Notice is hereby given that a Meeting of

the Policy Review Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Wednesday, 18

May 2016

10.30am

Council Chambers

15 Forth Street

Invercargill

|

|

Policy Review Committee Agenda

OPEN

|

MEMBERSHIP

|

Chairperson

|

Rodney Dobson

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Lyall Bailey

|

|

|

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

|

Chief Executive

|

Steve Ruru

|

|

|

Committee Advisor

|

Fiona Dunlop

|

|

Terms of Reference for Policy Review

Committee

This committee is a committee of Southland

District Council and has responsibility to:

·

Review Council policies on a regular basis as to

their relevancy and appropriateness.

·

Recommend new policies or changes to existing

policies as required.

·

Ascertain the impact of proposed Government

legislation on Council policies or activities and make responses/submissions on

regional matters, SOEs, etc.

·

Review Asset Management Plans (including the

renewal policy) for Council's infrastructural assets such as roading, water and

sewage schemes and other Council property.

|

Policy Review Committee

18 May 2016

|

|

TABLE OF

CONTENTS

ITEM PAGE

Procedural

1 Apologies 5

2 Leave of

absence 5

3 Conflict of

Interest 5

4 Public Forum 5

5 Extraordinary/Urgent

Items 5

6 Confirmation

of Minutes 5

Reports

7.1 Venture

Southland Community Development Update 13

7.2 Venture

Southland Projects and Activities Report February - March 2016 33

7.3 Tourism

Trends and Issues 55

7.4 Draft

Reserves Management Policy 67

7.5 Community

Futures Project update 85

At the close of

the agenda no apologies had been received.

2 Leave

of absence

At the close of

the agenda no requests for leave of absence had been received.

3 Conflict

of Interest

Committee

Members are reminded of the need to be vigilant to stand aside from

decision-making when a conflict arises between their role as a member and any

private or other external interest they might have.

4 Public Forum

Notification to

speak is required by 5pm at least two days before the meeting. Further

information is available on www.southlanddc.govt.nz

or phoning 0800 732 732.

5 Extraordinary/Urgent

Items

To consider, and if

thought fit, to pass a resolution to permit the committee

to consider any further items which do not appear on

the Agenda of this meeting and/or the meeting to be held with the public

excluded.

Such resolution is

required to be made pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987, and the Chairperson must advise:

(i) the

reason why the item was not on the Agenda, and

(ii) the

reason why the discussion of this item cannot be delayed until a subsequent

meeting.

Section 46A(7A) of the Local Government Official Information and Meetings

Act 1987 (as amended) states:

“Where an item

is not on the agenda for a meeting,-

(a)

that item may be discussed at that meeting if-

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b)

no resolution, decision or recommendation may be made in

respect of that item except to refer that item to a subsequent meeting of the

local authority for further discussion.”

6 Confirmation

of Minutes

6.1 Meeting

minutes of Policy Review Committee meeting of 9 March 2016

|

Policy Review Committee

OPEN MINUTES

|

Minutes of

a meeting of Policy Review Committee held in the Council Chambers, 15 Forth

Street, Invercargill on Wednesday, 9 March 2016 at 9.02am.

present

|

Chairperson

|

Rodney Dobson

|

|

|

|

Mayor Gary Tong

|

|

|

Councillors

|

Lyall Bailey

|

|

|

|

Stuart Baird

|

|

|

|

Brian Dillon

|

|

|

|

John Douglas

|

|

|

|

Paul Duffy

|

|

|

|

Bruce Ford

|

|

|

|

George Harpur

|

|

|

|

Julie Keast

|

|

|

|

Ebel Kremer

|

|

|

|

Gavin Macpherson

|

|

|

|

Neil Paterson

|

|

IN ATTENDANCE

Chief Executive Steve Ruru, GM Community

and Futures Rex Capil, Communications Manager Louise Pagan, Team Leader

Governance Chris Dolan and Committee Advisor Fiona Dunlop.

1 Apologies

There were no

apologies.

2 Leave

of absence

There were no

requests for leave.

3 Conflict

of Interest

There were no conflicts of interest declared.

4 Public

Forum

There was no public

forum.

5 Extraordinary/Urgent

Items

There were no

Extraordinary/Urgent items.

6 Confirmation

of Minutes

|

Resolution

Moved Cr

Keast, seconded Cr Bailey and resolved:

That the

Policy Review Committee confirms the minutes of Policy Review Committee, held

on 18 November 2015 as a true and correct record of that meeting.

|

Reports

|

7.1

|

Venture Southland Projects and Activities Report September -

October 2015

Record No: R/15/11/20747

|

|

|

Paul

Casson Chief Executive of Venture Southland was in attendance for this item.

|

|

|

Resolution

Moved Cr Paterson, seconded Cr

Dillon and resolved:

That the Policy

Review Committee:

a) Receives

the report titled “Venture Southland Projects and Activities Report

September - October 2015” dated 22 February 2016.

|

|

7.2

|

Venture Southland Project and Activities Report November and

December 2015 and January 2016

Record No: R/16/2/2423

|

|

|

Paul Casson

Chief Executive of Venture Southland was in attendance for this item.

Mr Casson advised that the purpose of the report was to

update the Council on Venture Southland projects and activities for November

and December 2015 and January 2016.

Council noted that there were many projects and activities

covered in the report.

Mr Casson highlighted the progress with the work at the

Awarua Satellite Ground Station. Venture Southland had project managed

the installation of Spire-Global’s new satellite ground station at

Lochiel. This was commissioned on 11 December 2015. An

arrangement with existing satellite operators that will allow for fibre-optic

connectivity to the Awarua Satellite Ground Station was negotiated by Venture

Southland.

Mr Casson also advised

that the Aeromagnetic Survey of Southland began in Southland and Otago in

January 2016. The data gathered will be available free to industry and

investors. The survey is to continue over the 2016/2016 summer and

expected to end in March 2017. To date a fixed wing aircraft has

surveyed 4,536 km, which is 6% of the total survey area of Southland Region.

Council noted that Venture Southland has been successful

in being awarded the Regional Business Partner Programme. This programme was

retendered in mid-2015, with Venture Southland being notified of the

appointment in late 2015. The new contract began in January 2016 with the

migration of the Business Mentors programme into the formal Regional Business

Partner Programme.

Also noted was that the successful bid allows Venture

Southland to continue the partnership with New Zealand Trade and Enterprise

and Callaghan Innovation to ensure local businesses are able to access

support services including research and development, and innovation support,

management training, business mentor and business referral and support

services. To date, Venture Southland has seen a significant increase in

uptake of services in 2016. Venture Southland will continue to work

with New Zealand Trade and Enterprise to ensure the available funding matches

demand as closely as possible.

Mr Casson further

advised that the Southland Dairy Lean programme has been formally recognised

and endorsed by DairyNZ. It will be progressively rolled out throughout New

Zealand and will be rebranded as the ‘Farm Tune’ Programme. Southland

delivery of Farm Tune began in mid-January 2016, with 12 farms as part of the

programme. Feedback on the initial sessions has been very positive. The

formal training programme will continue until the end of April, with

follow-up and on-farm session continuing throughout the year.

|

|

|

Resolution

Moved Cr Harpur, seconded Cr Dillon

and resolved:

That the Policy

Review Committee:

a) Receives

the report titled “Venture Southland Project and Activities Report

November and December 2015 and January 2016” dated 19 February 2016.

|

|

7.3

|

2016 Southland District Council Holiday Programme Report

Record No: R/16/1/1257

|

|

|

Paul

Casson, Chief Executive of Venture Southland and Sally Hayes, Invercargill

Licensing Trust Kidzone Trust Festival Director were in attendance for this

item.

1

Miss Hayes advised that the report provided an

evaluation of the 2016 Southland District Council Holiday Programme and

identified areas to consider for the 2017 programme.

2

3

The Committee noted that the programme

attendance numbers far exceeded those in any other year that the programme

has been delivered. Feedback on programme was that it continues to be very

popular with families in the district with 50% of them having never attended one

before.

4

5

Miss Hayes also advised that going forward the

programme will aim to maintain and in some areas grow attendance numbers and

that feedback, both positive and constructive will continue to be sought for

this programme with the aim to continue delivering a programme that is best

suited to the communities that use it.

6

7

The Committee also noted that online

registration was available this. Parents advised that it was convenient

rather than wait for an Area Office to be open to register.

Miss Hayes commented that for the delivery of the 2017 Holiday

Programme that a few more resources on the team to assist with the delivery

and a uniform specific to the programme would be helpful.

|

|

|

Resolution

Moved Cr Bailey, seconded Cr Keast

and resolved:

That the Policy

Review Committee:

a) Receives

the report titled “2016 Southland District Council Holiday Programme

Report” dated 26 February 2016.

|

|

7.4

|

Draft Use of Unmanned Aerial Vehicles Policy

Record No: R/16/1/739

|

|

|

Tamara Dytor, Policy

Analyst was in attendance for this item.

|

|

|

Ms Dytor advised that the report presents a draft of the

Unmanned Aerial Vehicles (UAVs) Policy to allow the Southland District

Council to determine its approach to the use of UAVs, such as drones above

Council owned or controlled land or property.

She also advised that under new rules introduced by the

Civil Aviation Authority (CAA), Council can grant or decline consent for the

use of UAVs on or above property that it owns or controls. This report

seeks guidance from the Policy Review Committee regarding the management and

regulation of UAVs in Southland District.

The Committee were advised of an addition to the policy

that would include the reporting of near misses with unmanned aerial

vehicles.

|

|

|

Resolution

Moved Cr Kremer, seconded Cr Macpherson

recommendations a – c, d with an addition (as indicated) and e:

That the Policy

Review Committee:

a) Receives

the report titled “Draft Use of Unmanned Aerial Vehicles Policy”

dated 26 February 2016.

b) Determines

that this matter or decision be recognised as not significant in terms of

Section 76 of the Local Government Act 2002.

c) Determines

that it has complied with the decision-making provisions of the Local

Government Act 2002 to the extent necessary in relation to this decision; and

in accordance with Section 79 of the Act determines that it does not require

further information, further assessment of options or further analysis of

costs and benefits or advantages and disadvantages prior to making a decision

on this matter.

d) Endorses

this policy for consultation with Community Boards and Community Development

Area Subcommittees on prohibited locations in local areas with the

delegation to the Chief Executive Officer to include conditions for reporting

of near misses with Unmanned Aerial Vehicles.

e) Recommends

the draft policy for consideration by Council following feedback from

Community Boards and Community Development Area Subcommittees.

|

|

7.5

|

Community Futures Project

Record No: R/15/12/22429

|

|

|

Tamara Dytor, Policy

Analyst was in attendance for this item.

