Notice is hereby given that a Meeting of

the Activities Performance Audit Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Wednesday, 9

March 2016

10.30am

Council Chambers

15 Forth Street, Invercargill

|

|

Activities Performance Audit Committee Agenda

OPEN

|

MEMBERSHIP

|

Chairperson

|

Lyall Bailey

|

|

|

Mayor

|

Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

|

Chief Executive

|

Steve Ruru

|

|

|

Committee Advisor

|

Alyson Hamilton

|

|

Terms of

Reference for the Activities Performance Audit Committee

This committee is a committee of Southland

District Council and has responsibility to:

·

Monitor and review Council’s performance

against the 10 Year Plan

·

Examine, review and recommend changes relating

to Council’s Levels of Services.

·

Monitor and review Council’s financial

ability to deliver its plans,

·

Monitor and review Council’s risk

management policy, systems and reporting measures

·

Monitor the return on all Council’s

investments

·

Monitor and track Council contracts and

compliance with contractual specifications

·

Review and recommend policies on rating, loans,

funding and purchasing.

·

Review and recommend policy on and to monitor

the performance of any Council Controlled Trading Organisations and Council

Controlled Organisations

·

Review arrangements for the annual external

audit

·

Review and recommend to Council the completed

financial statements be approved

·

Approve contracts for work, services or supplies

in excess of $200,000.

|

Activities Performance Audit Committee

09 March 2016

|

|

TABLE OF

CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of

Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Minutes 5

Reports

7.1 Submission

on Proposed changes to Vehicle Dimensions and Mass Rule 13

7.2 Contract

Extension - Southland Streetlight Maintenance Contract 09/42 33

7.3 Foveaux

Alliance Contract Number 06/26 Extension to July 2017 37

7.4 Annual

Report 2015/2016 Timetable 41

7.5 Financial

Report for the period ended 30 November 2015 47

7.6 Financial

Report for the period ended 31 December 2015 81

7.7 Internal

Audit 115

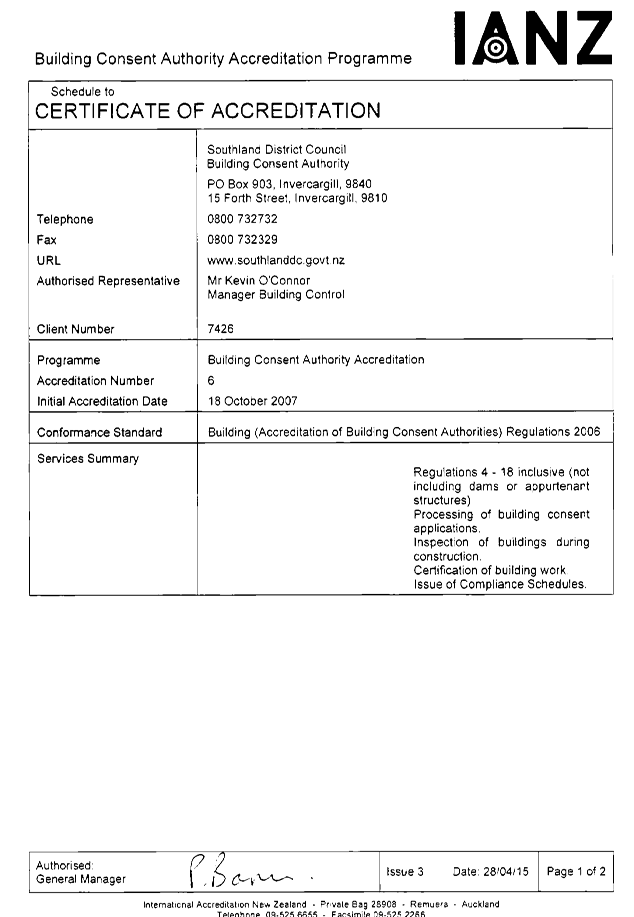

7.8 Follow-up

on Strong Recommendations and Recommendations from 2015 IANZ Reaccreditation

Audit of Southland District Council 135

7.9 Southland

Museum and Art Gallery Quarterly Report Against Statement of Intent 145

1 Apologies

At the close of

the agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Committee Members

are reminded of the need to be vigilant to stand aside from decision-making

when a conflict arises between their role as a member and any private or other

external interest they might have.

4 Public Forum

Notification to

speak is required by 5pm at least two days before the meeting. Further

information is available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the committee

to consider any further items which do not appear on

the Agenda of this meeting and/or the meeting to be held with the public

excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i)

The reason why the item was not on the Agenda,

and

(ii) The reason why the

discussion of this item cannot be delayed until a subsequent meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a) That

item may be discussed at that meeting if-

(i) That item is a minor

matter relating to the general business of the local authority; and

(ii) the presiding member

explains at the beginning of the meeting, at a time when it is open to the

public, that the item will be discussed at the meeting; but

(b)

no resolution, decision or recommendation may be

made in respect of that item except to refer that item to a subsequent meeting

of the local authority for further discussion.”

6 Confirmation

of Minutes

6.1 Meeting minutes of Activities

Performance Audit Committee, 27 January 2016

|

Activities Performance Audit Committee

OPEN MINUTES

|

Minutes of

a meeting of Activities Performance Audit Committee held in the Council

Chambers, 15 Forth Street, Invercargill on Wednesday, 27 January 2016 at

10.35am.

present

|

Chairperson

|

Lyall Bailey

|

|

|

Mayor

|

Gary Tong

|

|

|

Councillors

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

Rodney Dobson

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

arrived @10.40am

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

Chief Executive, Steve Ruru, Group Manager Environment and Community, Bruce Halligan, Group

Manager Services and Assets, Ian Marshall, Group Manager Policy and Community,

Rex Capil, Chief Information Officer, Damon Campbell, Chief Financial Officer,

Anne Robson, Manager Human Resources, Janet Ellis, Manager Communications and

Governance, Louise Pagan, Web Officer, Governance and

Communication, Sarah Bedford, Committee Advisor, Alyson Hamilton, Press.

1 Apologies

|

Moved Cr Ford, seconded Cr Paterson and resolved:

That the apology for lateness lodged by Cr Kremer be accepted.

|

2 Leave

of absence

There were no

requests for leave of absence received.

3 Conflict

of Interest

There were no conflicts of interest declared.

4 Public

Forum

There were no

members of the public seeking speaking rights in the Public Forum section of

the meeting.

5 Extraordinary/Urgent

Items

There were no Extraordinary/Urgent

items.

6 Confirmation

of Minutes

|

Resolution

Moved Cr

McPherson, seconded Cr Douglas and resolved:

That the

minutes of the Activities Performance Audit Committee meeting held on 9

December 2015 be confirmed as a true and correct record.

|

7 Reports

|

7.1

|

Service

Delivery Review - Community Development Activity

Record No: R/16/1/57

|

|

|

Report by Rex Capil, Group Manager, Policy and Community,

regarding a Service Delivery Review (SDR) in regards to Community Development

Activity, was tabled.

Group Manager, Policy and Community, Rex Capil was in attendance

for this item.

Mr Capil presented to the Committee a power point presentation in

regards to the SDR explaining the Economic and Community Development.

1 Mr

Capil advised the purpose of this report is to provide the Committee with

background information on the process and rationale for the (SDR) of the

community development activity to be undertaken in terms of Section 17A of

the Local Government Act 2002.

2 Mr

Capil informed for the purpose of this SDR the community development activity

of Council incorporates regional economic development, enterprise and

business development, events and conferences, tourism and destination

marketing and local community development.

3 Mr

Capil explained this community development activity is defined and detailed

in the Southland District Council 10 Year Plan 2015-2025 and is delivered on

behalf of Council by Venture Southland - a joint committee of Southland

District Council, Invercargill City Council and Gore District Council.

4 The

meeting was informed the report discusses the requirements of the Local

Government Act 2002 under Section 17A to carry out a delivery of service

review.

5 Mr

Capil explained the terms of reference discusses the current situation and

future challenges and opportunities for Council when considering its

involvement in the community development activity.

In addition Mr Capil advised the terms of reference

provides details of the specific deliverables required as a result of

undertaking the delivery of service review - in terms of a comparative

analysis of the current service delivery model and consideration of future

service delivery options for Council’s community development activity.

Mr Capil informed that whilst reviews required to be

completed by June 2017 implementation may require further time with regional

leadership roles to be clarified.

Mr Capil advised that going forward it is intended to

initiate discussions with Invercargill City Council, Gore District Council

and Environment Southland to invite discussion on this SDR process and to

meet with Venture Southland to confirm the process and involvement required.

|

|

|

|

|

|

Resolution

Moved Cr Kremer, seconded Cr Duffy

and resolved:

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Service Delivery Review - Community Development

Activity” dated 18 January 2016.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Endorses

the draft Service Delivery Review Terms of Reference for

Community Development Activity to be undertaken in terms of Section 17A

of the Local Government Act 2002.

e) Endorses

the approach to invite Invercargill City Council, Gore District Council and

Environment Southland to partner in this Service Delivery Review process.

f) Endorses

the approach to require Venture Southland (as the joint committee of

Southland District Council, Invercargill City Council and Gore District

Council currently delivering the community development activity) to

participate in the Service Delivery Review process.

g) Requests

Council support a formal approach be made to Invercargill City Council, Gore

District Council and Environment Southland to undertake a joint Service

Delivery Review process involving all four councils.

h) Requests

to Council that, subject to this joint approach being undertaken, it supports

the terms of reference being amended accordingly to reflect this regional

approach in order to ensure consideration of regional level issues and

other local authorities’ specific local issues.

|

|

7.2

|

Formation

of Governance Group for the Around the Mountains Cycle Trail project

Record No: R/15/11/21263

|

|

|

Group Manager, Services &

Assets, Ian Marshall was in attendance for this item.

1 Mr

Marshall reported the purpose of this report is to establish a governance

group charged with overview of the completion of the Around the Mountains

Cycle Trail project.

2 Mr

Marshall advised this report to the Activities Performance Audit Committee

(APAC) recommends the formation of a project subcommittee. Mr Marshall

added what is proposed is a subcommittee to be called the Around the

Mountains Cycle Trail Project Subcommittee.

3 Mr

Marshall advised this subcommittee will perform the role of governance oversight

on behalf of the APAC Committee for the Around the Mountains Cycle Trail

Project.

The Committee noted the project

covers the work necessary to complete the cycle trail from Kingston to Walter

Peak Station.

4 Mr

Marshall explained the subcommittee will approve procurement plans, let

contracts and provide overall direction of the project; ensure the project

stays on-time and within approved budgets.

5 Mr

Marshall confirmed the overall budget will be approved by the Southland

District Council and that the subcommittee will act as a conduit for communication

and consultation.

6 Mr

Marshall advised it is proposed the subcommittee include the Chairman of the

APAC committee, who will Chair the subcommittee, the Mayor and four District

Council Councillors.

Cr Baird commented at the need

for this subcommittee stating that he felt there is currently a Around the

Mountains Cycle Trail project team and wished it noted that he does not

support the establishment of the subcommittee.

|

|

|

|

|

|

Resolution

Moved Mayor Tong, seconded Cr Douglas

and resolved:

That the Activities Performance Audit Committee:

a) Receives

the report titled “Formation of Governance Group for the Around the

Mountains Cycle Trail project” dated 13 January 2016.

b) Determines

that this matter or decision be recognised not significant in

terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Adopt

the Terms of Reference for the formation of an Around the Mountains Cycle Trail

Project Subcommittee.

e) Appoints

the Chairman of the Activities Performance Audit Committee as a member and

Chairman, of the Around the Mountains Cycle Trail Project Subcommittee.

f) Appoints

his Worship the Mayor as a member of the Around the Mountains Cycle Trail

Project Subcommittee.

g) Appoints

Councillors Dobson, Duffy, Dillon and Kremer to be members of the Around the

Mountains Cycle Trail Project Subcommittee.

|

Cr Baird requested that his vote against

the motion be recorded in the minutes.

Public Excluded

Exclusion of the Public: Local Government Official Information and

Meetings Act 1987

|

Resolution

Moved Cr Ford, seconded Cr Dobson

That the public be excluded from the following part(s) of the

proceedings of this meeting.

C8.1 Tenders

and Costing for the Proposed Memorial Hall Upgrade at Winton

C8.2 Quarterly Risk Reports

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter, and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

|

General subject of each matter

to be considered

|

Reason for passing this

resolution in relation to each matter

|

Ground(s) under section

48(1) for the passing of this resolution

|

|

Tenders and Costing for

the Proposed Memorial Hall Upgrade at Winton

|

s7(2)(b)(ii) - The

withholding of the information is necessary to protect information where the

making available of the information would be likely unreasonably to prejudice

the commercial position of the person who supplied or who is the subject of

the information.

s7(2)(h) - The withholding

of the information is necessary to enable the local authority to carry out,

without prejudice or disadvantage, commercial activities..

|

That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding exists.

|

|

Quarterly Risk Reports

|

s7(2)(g) - The

withholding of the information is necessary to maintain legal professional

privilege.

s7(2)(h) - The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities..

|

That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding exists.

|

That the Chief Executive, Steve Ruru, Group Manager Environment and Community,

Bruce Halligan, Group Manager Services and Assets, Ian Marshall, Group Manager

Policy and Community, Rex Capil, Chief Information Officer, Damon Campbell, Chief

Financial Officer, Anne Robson, Manager Human Resources, Janet Ellis, Manager

Communications and Governance, Louise Pagan, Committee

Advisor, Alyson Hamilton be permitted to remain at this

meeting, after the public has been excluded, because of their knowledge of the

items C8.1Tenders and Costing for the Proposed

Memorial Hall Upgrade at Winton and C8.2 Quarterly Risk Reports This knowledge, which will be of assistance in relation to the

matters to be discussed, is relevant to those matters because of their

knowledge on the issues discussed and meeting procedure.

The public were

excluded at 10.50am

Resolutions in

relation to the confidential items are recorded in the confidential section of

these minutes and are not publicly available unless released here.

The meeting returned to open meeting at

11.28am.

The meeting concluded at 11.28am. CONFIRMED

AS A TRUE AND CORRECT RECORD AT A MEETING OF THE Activities Performance Audit Committee HELD ON 27 JANUARY

2016.

DATE:...................................................................

CHAIRPERSON:...................................................

