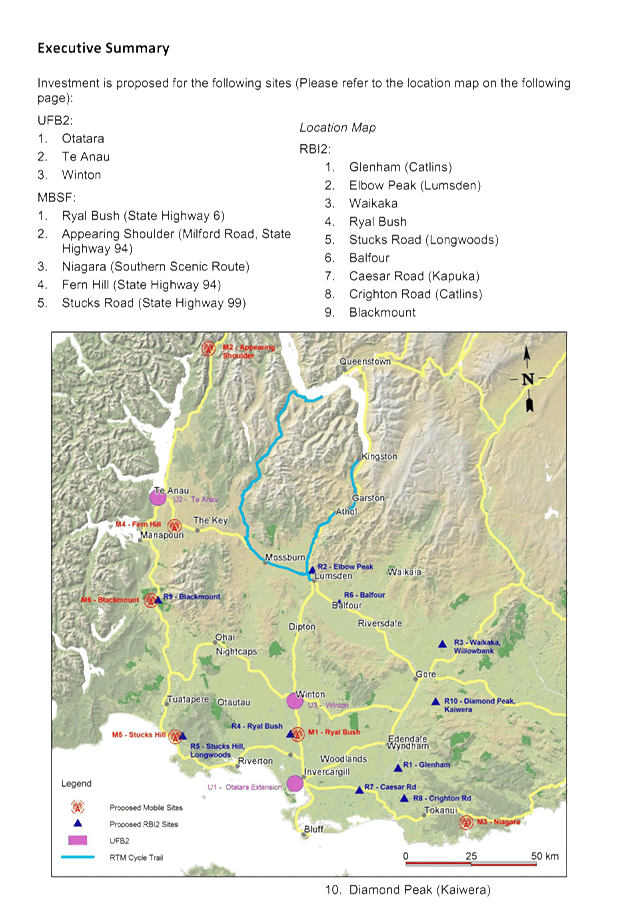

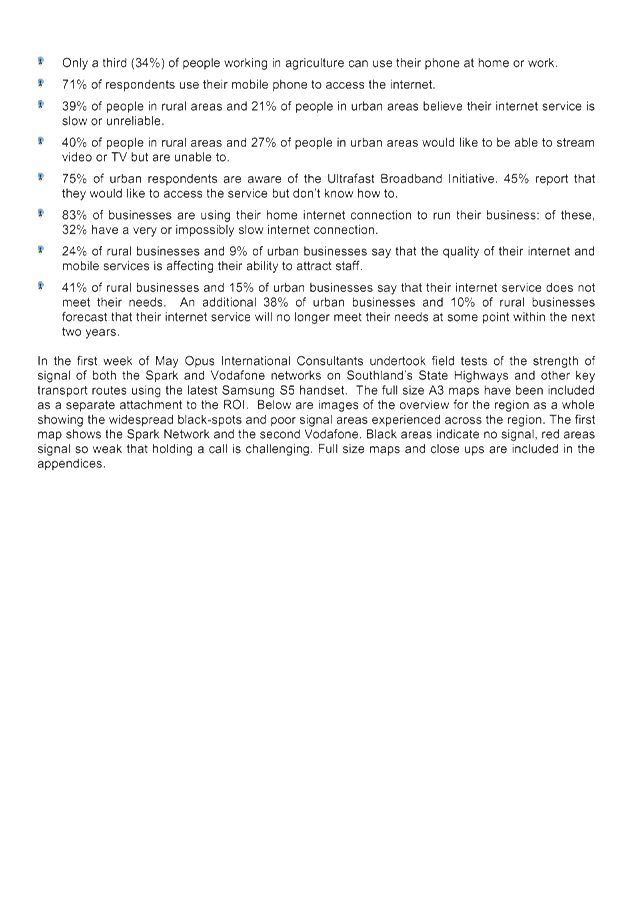

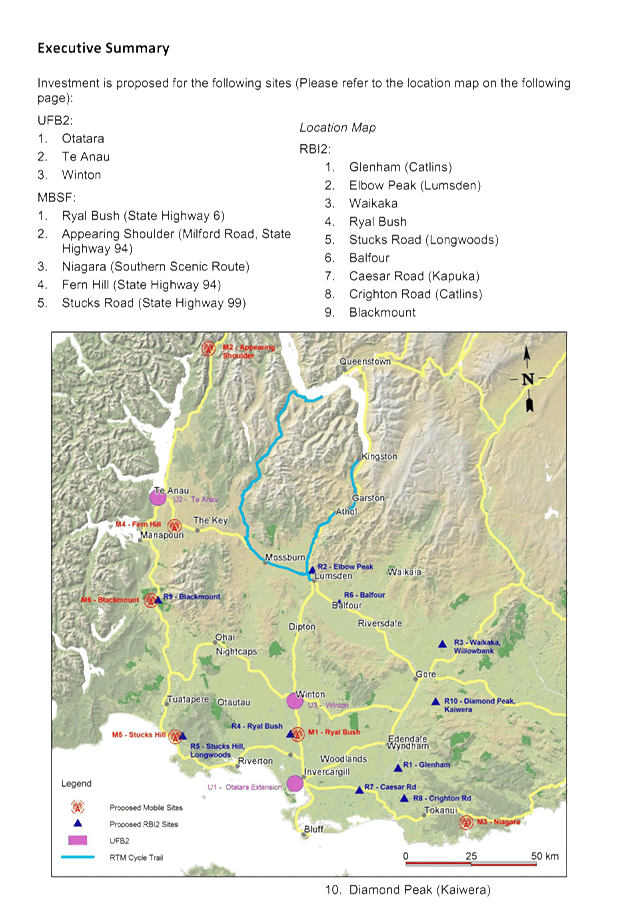

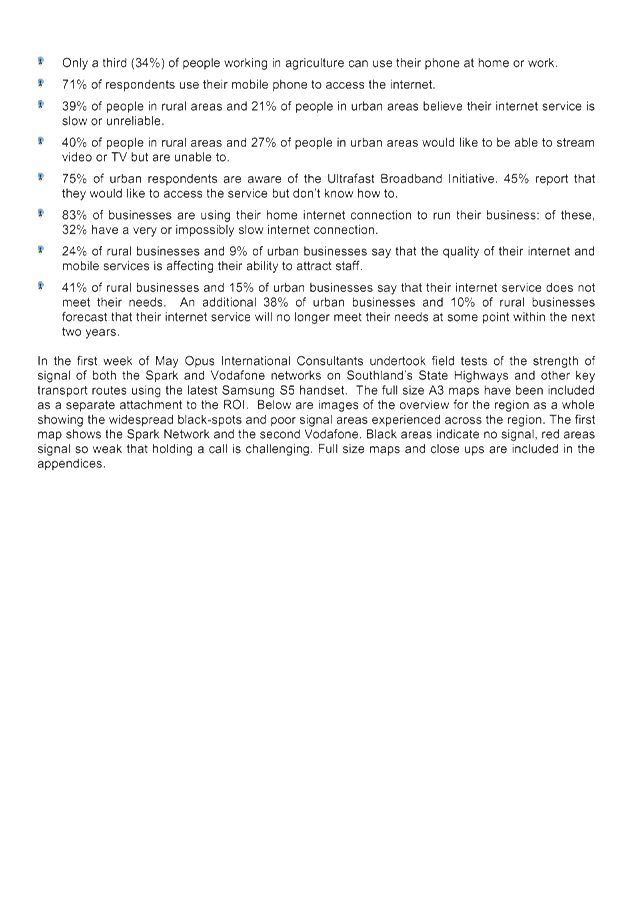

10. Investment is proposed

for the following sites (Please refer to the location map on the following

page):

Urban

Fibre UFB2:

1. Otatara

2. Te

Anau

3. Winton

Rural

Broadband RBI2:

1. Glenham

(Catlins)

2. Elbow

Peak (Lumsden)

3. Waikaka

4. Ryal

Bush

5. Stucks

Road (Longwoods)

6. Balfour

7. Caesar

Road (Kapuka)

8. Crighton

Road (Catlins)

9. Blackmount

10. Diamond

Peak (Kaiwera)

Mobile

Black Spots MBSF:

1. Ryal

Bush (State Highway 6)

2. Appearing

Shoulder (Milford Road, State Highway 94)

3. Niagara

(Southern Scenic Route)

4. Fern

Hill (State Highway 94)

5. Stucks

Road (State Highway 99)

6. Blackmount

(State Highway 99)

11. Letters of support

were provided by the following:

· SDC – Gary Tong (Mayor),

Steve Ruru (CEO)

· ICC – Tim Shadbolt

(Mayor), Richard King (CEO)

· GDC – Tracy Hicks

(Mayor), Stephen Parry (CEO)

· Sarah Dowie – Member of

Parliament for Invercargill

· Todd Barclay - Member of

Parliament for Clutha-Southland

· Ria Bond – NZ First List

Member of Parliament based in Invercargill

Community Support Letters

12. Over 90 letters of

support were received from residents and businesses throughout the region.

13. Venture Southland

staff wish to acknowledge the tremendous support and the positive collaboration

that has been received from local politicians, businesses, residents,

land owners and Councils towards the preparation of the Registration of

Interest and it is hoped that this region-wide effort and the quality of the

technical submission is recognised by the MBIE review team.

14. Venture Southland is

currently reviewing and updating the operative Southland Digital Strategy to

reflect the feedback that has been received from the ROI consultation and

digital survey processes. It is expected that this review work will be

completed by the 28th of August 2015.

15. It is suggested that

Venture Southland convene a Regional Steering Group made up of Council,

community and business representatives, to oversee the further development of

the project once the overall process and timeframes are known. The proposed

make-up of the Steering Group; if supported would be the subject of a future

report to the Joint Committee.

16. Further updates will

be provided as the bid evaluation process advances.

|

Recommendation

That the Policy

Review Committee:

a) Receives

the report titled “Southland Registration of Interest to Ministry of

Business, Innovation and Employment - Ultra Fast Broadband 2, Rural

Broadband Initiative 2 and Mobile Blackspot Fund” dated 19 August 2015.

|

Attachments

a Compliant

Bid - Preamble and Executive Summary and Alternative Bid - Executive Summary View

|

Policy Review

Committee

|

26 August 2015

|