Ms

Dytor advised that the report provides the Policy Review Committee with an

update on the Community Futures Project as well as recent and upcoming

engagements with community stakeholders.

The

Committee noted that the Community Futures Project was developed to

inform elected members about the impacts of demographic change on communities

and to date, the Project has focused on demographic projections for Ohai and

Nightcaps. The Project focuses on the implications of projected

demographic change for Ohai and Nightcaps, both of which are likely to

decline in population over the next 30 years.

Demographic

change has implications across a range of Council activities. Changes

in demographics will impact on the demand for services, township viability

and vibrancy, rates affordability and funding equity.

The Committee also noted that there was a

workshop for elected members and staff were held on 18 and 19 November 2015,

with presentations by demographers Dr Natalie Jackson, Rachael McMillan and

Dr Peter Matanle. A forum for community stakeholders was held in the

Southland District Council Otautau office on 24 February 2016 and a further

forum for all residents is scheduled for 10 March 2016 in the Nightcaps

Community Hall.

Ms

Dytor further advised that Officers will continue with community engagement

and use feedback and research to identify key issues and priorities.

These will be communicated to Elected members, who may wish to direct

Officers to develop potential options for infrastructure, services and

projects. An analysis of options will be used inform the content of

Asset Management Plans and the Long Term Plan 2018-2028.

|

|

|

Resolution

Moved Cr Baird, seconded Cr Harpur

and resolved:

That the Policy Review Committee:

a) Receives

the report titled “Community Futures Project” dated 2 March 2016.

|

The meeting concluded at 10.01am. CONFIRMED

AS A TRUE AND CORRECT RECORD AT A MEETING OF THE Policy Review Committee HELD ON WEDNESDAY 9 MARCH 2016.

DATE:...................................................................

CHAIRPERSON:...................................................

|

Policy Review

Committee

18 May 2016

|

|

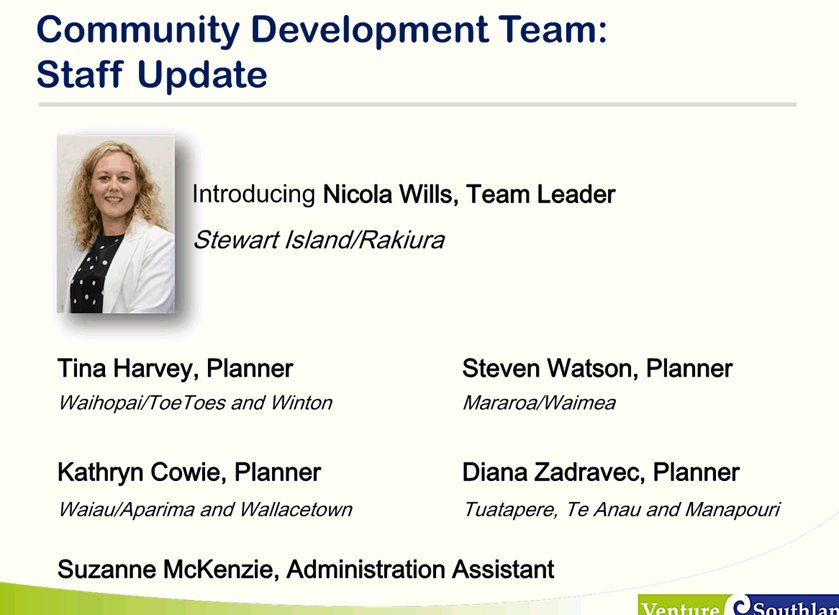

Venture

Southland Community Development Update

Record No: R/16/4/6220

Author: Nicola

Wills, Community Development Team Leader

Approved by: Rex Capil,

Group Manager Community and Futures

☐

Decision ☐ Recommendation ☒ Information

Introduction

1 Please

find attached the Venture Southland Community Development Update, which is

focused on the Waiau Aparima area.

2 A

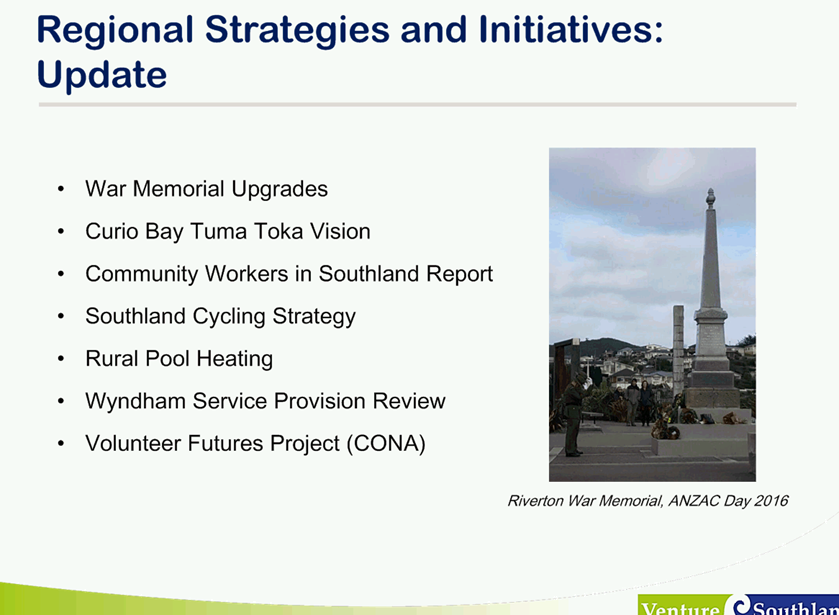

highlight for the team has been the improved state of War Memorials across the

region during recent ANZAC day commemorations. This has been due to recent

restoration work completed to a number of memorials, facilitated by Venture

Southland.

3 The

Community Development team have had a busy last quarter and we are looking

forward to working on a number of future projects with the SDC Community and

Futures team and other SDC staff.

|

Recommendation

That the Policy

Review Committee:

a) Receives

the report titled “Venture Southland Community Development

Update” dated 9 May 2016.

|

Attachments

a Venture

Southland Community Development Update View

|

Policy Review

Committee

|

18 May 2016

|

|

Policy Review

Committee

18 May 2016

|

|

Venture Southland Projects and Activities Report

February - March 2016

Record No: R/16/4/6223

Author: Hunter

Andrews, Communications Manager Venture Southland

Approved by: Rex Capil,

Group Manager Community and Futures

☐

Decision ☐ Recommendation ☒ Information

Purpose

1 The

purpose of this report is to update the Southland District Council on Venture

Southland projects and activities for February and March 2016. The

accompanying document provides highlights and a full report.

|

Recommendation

That the Policy

Review Committee:

a) Receives

the report titled “Venture Southland Projects and Activities Report

February - March 2016” dated 10 May 2016.

|

Attachments

a Report

to Venture Southland Joint Committee - 18 April 2016 - Projects and Activities

Report February - March 2016 View

|

Policy Review

Committee

|

18 May 2016

|

To: Venture

Southland Joint Committee

Date: 18

April 2016

Subject: Projects

and Activities Update February – March 2016

Author: Hunter

Andrews, Communications Manager

Approved: Paul

Casson, Chief Executive

SUMMARY

Venture Southland projects and

activities update for February – March 2016.

RECOMMENDATION

THAT THE VENTURE SOUTHLAND PROJECTS AND ACITIVITES REPORT -

FEBRUARY – MARCH 2016 REPORT BE RECEIVED.

COMPLIANCE STATEMENT

This recommendation is consistent with the Venture Southland

Business Plan 2015/16, which has been adopted following public consultation.

SOME OF THE HIGHLIGHTS

CONTAINED WITHIN THE REPORT:

Regional Business Partner Programme

Venture Southland has seen a significant increase in uptake

of business support services through the Regional Business Partner Programme,

so far, in 2016. While the start of the year is traditionally a busy period, as

companies plan their activities for the year, 2016 has been particularly busy.

A significant factor in the growth has been the increased levels of training

associated with Health and Safety. This has been particularly evident across

the dairy sector.

Awarua Satellite Ground Station

Venture Southland has continued to provide oversight to

engineering matters at Awarua and Lochiel on behalf of satellite operators

hosted there. A visit from a potential new operator from Europe is scheduled

for April 2016.

The arrangement with existing

satellite operators to share the costs for installing fibre-optic connectivity

to the Awarua Satellite Ground Station has been agreed and will be funded by

one of the international partners at the estimated $130,000 cost, and new users

will pay a capital connection cost as these parties take up the service.

Aeromagnetic Survey of

Southland

In November 2015, New Zealand Petroleum and Minerals (NZPAM)

began the aeromagnetic survey in Nelson and Marlborough and in January, the

survey began in Southland and Otago. The aim of the survey is to get better

insights into geological hazards (including fault lines); understand regional

water resources; and gather information on climate, soil and geology. The data

gathered will be available free to industry and investors.

2016 Southland Business Survey

Venture Southland is once again measuring the level of

confidence within the Southland business community. This is the third year that

Venture Southland has surveyed the Southland business community. Data collected

in the two previous surveys has been used to contribute to and to develop a

wide range of regional initiatives including the Southland Regional Development

Strategy - the Southland Regional Labour Force Survey, as well as sector

training, events and initiatives.

Invercargill i-SITE & Visitor Information Services

The information services team have experienced a busy

February, with a 10% rise in revenue from bookings and retail, while averaging

an additional 6 non-financial transactions per hour (e.g. destination advice,

events information and giving directions). March was quieter, with an 8%

drop in bookings compared with the same period in 2015, and with approximately

3.5 non-financial transactions per hour. However the retail sales showed

a 17.5% increase over March 2015.

Southland Festival of the Arts

The Festival begins on April 26 and continues into

May. Venture Southland programmes and selects the festival and

coordinates nine events with eighteen performances around the region.