|

Activities

Performance Audit Committee

9 March 2016

|

|

Submission

on Proposed changes to Vehicle Dimensions and Mass Rule

Record No: R/16/2/1514

Author: Joe

Bourque, Strategic Manager Transport

Approved by: Ian

Marshall, GM - Services and Assets

☐

Decision ☐ Recommendation ☒ Information

Summary

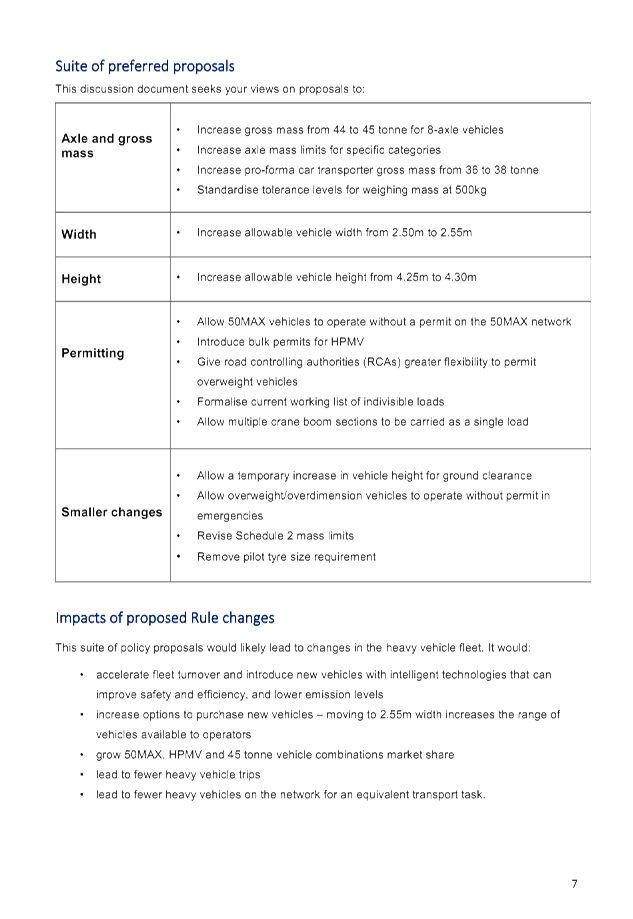

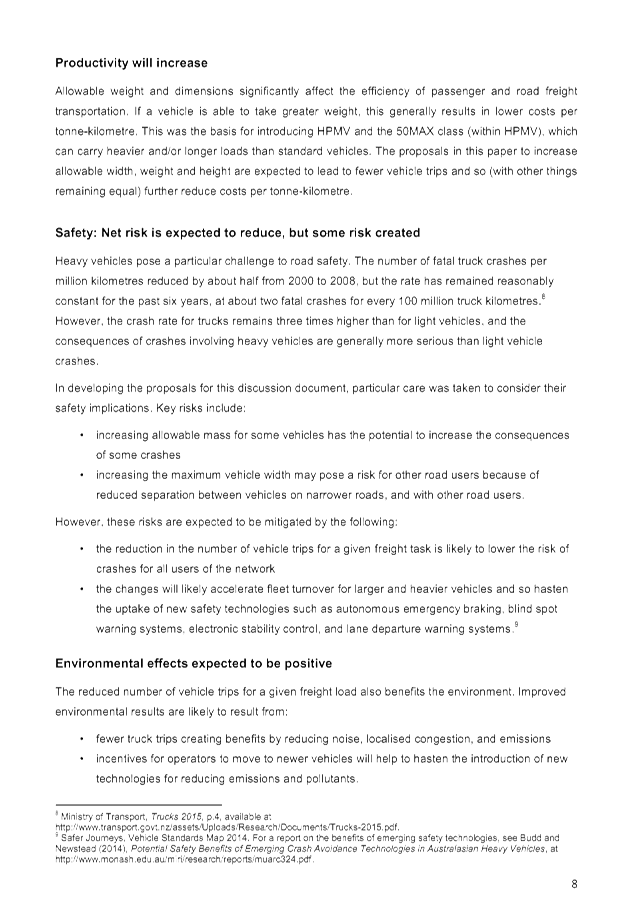

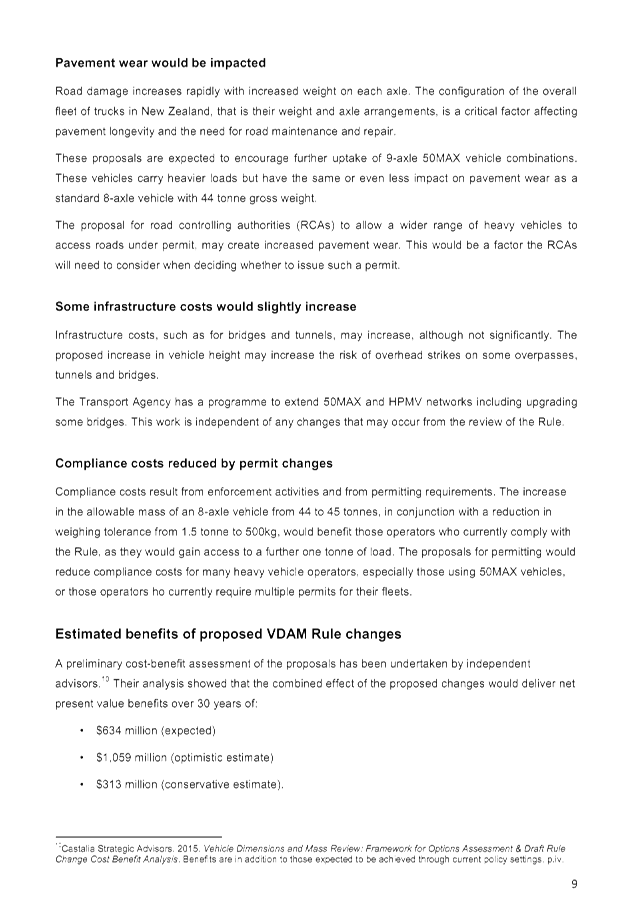

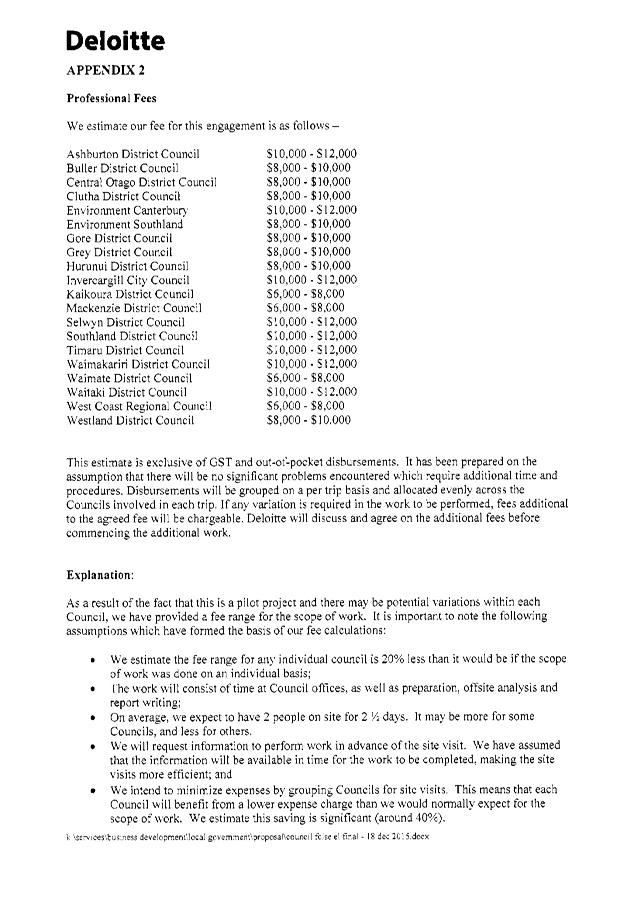

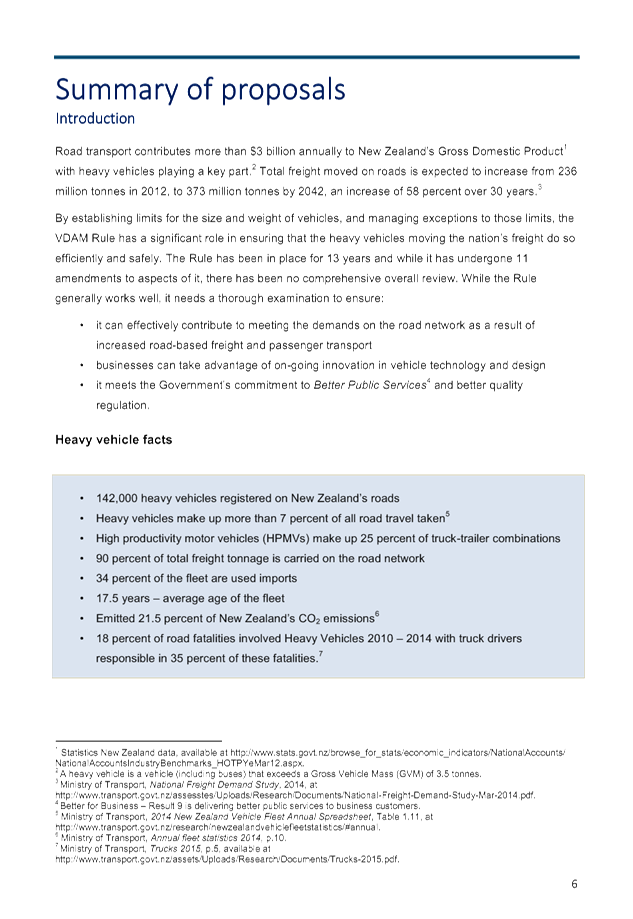

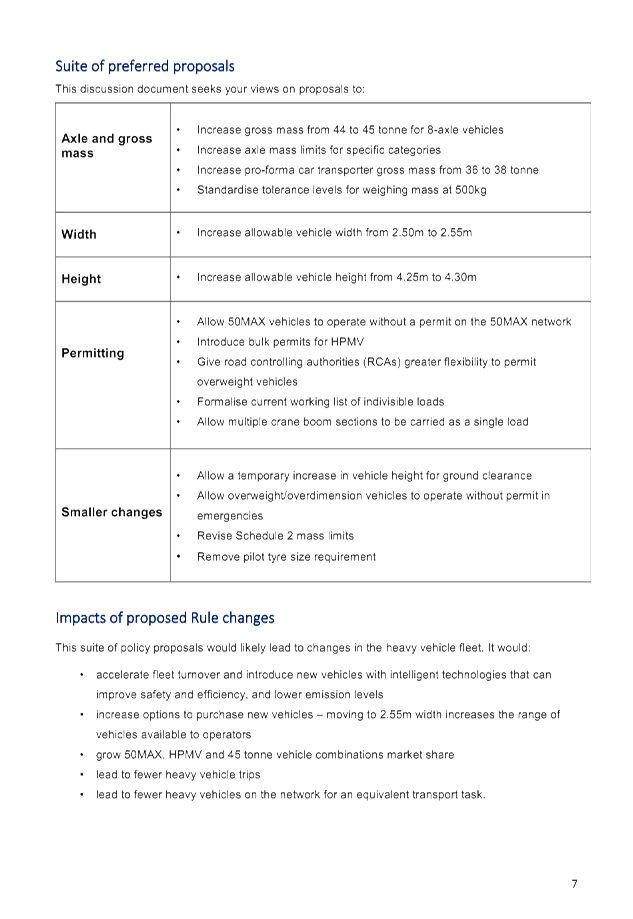

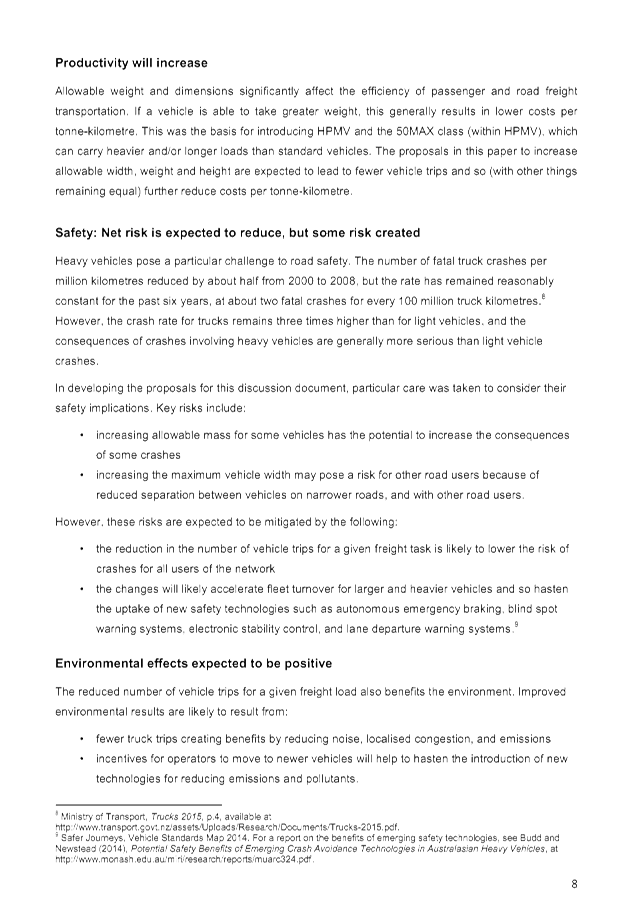

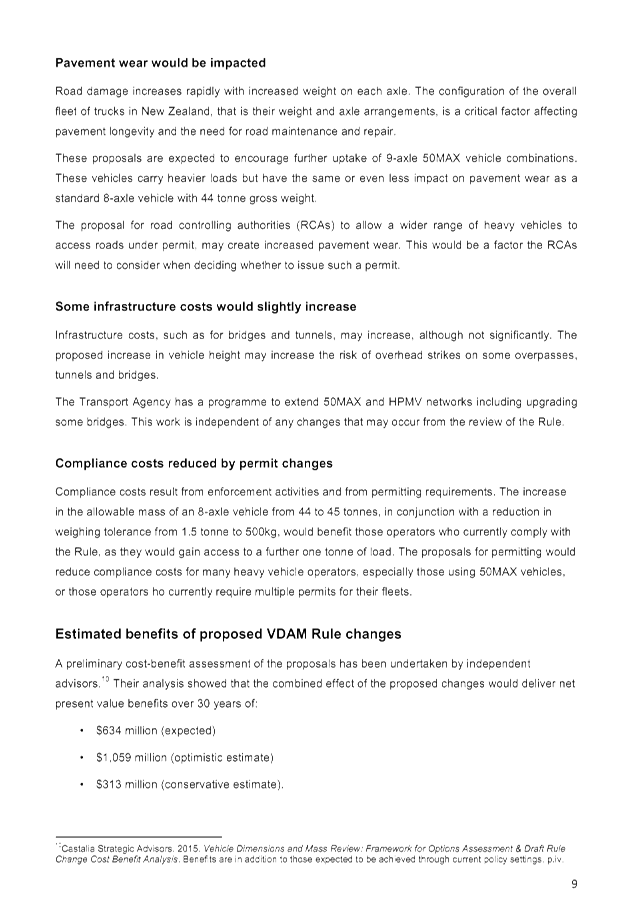

1 This

paper provides a summary of the proposed changes to the Land Transport Rule:

Vehicle Dimensions and Mass 2002 and provides the Activities Performance Audit

Committee (APAC) with a summary of the submission lodged with the New Zealand

Transport Agency. The submission supports some of the changes proposed but

opposes those which are expected to adversely impact on the Southland District

Council roading network.

Discussion

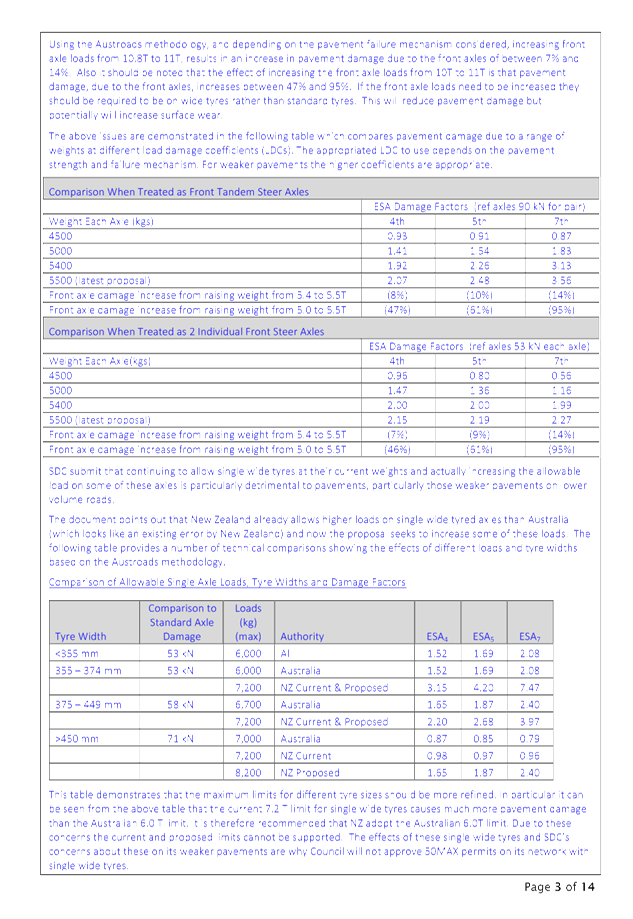

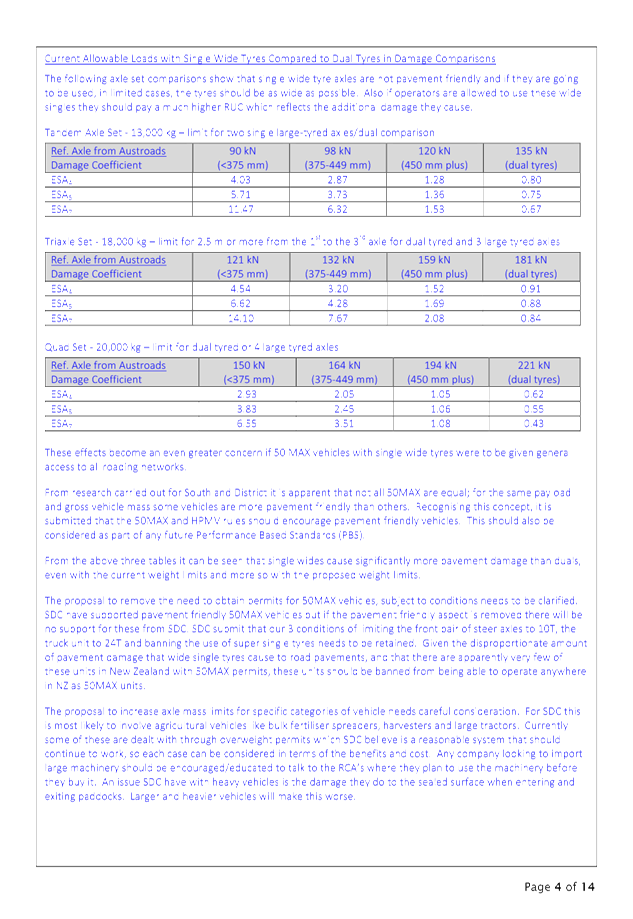

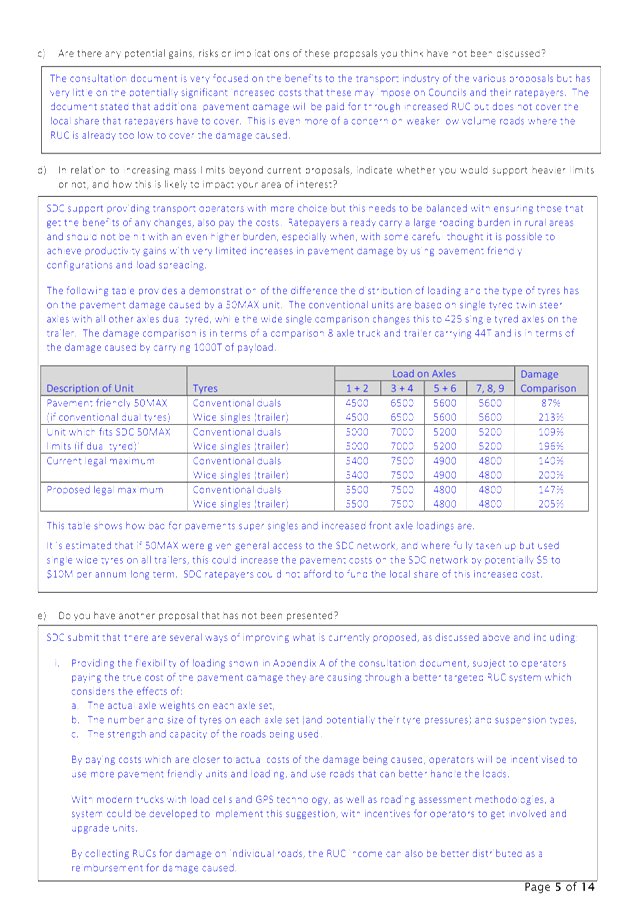

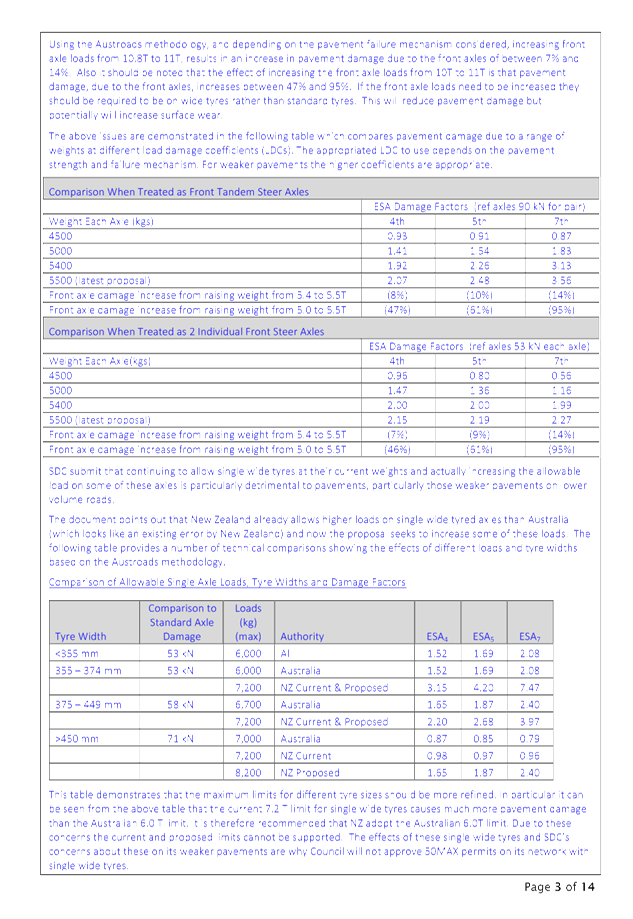

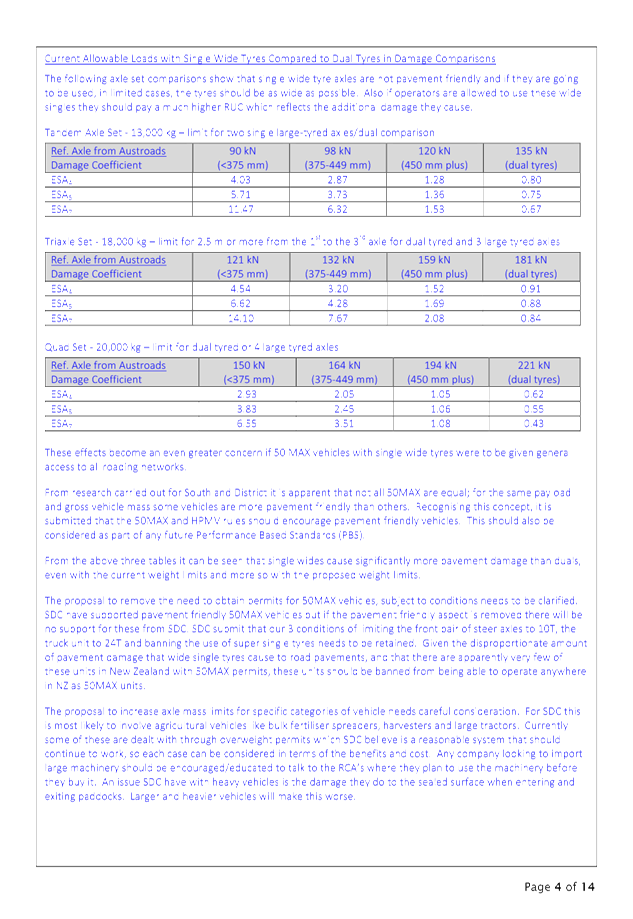

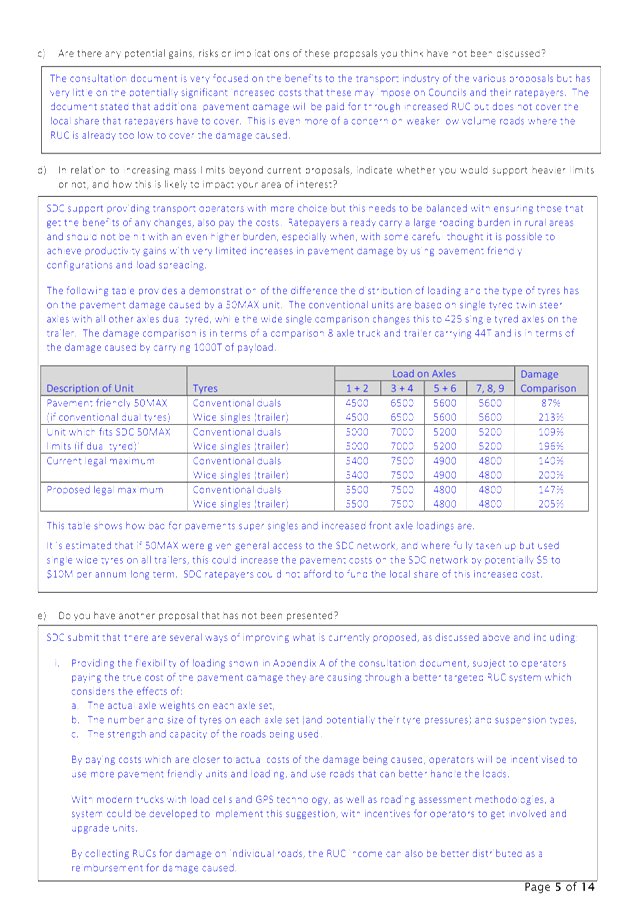

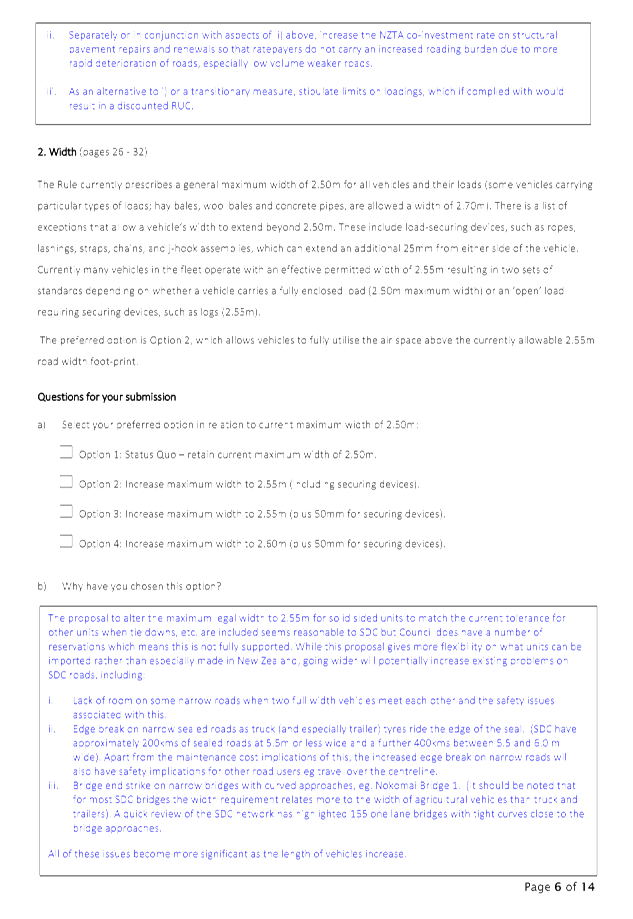

2 The

discussion document focuses on three main areas. These are the general

requirements for dimension and mass limits, permitting and access condition,

and management of overdimension loads.

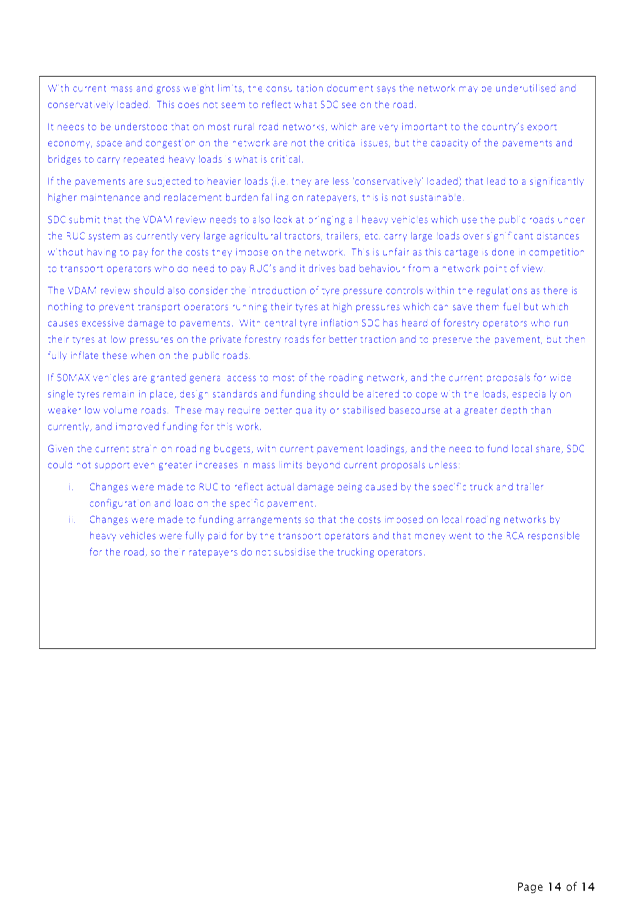

3 Southland

District Council generally support the aims of giving operators access to new,

safer, more efficient vehicles with hopefully better environmental and safety

outcomes.

4 However,

how this is done needs to be better balanced against the increased cost to Road

Controlling Authorities (RCA) as on local roads, Road User Charges (RUC) only

pay for half the damages, rate payers end up paying for the rest.

5 The

total cost and more specifically the cost to ratepayers in general is a

fundamental aspect not addressed by the consultation document.

6 The

submission drafted by the Transport Team supports some of the proposed changes

such as increase in vehicle height and reduction in weight tolerance around

enforcement from 1.5 Tonne to 500kg.

7 The

submission opposes the proposal on increasing the mass limits for front steer

axles from 10.8 Tonne to 11 Tonne as these already cause a disproportionate

amount of pavement damage.

8 The

submission also opposes the removal of 50MAX permitting without inclusion of

the standard SDC conditions. The submission does propose that this could be

reviewed provided there is an improved mechanism for more accurately collecting

and distributing RUC’s based on actual damage caused.

9 The

consultation paper does recognise the effect on weak roads and structures from

vehicles with higher axle mass. The effect on these roads may result in more

rapid failure of the pavement.

10 Attached

to the APAC report is a copy of the submission lodged by the Transport Team in

response to the proposed changes.

11 For

additional information, appended to the report is the summary section of the

discussion document however the full version is available online at www.transport.govt.nz/land/vdam/.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Submission on Proposed changes to Vehicle Dimensions

and Mass Rule” dated 25 February 2016.

b) Endorses

the submission on the Submission on Proposed changes to Vehicle Dimensions

and Mass Rule.

|

Attachments

a Vehicle

Dimensions and Mass Review Submission View

b VDAM

Rule Discussion Document Summary of Proposal View

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

9 March 2016

|

|

Contract Extension - Southland Streetlight Maintenance

Contract 09/42

Record No: R/16/2/1561

Author: Joe

Bourque, Strategic Manager Transport

Approved by: Ian

Marshall, GM - Services and Assets

☒

Decision ☐ Recommendation ☐ Information

Purpose

1 This

report is to consider the recommendation to extend the Southland District

Council’s Streetlight Maintenance Contact (09/42) with Council’s

current contractor.

Executive

Summary

2 The

purpose of the Southland District Council’s Streetlighting Contract

(09/42) is to cover all maintenance aspects of the street light and pole

network across the Southland region.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Contract Extension - Southland Streetlight

Maintenance Contract 09/42” dated 1 March 2016.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Approves

the extension of the Southland Streetlight Maintenance Contract 09/42

contract to Otago Power Services effective from 29 February 2016 to 1 March

2017.

|

Content

Background

3 Otago

Power Services was awarded the Southland District Council’s Streetlight

Maintenance Contract (09/42) on 28 January 2010 with a commencement date of 1

March 2010.

4 The

contract was for an initial period of three years (expiring 12.00 midnight, 28

February 2013). The contract made provision for a two-year rollover,

which was adopted in

March 2013.

5 The

two-year rollover expired at midnight 28 February 2015. A 12 month

extension of this contract was negotiated with the contractor and approved by

NZTA. This current extension will expire on 1 March 2016.

6 Throughout

the six year period to date, communication between Council and Otago Power

Services has been excellent. Where service delays were inevitable or on

the rare occasion timeframes could not be met, Council was notified accompanied

by a valid explanation.