Southland Cycling Strategy

Status: UNDERWAY -

due to be completed by June 2016.

The strategy will provide direction for planning and

investment decisions and will identify feasible projects for inclusion in

future works programmes aimed at improving cycling infrastructure and

opportunities in the region. A Steering Committee has been formed

consisting of representatives of the three Councils plus Sport Southland. A

preferred contractor has been selected and public consultation is soon to get

underway.

Winton Memorial Hall Upgrade

Funding applications have been submitted for the major

upgrade of the Winton Memorial Hall. $50,000 was recently granted by the

Community Trust of Southland. Further funding applications were submitted

to the Lottery Community Facilities Fund, SDC Community Initiatives Fund and

gaming machine funding organisations. These further funding applications are

currently pending.

Mossburn Rugby Club

Venture Southland staff are working alongside the Mossburn

Rugby Club to assist with securing funding towards the installation of lights

for one of the rugby fields. Planning is also underway for the removal of

power lines and poles.

BUSINESS TEAM

Wood Energy South

There are four feasibility projects completed or currently

underway. These include: Corrections, Tisbury School, Danone and S.I.T. The

S.I.T feasibility will be completed by students as part of their research

project with Wood Energy South providing the technical support and guidance. A

second project for S.I.T students is examining the volume of combustible waste

from Southland businesses.

The National Specifier and Consultants practice paper has

endorsed by the Bioenergy Association of New Zealand and IPENZ endorsement is

being sought. This paper will be officially launched in May in conjunction with

an Industrial Symposium which will highlight case studies from Europe and will

focus on high volume; large scale boiler systems fuelled by wet wood chip and

mixed biomass fuels.

Methane Recovery

A study of the dairy methane

recovery project will be undertaken to evaluate the electrical, thermal and

biological performance of installation with a view towards wider use of this

technology for efficient investment. An integrated plan and typical design for

a methane recovery system has been completed with consultants from Parsons

Brickernhoff and Venture Southland is now developing a monitoring plan and

funding proposal with NIWA, EECA and DairyNZ to support the concept of making

this a reliable and streamlined process.

This work will review the installation, design, methodology

and technology integration to provide a framework for the development of a

repeatable process for similar farms, process industries or even human effluent

treatment systems.

Awarua Satellite Ground Station

Venture Southland has continued to provide oversight to

engineering matters at Awarua and Lochiel on behalf of satellite operators

hosted there. A visit from a potential new operator from Europe is scheduled

for April 2016.

The arrangement with existing

satellite operators to share the costs for installing fibre-optic connectivity

to the Awarua Satellite Ground Station has been agreed and will be funded by

one of the international partners at the estimated $130,000 cost, and new users

will pay a capital connection cost as these parties take up the service.

Silica

Venture Southland has completed a Silica Opportunity

profile. This project is focused on process technology, market trends,

infrastructure, electricity demands and the consent related matters, economic

impacts and financial viability. This document is currently being peer

reviewed.

Detailed analysis of the Southland silica gravel samples has been

conducted by SINTEF, Norway, confirmed

the presence of high quality silica deposits which can be processed to

manufacture electronics grade and solar grade silicon.

Aeromagnetic Survey of

Southland

In November 2015, New Zealand Petroleum and Minerals (NZPAM)

began the aeromagnetic survey in Nelson and Marlborough and in January, the

survey began in Southland and Otago. The aim of the survey is to get better

insights into geological hazards (including fault lines); understand regional

water resources; and gather information on climate, soil and geology. The data

gathered will be available free to industry and investors.

Australian contractor, Thomson Aviation is flying survey

aircraft over the Southern Southland Plains areas to map the geological systems

to a depth of 500m and surface soils. The surveying will continue over the

2016-2017 summer, and it is expected to end in March next year.

The Te Anau Basin area has been completed and the survey

data first iteration analysis has been completed three weeks ahead of schedule

and passed on to SDC.

The first iteration of the mapping data analysis will show

the general nature of the geological systems a further iteration of this data

will most likely be necessary to gain a more detailed understanding of water

resources (location and volume). Venture Southland will contribute $100,000

towards this interpretation work. The Councils may also choose to invest in

further aerial mapping and data analysis for areas of specific interest to

them.

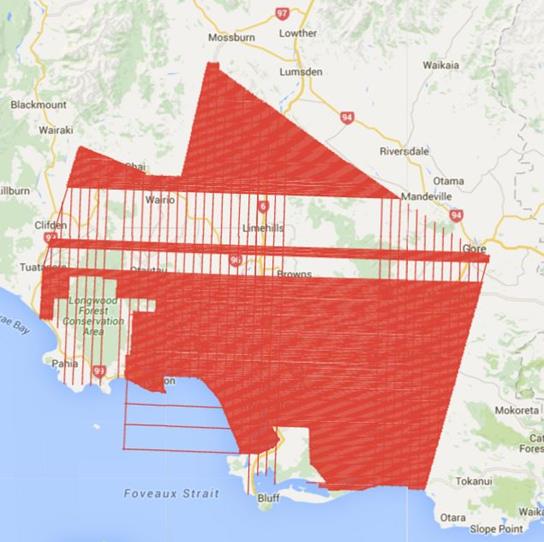

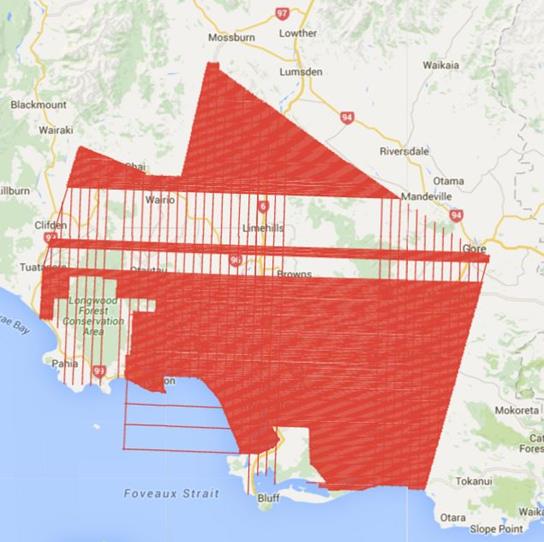

As of 7 March 2016,

Thomson Aviation have acquired 21,731 line km in Southland (Block FG), which is

72% of the survey block (area that has been surveyed to date is shown below in

red). The Southern Southland area is now close to completion and the data

analysis has been initiated.

Southland Youth

Futures – ‘Invest in Youth’

Southland Youth Futures ‘Invest in

Youth’ media campaign officially launched in Saturday’s issue of Southland

Times on 27 February. The full page advertisement called for

businesses to commit to developing and training young people in Southland to

meet their labour force skills shortages.

One of the biggest challenges

for businesses highlighted in the Southland Business Survey 2015 is attracting

and getting the right staff. Nearly 60% of survey businesses surveyed

recognised that recruiting and retaining staff will impact on their business in

the next three years.

The Invest in Youth initiative

proposes another way for employers - connecting with young people before they

leave school. A Working Group of 12 committed Southland businesses have adopted

youth friendly practices and will be speaking at nine Southland secondary

schools in April and May this year about productive industries job

opportunities. The programme also includes site visits in May for interested

young people, and work experience in the July and September school

holidays.

An Invest in Youth workshop held for

Southland businesses on 31 March 2016 had HR consultant Melissa Vining

explain practices for mentoring young staff. Business Partner

Niagara Human Resource Advisor Tarl Barnes spoke on behalf of the

Working Group about why their business is committing to investing in youth and

what the Employers Excellence Model’s youth friendly standards means to

their business.

A total of 20 businesses attended the

workshop out of initial interest from over 30, and five more businesses are

keen to join the Business Partners to be involved in connecting young people

with job opportunities in schools.

You can visit www.southlandyouthfutures.nz

to hear first-hand from young people about the opportunities their workplace

has given them to train and learn on the job.

Regional Labour Market

Strategy 2015-2031

Workforce skill attraction and recruitment continues to be

the number one strategic priority for businesses in Southland. The Labour

Market Assessment undertaken by Venture Southland has informed the key outputs

enshrined in the Regional Development Strategy.

‘Welcome to Southland” newcomers information

guides are currently being redeveloped. Venture Southland is working with

employers, migrants and support agencies to ensure that the proposed guidelines

meet the requirements. These documents are also being translated into Chinese,

and a range of additional languages is being assessed. An integral part of the

updated resources are guides to employers to ensure they start a successful

settlement programme with both their staff member and wider family. Options for

resourcing the Labour Market initiative are being investigated.

Regional Business Partner Programme

Venture Southland has seen a significant increase in uptake

of business support services through the Regional Business Partner Programme,

so far, in 2016. While the start of the year is traditionally a busy period, as

companies plan their activities for the year, 2016 has been particularly busy.

A significant factor in the growth has been the increased levels of training

associated with Health and Safety. This has been particularly evident across

the dairy sector.

Venture Southland will continue to work with NZTE to ensure

the available funding matches demand as closely as possible.

Interest in Research and Development grants has also been

higher than normal in the first quarter of 2016. Venture Southland is working

with a number of companies across a variety of industries to either connect

them with experts to assist in their development or to access funding support

through Callaghan Innovations grant system.

Callaghan Innovation have also committed to running a number

of Design Thinking and Innovation Ready workshops in the region across the

year, to help prepare businesses for innovation and to make those who are

already innovating more aware of the range of programmes and services on offer.

Business Mentors New

Zealand

The Business Mentors programme, which is now contracted as

part of the Regional Partner Programme, has had steady interest in the first

quarter. Venture Southland will be holding a business mentors accreditation

seminar, for new and existing members on the 28th April. This

provides the opportunity for those new to mentoring to understand the programme

and process as well as learn new skills. It is anticipated that 10 new business

mentors will register for the programme, increasing the Business Mentor pool to

over 50 mentors.

Lisa Ford, the General Manager from Business Mentors New

Zealand, will also host an event that evening for Southland mentors, to

recognise their on-going contribution to the success of the programme.

Southland Dairy Lean

– Farm Tune

The 12 farms, in the 2016, are now currently half way

through the formal programme. Feedback on the initial sessions has been very

positive. The formal training programme will continue until the end of April,

with follow-up and on-farm session continuing throughout the year.

The programme has seen increased interest following recent

pay-out announcements and increased focus on health and safety. Venture

Southland is currently working with DairyNZ to rapidly expand the programmes

scale to meet increasing demand.

DairyNZ is currently in discussions with Callaghan

Innovation to contribute to the growth of the programme delivery. This work

with DairyNZ relates to trying to align Callaghan Innovation’s focus on

technology extension with the primary industry need.

Lean Manufacturing - 2016 Lean Cluster

The 2016 Lean Manufacturing Programme has begun with 6

companies participating. These companies come from a range of industries across

the region.

Pipers Produce, Retro Organics, Lewis Windows and Doors, Vet

South, Phoenix Services and NES began the programme in early March and will

continue with the training for the next 6 months.

After significant discussions with Callaghan Innovation,

they have agreed to support the Venture Southland Lean Cluster initiative. They

will contribute funding to the on-going Lean training of both larger and small

scale businesses. While the Southland model doesn’t directly fit their

Lean funding programme, they have recognised the contribution that this

programme makes to enabling businesses across a wide range of sizes that are

often interconnected, to gain efficiency through Lean thinking. This is

currently the only Lean cluster programme funded by Callaghan Innovation and

recognises the significant impact the programme has made over an extended

period of time.

As well as improved productivity, one of the outcomes of the

Lean programme is the establishment of a platform for the implementation and

on-going delivery of comprehensive health and safety programmes. Callaghan

Innovation also sees it as a tool to enable innovation and will look to

leverage the programme into their wider support structures.

2016 Southland Business Survey

Venture Southland is once again measuring the level of

confidence within the Southland business community. This is the third year that

Venture Southland has surveyed the Southland business community. Data collected

in the two previous surveys has been used to contribute to and to develop a

wide range of regional initiatives including the Southland Regional Development

Strategy - the Southland Regional Labour Force Survey, as well as sector

training, events and initiatives.

The survey touches on the current business environment,

where Southland companies are doing business, where they are exporting,

challenges, use of new technology and employment trends among other

topics.

The 2015 survey highlighted that 58% of businesses said that

finding the right people was their top challenge, up 20% on 2014. Exports and

business confidence were strong and more businesses were online - many using

social media.

Because the survey is undertaken annually, we are able to

track trends and impacts of factors such as global commodity price fluctuations

and online retail, on Southland businesses

The survey opened on 01 March and concluded on 1 April. A

total of 421 businesses completed the survey. This level of response

allows for the analysis to be completed at a 95% confidence level +/- 4%. The

data analysis will be concluded by the end of April 2016.

Retail Workshop

Venture Southland is bringing First retail Group to

Invercargill for a one-day workshop for Southland retailers of all sizes and

formats on 20 April 2016.

To stay relevant, successful business owners understand

trends, re-define their proposition and delivery – and reach beyond

traditional trading boundaries. First Retail Group will offer retailers

practical tips and tools to succeed in the rapidly transforming retail

environment, where customer behaviour and expectations are changing fast. The team

will discuss key drivers influencing shoppers today and share ways in which

businesses of all sizes can leverage these trends and opportunities. A

Southland Regional Development Strategy representative will also be in

attendance.

To view the workshop flyer,

click here http://www.venturesouthland.co.nz/images/retail_success_workshop-a5.pdf.

SOUTHLAND TOURISM & EVENTS TEAM

Media Results and Familiarisations

Venture Southland hosts a number

of famils with media different platforms including social media, print and

digital. Please see list below that includes the areas that were explored along

with the journalists name and publications they are associated with. Southland

stories from famils (familiarisation) facilitated by Venture Southland have

featured in number of national and international magazines, newspapers,

international websites and television shows.

· Otago Daily Times (Andrew Tait) – Stewart

Island, February 2016

· Bike Rider Magazine (Kevin Kingham) – Burt Munro

Challenge, February 2016

· Woman’s Day (Sarah-Kate Lynch) – Transport

World, February 2016

· Kia Ora Magazine – Southland Events February

2016, April 2016

· PuntoIT Italian Publication – Stewart Island

– February 2016

· New Zealand Geographic (Shaun Barnett, Craig Potton)

Stewart Island – March to April 2016

· NZ Herald Travel (Louise Richardson) Taste of

Southland, Savour the South - March 2016

· Perth Now (Chris Pritchard) This is the Island Kiwis

call Home, Stewart Island – March 2016

· Meeting News, Incentive adds a Southern Touch, ILT,

Invercargill, Bill Richardson Transport World, Heartland Hotel Croydon –

March/April 2016

· NZ Herald Travel (Louise Richardson) Deep South

– Southland, Catlins, Riverton, Stewart Island, Western Southland –

March 2016

· NZ Herald Travel (Louise Richardson) A rich journey

back through time – Croydon Aviation Heritage Centre, Bill Richardson

Transport World, Eastern Southland Gallery – March 2016

· TNZ (Tony Rogers - Special Interest Publication)

– Clutha, Gore, Stewart Island, Invercargill

· TNZ IMP (Josha Remus - Germany) – Stewart Island

· TNZ IMP (Win Schumacher - Israel, Germany, Austria,

Switzerland) – Stewart Island, SSR (West), Invercargill

· Life and Leisure (Cheree Morrison, Jane Usher) –

Invercargill, Riverton, Heritage Harvest Festival

· In To New Zealand (Chinese Documentary —Actor

Shawn Dou with Adventurer Gang Zheng) Southland featured in 3 of 6 episodes

– more than Auckland and Rotorua who are featured twice. Burt Munro

Challenge, E Hayes and Sons, Wairaurahiri/Western Southland

Trade Shows, Famils & Promotion

The utilisation of trade

channels such as inbound operators (IBOs) and national tourism organisations

(Tourism NZ) is a recognised format for driving sales to commissionable

products (businesses that charge and offer commission to distribution channels)

and building brand recognition in an affordable manner. Trade activities for

the period include:

· Kiwilink Activity – Japan/Korea

· Market Insights/RTO Workshop Sydney (one-to-one

meetings with Australia based IBO, wholesaler and channel partners)

· UK with IMA

representation (Enterprise Dunedin)

· Generous Southern Coast Meeting, Christchurch (meeting

with Chc Airport, Waitaki RTO, Enterprise Dunedin about shared promotion)

Consumer Campaigns, Digital/Social Media and Consumer

Shows

The Southland tourism team

undertakes and participates in a number of consumer focused campaigns. These

appeal directly to consumers to create awareness, shape perceptions, influence

decision making and act as call to actions through major information sources.

Below is a list of consumer activities undertaken by Venture Southland for the

past three months:

· Air

NZ Airpoints for Business promotion – targeting Business owners/managers

· Southlandnz

Facebook Reach for Feb 2015 through to Mar 2016 totalled 444,331

· Southland.nz

Instagram Followers from end of Jan 2015 to Mar 2016 increased from 6802 to

10,100 followers

· Secrets

of South – targeting AKL, WELL and CHC – with featured content in

Herald Travel Magazine, the Coast radio station and Herald Online

· On

your door step preparation – targeting locals with local products in

shoulder season

· Air

NZ Grabaseat – Bluff Oyster and Food Festival package promotion –

bringing an A320 jet to Invercargill from Auckland for the day (notably this

sold out (169 seats) in under 4 days)

· Z,

AVIS & Kit Kat Take a break promotion – point of sale promotion at Z

petrol stations

· MoreFM Radio Jase and Lana Show – Bluff Oyster

Festival Opening – Oyster giveaway

· i-SITE Social Media Plan put in place with focus on

events marketing and increasing followers

· Mini Event Promotion – including the Farm Jam,

Sharks Basketball, Heritage Harvest Festival, Lap the Lake, Festival of the

Arts, & Southland Multi-cultural Food Festival

Invercargill i-SITE & Visitor Information Services

The information services team have experienced a busy

February, with a 10% rise in revenue from bookings and retail, while averaging

an additional 6 non-financial transactions per hour (e.g. destination advice,

events information and giving directions). March was quieter, with an 8%

drop in bookings compared with the same period in 2015, and with approximately

3.5 non-financial transactions per hour. However the retail sales showed

a 17.5% increase over March 2015.

On Friday, 1 April the Southern Region i-SITE Managers

meeting was held in Invercargill. This meeting takes place three times a

year and includes managers from Invercargill, Oamaru, Dunedin, Central Otago,

Queenstown, Lake Wanaka, Fiordland and Clutha i-SITEs, and also a

representative from i-SITE New Zealand. There were discussions on a

variety of topics including the new Health and Safety Legislation, i-SITE

membership requirements, the i-SITE brand refresh, and freedom camping.

Each i-SITE also reported on their results over the previous quarter.

Tourism Liaison Committee and SoRDS

In March the Tourism Liaison Committee met for the sixth

time at the Ascot Park Hotel. Agenda items included an introduction to

the Southland Regional Development Strategy (SoRDS) from Chris Ramsay, a review

of key tourism statistics and the new quarterly Accommodation Surveys.

Other general agenda items included:

· Development of an events calendar for planning use by

accommodation operators

· TLC & SoRDS workshop facilitated by Venture

Southland for industry and public consultation on development ideas

· Sector updates from districts and businesses from

various members of the committee.

Venture Southland is providing support for SoRDS with

representation on the tourism and destination attraction action teams.

Southern Scenic Route Steering Committee

The SSR Committee met in March to discuss the changes and

reprint of the SSR brochure, final design changes will be submitted to the

graphic designer by 18th April with the print run being completed by

June. The committee also discussed changes to the road safety information on

the website and creating a social media campaign to begin with the release of

the new-look brochures.