7 Otago

Power Services has adequately delivered on the requirements as set out in the

contract and on this basis the Strategic Transport Department recommend the

implementation of a further 12 month extension.

8 Council

have been notified by Otago Power Services that they have been purchased by

Powernet Ltd. Otago Power Services will be amalgamated into the Powernet

business at the end of March 2016. It is expected this amalgamation will have

no effect to the service being provided.

Issues

9 There

are no significant issues to be considered.

Factors to Consider

Legal

and Statutory Requirements

10 No

unusual legal considerations are involved with this contract.

Community

Views

11 Considering

the nature and value of the contract works, no specific community views are

deemed to be necessary at this stage of the proposal.

Costs

and Funding

12 To

extend the contract by an additional year, the original contract base rates

will be adjusted in accordance with New Zealand Transport Agency’s Cost

Adjustments Factors, Table 1, Part 1 - Maintenance.

13 The

existing maintenance contract has an annual value of around $100,000 and covers

the general maintenance requirements of all street lights and poles (including

pedestrian lighting).

14 The

proposed costs associated with the extension fits within the Traffic Services

budget allocation within the overall roading programme. Co-funding from

NZTA will cover 53% of the cost with the remaining 47% coming from rates.

15 The New Zealand

Transport Agency have been sent a letter for their input on the proposed

contract extension, indications are that they are in agreeance with the

proposal.

Policy

Implications

16 There

are no substantive Policy or District Plan considerations relevant to this

matter.

Analysis

Options Considered

17 Council

has the following options to consider with streetlighting maintenance:

(a) Extend

existing streetlighting maintenance contract.

(b) Do

not extend existing streetlighting maintenance contract.

Analysis of Options

18 Option

1 - Extend existing streetlighting maintenance contract

|

Advantages

|

Disadvantages

|

|

· Allows

time to confirm funding for a Light Emitting Diode (LED) replacement

programme from NZTA. LED’s offer significant savings in consumption and

maintenance costs compared to current lighting technology on the SDC

network.

· Allows

time to investigate the current LED market as to what products are suitable

for the SDC network. This would allow time to monitor how larger

Council streetlighting networks are adapting to the LED change and piggyback

ideas onto the smaller SDC network.

· Allows

the opportunity for SDC to combine an LED replacement programme into a future

maintenance contract which may result in savings.

|

· There

are no significant disadvantages to this proposed option.

|

19 Option 2 -

Do not extend existing streetlighting maintenance contract

|

Advantages

|

Disadvantages

|

|

· There

are no significant advantages to this proposed option based on a limited term

contract.

|

· Leaves

Council with no maintenance contractor for streetlighting after 1 March 2016.

· Does

not provide any time to confirm funding from NZTA for an LED replacement

programme.

· Does

not allow time to investigate current LED market to determine best products

for SDC network.

· Does

not allow time for Council to evaluate how Council’s with larger

lighting networks have undertaken replacement programmes.

|

Assessment of Significance

20 The

recommendation is not considered significant as the contract forms part of the

annual SDC roading programme.

Recommended

Option

21 The

Strategic Transport Department recommend that the current Southland

Streetlighting Maintenance Contract (09/42) is to be extended a further 12

months, allowing sufficient time to incorporate funding and supply of LED

technology into any future maintenance contract.

Next

Steps

22 Formally

notify the existing contractor (Otago Power Services) that extension has been

accepted.

23 Strategic

Transport Department will continue working towards future maintenance contract

and LED replacement options ready for a new contract to commence in March 2017.

Attachments

There are no attachments for

this report.

|

Activities

Performance Audit Committee

9 March 2016

|

|

Foveaux Alliance Contract Number 06/26 Extension to

July 2017

Record No: R/16/1/1386

Author: Joe

Bourque, Strategic Manager Transport

Approved by: Ian Marshall,

GM - Services and Assets

☒

Decision ☐ Recommendation ☐ Information

Purpose

1 To

request a one year extension of the current Foveaux Road Maintenance Alliance

Contract (number 06/26).

Executive

Summary

2 This

report outlines the recommendation to offer Fulton Hogan a one year extension

on the current Foveaux Alliance Contract and aligning the contract expire dates

of all three Alliance Maintenance Contracts.

3 This

will create the opportunity to potentially reduce the number of contracts from

three to two and allow due consideration of potential contract boundaries.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Foveaux Alliance Contract Number 06/26 Extension to

July 2017” dated 25 February 2016.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Approves

the one year extension of contract number 06/26, known as the Foveaux

Alliance contract with Fulton Hogan effective from 1 July 2016.

|

Content

Background

4 The

Foveaux Alliance was one of the first contracts of its type in New Zealand. The

agreement is due to expire on 30 June 2016.

5 The

contract was extended to June 2016 to allow for the completion of the service

level review as outlined in the Local Government Act (Section 17A).

The review was carried out by

independent consultants Morrison Low and reported back to the Activities

Performance Audit Committee in October 2015.

6 The

performance overview concludes “Actual service deliver performance is of

a high standard and providing a very good value for money’.

7 In

addition to the above review Morrison Low was engaged to carry out a review on

optimisation of roading contracts.

8 One

of the conclusions of the review is to consider the potential to reduce the

number of road maintenance contracts from three to two, to provide the maximum

advantage to SDC in reducing and streamlining governance and management while

maintaining the opportunity for a viable road maintenance market to continue to

exist.

9 As

part of this change the Strategic Transport Team will need to consider and

optimise the boundary for any new contracts.

Issues

10 The

nature and timing of the Service Level Review has resulted in an insufficient

time frame to consider the recommendation and implement potential changes in a

timely manner which would not unduly impact on the road service delivery.

11 Alignment

of Contract expiry dates needs to be considered to allow changing the scope of

the contracts and so facilitating a potential reduction in the number of

roading contracts from three to two.

12 A

short term contract could be tendered but the cost of a contract procurement

process for this type of contract is in the order of $100,000

Factors to Consider

Legal

and Statutory Requirements

13 No

unusual legal considerations are involved.

14 As

with all services procured, but larger value projects in particular, there is

the risk of a legal challenge regarding the awarding or extension of contracts

from other contractors.

15 This

risk is considered low because of the factors already discussed above.

Community

Views

16 No

Specific community views have been sought at this point in time.

Costs

and Funding

17 The

programme of works forms part of the overall roading programme for 2016/2017

season and fits within the Annual Plan programme.

Policy

Implications

18 Councils

Strategic Transport has notified our intensions and received approval from our

programme Investors NZTA and Council’s Alliance Contract Leadership Team.

19 Strategic

Transport has also considered Council’s current procurement Strategy as

well as its transport Strategy and considered this is the best interim

solution.

Analysis

Options Considered

20 New

Contract

21 Extend

contract by an additional one year

Analysis of Options

Option

1 – New Contract

|

Advantages

|

Disadvantages

|

|

· Provides

more long term certainty to the contractors on forward workloads.

· Allows

the contractor to make capital investment such as plant.

|

· Removes

the options to consider and implement changes recommended from Morrison Low

review.

· NZTA

Network Outcome Contract starting on 1 June 2016 potentially places a risk of

reduced competitive tendering from the market.

|

Option

2 – Extend Contract

|

Advantages

|

Disadvantages

|

|

· Allows

for due consideration of reducing contract numbers and optimising the

network.

· Allows

for alignment of contract expire dates.

|

· Does

not allow the contractor to commit to long term investments such as renewing

expensive equipment/plant.

|

Assessment of Significance

22 Extending

the contract is not considered significant or a major drawback. If

anything it allows Council to buy time and construct a better, improved model

whilst waiting to view how Highway Network Outcome Contract impacts our the

local market.

Recommended

Option

23 Endorse

the recommendation of a one year extension of the Foveaux Alliance Contract

Next

Steps

24 Provide

written confirmation to Fulton Hogan that the contract has been extended by an

additional one year.

Attachments

There are no attachments for

this report.

|

Activities

Performance Audit Committee

9 March 2016

|

|

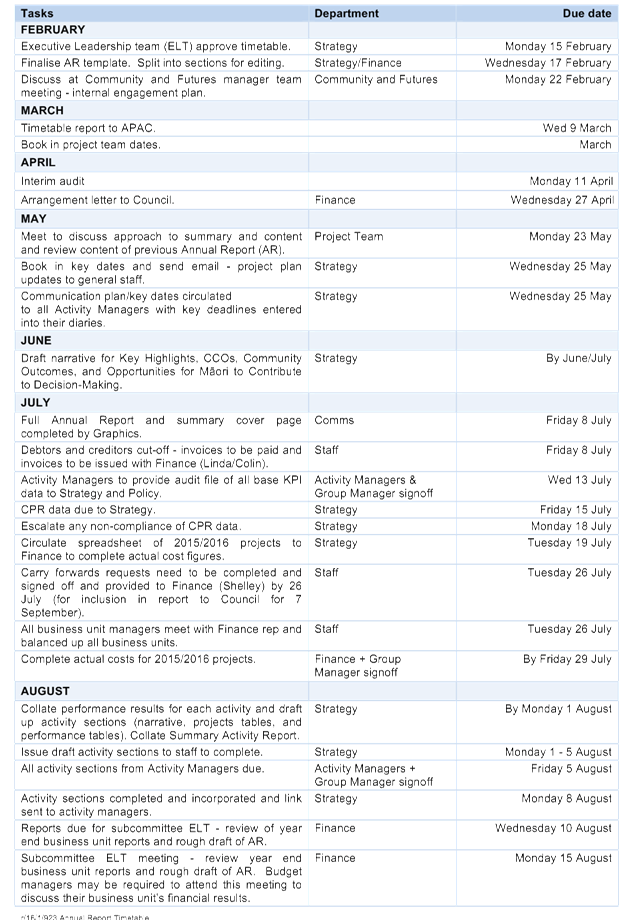

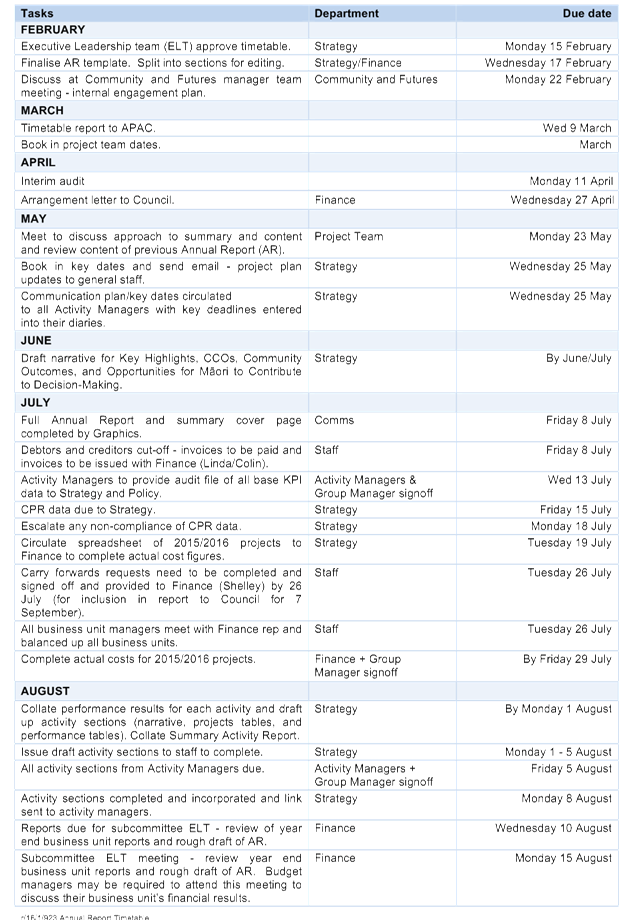

Annual Report 2015/2016 Timetable

Record No: R/16/2/2532

Author: Shannon

Oliver, Planning and Reporting Analyst

Approved by: Rex Capil,

Group Manager, Community and Futures

☐

Decision ☐ Recommendation ☒ Information

Purpose

1 The

purpose of the report is to provide the key dates for Annual Report 2015/2016

timetable for information.

Executive

Summary

2 The

Annual Report is the key planning document for Council. The Annual Report

reports on Council’s performance against the 2015-2025 Long Term

Plan. The timetable has been prepared so that adoption of the Annual

Report occurs on 28 September 2016. The project team will consist of

staff from the Finance, Strategy and Policy and Communications teams.

Content

Background

3 The

Annual Report is a means for Council to account and report to the community on

its performance of the preceding financial year - in this case from 1 July 2015

to 30 June 2016. It reports on outcomes, performance measures (both

financial and non-financial) and provides information on the result achieved

against budgeted results.

The purposes of an Annual Report

are:

(a) To

compare the actual activities and the actual performance of the local authority

in the year with the intended activities and the intended level of performance

as set out in respect of the year in the Long Term Plan and the Annual Plan;

and

(b) To

promote the local authority's accountability to the community for the decisions

made throughout the year by the local authority.

4 As

with previous years both an Annual Report and a Summary Document are

produced. Similarly, as previously done, the Summary Document will be

distributed to all Council’s offices and made available on request.

Both the Summary Document and full Annual Report will be made available on the

Council’s website. The report availability will be advertised on

the Saturday edition of The Southland Times on Saturday, 8 October 2016 (the

delay is to allow for the printers to produce the printed versions).

5 The

Project Manager will be the Corporate Planning and Performance Advisor (once

appointed).

6 The

Annual Report is audited by Audit New Zealand which provides the reader with a

level of assurance of the consistency and accuracy of the information

reported.

7 The

Audit team are currently proposing the following audit dates:

• Interim

visit from 11 April 2016 for one week.

• Final

visit, two weeks in August/September 2016. The proposed options are 29

August to 9 September, or 5 September to 16 September 2016.

• Verbal

audit clearance is expected by Monday, 19 September 2016.

· They

will also be present at the Adoption meeting 28 September 2016.

8 Audit

New Zealand expect to confirm the audit dates in March with the Finance Team

and the audit arrangements letter will be included in the APAC agenda for

approval on 27 April 2016.

9 It

was agreed at the Executive Leadership Team meeting on 22 February 2016 that an

Executive Leadership Team Subcommittee would be formed for the purposes of

reviewing the document.

10 The

key dates for Council are:

· The

draft Annual Report (not including audit changes) will go to a Council workshop

on Wednesday, 7 September 2016 to receive feedback on the document.

· The

Annual Report will be adopted by Council on Wednesday, 28 September 2016.

Factors

to Consider

Legal

and Statutory Requirements

11 Section

98 of the Local Government Act 2002 states that:

(1) A

local authority must prepare and adopt in respect of each financial year an

Annual Report containing in respect of that year the information required by

Part 3 of Schedule 10.

(2) The

purposes of an Annual Report are—

(a) to

compare the actual activities and the actual performance of the local authority

in the year with the intended activities and the intended level of performance

as set out in respect of the year in the Long Term Plan and the Annual Plan;

and

(b) to

promote the local authority's accountability to the community for the decisions

made throughout the year by the local authority.

(3) Each

Annual Report must be completed and adopted, by resolution, within four months

after the end of the financial year to which it relates.

(4) A

local authority must, within one month after the adoption of its Annual Report,

make publicly available—

(a) its

Annual Report; and

(b) a

summary of the information contained in its Annual Report.

(5) The

summary must represent, fairly and consistently, the information regarding the

major matters dealt with in the Annual Report.

(6) A

local authority must, within one month after the adoption of its Annual Report,

send copies of that report and of the summary prepared under subsection (4)(b)

to—

(a) the

Secretary; and

(b) the

Auditor-General; and

(c) the

Parliamentary Library.

12 Information

that must be included can be found in Schedule 10 Part 3 of the Act, and

includes:

· Groups

of activities

· Capital

expenditure for groups of activities

· Statement of

service provision,

· Funding

impact statement for groups of activities,

· Internal borrowing,

· Council-controlled

organisations,

· Financial

statements,

· Rating

base information,

· Reserve

funds,

· Remuneration

issues,

· Employee

staffing levels and remuneration,

· Severance

payments,

· Statement

of compliance,

· The

activities that the local authority has undertaken in the year to establish and

maintain processes to provide opportunities for Māori to contribute to the

decision-making processes of the local authority.

13 The

Annual Report and Summary Document reports on Council’s performance

against the Annual Plan (which is based on the first year of the

Council’s Long Term Plan 2015-2025) under the Act.

14 As

each Annual Report must be completed and adopted, by resolution, within four

months after the end of the financial year to which it relates, this makes 31

October 2016 the last day available to meet this timeframe.

Community

Views

15 As

the Annual Report is a report on activities undertaken during the year, no

consultation is required as the consultation has already occurred as part of

the Long Term Plan process.

Costs

and Funding

16 There

is a fee provided to Audit New Zealand to audit the Annual Report.

Policy

Implications

17 There are no

policy implications.

Assessment of Significance

18 Whilst

the Annual Report is an important accountability document for Council, this

report merely sets out the associated timetable key dates and is therefore of

low significance.

Next

Steps

19 The

Project Team will provide a draft document to Council at a workshop on 7

September 2016.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Annual Report 2015/2016 Timetable” dated 25

February 2016.

b) Determines

that this matter or decision be recognised as not significant

in terms of Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

|

Attachments

a Draft

Annual Report Timetable 2015 2016

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

9 March 2016

|

|

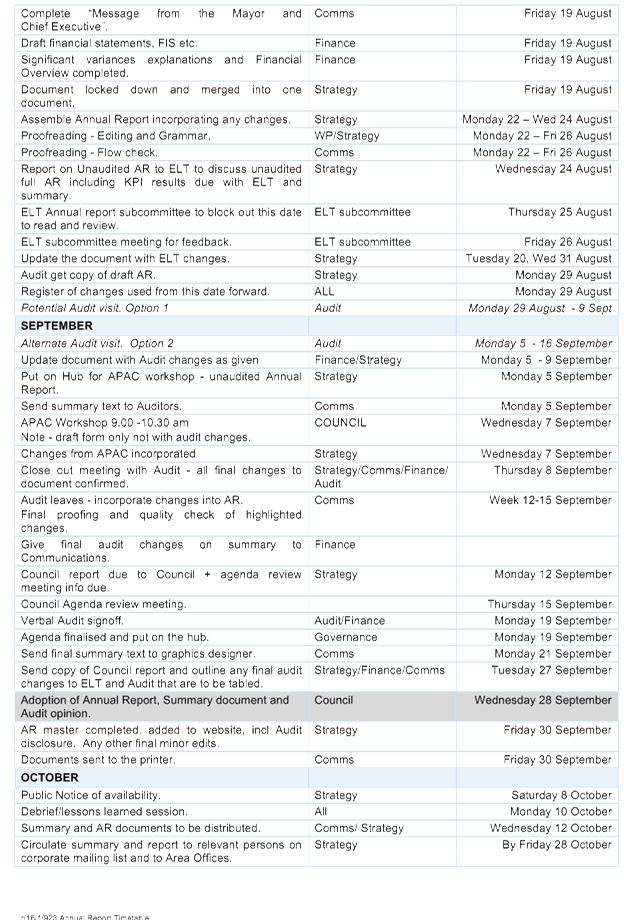

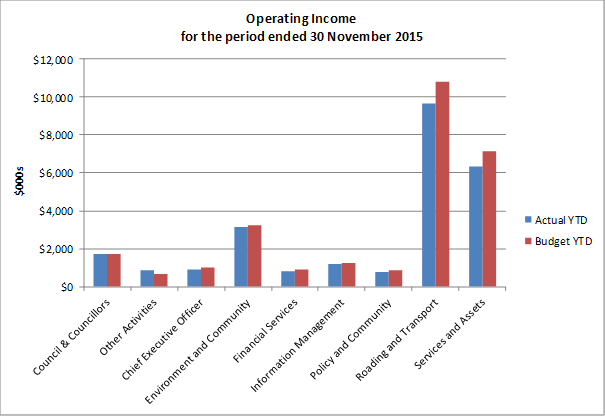

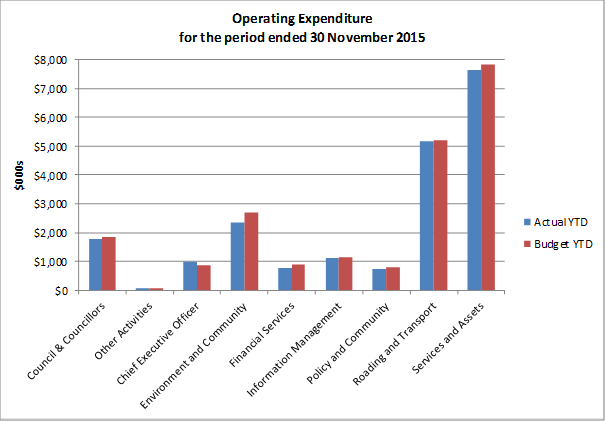

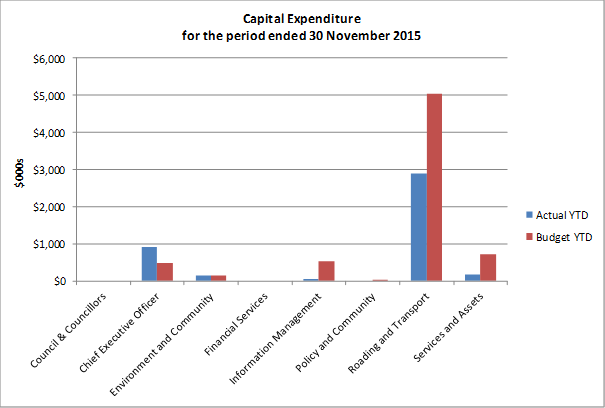

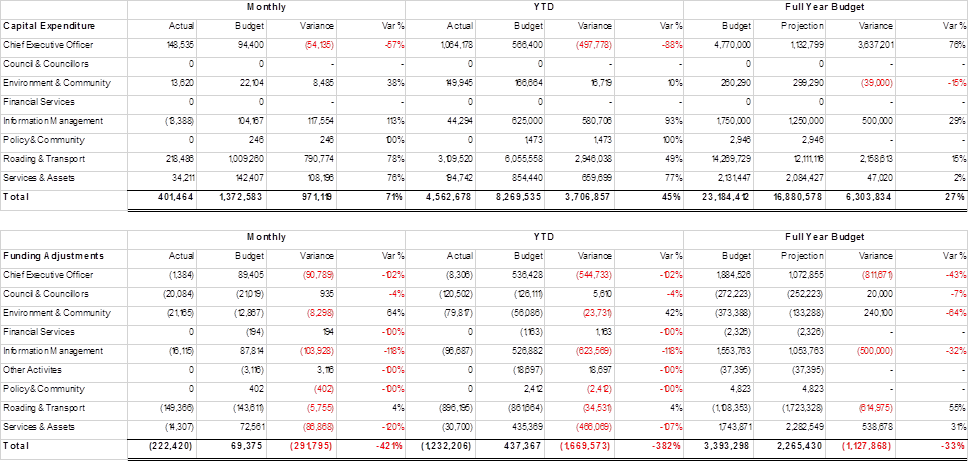

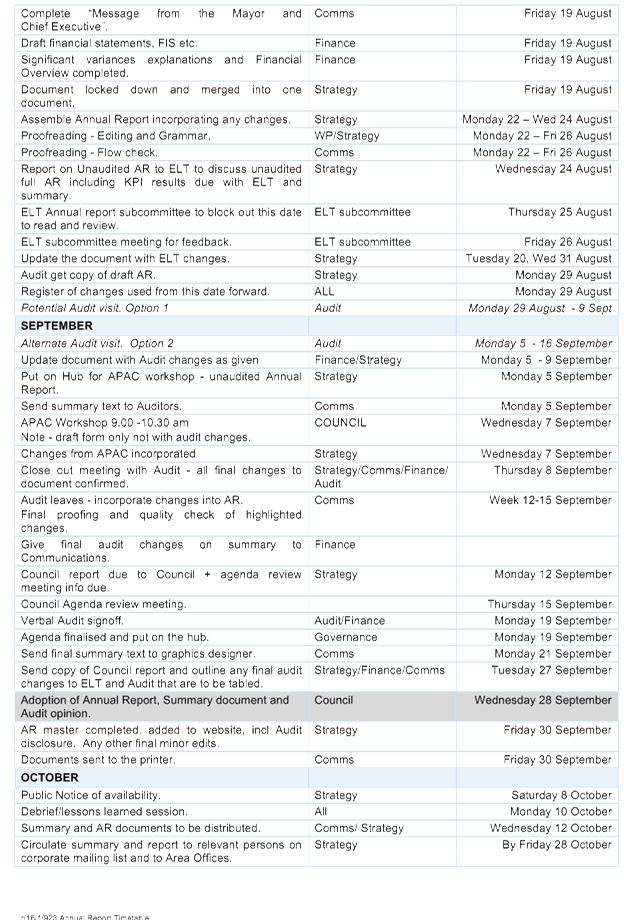

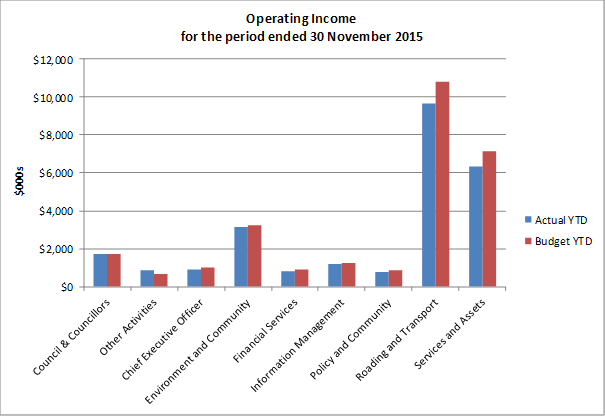

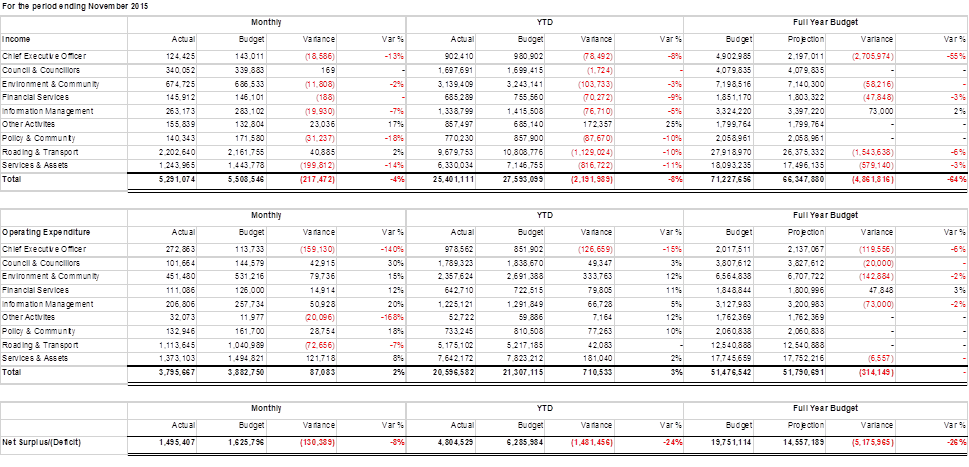

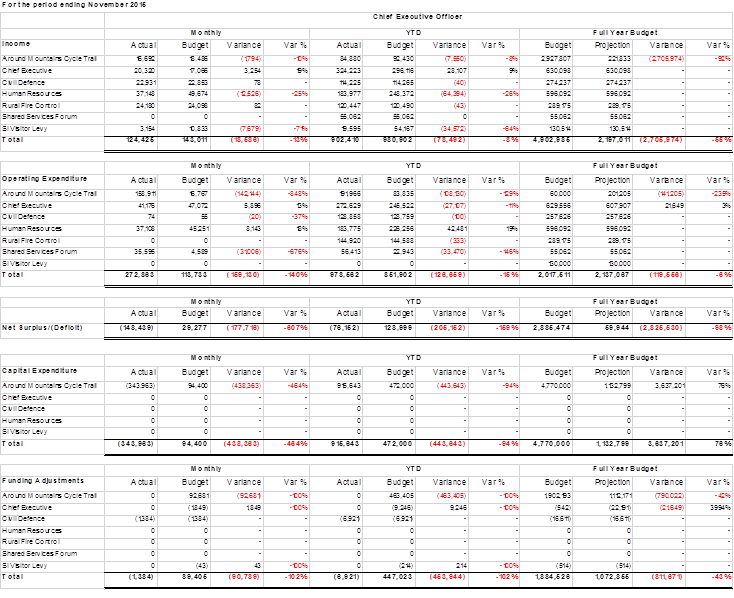

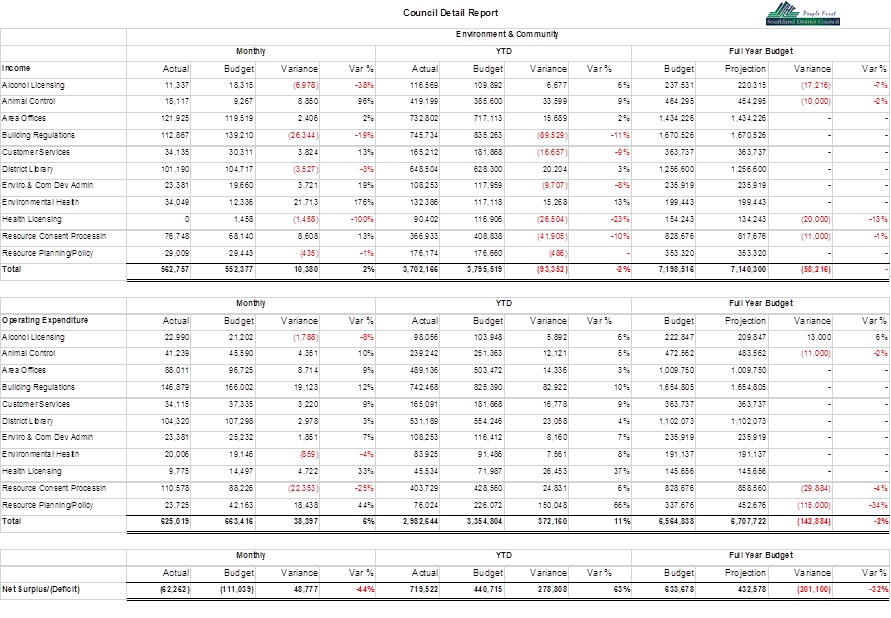

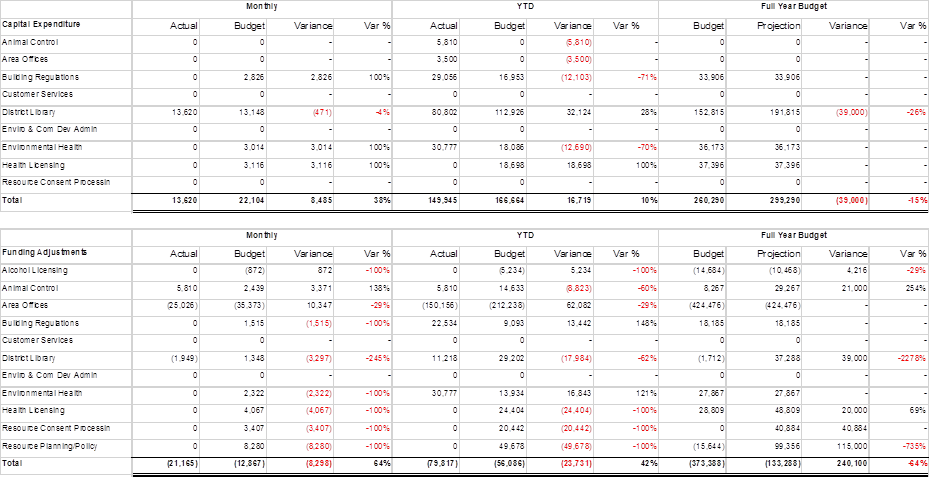

Financial Report for the period ended 30 November 2015

Record No: R/16/1/1086

Author: Susan

McNamara, Management Accountant

Approved by: Anne

Robson, Chief Financial Officer

☐

Decision ☐ Recommendation ☒ Information

Background

1. This

report outlines the financial results to 30 November 2015. At 30 November

2015, 42% of the financial year is complete.

2. Within

the report, no issues have been identified that raise any concerns for Council

relating to the end of year financial position.

Overview

3. The

financial commentary centres on the summary sheet in Appendix A which draws the

totals from each of the key groups together. Commentary provided focuses

on the year to date (YTD) results. The budget numbers included in the

monthly and year to date section are based on the full year projection budget

included in the final section of the reports. The full year projection

budget is a combination of the budget included in the Long Term Plan for

2015/2016 and the carry forward and forecast amounts previously approved by

Council.

4. More

detailed variance explanations for each group can be found in the attached

Appendix B. The budget numbers included in the monthly and year to

date section are based on the full year budget provided in the third

column. The full year budget in these reports is a combination of the

budget included in the Long Term Plan for 2015/2016 and the carry forward

amounts previously approved by Council.

5. As

part of the monthly review, finance staff look over the phasing/timing of the

budgets and they are revised in conjunction with budget managers where appropriate.

Where specific phasing of the budgets has not occurred, one twelfth of

budgeted cost is the default to establish the monthly budget.

6. The

financial tables this month include the forecasting data discussed at the

Council’s December meeting. In summary,

- The

monthly and annual budget columns are the combination of the Long Term Plan

(LTP) budget plus the carry forwards approved by Council in August 2015

plus/less changes as a result of forecasting.

- The

FY Budget is the LTP budget for the year.

- The

FY Projection is the forecasted year end result.

7. Staff

will continue to refine the format of this report, with additional features

being added to enhance the financial information given. Any feedback or

suggestions on further amendments that could be made to this report are

welcome.

8. Results

at a glance, compared to budget year to date.

|

INCOME YTD

|

|

OPERATING EXPENDITURE YTD

|

|

Actual

|

Budget

|

|

|

Actual

|

Budget

|

|

|

$25.4M

|

$27.6M

|

|

|

$20.6M

|

$21.3M

|

|

|

Variance

|

$2.2M

|

8%

|

|

Variance

|

$0.7M

|

3%

|

|

NET SURPLUS YTD

|

|

CAPITAL EXPENDITURE YTD

|

|

Actual

|

Budget

|

|

|

Actual

|

Budget

|

|

|

$4.8M

|

$6.3M

|

|

|

$4.2M

|

$6.9M

|

|

|

Variance

|

$1.5M

|

24%

|

|

Variance

|

$2.7M

|

40%

|

Income

9. Overall

for the YTD, income is 8% ($2.2M) under budget ($25.4M actual v $27.6M budget).

10. Services

and Assets income is under budget by $817K due to a number of items.

11. The largest

being forestry revenue which is currently $569K under budget. Harvesting

is expected to begin in early February and it is forecast that total harvesting

income will be $588K less for the year than had been budgeted in the Long Term

Plan. This is due to an estimated harvest of 6,000 tonnes less than was

budgeted and the actual sale price being $6 a tonne less than budgeted at $43

tonne.

12. The

income in District Water is under budget by ($53K). Within this business

unit invoicing for water meter charges are $11K lower for the first quarter

than previous years. Generally this is due to reduced water volumes taken

as a result of changes in commercial business practice of a couple of

consumers.

Additionally, in 2014/2015 we

accrued the last quarter of water meter charges into the accounts. This

has resulted in our income being one quarter less to date ($22k). From

the January 2016 accounts we will be including an accrual estimate to balance

this.

13. Work

scheme revenue is $66K under budget as a result of less work being completed

overall due to being one supervisor less. This is partially offset by a

vacant staff position ($35K) and reduced material purchases of $6K. Also

the Work Scheme Supervisor is currently liaising with Probation Services to

secure a contribution for this financial year. This contribution is

expected to be approximately $32K per annum. Even if this is received, it

is still anticipated that the business unit will be in deficit at year end, by

approximately $15k due to having one crew less. However staff anticipate

that this deficit can be made up next year once the supervisor position is

filled.

Operating Expenditure

14. Overall

for the YTD, operating expenditure is 3% ($0.7M) under budget ($20.6M actual vs

$21.3M budget).

15. The

Chief Executive group is currently over budget by $127K. Within the

Around the Mountains Cycle trail $108K is the result of moving costs relating

to the appeal process into a separate code for easy identification. At

year end this will be moved back to capital expenditure. The Chief

Executive business unit is $27K over budget due to the timing of costs relating

to the organisation review however it is expected at year end that costs

overall will be within budget.

16. Environment

and Community expenditure is $334K under budget. This is mainly in the

regulatory areas of building regulation ($64k), resource consent processing

($47k) and resource planning ($132k).

Current market conditions has

resulted in less building and resource consent activity resulting in lower than

budgeted income and expenditure in these areas. It is anticipated that

this trend will continue to year end, however overall the business units will

still be in surplus. The District Plan mediation processes have been

delayed at the direction of the Environment Court due to the status of

Environment Southland’s Regional Policy Statement. Until the

Regional Policy Statement is progressed the amount of expenditure on the

District Plan during this year is uncertain.

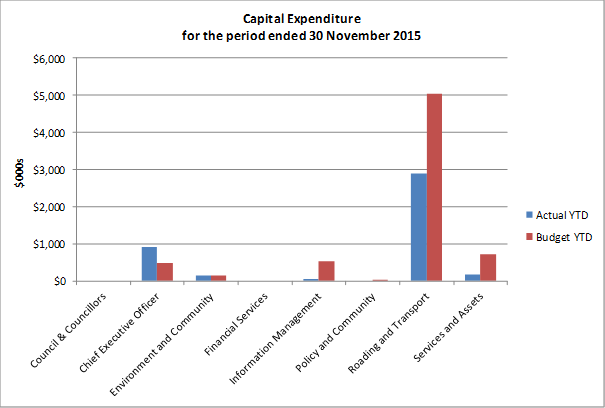

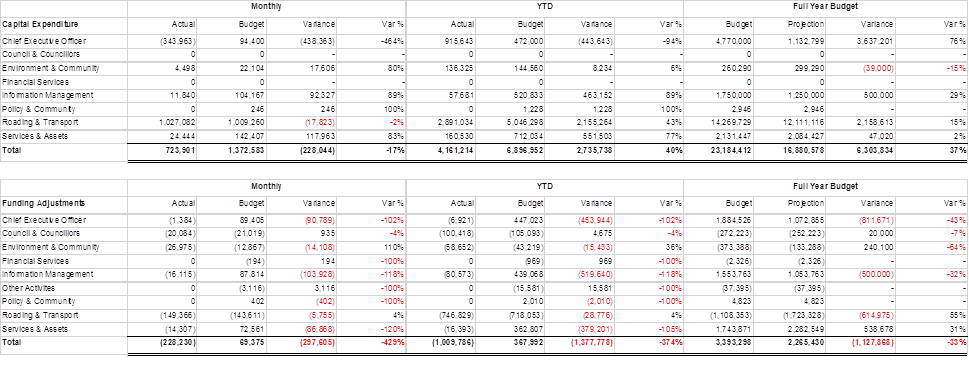

Capital Expenditure

17. Overall

for the YTD, capital expenditure is 40% ($2.7M) under budget ($4.2M actual vs

$6.9M budget).

18. Information

management capital expenditure is under budget $463K due to minimal capital

work being undertaken to date. Included in the budget are costs

associated with the core systems review and digitisation project.

Work has been planned for the digitisation project in the second half of this

financial year. There has been $25K spent on the digitisation compared to

a forecasted YTD budget of $104K. It is expected to be close to budget at

year end. At this stage no significant expenditure has been identified

for the core systems review and it is expected that the majority of the budget

of $1M will be deferred.

19. Services

and assets capital expenditure is under budget year to date, $552K due to

minimal capital work being undertaken to date beyond the purchase of Hansen

software. The Curio Bay sewerage project is still in discussion ($970k),

quotes are being received on the costs to construct and initial contact has

been made with DOC and the trust towards a contribution to operating

costs. At this stage it is planned to report back to Council towards the

end of April 2016. Public convenience upgrades in Winton (Ivy Russell

Park) and Dipton are out for tender, Colac Bay toilets are in design phase, the

Waikaia toilets are being built in conjunction with the Waikaia museum rebuild

and the Athol toilet is completed.

$375k has also been included in the

LTP for an increase in the forestry valuation at year end. This has been

phased to appear in June.

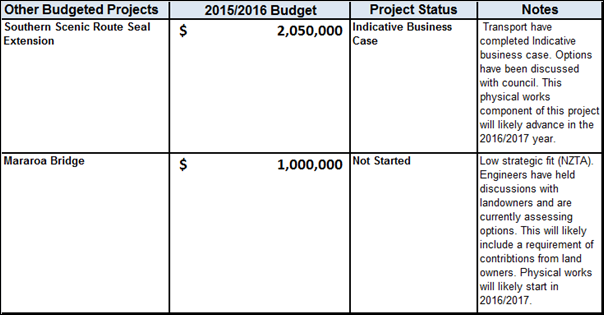

Roading and Transport

20. The

seasonality of the capital works programme directly affects the level of income

received from NZTA.

21. Operational

expenditure is in line with the long term plan budget and the NZTA approved

budget for 2015/16 even though weather events over winter put a strain on the

budgets.

22. The

Roading and Transport team have forecast that capital expenditure will be under

budget at the end of the year. This variance is partly due to the

Southern Scenic Route extension and Mararoa Bridge projects being deferred to

the 2016/2017 financial year ($2.48M). This is offset by additional rehabilitation

projects, changes in scope and market prices ($321K).

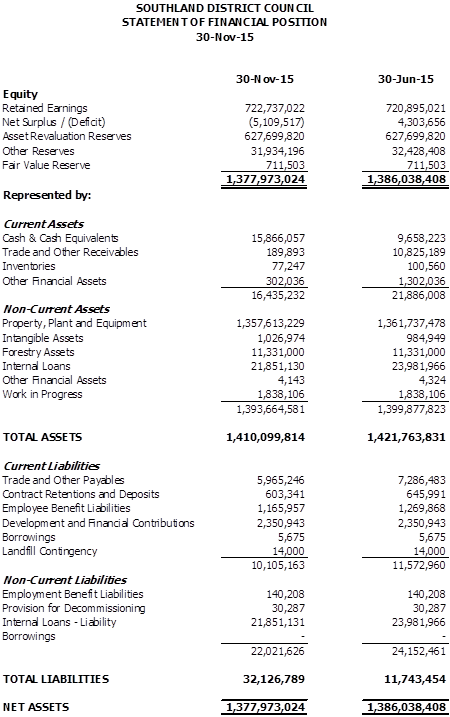

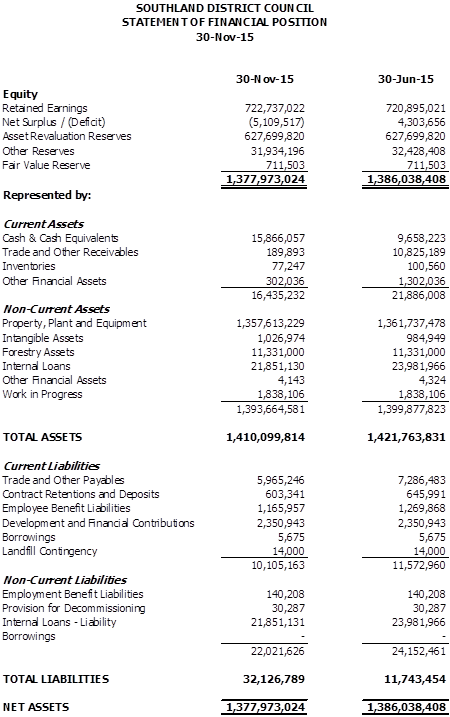

Balance Sheet

23. Council’s

financial position as at 30 November 2015 is detailed below and is only for the

activities of Council. The balance sheet as at 30 June 2015 represents

the audited balance sheet for activities of Council and includes SIESA and

Venture Southland.

24. At 30 November 2015, Council

had $6.0M invested in four term deposits ranging from three to six month

maturities. Interest rates on these deposits vary from 3.3% to 3.54% per

annum. The next term deposit will mature in mid-December.

The

details at 30 November 2015 are:

|

1

Amount

|

2

Where Invested

|

3

Interest Rate

|

4

Term of Investment

|

5

Date of Expiry

|

|

6

$2,000,000

|

7

ASB

|

8

3.3%

|

9

91 days

|

10

13 Dec 2015

|

|

11

$1,000,000

|

12

BNZ

|

13

3.54%

|

14

153 days

|

15

18 Jan 2016

|

|

16

$2,000,000

|

17

Westpac

|

18

3.41%

|

19

119 days

|

20

12 Feb 2016

|

|

21

$1,000,000

|

22

BNZ

|

23

3.5%

|

24

183 days

|

25

20 Apr 2016

|

25. Funds on call are the result of

rates received at the end of November and held to ensure there is enough cash

available to meet commitments as they fall due. In early December

additional funds were put into term deposit.

|

26

Balance at 30 November

|

27

Where Invested

|

28

Interest Rate

|

|

29

$6,602,088

|

30

BNZ

|

31

1.90%

|

|

32

$3,000,000

|

33

Westpac

|

34

2.25%

|

26. External

borrowings are still not required, with internal funds being used to meet

obligations for the year to date. The borrowings shown in current

liabilities is the outstanding amount of assets funded by finance leases for

computer equipment.

|

Recommendation

That the Activities

Performance Audit Committee:

a) Receives

the report titled “Financial Report for the period ended 30 November

2015” dated 25 February 2016.

|

Attachments

a Summary

Financial Report View

b Detailed

Commentary View

|

Activities

Performance Audit Committee

|

09 March 2016

|

Key Financial

Indicators

|

Indicator

|

Target*

|

Actual

|

Variance

|

Compliance

|

|

External Funding:

Non rateable income/Total income

|

> 39%

|

28%

|

-11%

|

x

|

|

Working Capital:

Current Assets/Current Liabilities

|

>1.09

|

1.63

|

0.54

|

a

|

|

Debt Ratio:**

Total Liabilities/Total Assets

|

<0.73%

|

0.74%

|

0.01%

|

x

|

|

Debt To Equity Ratio:

Total Debt/Total Equity

|

<0.01%

|

0.00%

|

-0.01%

|

a

|

* All

target indicators have been calculated using the 2015/25 10 Year Plan

figures.

** Excludes

internal loans.

Financial

Ratios Calculations:

|

Non

Rateable Income

|

|

Total

Income

|

External Funding:

This ratio indicates the percentage of revenue received

outside of rates. The higher the proportion of revenue that the Council

has from these sources the less reliance it has on rates income to fund its

costs.

|

Current

Assets

|

|

Current

Liabilities

|

Working Capital:

This ratio indicates the amount by which short-term assets

exceed short term obligations. The higher the ratio the more comfortable

the Council can fund its short term liabilities.

|

Total

Liabilities

|

|

Total

Assets

|

Debt Ratio:

This ratio indicates the capacity of which the Council can

borrow funds. This ratio is generally used by lending institutions to

assess entities financial leverage. Generally the lower the ratio the

more capacity to borrow.

Debt to Equity Ratio:

It indicates what proportion of equity and debt the Council

is using to finance its assets.