Product

Development, Industry Engagement, Business Advice and Projects

The tourism

team met with and advised a variety of tourism sector operators and is

undertaking projects in relation to:

· Southland

Museum and Art Gallery (Invercargill) – product development

· Waihopai

Wharekai Redevelopment Project (Murihiku Marae) (Invercargill) – product

development (ongoing)

· Croydon

Aircraft Company/Croydon Aviation Heritage Centre/Gore District Council (Gore)

– strategic development (ongoing)

· Te

Hikoi (Riverton) – product development (ongoing)

· The

Good Studio (Riverton) – diversification project

· Borland

Lodge Adventure and Education Trust – digital review

· Hospitality

NZ (Invercargill & Gore) – accommodation sector research

· Welcome

Rock Trails (Garston) – Business mentor and events

· Beaks

and Feathers, Curio Bay Accommodation, Tussock Country, ILT, Bill Richardson

Transport World, Experience Mandeville – developing trade product

· Regional

Cycling Initiatives

· STQRY

project

Conference Incentive

Fund

In September 2014, Venture Southland and the Invercargill

Licensing Trust entered into a partnership to attract conferences to

Invercargill. The fund has now been operating for 14 months and to date

this fund has attracted 12 conferences to Invercargill. This includes 6 in 2016

and 2 scheduled for 2017. We are currently looking at options forward which

will continue to provide incentives to attract conferences.

SDC Holiday Programme

This year’s attendance numbers increased 33% on 2015.

Based on feedback from the 2016 Southland District Council Holiday Programme,

the programme continues to be very popular with families in the district with

50% of them having never attended the SDC Holiday Programme before. These

statistics reinforce the success of the programme whilst ensuring that it

continues to be well utilised by the Southland community.

ILT Kidzone Festival

Planning is underway for the 2016 ILT Kidzone Festival which

is being held at James Hargest College Senior Campus from Wednesday 13 July to

Monday 18 July. A new website is currently being developed and all our

promotional material is with the designer. Tickets are on sale from Monday 16

May from the festival website (www.iltkidzone.co.nz);

the Invercargill i-SITE, Southland District Council Area Offices and the Gore

Visitor Centre.

Interschools’ Speech Competition

The 2016 Venture Southland Interschools’ Speech

Contest is all go with both the area finals and the grand final scheduled for

September. The contest involves two levels: Level 1 - Years 5 and 6 and Level 2

- Years 7 and 8. This year we have had a record 61 schools register for the

competition which will see the very best speakers from all over Southland

battle it out for top honours in oral language presentation.

Summer Sounds of Southland—outdoor concerts

This is the third year that a suite of outdoor performances

showcasing local musicians was presented. Concerts were held in South City,

Glengarry and two in Invercargill including the popular Waitangi Day

concert. Hundreds of people attended and the bands were very well

received. A fifth concert planned for Bluff was cancelled due to

inclement weather. Due to circumstances, the rain-out replacement concert was

not staged. It is planned that there will be two concerts in Bluff next

year to make up for this lost opportunity. The concerts were supported by

the Invercargill Creative Communities Scheme, the ILT and The Ministry of

Culture and Heritage’s Waitangi Day Celebrations Fund

Southland Buskers Festival

Venture Southland supports the ICC Charitable Trust’s

presentation of four days of professional street performance, with acts

selected from the World Buskers Festival in Christchurch. The festival, now in

its seventh year, attracted thousands of people to Queens Park, Wachner Place

and the Southern Farmers’ Market.

Shakespeare in the Park

Five performances of the comedy A Twelfth Night were

presented in Queens Park in February. Directed by local thespian,

Jonathan Tucker, the show involved a cast and crew of thirty. The

production is presented by the Shakespeare in the Park Charitable Trust and

produced by Venture Southland. Around one thousand people attended the

sixteenth annual event.

Southland Festival of the Arts

The Festival begins on April 26 and continues into

May. Venture Southland programmes and selects the festival and

coordinates nine events with eighteen performances around the region.

Creative New Zealand’s Regional Arts Pilot for

Southland

This arts-based pilot will attract $400,000 into the region

over two years. The contract is managed by Murihiku Arts Incubator with

Venture Southland providing support and advice.

DESTINATION FIORDLAND

Effectively Engage with Travel Trade

· Appointment schedule submitted for TRENZ – Sarah

and Philippa attending. Fiordland Outdoors Company, Trips & Tramps,

Destination Fiordland, Distinction Hotels, Luxmore Jet and Fiordland Lodge have

registered.

· Sarah attended TNZ RTO Workshop in Sydney in March

(15-18 March) – face to face meetings with Australian agents

· Post RTO Workshop sales calls and frontline training

completed with 6 agents and Tourism New Zealand in Australia

· Hosted Alana from TNZ – Trade Development

Executive for North America based in LA.

Effectively

engage with Media

· Hosted the photographer from Discover Magazine (the

inflight magazine for Cathay Pacific)

· Hostel Japan TV Crew doing a recce for popular

Japanese Travel Show (TNZ). Will return in April to do the shoot.

· Assisting Fox Films with information for the film

shoot in Milford Sound (direct/Venture Southland)

· Hosted social media influencer – Bear Foot

Theory

· Liaison with TNZ on TV show filming in Fiordland

Domestic Marketing

· Promotion of Te Anau Tartan Festival and Te Anau

Enduro

· Hosted More FM in Te Anau as part of the Real Journeys

promotion in February

Develop a robust online presence

· Phase 2 of www.fiordland.org.nz in progress

· Instagram followers increased from 442 to 600 since

last report

· Facebook likes increased from 4901 to 5129 since last

report

· Google Analytics for www.fiordland.org.nz – for 1 Nov 15 to 31 Jan 16 – users up

35%, sessions up 32%, page-views up 13%, 78% increase in visits from Android,

37% from IOS. 87% increase in usage from Mobile device.

Develop & Communicate the DF brand

· Attended the first branding workshop initiated by Air

New Zealand who paid for flights to Auckland for the attendees. 20 of the

30 RTOs attended. Air New Zealand has commissioned a design consultancy

to work with the RTOs on branding and communicating the brand. 2nd

workshop in April.

· The work completed at this first workshop has been

distributed to the DF Board for feedback

· Friday radio slot continues

· Article in the Advocate continues through 2015

· Maintaining activity on Instagram and Facebook

Effectively engage with, promote and support DF members

· Fast Facts continues in Campaign Monitor – good

stats for this. 40% of recipients opened the last edition

· Date set for Fiordland Tourism Expo – 14th

October 2016

· Date set for next networking function – 19th

April

· Setting up Health & Safety and Employment workshop

for late April

Develop & Maintain Key Relationships

· SL attending European Product Workshop in April

(London), Best of NZ Series July or Sept (USA), Kiwi Link India July (Mumbai),

Kiwi Link LATAM Sept (Brazil, Chile, Argentina), Kiwi Link SEA (Indonesia)

· Working with Southern Lakes on TRENZ

attendance/stand/networking function

· Attended Southern Lakes Meeting in Queenstown

· Sarah attended Southern Scenic Route meeting

· TCB & SDC – attended Cycling meeting in Te

Anau

Develop & Enhance Relationship with Venture Southland

· Looking at joint iSITE famil later in year

· Attended LEAN management workshop in February

· Attended All Staff meeting remotely in March

· Looking at joint opportunities after IBO Trade Event

in Auckland – famil programme

Use local events to promote the region

· Te Anau Enduro (March) – ran successfully and

will probably become a regular fixture on the events calendar

· Te Anau Tartan Festival (Easter) – another

successful event – the Pipeworkz concert on Easter Friday was a

sell-out. The highland games were popular but not as many people as

last year – perhaps a reflection that Warbirds was on in Wanaka this

year.

· Continue with hiring equipment to community groups

· Funding applications. Working with the Te Anau

Rodeo Club on quotes for some Portaloos. Also investigating funding for a

new events sign at the entrance to town

· With funding from the Te Anau Community Board ceasing

in 2018, the Trust has agreed to be part of the organising group for a second

“Battle of the Lakes” event, which is held in conjunction

with Gerry Forde (Spirit of a Nation). While this will be a huge amount

of work, it is expected that our share should be around the $10K mark.

The date has been set for Saturday 13 August.

Recent media results

· Life and Leisure (NZ) – March 2016, Fiordland activities included in

a Southland feature(Venture Southland)

· Bear Foot Theory (Feb 16) – social media influencer – 11.7k

followers on Instagram, 50k new visits per month to website

www.bearfootheory.com

· Wilderness Magazine (NZ) – March 2016 – Takitimu feature

· Go Travel (NZ) – Autumn 2016 – Fiordland feature

· RV Travel Lifestyle – March/April 2016 – Road to Milford feature

COMMUNITY DEVELOPMENT TEAM

Regional Initiatives and Significant Projects

Curio Bay Tumu Toka

Vision

Possibly the busiest stage of the project in its 15 year

history with all aspects due to be completed and/or built by the end of 2016

(accommodating penguin breeding and nesting times; peak visitor season):

· The South Catlins Charitable Trust is making

significant progress preparing a new ablutions block in Invercargill to be

transported to the Curio Bay Campground next month.

· This Trust is also confirming final alterations to the

Natural Heritage Centre in preparation for a building consent application to be

submitted. Please note that the DOC public toilets are attached to this

facility and it remains at a central arrival point to the area.

· The Trust will soon ask for expressions of interest

from interpretation consultants who will develop and design the interpretation

components associated with telling the story of the Jurassic period (and 180

million year old petrified forest); tangata whenua and local wildlife. An

Exhibition Brief has been developed by Venture Southland with consultation from

the Trust, iwi and DOC.

· DOC is progressing concept plans for the new car park

and has recently generously donated paint through Dulux for the project.

· SDC is finalising details regarding the waste water;

· Successful Governance Group meeting in March with

another planned in April.

Venture Southland is providing overall assistance with

coordination of all components associated with achieving the vision and working

closely with the Trust in particular. The project is at a critical stage

after many years of preparation.

With growth in tourism in the region, particularly in the

Catlins and along the Southern Scenic Route, there is more and more need for

improved visitor management, provision of adequate infrastructure and high

quality unique visitor experiences – all which will be provided with this

project thanks to a collaborative approach from key stakeholders.

Switzers Waikaia Museum Redevelopment

Switzers Waikaia Museum Redevelopment

The old museum has been demolished and the site prepared for

the build of the new facility. All funding has been secured for this

project including generous support from community funders, SDC and locals

(through a sustained fundraising effort over many years). The collection

has been successfully catalogued and stored by the Roving Museum Officer and

the Committee over many months and there is a high level of excitement within

the community.