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

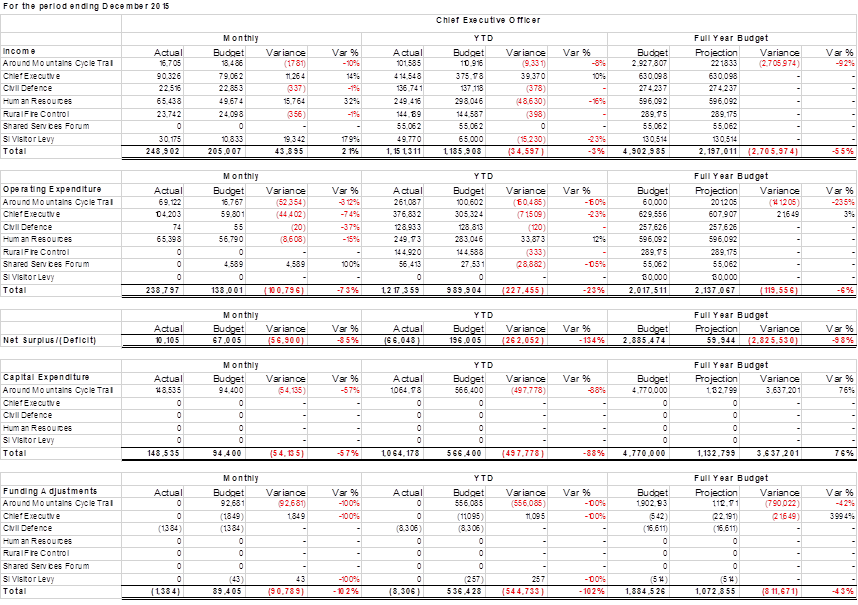

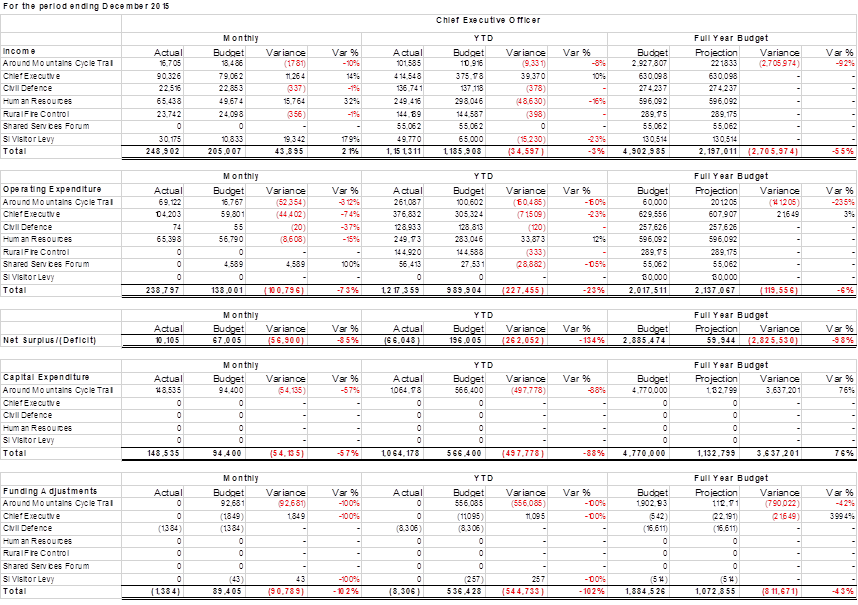

CHIEF EXECUTIVE COMMENTARY

For the year-to-date, income is under budget by 8%

($78K). Expenditure is over budget by 15% ($127K). The year-to-date

position is $205K under budget.

Chief Executive

Income in this business unit is 9% ($28K) over budget, due

to higher rates penalties income ($25K). Expenditure is 11% ($27K) over

budget. This is a result of higher membership fees ($14K) due to higher

annual SOLGM fees and an unbudgeted joining fee for the Local Government

Operational Effectiveness Survey. Additionally consultant costs are over

budget ($25K) due to the timing of Organisational Review Costs. This is

offset by legal costs ($19K) under budget and project consultant costs ($5K).

Civil Defence

Income and expenditure are on budget.

Human Resources

Income is 26% ($64K) under budget. Expenditure

year-to-date is 19% ($42K) under budget due to reduced expenditure on staff

costs ($6K), training costs ($14K), recruitment costs ($13K) and OSH expenses

($7K). As this activity is internally funded, the reduced expenditure impacts

directly on income.

Around the Mountains Cycle Trail

Income is 8% ($8K) under budget with no funding received to

date. Capital expenditure is over budget by 94% ($444K) due to the timing

of work undertaken on Stage 2.

Rural Fire Control

Income and expenditure are on budget.

Shared Services Forum

Income is on budget. Expenditure for year-to-date is

over budget by 146% ($33K) due to higher consultant costs ($28K) in relation to

the Southland Regional Development Strategy. Council’s share

of additional costs for the Southland Regional Development Strategy is intended

to be funded by rates collected for Community Outcomes (previously

Our Way Southland).

Stewart Island Visitor Levy

Income is 64% ($35K) below budget. Expenditure is

currently on budget with grants expected to be paid in May.

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

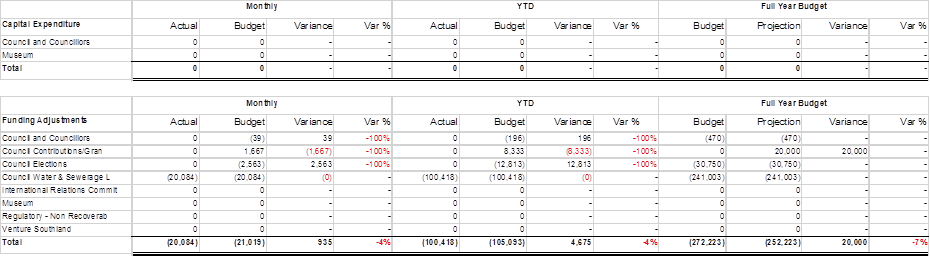

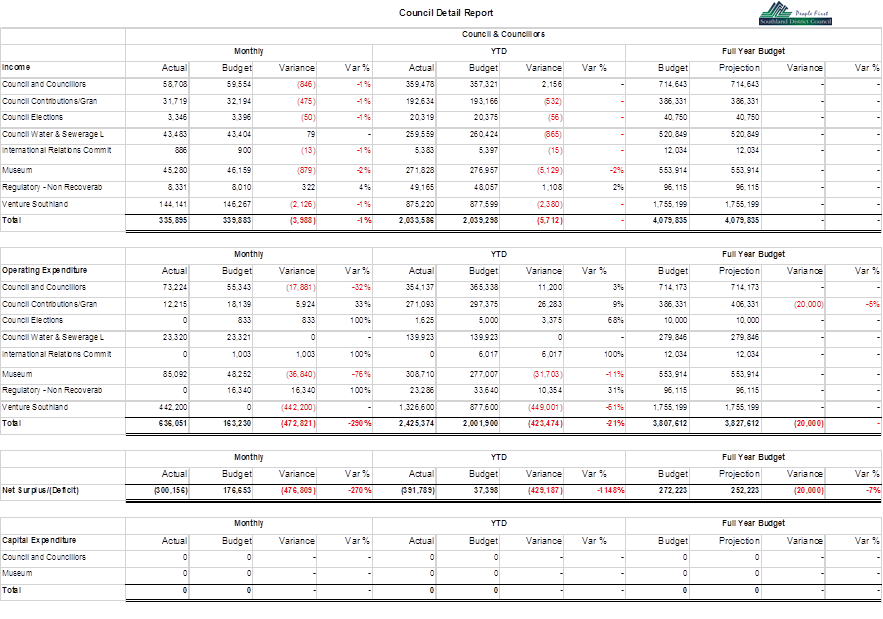

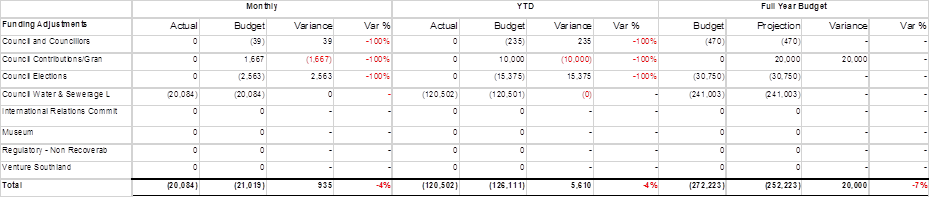

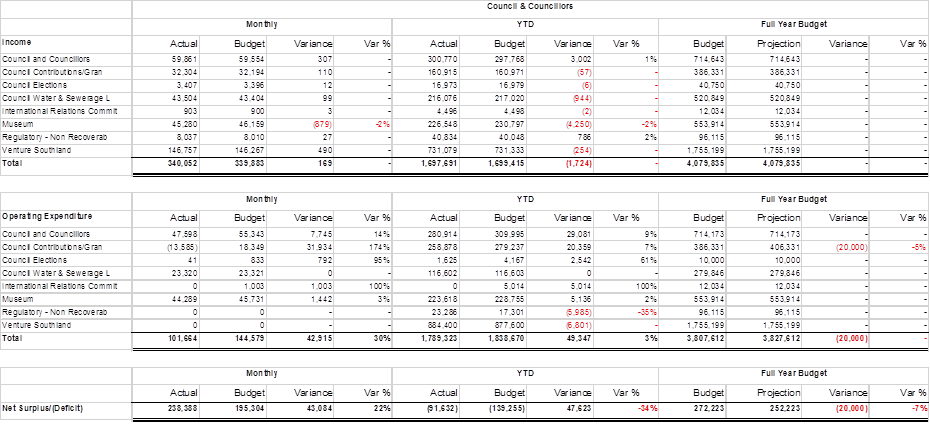

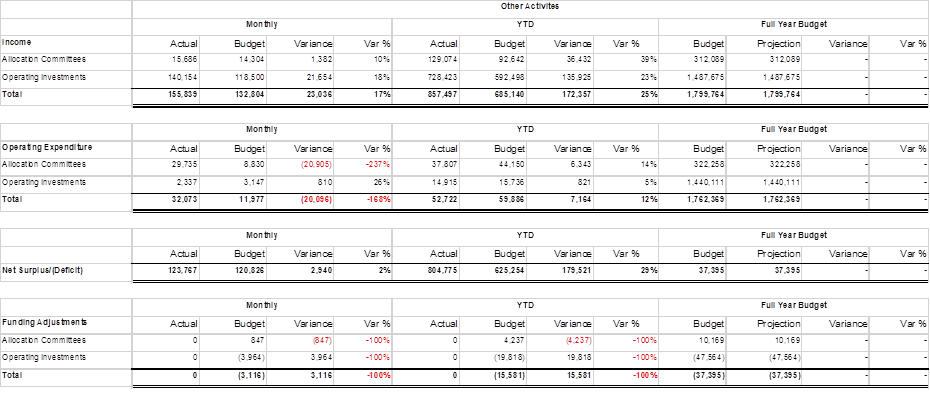

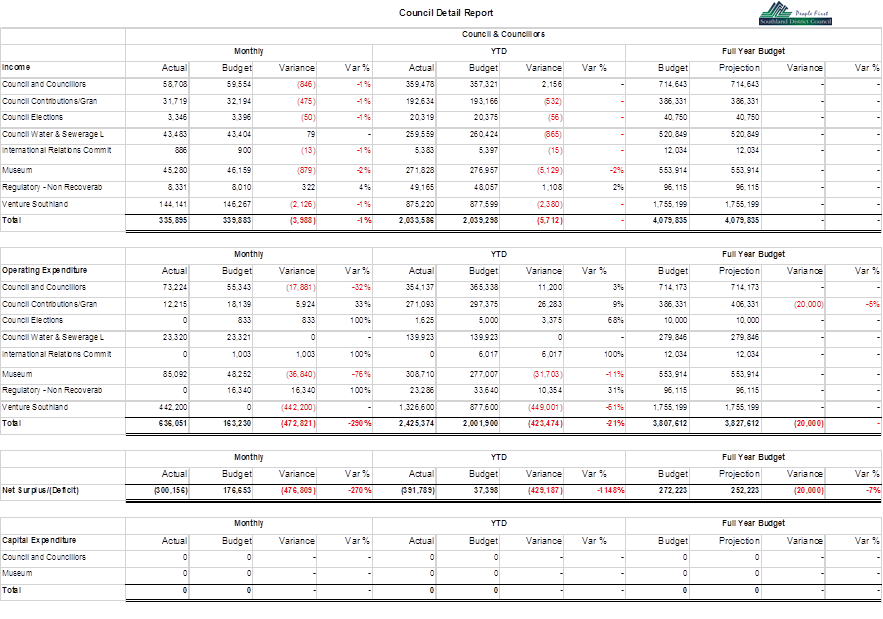

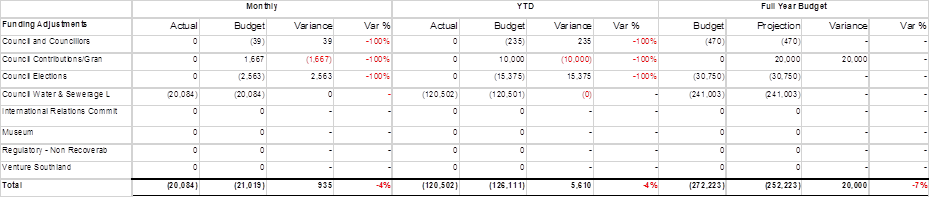

Council and Councillors’ Commentary

For the year-to-date, income is on budget. Expenditure is 3%

($49K) under budget.

The year-to-date position is $48K over budget.

Council and Councillors

Income is on budget. Expenditure is 9% ($29K) under

budget due to Councillor’s salary ($6K), mileage costs ($4K),

communication costs ($4K), travel costs ($3K), youth council ($4K) and catering

costs ($4K).

Council Contributions/Grants

Income is on budget. Expenditure is currently under

budget 7% ($20K) due to the timing of Miscellaneous Grants.

Council Elections

Income is on budget. Expenditure is 61% ($3K) under

budget with pre-election costs expected to be incurred later in the year.

Council Water and Sewerage Loans

Income is on budget. Expenditure is on budget for the

year-to-date.

International Relations Committee

Income is on budget. Expenditure is $5K under budget

with minimal activity year to date.

Museum

Income is 2% ($4K) under budget due to the timing on grants

income. Expenditure is under budget 2% ($5K).

Regulatory - Non-Recoverable

Income is on budget. It is likely the $23K invoiced

will not be recovered. Expenditure is over budget by 35% ($6K) as a

result of the timing of quarterly charging.

Venture Southland

Income is on budget. Expenditure is currently $7K over

budget with Venture Southland funding being higher than budgeted.

Expenditure is expected to be $14K over budget at year end.

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

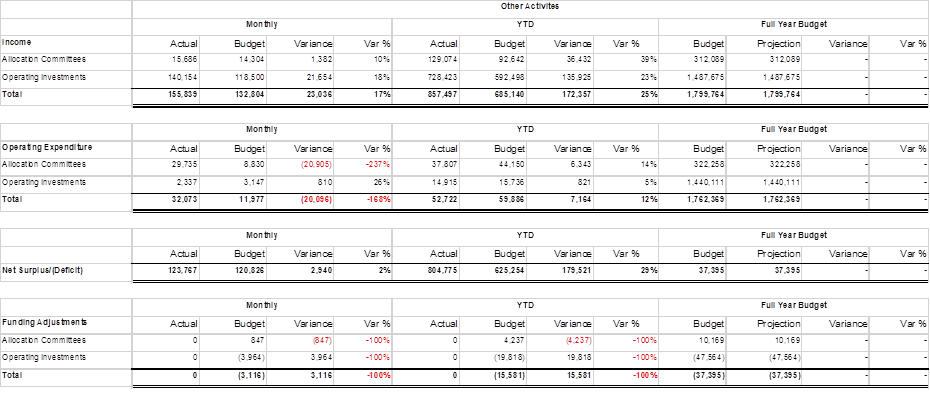

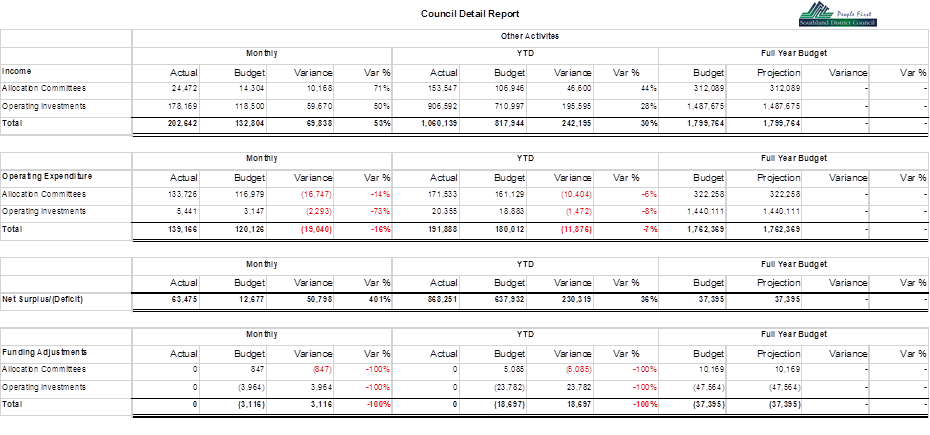

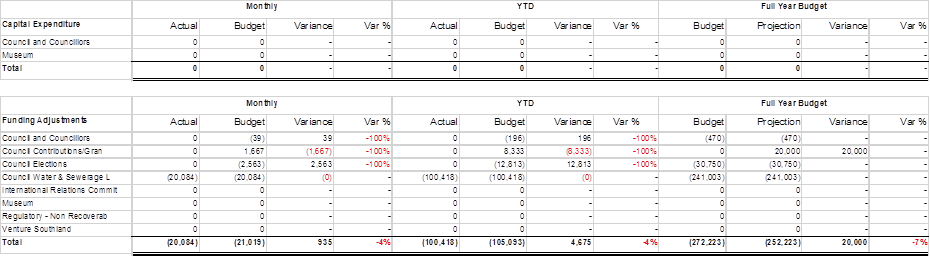

OTHER

ACTIVITIES COMMENTARY

Allocations Committee

Income is 39% ($36K) over budget due to an unbudgeted

donation relating to the Men of the Trees Fund ($28K) and the timing of grant

income received. Expenditure is ($6K) under budget by with the first

round of Allocation Committee meetings held in November.

Operating Investments

Currently, the majority of

Council’s reserves are internally loaned by Council or its local

communities for major projects. Council has set the interest rate to be

charged on these loans as part of its 10 Year Plan process and interest is

being charged on a monthly basis on all internal loans drawn down at 30 June

2015.

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities Performance

Audit Committee

|

09 March 2016

|

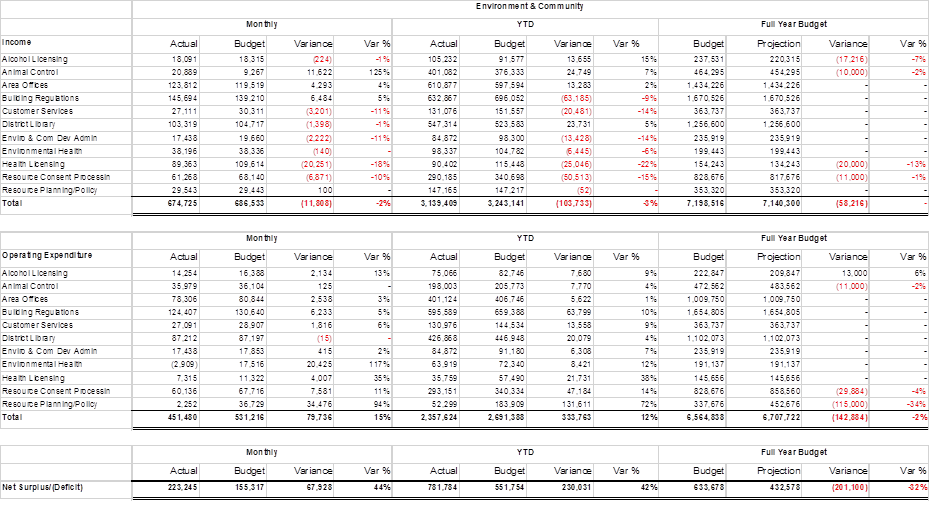

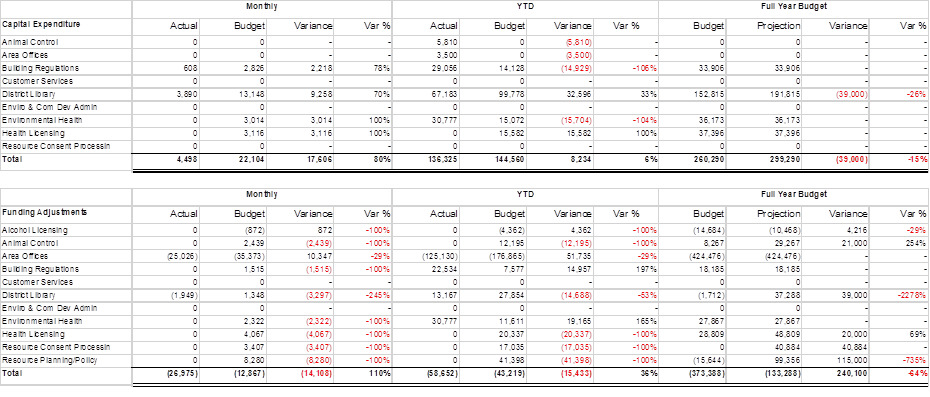

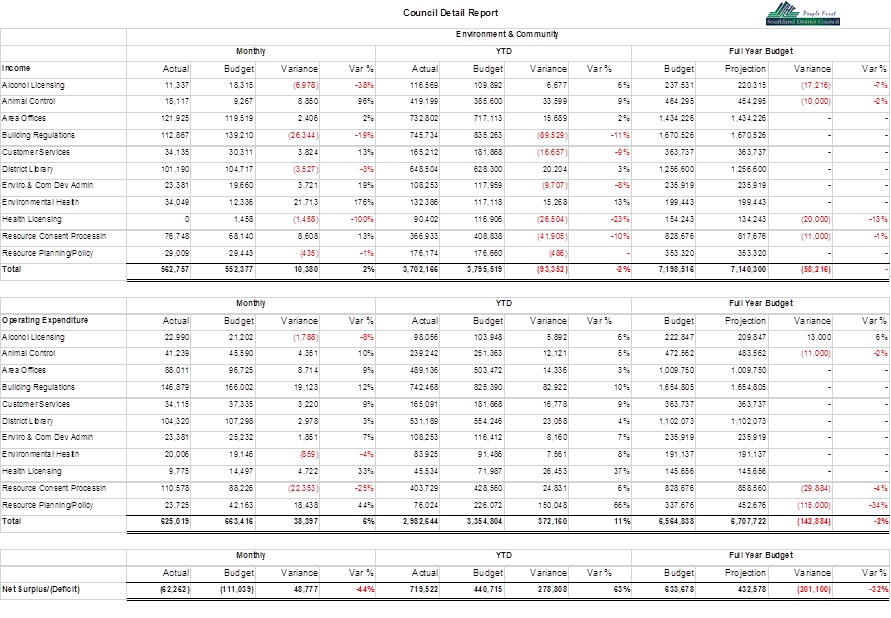

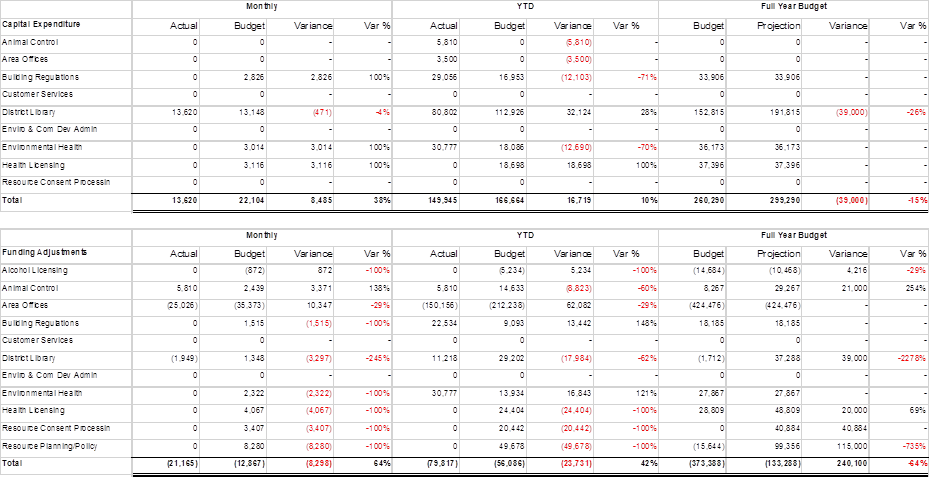

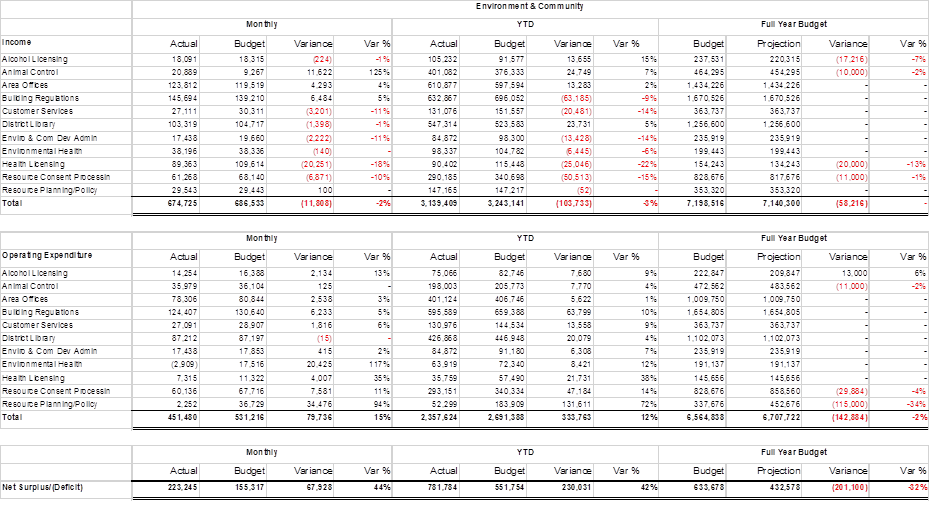

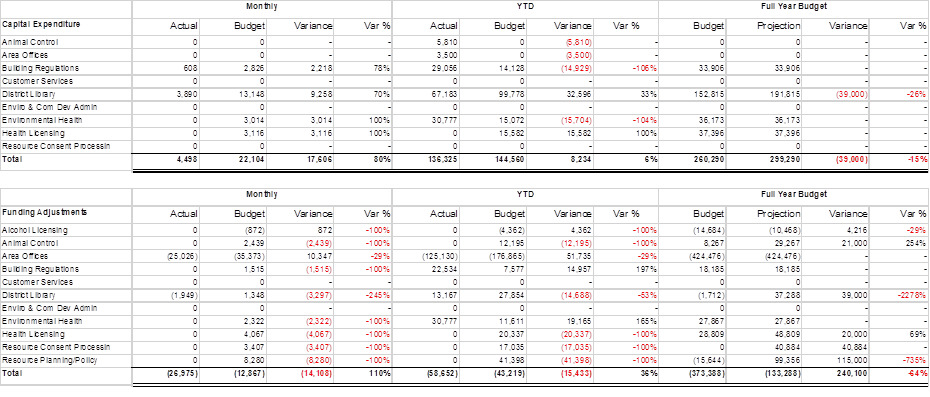

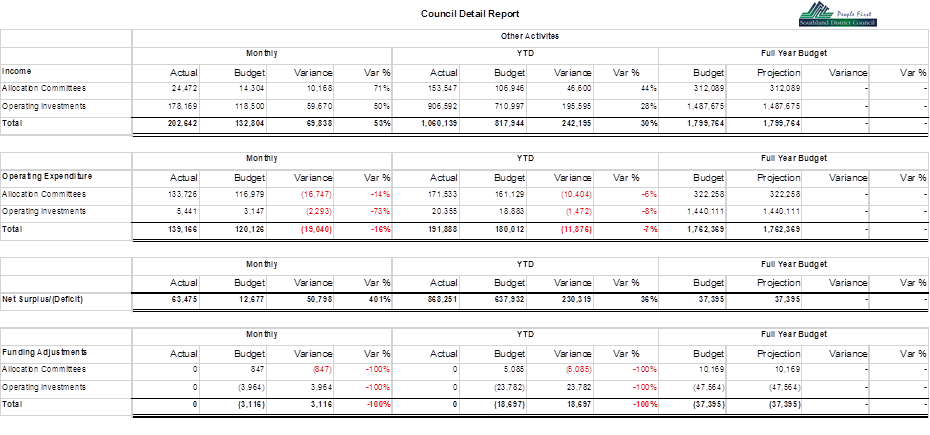

ENVIRONMENT AND

COMMUNITY COMMENTARY

Overall November 2015 monthly income for the Environment

and Community Group was 2% ($12K) below budget at $675K actual versus $687K

budget.

Key features of this month’s income were that Building

Consent income was ahead of budget by 5% ($6K), which is positive with a good

month for incoming consents; and Animal Control income was 125% ($12K) ahead of

budget due to income from infringements and the courts.

Conversely, Resource Consent income was below budget by 10%

($7K) and Health Licensing income was below budget by 18% ($20K), generally

reflecting lower levels of monthly incoming activity than budgeted.

The Health Licensing income figure is also affected by less

income than expected coming via the Gore District Council contract, as Gore

District Council now has a staff member performing some of these functions

in-house.

Overall November 2015 monthly expenditure for the

Environment and Community Group was 15% ($78K) below budget ($451K actual v

$530K budget).

Most departments were below budget expenditure-wise,

reflecting a close focus on spending. The expenditure variance of 117% in the

Environmental Health area is a result of a correction made to the timing of

expenditure.

The Resource Planning/Policy area continues to be well below

budget. This is due to District Plan mediation processes which were expected to

occur in mid-2015 but which have been delayed at the direction of the

Environment Court due to the status of Environment Southland’s Regional

Policy Statement content relating to the biodiversity issues, which is relevant

to several District Plan appeals. There has been no recent progress on this.

Overall YTD Summary as at end of November 2015 of 15/16

financial year:

Overall Group YTD Income at the end of November 2015 for

the 15/16 financial year is 3% ($104K) below budget, at $3.14M actual versus

$3.24M budget.

Overall Group YTD Expenditure at the end of November 2015

of the 15/16 financial year is 12% ($334K) below budget at $2.36M actual versus

$2.69M budget.

Hence, while anticipated income has been quite considerably

less than budgeted reflecting current subdued commercial and industrial

development activity levels within the

district; expenditure is also significantly under budget, by

a greater extent than income.

Management staff within the group are closely monitoring

incoming work as well as expenditure, and associated resourcing requirements.

As referred to above, the Resource Planning/Policy area is

significantly under budget year to date, but it is likely that further costs

will be incurred in the Environment Court appeal/mediation process in the

later part of the 15/16 financial year. The timing of this is largely out of

the Council’s control, being dependent on the speed of progression of

Environment Southland processes.

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

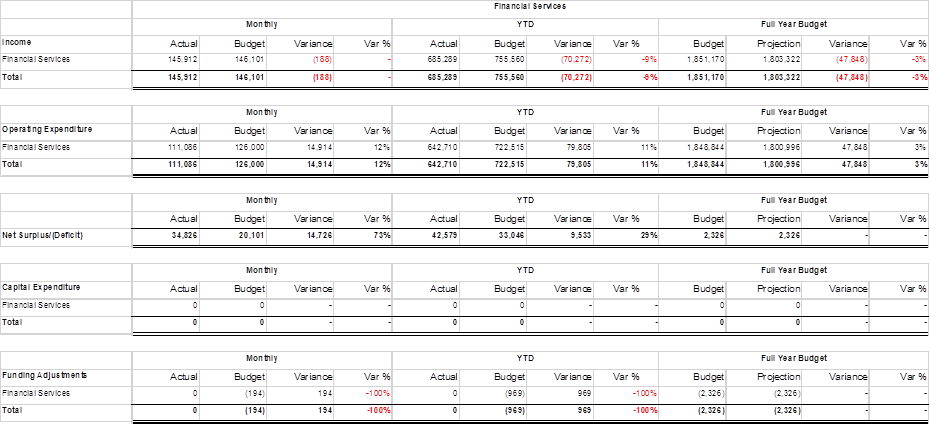

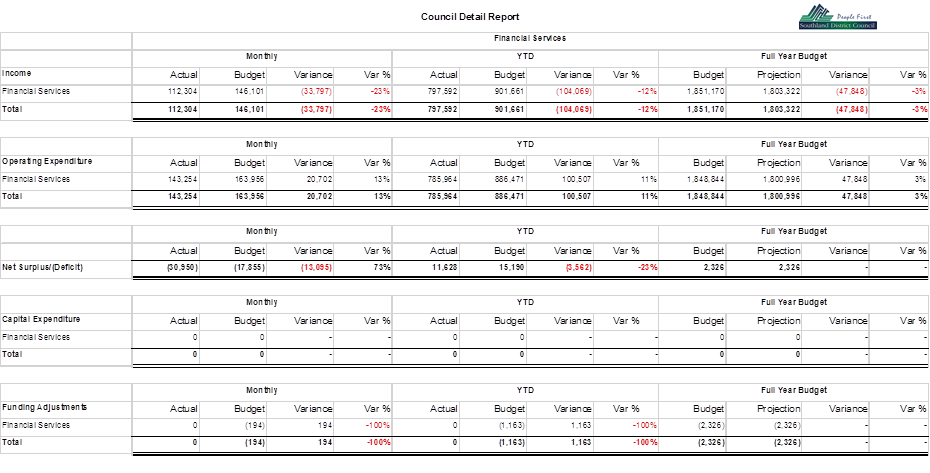

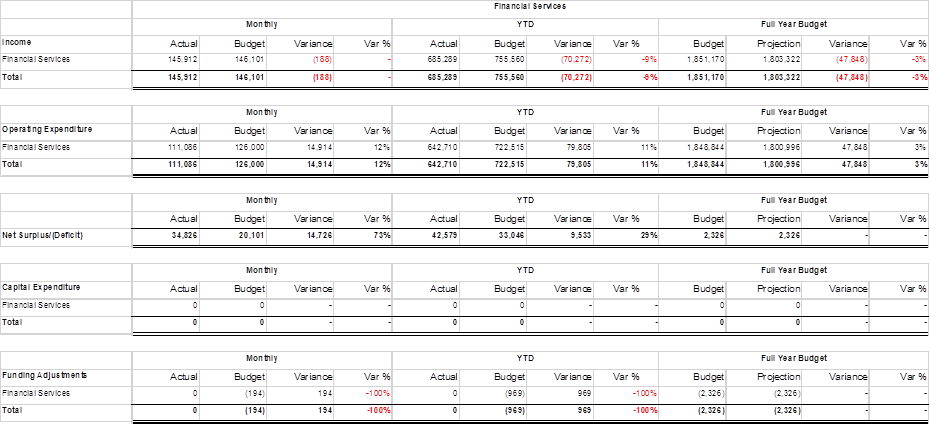

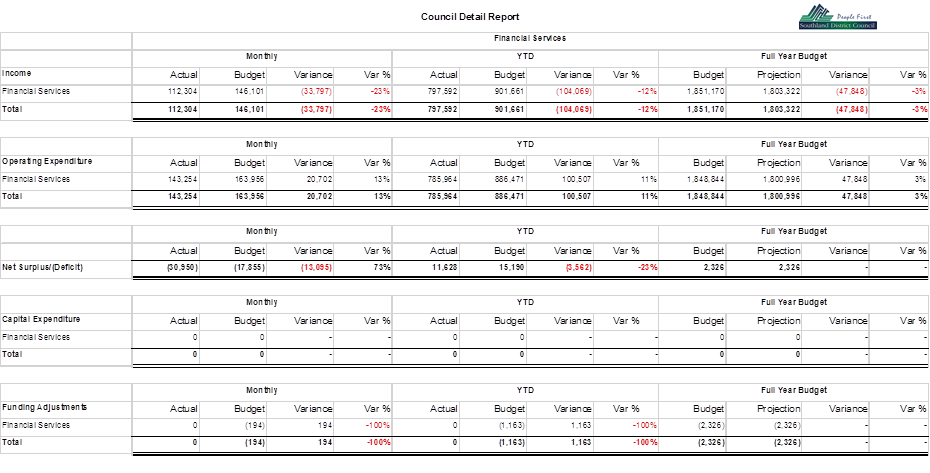

FINANCIAL

SERVICES COMMENTARY

Income is 9% ($70K) under budget. As this activity is

internally funded the reduced expenditure impacts directly on income.

Expenditure is 11% ($80K) under

budget. This is primarily due to the following:

• Staff

costs are $45K under budget due to a vacant position.

• Valuation

roll maintenance costs are $11K below budget.

• Public

Liability Insurance costs for the year are $11K under budget.

• Other

Insurance costs for the year are $7K under budget.

• Debt

collection costs are $9K below budget.

• Visa/MasterCard

Charges are $7K below budget.

• Printing

costs are $5K below budget.

• Audit

fees $5K over budget due to timing on audit work.

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

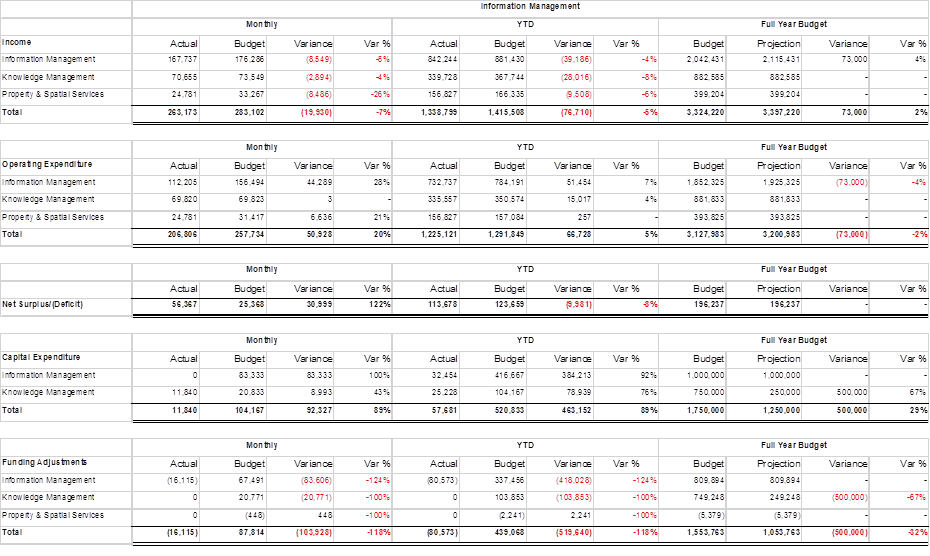

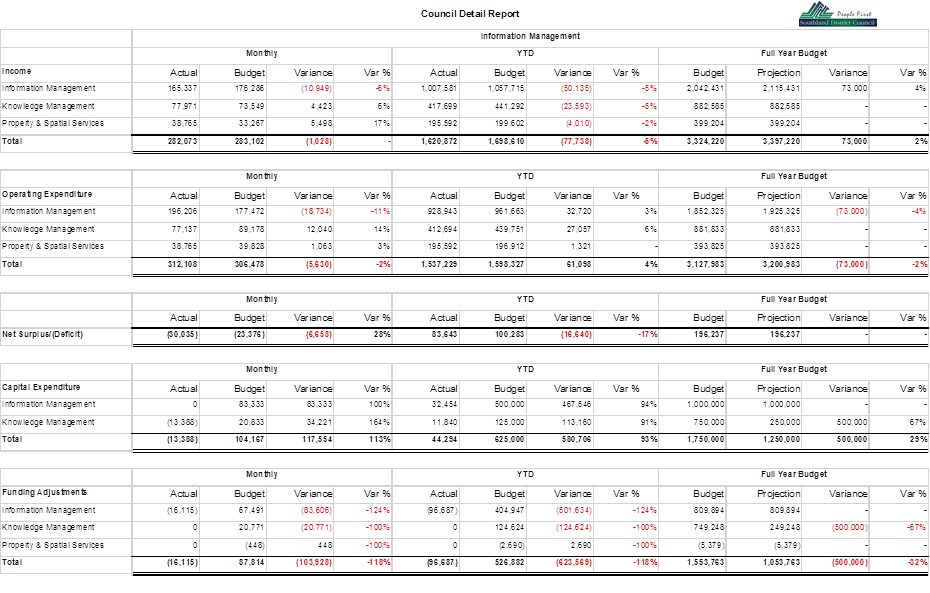

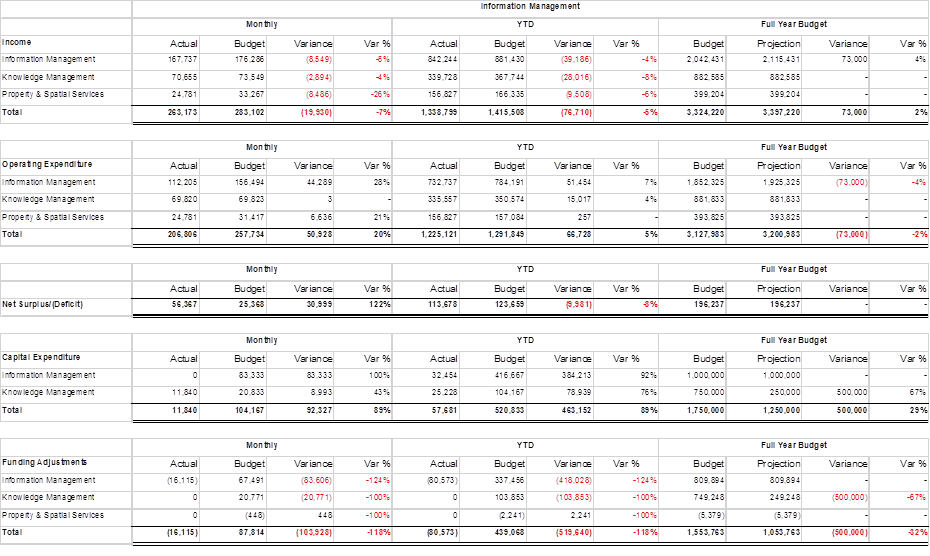

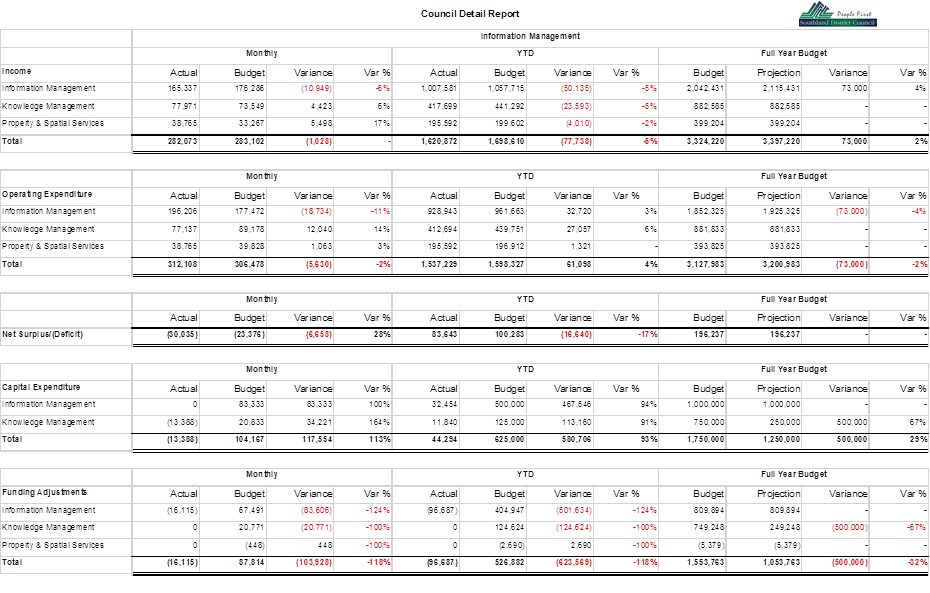

INFORMATION

MANAGEMENT COMMENTARY

Income is 5% ($77K) under budget for the year-to-date.

Overall expenditure is 5% ($67K) under budget. The year-to-date position

is $10K under budget.

Information Management

Income is 4% ($39K) under budget due to lower income

recoveries for the BIAPA Business unit ($35K) as a result of lower expenditure.

Additionally, computer hire income ($18K) is below budget. Expenditure is

6% ($51K) under budget due to lower staff costs ($56K) resulting from current

vacancies, photocopy user charges ($13K), telephone call costs ($10K), and

lower contributions to the BIAPA business unit ($43K). This is offset by higher

consulting costs ($59K) and software licence fees ($10K).

Knowledge Management

Income is 8% ($28K) under budget. Expenditure is 4%

($15K) under budget, with staff costs ($14K), training costs ($2K) and

consultant costs ($5K) underspent. This is offset by overspends on software

licence fees ($7K). As this activity is internally funded the increased

expenditure impacts directly on income.

Property and Spatial Services

Income is under budget ($10K). Expenditure is on budget with

overspends in consultants ($21K). This is offset by photography costs

($11K), training costs ($3K) and software costs ($4K).