Research and Strategies

Southland Heritage Sector Research

Status: COMPLETED

The aim of the research was to undertake investigation into

the heritage sector in Southland that not only provides insights into the

current situation, but also identifies key issues, challenges and opportunities

associated with future development, support and funding.

It looks at issues associated with delivering heritage at a

local level and a key project identified is the need for regional

storage. The document is currently being peer reviewed and a final draft

will be presented to the Southland Regional Heritage Committee shortly.

Southern NZ Cruise Destination Strategy

Status: COMPLETED

The review has been completed, and a draft document

produced. Venture Southland will now assist with implementation alongside

key stakeholders.

Southland Cycling Strategy

Status: UNDERWAY -

due to be completed by June 2016

The strategy will provide direction for planning and

investment decisions and will identify feasible projects for inclusion in

future works programmes aimed at improving cycling infrastructure and

opportunities in the region. A Steering Committee has been formed

consisting of representatives of the three Councils plus Sport Southland. A

preferred contractor has been selected and public consultation is soon to get

underway.

Catlins Tourism Strategy Review

Status: COMPLETED

– implementation underway

This development of this document was facilitated by Venture

Southland at the request of the local community. In partnership with a

number of stakeholders, it identifies that there has been and continues to be

significant growth in visitor numbers in the Catlins. A framework has

been developed which identifies projects associated with infrastructure,

product development, promotion/marketing and environment and heritage.

Venture Southland is currently working alongside Catlins Coast Inc to identify

priority projects and an implementation process.

Pool Heating Assessments

Status: UNDERWAY

– due to be completed by July 2016

Pool heating assessments are currently underway for the

following pools – Riverton, Otautau, Tuatapere, Manapouri, Fiordland,

Hauroko and Riversdale.

These reports will identify for each pool various options in

regards to making their pool more energy and cost efficient. The

Riversdale pool heating assessment has been completed and the school has

recently installed a solar heating system. One option is to closely monitor how

it goes this next season – this information will be useful for other

pools looking at similar technology.

Volunteer Research

Status: UNDERWAY

– due to be completed end of 2016

The goal of this research is to review the 2010 Community

Organisation Needs Assessment (CONA) with particular emphasis on volunteering

in the community. There are two key objectives relating to understanding

both the Southland volunteer sector and also the people who make up this sector

(many as volunteers). This is key piece of work of interest to the

Southland Regional Development Strategy.

Ohai Nightcaps Research

Status: COMPLETED

This research looked at declining communities, with

particular focus on Ohai and Nightcaps. Dr Natalie Jackson was contracted

to provide demographic insights into this community and the SDC Community and

Futures group is now looking at the next steps. Venture Southland will

continue to partners with SDC and will support where required.

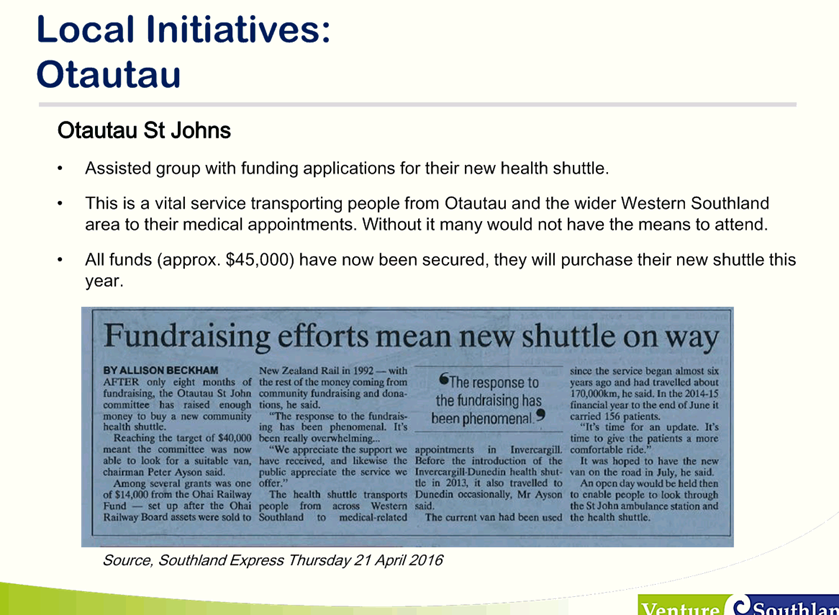

LOCAL INITIATIVES

The Community Development team has been busy preparing

funding applications for the recent rounds of the Southland District Council

funds:

- SDC Community Initiatives Fund

- Southland Regional Heritage Fund

- Southland District Heritage Fund

- Sport NZ

- Creative Communities NZ

- Northern Southland Development Fund

The Community Development team work alongside a large number

of community groups and initiatives throughout the year, providing a range of

services. The following are a brief update of just some of these

projects:

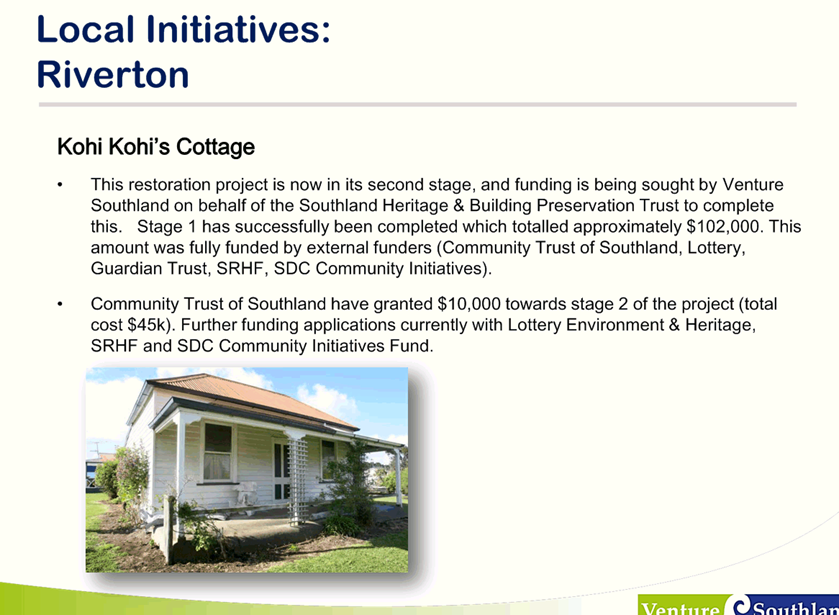

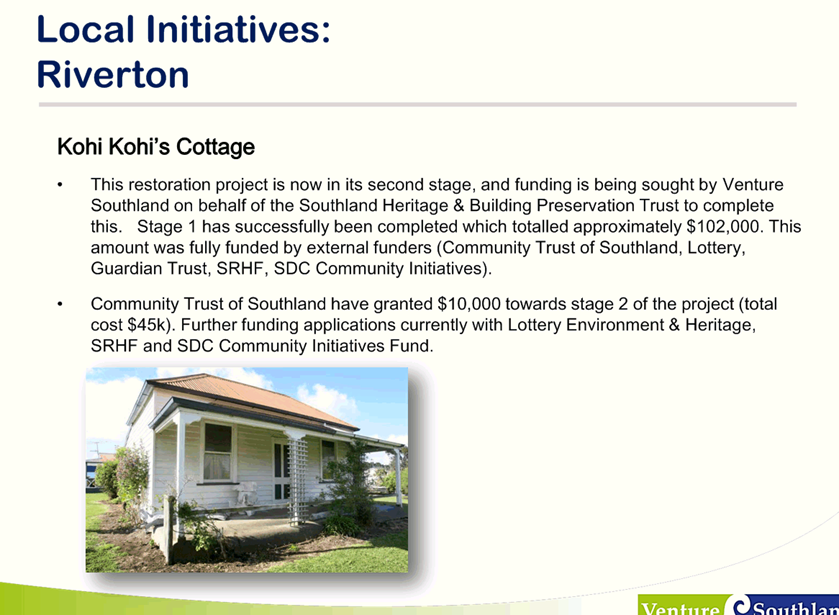

Kohi Kohi Cottage

Venture Southland staff are working alongside the Southland

Heritage and Building Preservation Trust with stage two of the restoration of

Kohi Kohi Cottage. $10,000 funding from the Community Trust of

Southland has been secured to date and further funding applications are

pending.

Winton Memorial Hall Upgrade

Funding applications have been submitted for the major

upgrade of the Winton Memorial Hall. $50,000 was recently granted by the

Community Trust of Southland. Further funding applications were submitted

to the Lottery Community Facilities Fund, SDC Community Initiatives Fund and

gaming machine funding organisations. These further funding applications are

currently pending.

Wyndham SDC Service Provision Review

Venture Southland staff are working alongside the Southland

District Council as part of a project team to review the provision of council

area office services. Community consultation will be undertaken through

key stakeholder meetings, surveying the community and a public forum.

Feedback provided during this consultation will guide decision regarding future

service provision requirements.

Tuatapere Pool

The redevelopment of the pool was completed in December

2015. Venture Southland continue to work alongside the Tuatapere Baths

Society with various aspects of the project for examples, accountability for

funding, change of land ownership, development of an operational manual and

planning processes and further minor plant improvements.

Fiordland Vintage Machinery Club

The Fiordland Vintage Machinery Club is planning to expand

their facilities by building a new storage shed. Staff are working

alongside the Club to identify potential funding sources for operational and

capital funding. Assistance has been provided with funding applications.

Mossburn Rugby Club

Venture Southland staff are working alongside the Mossburn

Rugby Club to assist with securing funding towards the installation of lights

for one of the rugby fields. Planning is also underway for the removal of

power lines and poles.

|

Policy Review

Committee

18 May 2016

|

|

Tourism Trends and Issues

Record No: R/16/4/6201

Author: Warrick

Low, Tourism and Events Maanger

Approved by: Rex Capil,

Group Manager Community and Futures

☐

Decision ☐ Recommendation ☒ Information

Purpose

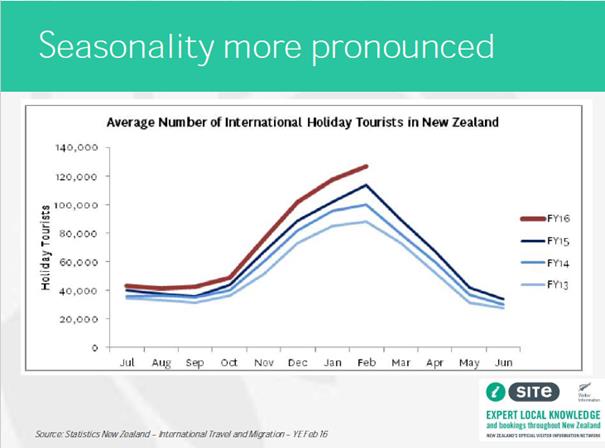

1 It

is the intention of this report to provide a brief update on tourism in

Southland including insights on visitor numbers and market trends. It is

also important to acknowledge factors outside of Southland which affect our

region, including the increasing numbers of direct international flights.

This report will also touch on the impacts of growth and subsequent pressures

that are presented for not only Council, but the wider Southland community

– it is currently estimated that over the main tourist season (now

commencing in October through to April) the Southland region is accommodating

approximately four times its resident population. The increase in visitors

brings opportunities but also requires a collaborative approach and

understanding between all those involved directly and indirectly in the

industry to fully realise the benefits.

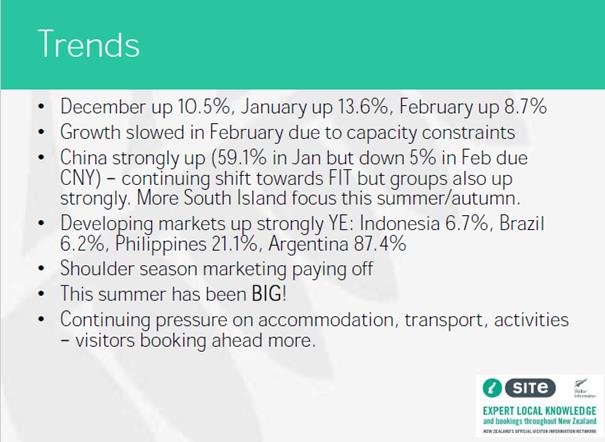

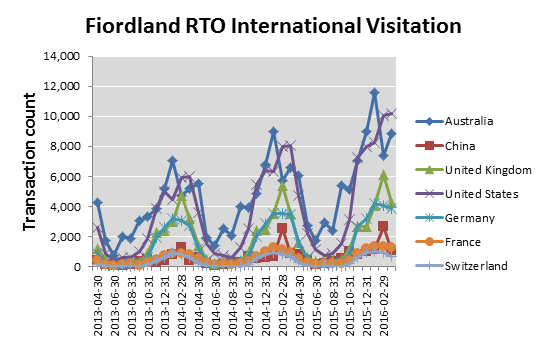

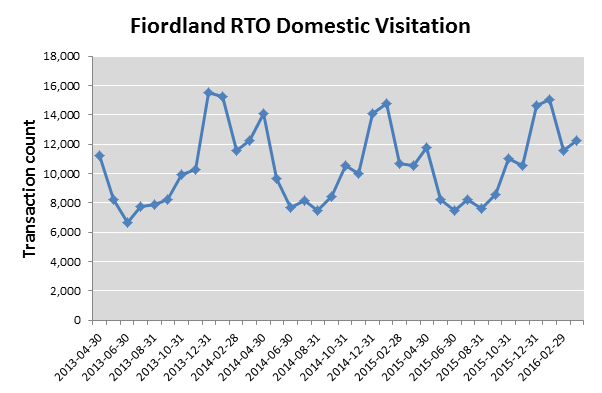

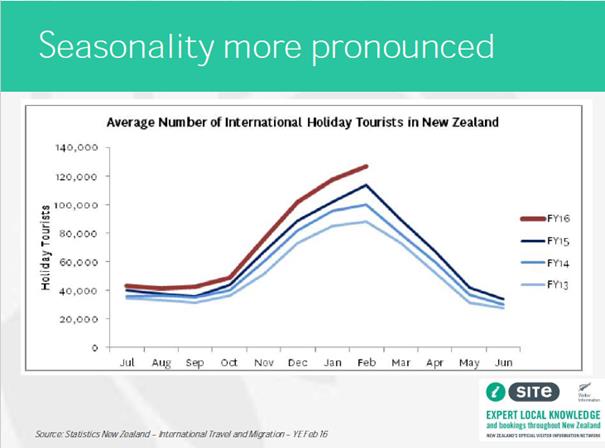

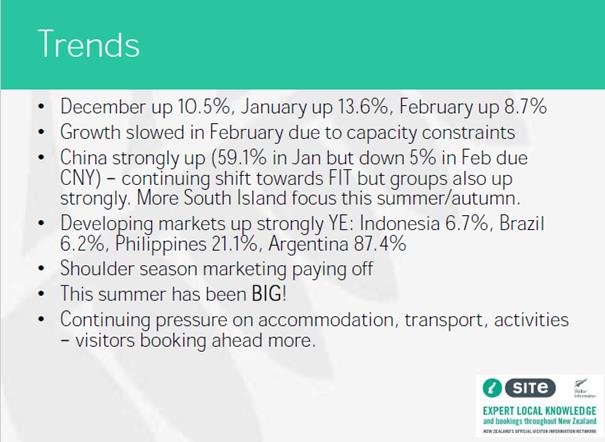

Significant

Recent Growth

2 It

is undisputed that there have been more visitors in Southland in recent

times. While it can be argued that the statistics available to us do not

provide a comprehensive picture of the current Southland situation, they do

nevertheless reflect this growth:

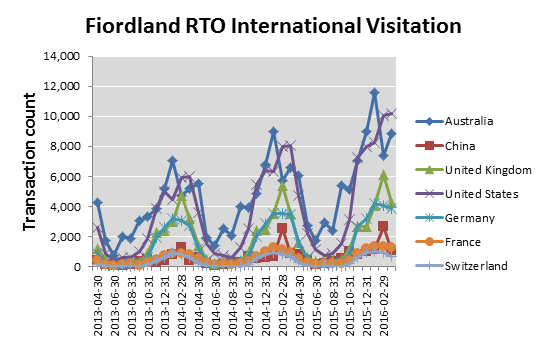

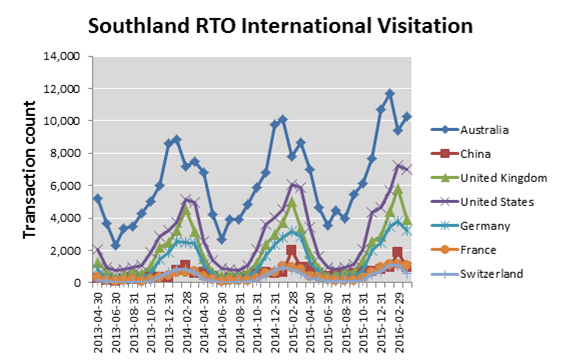

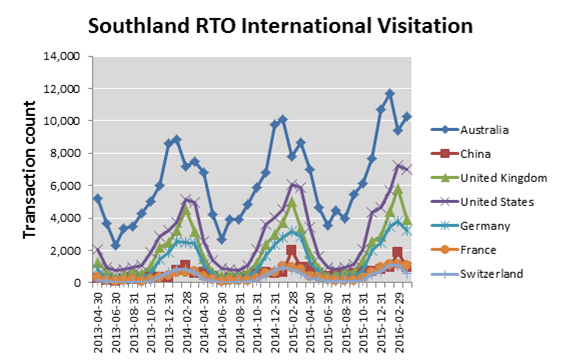

- International

tourism growth of 10% for the year ended March 2016 (International Visitor

Survey)

- Growth

in Fiordland of 10.8% and in Southland of 8.7% (Commercial Accommodation

Monitor)

- Emergence

of markets such as China (+27.8%), India (13.8%), Korea (+20.7%) and Argentina

(+140%) – note also Philippines.

- Resurgence

of traditional markets particularly Australia (+7.2%), Germany (+11.5%) and the

USA (+11.8%)

- Domestic

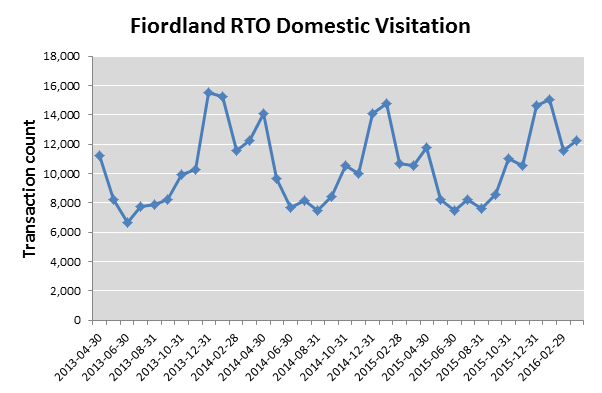

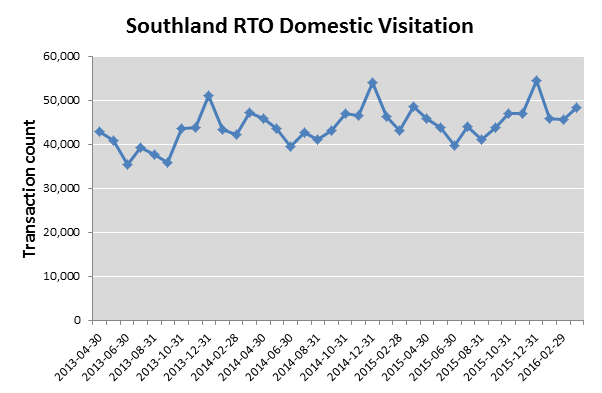

tourism has been comparably very slow for Fiordland with growth of 1.8% over

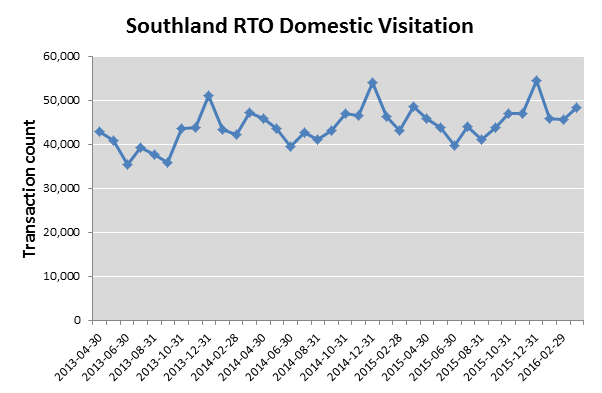

the last 2 years year, while Southland experienced 8.5% in domestic growth.