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

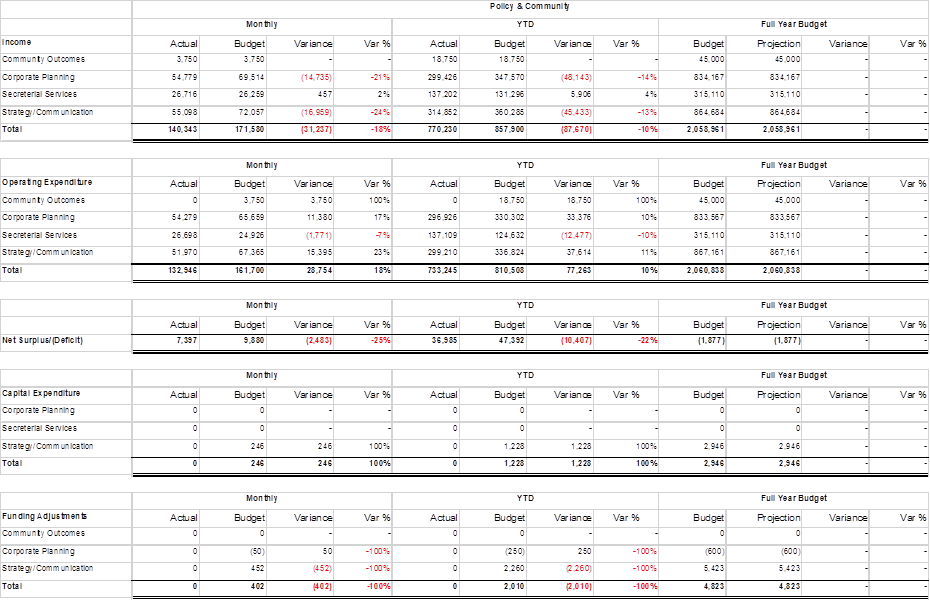

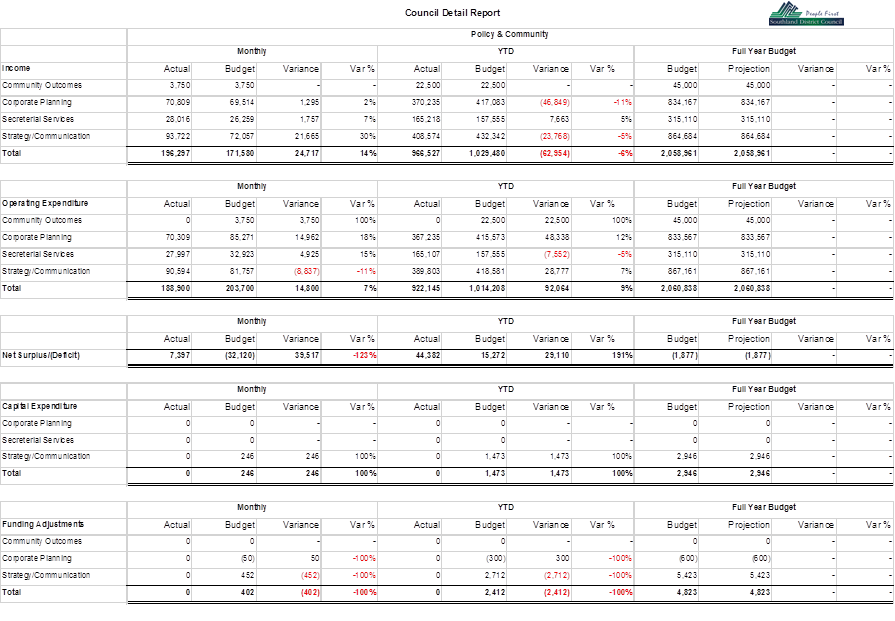

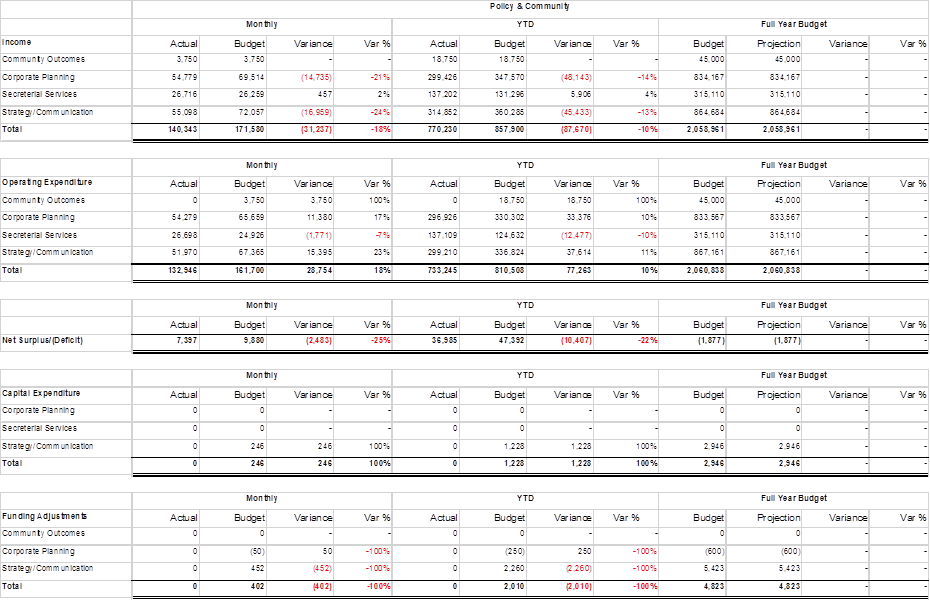

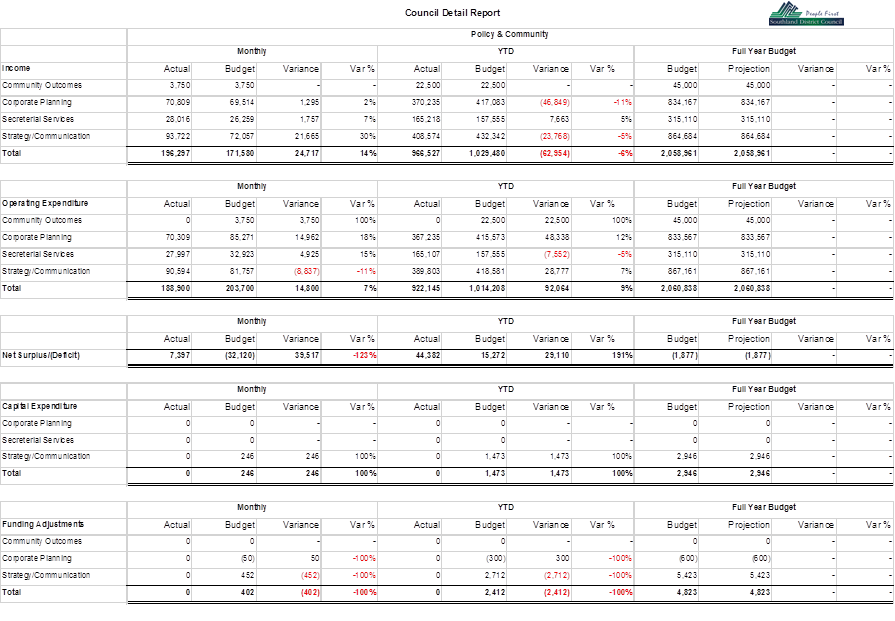

POLICY AND

COMMUNITY COMMENTARY

Income for the year-to-date is 10% ($88K) under

budget. Expenditure for the year-to-date is 10% ($77K) under

budget.

Community Outcomes

Income is on budget. Expenditure is under budget by $19K.

Part of this budget has been identified to fund the Southland Regional

Development Strategy.

Corporate Planning

Income is 14% ($48K) under budget. Expenditure is 10%

($33K) under budget due to lower staff costs ($10K), internal overheads ($10K),

training ($4K), lower costs on the district survey ($6K) legal costs ($2K) and

consultant costs ($4K).

Secretarial Services

Income is 4% ($6K) over budget. Expenditure is 10%

($12K) over budget due to overspends on internal photocopying ($5K), training costs

($5K) and advertising ($4K). As this activity is internally funded the

increased expenditure impacts directly on income.

Strategy/Communication

Income is 13% ($45K) under budget. Expenditure is

underspent by 11% ($38K) due to website costs ($4K), communication costs

($14K), newspaper advertising ($5), first edition costs ($4), software licence

costs ($3K) and internal overheads ($10K). This is offset by radio

advertising costs ($8K) and training costs ($3K). As this activity is

internally funded the reduced expenditure impacts directly on income.

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

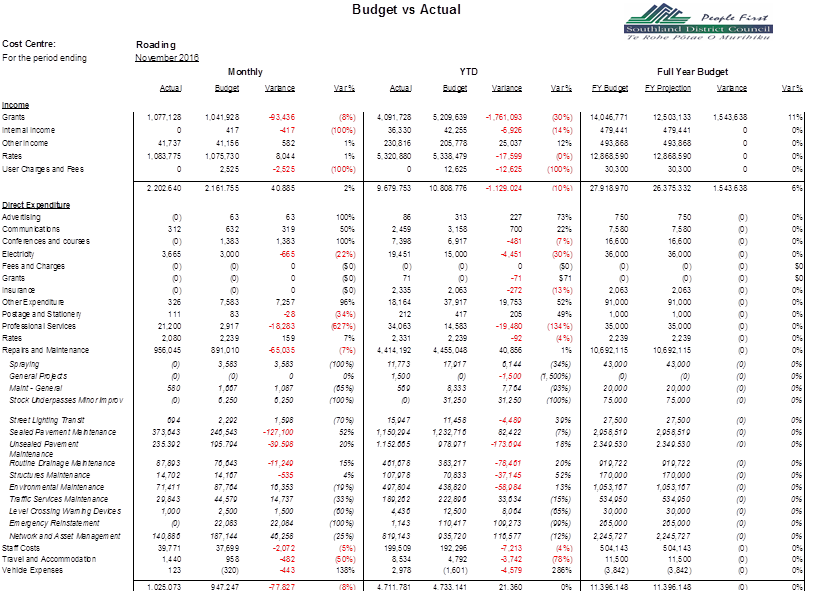

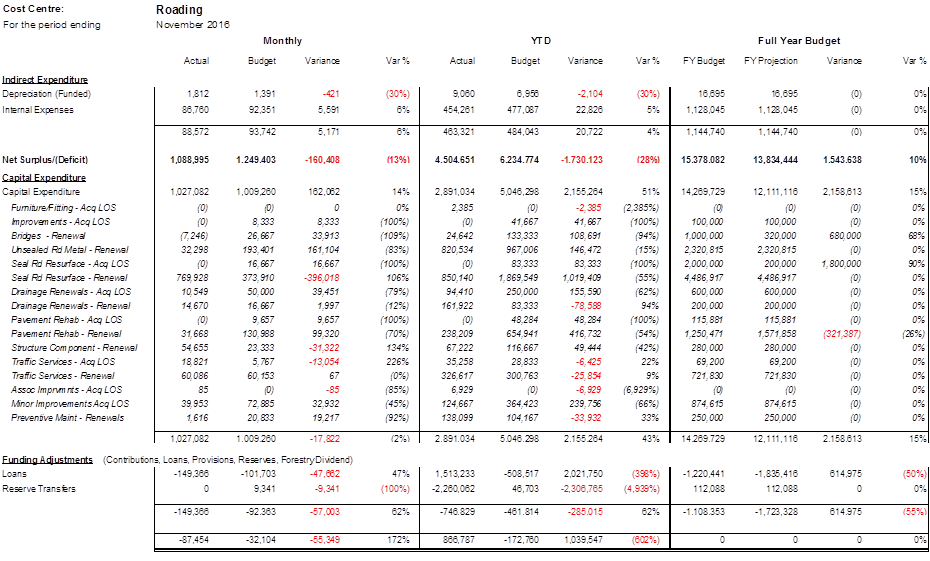

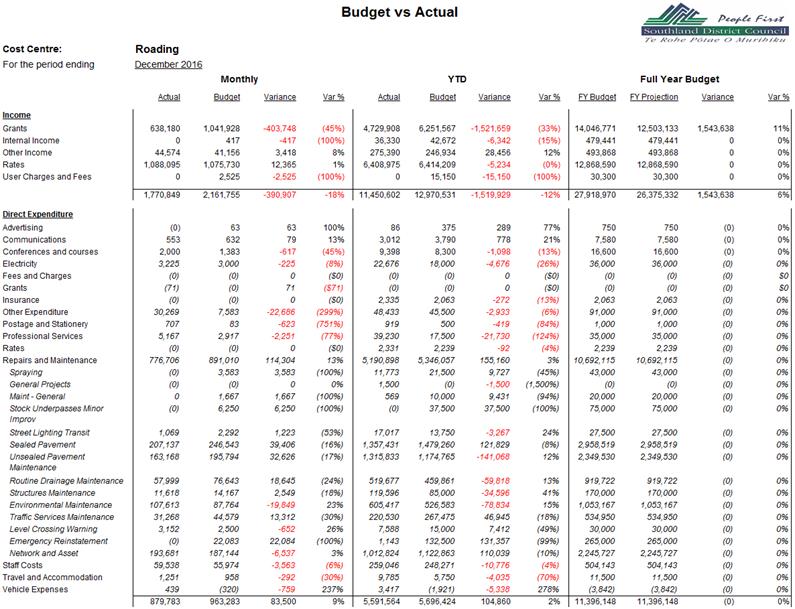

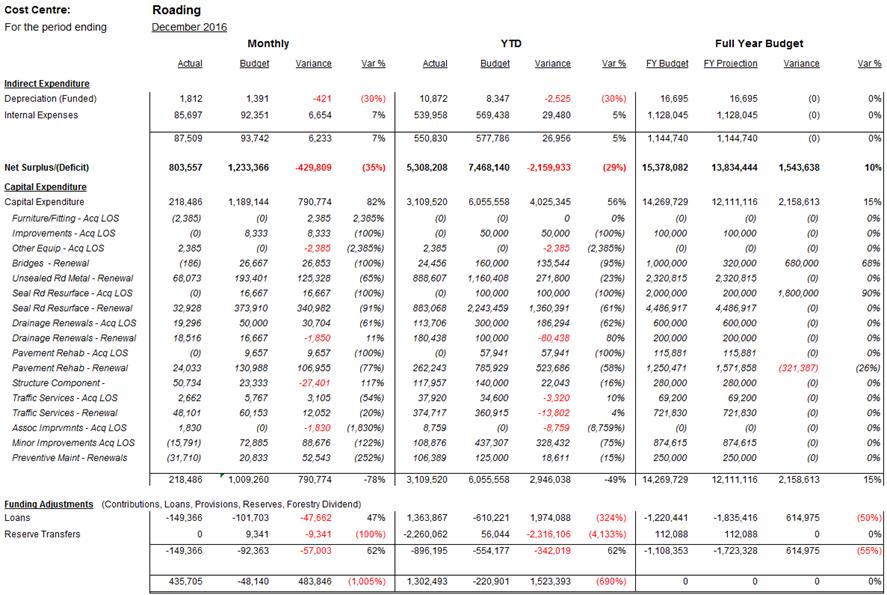

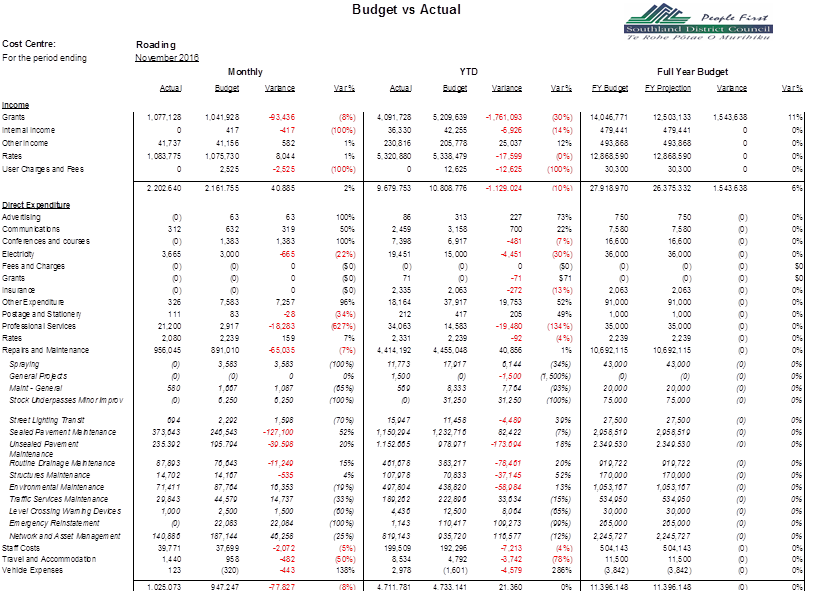

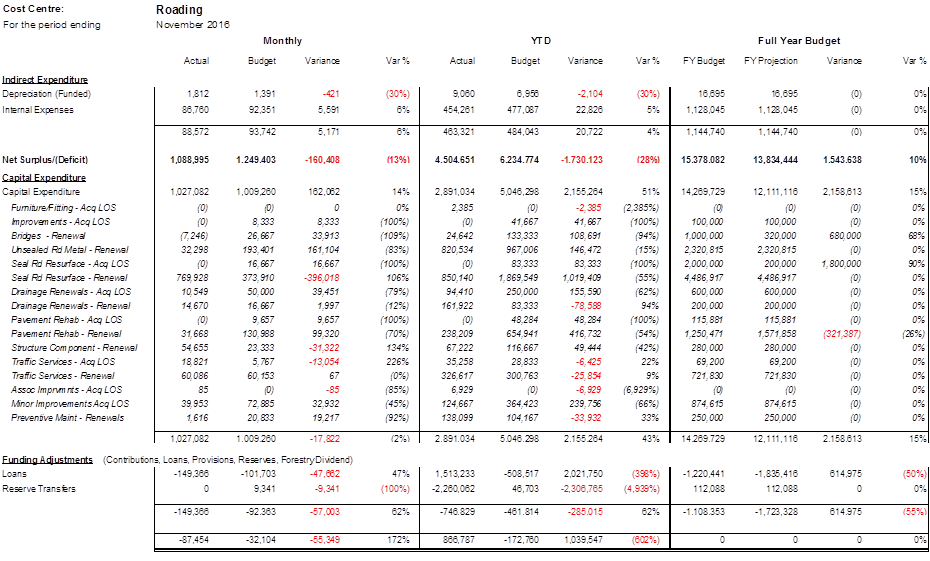

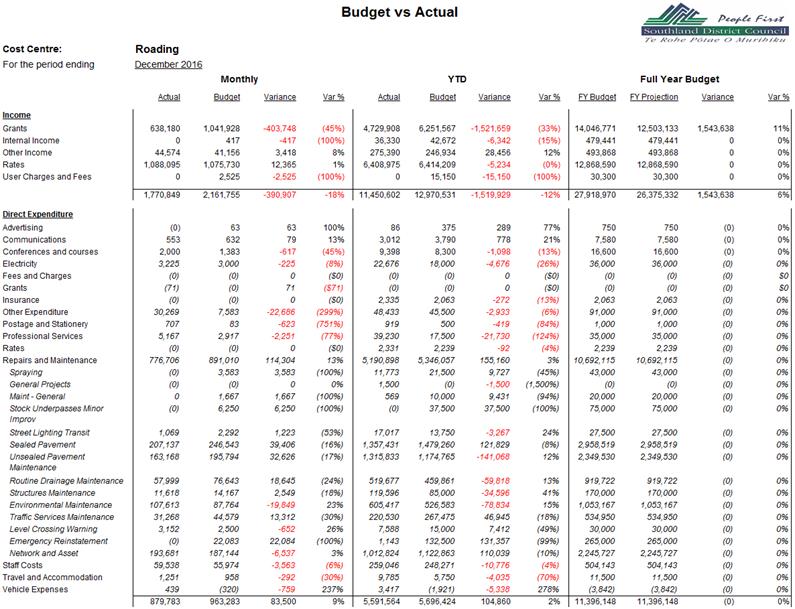

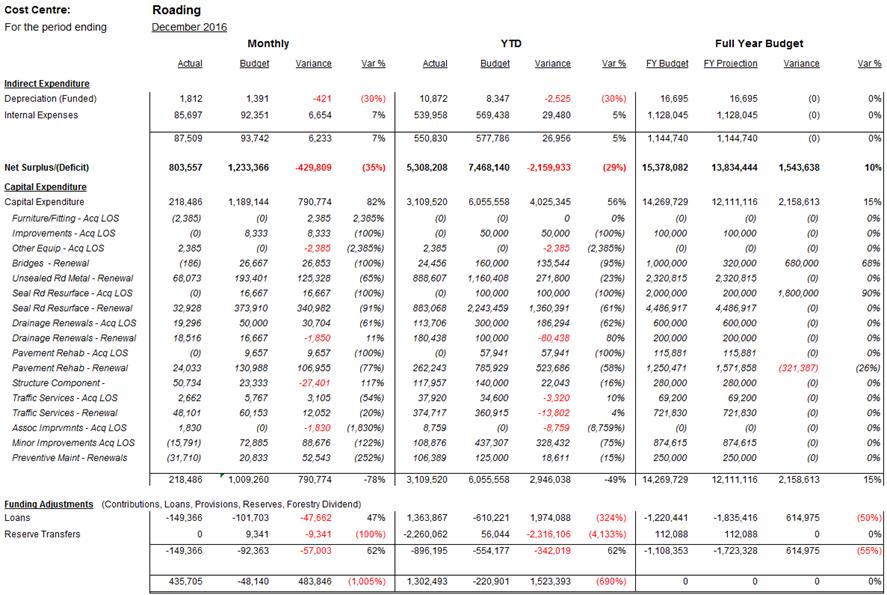

STRATEGIC TRANSPORT

Overall Financial Performance

Transport remains focused on

delivering value for money. The current focus of the business unit is the

‘lead in work’ required for its capital works programme.

Overall maintenance budgets are in line with actual

expenditure year to date. Due to related weather events over the winter

period, this has put a strain on the resilience budgets. This will likely

be offset in operating expenditure and will be monitored closely over the

financial year.

It is also noted that unsealed roads costs are over

budget. This is primarily due to grading and other ad-hoc work.

This line item will likely align in the new calendar year but will be monitored

closely.

There is a maintained focus of responding to the needs of

the network while working within Annual Plan and NZTA budgets.

Council’s Transport capital expenditure is under

budget primarily due to timing. Council is currently in the planning

stage for this year’s programme. Of note, there has been a significant

drop in the bitumen index over the last few months.

It is forecasted along with

project being deferred until the next financial years (namely the Southern

Scenic Route extension and Mararoa Bridges projects) that capital

expenditure will significantly be under budget at year end. Reseal

work has commenced.

A lot of construction work

namely rehabilitations will commence in the new calendar year. Some more Minor

Improvement work will also be advanced also in the new calendar year. Our safe

systems Engineer is currently collecting appropriate data which will be used to

evaluate appropriate and prioritise safety investment in the new calendar year.

|

Key

|

|

|

Largely on Track

|

|

|

Monitoring

|

|

|

Action Required

|

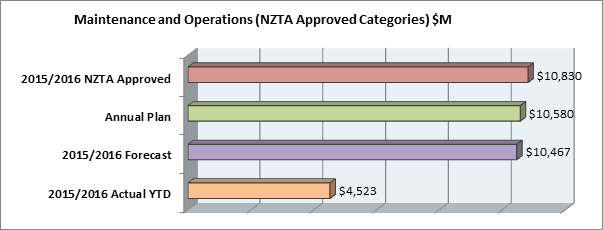

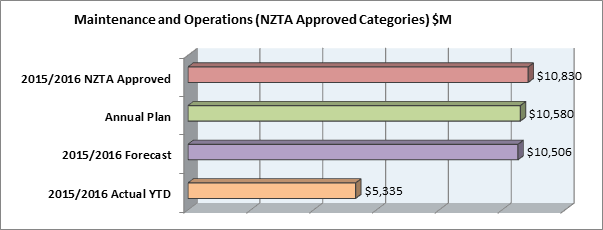

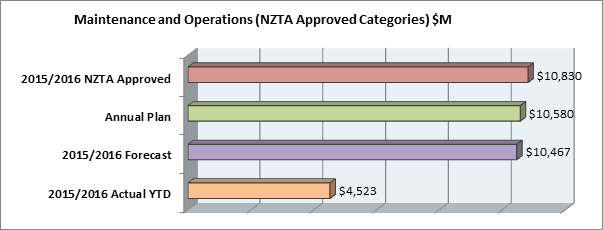

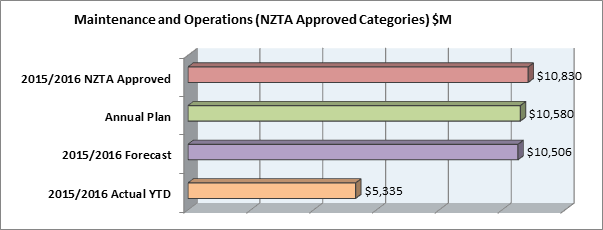

Maintenance and Operations (excluding Special Purpose

Roads):