3 So

in short, Southland’s biggest market remains the domestic market ($290

million). The largest international market is Australia and this has grown in

recent times. This market is attractive because of their close proximity

and ease for them to get here (QTN, DUD, & CHC airports) and ability to

repeat visit many times (estimated to be at least 4).

4 Traditional

markets such as the USA and Germany have shown strong resurgence with increased

connectivity and positive perceptions of New Zealand as a safe and ‘must

do’ destination. Specifically for Southland, there is a high resonance

with these markets due to special interest activities, access to the nature

world and proximity to the resort destination of Queenstown.

5 The

Chinese market continues to experience significant growth and currently is

Southland’s 5th largest international market that experienced

45% growth for year ended March 2016 (Regional Tourism Indicators).

Another observation with this market is the quick evolution of free and

independent (or self-driving) travellers, opposed to the traditional coach group

travel.

6 It

is important to remember that the majority of visitors to Southland (70%) are

domestic and from other parts of New Zealand, so under a third are

international (though notably the proportion of international is

increasing). This situation is reversed when we consider Fiordland where

around three quarters are of an international origin.

7 While

exact visitor numbers are at this time impossible to record, the estimate based

on commercial accommodation nights in the region, acknowledging daytrip

activity (travelling from home residence or alternate accommodation and

returning within one day) combined with alternate accommodation forms (such as

AirBnB, Bookabach, freedom camping and staying with friends and family) suggest

the visitor numbers to the region are in the region of 550,000. This number

excludes the vast number that undertake day visitation from Queenstown through

to Fiordland attractions (particularly Milford Sound). This estimate suggests

that over the main tourist season (now commencing in October through to April)

the Southland region is accommodating approximately 4 times its resident

population.

Reasons for Growth

8 The

growth can be attributed to a number of factors from increased interest in New

Zealand as a whole - through to the culmination of years of work marketing and

positioning the region and raising its profile so there is awareness of the

unique offerings and points of difference in Southland.

9 A

number of other factors included below relate to what is happening outside the

region:

- Tourism

New Zealand are focussing on dispersing visitors to the

‘regions’ and out of places that are at regularly at capacity

like Queenstown. They are also focussed on trying to extend the

tourism season beyond the traditional period. This is being reflected

with an increasing number of joint ventures between Tourism New Zealand and

Venture Southland including key campaigns highlighting our regions (of

particular interest to them are Stewart Island, Fiordland and the Catlins).

Similarly Air New Zealand and Venture Southland are partnering on a number of

initiatives to develop Invercargill as a more significant port of entry.

- Recent

media and promotion has highlighted Southland (particularly Milford Sound, The

Catlins and Stewart Island) as a desirable destination. These include top world

ranking of experiences and celebrity endorsement (Prince Harry).

- Increased

air connectivity to major South Island ports (to Christchurch and

Queenstown from USA, Australia and China; as well as increased domestic

capacity) – please see the attachment to this report showing projected

direct international flights as provided by Tourism New Zealand.

- SOUTH

partnership between Christchurch International Airport and Regional Tourism

Organisations (including Southland and Fiordland) encouraging regional

dispersal.

- Pressure

on traditional destinations where carrying capacity of accommodation is

being exceeded, particularly in international holiday periods i.e. Queenstown.

- While

visitation durations continue to be constrained for many markets (Australia

11.3 days, China 8.4 days, USA 13.9 days, opposed UK 27.3 days and Germany 49

days) the South Island is becoming a viable single destination, a return

visit destination or short break destination (Tourism New Zealand)

Benefits

and Opportunities

10 Tourism

growth has generated some significant economic benefits - with the region

receiving $460 million in GDP contribution, in which $290 million can be

attributed to domestic visitors and $140 million from international visitors.

11 The

Southland Regional Development Strategy is looking at increasing this to a

target of $1billion in GDP contribution by 2025 (note the national goal is

$41billion). This assumes that infrastructure and services will also

continue to be developed alongside product development offerings and

experiences.

12 The

Tourism Industry Association of New Zealand (TIANZ) indicates that the tourism

sector contributes directly to the employment of 1 in 10 persons in the region.

With MBIE identifying Southland as one of the least diversified regions in the

country, the role of the tourism industry as supporting industry provides a

strong alternate.

13 A

challenge is finding a method of securing a proportion of this expenditure to

ensure the sustainability of the local industry and communities. This not only

includes appropriate economic development, but also a positive relationship

between hosts and visitors, maintenance of cultural traditions and the

protection of the natural environment and provision of appropriate

infrastructure and services.

14 MBIE

has forecast international visitor numbers to continue to grow till 2021 at a

rate of between 3.5 and 4%. Southland is the only region to have consistent

growth each month for the last two years, and the only one to have an average

double digital growth over this period (11.2%). In only two months did

Southland not exceed the national average (Jan 2015, Dec 2016). This suggests

that market demand for Southland experiences is strong.

15 The

challenge remains to maximise the benefit of increasing numbers of visitors for

our economy, communities and environment. It is also acknowledged that

the focus is not to increase visitor numbers necessarily, it’s about

increasing the yield or value out of those visiting – get them to

stay longer and spend more. You do this by providing more things for them

to spend their money on (called Tourism Product) and ensuring there is an

ability for them to stay longer (accommodation, infrastructure).

Considerations

16 The

down turn in the dairy sector (amongst other things) has seen many regions in

New Zealand now focus on tourism to assist with diversifying their

economies. Many regions are looking at how they facilitate this including

aligning their regional tourism organisations alongside community development

and economic development agencies (like what we have been doing in Southland

for 15 years). This is important to ensure a collaborative and comprehensive

approach.

17 However,

a key point is that visitors have fixed time for their holidays and are now

being actively lobbied by many regions offering a range of diverse experiences.

It is therefore very important that Southland continues to understand what kind

of experiences different types of people want and then matches it to what we

can provide.

18 While

tourism is booming and there are certainly opportunities that this presents,

Southland will not necessarily maximise the benefit of this unless there is a

coordinated effort by many to understand what visitors want and what we can

provide.

19 It

is also acknowledged nationally that tourism growth has significant impact on

physical environments and host communities. This means there is a need to consider

infrastructure provision and investment, as highlighted by TIANZ CEO Chris

Roberts. He states that priorities for the sector governance are to co-ordinate

and contribute to a significant body of work that identifies:

- The

key tourism infrastructure needs in the short, medium and long-term

- The

scale of those infrastructure needs

- The

location and timing of those key infrastructure needs

- Barriers

to investment and options for removing those barriers

- New

funding models and policy setting

20 In

Southland, we are already seeing that the growth in visitor arrivals has put

pressure on some of our most popular destinations - with pressure falling on

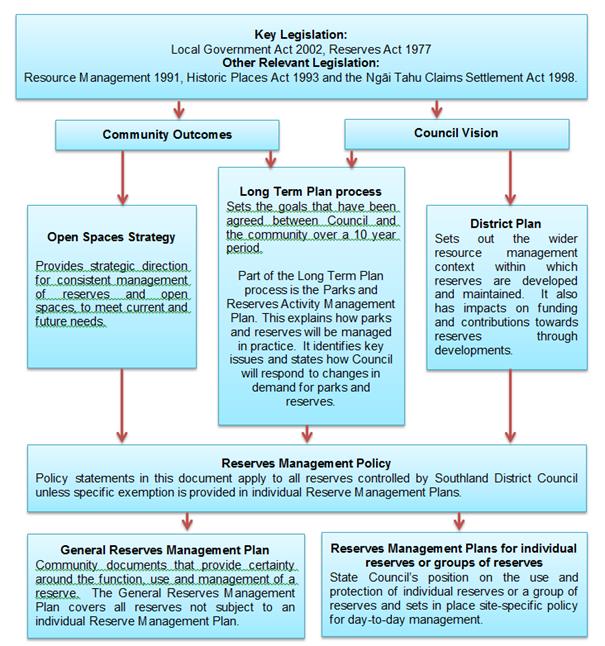

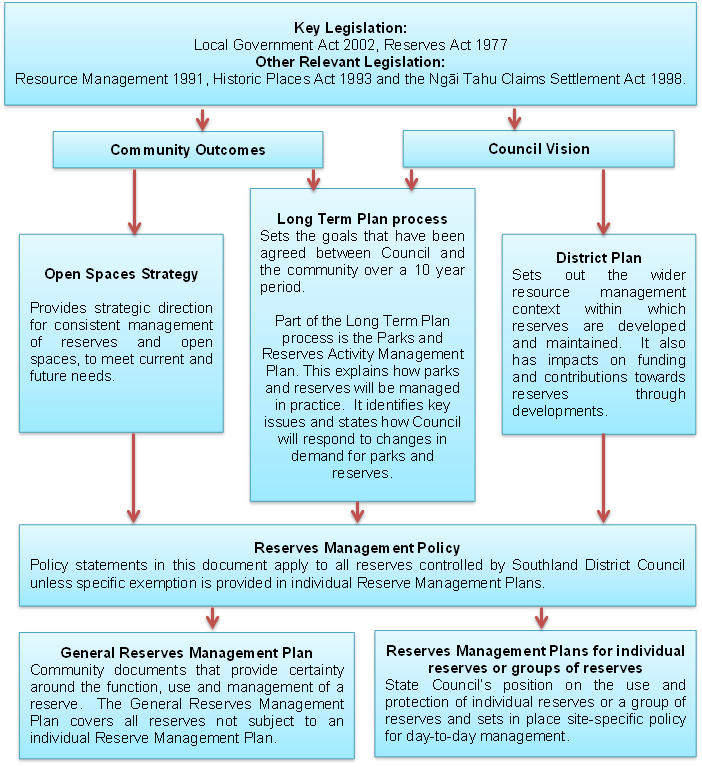

communities, DOC, Councils and others to provide additional and improved