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

42%

|

43%

|

43%

|

42%

|

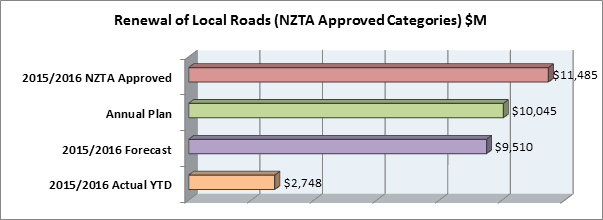

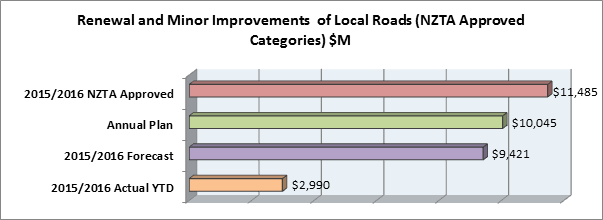

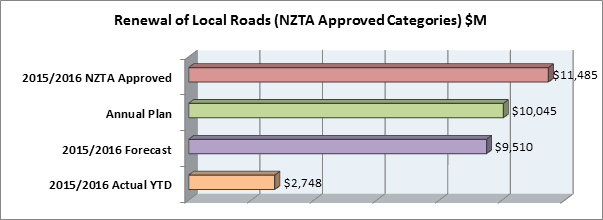

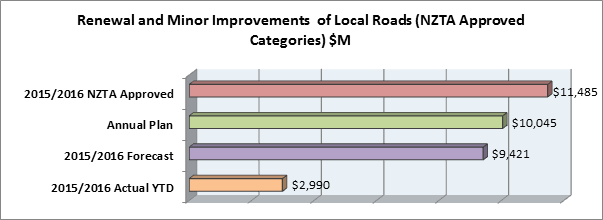

Renewals and Minor Improvements:

|

Financial Tracking vs Plans

|

|

YTD

|

Forecast

|

Annual Plan

|

NZTA Approved

|

|

42%

|

29%

|

27%

|

24%

|

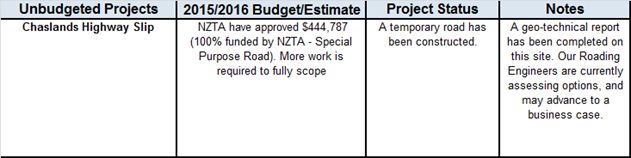

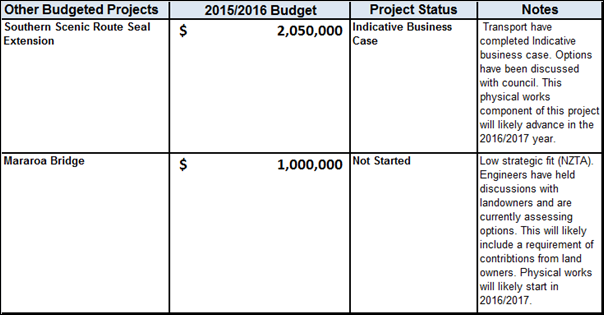

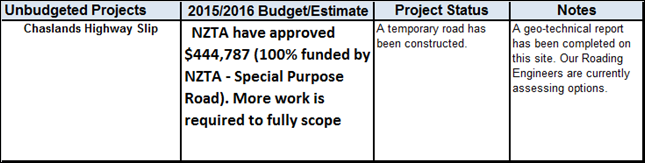

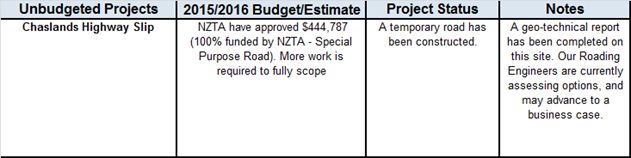

Other Budgeted Projects:

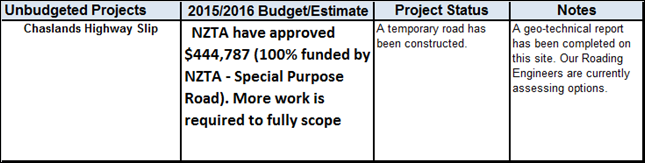

Unbudgeted Projects:

|

Activities

Performance Audit Committee

|

09 March 2016

|

|

Activities

Performance Audit Committee

|

09 March 2016

|

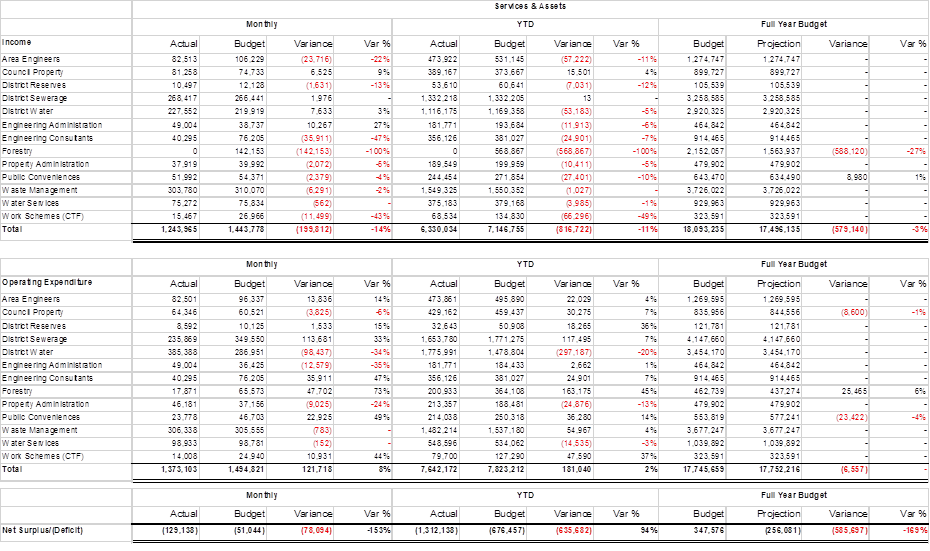

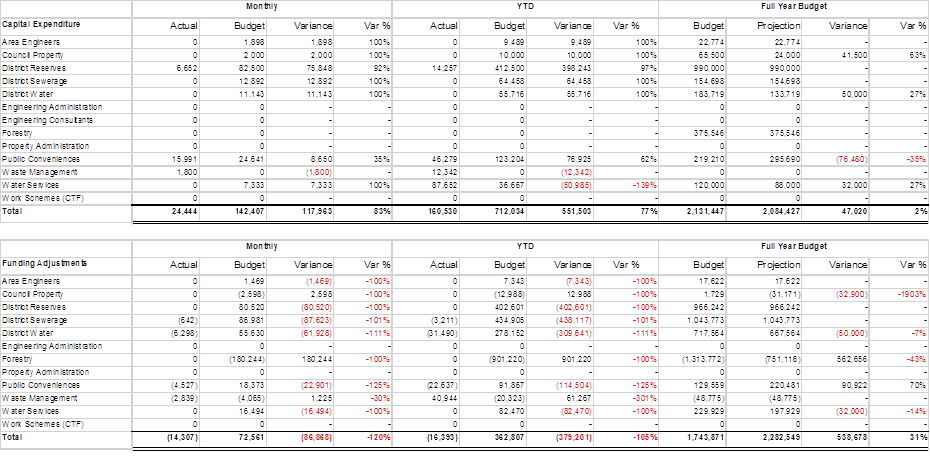

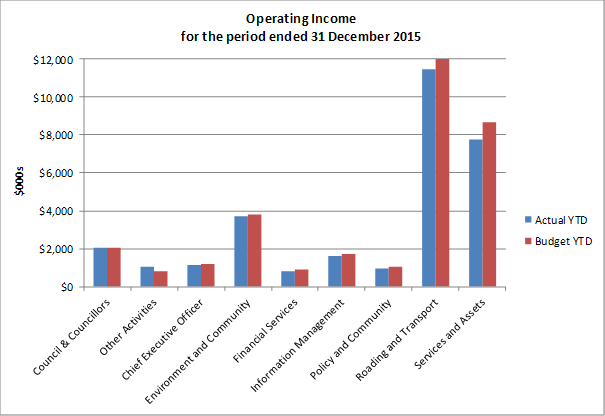

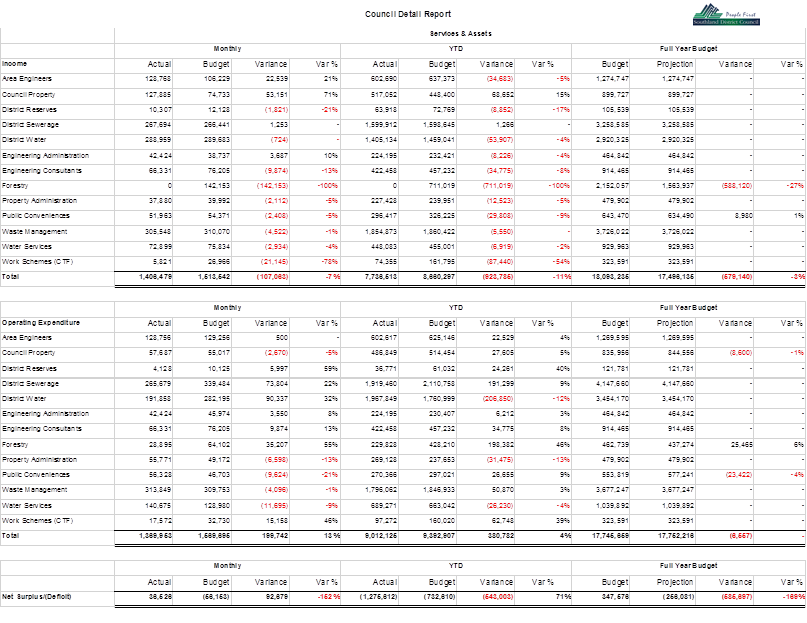

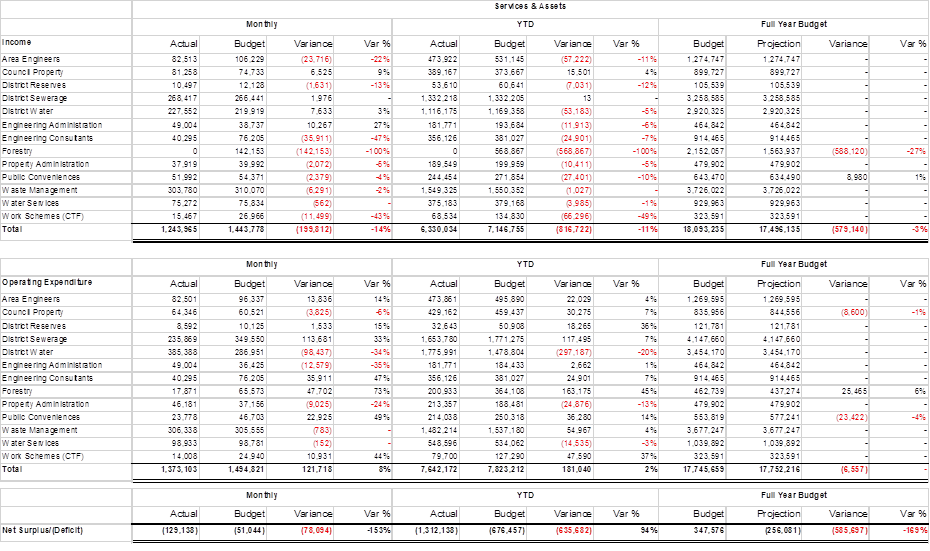

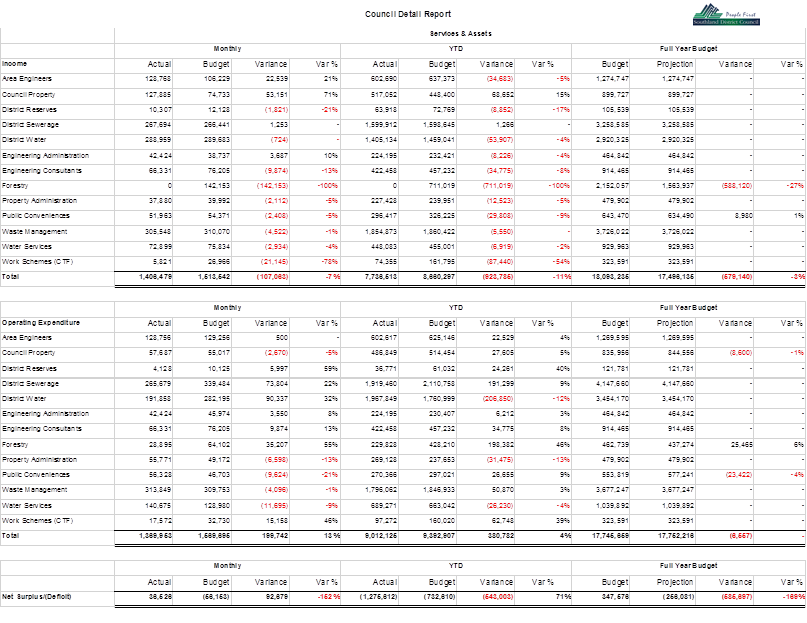

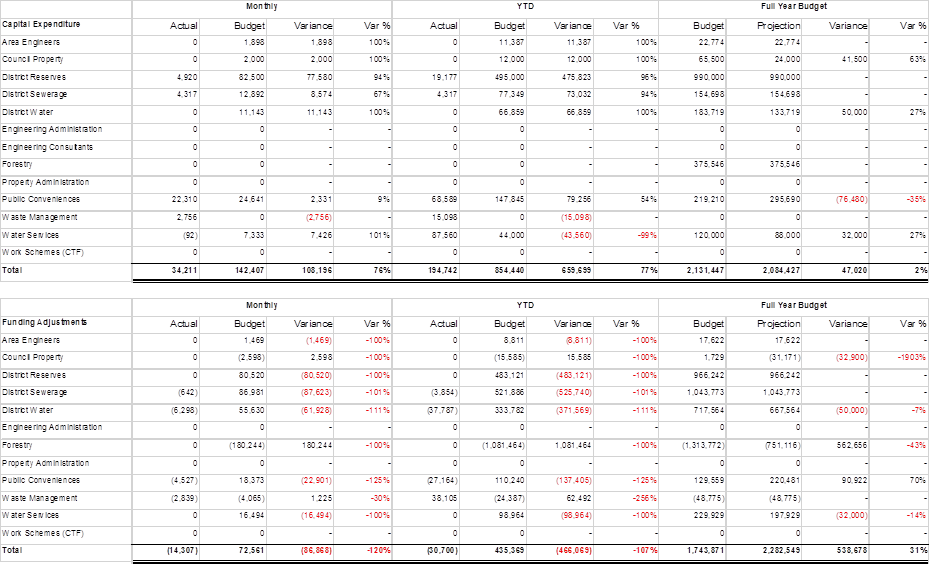

SERVICES AND

ASSETS (Excluding Roading)

COMMENTARY

Overall Financial Performance

Income

Actual income is $6.33M compared

to a budget of $7.15M.

Key Highlights

Area Engineers income is under budget due to expenditure under

budget. This business unit is balanced up with income collected from

different business units.

District Water income is under budget due to actual income from metered

billing is less than budget.

Engineering Consultants income is under budget and this is reflective of operating expenditure

underspends.

Forestry nil income received during November.

Harvesting is scheduled to begin in January of the first 10,000 ton sale area

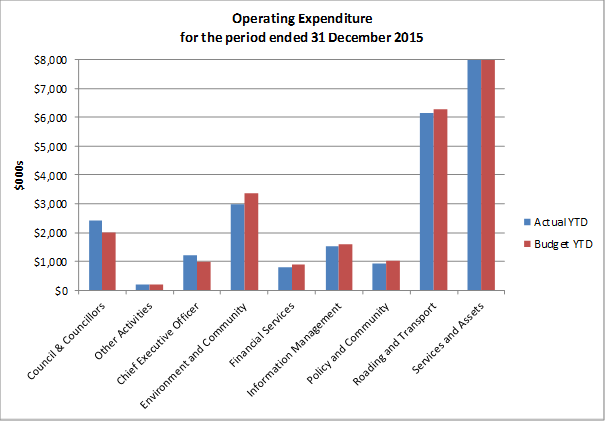

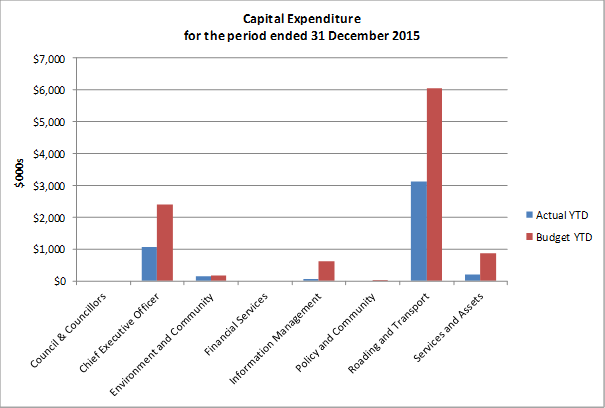

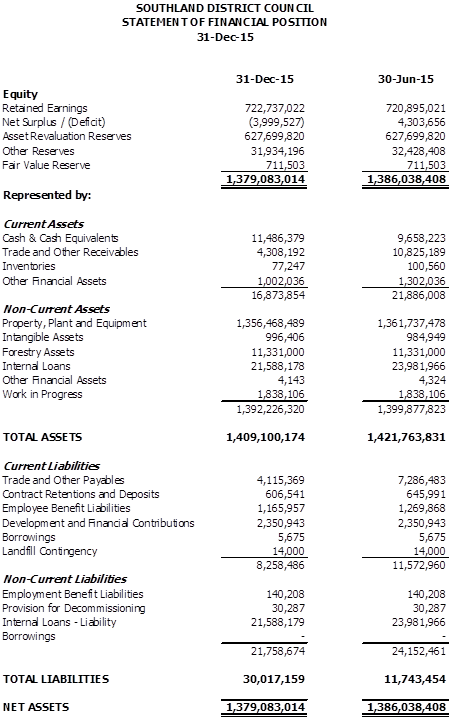

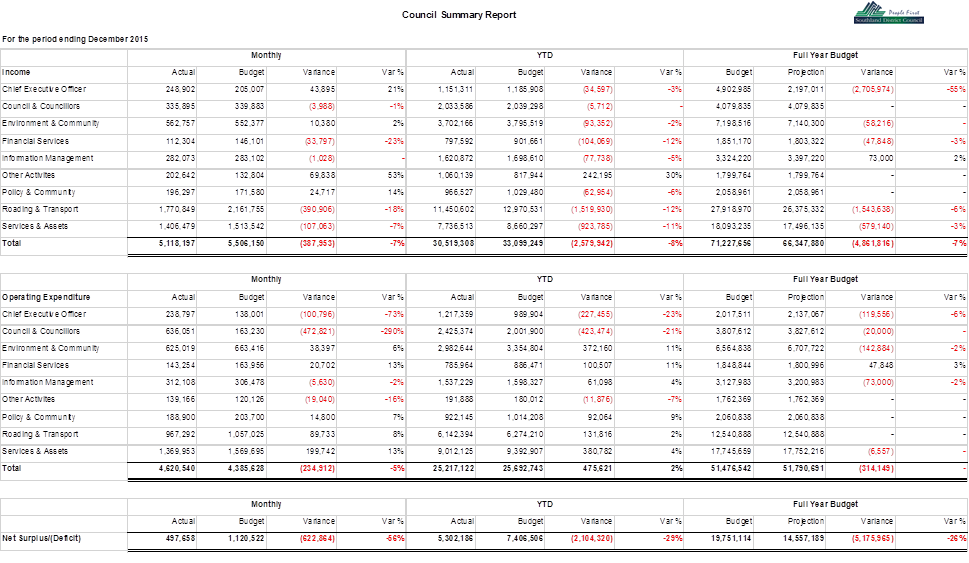

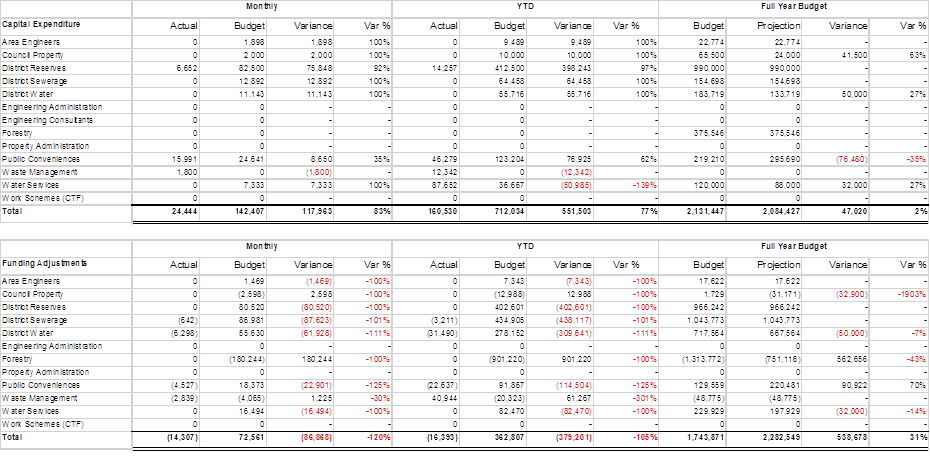

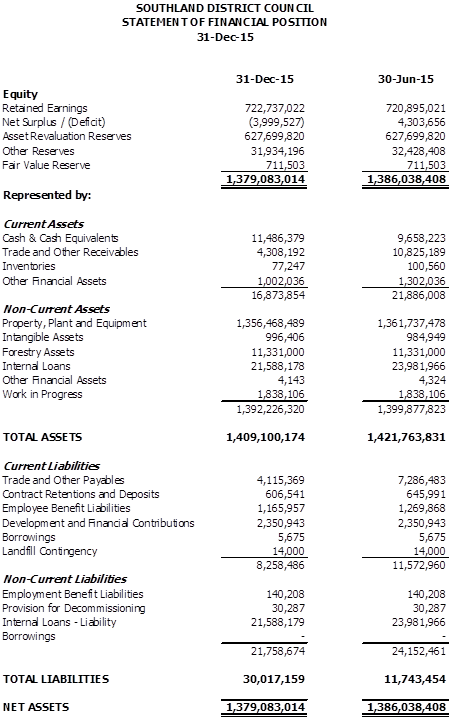

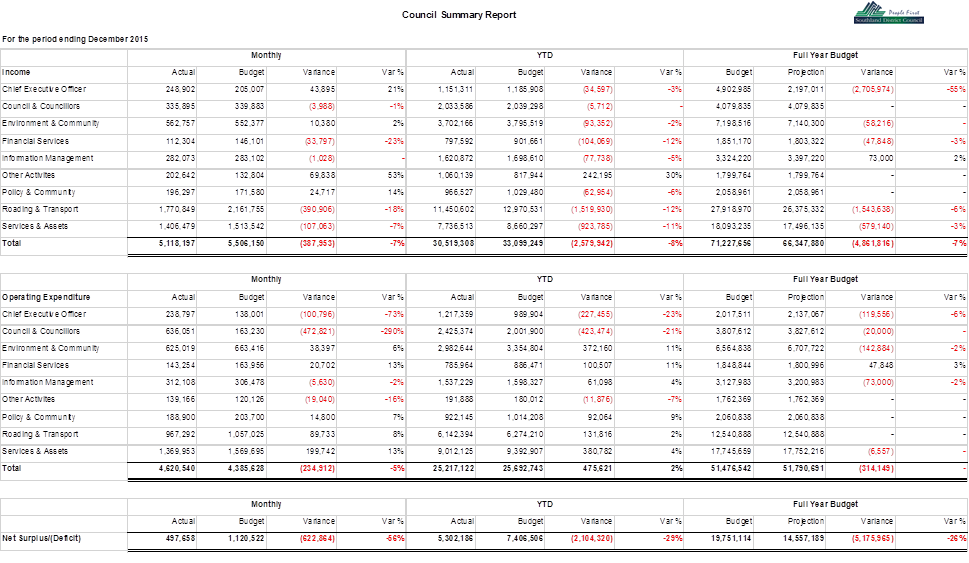

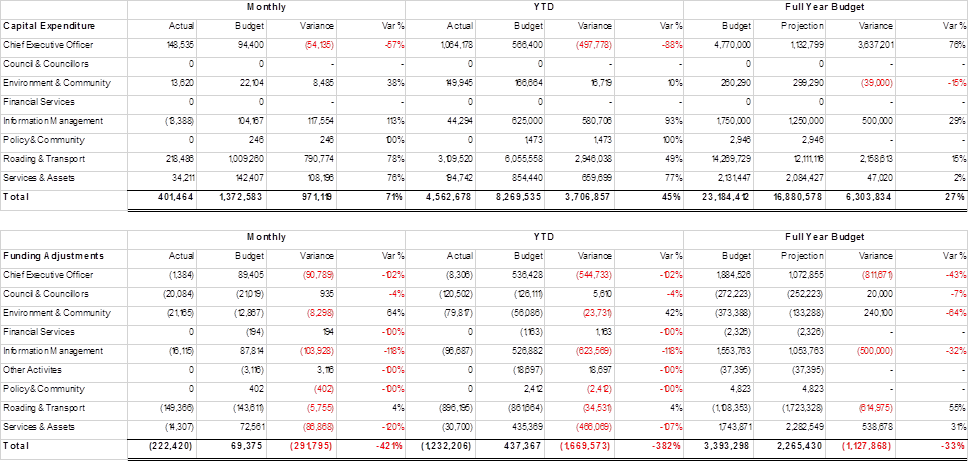

in Dipton. There are 40,000 tonnes planned to be harvested from the